14/11/22 CPT Global Investor Brief and AGM Presentation

FY22 ended up being a transition year for CGO, as the business moves to a US focused operation after the CEO role was taken over by the former manager of the US who has done a fantastic job driving growth there.

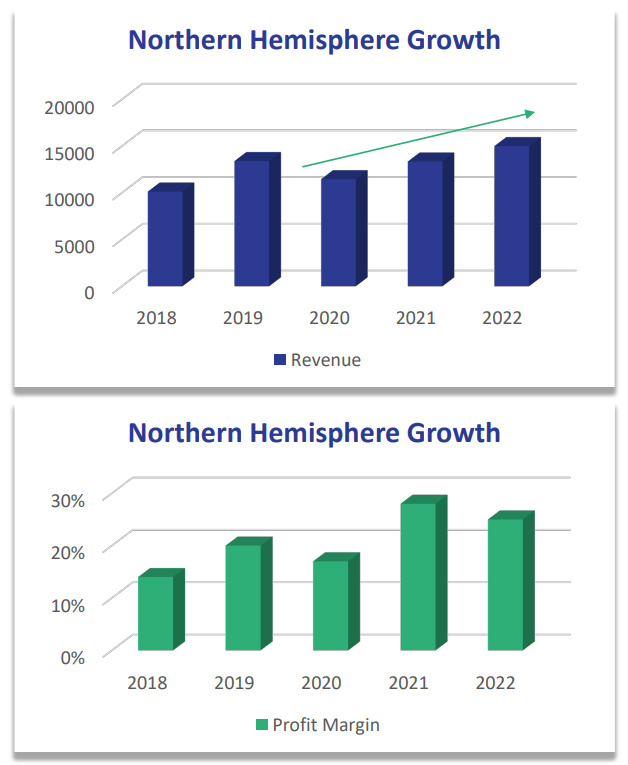

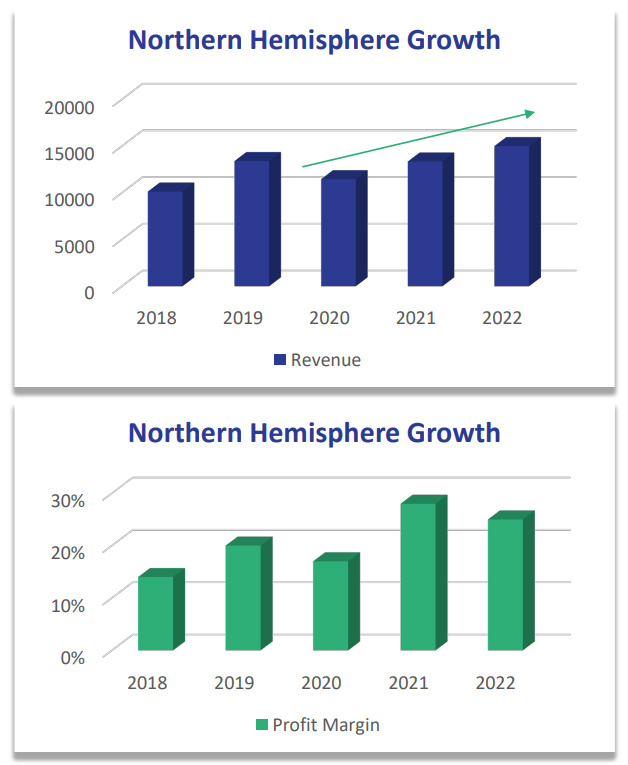

US revenues continue to grow strongly and margins held up well despite some travel costs coming back post-Covid restrictions. Management guided to putting on new sales staff in the US to leverage that momentum further. Conversely, Australia had a tough FY22 with some major contracts rolling off:

Put it all together and FY22 ended up being weaker than expected but the growth in the US shows great promise moving forward. Some one-off costs hit the 2H22 in particular but based on the commentary I expect FY23 should see CGO earning $2-3m NPAT.