@BoredSaint shared Clinuvel’s 1H22 results yesterday and the results seemed OK.

I’ve had CUV on my watch list for a while now. It’s an interesting, profitable, high growth biotech which is exploring other uses for its key formulation afamelanotide. If some of these other options are successful it could be a game changer for the company.

With the share price down over 15% to $18.70 today after what seemed to be a reasonable result, I was tempted to take a ‘nibble’ as it would be described on “The Call”.

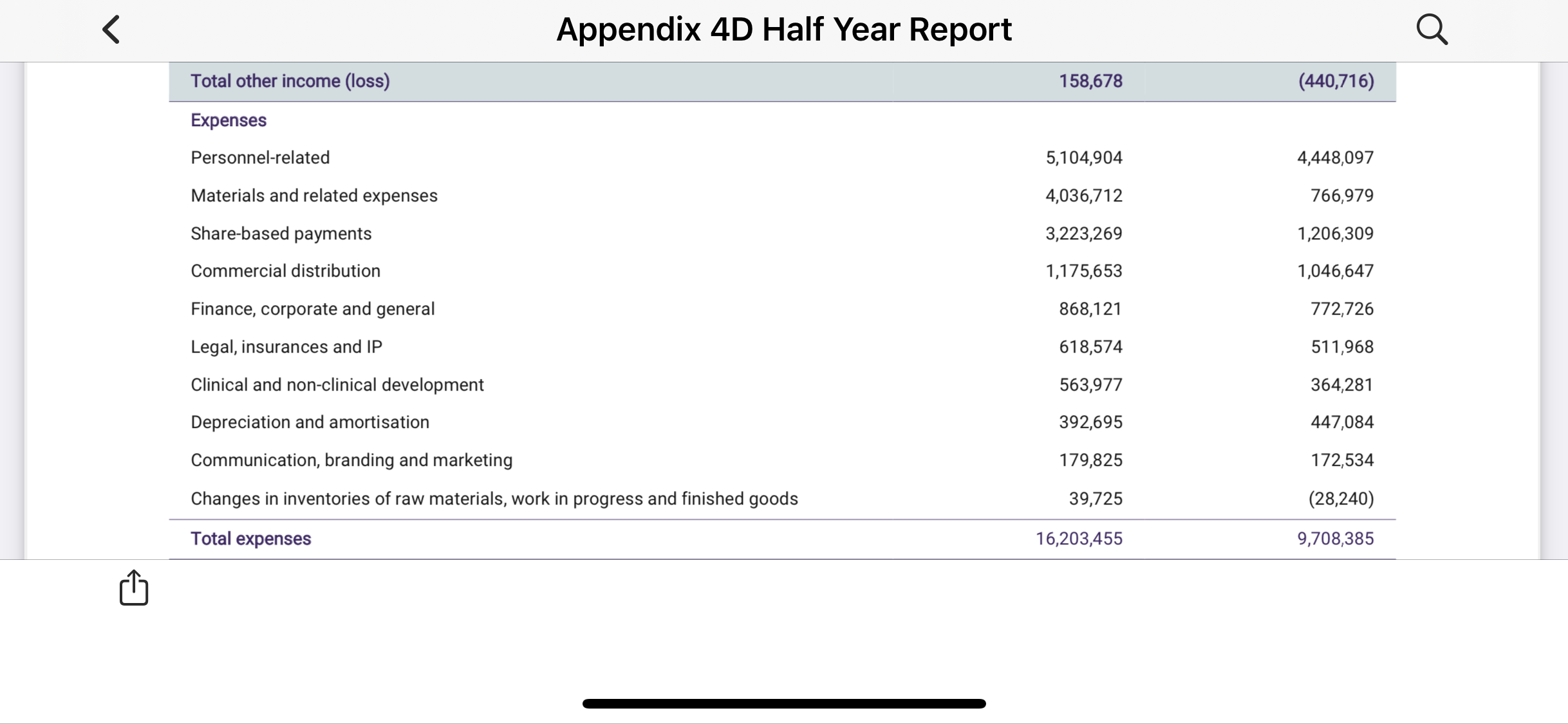

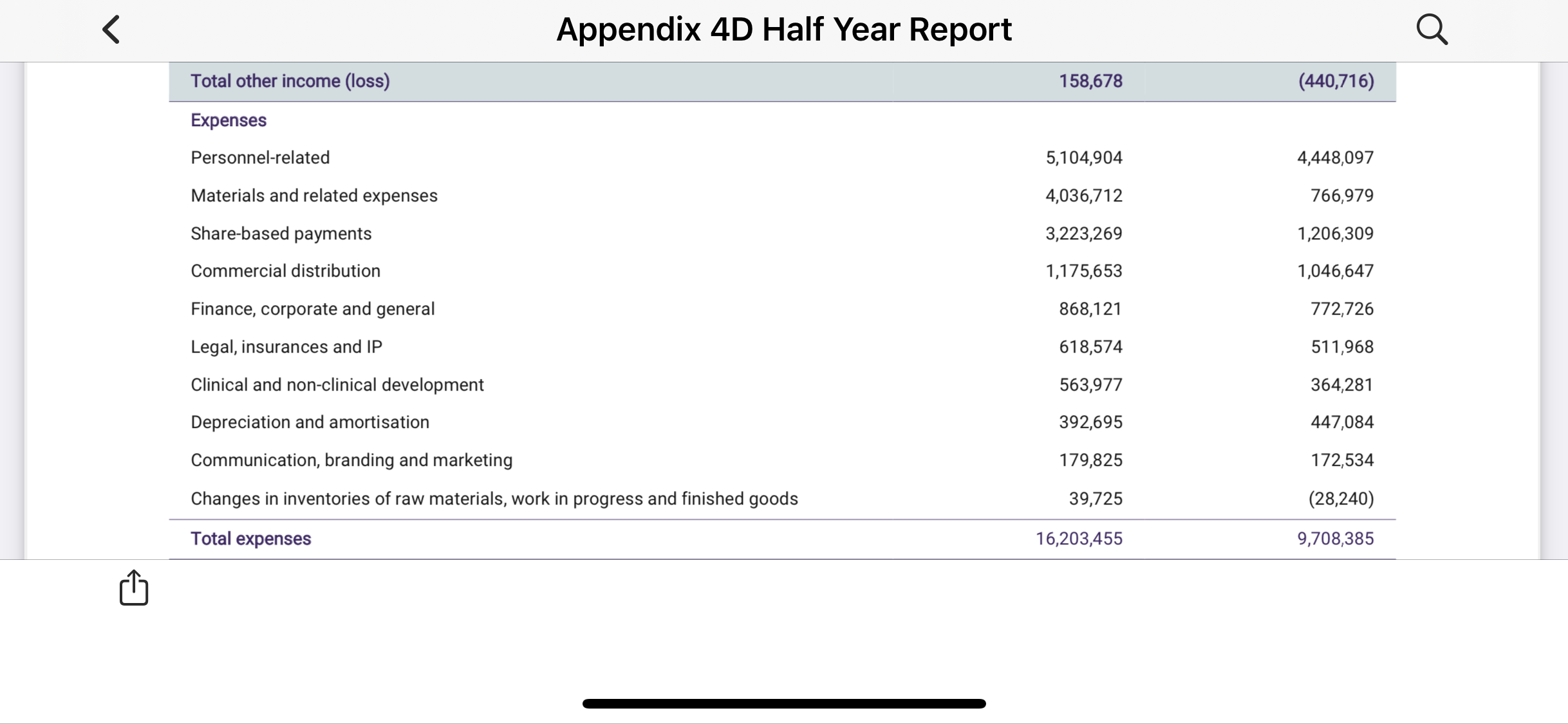

After delving a bit deeper into the P&L, I’ve now changed my mind. While the highlights for the half year looked good, the increase in expenses, particularly the materials is frightening! ‘Expenditures on essential materials and related expenses increased 426%, from $0.767 million in H1-FY2021 to $4.037 million in H1-FY2022’

While the company was blaming income tax related expenses to the 10% decline in EPS, I think material expenses are the biggest concern going forward.

Analysts on SWS had forward FY22 EPS at 55 cps. With 1H22 earnings at 11.9 cps it seems very unlikely forecast full year earnings can be achieved.

I’ll be keeping Clinuval on my watch list until the 2H22 results are released.

See the P&L In the 1H22 Report , and extract on material expenses below:

“Materials and Related Expenses

Materials and related expenses primarily reflect purchases to support the acquisition of materials used in the production of finished product by the Group’s contract manufacturers and other materials purchases related to the development programs. Expenditures on essential materials and related expenses increased 426%, from $0.767 million in H1-FY2021 to $4.037 million in H1-FY2022.

The Group engaged its contract manufacturer during the reporting period to undertake a number of batch manufacturing campaigns to meet longer term commercial demand, as well as to meet the forecasted clinical supply needs of the expanded R&D program. The increase in the volume of manufacturing campaigns with lower than anticipated yields contributed to the significant increase in materials and related expenses reported. Further campaigns to manufacture finished product are intended in the remainder of FY2022 and beyond.

Other material and related expenses include purchases of both raw material peptide and excipient material in support of the manufacturing campaigns. Other expenses in H1-FY2022 that were absent in the pcp include materials and related purchases on PRENUMBRA®, the liquid drug delivery formulation of afamelanotide.”