24/8/21 Preliminary Final Report

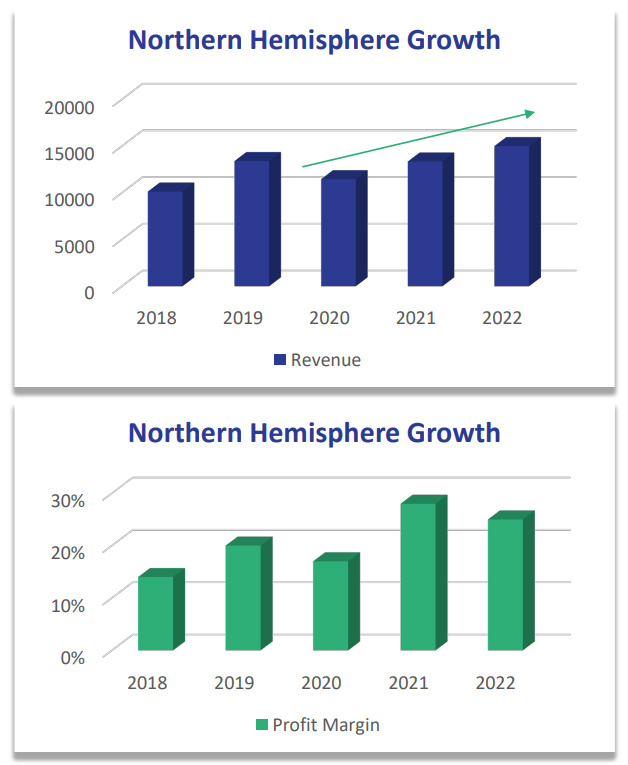

A great report from CGO, registering strong revenue growth and a record profit result. Headline numbers were 34% revenue growth to $33.3m and NPAT more than tripled to $3.4m (with no Government support).

The report was a pleasure to read with management clearly articulating the current business and it's potential but also the growth paths open to them with a defined five year plan to build software tools that can eventually be sold under a SaaS model.

Half on half, 2H was a bit weaker than the 1H but management flagged this in prior updates given the big pull forward of demand as Covid hit with customers rushing to digitise solutions and CGO's testing and tuning services in high demand as systems designed for pre-Covid levels of activity were being overrun.

Nonetheless, 2H was still highly profitable as tailwinds of reduced travel costs continued to help, and management conceded that while some travel will return, conversations wtih clients suggest many will allow remote work moving forward. Over the year, $1m in travel costs were saved, with USA down 87% and Aus down 55%.

Geographically, Aus revenue grew 51% and USA grew 35%. A specific percentage wasn't provided but management commented that Canada in particular was weak on the back of a key client delaying services.

The balance sheet is pristine with $4.3m cash and no debt and cashflow was strong despite some prepayments being made.

Looking forward, management commented that they are seeing a bit of fee pressure from clients which will likely see FY22 flat, but given the record result it would still be a solid achievement. From a margin point of view, labour shortages mean some increasing in contractor costs may crimp margins a little.