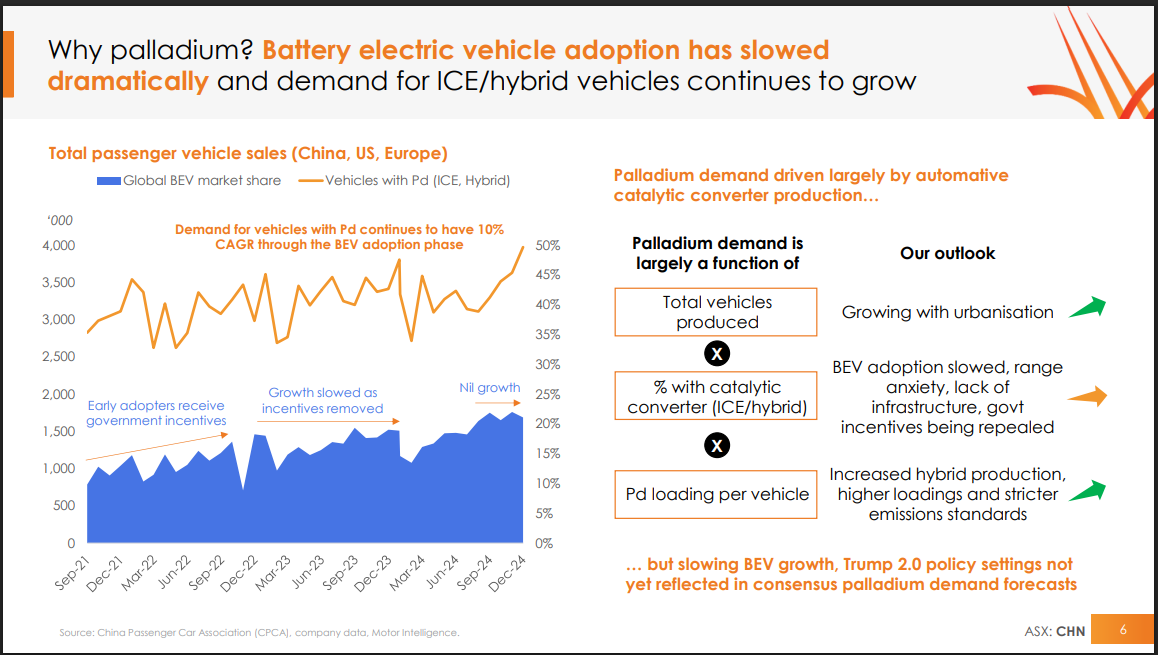

Statement of Cash Flows Cash and cash equivalents at 30 June 2025 were $70.8 million (2024: $88.9 million). Cash used in operating activities reduced from $44.1 million to $17.8 million, primarily due to a reduction in cash flows associated with exploration and evaluation expenses of $23.9 million and a reduction in cash paid to suppliers and employees of $1.6 million.

Net cash used in investing activities decreased significantly during the financial year, predominantly due to the acquisition of a private property and financial assets in the prior financial year.

On the corporate front, disciplined financial management saw FY25 operating cash outflows reduced to $18 million – the lowest level in six years

– adapting to lower commodity prices and preserving our strong cash and listed investment balance of $78 million. This strong position ensures we are well funded through to a Gonneville Final Investment Decision targeted for late CY27.

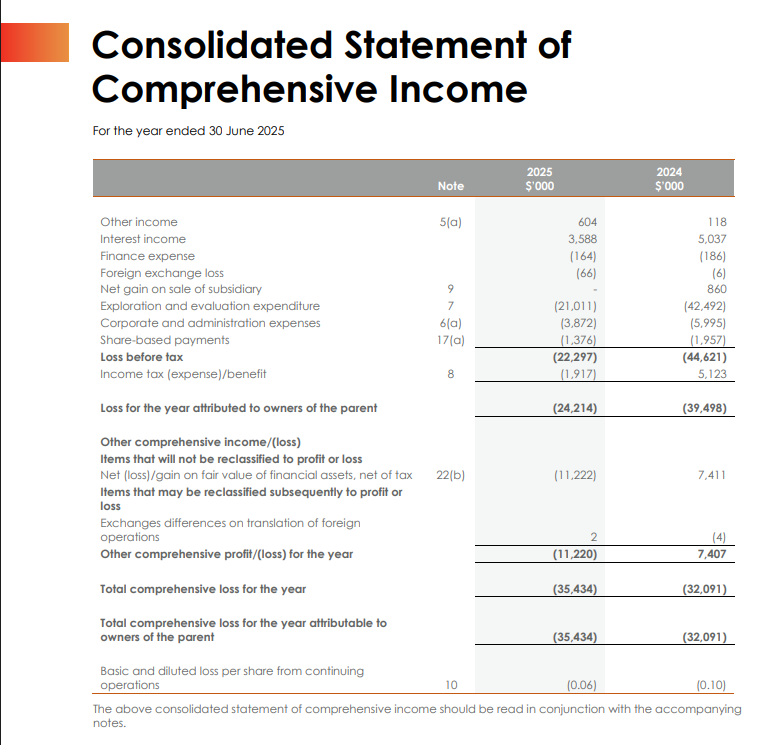

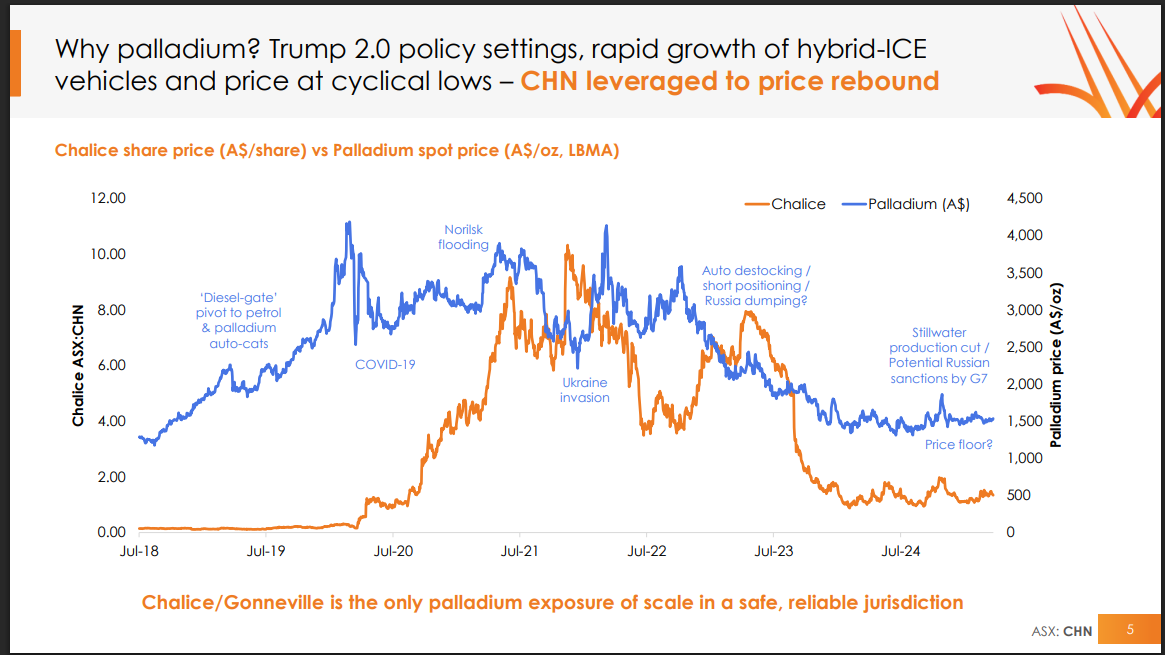

Gonneville is forecast to generate ~45-50% of its revenue from palladium,

The outlook for Chalice With a strong balance sheet, Chalice is well funded to advance Gonneville to a Final Investment Decision in late 2027, while continuing to explore priority targets. Anticipated milestones in FY26 include completion of the PFS, commencement of financing discussions, progression of offtake negotiations and submission of the Environmental Review Documents to regulators for major environmental approvals.

Return (inc div) 1yr: 71.07% 3yr: -14.19% pa 5yr: 0.90% pa

CHN liquidity average traded daily : $3,000,000

Palladium