31-Jan-2025: Quarterly Report (December Qtr, FY25)

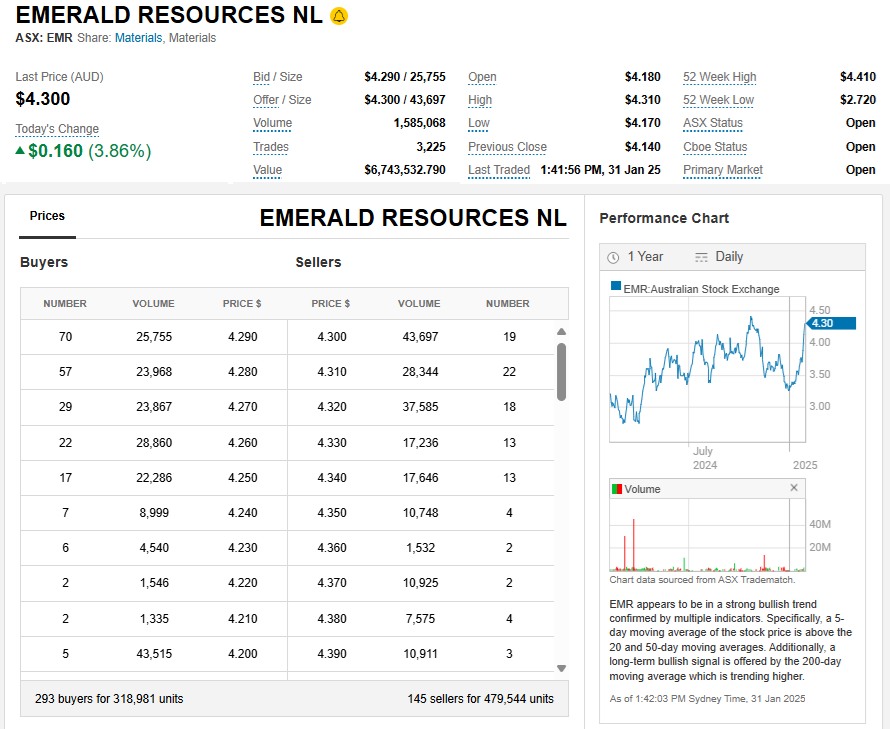

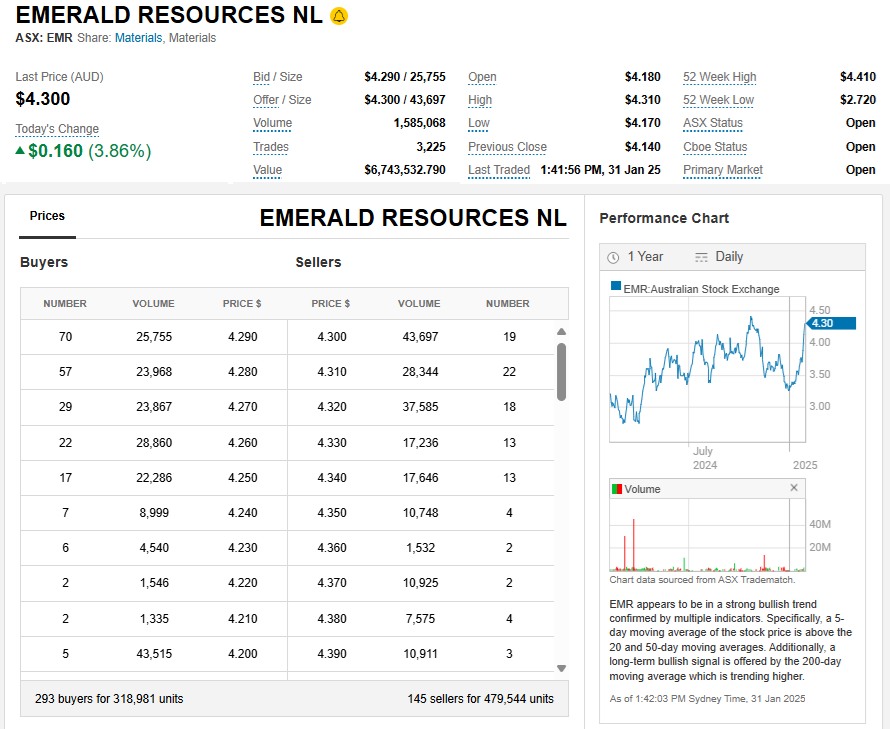

EMR up over +3% today already (at 2:30pm) and up by around +33% in January (1 month) based on a closing price on December 31st 2024 of $3.25 and an intra-day-high SP of $4.32 today (so far).

And they were as high as $4.41 briefly in October, so they've been up here before.

Here are the other two positive newsflow releases from Emerald during January:

06-Jan-2025: Record-Quarterly-Gold-Production-of-319Koz-at-Okvau.PDF

28-Jan-2025: Emerald Continues Exploration Success.PDF

Disc: I hold EMR in my SMSF as well as here. They are currently producing gold at Okvau in Cambodia, and they are developing a WA gold project as well which looks very promising, and they have been finding enough new gold in Cambodia to suggest they will be able to get a second Cambodian gold mine operating over the next few years.

The most important thing to note about Emerald is that their MD, Morgan Hart, and his executive team and their Board are experienced with succesfully getting gold projects up and running on-time and on-budget, or better, including in West Africa and Western Australia, and now also in Cambodia.

Many of them were together back in the Equigold days - Equigold was acquired by Lihir in 2008 after Morgan Hart and his team at Equigold had established the Mt Rawdon mine in Queensland and the Bonikro gold project in Ivory Coast (Côte d’Ivoire), West Africa, then Lihir itself was acquired by Newcrest Mining, which was later acquired by Newmont Goldcorp, the world's largest gold mining company. That Equigold team went on to establish Regis Resources (RRL) back in the early days when they built multiple profitable gold mines at Duketon in WA from scratch.

Most of the smarter people from early RRL (Regis) ended up at either Emerald (EMR) or Capricorn Metals (CMM) and both EMR and CMM have done very well, which has a lot to do with the relevant past experience of their senior management teams and Boards.

CMM look fully priced to me up here, so I no longer hold any in real-money portfolios, just a small position here, however EMR has been trading at a discount relative to their peers due to the perceived risk of operating in Cambodia. Perhaps not so much now after a +33% SP rise in January... But that's why I've been holding EMR in my Super portfolio and not CMM - both are great companies with excellent management teams who know gold mining very well, but EMR had more upside (IMO) due to their lower share price relative to my estimate of their intrinsic value; my opinion only of course - and I've clearly been wrong before - and will be again.

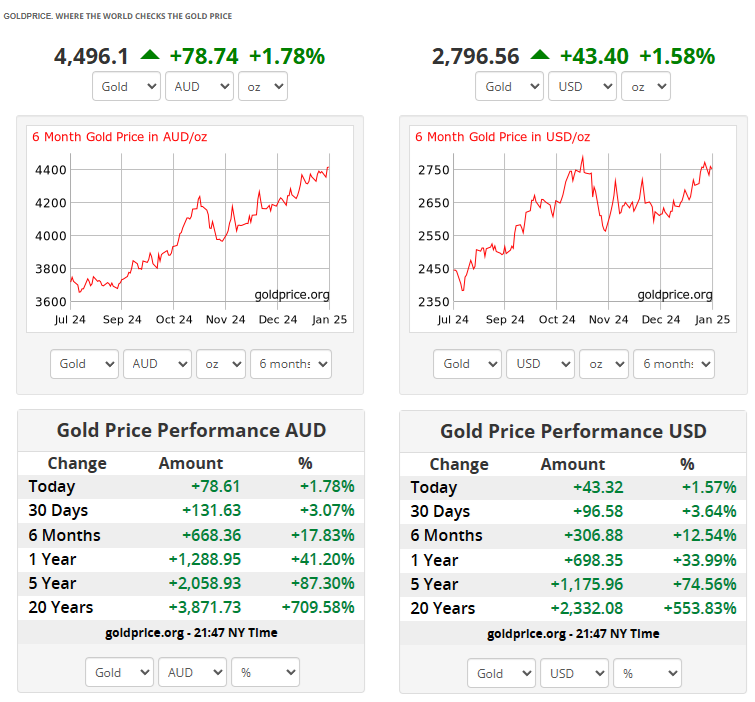

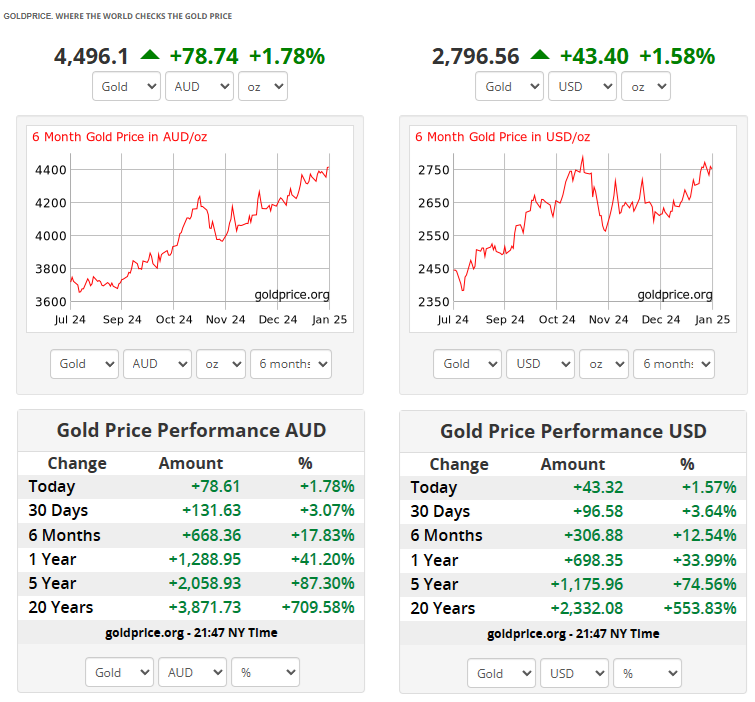

The Australian sharemarket (as measured by the XJO; the ASX200 Accumulation index - a.k.a. Total Return index) hit another new all-time high today, and the ASX will likely close at a new all-time high today, while the Australian Dollar gold price made another new all-time high today as well:

Source: https://goldprice.org/

So, there's an argument to be made that there is substantial downside from here if the gold price falls significantly, but if you're bullish on gold, as I still am, then you could do worse than holding EMR. I wouldn't be adding to a position or buying a new position in EMR up here myself; I'd rather wait for a decent pull-back, and if you look at their chart you'll see that their share price can be very volatile so we do get plenty of pullbacks. Patience will be rewarded!

Disc: Holding.

P.S. Money of Mine was back online this week by the way.