Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Scroll down - latest update is at the end.

12-April 2024: Same thing applies here as I wrote last night for Capricorn Metals (CMM). I haven't updated price targets for either company for years, but they haven't cared much about that and have just got on with it.

Both CMM & EMR have ex-RRL (Regis Resources) people working for them, but these are the people that built Regis into one of Australia's top 5 gold miners back in the day - at Duketon, not the later management who overpaid for 30% of Tropicana and are dragging their feet on McPhillamys because the costs blowing out has made it hardly worth the effort now, and it will take an enormous effort to get McPhillamys up and running from here, and I've recently lost faith in the current Regis management to get that done in any sensible timeframe, but I digress...

Emerald through it's Cambodian subsidiary Renaissance Minerals has developed Okvau which became Cambodia's first commercial gold mine, and the Cambodians seem reasonably pleased to have the new industry in the country employing locals and producing money and benefits for the locals and the government.

Warning: The following two sites do use pop-up ads and cookies, so best to use a pop-up blocker and a cookie cutter (good firewall) or maybe skip the next four links:

https://www.khmertimeskh.com/501396101/cambodia-produces-nearly-9-tons-of-gold-minister/ [22-Nov-2023]

https://www.phnompenhpost.com/business/first-commercial-gold-mine-online [21-June-2021]

There are a few coyboys and locals trying to mine gold themselves in different parts of Cambodia without proper safety precautions, and than can have tragic consequences:

https://www.khmertimeskh.com/501285265/gold-mining-pit-accident-in-central-cambodia-claims-four-lives/ [06-May-2023]

That image (above) is from that tragic incident referred to in the article linked to above the image.

Emerald's Okvau mine, on the other hand, while it looked quite rural in it's early days compared to larger scale mining operations in other countries, has become a decent sized mine and processing plant now, and they do follow proper safety guidelines as well as ahering to the local laws and regulations.

Source: https://www.phnompenhpost.com/business/australia-gold-industry-adds-lustre-cambodias-diversification-plans [23-June-2021]

Excerpt:

Australian charge d’affaires Luke Arnold said compatriot Renaissance Minerals (Cambodia) Ltd’s commercialisation of gold in southwestern Mondulkiri province’s Okvau area will underpin Cambodia’s goal to diversify its foreign investment profile and assist the Kingdom in building a more resilient economy.

Arnold and Australian embassy second secretary Rhys Haynes on June 21 joined the energy and environment ministers and other senior Cambodian government officials for a ceremony marking the commencement of gold mining operations at the Okvau Gold Project in Mondulkiri’s Keo Seima district.

Owned by the Australian Stock Exchange- (ASX) listed company Emerald Resources NL, Renaissance established the project – Cambodia’s first commercial gold mine – and will operate it.

Arnold said the embassy is “pleased that an Australian mining business is helping support the Royal Government of Cambodia’s goal of diversifying its sources of foreign investment.

“Investments from Australia, like this project, will ultimately assist Cambodia to build a more resilient economy and a balanced strategic outlook in our region.”

Prime Minister Hun Sen on June 21 took to Facebook to congratulate all parties involved with the commercialisation of the project.

He said the undertaking was nearly 14 years in the making, following successful feasibility studies and environmental impact assessments.

Construction of the necessary infrastructure and facilities to support the gold project started in mid-2020, with a total investment of around $120 million, he said.

“The start of operations makes it clear that our past efforts in the mining sector were indeed viable, and we can extract natural resources from underground and reap their benefits for our socio-economic system, with high accountability for the environment and society.”

“[But] the launch of the gold industry is not just an invitation to encourage people to take up gold mining businesses – it is one of the most risky ventures, and requires a lot of capital and specialised skills,” the prime minister cautioned.

According to the embassy, the Cambodian government estimates that the Okvau Gold Project will generate more than $300 million in tax revenues and royalties over seven years, which will provide vital funding for public services and help offset the economic impact of Covid-19.

Emerald Resources has committed to applying high environmental, social and governance (ESG) standards throughout the project, in line with the Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises and relevant Cambodian legislation, it said.

It added that it understands that the project’s Environmental and Social Impact Statement was the first of its kind to be audited to the International Financial Corporation’s (IFC) Environmental and Social Performance Standards.

And the charge d’affaires said the IFC’s audit “sets a high bar for future projects and will help ensure that the emerging Cambodian mining industry can attract interest from high-quality international mining companies, which will be more likely to deliver benefits for the Cambodian people and minimise negative environmental and social impacts”.

--- end of excerpt ---

Hopefully that's more than just talking the talk, and they actually walk the walk and do what they say they will in terms of minimising adverse environmental impacts and setting a high standard for future Cambodian mining projects to meet.

The main thing is that the wealth is being shared around, instead of ALL of it being siphoned out of the country. Many of these countries need the experience and investment dollars that companies like EMR can bring to the table to unlock the wealth that would otherwise mostly stay buried underground. However with $300 million in taxes and royalties (government estimates, see above) flowing back to the Cambodian government over the initial 7 years of this mine - assuming the mine life does not get extended further due to further gold being discovered - as is often the case, it is little wonder the Cambodian government is so supportive of this project.

The market often doesn't know what to do with Emerald, because there is no history of Cambodian gold mining to look at, as Emerald are pioneers at developing and operating a commercial gold mine in Cambodia. Their share price continues to grind higher however as they keep presenting more and more positive news and no real negative news.

Then there is Bullseye Mining, a private (unlisted) gold company that owns projects in Western Australia. Emerald made a takeover offer for Bullseye back in December 2021. Here we are now, 2 years and 4 months (28 months) later, and they (EMR) still only own 78.26% of Bullseye Mining, and that takeover is still ongoing - it just keeps getting extended and extended.

Emerald have control of Bullseye, including controlling their Board, with the two companies having the same company secretary (Mark Clements) and the MD of EMR, Morgan Hart, now being the Chairman of the Bullseye Board. The Bullseye Board has always unanimously recommended that shareholders accept Emerald's offer, so that's not the sticking point - it is 2 or 3 stubborn shareholders who are holding out for a higher offer and refusing to sell. My understanding is that at least 2 of them are Chinese companies. Anyway, it appears that Emerald is going ahead with its plans for Bullseye and their WA gold projects with or without the support of those minority shareholders who are refusing to sell their Bullseye shares, and with 78% of the shares under their control, Emerald have effective control anyway - it's just messier with minority shareholders, but still doable.

You can read more about Bullseye here: https://www.bullseyemining.com.au/site/About-Us/company-overview

And Emerald here: https://www.emeraldresources.com.au/about/

WA:

Bungarra Pit, WA.

Cambodia:

Okvau Open Pit, July 2023.

Processing Plant.

Okvau Maintenance Crew.

Ball Mill Reline Crew.

Further Reading:

EMR:

MNN Awards: Hart's Emerald a quiet achiever (miningnews.net)

Executive management - Emerald Resources

Board of Directors - Emerald Resources

(24) Emerald Resources NL: Posts | LinkedIn

Tim Treadgold: Why it's time to take a closer look at Emerald Resources - Stockhead

CMM:

Ex Regis team to take reins at Capricorn Metals: sources (afr.com)

capmetals.com.au/corporate/senior-management/

(24) Capricorn Metals Ltd: Overview | LinkedIn

-----

As I said, EMR and CMM both have ex-Regis Resources (RRL) people there from the earlier Duketon build-out days, and many of those guys were together at Equigold before Regis.

I no longer hold Regis Resources, Capricorn Metals or Emerald Resources in any of my real money portfolios, however I do have a CMM and an EMR position here in my Strawman.com virtual portfolio. I have made money on CMM and EMR and lost money on RRL both here and in real life. I should have realised that the best part of RRL were the former management, who all turned up at either CMM or EMR. RRL has been a poor investment for most people after they left. EMR and CMM on the other hand just keep on grinding higher.

Monday 23rd December 2024: Update:

Merry Christmas All. Time to update my EMR price target. Some background here if anybody is keen to read the thesis by Joshua Baker (@BkrDzn) back in 2020: https://strawman.com/member/uploads/perspective/8341/20-10-30_EMR_Research_Note.pdf [30-Oct-2020]

Well, how are they travelling? Very well. Okvau in Cambodia is producing. Based on the gold they have already found at Memot, Emerald believe Memot has the potential to become the company's second standalone gold mining operation in Cambodia - see announcement excerpt below:

Memot Gold Project Resource Increases by 120% to 1,030,000ozs [13-Dec-2024]

Highlights

- Memot Gold Project Indicated and Inferred Mineral Resource Estimate of 19.5Mt @ 1.65g/t Au for 1.03Moz;

- This represents an increase of 120% from the previous estimate announced in December 2023;

- 68% of resource estimate classified as “Indicated”;

- Memot Gold Project remains open in all directions and at depth. Four double shifting diamond drill rigs continue targeting extensions of the mineralisation with the aim of a mid-2025 resource update;

- The style of mineralisation intersected to date, gives the Company confidence that the Memot Gold Project can lend itself to either selective mining (higher grade) or bulk mining (higher tonnage) options when developed;

- +85% metallurgical recoveries anticipated from conventional CIL flow sheet;

- Feasibility studies continue in advance of a development decision and anticipated commencement of development in 2025;

- Work to date supports Emerald’s view that the Memot Gold Project has the potential to be a second standalone operation for the Company in Cambodia;

- Results in the Updated Resource Estimation include:

- 6m @ 348.76g/t Au from 125m including 1m @ 2,090g/t Au from 130m (DD24MMT243);

- 9m @ 12.61g/t Au from 193m including 1m @ 64.50g/t Au from 197m (DD24MMT256);

- 14.8m @ 3.94g/t Au from 288.4m including 0.6m @ 58.10g/t Au from 292.4m (DD24MMT303); and

- 4m @ 13.49g/t Au from 63m including 2m @ 26.31g/t Au from 63m (RCDD24MMT158).

--- end of announcement excerpt --- click here for the full announcement.

Memot is open in all directions and at depth - so they haven't yet found the lateral boundary of the deposit in any direction - or the vertical depth of the deposit. Mineable gold could extend a lot further yet.

And today - 23rd December 2024 - they have released some positive news about their Dingo Range Gold Project - acquired through the eventual takeover of Bullseye Mining by Emerald in April this year (2024) - saying that Dingo Range has the potential to be the Company’s first standalone mining and processing operation in Australia.

Maiden Gold Resource of 1.01Moz at Dingo Range Gold Project [23-Dec-2024]

Highlights

- Maiden Dingo Range Gold Project Measured, Indicated and Inferred Mineral Resource Estimate of 28.0Mt @ 1.13g/t Au for 1,010Koz;

- Maiden resource includes the Boundary to Bungarra trend and Freeman’s Find Prospects which is constrained only by the drilling completed and remains open at depth and along strike;

- Work to date supports Emerald’s view that the Dingo Range Gold Project has the potential to be the Company’s first standalone mining and processing operation in Australia;

- +90% metallurgical recoveries anticipated from conventional CIL flow sheet (free milling);

- Drilling continues over the prospects in advance of further resource updates throughout 2025;

- Feasibility studies continue in advance of commencement of development in 2025;

- Various data sets for each calculation were finalised between September and November 2024, subsequent intersections outside of the resource calculation expected to be included in the next update include;

- 19.0m @ 2.59g/t Au from 75.0m (RC24NPT132);

- 2.0m @ 15.09g/t Au from 15.0m (RC24FMF030);

- 5.7m @ 4.50g/t Au from 99.0m (RCDD22NPT030);

- 6.0m @ 3.90g/t Au from 96.0m (RC24FMF024);

- 22.0m @ 1.03g/t Au from 105.0m (RC24NPT126);

- 1.0m @ 21.00g/t Au from 8.0m (RC24HUR077); and

- 6.0m @ 2.74g/t Au from 112.0m (RC24HUR083).

--- end of excerpt from today's announcement --- Click here for the full announcement.

Dingo Range is open at depth and along strike, so they haven't yet determined how deep the gold goes, or how wide it is spread. The more they drill, the more they find.

So they have two development projects, one in central WA (Dingo Range) and one in Cambodia (Memot) where they also have a successful producing gold operation already (Okvau).

And Morgan Hart, EMR's MD for the past decade, who was also instrumental in establishing Regis Resources Duketon mines back in the day (before he moved to run EMR) is still active in M&A - as this announcement shows: Emerald Becomes 20.5% Shareholder in Golden Horse Minerals [09-Dec-2024].

Good stuff. Very good track record of project development through to profitable mining. (As I have mentioned here a few times already)

EMR has been in a strong uptrend for a couple of years, but appears to have dropped below that rising channel lately:

I hold EMR, both a small position here as well as a proper position in my SMSF. They have appeared overbought a few times along the journey, but that hasn't stopped them from continuing to rise. They don't look overbought today however. They got sold down in the recent post-Trump-election gold sell-off but just haven't recovered much yet.

I would argue that they are better value now than they were a year ago, because they have been finding plenty more gold and they are on track to be a multi-mine producer in the next few years, probably with two producing mines in Cambodia and one in Central WA as well. They didn't spend 3 years acquiring Bullseye (13-Dec-2021 to 26-April-2024 although discussions between Emerald and Bullseye began back in May 2021) just to spend a few million drilling holes there. That is going to be EMR's first Australian gold mine; it's just a matter of when.

In Summary, recent news is positive. There's nothing negative about Emerald Resources that I can put my finger on, so this -23% SP pullback from $4.40 to $3.40 is an opportunity IMO. I topped up my EMR position in my SMSF today.

I believe they'll resume their uptrend soon enough. Very well run company!

23rd July 2025: Update:

When I raised mmy price target (PT) for EMR on 23rd December (2024) from $4.15 to $4.65, their SP was $3.40 (and they closed @ $3.30 the following day). However, the EMR SP has tagged or got above my most recent $4.65 PT on three occasions since then (in early May, early June, and again in mid-June 2025) before falling back down to below $3.60 on July 11th (12 days ago).

They're still a purely Cambodian gold miner, and their share price has been very choppy - much more so than their peers with similar market caps. EMR do have a development project in WA (Dingo Range, acquired through their takeover of Bullseye Mining), but those projects won't be producing gold for a few years - so there's both the development risk associated with that, plus the perceived risk of operating a gold mine in Cambodia, being a country without a strong history of large scale gold mining.

There's plenty of artisanal and small-scale gold mining in Cambodia but overseas listed companies have stayed away until Emerald proved that gold mining can work in Cambodia at scale if you do things right, including treating the locals and the government there with respect and freeing up some of the countries buried wealth for the benefit of all stakeholders.

Artisanal and small-scale gold mining (some images of that are included in my earlier updates to this "Val" thread, so scroll up for those) is a labor-intensive, low-technology method of gold extraction that provides livelihoods for millions worldwide, particularly in the global south, though it is often unregulated and associated with significant environmental and health risks, and a fair bit of that is associated with the use of mercury.

In Cambodia, the government there has welcomed Emerald and appears to appreciate that Emerald have behaved well and provided economic and other benefits to the country. It looks like Emerald are now planning to build a second standalone mine in Cambodia, as I've previously detailed here, and that will also be welcomed by Cambodia.

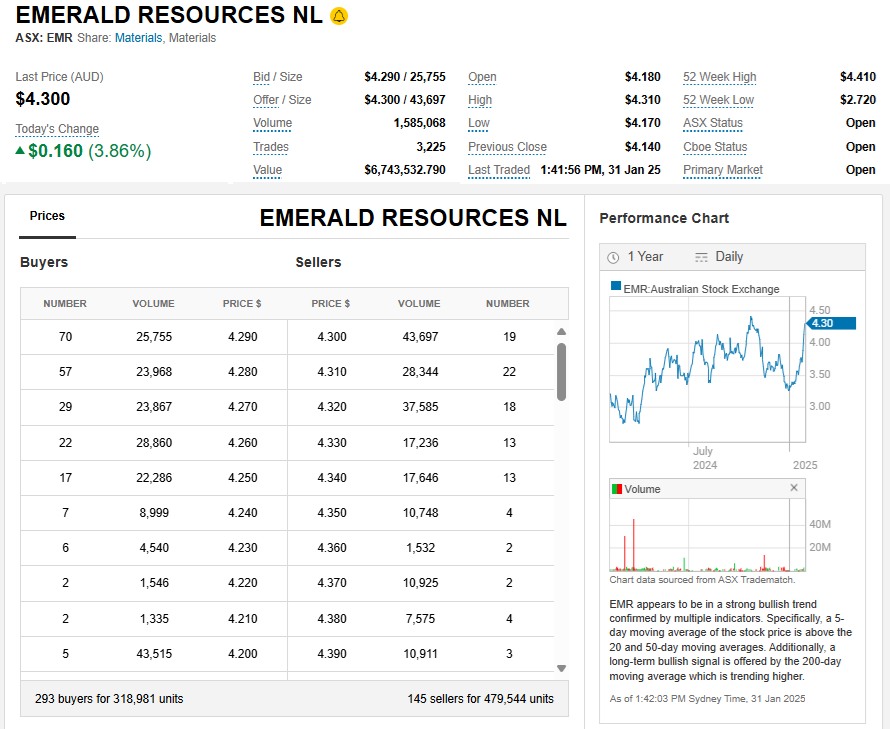

Meanwhile, gold sector investors aren't so sure if Emerald (EMR) is going to give them the best bang for their bucks; sentiment waxes and wanes and can turn sharply from positive to negative and then back again, as EMR's one year graph demonstrates:

I think there is at the very least trading opportunities with EMR, to buy when sentiment turns negative and their share price heads south, and then trim or exit when the share price returns to higher levels. Alternatively they have provided some excellent longer returns as well if you're more inclined to buy and hold (and ride out or ignore that volatility):

[Yeah, their SP has risen another couple of cents between those two chart screenshots from Commsec in the past few minutes]

Emerald released this announcement today:

Significant Resource Growth at Memot and Dingo Range [35 pages, 23-July-2025 8:52am]

This updates concerns both their second Cambodian project (Memot) and their WA development project (Dingo Range) and details the additional gold that they've found plus their other progress.

Emerald’s Managing Director, Morgan Hart, commented: "Since our last resources report in December 2024 we are pleased to report significant gold resources growth across both the Memot and the Dingo Range Gold Projects for a total additional 670k ounces gold. This represents a 30% and 35% increase respectively. Importantly, the mineralisation remains open along strike and continues at depth, constrained only by the extent of drilling completed to date and our drilling program is ongoing.

"The feasibility studies and permitting activities are progressing across both projects in preparation for the commencement of development. At the Memot Gold Project, studies completed to date have supported the submission of an Industrial Mining Licence application, the Mineral Investment Agreement negotiations are well advanced and both are expected to be finalised imminently. These represent key steps toward the development of the project.

"Dingo Range Gold Project studies completed to date continue to support full licencing of the project with the installation of the camp to support development and operations progressing well.

"These significant advances support our strategic objective of becoming a multi-mine, +300K ounce per annum gold miner and we look forward to providing further resource updates in 2025."

Here's where the two projects are located:

Memot is 100 km from Okvau, as the crow flies, obviously further by road.

I am trading EMR in my real money portfolios - mostly using my SMSF - so in and out, not always holding, and they remain a small position in my Strawman.com portfolio. Once I see a positive FID on Dingo Range - with all permits received - I will likely become a longer term holder of EMR IRL, rather than trading them, because I believe their SP will exhibit less volatility once it becomes obvious that they will soon also be producing gold in WA - in addition to Cambodia. We're not there yet, so for now they remain mostly a trading stock for mine.

Very good management. And that's very important in gold mining where poor capital allocation decisions by management can make massive differences to outcomes for shareholders.

[Raising my PT slightly from $4.65 to $4.77 to reflect the higher gold price and their continuing success with gold resource growth.]

31-Jan-2025: Quarterly Report (December Qtr, FY25)

EMR up over +3% today already (at 2:30pm) and up by around +33% in January (1 month) based on a closing price on December 31st 2024 of $3.25 and an intra-day-high SP of $4.32 today (so far).

And they were as high as $4.41 briefly in October, so they've been up here before.

Here are the other two positive newsflow releases from Emerald during January:

06-Jan-2025: Record-Quarterly-Gold-Production-of-319Koz-at-Okvau.PDF

28-Jan-2025: Emerald Continues Exploration Success.PDF

Disc: I hold EMR in my SMSF as well as here. They are currently producing gold at Okvau in Cambodia, and they are developing a WA gold project as well which looks very promising, and they have been finding enough new gold in Cambodia to suggest they will be able to get a second Cambodian gold mine operating over the next few years.

The most important thing to note about Emerald is that their MD, Morgan Hart, and his executive team and their Board are experienced with succesfully getting gold projects up and running on-time and on-budget, or better, including in West Africa and Western Australia, and now also in Cambodia.

Many of them were together back in the Equigold days - Equigold was acquired by Lihir in 2008 after Morgan Hart and his team at Equigold had established the Mt Rawdon mine in Queensland and the Bonikro gold project in Ivory Coast (Côte d’Ivoire), West Africa, then Lihir itself was acquired by Newcrest Mining, which was later acquired by Newmont Goldcorp, the world's largest gold mining company. That Equigold team went on to establish Regis Resources (RRL) back in the early days when they built multiple profitable gold mines at Duketon in WA from scratch.

Most of the smarter people from early RRL (Regis) ended up at either Emerald (EMR) or Capricorn Metals (CMM) and both EMR and CMM have done very well, which has a lot to do with the relevant past experience of their senior management teams and Boards.

CMM look fully priced to me up here, so I no longer hold any in real-money portfolios, just a small position here, however EMR has been trading at a discount relative to their peers due to the perceived risk of operating in Cambodia. Perhaps not so much now after a +33% SP rise in January... But that's why I've been holding EMR in my Super portfolio and not CMM - both are great companies with excellent management teams who know gold mining very well, but EMR had more upside (IMO) due to their lower share price relative to my estimate of their intrinsic value; my opinion only of course - and I've clearly been wrong before - and will be again.

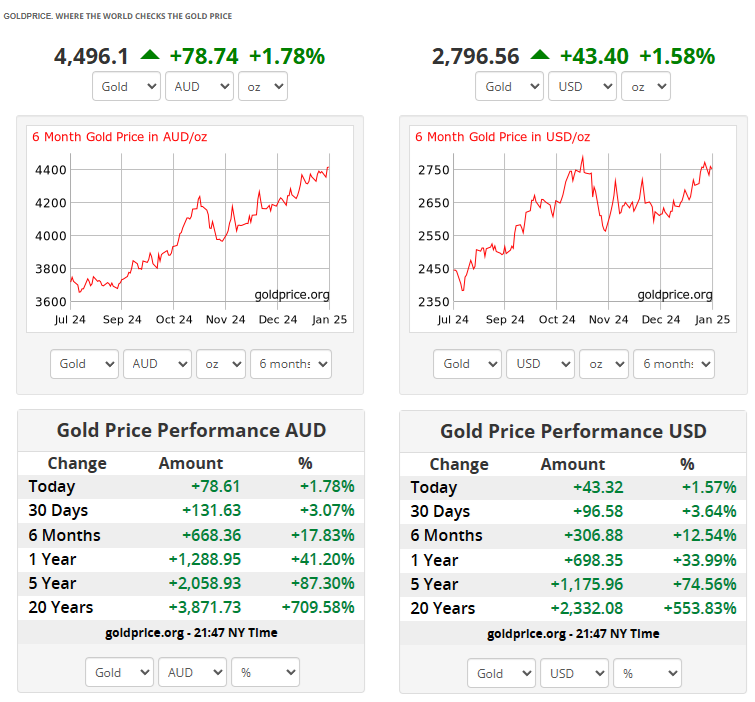

The Australian sharemarket (as measured by the XJO; the ASX200 Accumulation index - a.k.a. Total Return index) hit another new all-time high today, and the ASX will likely close at a new all-time high today, while the Australian Dollar gold price made another new all-time high today as well:

Source: https://goldprice.org/

So, there's an argument to be made that there is substantial downside from here if the gold price falls significantly, but if you're bullish on gold, as I still am, then you could do worse than holding EMR. I wouldn't be adding to a position or buying a new position in EMR up here myself; I'd rather wait for a decent pull-back, and if you look at their chart you'll see that their share price can be very volatile so we do get plenty of pullbacks. Patience will be rewarded!

Disc: Holding.

P.S. Money of Mine was back online this week by the way.

21-Sep-2021: Okvau Gold Mine Ramps Up to Full Production

HIGHLIGHTS

- Commissioning of the Okvau gold plant complete with ramp up of operations to full production

- Over 19koz gold produced to date including ~12koz gold poured

- Gold shipments to the refiner commenced in July 2021

- Gold production to end of Quarter 2021 on track for ~23koz (inclusive of gold in circuit)

- Process plant throughput 10% above DFS targeted nameplate rate of 2.0Mtpa

- Sulphide ore production for the first 15 days of September has averaged 420 ounces per day recovered, confirms plant is capable of +100koz p.a. gold production

- Grade control and mill production showing a strongly positive reconciliation to reserve for fresh rock sulphide ore and oxide ore

- Sulphide ore gold recoveries consistent with expected recoveries for the areas mined (~82%). Life of mine recoveries remain in line with the DFS of ~84%

- Mining operations are on schedule and in line with milling requirements, meeting all ore and waste feed requirements

- AISC materially on budget with guidance for remainder of FY2022 in line with DFS forecasts at 25-30koz per quarter at cash costs in a range of US$720 – US$780/oz

Emerald Resources NL (ASX: EMR) is pleased to advise that it has completed ramp up activities at its 100% owned 2.0Mtpa Okvau Gold Mine. The management team will continue to focus on optimising the performance of the Okvau Gold Mine.

Emerald’s Managing Director, Morgan Hart, said:

“It is pleasing to announce that we have achieved the successful ramp up of operations to full production at the Okvau Gold Mine which now places Emerald in the ranks of a 100,000+ ounce per annum gold producer."

"Importantly we are either meeting or exceeding the Okvau Gold Mine DFS1 which is a testament to the skill and quality of our staff and contractors in light of the significant challenges of the global pandemic and commissioning and ramp up activities during the recent wet season."

"We look forward to positive cash flows from the Okvau Gold Mine providing the opportunity to grow the Company through exploration and acquisition. Notably with environmental approvals recently granted at the Memot Project, our exploration is scheduled to commence on a maiden drilling campaign in the near term.”

--- click on the link at the top for the full announcement, with photos ---

Disclosure: I hold EMR shares in RL and in my SM portfolio. They have some impressive experience and prior track records in terms of management, key personnel and their board, and they have MACA (MLD) doing their contract mining for them - I also hold MLD shares. I don't normally go for gold producers with a single mine, especially if it's located outside of Australia. Okvau is in Cambodia. However, I'm backing the management and board in this case.

The ramp-up has been excellent - with no real issues having impeded it. Their costs should be world-class (i.e. low). This is shaping up as an excellent project, and one that I think a few larger gold producers would now be casting an eye over in terms of Okvau being a possible bolt-on acquisition for them at some stage.

I think we're in for a period of consolidation within the industry, so I'm expecting M&A, I just don't know who and when. But if you hold shares in the best producers, both established and emerging, it's a good start.

24-June-2021: Maiden Gold Pour at the Okvau Gold Mine

Emerald Resources NL (ASX: EMR) (“Emerald”) is pleased to advise that it has commissioned the gold room and poured first gold at its 100% owned 1.14Moz Okvau Gold Mine.

Two gold bars weighing a combined 8.6kg were produced during the three day commissioning of the gold room.

Emerald’s Chairman, Simon Lee AO, said: “I share absolute pride and the sense of achievement with our unwavering staff, trusted contractors and suppliers in Australia and Cambodia who have battled unprecedented challenges to remain categorically focused on meeting our target of commissioning and first gold production from the Okvau gold mine on time and on budget.”

“This could not be achieved without the leadership of our experienced executive and management team led by Managing Director Morgan Hart and Executive Director, Mick Evans and the support from the Government of Cambodia and its people. We are truly lucky to operate in a country steeped in traditions and wonderful people.”

Emerald’s Managing Director, Morgan Hart, said: “The first gold pour is a major milestone for both the Company and for Cambodia as the project becomes the first modern large scale mine to operate in the country. This marks the creation of a new industry for Cambodia bringing opportunities and benefits for the people of Cambodia.”

“Construction activities have remained on budget and the first gold pour has remained on schedule despite the logistical challenges brought on by the global pandemic. It is a testament to the skill and experience of the team we have assembled on site throughout this process."

"First gold doré production at Okvau is a significant achievement for Emerald, as whilst it continues commissioning activities ramping up to full production, it has successfully transitioned to the ranks of an international gold miner.”

Project Update

Commissioning activities at Okvau are well advanced and have initially focussed on the processing of oxide ore from crusher to the SAG mill, and through the CIL tanks, stripping circuits and detox circuit. The focus will now shift to commissioning the fine grind float circuit and adding higher grade sulphide ore to the process plant over coming weeks as the Okvau Gold Project ramps up to full production.

The Company maintains its guidance that the production at the Okvau Gold Project is forecast to be 100,000oz to 110,000oz per annum in line with the Company’s Definitive Feasibility Study releases on 1 May 2017 and subsequently updated on 26 November 2019.

[I hold EMR shares.]

8-June-2021: First Ore Feed and Commencement of Wet Commissioning of Okvau Gold Plant

- Crushing Circuit and Processing Plant in start-up wet commissioning phase in advance of maiden gold pour this month

HIGHLIGHTS

- Crushing circuit commissioned and stockpiling crushed ore

- First ore feed to the processing plant and wet commissioning commenced

- Okvau substation energised and fully operational

- Tailings Storage Facility (Stage 1) completed and ready for tailings discharge

- 245,000 tonnes of ore on the ROM

- Ramp up of gold in circuit allowing for maiden gold pour this month

Emerald Resources NL (ASX: EMR) is pleased to advise that it has commenced crushing activities, delivered the first ore feed to the Mill and has commenced wet commissioning of the Processing Plant at the Company’s 100% owned 1.14Moz Okvau Gold Project in advance of the maiden gold pour this month.

Emerald’s Managing Director, Morgan Hart, said:

“The first ore feed and commencement of wet commissioning of the Okvau Gold Project is a significant milestone for the Company and represents the exceptional efforts by our experienced construction and development team with co-operation from our quality contractors and global suppliers.”

“The Project has remained on budget and on schedule despite the logistical challenges brought on by the global pandemic and is a testament to the skill and experience of the team we have assembled on site throughout this process.”

“Construction activities are nearing practical completion and open-pit mining has delivered over 245,000t of predominantly oxide ore on the ROM pad. The oxide feed is being used to wet commission the SAG Mill and leaching circuit for the first few weeks of operation allowing a ramp up of gold in circuit in advance of the maiden gold pour this month. Hard rock, sulphide feed will be added to the circuit in the coming weeks to commission the float regrind circuit.”

[I hold EMR shares.]

30-Apr-2021: Quarterly Activities Report

Quarterly Report for the period ended 31 March 2021

Highlights

Development Activities - Okvau Gold Project

- Okvau Gold Mine Development continues to be “On Time-On Budget”;

- Overall project construction is nearing practical completion;

- Aspects of project commissioning expected to commence in May 2021;

- First gold production expected before the end of current Quarter;

- Earthmoving activities continued in line with project schedule with first ore delivered to ROM and first blasting during the Quarter. [MACA (ASX:MLD) have the earthmoving and mining contract at Okvau]

Exploration – Near Mine and Regional Licences

- Okvau Gold Project - High grade intersections continue to support structural feeder zone interpretation;

- Environmental assessment progressing on highly prospective Memot Project. Preliminary rock chip sampling undertaken including 40.4, 27.3, 23.6 and 13.7 g/t Au;

- Significant gold-in-soil Auger soil sample results from infill programme on the previously announced O’Kapai Prospect (O’Kthung Licence) including 1,000 and 434 ppb Au.

Funding

- Consolidated cash at 31 March 2021 was approximately A$47 million;

- Emerald remains fully funded to develop the Okvau Gold Project with additional contingency.

COVID-19

- The commitment and dedication of the Company’s construction and operational workforce has limited the impact of the COVID-19 pandemic to a level that to date has not delayed the project from forecast or increased costs materially;

- Travel between Australia and Cambodia continues to be restricted but is being managed through longer rosters and regional sourcing and the dedication of key employees on site at Okvau;

- Uncertainties around international freight have now been largely overcome with in excess of 95% of all equipment on site, approximately 4% in transit and less than 1% remaining to be shipped.

Commenting on the Quarter ended 31 March 2021, Emerald’s Managing Director, Morgan Hart, said:

"The global pandemic has continued to present challenges during the Quarter. However, our suppliers, logistics team and construction crew have worked safely and efficiently so that we are now in the final stages of construction of the Okvau Gold Project and expect to deliver first gold production prior to the end of the current quarter.”

“The expected first gold production will mark a significant milestone for Emerald and herald a new chapter for the Company as a +100,000 ounce per annum gold producer with an average LOM AISC of US$754/oz. First gold production at Okvau represents the first step in the Company's stated strategy to become a multi-mine gold producer."

--- click on the link at the top for the full report ---

[I hold EMR shares. I have shares in a number of gold producers, plus a small handful of project developers, and Emerald Resources is the ONLY gold project developer I hold who has a project located outside of Australia. I am backing their very experienced and well-credentialed management team, who have sensibly partnered with the Cambodian government to ensure favourable treatment in-country (or at least to hopefully ensure they do not get seriously rogered). Their grades at Okvau are outstanding.]

09-April-2021: Okvau Gold Project On Track For Commissioning 2Q of 2021

Emerald Resources NL (ASX: EMR) is pleased to advise that its 100% owned 1.14Moz Okvau Gold Project is tracking on-time and on-budget for commissioning and first gold pour in 2Q21 [i.e. the current June Qtr].

Emerald’s Managing Director, Morgan Hart, said: “Our dedicated team in country has advanced the development of the Okvau Gold Project significantly in recent months to be on schedule for the successful commissioning of the process plant and deliver first gold production prior to the end of the current quarter.”

“This represents an exceptional effort given the logistical challenges brought on by the global pandemic and done whilst maintaining first-class protocols to ensure the continued health and wellbeing of staff, contractors and stakeholders.”

"The expected first gold production will mark a significant milestone for Emerald and herald a new chapter for the Company as a +100,000 ounce per annum gold producer with an average LOM AISC of US$754/oz.”

--- click on the link above for the full announcement ---

Also, recently: 05-March-2021: 121 Mining Conference APAC Presentation

Disclosure: I hold EMR shares. It is an exception to my rule of not owning shares in gold mining companies whose mine (or majority of mines) is/are located outside of Australia. There is sovereign risk associated with operating in Cambodia for sure, but it's a very small position for me, and the low projected AISC and pedigree of their management and board are enough to get me to make that exception. High risk, high potential return. But only with money I can afford to lose. You don't bet the farm on companies like this.

Attched is a research note on EMR, which gives an overview and potential valuation ranges on the stock.