Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

CUV released an update on it's ongoing CUV105 Study of Vitiligo, due to be completed with full study results in 2026.

SCENESSE efficacy in vitiligo - new cases presented to EADV

Having followed and been an investor in Clinuvel for a number of years, each update on the CUV105 study is promising. The clear visual impact Scenesse implants, along with NB-UVB (Narrowband UV-B) Phototherapy, has on re-pigmentation of the affected skin areas, increases the efficacy, safety and validity of this treatment which increased the probability of commercialisation for treatment of patients who suffer from Vitiligo.

I haven't gone through and updated my valuation after the FY25 results yet, which came in below expectations due to increased spending on a few areas including personnel. However with a warchest of cash ($224m as of June 30, 2025 *which is ~39% of the entire MC), you only have to factor in a small probability of Scenesse's success in the huge Vitiligo for the current SP to be undervalued.

Disc. Held in RL & on SM.

Clinuvel Pharmaceuticals (CUV) reported last week. From their presentation:

I thought this was a pretty good result as seasonally 1H is the weaker half of the year. On a operational level, Revenues increased by 10% compared to the pcp with interest income also boosting revenues due to the large cash balance.

In November 2024, the business decided to refocus into 3 core clinical programs: Porphyria (EPP & VP), Vitiligo and ACTH. With a 4th additional focus into photocosmetics.

To date, only Porphyria is revenue generating with the hope that the other segments will become revenue generating in due course pending results.

Surprisingly, the report did not touch upon anything from the photocosmetics side of the business although they did mention briefly that they are due to release new products in 2026 which contain melanocortins ("M line" products).

Listening into the investor briefing, there seems to be a sense that the business is in some what of a transition phase away from the current Managing Director (Phillipe Wolgen) who was announced to be stepping down but was then extended till June 2026. Normally Phillipe would lead the results but this was instead lead by the CFO and the lead of the clinical programs instead. There was mention that they are not sure how the new CEO/MD will decide to take the business going forward and perhaps this is why the share price has been depressed.

CUV screams cheap on all valuation methods, with a strong balance sheet and no debt, it seems the market is waiting for some certainty as to the future leadership of the business. I will admit that there have always been rumblings of issues behind the scenes and perhaps their inability to find a new MD/CEO may hint at these issues.

Given that operationally the results are still strong, I will continue to hold as I believe the risk/reward proposition still exists. But definitely not as high conviction as I was previously.

Disc: Held IRL and on Strawman.

This is gonna be a little bit long winded and more of a journaling mechanism for my myself so that I don't have to keep looking back through previous reports.

Clinuvel Pharmaceuticals reported their FY24 results last week. From their report:

I thought this was a strong result considering the 1H was relatively weak. Revenue growth was boosted by an increase in interest income although on an operational level, revenue was still up 12.6% if you back out the interest income.

Expenses increased but within the 5 year plan which was forecast in 2020 and due to complete at the end of FY25. So far a total of $125.2m has been spent as part of the plan to spend $175m. A further 3 year plan will be announced later in the year.

The clinical pipeline is unchanged with still a single product currently on market although they have expanded access to Scenesse and expect further expansion in the coming year. Management expect further growth in the US and into Canada as well as a potential entry into the Latin American market through a partnership. This should provide some moderate growth in revenue (I expect similar low double digit or maybe high single digit growth in revenue for the coming FY).

OTC products have had a soft relaunch with 3 product lines that will be available: Protect has 2 products currently available: Cyacelle and Cyacelle Radiant, Preserve will be products which prevent premature ageing through photodamage, and Bronze which will likely provide a pigment. Preserve and Bronze products will contain melanocortins but have yet to be launched. No mention of any sales numbers so I don't expect there to have been many yet.

At the current share price, CUV trades on a PE of around 22x. I think this is reasonable for just the Scenesse for EPP business which should continue to grow at around market rates. Future growth is really going to come from the next indications for Scenesse of which Vitiligo is the closest indication that Clinuvel are working towards for an FDA approval. The annual report did state that By the end of FY2027 we expect to have achieved our product objectives and progressed the conditions to be treated... The treatment of vitiligo offers the prospect of revenues of US$490 - 570 million in the first two years of distribution from the treatment of approximately 6,000 patients. This will transform the financial profile of the Company. Although I have have high hopes that this is met, the continued delay of Clinuvel getting their FDA approval for Vitiligo means that I will be watching with caution as to whether this will be actually achievable. This coupled with the ongoing delay in their launch of OTC products means that it is hard to value these segments of the company at the current stage.

A few comments based on questions from the earnings call.. Clinuvel don't allow analysts to ask direct questions and instead collate and Investor Relations ask the CEO and CFO to comment on the general gist of the questions received.

The CEO was asked regarding why the share buyback program has paused in the last 2 months, of which the CEO quickly said that it is an ASIC rule that buybacks shouldn't occur 2 months prior to results being released. And hence the buyback program should continue shortly now that results have been released.

The CEO was also asked to comment on the news that the Vitiligo study (CUV105) had been amended. The announcement here. He basically said that the study had to be amended as the patients who were receiving the base therapy (no Scenesse) didn't have any motivation to continue the study as they could not see any improvement. This is obviously a negative for the study as without these patients they will not be able to complete the study. However, as an amendment, Clinuvel have agreed to allow these patients to have access to Scenesse post study for 20 weeks meaning that all patient's enrolled in this study will eventually have Scenesse which will enable further data to be generated. Although seen as a negative initially, the CEO did say that this was in fact a positive as it shows the greater efficacy of the combination (Scenesse + UV) in treatment of Vitiligo. This will however extend the study time.

Some things I'm looking for in the upcoming FY that would ensure the thesis is intact:

- Continued growth in their base Scenesse for EPP segment

- Continued development in the other indications for Scenesse understanding that this will still be a few FY away from any concrete results

- A base launch of their OTC products. Management have stated goals of a proper launch in 2025 and for Clinuvel to be a household name in 2026.

Annual Report here

Investor Presentation here

Disc: Held IRL and on Strawman.

Interesting article from ABC news on a potential competitor to Clinuvel:

https://www.abc.net.au/news/2024-05-28/sun-allergy-dan-buss-new-treatment/103780492

No mention of Clinuvel in the article which is surprising given that the treatment is TGA approved and is currently the only treatment available to EPP.

Doing some basic research on Bitopertin, the drug works slightly differently to Scenesse in that it may also aid with preventing liver damage which is a common side effect of patient's with EPP.

Currently the drug is still undergoing trials in Australia and US but represents a potential competitor to Clinuvel in the future.

Disc: Held IRL and on Strawman.

Went through the company newsletter and liked what I saw with the shift to present some targets

...until the comment on the hedge funds about the buyback

Hedge funds are there to hold companies to account, improve market efficiency and public disclosure. For the sake of shareholders, I wished the board would ignore the short sellers and instead focus more on running the company, achieving targets, seeking opportunities and keeping the trials on track. This I believe, will drive the share price and not the buyback.

FYI, the patents protection run out 2027?? From Bell Potter

[held but with not much conviction]

Clinuvel initiates buyback of 1.5m shares

Up around 8% on the news.

Held on ASX comp portfolio only :(

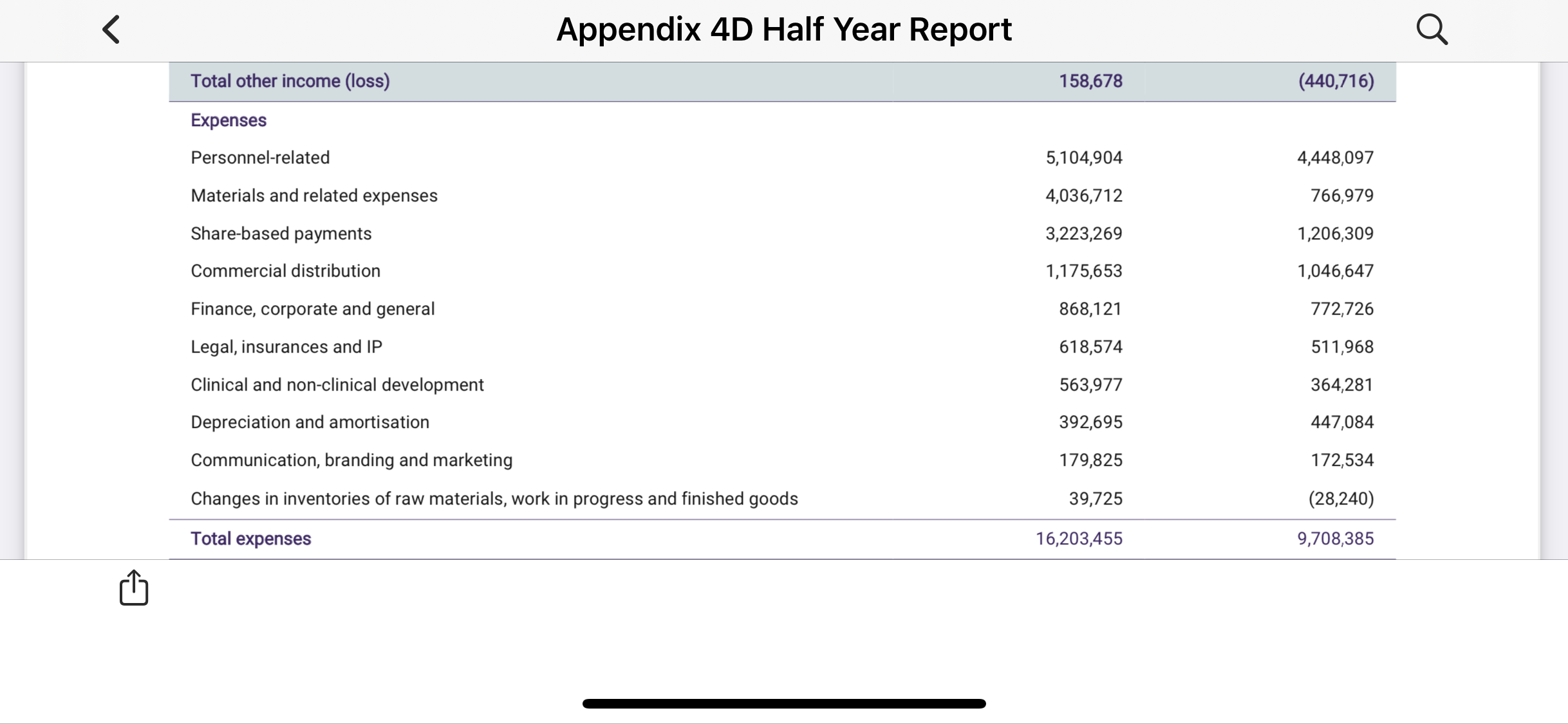

Clinuvel Pharmaceuticals reported last week. From their result:

I'm a little bit on the fence about this result. Top line growth of 10% is not too bad, this does not include the increased interest income gained from their large cash reserve as well. Expenses however increased leading to a fairly flat NPBT result. This was mostly due to an increase in personnel-related costs and share based payments.

On a cash basis, it was still a very strong result. With cash receipts of $43.58m for the half which was another record result. Operating cash flow of $26.38m was a record as well and a very healthy cash balance of $174.5m.

Updated cash flow chart below:

The market did not particularly like the result with shares down 10+% on the day. To be honest I didn't think the result was too bad after digging into the details. Perhaps the market thinks that their growth in their primary revenue generator is slowing however there is still plenty in the growth pipeline in regards to other indications for their Afamelanotide product.

Over the weekend they were also invited to speak at a function hosted by Lady Gaga to increase exposure of the brand name to the wider public. This is to increase their marketability of their OTC products which have yet to be launched publically.

I personally did sell out of some shares in my RL portfolio towards the end of last year as I needed the funds for other investments. But at the current share price I think its starting to look interesting again especially if they manage to complete their clinical trials in vitiligo and properly launch their OTC products.

Disc: Held IRL and on Strawman.

Clinuvel Pharmaceuticals released their FY23 results yesterday:

On the surface it looks like a solid result, and I personally think the result is in line with what I expected.

Revenue increased on the back of increased sales of Scenesse but also the company generated close to $4m in interest due to the large amount of cash on the balance sheet.

NPAT also increased although this was boosted by a negative expense due to an increase in inventory held. This figure was $2.5m at the half year results and increased to over $7m by year end. Backing this out, underlying profit still increased by over 10%.

On a cash flow level, CUV is still very cash generative as shown by their modest increase of cash reserves. Since the company has decided to stop reporting quarterly cash flow statements, I have updated my cash flow chart into half year segments.

Note: For FY23 H2 I have taken out the income tax expense to show a better idea of the underlying cash flow of the business. This is the first period that CUV have had to pay income tax and in future charts I will likely include this back in.

Its a little hard to see the seasonality trend now since they report half yearly, in the past Q1 and Q4 were the more active quarters due to being summer in the northern hemisphere but now that the figures are combined it is difficult to see whether this seasonality still occurs.

I will likely do a separate post on the operational parts of the business reported in the Annual report as to not make this post too long. Although I just wanted to point out 1 thing in the remuneration section that I found interesting:

Digging through to find how much revenue was generated from said product: $0.009m (or $9000). This equates to around 70 bottles of Cyacelle...

Disc: Held IRL and on Strawman

Is this an over-reach by Clinuvel? A red flag in safety of its drug or anti-competitive behavior by a biopharma. An interesting read.

I think it certainly raises some questions.

Clinuvel released an operational update video 2 days ago for those interested:

CLINUVEL Operational Update - YouTube

Some interesting points:

- There was an update on Cyacelle their new OTC sunscreen. Currently being launched in Europe and seems to be well received so far.

- The US currently has 50 centres trained to treat EPP with Scenesse and there are plans to open 70 more centres (up to 120).

- There was talk of a potential NASDAQ listing. If the stock was to change exchanges, then it will not be dual listed but rather a single NASDAQ listing. This is the first I've heard of this.

Disc: Held IRL and on Strawman.

Clinuvel released the first of 4 OTC products yesterday.

Cyacelle is a polychromatic sunscreen which protects skin against UVB, UVA and HEV light. The aim is to provide protection to 3 distinct populations at highest risk of skin cancers and photodamage:

- Longer Term Immune Suppressed

- Patient's affected by skin cancers and their immediate families

- Those who spend extended time outdoors eg. professional athletes, construction workers, farmers etc.

The product will have 2 different distribution methods:

- Distribution through hospitals to patient's suffering with EPP and XP as an adjunct to their normal treatment with Scenesse (Afamelanotide)

- European distribution through an E-commerce platform. A quick check of the website shows the price at 74 Euros from: CLINUVEL Ecommerce Store – Clinuvel

As mentioned above, this product is the first of 4 products due to be released to wider audiences. The other 3 are still in development but will be:

- Reflective and Refractive screens - Ultimate polychromatic Screens

- Melanocortin based emulsions - Assist DNA repair

- Melanocortin based emulsions/lotions - Stabilisation of skin pigmentation

It remains to be seen how successful these products will be. The skin care market is very competitive and so Clinuvel will need to be strategic with the products they launch.

Will keep a close eye on this development with a close attention on the inventory line in future reports. I believe the latest increase in inventory was related to stocking of these OTC products in preparation for commercial launch but details from the last report were scarce.

Full announcement here

The company also announced today that they will no longer be providing quarterly cash flow statements (they were doing so voluntarily since 2018).

Disc: Held IRL and on Strawman.

Clinuvel Pharmaceuticals (CUV) reported their 1H FY23 results last week. From their report:

The headline numbers all look solid for Clinuvel but I think its important to look deeper into the underlying figures behind these numbers.

NPAT was stated at $11.4m representing a 94% increase to PCP however this was boosted by $2.6m of negative expense relating to changes in inventory. The report stated that this was due to there being an increase in the inventory levels. The reason for this increase was to ensure capacity to service out commercial distribution programs in the near term and beyond. Could this be related to the slowdown in cash receipts for Q2 (see my previous straw)? Or it could be related to their new OTC products. Time will tell on this one. Taking out the $2.6m, I'd say underlying operating profit would be around $8.78m which still represents close to a 50% increase in NPAT compared to PCP. Note that 2H is often a stronger half (2H FY22 had over $40m in revenue).

In my last straw I incorrectly stated that the 5 year projected expenditures would be $120m. The correct figure should be $175 in which at the halfway point they have so far spent $62m in expenditure to grow the business. Given that they are FCF positive and have cash balance of over $140m, CUV are well capitalised to continue on this growth trajectory.

I still believe the thesis for owning CUV lies in their ability to expand their pharmaceutical portfolio. I will outline their projects briefly below.

Expanded Clinical Program

DNA Repair Program

- CUV are using their drug afamelanotide to see if it can repair the DNA of skin damaged by UV radiation and visible light.

- They are first targeting individuals who suffer from a rare genetic disorder called Xeroderma Pigmentosum in which individuals have an inability to repair the DNA of UV damaged skin. This places them at extreme risk of developing skin cancers

- Early studies have been positive in showing that the drug was well tolerated and reduced UV provoked skin damage

- 2 Additional studies have been planned

- The TAM for this could be up to 2 billion people globally who are at an increased risk of skin cancer (most likely those with pale and fair skin colour)

Arterial Ischaemic Stroke (AIS)

- Afamelanotide has been shown to offer neuroprotection and be able to act as an anti-oxidative hormone

- A world first study found 5 out of 6 patient's who had suffered a stroke and were given afamelanotide achieved improved scores on the National stroke scale

- Another study is due to begin later this year

Vitiligo

- A condition which affects between 0.1%-2% of the worlds population. The condition affects pigment producing cells of the skin (melanocytes) resulting in patches of lighter and depigmented skin in patients who are of a darker skin complexion

- Initial studies found the afamelanotide along with phototherapy was able to repigment these skin lesions

- Future studies are focusing on patient's of a darker skin complexion and also assessing afamelanotide as a monotherapy due to commence later this year

Over the counter solutions

- As was mentioned in the past year, CUV are expanding into over the counter products

- The first product Cyacelle is due to be released later this year and is a polychromatic solar screen which provides protection to a wider range of UV light compared to most sunscreens currently available

- A second product has also been announced which will manage solar exposure through reflective and refractive properties

- Other products in development include melanocortins that will assist DNA skin repair

- These products are targeted at those with increased risk of skin cancers

Disc: Held IRL and on Strawman.

Clinuvel Pharmaceuticals (CUV) released their 4C today. From their release:

My takeaway:

Bit of a disappointing quarter from CUV and they knew it given they muddled around with the figures in their "highlights" by providing CY figures and not comparing to PCP.

On a PCP basis, cash receipts were down compared to this time last year ($13.12m cash receipts and $5.746m Operating cash flow).

Given their product (which targets individuals with sensitivity to sunlight), a weaker quarter was expected (they have a strong seasonal bias towards Q1 and Q4 which is the Northern Hemisphere Spring and Summer quarters). And perhaps they had a lot of brought forward sales given Q1 was very strong. I think they should still have sales and profit growth for the FY however.

Expenditures which are expected to be $120m for the 5 years FY21-25 increased to $62m. The amount of expenditure decreased compared to last quarter perhaps as a result of decreased cash receipts and prudent capital management.

Cash balance increased again and is now at $140m which provides them with plenty of cash to continue on their growth trajectory.

Overall despite a disappointing cash quarter, it seems that their projects are progressing well and they are diversifying their pharmaceutical portfolio which should provide profitable benefits in the long term.

Will update valuation and provide more detail at HY results.

Disc: Held IRL and on Strawman.

Clinuvel Pharmaceuticals (CUV) released their quarterly report a few days ago. From their release:

Another record quarter in terms of cash receipts. Q4 and Q1 are seasonally the best quarters due to them being the Spring and Summer months in the Northern Hemisphere.

Expenditures are increased compared to past quarters but this was expected as the company expects to need to spend $175m in the 5 years up to June 30 2025. So far $55m has been spent with an expected $120m to be spent subsequently in upcoming years. Cash balance has increased to $137m+ so the company is well funded to continue on this growth trajectory.

I will post a separate straw in regards to progress with their other products shortly.

Disc: Held IRL and on Strawman.

Update 14/09/2022

Updating based on learning more about the company as well as FY22 results

Assuming 20% pa revenue growth for 5 years and the net profit margins stabilising at around 25%. I can see the company generating around $40m NPAT in 5 years time.

Applying a 40x PE to those earnings and discounting back 10% pa would give a valuation around $18.60.

I see this as more of a buy price if I were to top up my holdings.

Disc: Held IRL and on Strawman

Original Valuation

Clinuvel Pharmaceuticals (CUV) is a company that operates in a very niche area of healthcare. Their product "SCENESSE" (afamelanotide) treats a rare disorder called erythropoietic protoporphyria (EPP). Patients who suffer this condition are very sensitive to sunlight causing extreme pain.

CUV has been profitable since FY17 and have grown NPAT from $7.2m in FY17 to $24.7m in FY21. Excluding FY20 which was affected by Covid-19. NPAT has grown at over 30% YOY.

If we assume modest growth of 20% for FY22, NPAT would come in at approximately $30m. CUV has historically traded at PEs of between 40x and 120x. If we apply a fwd PE of 40x, this gives a valuation of $24.29.

Currently CUV are trying to develop and expand use of their drug into unmet medical areas which may further improve their growth prospects. However as with a lot of biotech companies this would come with risks of having to go through lots of trials which may increase cash burn. That being said, I believe CUV represents an interesting proposition of them having a very successful and highly cash generating drug and the potential to use that cash to increase the use case of their drug. Instead of coming to the market to fund their development.

At the current share price ($22.66) I will likely have a starter position in the next coming days in order to follow this company more closely. Will unlikely add to Strawman portfolio as I have run out of straw dollars :')

Disc: Not held at time of writing but will likely be buying in the next few days/weeks.

Been a bit busy with work lately so haven't had a chance to read through the FY22 results and Annual Report until now.

FY22 Results:

- Revenue = $65.72m (up 37%)

- NPBT = $34.32m (up 33%)

- NPAT = $20.88m (down 16%)

As expected NPAT has decreased YoY due to utilisation of tax credits in previous years. Net Profit margin has also fallen to around 32% and I expect this will continue to fall slightly as the company finishes utilising tax credits. There will also be an increase in planned expenditures in the coming years.

On a cash flow level, this has been very strong with FCF of around $39m generated (this has already been stated in their quarterly cash flow reports) providing them with a cash balance of over $120m. Management have said that they like to have this cash buffer available given current economic uncertainties but may also utilise the cash for future expansion and potential acqusitions.

The pipeline remains strong for their core product Afamelanotide with further clinical studies to determine its efficacy in treating other diseases apart from EPP. These are still early stage and I expect the majority of the growth to come from their treatment of EPP as they continue to expand into new territories and also increase the number of patients treated.

Some new over the counter products are also in development for high risk individuals and these will be launched in the coming FY. Management have hired ambassadors to try and promote their products. I don't expect anything material in the coming FY from this segment of the business but could be an area to keep an eye on.

Overall I am happy with how the company has performed in the past FY and expect further growth to occur in the next few years. Clinuvel remains an interesting biotech company given they have an existing successful product and are using that to fund other projects to stimulate further growth.

Will update valuation later to reflect these results.

Disc: Held IRL and on Strawman.

Firstly, massive thanks to @Vandelay for suggesting a meeting with Dr Wolgen and also @Strawman for organising the meeting. Was certainly very insightful to hear his insights into his company and also the pharmaceutical industry in general.

Just wanted to post this straw as a response to the meeting but also general commentary around the company. It was great to hear CUV discussed in various podcasts given it is quite under covered by general analysts.

Clinuvel Pharmaceuticals' main source of revenue is through its product SCENESSE® which is used to treat Erythropoietic Protoporphyria (EPP), a rare disease in which affected individuals have an increased sensitivity towards sunlight. Scenesse is given as a subcutaneous (under the skin) implant and the recommended dosage is every 2 months. The cost per implant is approximately $50,000 although this varies depending on geography and healthcare rebates.

For ease of calculation, I'm going to assume that each implant cost $50,000.

Although the medication is recommended every 2 months, most patients undergo the procedure 2x a year usually during Spring and Summer months when sunlight is at its strongest and hence the cost per patient per year is around $100,000. This cyclicality is shown in their quarterly results in which Q4 (March-June) and Q1 (July-September) are the most productive quarters due to it being Spring and Summer in the Northern Hemisphere. Given the need for patients to continually have a new implant placed, this gives Clinuvel basically recurring revenue every year, provided that the patient wants to continue with the treatments of course.

In FY21, Revenue came in at around $48m. So by basic calculations equates to around 480 patients treated for the year. Results for FY22 are yet to be released at the time of me writing this straw but based on their quarterly results, I expect that revenue may grow by as much as 50% to around $72m, so around 720 patients treated. I believe long term they should be able to target 1000+ patients treated per year. This would represent around 1% of people affected by EPP worldwide.

Now just commenting on net margins. In FY21 they reported net margins of over 50% (Revenue of $48m, NPAT of $24.7m). However this is misleading given that CUV had tax losses to utilise from the past and thus only paid income tax at a rate of around 3.8%. I expect that this will increase going forward, and was already shown in their 1HFY22 results in which there was income tax paid at a rate of around 30% which ended up decreasing net margins to around 23.5%. This is where I believe their true net margins will stabilise going forward. So on revenue of around $72m for FY22, NPAT should be around $17m. Still impressive for a pharmaceuticals company. And as Strawman likes to say, paying more tax just means you're making more money.

With that being said, I am expecting NPAT to drop in the upcoming results given their increase in tax requirements which would put them on a PE of around 60x. You could argue that this may be expensive but the company has grown revenue by 4-5x in the last 5 years with still a long runway for further growth. I am also expecting their dividend payout to increase given the amount of FCF they have generated in the past year (And Dr Wolgen also noted that this may be the case in the meeting).

Going forwards, CUV are expanding their product set into other areas including over the counter (OTC) products. I personally don't mind this pivot given the amount of cash they are already generating from Scenesse. Still very early stages and as Dr Wolgen stated, not expecting to contribute much towards revenue in the coming FY but certainly an area to keep an eye on.

For me, the thesis would break if a successful competitor manages to take significant market share. Or if they spend too much money chasing other avenues of growth. I don't see this occurring in the near term and therefore am happy to hold long term and see how it plays out.

Disc: Held IRL and on Strawman.

[Disc: held IRL]

Graham Witcomb's recent write up on CUV over at Intelligent Investor is worth a read for those with an account (free to create). Of particular note is Graham's commentary on emerging drug "dersimelagon" which is in phase III trials and which "... works in a similar way to Scenesse but – critically – is administered as a convenient once-a-day oral tablet."

I haven't yet had a chance to do any significant digging of my own so no further insights to add at this stage, but definitely something to be aware of and keep an eye on.

Clinuvel Pharmaceuticals reported their quarterly for FY22 Q3 today. From their release:

Note: CUV are not required to report quarterly anymore but do so to update their investors.

My takeaway:

Another solid quarter from CUV with record cash receipts when compared to Q3 in the past. Cash expenditures are elevated as was flagged previously by management due to their increasing investment to diversify their product mix. Q3 is historically a slow quarter and I have graphed out their cash flow from the past 4 years below.

Cash balance has hit $100m for the first time providing them with good reserves for future investment. If the trend continues then we should be expecting quite a bumper Q4 and Q1 coming up so will be watching on with interest.

Disc: Held IRL and on Strawman.

Clinuvel Pharmaceuticals released an update to their clinical study of using Afamelanotide in stroke patients.

From their release:

- First use of afamelanotide in arterial ischaemic stroke (AIS) patients

- Drug well tolerated

- Five of six patients showed improved neurological functions (NIHSS scores)

- Final results on day 42 of the trial to follow.

CLINUVEL today released positive preliminary results from its pilot study (CUV801) in arterial ischaemic stroke (AIS), evaluating afamelanotide in six adult patients. The trial focused on the safety of multiple afamelanotide doses and patient recovery over 42 days, using the National Institutes of Health Stroke Scale (NIHSS1 ) and brain imaging (CTP and MRI).

“This is the first time that a melanocortin has been administered to stroke patients. No adverse drug reactions were reported, and a meaningful improvement was seen in five of the six patients’ health by day 8,” CLINUVEL’s Head of Clinical Operations, Dr Pilar Bilbao said. “We are awaiting the results from the final evaluation of the patients at day 42, which will give us further data on afamelanotide as a possible treatment for this life-threatening disease.

Encouraging to see some good preliminary results in a new vertical that CUV are trying to explore with their current product. However this is still very early stage.

Full Announcement: 4570kcm7mvs2cg.pdf (asx.com.au)

Disc: Held IRL and on Strawman

@BoredSaint shared Clinuvel’s 1H22 results yesterday and the results seemed OK.

I’ve had CUV on my watch list for a while now. It’s an interesting, profitable, high growth biotech which is exploring other uses for its key formulation afamelanotide. If some of these other options are successful it could be a game changer for the company.

With the share price down over 15% to $18.70 today after what seemed to be a reasonable result, I was tempted to take a ‘nibble’ as it would be described on “The Call”.

After delving a bit deeper into the P&L, I’ve now changed my mind. While the highlights for the half year looked good, the increase in expenses, particularly the materials is frightening! ‘Expenditures on essential materials and related expenses increased 426%, from $0.767 million in H1-FY2021 to $4.037 million in H1-FY2022’

While the company was blaming income tax related expenses to the 10% decline in EPS, I think material expenses are the biggest concern going forward.

Analysts on SWS had forward FY22 EPS at 55 cps. With 1H22 earnings at 11.9 cps it seems very unlikely forecast full year earnings can be achieved.

I’ll be keeping Clinuval on my watch list until the 2H22 results are released.

See the P&L In the 1H22 Report , and extract on material expenses below:

“Materials and Related Expenses

Materials and related expenses primarily reflect purchases to support the acquisition of materials used in the production of finished product by the Group’s contract manufacturers and other materials purchases related to the development programs. Expenditures on essential materials and related expenses increased 426%, from $0.767 million in H1-FY2021 to $4.037 million in H1-FY2022.

The Group engaged its contract manufacturer during the reporting period to undertake a number of batch manufacturing campaigns to meet longer term commercial demand, as well as to meet the forecasted clinical supply needs of the expanded R&D program. The increase in the volume of manufacturing campaigns with lower than anticipated yields contributed to the significant increase in materials and related expenses reported. Further campaigns to manufacture finished product are intended in the remainder of FY2022 and beyond.

Other material and related expenses include purchases of both raw material peptide and excipient material in support of the manufacturing campaigns. Other expenses in H1-FY2022 that were absent in the pcp include materials and related purchases on PRENUMBRA®, the liquid drug delivery formulation of afamelanotide.”

Clinuvel Pharmaceuticals released their 1H FY22 results today. From their release:

NPAT was down 10% as a result of PCP having a tax benefit. On an NPBT level they are up 50% on the PCP.

Overall I think this was a pretty good quarter from the company. They are using their main product, Afamelanotide, as their foundation product to branch into a more "diversified and sustainable speciality pharmaceutical". Since FY21 they have been implementing a new strategy of growth in which they have stated are the following objectives:

- Grow commercial operations based on the pharmaceutical drug SCENESSE® for EPP patients;

- Develop innovative melanocortin products to treat a range of indications with an unmet medical need;

- Commercialise non-prescription healthcare solutions (dermatocosmetic products) to a wider population at highest risk of skin cancers due to the long term exposure to ultra-violet (UV) and high energy visible light; and

- Increasingly integrate critical parts of the value chain ‘in-house’

I think the next few years represent an exciting period for the company. However as with all biotech and pharmaceutical companies this isn't without risk. Management have had a very good history of good control of expenses whilst developing their main drug and so I do have faith in the management team to be able to implement this strategy without the need for external funding. The last few years have generated enough cash for this expansion to occur.

I will maintain my valuation on Strawman for now. 2H is usually a much stronger half for CUV as shown in their table below.

Disc: Held IRL, not helf on Strawman

4th June 2019: From Moelis Australia: CLINUVEL PHARMACEUTICALS LTD (HOLD)

"Minimal concerns over FDA delay" - http://research.moelis.com.au/ResearchPortal/DownLoad?E=behbkccbd

Price Today (07-Jun-19): $31.69.

Moelis Target Price: $26.43. (Lower than current SP).

Disclosure: I don't hold.