Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

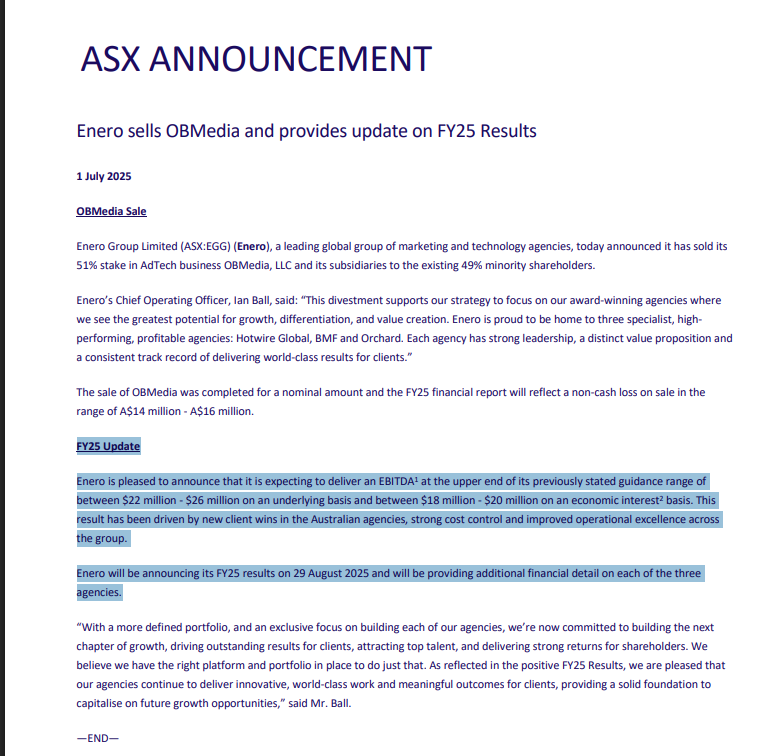

Outlook: FY25 Update Enero is pleased to announce that it is expecting to deliver an EBITDA1 at the upper end of its previously stated guidance range of between $22 million - $26 million on an underlying basis and between $18 million - $20 million on an economic interest2 basis.

This result has been driven by new client wins in the Australian agencies, strong cost control and improved operational excellence across the group. Enero will be announcing its FY25 results on 29 August 2025 and will be providing additional financial detail on each of the three agencies.

Noted this EGG is carrying some debt as per announcement here:

ASX Announcement Replacement of debt facility 23 June 2025.

Enero Group Limited (ASX: EGG) (Enero) today announced it has entered into an agreement for a new $15 million revolving secured bank facility with National Australia Bank (NAB) for 16 months expiring in October 2026.

This replaces the previous $50 million facility. The scaled back facility reflects reduced capital needs with the facility available to fund short-term working capital and general corporate requirements of Enero.

The facility is on terms that Enero considers market standard and appropriate for a facility of this size and duration. As at 31 May 2025, Enero had a cash balance of $38.8 million and a debt draw down of $2.5 million.

the eps growth has been falling in recent times so a no go investment here for me. plus the lack of cash flow at the moment..

Last

86.5¢

Change

0.180(26.3%)

Mkt cap !

$78.48M

This was one of my big calls, and I was quite excited about the potential for Enero Group (EGG) up until the FY23 results. Then something strange happened which I could not understand. OBMedia, the jewel in Enero’s crown, was growing like a mushroom…until it didn’t. It all seemed to unravel at the end of 2H23. One slide in the FY23 report tells it all, it confused analysts on the call, and it put up a huge red flag for me.

In the space of one month OBMedia’s revenue almost halved (on an annual basis). The reasons management gave for this huge drop were:

Huh! This explanation was well above my pay grade, so at that point I decided to start reducing our holdings. Of course another strategic review followed to work out what to do with OBMedia to maximise shareholder value.

The 1H24 report revealed that earnings per share had fallen by 54.3%. Management said they were continuing the strategic review with respect to OBMedia and were considering sale of the business with indicative offers due by the 25 March 2024. Well, the 25 March has come and gone…and so far crickets!

I’m probably a bit impatient and a really great deal is about to be announced for long suffering shareholders. However, I’ve taken the opportunity of a run up in the share price in anticipation of some good news to get out completely. We are very fortunate to come out of this retrieving our cost price plus a few dividends, less brokerage. Now watch for the huge offer for OBMedia! I hope so for the sake of others still holding Enero.

No longer held and relieved

Just starting to research Enero (EGG) I see the share price is off recent highs, now trading back around 2020 prices, Pays a dividend, and has actively been buying back shares.

A few brokers i hear comment on this stock always state they are not really sure what this company actually does, however all seem to say that the OB Media department appears to be the jewel in this companies crown.

SM has a lot of discussions regarding this company, however not a lot of Investors.

Just wondering if anyone has done a deep dive?

As always would love to anyone's thoughts.

https://enerostreaming.s3.ap-southeast-2.amazonaws.com/EneroAGM_2023.mp4

Depending on peoples thoughts maybe Andrew could reach out and arranger a meeting for us all.

Disc - Not held.

I’m still here, but not as EGGcited as I was eight months ago :) I haven’t posted any straws on Enero Group (EGG) for months.

This was one of my favourite picks at one stage. However, over the past year there has been some strange things going on with the jewel in the crown - OBMedia. Over recent years it has been growing like a mushroom with metrics to envy. The strength of the OBMedia business was why I built a position in Enero (EGG) in the first place.

Buts what’s the go now? I have no idea. First management tell us that the quality of the revenue from some clients of OBMedia was poorer quality than others, so they were pausing these accounts to improve the quality of the earnings overall. Then we were told they decided to drop those clients altogether preferring to maintain only the clients returning the superior metrics. I don’t understand the logic, I don’t understand how things will improve from here, but we’ve been told they have been improving and will keep improving even as the US technology sector improves. This sounds like “Hope” to me, and we all know hope is not a strategy.

Then there is another strategic review, this time to look at how management can maximise the value of the OBMedia businesses to it’s shareholders. One option to be considered is selling off OBMedia. What the???

To be honest I’m confused, I don’t understand what’s going on with OBMedia, and I’m starting to get a whiff of rotten EGGs. I have a suspicion I’m not alone here given some of questions coming up at the shareholder meetings.

Management keep telling us the market significantly undervalues the business as they use our cash to support the on-market buy back. However, if the shares are so cheap and the outlook is so good why isn’t management buying them up on-market? The last insider buying was by independent non-executive director Ian Rowden in August when he bought 15000 shares @ $1.43 per share, totalling $21,450. To my knowledge CEO Brent Scrimshaw, who’s on a $2 million package, hasn’t bought any shares on market using his own money for a long time, even though he currently holds shares to the value of $774,300 or 0.54% of the business. Part of Brent’s package comes as shares.

I’ve been reducing our holding of Enero at opportune times to limit our exposure in case Humpty has another great fall. Currently faith and hope is my strategy. Let’s see how that plays out!

Disc: Held IRL and SM

Technically speaking EGG broke my rules this morning with the greater wave 4 dropping into wave 1 territory gapping down with high volume below th 50 on the 1D. Im now out completely untill I see another set up. You win some and you loose some. Move on.

Last leg up before decent drop.

Quick update. EGG has reached my target buy $ for the last leg up (5th Leg) as you can see in 1hr chart on the right with the 50 sma as support right under it. However beware. On the 9D chart the Stochastic is ahead of where it should be noted by the Green circle on the indicator. So if you do buy in keep your stop tight under it. Should only be a short term position. Good luck

Im waiting for another buy in point at the bottom of wave 4. It may climb higher to the 1.95 for the small B target in the ABC marked in Orange however (as the 1hr stocastic shows its below where it should be) then should drop back down to the 1.81 to 1.75 area before then climbing to 2.01 to 2.07 area for the ending wave 5. Keep track of this and see how it plays out.

I’m a fundamental investor at heart, however, I’ve been caught too many times buying undervalued falling knives too early and selling over-valued stocks caught in an updraft too early. So now I do take some notice of the charts and the MACD to make Buy, Hold and Sell decisions.

I noticed today that Enero has broken through the 50 Day Moving Average for the first time since January. The share price has nudged it several times in the past few months, but has retreated each time. The MACD has also broken into positive territory for the first time since January.

My fundamental brain tells me charts mean nothing, but charts mean something to a lot of traders, so because of this there is pricing inefficiency and charts do have an influence on the short-term share price. In the long-term charts mean nothing and share price is always drawn towards the fundamental value.

I think Enero has been well undervalued for months (I think mostly driven by the charts) and perhaps this is the break out investors have been waiting for… or it might just have a double digit fall tomorrow. Owning this stock has been like riding a roller coaster. It’s not for the faint hearted! Who knows what tomorrow will bring? It’s an exciting stock to hold…if you like that type of excitement! :)

Disc: Held IRL 9%, SM 11%.

In the April Investor webinar Ann Sherry indicated that the board had elected to carry out a share buy back program as she stated that even though they weren't putting a number on it the board thought the shares were worth north of $3.

Here's a rough scenario I put together to reach a value in that ballpark.

Part 1

• What does the company do and is it easily understandable?

Enero is a diversified global marketing agency that consists of five main businesses which are separated into two verticals, Brand Transformation & Creative Tech and Data.

BMF - Creative Agency - Brand Transformation

Hotwire Global - Creative Agency B2B Technology Companies

CPR - Public Relations

OBM - Web Traffic and customer acquisition

Orchard - Creative Agency - Digital Experience

• What is the problem the company is solving and how are they solving it? - Where? Why does it need solving?

Enero describes itself as a “Creative Technology” company. It uses technology driven brand transformation and customer experience solutions for their clients. This is where CMO’s face their largest challenges in brand marketing.

From Gartner.com

• What is the company business model? What is the pathway from product/service/offering to payment?

Creative Agencies

- B2B - Selling services to deliver specific scopes or projects

OBMedia

- Purchase traffic and sell the qualified traffic to search engines for advertisers.

• Is the product offering diverse and therefore income generation diverse?

The Enero group of companies operate across a range of areas within the marketing and advertising markets. These include PR, Creative Content, Digital Marketing, Digital Transformation and Analytics

• Is the company a price maker or price taker?

As a services company with many large global competitors Enero is a price taker, however by offering a premium service to marquee customers, they are able to maintain a small premium to competitors in some markets.

• Does the business generate recurring revenues? How reliable is this recurring revenue?

Currently 47% of Revenue comes from fixed retainers (Excludes OBMedia)

• Who are the core customers of the business?

Enero have a diverse range of customers from some of the most recognisable brands globally.

• Is the customer base diverse? / • Does the company operate in multiple markets/countries?

Eneros revenue is split across multiple markets and countries globally which provides diversification across revenue streams.

OBMedia which is the largest growing business within the group has a more concentrated customer base as it transacts for web traffic from search engine providers.

• Is it easy to convince customers to buy the products/service?

Currently marketing spend makes up ~9-10% of company revenues, which mean that companies are always spending to drive sales of their own products and services. Enero group provide expertise that is not usually maintained in house, and have a proven track record with their existing customer base.

Current economic headwinds will pose some short term challenges as business’s look to implement cost controls, but marketing will remain an important area to maintain sales and business growth. A Gartner survey reveals that spending will likely continue in the development of new digital tools and customer experience marketing tools.

• Does the company operate in stable markets?

Enero operates in stable markets across the US, Asia, Australia, UK & Europe

• Is the company disruptive and innovative in its field?

Across the operating business’s it is recognised that being at the forefront of digital marketing and analytics will continue to drive outcomes for their clients. Enero has demonstrated this in the past with the integration of ROI into Hotwire which has expanded their offering to clients.

• Are the profit margins attractive (better than industry)?

Enero are feeling some impacts to margins, but are still inline with industry.

• What are the CAPEX requirements and are they ongoing?

Enero is predominantly a services business, so does not have significant ongoing capital costs. The largest operating expenses are on staff wages.

• What extent does the business experience operating leverage?

The creative agency parts of the business are limited in the amount of operating leverage that can be generated as can be seen by the consistent historical margins. This can be improved going forward through the integration of technology products in the service mix, but it will only be limited.

OBMedia can experience much more operating leverage than the other businesses as it does not require the same operating resources as the creative agencies. This can be seen by the much higher EBITDA margins in the U.S. Enero only owns 51% of OBMedia.

• How does interest rate increase and inflation affect the business?

Inflation mostly impacts the business through increased impacts of staff costs, some of these costs can be passed onto customers, but on a delayed cycle due to the retainer and project structure of business.

14/06/23

See my Trading Update straw and discussion for justification.

09/03/23

Following on from @loshell’s Humpty Dumpty theme and the excellent straws (‘Humpty Dumpty’ and the 1H23 Financials), I will attempt to value Anero Group (EGG). I won’t repeat @loshell’s coverage here.

Not only did Humpty Dumpty have a great fall after what seemed to be a pleasing 1H23 result, Humpty continued to roll down the hill for another 3 weeks and the share price fell over 40% ($3.00 on 15 February down to a low of $1.71, and closing at $1.80 today). It does appear the hill is levelling out and Humpty is finally getting some market support, albeit weak!

@loshell pointed out from the update, “the first six weeks of H2 has delivered a continuation of the macroeconomic headwinds experienced in FY23 H1” and “The Brand Transformation segment has experienced a slow start to the calendar year. The segment continues to see the impact of slower client decision making and conservatism across all geographies and in some cases, constrained client budgets.”

So Anero is finding that revenue growth in the current macroeconomic climate is steadying. Over the past 5 years Anero’s earnings have grown at 24.6% per year and the ROE has almost quadrupled from 4.8% to 18.4%.

Source: Commsec

Management said “Enero Group has delivered remarkable financial results in FY23 H1 with an impressive EBITDA margin of 34%. Within the portfolio OBMedia has delivered substantial growth through traffic diversification and ongoing technology investments,” and “Enero has accelerated towards a leaner, differentiated offering across key markets. Through deep vertical expertise and integrated client support, we are confident that we will continue to deliver ongoing growth as we leverage programmatic digital media, marketing automation, and data analytics services.”

According to S&P Global data on Simply Wall Street, analysts are expecting Anero to grow earnings at a steadier rate of 14% per year over the next 3 years, forecasting FY23 earnings of $31 million or 33 cps (currently 93 million shares). Based on these forecasts, future ROE should be c. 17%, down slightly on FY22 ROE of 18.4%.

Anero fits my criteria for a quality business:

- ROE almost quadrupling over 5 years to 18%

- Gross margin 34%

- Earnings have grown at 24% over 5 years

- Earnings forecast to grow at 14% over next 3 years

- Debt to Equity ratio 15% ($26 million debt, equity $178 million)

- More cash on hand than debt ($38 million)

- 54% of earnings reinvested back into the business at 17%

- Sustainable fully franked dividend of 7%, payout ratio of 46% (10% yield including franking credits)

- Global business with good runway for growth

- Future facing (AI informed marketing and communications technology).

While there might be some short term pain for this business due to the macroeconomic conditions impacting client budgets, I think the long term outlook is strong.

Valuation

As Scott Phillips from The Motley Fool would say “Did the market have the share price right before, or does the market have it right now?”

Most of the commonly used metrics suggest that Anero looks cheap. Current PE on forecast FY23 earnings is 5.4x. Over the last 5 years the annual average PE has been between 8.3x and 11.3x (Commsec). The industry average PE is currently 15x (Simply Wall Street data).

The PEG ratio is 0.5x. Peter Lynch wrote in his 1989 book One Up on Wall Street that "The P/E ratio of any company that's fairly priced will equal its growth rate" - Wikipedia

The Book Value for Anero (your equity in the business) is worth $1.91 according to my calculations and figures in the Half Yearly Reports and Accounts (equity $178.3 million, shares 93 million). This means you are currently paying $1.80 for $1.91 worth of equity in the business. Anero is currently putting your equity to work earning 17% per year. In effect, that gives you an 18% return on your $1.80 per share investment. Nice!

If I use McNiven’s StockVal Formula assuming a normalised ROE of 17%, Equity of $1.90 per share, 54% of earnings are reinvested, and dividends franked at 100%, I could pay $2.70 per share and expect a 15% annual return. If I was happy with a 12% annual return I could up to $3.80 per share. At the current price of $1.80 I could expect an annual return of 20%. Why is this higher than the 18% I quoted when talking about book value in the section above? Franking credits make a big difference to your returns!

No matter which way you crack this EGG it looks incredibly cheap, which is why I added it to our IRL portfolio today.

Disc: Held IRL (1%) and accumulating

Enero provided its FY2023 Trading Update on the 8th June 2023.

Enero expects net revenue of between $241 million and $244 million, representing 24% to 26% year-on-year growth.

It also expects EBITDA (excluding significant items) of between $78 million and $81 million, representing 18% to 22% year-on-year growth.

Since the trading update the share price has shed a further 20% closing at $1.365 today (14/06/2023).

I thought guidance for FY2023 looked reasonably solid. I’ll go through this in more detail below. I think the biggest concern is slowing growth and weaker EBITDA margins for OBMedia due to a tougher economic climate, and fears this might get worse.

Enero said “Creative Technology and Data is expected to deliver net revenue in the second half of FY23 of between $51 million and $53 million, representing 8% to 12% year-on-year growth albeit with lower than anticipated growth rates due to reduced traffic in OBMedia. EBITDA Margins are expected to be in the high 50s range in the second half (from 63% in H1 FY23).

Traffic quality continues to be OBMedia’s key priority. During the second half, OBMedia proactively reduced its traffic purchases from certain publishers in order to maintain its quality metrics. As a result, OBMedia’s revenue has been affected with the largest impact expected in Q4. OBMedia is committed to continuing to build trust and long-term business relationships with our key advertising partners.”

In 1HFY23, the Creative Technology and Data (CT&D) segment contributed 78% to the group EBITDA from 48% of group revenue with an EBITDA margin of 63%.

In the second half the CT&D segment is expected to contribute about 75% to group EBITDA from 46% of group revenue with an EBITDA margin in the high 50s. There is a slight deterioration in earnings contribution and the quality of earnings compared to the first half.

Second half revenues and EBITDA on a shareholder economic interest basis I estimate to be c. $90 million and c. $26 million respectively. My calculations (below) are based on the revenues and margins for the CT&D and BT segments provided in the trading update (Workings below)

FY23 Revenue (Economic Interest to shareholders)

CT&D Revenue = $52 million (mid point) x 51% (economic interest) = $30 million

Brand Transformation (BT) Revenue = $60 million (mid point)

Total 2H Revenue (economic interest) = $90 million.

FY23 EBITDA (Economic Interest to shareholders)

CT&D EBITDA = $52 million x 59% (margin) x 51% (economic interest) = $15.6 million

BT EBITDA = $60 million x 16.5% (margin) = $9.9 million

Total 2H EBITDA (economic interest) = $25.5 million.

I’ve compared my estimated 2H23 revenue and EBITDA to the previous 6 years on the economic interest basis charts provided in the Enero Strategy Presentation (4/04/23).

If these assumptions are correct, we should still see revenue and EBITDA growth for FY23 on an economic interest to shareholders basis.

I used a spreadsheet (copied below) to model FY23 NPAT and EPS based on last years costs. This may not prove to be accurate, however it is in the ball park (but lower than) updated analyst forecast consensus.

Analyst Forecast Consensus (3 analysts, Simply Wall Street data)

At the current share price of $1.37 the following metrics apply for FY23 forecasts:

PE = 5

EBITDA margin = 32.5%

Dividend = 9.5% fully franked (46% payout ratio)

PB ratio = 0.8

FY23 ROE = 14%

Valuation

Valuation needs to be based on forward earnings and ROE which is difficult to estimate with economic conditions worsening.

Using McNivens StockVal formula and assuming 3 tough years with flat earnings growth, ROE down to 14%, and requiring a minimum annual return of 15% (a higher margin of safety), I get a valuation of $2.04 per share.

Disc: Held IRL (7.5%), SM (10%), Adding.

Enero Group Limited (ASX:EGG) today provides a trading update, expecting to deliver the following results for the 12 months ending 30 June 2023 (FY23):

Net revenue of between $241 million and $244 million, representing 24% to 26% year-on-year growth

- Creative Technology and Data net revenue of between $113 million and $115 million, representing 30% to 33% year-on-year growth

- Brand Transformation net revenue of between $127 million and $129 million, representing 19% to 21% year-on-year growth

EBITDA1 (excluding significant items) of between $78 million and $81 million, representing 18% to 22% year-on-year growth.

Creative Technology and Data Segment

Creative Technology and Data is expected to deliver net revenue in the second half of FY23 of between $51 million and $53 million, representing 8% to 12% year-on-year growth albeit with lower than anticipated growth rates due to reduced traffic in OBMedia. EBITDA Margins are expected to be in the high 50s range in the second half (from 63% in H1 FY23).

Traffic quality continues to be OBMedia’s key priority. During the second half, OBMedia proactively reduced its traffic purchases from certain publishers in order to maintain its quality metrics. As a result, OBMedia’s revenue has been affected with the largest impact expected in Q4. OBMedia is committed to continuing to build trust and long-term business relationships with our key advertising partners.

Brand Transformation Segment

Brand Transformation is expected to deliver net revenue in the second half of FY23 of between $59 million and $61 million, representing 12% to 16% year-on-year-growth.

As indicated in the first half of FY23 results, Enero has remained focused on managing near-team margins. In the second half of FY23, cost-saving and restructuring initiatives are expected to deliver consistent margins for the Brand Transformation segment around 16-17% (H1 FY23:17%) despite a challenging macroeconomic environment.

Enero will announce its FY23 financial results on 18 August 2023 and will provide further disclosures on the finalisation of purchase accounting and contribution to earnings of the ROI DNA and GetIT acquisitions.

Enero has certainly been smashed this year, but it is hard to pin point why. The board thinks the market has it wrong and is undergoing a 10% on-market buy back. It couldn’t have picked a better time to buy back shares with the share price ($1.64, book value is $1.90) at the lowest point since October 2020.

I think the market has been cautious about Enero’s high exposure to the US Tech stocks.

Some of the FAANG stocks are amongst Enero’s blue chip US clients. The FAANG index took a beating last year, but it has beenrapidly recovering. The FAANG+ index is up 55 per cent this year. I am wondering if Enero’s outlook is as dire as the market thinks it is?

Enero’s growth has been exceptional over the last 6 years, yet the business is being punished.

Analysts are forecasting earnings to grow at 13%, and the forecast ROE is 18%, yet the PE is sitting at less than 6. The business has net cash on the balance sheet and should continue to have strong free cash flows. The current dividend yield is 8% fully franked while it continues to reinvest 46% of its earnings. After the buy back the ROE could approach 20%.

I really don’t get it, but I might find out why when the FY23 results are announced. I might also find myself with not only ‘EGG on my face’ but EGG all over our portfolio as well!

Disc: Held IRL 9.5%, SM 9.4%

I have recently bought back into Enero, initially on a value trade basis. I think the market has overcooked the downside and downwards momentum has eased. The current market price, looking from a sum of the parts or PE basis, values the company extremely cheaply. I see at least a 50% upside. Using this as another tester for my non-deep dive, small position trade strategy, I see money on the table, jumping in to see if it comes true.

As a previous holder (for a short period of time) I was surprised to see how hard this has been dumped by the market. The amount of profit attributable to non-controlling interests was of concern when I initially looked at half yearly results. Until I saw a tweet that it pointed out to me that OB Media is making all the profit for Enero. The rest of the business' owned by Enero are only breaking even. However, having a think about it, even if you value everything at zero besides OB Media. OB Media is making an annualised profit somewhere in the range of $50-60m based on the half year results (don't know if this is seasonal?). Putting an ultra-conservative 10xPE on OB Media (remembering this business has growing rapidly over the past few years) that would put the value of Enero's ownership of OB Media at a minimum of $250mil with the current market cap sitting at around $173m ($1.87 share price). Looks like the market may have overshoot to the downside, I have taken a small position, initially as a bit of value trade as a result.

Based on a PE multiple of 12 for an NPAT of $25 mil. This is a conservative valuation that is purely based on OB media and other companies being worth near zero.

Thanks for your straws on Enero’s Investor Strategy Webinar and the On-market Share Buyback @loshell. Your comments about whether the 10% on-market share buyback is the best use of capital has got me thinking. My immediate reaction was YES I like this! But now I want to explore this further.

At the end of December 2022 Enero had $38 million (or 21%) of $178 million (total shareholder equity) sitting in cash. As a shareholder this is not ‘their equity’, it is ‘my equity’! Am I happy to have 21% of my invested equity in Anero sitting in cash? I don’t particularly like my own equity sitting in cash if I can find a better use for it. Especially when inflation is eating it away at 6% each year! If I could find an investment that returns over 15% per year at a relatively low risk, I would rather put it there!

If the analysts forecasts turn out to be correct, Enero will be highly cash generative over the next three years. Free cash flows are forecast to be $115 million in FY23, $80 million in FY24, and $80 million in FY25 (Simply Wall Street data). If this turns out to be correct, Enero will be spewing cash and will be trying to find a use for it.

So yes, I think Enero should find a better use for ‘my cash’ then letting it accumulate. The question is, what should they do with it? I can think of two options for the cash that are better than letting it sit on the balance sheet:

- Return excess cash to shareholders

- Aquire a businesses that is immediately earnings accretive with ROIC higher than 20%

Why have I been so specific for option 2? My investment thesis for Enero is based on future returns on equity of at least 18%. I don’t want Enero to risk ‘my cash’ acquiring a business that might dilute these returns. With Enero shares currently trading at $1.86 per share I am getting $1.92 worth of equity in the business. That makes Enero at the current share price sound incredibly good value.

However, there is something management can do to make my returns even better, and that is Option 1…Return my cash!

There are two ways for Enero to return my cash:

- Share buyback

- Special dividends

I would be happy with either of these options, but let’s do the sums on each to see which would be better.

Share BuyBack

The Anero board has announced that they will buy back up to 10% of its shares over 12 months starting in May. Now, if there was ever a case where I was hoping for the share price for a company I own to stay low, this would be it! If Enero buys back 10% of the shares outstanding using ‘my cash’ to do it, I want them to be cheap. At $1.86 I would be happy for them to buy as many as they can get hold of. That’s what I’ve been doing under $1.85.

However, there is something magic that happens when Enero buys back shares that I can’t do when I buy additional shares in the business.

When the Enero board uses excess cash on the balance sheet to buy back shares it further improves ROE. How does that work? There are a few things that happen when Enero uses spare cash to buy back shares. Firstly, as the cash is used to buy back shares the total shareholder equity goes down (final equity = starting equity - cash used for the share buyback). Secondly, because they are using ‘lazy’ money the total profits will remain about the same, but they are now shared with 10% fewer shareholders (a bigger slice of the pie). So after the share buyback on a per share basis the NPAT per share will go up by 11% per share (100/90 - 100) The equity will remain about the same, providing the shares can be bought back at $1.90 per share (10% less equity over 10% less shares).

Analysts (SWS data) are forecasting FY24 earnings to be 37 cps. I notice this forecast has not changed since Enero announced the on market share buyback. In effect if Enero buys back 10% of its shares by June 2024, the forecast earnings should increase by 11% to 41 cps. Now over the next 12 months equity per share will also increase by the earnings reinvested to $2.08 ($1.92 x 1.083, reinvesting 46% of 18% return) On that basis Anero’s ROE in FY24 should increase to 20%. That makes Enero a better quality business and investors are likely to pay a higher PE ratio than the current 5.8x. This is how the share buyback magic works. I would struggle to find a better investment anywhere else.

Now, how much will the share buyback cost Enero? If Enero can buy back 9.3 million shares (10% of 93 million outstanding) at $1.90 per share, the 10% share buyback will cost $17.67 million (10% of the current total equity). Enero currently has $38 million sitting in cash. So after the buyback they will still have $20 million left over plus any free cash that has accumulated in FY23 and FY24. It seems Enero will not be left short of cash, and will have plenty left over to continue paying between 40% to 60% of its earnings as fully franked dividends, and also pay down some debt. In fact in future they might need to buy back more shares or pay higher fully franked dividends. Such a problem to have! :)

Special Dividend

At the current share price it doesn’t make sense for Anero to pay out spare cash as a special dividend. Paying out a 10% dividend would reduce the total shareholder equity by 10% to $1.73 per share. With reinvested earnings we would end up with equity of $1.87 per share in FY24. With forecast NPAT of 37 cps, ROE would be 19.7% (Similar ROE to the share buyback). However my equity in Enero would be 10% less. Given there will be some tax to pay on the dividends I think I would prefer to leave my cash with Enero where it has the potential to return 18% to 20% per year.

Disc: Held IRL (2.5%), accumulating below $1.85

[Held; recent top up @ $1.78 puts EGG at ~3% of our portfolio]

I tuned in yesterday to observe proceedings and ask a few questions (only one of which was ultimately asked by the moderator). I'll provide some of my observations/takeaways.

The session opened with a short intro by Chairperson Ann Sherry, followed by a group overview from group CEO Brent Scrimshaw (who yesterday was reappointed for another 3 year term), then most of the CEOs of Enero group's businesses (OBMedia, BMF, Orchard, ROI DNA, Hotwire) presented a short spot, then the group CFO spoke and finally some Q+A with all the speakers. Everything was pretty tightly choreographed and some of the session felt a little bit robotic, though this shouldn't be a surprise given the group's professional familiarity with PR + comms. They were clearly trying to sure-up investors alarmed at the tanking share price and/or drum up new investor interest.

OBMedia

For obvious reasons given their significant financial contribution to Enero's overall financials, OBMedia was the focus of a majority of attendee questioning. It was the first time I've seen OBMedia's management in person and unlike the business performance, CEO/co-founder Raja Gupta was pretty uninspired and unconvincing as a presenter. He seemed to be on a very tight leash and often answered questions with very politician like non-answers and appeared to me to be reading from some sort of script or talking points. CTO/co-founder Mike Lynn was a bit better but perhaps came across that way because he got to talk more about the techie stuff. Their presentation slot starts at 27:00 into the meeting and questions were answered during Q+A towards the end.

I asked "Re OBMedia: Can someone please speak in general terms about whether OBMedia customers commit to contracted minimum spends or any other sort of ongoing spend arrangement, or is customer spend determined minute to minute and could theoretically drop to zero if they chose to pull their spend for any reason?" which was edited by the moderator to "Re OBMedia: Can someone please speak in general terms about whether OBMedia customers commit to contracted minimum spends or any other sort of ongoing spend arrangement".

Raja responded that there is no committed spend, and their earnings are all tied to performance metrics i.e. client OBMedia spend can fluctuate dynamically day to day and is contingent on them hitting undisclosed performance metrics. Not quite the answer I was hoping for, but then the business results are clearly impressive and satisfying to their customers.

Their value add seems largely to be detection and removal of robot-generated clicks combined with click data augmentation that increases the value of each click to the advertisers. They rely on first party data + don't rely on cookies for the click data augmentation and assert that they are well placed to avoid/mitigate impact from the increasing focus on web privacy and associated war on cookies and user tracking which makes sense to me given the way they operate. They also assert a moat around their deep relationships with Google and Bing in particular.

Main risks appear to be borking or losing an edge in robot detection or their application of big data and AI to augment their click stream, but this is one of those businesses that the more data they get their hands on, the better they can be and this builds significant competitive advantage + barrier to entry.

Other businesses

All the other CEOs who spoke were decent and their businesses seem pretty traditional in the way the operate and generate revenue. There's also a good mix of business-to-consumer and business-to-business focus across the group which is good for diversification of revenue opportunity and increases TAM.

BMF in particular has received a good amount of positive industry recognition:

Q+A

Q+A started at 1:23:00 into the meeting. A selection of the more interesting questions:

- A few questions probing the individual business CEOs on what value they feel their particular business gets from being part of the Enero group. Geographic reach to help growth and overall corp culture were key positives.

- Should OBMedia be spun off as a separate public company? No.

- Asked about the buy back and what the board feels the business should be valued at given their assertion the business is currently undervalued, Brent and Ann were a bit cagey but Ann ultimately said she felt "$3 was undervalued, so north of $3 per share" was closer to fair value.

- How will macro affect OBMedia revenue? Cagey; not really answered.

- OBMedia's biggest competitor? Most visible is System 1

Parting thoughts

Useful session, I like the mix of businesses within the group and feel pretty content as a shareholder.

The board thinks the market is derp and is going to divert some of their free cash towards an on-market buy back of up to 8,804,510 of the 92,720,374 shares on issue commencing May 1st 2023.

Personally unconvinced its the best use of their cash, but we shall see.

UBS Group Bought 5.6M shares with a 6.09% vote back on 17th march. Shows a level of confidence and also probably an unjustifiably beaten down stock.

For interested investors Enero Group has just announced it will hold a Strategy Webinar on Tuesday, 4th April 2023 - ASX Announcement

Investors will hear details of Enero Group’s recent transformation, Group strategy, a deeper understanding of the portfolio brands and business models, and Group capital management framework. Investors will be able to participate in a live Q&A following the presentation.

Date: Tuesday 4th April 2023

Time:10.00 am to 11.45am AEST

Registration: By Friday 31 March

https://us02web.zoom.us/webinar/register/WN_uKNmcA95StmtDmDkWtsQMA

As I build conviction in the Enero Group (EGG) I’m trying to dig up more information on the risks to explain why Enero’s share price is down 54% in less than 12 months when it’s 5 year performance has been outstanding.

Management refer to macro headwinds they have been experiencing this year in the 1H23 Results Webcast . Shame there were no questions at the end. Either the analysts were all happy, they were all on other webcasts, or they just were too busy pushing the sell button! :)

I think the market is expecting the macroeconomic climate to have a devastating impact on advertising budgets. I don’t think it will be as bad as the market is expecting. Analysts are still forecasting earnings growth to continue, albeit slower at 14% per year. When it comes to advertising and cost cutting, businesses are damned if they do and they are damned if they don’t! I haven’t seen Aldi pulling back on the ads lately…nor Nick Scali!

They do expect advertising to drop back in the Health Care sector after being boosted by government spending during COVID. However, Health Care only makes up 8% of its revenue.

Anero has high exposure to the technology and telco sector (43%) and there has been widespread cost cutting by technology companies, especially in the US where Anaero has 53% of its business. So it could be a tougher year for them.

BMF, a subsidiary of Anero Group, have a long history of successful ad campaigns with Aldi including the latest “Shop Aldi First” campaign. Aldi has recently renewed their contract with BMF, and why wouldn’t they? You have just got to love the award winning creativity and quirkiness of the Aldi ads. They always make me chuckle! I don’t mind shopping there either. Where else do you go in for a banana and come out with a robotic vacuum cleaner (true story)! :)

Disc: Held IRL (2%)

Following on from my "Humpty Dumpty" straw, I've spent some more time with EGG's half yearly report to try determine if I should be worried or happy to have an opportunity to increase my holding. I've picked a few themes of potential concern to provide some commentary on.

"Brand transformation" EBITDA margin crunched from 27% in 1H22 to 17% in 1H23

As best I can tell, the bulk of the damage here was done by an increase in employee expenses which don't appear to be permanent/structural in nature and the report notes:

During the half year ended 31 December 2022, the Group started a restructuring process to mitigate costs across the Brand Transformation segment. This is largely related to redundancy costs in Hotwire UK, which continued to further integrate its communication and marketing services businesses into a single account management team.

Something to keep an eye on going forward, but feeling ok about this at this stage as they continue to digest their acquisitions and streamline operations.

Debt position

The $50M facility from which they drew $36.3M to fund the ROI DNA purchase was partially repaid down to a balance of $26.0M and they have $38.0M cash.

No concerns here for me.

Cash flow/conversion

At the end of 1H23 they had $99M in receivables and $91M in payables on the balance sheet, of which ~$5-6M were expected by management to be recognised in 1H but payment slipped until early in the new year per their "adjusted" 74% cash conversion percentage i.e. if we attribute the late payments to 1H23, they entered 2H23 with ~$95M receivables.

My take: "Oh well", but not a concern at this stage.

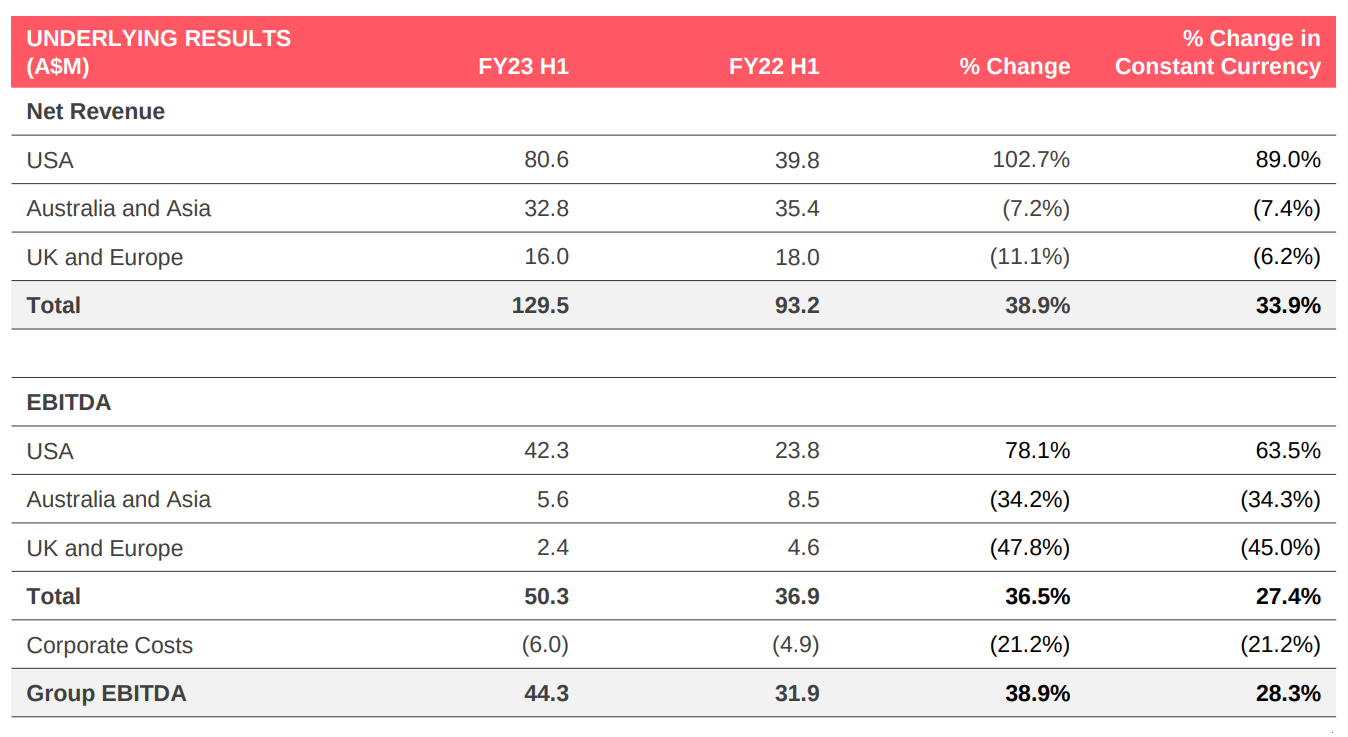

Results by geography

The US market is driving all the growth mostly thanks to OBMedia and a nice FX-cherry-kick on top. All in all, the acquisitions and diversification in the business appear to be paying off handsomly. I'm a little surprised to see AU/Asia going backwards, though without deeper insight that's mostly a curiosity rather than a concern. Given the size of the US market contribution to the group, the primary short term risk is US economic deterioration hammering their US businesses.

How recession proof is clients' OBMedia spend? I find it hard to imagine clients completely turning off the tap, but it could certainly shrink substantially or become more lumpy for an extended period. Given how hard OBMedia has been firing though it seems to be sufficiently resilient at the moment in the face of I guess what you could call "storm clouds on the horizon".

General thoughts

At a SP of $2.30, TIKR tells me the forward PE is 6.6 on a FY23 EPS estimate of 35c. That estimate seems a little too bullish given the 1H results and commentary, but given their current run rate it looks like they shouldn't go backwards (FY22 EPS were 30c) so if we say they'll manage EPS of 31-32c they're trading on a forward PE of ~7.3 which is certainly low by EGG's historical standards.

They're paying out 35-40% of earnings in dividends, and with the retained 60-65% of earnings they've been generating increasingly good returns on equity and capital as well:

My sense is that while there's plenty of short term risk here, I'm still pretty comfortable with how the group as a whole is executing and do not see any reason to panic.

I'll probably be pretty cautious about topping up between here and the end of FY reporting as there may well be more camel and less rocket to come, but still feeling pretty good about it as a long term hold and easing into topping up over the coming months.

[Held IRL; edited to add the cash flow/conversion slide I forgot to include]

EGG had a great fall today and sustained a few cracks after announcing their not too shabby 1H23 results + 6.5c FF dividend, but management's trading update and outlook commentary presumably spooked folks and sent them heading for the exits. A few choice excerpts:

- While still early in calendar 2023, the first six weeks of H2 has delivered a continuation of the macroeconomic headwinds experienced in FY23 H1.

- The Brand Transformation segment has experienced a slow start to the calendar year. The segment continues to see the impact of slower client decision making and conservatism across all geographies and in some cases, constrained client budgets.

- Enero remains focused on managing near team margins and will continue to take appropriate steps to address current macroeconomic headwinds while positioning the business to capture client demand.

High level looks ok but masks some interesting segment level zigging and zagging + cash flow/conversion issues:

I need to do some more digesting of all the results, but I'm not currently feeling at all spooked like everyone else seems to be. Perhaps I should be?

Barring any revelations that lead me to panic too, I'll probably start gradually DCAing to top up at these levels until Humpty Dumpty can be patched up and placed back on the wall... or a rocket... or any mode of transport suitable for getting the share price north bound instead of smelling like the south end of a north bound camel.

I have sold out of Enero Group due to a clear three-point trend line break that I stipulated in my thesis would result in a sell decision. Unfortunately, I wasn't paying close enough attention when the price drop continued a long way past the $3.20 mark I was worried about when I wrote my previous quarterly update straw. Looking at the market depth, there isn't many buyers so I was also very worried this could drop quickly on any unwelcome news. Is the right or wrong decision??? No idea, I am trying to keep within a rules-based system in this case (following QAV podcast concepts regarding momentum). After the last quarterly result, I did not increase my conviction (worrying sign) and my holding IRL was only at 1/3 of a normal position so not much is lost or gained either way.

I will be continuing to monitor Enero. Looking for momentum to be reestablished or good FY end results. The talk of recession isn't a good sign for marketing spends by business but then again Enero did an excellent job over the COVID years in increasing sales.

Enero has today announced the sale of The Leading Edge and The Digital Edge for $1.35M. These two businesses only accounted for between 1.4-1.7% (depending on period used) of revenue for the group so won't have a material impact.

Given the very low percentage of revenue comparatively to the other businesses that makes up Enero's portfolio, the offloading makes sense. My reading on the CEO comments were that these two businesses are too small for the group and given they were purchased in July 2004 could only have gone backwards and/or not growing. Management wants businesses in the group that can scale and add to current capabilities.

With regards to my thesis the QAV three-point trend line has been broken recently, however, this is clearly on the back of market weakness. Will reassess position if price declines below $3.20.

March 2021: Currently the largest position in WAM Microcap (ASX: WMI) - as at 16-Mar-2021 - you can hear WMI's lead PM (portfolio manager) Oscar Oberg outline their investment thesis (IT) for EGG here: https://www.youtube.com/watch?v=W09bZO_ASJk

EGG were also the third largest position in the Forager Australian Shares Fund (ASX: FOR) at the end of Feb, and Enero is a company that FASF (FOR) have held for many years, through their ups and downs. Lately they've been more "ups". Here's what Steve Johnson had to say about Enero in the Forager February 2021 Newsletter: Enero Group (EGG) wins the award for the portfolio’s most outstanding result. Marketing agencies were supposed to be suffering in 2020. Profits for competitor WPP (WPP) fell 32% for the year ended 31 December. Enero bucked the trend reporting a 129% increase in earnings for the latest six-month period. Its main agencies, led by tech public relations firm Hotwire, are exposed to some healthy end markets. Modest but impressive revenue growth was bolstered by a lack of travel and other expenses Enero didn’t have to incur. But the juice came from advertising tech company OB Media, a business Enero bought 51% of way back in 2007. It didn’t contribute much for the subsequent decade, but in recent years OB has become the primary driver of Enero’s growth. In addition to helping its clients with email and other digital marketing, OB’s platform places Google shopping ads on some 300 publishers’ websites. It clips the ticket for each transaction and, with online shopping growing like a weed, there have been a lot of tickets to clip. With just 18 employees, OB looks to have generated $9.4m of profit in the first half of the year alone. We’ve been worried that this business could return to the dark old days but management are increasingly confident that its growth is sustainable. If so, Enero still looks cheap. The company’s board showed their confidence with a 320% increase in the interim dividend to $0.105 per share. While that is a particularly large increase, we have collected or are due to collect healthy dividends across most of the portfolio this financial year. Some of that is one off, but you should also take it as a sign of the healthy state of the underlying businesses and continuing attractive value on offer. --- ends --- I am looking to add EGG to my Strawman.com scorecard on Monday, or sometime this coming week. I also hold WMI shares, so I have real life indirect exposure to Enero through the WAM Microcap LIC (listed investment company). I did previously also hold units in FOR (the Forager Australian Shares Fund listed investment trust) but I have since rotated that money into other opportunities. I have removed FOR but WMI is still on my Strawman.com scorecard.

UPDATE - 11-Dec-2021: Well, I bought some at $2.95 in March - the week I posted that stuff above - bought here but not in RL - and sold those virtual shares in May at $2.97 because I wanted to move those funds into something I saw as a better opportunity (can't remember what it was now tho). And they took out my $3.77 PT in October, and they've been above that level since - although they can't seem to break through $4 and stay above it. Currently at $3.89. They're looking fairly fully valued, however I'm raising my PT now to $3.98, which isn't much upside from where they are now, so I'll be staying on the sidelines.

They did look good back in March when I wrote that stuff above - and EGG were trading at $2.99 and looking to break through $3/share, which they did one week later - on March 23rd, and now they're knocking on the door of $4/share, well, they were last month (November 2021) anyway. Haven't looked at them lately, but I note that WMI still list EGG as being in their top 20 largest positions, and Wilson Asset Management Group (who manage WMI and 7 other LICs) recently (in October) sold down from 11.31% to 8.78%, and they owned as much as 16.54% earlier (like at the start of this year - see below), so they have been reducing their exposure as the share price has been rising. So has NAOS. UBS has been in and out like a... pick pocket (currently out, or below 5%). RG Capital Multimedia (started by Reg Grundy) has also been selling down. Perpetual also reduced their exposure from 13.29% to 12.27% in August, although Perennial Value were buying in August - perhaps buying from Perpetual and RG Capital. So while the individual weightings are lower we still have Regal, Wilson, Perpetual and RG Capital as subs (substantial shareholders), as well as Perennial (being the newby), but NAOS and UBS are out.

I believe Forager still retains some exposure also, but I'm not 100% sure on that as I haven't been following FOR (the Forager Australian Shares Fund LIT) lately, and if they do still hold EGG it's below that 5% threshold for substantial shareholders (as listed above).

Edit: Additional: I have also sold out of WMI at a really good profit (and after accumulating a few good dividends too) because they started trading at a premium to their NTA so I took profits and rotated the money into other ideas. So FOR, WMI and EGG are all sold positions (so they're all off my Strawman.com scorecard now) and I don't hold any of those 3 in real life either at this point in time.

Overview

Enero Group is a group of marketing and communication services companies in Australia and internationally. Its services include strategy, market research and insights, advertising, public relations, communications planning, designing, events management, direct marketing, and programmatic media.

A list of the companies within Enero group is below:

- bmf

- CPR

- The Digital Edge

- Hotwire

- The Leading Edge

- OB media (51% owned by EGG with founders owning the other 49%)

- Orchard

- McDonald Butler Associates (recent acquisition)

The jewel in the Enero crown is OB media which is a fast growing, people light business providing digital ad services.

Customer Value Creation

The companies within the group provide marketing and communication services to a large range of blue chip companies and government bodies. Customers clearly find value in the services offered given the retention rate of over 60% after 4 years. Enero must be providing a positive ROI for customers to have such strong retention.

Local example of work from bmf. bmf is responsible for ad campaigns most Australians would have seen from brands such as Aldi, Tip Top, Sportsbet and Audi and government campaigns for cybercrime and violence against women.

Main Thesis

Thesis for Enero is a smaller sized position for a P/E play type buy initially. I believe Enero is undervalued especially given the revenue and profit growth over the past year that appears to be continuing. The share price has strong momentum. I can see potential for growth to continue through M&A activities and organic growth. The company is net cash and strongly profitable.

The company has strong backing from many of Australia's best fund/money managers including Regal Funds, Perpetual, WAM, Perennial Value and Forager funds. These funds have 47.4% of all shares as of 7/1/22. It will be clear if these funds are all heading to the exit at the same time.

Exit will be at full valuation. However, given the strong growth of the fundamentals of the business, I expect the valuation to grow over time.

General

- Company isn't a scalable model. Organic growth and acquisitions are way to increase revenues. Lots of cash for acquisitions.

- R+D not required due to the staff creating the content for clients, staff creativity is their end product.

- Previously, wasn't interested because I was worried about marketing spend during COVID, this turned out to be very wrong.

- Revenue is not mainly from Australia but spread around the globe. Revenues are reporting in "net revenues" rather than gross due to the costs being transferred directly through to customers. FY21 revenue is split:

- Australia - $65 mil

- UK and Europe - $35.5 mil

- USA - $60 mil

Positives

- Strong profitability with expanding margins. Business appears to be at a point of operating leverage, revenues have accelerated but costs are flat.

- Strong institutional ownership especially for a $300 mil EV company.

- Highly experienced board and management. Given group companies are run by internal management teams the board and CEO of EGG are responsible for capital allocation within the group more than the day-to-day operations of the business.

- Board experience is extremely impressive:

- Chairwomen experience includes directorships of ANZ, SYD airport, UNICEF. Former CEO of Bank of Melbourne, Westpac NZ and Pacific and Carnival.

- Other directors have extensive experience in corporate Australia.

- Large blue-chip clients and government bodies as clients. These clients have a long relationship with the Enero businesses.

- Net cash business. No real need for R+D as the people are the innovators. Though talent retention is especially important.

- Weathered COVID very well. I thought this company would struggle initially but EGG has proved that sediment wrong.

- International business with revenues split between Australia, US and UK/Europe.

- After every recent quarterly announcement over the past year there has been a jump in the share price. Shows that Enero is beating market expectations.

- Glassdoor reviews of subsidiaries appear generally positive. Important in a business where the talents of the staff are important.

- The share price chart looks vey good. Bottom left to top right. Strong buying after last half results.

Negatives

- No moat. Competitive advantage is the creative people within the business and the experience they have with larger clients.

- Management doesn't have any significant skin in the game. Board is independent, which given the group structure of the business may not be a real issue.

- The 51% ownership of OBmedia makes it hard to determine the final profitability and cash flow. Numbers given are often based on 100% ownership.

Risks

- Management noted in FY22 Q1 update that discretionary travel costs may start to increase due to COVID reopening and there may be wage cost pressures.

- Growth stops. However, this is compensated for by the cheap EV/EBIT ratio.

- Loss of talented staff.

- General macro reduction in marketing spends.

- Fund managers that own the shares all head for the door at the same time.

- Must see margins and revenues remain stable or increase in quarterly updates.

- I could be late to the party here. Share price has already risen from a COVID bottom of around 80c.

Likelihood of loss/Probabilities of outcomes

Loss of capital calculations - using $3.88 share price = MC $334 mil.

Case: Cash = $50 mil (no contingent consideration) + FY21 underlying profit of $22.8 mil

- Down to cash = 85% drop

- 5x FY21 underlying earnings + cash = $164 MC = 51% drop

- 10x FY21 underlying earning + cash = $278 MC = 17% drop

- Current implied EV multiple based on underlying earning = 12.5x

Case: Cash = $30 mil (include contingent consideration) + FY21 underlying profit of $22.8 mil

- Down to cash = 91% drop

- 5x FY21 underlying earnings + cash = $144 MC =57% drop

- 10x FY21 underlying earning + cash = $258 MC = 23% drop

- Current implied EV multiple based on underlying earning = 13.3x

Case: Cash = $30 mil, FY22 EBIT = $45 mil giving underlying profit of $31.5 mil. EV based on contingent consideration being paid.

- 10x FY22 profit = $345 mil MC

- 10x EV/EBIT = $480 mil MC

- Current price EV/EBIT = 6.75x

How I expect this will play out

- Continued growth in the revenue and profitability. This is initially a PE play with a free option on the growth continuing.

- Expect the company to either return cash or make acquisitions at single digit PEs.

When to get out

- Breaking of three-point trend line (QAV podcast strategy). Given the strong share price appreciation, institutional ownership and fundamentals momentum I will be implementing soft stop loss based on the three-point trend line. This is something I will be trialling after review of previous investments I have made. If the price drops from here, something has changed and I am likely wrong (unless clearly in line with a general market decline). After the recent market decline EGG bounced straight off its low point (three-point trend line) and back to previous levels, so hopefully a good indicator of support.

- The fund managers start trying to get out.

- Revenue/profit growth slows.

- Valuation target is reached and you don't see any reason that the growth will continue. Ie, can't justify a higher valuation.

See valuation straw for valuation details. Buying plan - start initially with a 1/3 position. Wait for half year results for any further buying. Likely buy after good result (or get out) then at least another 3 months before next purchase.

26-Nov-2020: Taylor Collison: Enero Group (EGG): Record Margins Driving Strong EBITDA Growth

Analyst: CAMPBELL RAWSON, [email protected] +61 415 146 725 www.taylorcollison.com.au

- Recommendation: Outperform

- Market Capitalisation: $169m

- Share price: $1.95

- 52 week low: $0.80

- 52 week high: $2.30

Record Margins Driving Strong EBITDA Growth

- Our View

- Despite 63% operating EBITDA growth in 1Q21 and continued momentum in Q2, EGG’s valuation multiple is yet to expand. We remain attracted to EGG on valuation grounds as it trades on 3.7x our updated FY21 EV/EBITDA forecast, representing a 39% discount to the average of a group of listed peers. Despite revenue visibility of ~2 months only, we continue to see the valuation as undemanding especially given EGG is one of few marketing businesses currently experiencing growth. Exposure to high growth industries/companies underpins earnings and as competitors struggle, EGG’s strong cash position provides opportunity for acquisitive growth.

- Key Points

- Trading update highlights strength of strategy

- Despite global economic woes, EGG delivered 1Q21 operating EBITDA of $8.8m (excluding $1m JobKeeper receipts), growth of 63% on revenue growth of 11%. This represents an EBITDA margin of 23.6% which is a record level for EGG. This was partially driven by lower travel and occupancy costs as WFH conditions across all operating markets remain prevalent. Whilst this will likely revert somewhat during 2022, customer mix changes also boosted margin and should see margin sustained above historic levels through FY22. Strategy to target Tech and Healthcare firms is paying dividends as these clients remain insulated or even benefit from the economic malaise. Compared to more mature industries such as FMCG, Tech and Healthcare clientele are often more inclined to pay higher rates to help foster their growth trajectory. Finally, client growth is leading to economies of scale as bigger relationships lead to greater staffing efficiency and a further improvement to margin. We understand Q2 has continued at a similar run rate to Q1 where all geographies experienced revenue and operating EBITDA growth.

- Updated forecasts

- After a record quarter and continued traction in Q2, we upgrade our FY21 operating EBITDA forecast 23% to $32.8m on the back of improved margin from lower corporate expenses and greater than expected contribution from higher margin clients. We note earnings visibility is limited to two months and despite global economic challenges, momentum in marketing firms remains pivotal to attracting clients and talent and we forecast it to continue in 2H21, albeit at a slightly slower rate. Our FY22E Operating EBITDA is upgraded 15% reflecting an expected higher sustainable margin due to customer mix changes but offset by a reversion to FY20 levels for occupancy and travel costs. We note the decline in NPAT from FY21E to FY22E is due to an increased tax rate as EGG are utilising the last of historic tax losses in FY21.

- US based OB Media delivers notably higher margins than rest of group

- OB Media is EGG’s online-focused marketing firm which derives more revenue from technology than from people, when compared with most marketing companies. With a lower comparative staff cost, OB generates higher margins than other EGG companies. OB has strong relationships with beneficiaries of Covid-19 (such as Google) which has been part of the customer mix changes that has helped improve group margin. We estimate OB constitutes ~15% of group earnings (despite only 51% ownership) and believe a buyout of the remaining ownership could quickly be EPS accretive.

- Trading update highlights strength of strategy

--- click on the link at the top for the full TC report on EGG ---

[I do NOT hold EGG shares directly, however I do hold FOR shares, and the Forager Australian Shares Fund (ASX:FOR) does hold EGG shares, and has done for many years.]

28-Sep-2020: Taylor Collison: Enero Group (EGG): Initiating Coverage - Outperform

TC's Analyst: CAMPBELL RAWSON, [email protected], +61 415 146 725 - www.taylorcollison.com.au

Our View

We re-initiate coverage following an analyst change with an Outperform recommendation. We view EGG as a high-quality business operating in a congested industry where companies have to continually produce new ideas and reinvent strategies. In contrast to the majority of the marketing services industry, EGG’s earnings through Covid-19 have grown but the share price remains ~25% below January levels. We are attracted to EGG on valuation grounds as it trades on 3.5x our FY21 EV/EBITDA forecast, representing a 42% discount to the average of a group of listed peers. Earnings risks include the reliance on client relationships, economic conditions and competitors pricing pressure however we view EGG as well advanced at mitigating these and believe the level of risk to be more than priced into the current share price. We view EGG as having strong growth prospects over the long-term with no debt and exposure to high-growth industries providing the ability to organically and acquisitively achieve scale and capability in a highly fragmented industry. We expect the multiple gap to peer average to close as further scale is achieved and strong margins are maintained.

Key Long-Term Attractions

- Exposure to high growth sectors such as technology and healthcare

- Hotwire and Orchard have developed category expertise over many years and subsequently earn a large proportion of revenue from Technology and Healthcare clients respectively. Clientele in these industries are experiencing rapid growth which provides EGG the opportunity to grow alongside them. Compared to more mature industries such as FMCG [fast moving consumer goods], Tech and Healthcare clientele are often more inclined to pay higher rates to help foster their growth trajectory. Both industries are largely unaffected by the Covid-19 pandemic and seemingly are beneficiaries of some of the greatest changes to consumer behaviour in recent history. With group clients including Facebook, Zoom, GlaxoSmithKline and Novartis, we see EGG as well positioned to grow revenue and earnings alongside these highgrowth companies who we expect to grow irrespective of economic conditions.

- Further growth ambitions into vast USA market

- EGG’s USA operation has doubled revenue and almost quadrupled operating EBITDA since FY18 (organic and acquisitive growth). A simplified business model coupled with a renewed focus on larger clients set the platform and we understand the momentum is continuing into FY21. Hotwire leads the growth and continues to win clients and tenders, predominantly in the Tech sector. Recently appointed CEO, Brent Scrimshaw, has extensive brand and marketing experience including 18 years at Nike with senior roles as GM East Coast USA and CEO of Western Europe. With Brent’s experience and desire for geographic expansion, we anticipate Hotwire to follow clients into other operating regions. Momentum in this market bodes well for attracting clients and talent and subsequently underpins the bulk of our revenue and EBITDA growth forecasts.

- Conservative debt strategy

- EGG currently carries no true debt with acquisitions funded by cash and contingent consideration not exceeding remaining cash balances. A cash balance of ~$47m is currently offset by contingent consideration of $25.5m which is all payable by September 2021. We are attracted by the prudent debt strategy and believe the capital strength helps to offset any earnings risk associated with annual revenue churn of ~20% and ~2 months earnings visibility.

--- click on the link at the top for the full Taylor Collison report ---

Bear77 Notes: I do not hold Enero (EGG) shares directly, but I do hold shares in WMI (WAM Microcap Fund) and FOR (the Forager Australian Shares Fund), and they both hold positions in Enero (EGG). In fact FOR has held EGG pretty much for their (FOR's) entire existence, riding them down to their lows and then through their strong 2019 recovery, then through the massive falls in Feb/March 2020, and the recovery so far since then. There is actually quite a bit of fundie ownership of EGG:

- Forager (FOR) still own 5.17%;

- Perpetual (PPT) now own 13.29%;

- NAOS (in NCC & NSC) own 14.12%;

- Regal Funds Management own 13.07%; and

- Wilson Asset Management Group (in WMI & WAM) own 8.78% of EGG

WAX (WAM Research) may also hold some EGG, however EGG was not in WAX's top 20 at the end of August - but it WAS in WMI's (WAM Microcap's) top 20. WAM (the WAM Capital LIC) holds all the stocks that WAX, WAA (WAM Active) & WMI hold.

Also, we know that NAOS hold EGG in both their NCC & NSC LICs, but they may also hold EGG in NAC - which targets larger companies - their monthly reports say: "NAC generally invests in mid-cap industrial companies with a market cap of $400m-$1b+" while a recent NAOS company presentation had a graphic suggesting that NAC covers a range of market caps from $250m to $6 billion. In reality however, at the end of August, the Weighted Average Market Capitalisation of the Investments in NAC was $332.1 million and they definitely held companies like OCL (Objective Corp) whose market cap is only $118m (even smaller than EGG). We also know that all 3 of the NAOS LICs (NCC, NSC & NAC) are very concentrated (not too many positions), and there is a lot of crossover between the three of them.

In addition to those five fundies, a private investment firm, RG Capital Multimedia (originally set up by the late Reg Grundy, a legend of Australian TV and Radio) remains the largest EGG shareholders, with a 17.69% stake. RG Capital is now run by Susan McIntosh who is a non-executive Director of EGG.

Out of Enero's six member Board, only their CEO & MD, Brent Scrimshaw, does NOT hold shares or options in EGG.

Between the board members, RG Capital and the five fundies mentioned above, around 75% of the company is accounted for, leaving a small free float of around 25% - and Enero are a microcap company with a total market value of only $136 million (at yesterday's $1.57 closing price).

Liquidity can therefore certainly be an issue with EGG, as it can be with many microcap stocks, particularly those with reduced free floats (the shares available to the general public, i.e. not held by institutions or insiders). As I type this, we have 7 bids on the "buy" side, 5 offers on the "sell" side, and the lowest offer (at $1.595) is 11.5% above the highest bid (of $1.43). It is therefore not particularly unusual to see the SP move quite a bit in percentage terms on very low volume. This is par-for-the-course, i.e. comes with the territory with such companies. The five fundies who own stakes in EGG are used to dealing with such issues, and tend to be longer term focussed investors who know they have to be patient when either accumulating shares in such companies, or when reducing their exposure (or exiting their positions), with the possible exception of Wilson Asset Management, who can be in and out in a relatively short period when it suits them. That could be more difficult with EGG though, seeing as they own 8.78% of the company. I view that as a fairly high conviction position for a fundie like WAM (the manager, not the LIC) considering the lack of liquidity that EGG obviously has. Even more so for RG Capital, PPT, NAOS and Regal who each own over 13% of EGG.

Anyway, as I said, I don't hold EGG directly, however I do follow them because of the indirect exposure I have to them through my holdings in FOR and WMI. EGG appear to be one of the better advertising, brand management and promotional groups out there.

I used to own shares (directly) in WLL (Welcom Group) which was taken over at a healthy premium, so I know that there is money to be made in that space, when you pick the right players.

P.S. This is the second time I've typed all this - I first did it yesterday evening and it failed to save because Strawman.com had gone down for a system update. I had become complacent and never saved a back-up copy on my own computer (which I used to always do), so lost the lot...