The Bull case for FLX seems fairly straight forward - conceptually at least.

The pitch here is that if management can sell Nexvia modules to existing Subcontractors on the Felix Platform, they can rapidly increase their ARR.

For Example 10% of Subcontractors would be 4,300 paying $13k each = $56m ARR which is 4.7x the current pro forma ARR. Even if this took 5 years it represents 42% CAGR in ARR for a business that has just broken even at a FCF level and should quickly become highly profitable.

Some Scenarios

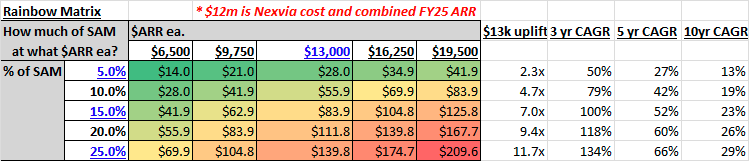

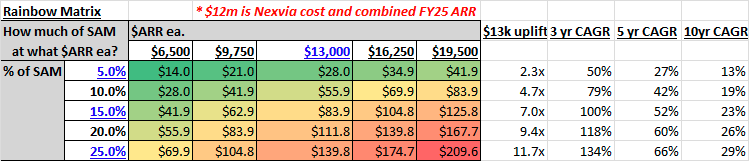

The below Grid shows how the Group ARR delivered for each percentage take up at different price points.

Here I'm looking at up to 25% of SAM (Servicable Addressable Market) converted at ARR per user from $6.5k being half the current Median of $13k, up to $19.5k being the current average ARR per user.

Felix is quoting $13k as their thinking for a price point. If they get 15% of the 43k subcontractors this is ARR of $83.9m, a 7.0x increase on current group ARR of $11.9m.

If they were to achieve this in 3 years that's 100% CAGR of ARR, but even if this took them 10 years it's a 23% CAGR in ARR.

If they picked up a more modest 5% of Subcontractors on Felix today over a 5-year period, this would see a 2.3x uplift in ARR at the median $13k per user or an ARR CAGR of 27%.

With the business now FCF break even, and exhibiting Operating Leverage, this growth should be highly profitable after the integration and GTM investment in FY26 which is fully funded.

Future Growth

This analysis ignores the increases in Vendors joining Felix as their Enterprise Clients sign up and compel them to.

Nexvia and Felix have each been growing their customer numbers at a CAGR of 25% over the last 3 and 4 years respectively.

Even if this growth rate halves, there would be 60% more vendors on Felix to market the Nexvia solution to in 5 years.

Another way of looking at this is that achieving 5% penetration of the current SAM would amount to just over 3% of the conservatively projected SAM in 5 years.

There are some other levers for future growth which management have recently pulled - the Pronto partnership in Jul-25 (https://www.marketindex.com.au/asx/flx/announcements/felix-signs-commercial-partnership-with-pronto-software-2A1605484) which integrates an additional 1,200 potential domestic customers (16x the current Enterprise customer count) and recent growth in Mining & Resources (May-25) - https://investorhub.felix.net/announcements/6954406

Anything that drops more Enterprise customers into the Felix Platform sucks another 1,500 Vendors each on average into the Nexvia funnel.

Execution Day

So the key questions here are 1) how many of the current 43,000 subcontractors can Felix sell Nexvia modules to, 2) for how much and 3) how quickly can they do this?

The conversion percentage and ARR per Vendor achieved will largely depend on management execution of 1) Integration of the two platforms into one, and 2) a Go To Market (GTM) strategy that optimises the Vendor monetisation opportunity.

In FY26 FLX will keep the separate engines of Felix Enterprise Monetisation and the Nexvia Platform for Contractors running while they integrate in the background and simultaneously develop a GTM strategy to be launched in FY27.

They have 12+ months and $10m+ cash to do this.

Size of the prize

The prize is so large because this could make both parts of the combined business worth a lot more than they are individually and grow the whole business a lot faster

Ultimate upside would be moving towards an industry standard. If that’s even possible, it is a long way off. More likely they would get acquired before then, but that’s not going to be anytime soon – see Coattails. So there should be a long duration of growth if they get this right.

See prior straw on Management for a look at their track record which might provide clues as to future success.

Buy vs Build

This M&A is to unlock Vendor Monetisation which is a long stated strategy so they ultimately decided to buy instead of build.

Picking up a proven platform that targets the Vendor / subcontractor set seems like a good way to de-risk this part of the strategy.

Buying Nexvia means they do not have to spend 12-18 months building something that may not actually gain traction.

Nexvia is proven in market and looks to be a very good fit for the Vendor side that Felix have cultivated but not yet monetised.

They are taking their time to develop a GTM strategy as they learn more about the Nexvia platform and Felix vendors willingness to pay for functionality.

This all seems like a focused, relatively conservative approach to balance aggressive growth plans…

Enter Briarwood

Briarwood is a NY hedge fund that specialises in international B2B SaaS.

They are high conviction, deep DD, long term investors who take a PE approach to public markets.

Briarwood are active but not activist looking to hold (and advise where they can) B2B SaaS businesses with the capacity to become long term compounders.

They don’t disclose performance numbers publicly but since 2017 they have compounded $155m of AUM by 27% CAGR to 1.06bn in FY25. This has been done through a range of market phases with B2B SaaS having fallen out of fashion in recent years compared to COVID days.

I take this 27% CAGR as a mixture of performance and net inflows less fees. They seem to be publicity shy but the founders and management have good pedigree.

These guys seem to really know what they are doing and are specialists in B2B SaaS looking to buy best in class wherever they find it.

I’m curious to know what if any role they played in identifying / green lighting the Nexvia buy for Felix, hopefully Mike can enlighten us when to talks to @Strawman this coming week.

Coattails

Briarwood conducted 6 months of intensive DD on FLX according to CEO Mike.

They took over 60% of the insto raise (about $11m) which is 16.1% of FLX post raise and 1% of Briarwood’s AUM.

This should given them a seat at the (board) table and a blocking stake for any would be acquirers.

They also negotiated the financial structure of the raise (in part at least) with the 5:7 attached options giving them the ability to raise their holding to 22% which at the strike price would make Felix 2.5% of their AUM all else being equal.

So they are taking a decent size stake with a view to taking a larger one if things unfold as they expect.

Disc: Held