Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

FLX Capital Raise History

Since IPO raised $39.122m. Todays Market Cap is $47.5m at today’s share price $0.16

· August 2025 Raised $16.5m, $16m Placement at $0.22 per share, $0.5m SPP at $0.21 per share. https://announcements.asx.com.au/asxpdf/20250912/pdf/06p4crb987frjy.pdf

· August 2023 Raised $3.822m, $3.0m via Institutional placement, $822,000 via SPP at $0.08 per share. https://announcements.asx.com.au/asxpdf/20230830/pdf/05t873gjx47z90.pdf https://announcements.asx.com.au/asxpdf/20230807/pdf/05sd8s4x7ghvqh.pdf

· May 2022 Raised $6.8m, InEight invested $2.75m at $0.36, $3.7 Institutional Placement at $0.30 per share, SPP raised $440,00 at $0.25 per share. https://announcements.asx.com.au/asxpdf/20220504/pdf/458nwh8h24wdvr.pdfhttps://announcements.asx.com.au/asxpdf/20220531/pdf/459h20nlgh9dr8.pdf

· IPO January 2021 Raising $12m at $0.36 per share https://announcements.asx.com.au/asxpdf/20210112/pdf/44rnq98nstbrjl.pdf

Here's the transcript from today's interview:

Thanks for all the great questions @Slomo. I'll be keen to get your thoughts on how he answered them.

My initial impression is that Mike is a pretty straight shooter, and although the share price hasnt gone well since the heady days of 2021 when it listed, the business does genuinely seem to be making progress. But as I said in the interview, the concern here is that they never grow into their cost base and realise any decent operating leverage. It's just a very familiar story for small cap ASX stocks. But Mike's response seemed reasonable -- you need to have a certain capability to play at the level they want. And it was encouraging to see consistent ARR growth and the transition to positive operating cash flow.

Much depends on the Nexvia acquisition, but the strategic rationale made sense to me.

Shares are roughly 4x pro-forma ARR, which hardly makes them cheap, but such multiples are rather limited. Could still be very good value if revenue growth remains strong and the operating leverage kicks in.

Anyway, here's chatGPT's summary:

1. Business Overview

Felix provides a cloud-based enterprise SaaS platform designed for large, capital-intensive sectors — construction, mining, infrastructure, energy, and property.

- Core capability:

- Manages subcontractors, suppliers, and third-party vendors by streamlining procurement, compliance, prequalification, RFQs, tenders, and contract awards.

- Marketplace effect:

- As enterprise customers onboard thousands of subcontractors, Felix builds a two-sided vendor marketplace with over 100,000 vendors.

- Revenue model:

- Primarily subscription-based SaaS, integrating tightly with existing enterprise systems. Vendors join free when invited by contractors.

2. Recent Results & Metrics

- Revenue growth: Up 22% YoY.

- Net revenue retention: 106%, indicating account expansion from existing customers.

- Positive operating cash flow: Achieved, marking a key inflection point.

- Marketplace scale: Vendors doubled since IPO — from ~52,000 (2021) to 100,000+ today.

3. Strategic Positioning

Integration, Not Replacement

- Felix complements rather than replaces ERP systems like SAP, Oracle, JD Edwards, and Workday.

- Felix integrates deeply with ERP and related systems, becoming the “source of truth” for vendor data — including compliance, banking, and relationships.

Network Effects

- Contractors require vendors to join Felix, onboarding them at zero cost to Felix.

- This accelerates vendor marketplace growth and creates a defensible moat similar to car-sales platforms — "buyers and sellers go where everyone already is."

4. Operating Leverage & Inflection Point

Mike highlights Felix’s 12-year journey:

- Pivoted midway from vendor monetization (“PlantMiner”) to enterprise SaaS.

- Required heavy upfront investment in platform robustness, security, and scalability to compete with global players like SAP and Coupa.

- After several cost-base resets, FY25 marked a shift to positive cash flow.

- Now positioned to unlock operating leverage — scaling revenues faster than costs.

5. Nexvia Acquisition

Rationale

- Acquisition cost: ~$12M (~3.8x FY24 pro forma ARR).

- Structure: 12-month earn-out based on ARR growth; earn-out shares priced at a premium (25c vs 22c transaction price).

- Location synergy: Nexvia is based five minutes from Felix HQ in Brisbane.

Strategic Fit

- Nexvia provides project and business management SaaS tools targeted at SMBs in construction — a large subset of Felix’s existing vendors.

- Unlocks a cross-sell opportunity to ~43,000 subcontractors on Felix’s platform:

- Nexvia’s average ARR per customer ≈ $13k/year.

- Estimated TAM: >$500M ARR within Felix’s ecosystem.

Integration Approach

- Culture first: Both teams move into a shared office to ensure cohesion.

- Technology: Both platforms built on similar stacks → easier integration.

- Go-to-market: Immediate cross-pollination of sales funnels; goal to upsell Nexvia to vendors already within Felix.

6. Partnerships & Growth Channels

- Pronto ERP partnership:

- Pronto has ~1,800 customers and ~$250M revenue.

- Even a 5–10% conversion rate could double Felix’s enterprise base (~75 today).

- Shift toward integrations & partnerships:

- Historically sales-led; now aiming to accelerate growth via channel partners.

7. AI Strategy

Two-phase roadmap:

- Phase 1 — Efficiency gains:

- Apply AI to automate manual workflows:

- Vendor prequalification reviews.

- Tender evaluations.

- Risk assessments.

- Phase 2 — Data advantage:

- Leverage Felix’s proprietary vendor and project data to deliver forward-looking insights:

- Predictive analytics for procurement risks.

- Strategic vendor management recommendations.

8. International Expansion

- Rationale: At ~$100k ARR per enterprise client, reaching $100M ARR would require ~1,000 customers → necessitates expansion beyond Australia/NZ.

- Approach:

- Follow existing multinational clients into new regions.

- Examples: DRA Global (South Africa) and PCL (Canada).

- Preference for organic pull over risky “big bang” launches.

9. Key Risks & Challenges

- Integration execution: Merging cultures, systems, and processes effectively.

- Scalability: Ensuring onboarding, customer success, and support keep pace with growth.

- Timing of monetization: Avoiding premature vendor monetization to protect network effects.

- Competition: Competing with global ERP ecosystems and niche SaaS players.

10. Outlook & Takeaways

- Felix is at an inflection point:

- From cash burn → cash flow positive.

- From pure SaaS → platform + marketplace + SMB upsells.

- Nexvia integration + Pronto partnership are near-term catalysts.

- Large untapped opportunity:

- Over 100,000 vendors.

- $500M+ ARR potential just within the existing ecosystem.

- Management positioning Felix as a future global player in vendor management SaaS.

Bottom Line

Felix is transitioning from a vertical enterprise SaaS provider into a broader ecosystem play:

- Enterprise contractors → core recurring revenue.

- Vendors → monetization upside via Nexvia.

- Data + AI → potential competitive advantage.

Execution on integration, partnerships, and international expansion will determine whether Felix achieves its ambition to become a dominant global player.

The Bull case for FLX seems fairly straight forward - conceptually at least.

The pitch here is that if management can sell Nexvia modules to existing Subcontractors on the Felix Platform, they can rapidly increase their ARR.

For Example 10% of Subcontractors would be 4,300 paying $13k each = $56m ARR which is 4.7x the current pro forma ARR. Even if this took 5 years it represents 42% CAGR in ARR for a business that has just broken even at a FCF level and should quickly become highly profitable.

Some Scenarios

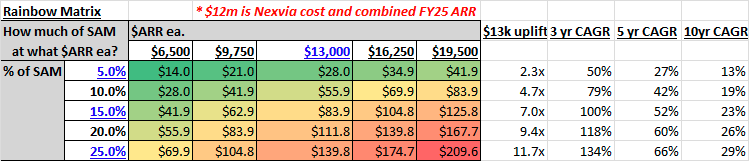

The below Grid shows how the Group ARR delivered for each percentage take up at different price points.

Here I'm looking at up to 25% of SAM (Servicable Addressable Market) converted at ARR per user from $6.5k being half the current Median of $13k, up to $19.5k being the current average ARR per user.

Felix is quoting $13k as their thinking for a price point. If they get 15% of the 43k subcontractors this is ARR of $83.9m, a 7.0x increase on current group ARR of $11.9m.

If they were to achieve this in 3 years that's 100% CAGR of ARR, but even if this took them 10 years it's a 23% CAGR in ARR.

If they picked up a more modest 5% of Subcontractors on Felix today over a 5-year period, this would see a 2.3x uplift in ARR at the median $13k per user or an ARR CAGR of 27%.

With the business now FCF break even, and exhibiting Operating Leverage, this growth should be highly profitable after the integration and GTM investment in FY26 which is fully funded.

Future Growth

This analysis ignores the increases in Vendors joining Felix as their Enterprise Clients sign up and compel them to.

Nexvia and Felix have each been growing their customer numbers at a CAGR of 25% over the last 3 and 4 years respectively.

Even if this growth rate halves, there would be 60% more vendors on Felix to market the Nexvia solution to in 5 years.

Another way of looking at this is that achieving 5% penetration of the current SAM would amount to just over 3% of the conservatively projected SAM in 5 years.

There are some other levers for future growth which management have recently pulled - the Pronto partnership in Jul-25 (https://www.marketindex.com.au/asx/flx/announcements/felix-signs-commercial-partnership-with-pronto-software-2A1605484) which integrates an additional 1,200 potential domestic customers (16x the current Enterprise customer count) and recent growth in Mining & Resources (May-25) - https://investorhub.felix.net/announcements/6954406

Anything that drops more Enterprise customers into the Felix Platform sucks another 1,500 Vendors each on average into the Nexvia funnel.

Execution Day

So the key questions here are 1) how many of the current 43,000 subcontractors can Felix sell Nexvia modules to, 2) for how much and 3) how quickly can they do this?

The conversion percentage and ARR per Vendor achieved will largely depend on management execution of 1) Integration of the two platforms into one, and 2) a Go To Market (GTM) strategy that optimises the Vendor monetisation opportunity.

In FY26 FLX will keep the separate engines of Felix Enterprise Monetisation and the Nexvia Platform for Contractors running while they integrate in the background and simultaneously develop a GTM strategy to be launched in FY27.

They have 12+ months and $10m+ cash to do this.

Size of the prize

The prize is so large because this could make both parts of the combined business worth a lot more than they are individually and grow the whole business a lot faster

Ultimate upside would be moving towards an industry standard. If that’s even possible, it is a long way off. More likely they would get acquired before then, but that’s not going to be anytime soon – see Coattails. So there should be a long duration of growth if they get this right.

See prior straw on Management for a look at their track record which might provide clues as to future success.

Buy vs Build

This M&A is to unlock Vendor Monetisation which is a long stated strategy so they ultimately decided to buy instead of build.

Picking up a proven platform that targets the Vendor / subcontractor set seems like a good way to de-risk this part of the strategy.

Buying Nexvia means they do not have to spend 12-18 months building something that may not actually gain traction.

Nexvia is proven in market and looks to be a very good fit for the Vendor side that Felix have cultivated but not yet monetised.

They are taking their time to develop a GTM strategy as they learn more about the Nexvia platform and Felix vendors willingness to pay for functionality.

This all seems like a focused, relatively conservative approach to balance aggressive growth plans…

Enter Briarwood

Briarwood is a NY hedge fund that specialises in international B2B SaaS.

They are high conviction, deep DD, long term investors who take a PE approach to public markets.

Briarwood are active but not activist looking to hold (and advise where they can) B2B SaaS businesses with the capacity to become long term compounders.

They don’t disclose performance numbers publicly but since 2017 they have compounded $155m of AUM by 27% CAGR to 1.06bn in FY25. This has been done through a range of market phases with B2B SaaS having fallen out of fashion in recent years compared to COVID days.

I take this 27% CAGR as a mixture of performance and net inflows less fees. They seem to be publicity shy but the founders and management have good pedigree.

These guys seem to really know what they are doing and are specialists in B2B SaaS looking to buy best in class wherever they find it.

I’m curious to know what if any role they played in identifying / green lighting the Nexvia buy for Felix, hopefully Mike can enlighten us when to talks to @Strawman this coming week.

Coattails

Briarwood conducted 6 months of intensive DD on FLX according to CEO Mike.

They took over 60% of the insto raise (about $11m) which is 16.1% of FLX post raise and 1% of Briarwood’s AUM.

This should given them a seat at the (board) table and a blocking stake for any would be acquirers.

They also negotiated the financial structure of the raise (in part at least) with the 5:7 attached options giving them the ability to raise their holding to 22% which at the strike price would make Felix 2.5% of their AUM all else being equal.

So they are taking a decent size stake with a view to taking a larger one if things unfold as they expect.

Disc: Held

Why would you bother?

At face value there are plenty of reasons to steer clear of this business.

It’s been listed for less than 5 years so not proven over the long term, with an Enterprise Value of just $45m (Market Cap of $48) before the recent M&A, it’s tiny – you can buy a couple of very nice house in Sydney on the water for that!

Until recently cash burning and at the mercy of markets to raise capital, even when they finally broke even they hit up the market for more cash to …. Wait for it …. Make a transformational acquisition!

Acquisitions like this often lead to the wrong kind of transformation, when they do, this can be followed by the dreaded strategic review (to reverse the transformation). Hopefully this is not the case here…

Even though they are FCF break even (just), the are still deeply unprofitable with -$4.7m NPAT in FY25 on Revenue of 8.3m and no sign of profitability coming in the next year or few.

At pro forma < $12m ARR they are still sub scale, even after the acquisition.

All of that said, they are now FCF break even, so let’s look at …

The M&A Bear Case.

I broadly agree with @Chagsy here that “integration risk and a failure to achieve hoped for synergies” are the big ones to watch.

This relatively young management team now need to integrate a new business into their fast growing platform that only has 75 paying customers, nearly ran out of cash a couple of years ago and has routinely come to the market gasping for more cash.

They don’t yet have a GTM strategy for this new business.

They don’t expect cost synergies, only revenue – which are often touted but typically harder to achieve with M&A.

A deal out of necessity?

Underlying Organic Growth Metrics have halved with Enterprise ARR Growth falling to 20% over FY25, down from 40-50% in the prior 3 years.

It looks like Opex / Capex may have been suppressed to hit FCF even and management have hinted at this. If Opex / Capex was held back to hit FCF Break even, has this restricted Organic Growth by underinvesting in the platform / business?

A lot more cash being generated than used in the M&A – is this a Cap Raise by stealth?

I suspect that if they came to the market with a plan to organically grow a Vendor side solution, they would not get funded, at least not without a big discount.

Dilution - A lot of dilution with an Extra 50% of existing SOI being issued through the placement and SPP. If all Options are exercised over time (requiring a 7% $SP CAGR over 5 years) this will amount to an Extra 75% of existing SOI being issued.

Multiples

EV/Sales Multiple is still high on FLX @ 5.2x (@ $SP of $0.22) given they are a long way off profitability and top line growth appears to be slowing.

EV/Sales Multiple not much lower on Nexvia @ 3.6x.

No significant multiple arb = 9% theoretical uplift (at FLX $SP of $0.22)

Disc: Held

We’ve seen CEO Mike Davis sparing with @Strawman a couple of times now and they’re set to lock horns again this Wed 10th Sep.

Management in a microcap is all the more important because they can have an outsized influence on performance compared to a larger, more mature / stable business.

Good management is even more important when there are a lot of risks, including a large integration to manage as well as a new GTM strategy to devise and deliver…

Long Tenure - The board have all been in place since 2021 when they listed. Senior Management have all been at it for 10+ years and have navigated some challenges in that time. I always look for management with scars (ideally not too many self-inflicted) and these guys have a few.

Skin in the game – Management owned 22% at board level, 25% including options (including the CEO) prior to the raise. Management have participated in past raisings and are expected to do so again. They have bought on market and so far have never sold.

Shareholder Friendly - I have generally found management to be measured, candid, transparent and not overly promotional. The inclusion of a SPP (as they’ve done in the past) is a good sign that management values retail as well as insto holders (or they just really need the money).

Also their recently launched investor hub has been a good way to ask question and get answers I have found - https://investorhub.felix.net/.

Success v Failure

Management have stuck to their strategy since IPO and largely delivered on what they said they would do, including this recent pivot to Vendor Monetisation.

They have potentially fallen short in a couple of areas. Firstly, they were growing fast and burning cash to do so when the market turned after inflation got away. This meant they had to pivot fast to hit FCF break even which they did in FY25 but they could not make it without a highly dilutive Cap raise at $0.08, very close to all time low.

Despite raising less than $4m they issued 47.5m shares. By contrast the IPO and subsequent raise saw 55.2m shares issued for $19m raised.

They were probably a bit unlucky here but they subsequently dealt with it well by targeting a break even date and getting there on time without running out of the cash they had just raised.

Secondly, the international growth they had envisaged and pursued has failed to materialise. They have done this mainly via partnerships to keep this adjacent growth capital light, so perhaps more out of their hand and a less clear line of sight than domestic growth. They now think it will still be there, but will just take longer to come through. They have been investing to accommodate this ahead of time with new modules and multi lingual capability which should help.

On balance they have delivered on what they said they would do and survived some bumpy roads on the ride. It sounds like they have learnt many lessons along the way.

The plan for FY26 and FY27

FY26 is all about continuing the growth plans for both Nexvia and FLX independently while in the background doing the integration and developing a Go To Market Strategy ahead of a FY27 launch.

This seems like a measured approach to keep both parts of the business steadily growing while they slowly bring them together for Vendor Monetisation launch in FY27.

They appear to be well funded to do this with Pro forma cash of $12-13m and both parts of the business at CF break even ahead of the integration and GTM launch.

Management have been candid about their current lack of GTM strategy for the vendor monetisation piece. I am very pleased to hear that they are taking their time with this. This is a critical piece that could make all the difference. So it’s more important to get it done properly than quickly. Exactly the sort of approach you’d expect from owner operators.

Disc: Held

Felix announced today that they are acquiring a SaaS platform to integrate into their current offering. They have so far concentrated in monetising Enterprise clients and have achieved moderate success to date i=with 20-25% CAGR in ARR and are now CF+ve.

This move aims to monetise the vendors (the SME submitting tenders for big projects)

Key highlights

- Felix has entered into a binding agreement to acquire 100% of the issued capital in Nexvia, a Brisbane-based SaaS platform for construction-focused SMEs

- Acquisition accelerates Felix’s Vendor monetisation strategy, unlocking a significant opportunity across its ~110,000-strong Vendor Marketplace

- Acquisition delivers FY25 pro-forma ARR of $11.9m, a 38% increase on Felix’s standalone FY25 ARR

- Purchase price of $12.0m, comprising $6.0m cash, $3.6m in Felix shares, and $2.4m in performance rights linked to FY26 subscription revenue growth targets

- Acquisition to be funded via a fully underwritten two-tranche placement to raise approximately $16.0m and a non-underwritten $1.0m share purchase plan

- Global investment manager, Briarwood Chase Management LLC and its private investment fund, Briarwood Capital Partners LP, has provided strong support for the Placement and is expected to hold a ~16.1% pro forma shareholding

- Integration plan underway, with commercial launch of combined Felix–Nexvia solution targeted in FY26

There are two things that immediately jump out at me: integration risk and a failure to achieve hoped for synergies.

On the surface, it's a great fit in terms of offering a fuller product suite and monetising all aspects of the construction project workflow. Also Nexvia has an enviable LTV:CAC of >10.

I'm going to be sitting on my hands for another 12-24 months watching how this goes with interest. Felix probably needed to do something to kick start growth from a straight line into an hockey stick and this may be just the right call. It likely comes with a similar increase in risk of failure. I wish them the best of luck and will happily take a position if there are early signs of success.

https://investorhub.felix.net/announcements/7111377

Presentation here: https://investorhub.felix.net/announcements/7111375

Here's the transcript from today's meeting with Felix founder and CEO Mike Davis:

Some points i'd emphasise:

Felix is not an ERP competitor. Rather than replacing platforms like SAP, Oracle, or Workday, Felix integrates directly into them. It acts as a fit-for-purpose front-end bolt-on tailored specifically for complex supply chain management in capital-intensive sectors. This allows Felix to complement, not compete with, existing systems, which helps enterprise adoption.

Felix is deeply embedded and hard to dislodge. Once integrated, Felix becomes mission-critical for managing vendor engagement, compliance, risk, and tender workflows across large project teams. This deep integration increases switching costs, contributing to strong customer retention and long-term stickiness. Good to see >100% revenue retention.

Network effects are becoming more visible. Mike noted that each new enterprise client brings thousands of vendors onto the platform, accelerating vendor-side adoption at minimal cost. Contractors benefit from a growing base of prequalified vendors, while vendors benefit from exposure to more projects — reinforcing Felix’s dual-sided marketplace dynamics.

Vendor monetisation remains underdeveloped. While vendor revenue has been flat, the growing base of enterprise clients (contractors) is building a rich, engaged vendor ecosystem. The monetisation of this side is still in the early innings but (in theory at least) there's latent potential.

International expansion has been slower than expected. Compared to early expectations, global growth has taken longer to materialise. That said, Mike reaffirmed it remains a key strategic priority, with some “green shoots” emerging via cornerstone overseas clients.

Disciplined capital management is front of mind. Felix is focused on standing on its own feet — they’ve reached operating and free cash flow breakeven, which is commendable in the current environment. Importantly, this is being achieved while continuing to invest in product maturity and future growth opportunities.

Thanks @Trancer for some great questions.

Well, it's finally happened: they are cash flow positive for the first time.

I'm no forensic accountant so there could be a bit of fudging going on to get the headline they need.

To briefly re-cap the thesis: its a classic SaaS land and expand strategy; the key is to onboard contractors with a test module and/or site and get them to see its merits and utilise in other projects.

The contractor ARR has experienced a CAGR of 38% over a three year period.

Forward looking indicators look rosy:

The less good bits were the reduction in NRR to 99% (I am impressed they continue to report this and not cherry pick the metrics that show them in the best light). unless this returns to the 115-120% they have previously achieved they are in trouble.

They have $2.3m in cash......eek!

Full announcement here

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02868832-2A1556728

Not held, patiently waiting to enter if the thesis continues to unfold.

FLX reported their full year results last week. For those not following along, they provide software for the construction industry to organise contractors, workflow and procurement. This means if a big construction company wants to use FLX to organise their work flow and procurement for their latest big project; all the subbies and providers also have to sign up to win the contracts and provide stuff for the procurement process. A true network effect if they can get critical mass.

The good bits are that they continue to sign new contractors, and the ones they have are using the platform more. This is evidenced by two date points:

NRR is running at 114%

ARR per contractor is increasing at a CAGR of ~16%

The number of contractors joining the platform is starting accelerate:

And if they win the prize of becoming the preferred platform in this space then the TAM is huge as there are ~1700 potential companies that could use there product in Australia. Let alone internationally.

As a SaaS business it has good gross margins of 76% So far so good, top line looks promising

BUT, to take a leaf out of @Scoonie 's playbook: yeah but where's the cashflow?

SO..... the bottom line is improving a bit, some expenses have been reduced but just the salaries still account for 103% of revenue. And they burnt through $5mill last year

AND, how much have they got left in the bank? About $4mill.

Are they going to make it?

No.

They had a cap raise last year, and they will be doing another one this year.

I would really like to see this company make it. Maybe next year, we will see some real exponential operating leverage appear.

I hold a couple of hundred bucks of shares to force me to keep an eye on their progress, but have no intention of putting any more in anytime soon.

Felix reported a few days ago. Ive been a bit stretched recently and haven't made any of the calls I wanted to attend. Zero.

Thanks to all the excellent reporting from the usual all-stars - much appreciated

I have had a token holding in FELIX for a number of years, mostly as a way of making sure I keep up with progress, rather than any serious investment case. It's so small as to be barely worth selling. I really like the narrative -see multiple other previous straws.

The report showed a company still losing money and still perilously short of funds. Im not tipping anything into them just yet, for sure. But there were some really positive lead indicators of future success. You can read the full report here

The bits that were positive are the significant increase in MRR and the NRR.

As a brief recap, the thesis rests on the classic land and expand model for SaaS companies.

They get revenue from the contractors (the big engineering companies that use their software) and the small fish that bid for the work (Vendors). The lead indicator of success is signing big contractors on small short term contracts (try before you buy) which then roll Felix's modules out more broadly to the group, and add more modules as they see the value add.

To date progress has been slow with linear increases in revenue, ARR and MRR (monthly recurring revenue) and a cost base that is vastly in excess of cash receipts. They have had a few big names sign up, but incremental revenue has been slow to materialise and they have started cutting their way to success, and executing ever-more diluting cap raises. Yeah.

So the headline figures still aren't great:

But increases in expenses have certainly moderated, and revenue has really started to increase. They report a number of new signings with big international companies but perhaps more important is the increase in work from earlier signings which has translated into a much better shaped graph in the MRR - evidence of traction. Over the last 12 months MRR has had a CAGR of 67% - too infinity and beyond!

This is probably the most telling slide:

This is also substantiated by the NRR of 116% which is pretty healthy.

So much for the good news.

The bad news is how long they fund the runway for profitability. And the news there is pretty desperate:

Management have indicated that they can get through to positive cashflow by Q1FY25

I certainly wouldn't put any of my money on it occurring without another significant dilution.

I really like the idea behind this company, and I think they will get there. It has a rule of 40 value that is attractive : 51 (If my maths is correct). The big question is around timing an entry, and I don't think we are quite there yet. It has the potential to be a complete killer in its category and I hope they make it. Happy to sit on the side lines until the risk reward ratio comes down a bit, even if it means not getting in at the cheapest price.

Felix released their quarterly update today. Below are the highlights and some thoughts:

Contractors

New contractor revenue grew to $800,000 an increase of 32% on the previous quarter, 1/3 of this was made up of new customers with 2/3 from expansion deals with existing customers

Contractor ARR increased 69% on the pcp to $4.8M

Total group ARR increased 47% on the pcp to $6.9M (below)

Contractor net revenue retention was a record 127%

3 new contractors were added for the quarter for a total of 48

No customer churn for the quarter

Vendor Marketplace

Vendors grew 15% to 84,460 compared to the pcp (below)

Felix achieved SOC 2 Type 1 certification and GPDR compliance (international data security certifications for NA and Europe) which they believe will reduce the sales cycle for international customers and expand their addressable market

Number of active projects increased 136% pcp

Request for quotations sent by contractors increased 64% pcp

Total contractor user accounts increased 25% pcp

TTM net operating cash outflow continues to improve (below)

Advertising and marketing costs continue to trend down, $45,000 for the quarter or $180,000 annualised. The previous 2 years’ advertising and marketing cost were $370,000 and $197,000 respectively highlighting a trend in Felix’s ability to grow Contractors and Vendors on the platform at less and less cost.

Felix’s biggest expense is employee related and this was $7.5M last year. Pleasingly, receipts from customers of $2.557M outpaced staff costs of $2.320M for the quarter. Cash outflow from operating activities was down to $575,000 with free cash flow of -$1M.

Following a recent capital raise the company now has $5.5M in cash not including an upcoming $450,000 ATO R&D tax rebate. Felix now has approximately 2 years cash runway with a reasonable chance another capital raise may be required.

Overall, Felix had a strong quarterly update. It will be interesting to see if the company can keep expenses down and continue to grow revenue in order to achieve positive free cash flows and avoid another dilutive capital raise.

Felix had a strong 4C and share price responded.

Market is worried about a capital raise but they are looking to avoid it and may yet pull it off.

They're hosting a Product Showcase this morning at 11am Sydney time.

Details here

https://www.felix.net/resources/product-showcase-feb2023

Disc: Held

31/01/23 4c

There were definite signs of progress on latest 4c in 3 areas

1) significant decreased cash burn

2) modest increase in contractor MRR and ARR

3) an update on collaboration with Ineight and indication of potential future income potential

starting with 1) decreased cash burn. The majority of the savings seem to be on staff and admin and they have reduced significantly:

In conjunction with a higher revenue cash outflow for the quarter was 654k - a huge improvement. However, this only leaves 4 Qs of cash in the kitty.........gotta be a raise coming soon.

2) FLX have been successful in signing a further 3 new contractors and expanding 6 existing contracts. So even though MRR increase is modest, this would support he land and expand SaaS strategy has traction and that NRR is healthy (even though these metrics are not reported). There were also a couple of big signs ups (New Hope Coal, and the companies delivering Victoria's North East link = $15bn project). One hopes the contracts will grow significantly over time.

3) FLX report that they have made succeeded in integrating the document systems that InEight uses with their procurement module and this opens up the possibilities for contract wins (of a much larger size) with InEight's customer base. InEight has a large international client base.

So in summary - good progress but still a long way to go and no cash with which to do it with. Surely have to have cap raise soon which will be ugly.

It would be great to see something magical happen in the next 6 months, but .....

----------------------------------------------------------------------------------------Latest update below.

The good bits:

- there was good improvement with the Contractor MRR (IMHO - this is the pathway to success - see previous straws)

- they are getting traction with a couple heavyweights (CIMIC, GPT) re-signing for larger contracts and with expanded modules. These can then be used a references/proof concept, for other large clients. This substantially improves the sales process by, in the eyes of new clients, de-risking a new process.

- they signed BG&E Resources for a couple of modules

The bad bits:

- Group ARR is flat. Again

- not much progress with the loudly trumpeted deal with InEight -see previous announcements

- staff costs 2.2 mil for the quarter and cash outflows of 2.3 mill. with 2.4 mill in cash and financing for 4 mill = guess wants coming soon!

Summary

- still a long way to go and not much cash to do it with. Likely another very dilutive Cap raise at a depressed market price which will be painful existing holders.

- The only reason I continue to follow FLX, is this company has the possibility to become a global leader in this field. If it can get traction before it runs out of the capacity to raise funds.

- I would love for that to happen, but am getting increasingly pessimistic about its chances

I hold about a hundred bucks IRL and confidently predict it will be worth <$50 in 6 months!

After using Felix on our latest project and watching the interview with Mike Davis. I thought I would share my thoughts with the Strawman community.

Mike’s background in the industry and plant miner demonstrates his understanding of the friction points with procurement processes and the issues that procurement and purchasing teams face repeatedly.

So is Felix the system I’ve been dreaming up every time I go back to writing scopes of work? Deep down it wants to be. On the surface beneath it’s terrible landing page, it ticks a lot of the boxes but dig a bit deeper and I feel they still have some work to do to be a solution that will be welcomed with arms wide open by contractors industry wide. Some examples below:

A key selling point Mike mentioned was the ability to pre qualify subcontractors to your company. Excellent check.

However in practice due to the vendor user management being extremely clunky meaning that typically I have experienced issues with ~ 50% of vendors either onboarding to register for our company or having the company registered but issues sending RFQs to the vendor because of the the contacts assigned to the company.

Creating RFQs manages the documentation well and integration with ineight for wider project doc control is great. The biggest issue is the platform is based around its plant hire roots so when an RFQ needs to be assigned to a service to determine which vendors are appropriate most of the options are not suitable outside of civil works or onsite trades. This means that a lot of the automatically selected vendors are not appropriate for the package and negates the selling point of vendor discovery / database and you find yourself still reaching for the little black book of contacts.

There are also plenty of small bugs that cause enough headaches that make it to hard to sell the benefits of a platform vs business as usual for many members of the team.

Most of these issues come from the basis of not customising the platform to suit the clients needs as Mike was saying is their current approach. How successful Felix is in the wider market is dependent on how flexible the management team are in this area.

On some of the metrics, I’d like to know if the reported vendor count is based on unique ABN. When I have been trying to register new vendors I have encountered some that are already on the system multiple times (sometimes over 5 times).

I don’t see the transition to vendors paying a subscription to use the platform coming easily. The fee although only small in comparison to an awarded contract will be a barrier for many of the smaller suppliers and operators. There is still a long way to go before business as usual won’t be a barrier in this area.

Anyway that’s a few thoughts down. Happy to try provide any specific feedback if anyone wanted it.

I have to rush off, but just some high level thoughts after today's meeting with Mike.

I'll admit it, I'm somewhat seduced by the business model -- at least in principle. I mean, it's a capital light software business that has the potential for the super strong network effects that often accompany marketplace businesses. Also, I often love companies that are well placed to benefit from a structural shift within an industry (in this case, towards a Cloud based procurement and contractor management) and that enjoy an early lead over competitors.

At the same time, they don't always hit the necessary critical mass and can bleed cash for a long time before any real scale is achieved. And I think it almost certain that Felix will raise again soon.

I think the partnership model is the way to go for offshore expansion, and the fact Mike reckons offshore revenue will be 90%-plus of the group total within 5 years is very interesting.

It seems that the story here is (potentially) -- good tech, and good base of banner clients that they have fought hard for, but to date the earlier expectations for revenue growth haven't been as strong as perhaps the market was expecting (maybe due to some overzealous guidance provided at the time of listing) and shares have bled off when coupled with the expectation for further dilution. BUT, the market potential is exciting, as is the industry tailwind. And there does seem some decent traction with contractors. These things -- especially at the enterprise level -- always takes much longer than most people expect.

Shares are roughly 3.8x revenue.

Adding them to a watchlist for now

14 Oct 2022: The ASX only sent out one free broker report today, and it's from CCZ Equities on Felix Group Holdings (FLX):

That link will give you the report, which is an "initiation of coverage" report from CCZ. They provide a variety of DCF valuations on page 27 of the report - ranging from 18 cents (FY23 Bear Scenario) to $1.90/share (FY23 Bull Scenario). Their FY27 DCF valuations for FLX range from $0.33 to $2.89/share (Bear/Bull Scenarios again). They also provide Base Scenario valuations, and their Base Case DCF for FLX is $0.58/share in FY23 and $0.91/share in FY27.

FLX closed today at 12 cents, down 2 cents (-14.29%) from yesterday's 14c/share close.

Source: About Us | Felix

Plain Text Link: https://www.felix.net/about

Disclosure: I do not hold FLX shares.

Felix have announced a capital raise of up to approximately A$7.4m, most (A$6.4m) coming from a placement, and another A$1M via a SPP for the plebs amongst us.

The placement is at 36c, or about 10c higher than the current share price. There is some math about deciding the issue price, being a 2% discount in the volume weighted average price of shares traded during the five days up to issue.

The raise is to be used for sales and marketing and to boost contractor conversion opps, as well as dev works. Run of mill stuff and not unexpected.

An accompanying slide deck shows the company continues to make progress, albeit probbaly not as fast as I'd like to see.

This is a small holding for me and I will contibute simply to avoid dilution.

FLX has been on a tear recently

First they announced a new cornerstone customer in the Real estate sector

they signed a 3 year contract with GPT (managing $25.3 billion of assets)

This will add an additional $300k in ARR, (ie $900k over the 3 years) which isn't huge but could well be a springboard to much bigger contracts with new construction projects (there are currently $4.8 billion underway or planned)

then they announced an international agreement with InEight

And these guys are no minnows:

"400,000 users and their software has been deployed on $US400 billion worth of construction projects"

I have read the announcement about 6 times and it is very light on details other than the promise of collaboration, integration and working together to pursue joint bids.There is no indication of what Felix stands to get out of this, so is impossible to quantify the potential range of dollar values.

The SP has appreciated from a low of $0.28 on 25/01 to $0.365 today.

So, lots of potential but still losing money hand over fist and costs increasing faster than revenues.

Will need to see some traction in revenue before increasing my tiny holding!

Felix (FLX) secures key customer in real estate sector

FLX is pleased to announce that it has secured a 3-year contract with GPT Group (ASX GPT) for its enterprise procurement management platform.

The contract will generate $300k of ARR, equivalent to approximately 7% of total contracted ARR, with a total contract of 900k over three years.

Key points

- First cornerstone customer in real estate sector, representing expansion into new verticals.

- Another significant company (9b market cap) to acquire FLX’s services, which provides continued endorsement for FLX’s product.

- GPT is one of Australia’s largest diversified property groups with a portfolio of 25b across 79 Australian office, logistics and retail assets. GPT has significant pipeline of developments with over 4.8b currently underway or planned, provided FLX with further organic growth opportunities.

A solid win for FLX before the release of their upcoming Q2 report.

DISC: hold a small position

Insider Alexander Waislitz (Thorney Technologies) purchased 360k worth of shares at .22c per share on 21 October. This upped their stake in Felix from 7m to 12m shares (voting power now 9%).

The company also recently presented at the Hidden Gems Webinar on 22 October, alongside TNG, FME and CBL.

Bullish signs following a promising quarterly update in Q1.

DISC: Held

Q1 FY22

@Chagsy, nice summary mate. As I indicated recently, I was going to strongly consider selling if this quarterly was a poor one. Like you, I have been pleasantly surprised reading the update. Key metrics are solid, but you hit the nail on the head - contractor growth is fundamental for the platform to attract vendors (and subsequently enable network effect to slowly do its thing). While a record six contractors were onboarded in Q1, I was perhaps most impressed at the size of some of those players, as you allude to. It is one thing to onboard a small business, but another to onboard a business worth around 2b.

Vendors in the marketplace continue to gradually increase too, albeit just under 7% in Q1 which is nothing to write home about - but my thesis was also based on gradual increases. The report mentions that the six new contractors are expected to onboard their vendors once implementation is completed in Q2, resulting in an additional 7000 vendors to marketplace. This bodes well for Q2 reporting.

Cash burn a little concerning, but with >7m in the bank they should have enough cash to sustain growth/operations for at least a few more quarters.

DISC: Held - I think there is enough in these figures to justify me continuing to hold my small position, noting I am paying close attention to the industry in which FLX has a number of competitors.

Proptech startup ProcurePro raises $2.6 million seed round

Article is here. ProcurePro launched in Brisbane in 2020, and are targeting the same sort of market as Felix. Bear in mind, there is strong competition in this field, with iseekplant.com.au (Australia's largest online construction marketplace) and VendorPanel, to name a few.

I bought a small parcel of Felix's shares a number of months ago. I wouldn't call their performance in that time outstanding, but they appear to be slowly ticking along. There are real and valid concerns about Felix successfully monetising their platform. I initially provided them with a bit of leeway here, given they are recording impressive growth to their suite of products/offerings - the idea is that they will eventually start to monopolise this when the network effect starts hopefully starts to do its thing. This is OK if they are market leaders with leading disruptive technology; the risk here is the market is slowly becoming more congested, which might create some real problems for Felix down the track. A reluctance to pay for a product will only become more extreme if there are other avenues for a particular business to seek that service.

With competition growing, the risk/reward ratio is starting to become a little murky. As per my thesis, I want to see gradual growth to both contractors and vendors - the idea being that this will create value for both as it continues to scale. That said, I want to see some ARR growth in Q1 FY22 due to less-than-ideal figures posted in Q4 FY21. I will be keeping a close eye on this in the coming weeks.

If there isn't any meaningful change/improvement to Q1 FY22 figures, I will consider selling and sitting on the sidelines with this one while Felix continues to develop and mature as a company.

EDIT: Spelling

I currently have the tiniest of holdings in FLX. It is a way of forcing me to keep up with companies I want to follow. Currently, there is not enough evidence of FLX being able to monetize their platform; in the form of accelerating ARR, for me to put any real money in.

It is a company very much on my watchlist as I think it has a lot of really good things going for it. It could be that ARR merely lags all the other metrics ie they are lead indicators of future revenue. But for now I am concerned that the headline increase in vendors, for example, is meaningless as this does not reflect a similar increas in revenue.

As always, would be very much like to be challenged on any assumptions or receive any feedback on teh subject

C

Key Highlights

- Expansion of enterprise platform with new Procurement Schedule module undergoing final testing and validation with cornerstone customer

- Early discussions across customer base indicates strong demand for the new module that drives operational efficiencies and greater transparency

- 52,234 Vendors in Marketplace increasing 53% pcp, significantly increasing the scale and value of future monetisation opportunities of the Marketplace

- Enterprise SaaS Contracted ARR¹of $1.9m as at 30 June 2021, up 25% pcp with a number of new contract discussions well progressed

- Three new Enterprise SaaS contracts won and one contract expansion across target sectors, highlighting the broad applicability of Felix’s enterprise platform

- Strong cash position of A$9.0m, as at 30 June 2021, providing funding flexibility to execute strategic initiatives and execute platform expansion

Thesis check / thoughts

- Contracted ARR graphic (figure 2) shows an increase of $1.9 million from $1.8 million. This is a little misleading for my liking – with the quarterly increase reported at 0.2million. Receipts from customers recorded a minor increase of almost 2% ($742,000 to $755,000).

- This is disappointing to be honest. I am hoping to see improvement to this metric in Q1 and Q2 FY22.

- In better news, the onboarding of 3 new SaaS contractors (and a contract extension) is encouraging. The customers are:

- Macmahon Holdings Limited (ASX: MAH) – this looks to be the most impressive customer added. MAH has an annual revenue of around $1.3 billion. It is also encouraging to see FLX onboarding a mining-related contractor.

- a joint venture between two major contractors, responsible for road maintenance and construction in Sydney

- a leading provider of civil engineering

- Retention rate was 100%, which is great to see.

- The number of vendors in marketplace increased to 52,234, up from 49,402 in the previous quarter.

- This is in line with my thesis – gradual growth of vendors in marketplace as more contractors/customers are onboarded. The latter makes Felix a more attractive proposition for vendors and should result in increased vendor subscriptions (also increasing the network effect over time).

- Cash burn rate steadied (due to the reduction in one-off IPO costs), with just over $1 million spent (in contrast to 3Q, where over $2 million was burnt). Cash position is strong at $9 million.

- Good to see ongoing improvement/investment to the Felix (platform), with the new offering of a Procurement Schedule.

All in all, I am bullish on the quarter, noting that ARR didn't increase as much I would have hoped. Even still, the onboarding of 3 new contractors, 100% retention rate and steady increase in marketplace vendors are all encouraging.

DISC: HELD

Overview

Felix Group Holdings Ltd (FLX) develops and operates a cloud-based enterprise SaaS and marketplace platform for the commercial construction and related industries in Australia and internationally. Its platform connects contractors and third-party vendors, automating and streamlining a range of critical procurement-related business processes in the sector. FLX monetises both contractors and vendors through SaaS subscriptions.

Vendor Marketplace

The company launched its online Vendor Marketplace in 2013, which has grown to become a leading marketplace for the Australian commercial construction sector. It is used by contractors to source vendors, and vendors to source new business leads.

Felix (platform)

In 2015, the company developed its enterprise solution, Felix – a solution used by asset owners, builders and managers to connect organisations and their supply chains. It centralises and streamlines vendor management and ‘source to contract’ processes.

For those interested in gaining a basic understanding of Felix’s procurement platform, I strongly suggest watching this video.

Thesis

- Founded-led, with a healthy 28% of the company owned by insiders.

- Sticky customers and a ‘trap door moat’ – once Felix is adopted, the platform typically becomes a core part of the business’s operations, making it difficult to replace. This results in high retention rates and low churn.

- ‘Network effect’ – as Felix grows, it will create increasing value for both contractors and vendors as it continues to scale. Contractor growth is important for this to occur as this will naturally attract vendors.

- My partner’s friend works in the construction industry as a project manager. I took the opportunity to ask him about Felix – had he heard of it, used it etc. In short, he had. He uses Felix in his day job and encourages others in the industry to do the same. A lame point, I know, but real-world application is encouraging.

- Growth – contractor (ARR) revenue is growing, albeit off a low base. It had a total of 8 customers at the end of FY 2018, H1 FY21 reporting suggests this figure is now at 21 (there are some sizeable companies among the mix, eg. CIMIC and Veolia). Vendor growth is also impressive, with over 40 thousand ‘vendors in marketplace’ spanning across 42 countries (up from 24,832 in HY20). Much of this growth has happened organically through contractors using Felix on international projects.

- Global total addressable market estimated to be worth $7.2 billion.

Monitor

- Contracted ARR – continued expansion confirms ongoing value in the Felix product. Ideally, I want to see this metric grow at a rate of 20% and over (YoY). Of note, contracted ARR did not increase from H1 to Q3 FY21. Keep an eye on this (slow quarters are expected, particularly in this current climate, this is why I will judge this metric YoY).

- Customer churn – continued adoption of Felix with high rates of retention and low customer churn for the thesis to remain intact. FLX reported no churn in H1 FY21, with one customer churning in 4C Q3 FY21. This was reportedly a ‘change in business circumstance’ and not financially material).

- Ability to monetise vendors – to date, FLX has not succeeded in growing revenue from vendors. In H1 FY21, FLX reported 43,865 vendors were using the marketplace, but only 1359 had subscribed. More vendors will begin to subscribe as more contractors adopt the platform – increasing the prospects of the vendor finding work. This will in turn increase vendor revenue and strengthen the network effect. This is expected to occur over several years, not instantly, making FLX a long-term hold for me. I want to see gradual increase in ‘vendors in marketplace’, but also the % of those venders that subscribe. I won’t put a % goal on this yet and will revisit in 6-12 months.

- FLX is debt free, with a reported cash balance of $10.1 million (as of 31 March 2021). As a newly listed company, it is difficult to judge the company’s track record and their ability to effectively use capital to grow. Keep an eye on this and their cash burn rate.

DISC: Recently added to RL portfolio ($0.26) and Strawman portfolio.

•Talented, aligned BOD with relevant experience, strong track record in construction & software & 22% ownership

-In addition, previous director David Williams (Oct 2020) owns 14.5%

-Robert Phillpot co-founded Aconex, acquired by Oracle for $1.6 billion in 2017

•2x Founder led with 6.5% ownership

-33% total insider ownership

•First movers with potential for strong network effects*

•Possess strong economies of scale with low/zero customer acquisition cost

•Posted first positive operating cashflow for the half of $194,799**

•Strong balance sheet with $10M cash & no debt

-Strong probability they can self-fund growth from here

•Possibly misunderstood/unknown

-Recently listed Jan 2021

-Financials before H1 FY21 report were not pretty (~$7M loss & -$7M FCF)

•Strong growth trajectory

•Large addressable market

•Disruptive construction technology platform

•Moderate tailwinds

-Shift from paper to digital

-Aus gov $110 billion Federal land transport infrastructure program over next 10 years

•Valuation: currently on a reasonable 9x price to sales

•Provides portfolio exposure to infrastructure through a higher gross margin tech play

Minor Concerns & Why I Would Sell

Construction & mining & resources industries are cyclical. This could be offset by expansion into other non-cyclical markets, including government, utilities & facilities management. Monthly recurring revenue from vendor subscription could mitigate this risk as well as the value of the platform to Enterprise customers (e.g. $75,000 cost for multiple 10 – 100’s of million dollar projects)

•Inability to onboard more meaningful Enterprise customers

•Inability to convert existing & new marketplace vendors from freemium model to paid subscription

•Inability to improve free cash flow

•Expenses outpacing revenue growth

•Founders selling a significant stake while not executing on growth strategy

To Monitor

•Ensure performance based LTI plan to be implemented July 2021 is reasonable. Provides for 25% cash bonus on base salary, made up of 50% for EBITDA target & 50% role specific performance measures. Applicable to CEO, CFO, CTO, COO.

* Continued innovation of new modules as well as conversion of vendors (currently 2.5%) to a paying subscription will be key

** Since writing this, the most recent quarterly saw an operating cash outflow of ~$1M excluding IPO related costs. Refer to my App 4C straw.

Highlights

Continued strong growth with

•Enterprise SaaS ARR up 37% YoY to $1.8M

•Enterprise user accounts up 56% pcp

•Requests for Quotations (RFQ) sent by Enterprise customers up 123% pcp

•Number of active projects up 890% pcp

•Vendor approvals up 164%

•Total active vendor compliance documents up 345% pcp

•Vendor evaluations up 70% pcp

•Vendors in Marketplace up 66% YoY to 49,400

This puts them on pace to comfortably outpace Vendor growth from the previous half.

•One customer churn but contract was not financially material. Previous half had zero churn.

While this level of growth is high it’s important to consider much of it is off a low-moderate base. Compliance documents growth could indicate vendors looking for more work. Could this lead to a higher number of paying vendors down the track? Most are currently on a freemium model. Growth in active projects suggests customers are finding value in Felix’s offering.

The market reacted with a minor selldown. My guess would be the operating cash outflow of $2.2M scared some investors. $1.2M of this was from the IPO, a one-off, and in addition due to “timing profile of recurring Enterprise licence fees”. My understanding is Enterprise fees are paid for the year upfront.

In the previous half, operating cashflow was +$194,799. Even if FLX continues to burn $1M Q, with $10M cash, this leaves them with over 2 years of cash runway.

I’m still new to the Felix story so it’s possible I’ve missed or misunderstood something.