Whilst not an investor, I find Domino's Pizza an interesting company as a franchisee.

Fast food companies, even those that find a special low-cost niche such as Dominos are significantly impacted by market cycles. Fortunately, Dominos has built themselves a good moat with their technology (OneDigital) and ability to deliver a hot pizza quickly at market beating prices, but they too are suffering.

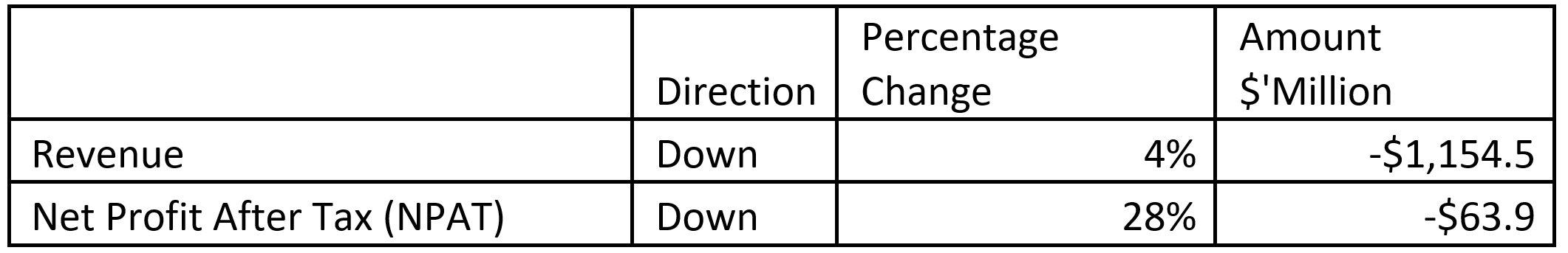

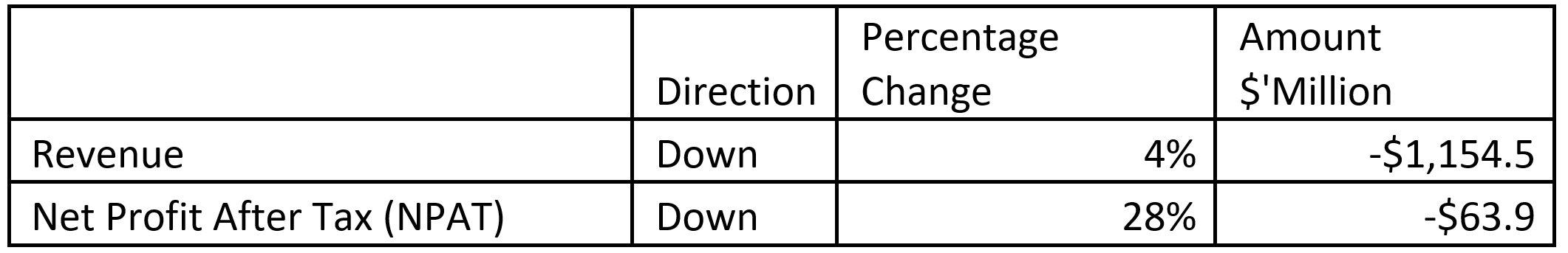

In their first half report released in February, they made the following comparisons with the same period in the last financial year.

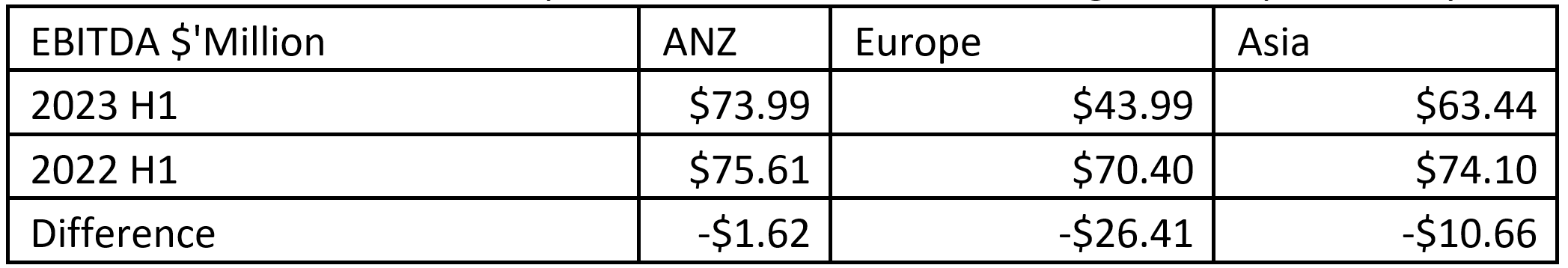

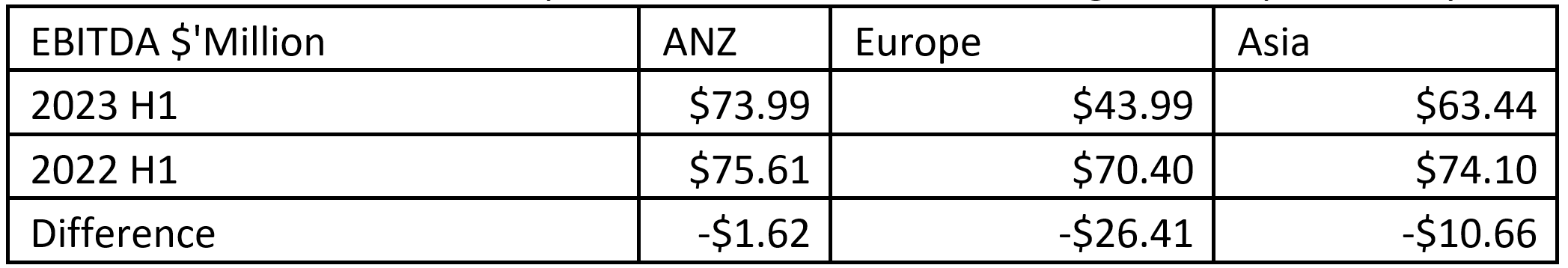

They operate in three broad regions: ANZ, Europe and Asia.

You can see from their market segment data that whilst ANZ performance is relatively flat (only a reduction of EBITDA of $1.62), but for Europe and Asia, the reduction is significant, particularly in Europe.

During the 2023 H1 period, they acquired Dominos Malaysia and Dominos Singapore, this is subsequent to their acquisition of Taiwan in 2021. They’ve also acquired Domino’s Cambodia in May this year.

Tuesday 2 weeks ago(13th June) they announced that they’re going to leave the Danish market (27 stores) and engage in a general optimisation program of their store network (closing underperforming stores). They estimate that this will improve EBIT by circa $30m in FY24 and deliver even bigger savings in future. Group CEO Dom Meij’s focus is on using this point in the cycle to focus on unifying their businesses and adapting global best practises and sharing more global services across the group.

This is a company that has dumped David Burness who has arguably made some poor investment decisions over his tenure of the ANZ business. He is being replaced by the APAC CEO Josh Kilimnik, and Don is bringing in his sister Kerri Hayman into COO role. Kerri used to work in her brothers store and currently owns 14 stores in the US which she will sell.

Whilst the unit economics involved are simmilar across all businesses, market sentiment to the category changes along with geography, culture and history. Look at Denmark for example, this business was bought as a distressed asset at a low price due to previous owners' regulatory failures. The ANZ franchise has not been able to turn negative perceptions around sufficiently to revive the brand there. Even with this aside, other Europan regions aren't loving Pizza as much as we do here in ANZ (note that UK is not part of the ANZ franchise).

Their opporutnity is to leverage consolidate their shared services across regions and acquistions. They've been very slow to do this. This will extend from their operating technology applications like OneDigital which provides the e-commerce eperience right though to back office IT, HR, Finance operations. As these crtical business operations services mature and start to rationalise and drive costs out, we'll see better performance in EMEA and the APAC businesses.

Not one i'll be investing in but certainly a great journey to follow.