Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

https://www.afr.com/street-talk/bain-capital-considers-domino-s-buyout-in-deal-worth-up-to-4b-20251028-p5n5u1

Jack Cowin's $5m buy a couple of months ago turned out to be a good insider signal after all, one I didn't follow unfortunately.

"The higher a monkey climbs a tree, the more you can see his ass" is attributed to oil investor T Boone Pickens. This also aptly reflects investing's holy grail: competitive advantage; something highly prized by the Strawman community.

Achieving it is immensely difficult; holding it is even harder, as competitors conduct a 360-degree analysis of the company holding that advantage—ass included!

Morgan Housel is one of my favourite business writers because of his unusual, quirky and thoroughly ‘bang on’ perspectives. On the subject of competitive advantages, he offers unique insights that shed light on the elusive nature of sustaining an edge over competitors, and it's damn difficult. He cites a horrifying statistic - 40% of all USA-based public companies lost all their value from 1980 to 2014! He uses Sears Roebuck as a prime example where his five BIG things, which eat away at competitive advantages, were present.

Let’s examine them using a current falling star – Dominos Pizza (DMP):

(1) Overconfidence and a belief that success in one specific field is automatically transferable to others. Sears couldn’t replicate its winning retail advantage in banking, insurance, and other areas. Could this be DMP and its aggressive international push?

(2) Misunderstanding the ‘growth leads to success’ mantra, which leads to a small, nimble company becoming a large company where an entirely different managerial skill set is required. The Peter Principle is the organizational manifestation of this point. Again, DMP!

(3) Sometimes, those who gain a competitive advantage are satisfied with fame, money, or success and become unwilling to defend what they’ve built. Was Don Meij’s pullback in 2024 a precursor here?

(4) Inability to adapt to new conditions. Sears failed to recognize that changing US economics led the wealthy to exclusive brands and most consumers to budget retailers like Walmart and Kmart, thereby hollowing out the middle. Has DMP misread its various international markets in this vein?

(5) Competitive advantage can come from being in the right place at the right time, which inevitably ends. Think of Kodak and digital photos. No question about it, DMP was in the right place at the right time.

With these pointers in mind, perhaps one can begin to form a view of when a competitive advantage might be coming to an end. For instance, do the living habits and share sell-downs by, say, Richard White of WiseTech Global indicate a potential “coming to an end” of its competitive advantage?

Likewise, does the recently announced retirement intention of Scott McMillan of Alliance Airlines, and the last of the founding directors, indicate a loss of sharpness that made AQZ an industry leader?

Food for thought & watch that monkey!

Just listened to @Strawman on the Motley Fool podcast discussing Domino’s Pizza Enterprises (DMP) and its current top level valuation. It prompted me to take another look after several years, when things were a lot different. I’ll be delving into it this week. Some initial thoughts below.

It reminds me a bit of something I once heard in sports betting. There was a professional gambler who made a lot of money betting on former champions when they were down during a match, with a belief that the market often miss prices champions when they're down. Maybe that applies here. Maybe not. But worth a closer look.

When I last looked at this several years ago, the management team seemed to have the golden touch with overseas expansion, and the Australian business was going from strength to strength. They were growing earnings strongly every year and appeared to have a long growth runway ahead.

I gave them the benefit of the doubt at the time, based on their short term success. But in hindsight, an Australian licensee of an American pizza brand trying to take pizza to Asia and Europe was kind of strange. Hindsight is a great thing!

Just some initial thoughts on how I plan to approach Domino’s valuation:

• The different trajectory of each regional business probably calls for a sum of the parts approach rather than looking at it as a blended whole

• What I’m understanding at the moment is that they’ve got a successful Australian business that could potentially be valued using more straight forward methods, and who knows, may alone be worth a fair portion of the current market cap and a struggling group of international businesses where the value is much harder to pin down

• I wonder if those offshore operations should be treated more like options; potentially valuable, but also at risk of being worth little or even costing money to unwind

• Another thing that needs to be considered is their franchise model. Most of the stores are not company owned, which changes the risk profile, and puts an added level of risk on the debt. Should a franchisor, already operating with high leverage from the business model itself, really be carrying this much debt?

• How much is the whole model at risk if Domino’s can’t ensure their franchisees are making money? That feels like the real point of fragility.. RFG's story comes to mind!

I welcome any input.. Could just be another stone to turn over but the natural contrarian in me is eager to take a look.

Is director John Cowin signalling a bottom on this train wreck?

335k shares acquired @ $15.11, for a ~$5m outlay.

wow, literally like the #tag

Domino's is down 15% on news that the new CEO is stepping down after only 8 months. That means it's down 90% from it's Sep 2021 peak and down 75% over the last 5 years. Always have to be wary of catching a falling knife, and it's outside my wheelhouse, but it's still profitable and I'm sure there is a good business in there somewhere.

When does it become good value? Maybe when it halves again.

When

When

Big move for Domino’s today, up 22% on their latest trading update.

H1 earnings still expected to be within guidance range ($84-86m NPBT) -- although that's down from $89.6m in the pcp.

But market no doubt encouraged by same store sales turning positive after a rather rough patch. Also, some big cost-cutting moves and a massive pull back in the Japanese market seen as a good thing. That's expected to add $15.5m in savings -- which is pretty big. Probably the right move, but be aware there will be "one off" cash costs of $37m, and a further $60m in writedowns... ouch)

Also good to see divvies maintained while net debt reduced.

The narrative seems to be that Dominos is (finally) becoming a a leaner, more profitable business. Maybe it works, maybe it doesn’t. Too early for me to take an interest, but worth keeping an eye on.

Also, this was a great point from Steve which i hadn't ever thought of before:

"Domino’s Pizza Enterprises has appointed 36-year brand veteran Kerri Hayman, group chief executive Don Meij's sister, to the top job in Australia and NZ."

Like to think this is on merit but really...

The widely expected earnings downgrade is here. It's a shame management didn't manage expectations earlier and fess up to it.

The ambitious store roll out has been pared back with more store closers (no net growth), and the long-term 2033 target of nearly doubling their current network to 7100 stores will not be reached by 2033. Again, the admission is too little, too late as the share price damage has already been done.

Dominos is following in the footsteps of Nanosonics with shares down a brutal 30% today. For many of us in microcap land these kind of drawdowns aren't that rare, but we're talking about multi-billion dollar companies here!

Amazing.

After market close yesterday, the pizza maker reported a 1.3% lift in same store sales, and a 8.8% jump in total network sales for the first half.

BUT, things weren't great in Asia which reported a 8.9% drop in same store sales, and a 1% pull back from the preceding half. Moreover, pre-tax profit for the first half is expected to be between $87-90m, a 15%-odd drop from the previous corresponding period (but up a bit on H2 FY23).

The company is talking about cost cutting, and was quick to point out that Aus/NZ had its best period in 6 years. Still, the market isn't having any of it.

On a trailing 12 month basis, the company has a PBT of about $163m. Let's call that $114m in net profit. So prior to today, shares were on a P/E of 44x, and are (at time of writing) on a trailing P/E of about 31x.

That seems tame relative to the Nanosonics' multiple, but it's another sign that the market has no tolerance for growth stocks that aren't, well, growing..

Interesting article about Dominos rolling out improved tech in Singapore. Could be a trial for other (similar sized) markets, although their 'fortress strategy' might mean this is possible in many of their markets.

https://www.prnewswire.com/apac/news-releases/dominos-dxb-marks-the-future-of-delivery-301989980.html

The logical next step to this might be to send the pizza out raw and have it cooked on the back of the bike with pedal power by the time it arrives.

Reminds me of the debate a few years ago as to whether Dominos was a pizza company or a tech company.

Lots of talking heads flapping their gums over that nonsense at what must have been a relatively quite time in markets.

I even heard one fund manager saying they were looking to eventually use drone delivery (when that was a hot topic) to fly the slice right into your mouth!

Disc: Held.

Whilst not an investor, I find Domino's Pizza an interesting company as a franchisee.

Fast food companies, even those that find a special low-cost niche such as Dominos are significantly impacted by market cycles. Fortunately, Dominos has built themselves a good moat with their technology (OneDigital) and ability to deliver a hot pizza quickly at market beating prices, but they too are suffering.

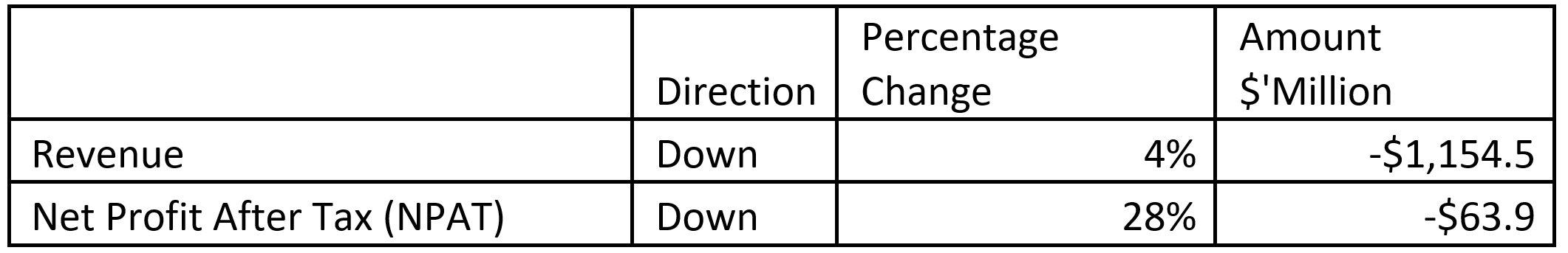

In their first half report released in February, they made the following comparisons with the same period in the last financial year.

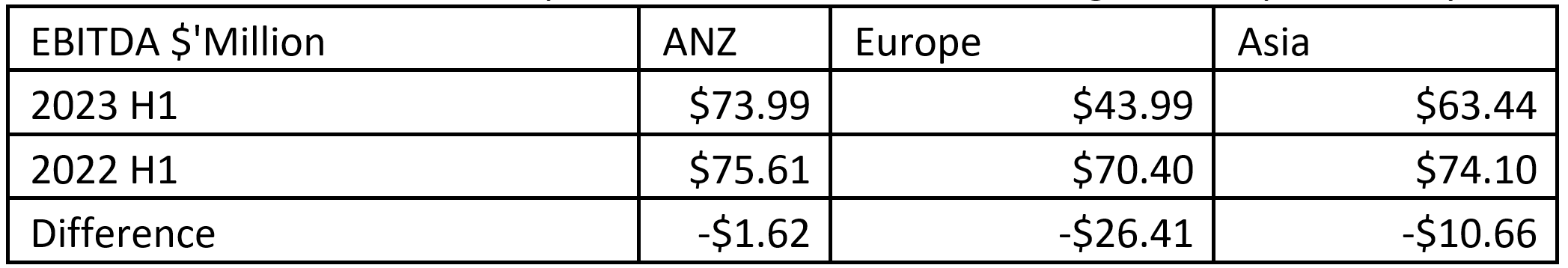

They operate in three broad regions: ANZ, Europe and Asia.

You can see from their market segment data that whilst ANZ performance is relatively flat (only a reduction of EBITDA of $1.62), but for Europe and Asia, the reduction is significant, particularly in Europe.

During the 2023 H1 period, they acquired Dominos Malaysia and Dominos Singapore, this is subsequent to their acquisition of Taiwan in 2021. They’ve also acquired Domino’s Cambodia in May this year.

Tuesday 2 weeks ago(13th June) they announced that they’re going to leave the Danish market (27 stores) and engage in a general optimisation program of their store network (closing underperforming stores). They estimate that this will improve EBIT by circa $30m in FY24 and deliver even bigger savings in future. Group CEO Dom Meij’s focus is on using this point in the cycle to focus on unifying their businesses and adapting global best practises and sharing more global services across the group.

This is a company that has dumped David Burness who has arguably made some poor investment decisions over his tenure of the ANZ business. He is being replaced by the APAC CEO Josh Kilimnik, and Don is bringing in his sister Kerri Hayman into COO role. Kerri used to work in her brothers store and currently owns 14 stores in the US which she will sell.

Whilst the unit economics involved are simmilar across all businesses, market sentiment to the category changes along with geography, culture and history. Look at Denmark for example, this business was bought as a distressed asset at a low price due to previous owners' regulatory failures. The ANZ franchise has not been able to turn negative perceptions around sufficiently to revive the brand there. Even with this aside, other Europan regions aren't loving Pizza as much as we do here in ANZ (note that UK is not part of the ANZ franchise).

Their opporutnity is to leverage consolidate their shared services across regions and acquistions. They've been very slow to do this. This will extend from their operating technology applications like OneDigital which provides the e-commerce eperience right though to back office IT, HR, Finance operations. As these crtical business operations services mature and start to rationalise and drive costs out, we'll see better performance in EMEA and the APAC businesses.

Not one i'll be investing in but certainly a great journey to follow.

Update - 02/03/2023

Domino's 1H FY23 report was quite poor and punished by the market. I think the market's reaction was surprising given that at the AGM last year they did warn that they could see that this half would be weak. Shares did fall at the time down to around $50 before running back to $70 as the market seemingly forgot about this profit warning.

I did buy some shares at around $50 last year before selling after the profit warning was given and so I do not currently own shares.

EPS for 1H FY23 was 73.5c. EPS has been declining since the covid "boost". Although I do believe as they begin to grow their expansion, this can recover.

Doubling 1H FY23 earnings and giving them a PE of 25x (decreased due to a slow down in growth) gives them a valuation of $36.75

Disc: Not held.

Original Valuation - 07/09/2022

Just a simple 30x PE for now as I look further into the company.

FY22 NPAT of $158.7m

EPS: $1.83

30x PE = $55

DIsc: Not Held

After Domino's released 1H23 results (and the share price taking an almost 25% haircut so far today) here are some of the broker (investment bank) early views:

JP Morgan: Overweight with a 12m Price Target of $85

Key positives: 1) ANZ solid result. With fewer headwinds in Australia, Domino’s is seeing solid sales and earnings results, with -0.3% network sales growth and +5.2% EBIT growth. Project Ignite has driven a step up in store openings

Key negatives: 1) Response to inflation not resonating. Price rises have led to customer counts below expectations since December 2022, resulting in further work to do in order to “balance the value equation”. 2) Store growth run-rate behind >8% target. Domino’s opened just 79 stores organically in 1H23, with management noting new store additions may be below the 8%-10% p.a.growth target in next 3-5 years depending on franchisee sentiment. We forecast 7.0% organic store growth in FY23. 3) Franchisee profitability is now below pre-COVID levels, as EBITDA per franchisee has fallen to $101,100, a 7.5% EBITDA margin in the 12mths to September 2022 vs. $103,900 in the 12mths to September 2019

Outlook and Guidance: The 6 week trading update was soft at -2.2% YoY, implying 3.9% p.a. CAGR vs. pre-COVID levels. This reflects an improvement from the ~4% p.a. exit run-rate in 1H23. In FY23, management now expects SSS to be below the 3% - 6% target range in their 3-5yr outlook, and new store openings “may be below” the 3-5yr outlook of +8% - 10%. Labour and commodity pressures are expected to persist at a less intense level in FY24

Likely change to consensus: Large downgrades are expected given the softer sales outlook and admission that network expansion will below targets. Further investment in the health of the Franchisee may be required

Morgan Stanley: Also Overweight with a Price Target of $85

Miss driven by lower sales in Asia and lower margins in Europe

Key Points:

Group SSS growth of -0.6% vs Cons. at +0.8%. ANZ +1.7% (vs Cons at +3.4%); Europe +0.3% (vs Cons at -0.5%) and Asia -6.6% (vs Cons at -2.9%)

EBIT margins: ANZ 15.7% (+80bpts YoY, vs Cons at 15%); Asia 9.4% (- 90bpts YoY, vs Cons at 10.7%); Europe 7% (-670bpts YoY, vs Cons at 8.9%)

Franchisee margin 7.5% (vs 9.8% @ 1Q22 and 10.3% @ 1Q21)

Guidance:

First 7 wks sales growth of +4.2%; SSS growth -2.2% (vs pcp of 1.7% and 2H22 of -4.3%)

FY23 SSS growth will be below annual 3-5 year outlook of +3-6% (vs Cons. 2.8%)

New store openings may be below 3-5yr outlook (vs Cons. 6% & 1H23 +2.1%)

Removed prior guidance “FY23 NPAT excluding ~A$7m FX headwinds expected to exceed FY22 NPAT”

UBS: Buy with a 12m Price Target of $78

ONE LINER

1H23 below UBSe & mkt due to Asia & Europe; 2H23E SSSg to be below 3-5yr outlook

UBS COMMENT

1H23 result below UBSe & mkt, especially SSSg in Asia and EBIT for Asia & Europe (vs mkt). Sales to start 2H23E subdued, resulting in 3-5yr outlook targets to not be achieved in SSSg and that new store openings will not be achieved either. Given 2H23E sales headwinds and weaker 1H23 NPAT, we see downside risk to FY23E NPAT guidance

I understand it us hard to time, and they probably didn't know the put call was coming? but makes you wonder why they would raise capital when the share price has fallen from the lofty levels of over $160 a share to now.

45jb3f5gf5s9fl.pdf (asx.com.au)

Never held as still can't get over why it is so succesful.

Network sales: +11.1% to $2.05b

• Online sales: +11.5% to $1.6b

• EBIT: -5.7% to $144.7m

• Underlying NPAT (after Minority Interest): -5.3% to $91.3m

• Asia: Added 10th market (Taiwan +156 stores) and added +87 organic stores. Sales grew +16.4% despite lifting of State of Emergency in Japan. EBIT -17.3% reflecting rebasing of Japan sales and accelerated corporate store openings compressing margins

• Europe: Regional sales (+11.9%, to $796.7m), with franchisees rising to COVID conditions by growing delivery sales through improved execution. EBIT grew +11.5%, to $49.7m

• ANZ: Multiple stores set records as Network Sales grew (+6.4% to $689.6m). EBIT -6.1% to $60.3m reflecting investment in franchisees (Project Ignite ~$6m) and temporary closure in New Zealand.

Domino’s Pizza Enterprises Ltd (ASX.DMP) is planning a record Full Year expansion of its store network2, as the Company and franchisees reinvest in their shared, long-term strategy.

In the first Half, the Company and its franchisees added +285 stores, (+156 acquired in Taiwan, +129 organic), and is on track for a ~500 store expansion3 this financial year.

Asia added +87 organic new stores, including +5 in Taiwan, Europe expanded by +39 stores, and Australia/New Zealand added +3 new stores. Following the commencement of Project Ignite, 19 corporate stores in Australia were refranchised to existing store managers and franchisees.

Group CEO & Managing Director Don Meij recognised the ongoing efforts and performance of more than 80,000 team members and franchisees, who had served their communities in some of the most challenging conditions the COVID-19 pandemic has imposed so far.

Despite the ongoing effects of COVID-19 in each of Domino’s 10 markets, Domino’s has reiterated the Company’s long-term store milestones, 3-5 year outlook for new stores openings (+9-12%) and same store sales (+3-6%), noting sales growth this year is expected to be slightly below this range.

Domino’s H1 earnings results were lower than the prior comparable period largely due to investments in Project Ignite (ANZ) and a rebasing of sales in Japan in Q2. The latter followed record growth that meant Japan same store sales remained +40% higher compared to pre-COVID-194.

Just two years after Domino’s served $3 billion in global food sales ($2 billion online), the Company expects this year to reach $4 billion in global food sales, with more than $3 billion online.

“It remains our intention to deliver another strong year of profit – a result of our long-term investments that accelerated during COVID-19,” Mr Meij said.

Pretty savage reaction to the earnings miss. Fallen now from a very inflated high of around $167 a few months ago. I’ve found it hard to value this one. Global growth company with a good track record and seemingly a long runway ahead but missed expectations a couple of times in a row now.

Disc: Not held but on watchlist

Domino’s Pizza Enterprises Ltd Financial Results For the six months ended December 2020

Global Food sales of $1.84b (+16.5%) | Half Year EBIT1 $153.0m (+32.3%)

Highlights

~ Network sales: +16.5% to $1.84b

~Online sales: +25.4% to $1.42b • EBITDA: +23.8% to $218.7m

~ EBIT: +32.3% to $153.0m (International EBIT: +55.7% to $99.9m: 65.3% of Group EBIT)

~ Underlying NPAT (after Minority Interest): +32.8% to $96.2m

~ Free Cash flow: up +50.3% to $124.4m

~Japan: Management and franchisees have accelerated new store openings (+68) and sales (+42.6% to ¥36.7b) through new customers and higher frequency, lifting EBIT +112.3%, to ¥4.2b

~ Europe: Regional sales (+13.8%, to €435.7m), reflected local COVID conditions and management response. Positive in all countries led by notable growth in Germany. EBIT grew +18.2%, to €27.2m

~ ANZ: Experienced franchisees grew sales (+5.7% to $648.0m) and expanded their businesses with new stores and refranchising of corporate stores. Improved margins lifted EBIT +9.8% to $63.7m

24-Apr-2020: COVID-19 Update No.4

25-Mar-2020: COVID-19 Update No.3

19-Mar-2020: COVID-19 Update No.2

16-Mar-2020: Update on COVID-19 (No.1)

Disclosure: I do NOT hold DMP shares.