Following on from my "Humpty Dumpty" straw, I've spent some more time with EGG's half yearly report to try determine if I should be worried or happy to have an opportunity to increase my holding. I've picked a few themes of potential concern to provide some commentary on.

"Brand transformation" EBITDA margin crunched from 27% in 1H22 to 17% in 1H23

As best I can tell, the bulk of the damage here was done by an increase in employee expenses which don't appear to be permanent/structural in nature and the report notes:

During the half year ended 31 December 2022, the Group started a restructuring process to mitigate costs across the Brand Transformation segment. This is largely related to redundancy costs in Hotwire UK, which continued to further integrate its communication and marketing services businesses into a single account management team.

Something to keep an eye on going forward, but feeling ok about this at this stage as they continue to digest their acquisitions and streamline operations.

Debt position

The $50M facility from which they drew $36.3M to fund the ROI DNA purchase was partially repaid down to a balance of $26.0M and they have $38.0M cash.

No concerns here for me.

Cash flow/conversion

At the end of 1H23 they had $99M in receivables and $91M in payables on the balance sheet, of which ~$5-6M were expected by management to be recognised in 1H but payment slipped until early in the new year per their "adjusted" 74% cash conversion percentage i.e. if we attribute the late payments to 1H23, they entered 2H23 with ~$95M receivables.

My take: "Oh well", but not a concern at this stage.

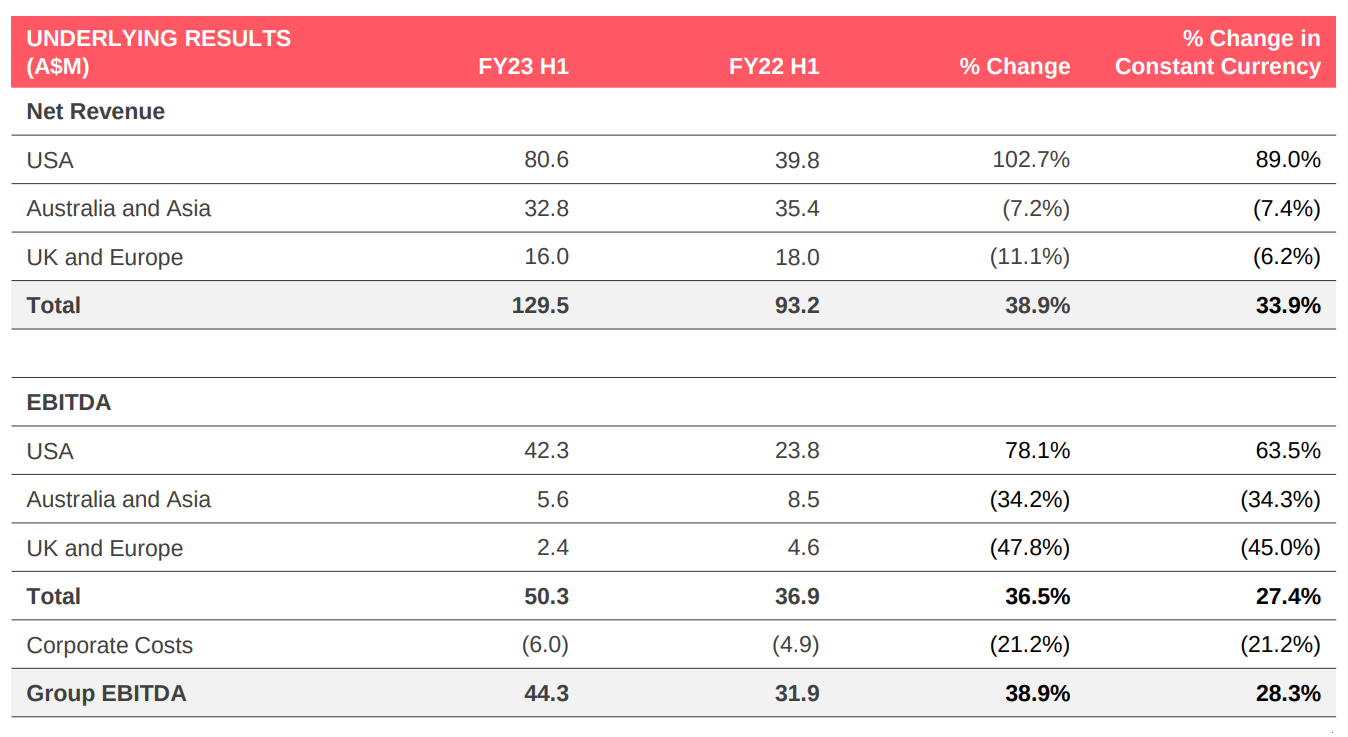

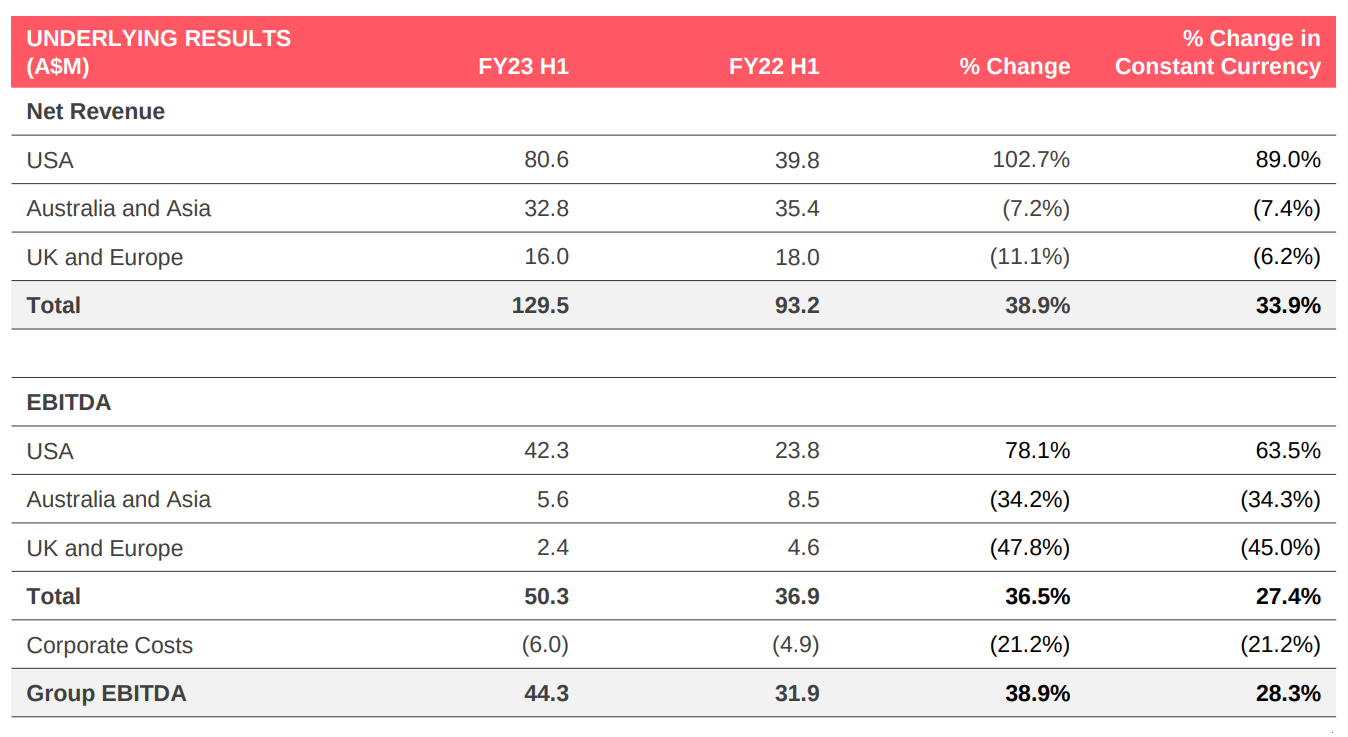

Results by geography

The US market is driving all the growth mostly thanks to OBMedia and a nice FX-cherry-kick on top. All in all, the acquisitions and diversification in the business appear to be paying off handsomly. I'm a little surprised to see AU/Asia going backwards, though without deeper insight that's mostly a curiosity rather than a concern. Given the size of the US market contribution to the group, the primary short term risk is US economic deterioration hammering their US businesses.

How recession proof is clients' OBMedia spend? I find it hard to imagine clients completely turning off the tap, but it could certainly shrink substantially or become more lumpy for an extended period. Given how hard OBMedia has been firing though it seems to be sufficiently resilient at the moment in the face of I guess what you could call "storm clouds on the horizon".

General thoughts

At a SP of $2.30, TIKR tells me the forward PE is 6.6 on a FY23 EPS estimate of 35c. That estimate seems a little too bullish given the 1H results and commentary, but given their current run rate it looks like they shouldn't go backwards (FY22 EPS were 30c) so if we say they'll manage EPS of 31-32c they're trading on a forward PE of ~7.3 which is certainly low by EGG's historical standards.

They're paying out 35-40% of earnings in dividends, and with the retained 60-65% of earnings they've been generating increasingly good returns on equity and capital as well:

My sense is that while there's plenty of short term risk here, I'm still pretty comfortable with how the group as a whole is executing and do not see any reason to panic.

I'll probably be pretty cautious about topping up between here and the end of FY reporting as there may well be more camel and less rocket to come, but still feeling pretty good about it as a long term hold and easing into topping up over the coming months.