A friend recently pointed me towards FOS Capital (ASX:FOS) and said it was worth a look. I'd never heard of it before, but having had a quick look it seems to have some merit.

First off, it's tiny -- $13m market cap, and averages about $10k per day in trade value. On that basis alone it's something you need to be very careful with. We've profiled companies like this before (eg Stealth Global), but still, it could be super difficult to fill a position, and even then it may prove to be something of a lobster trap (hard to get out once you get in).

Anyway, although the name makes it sound like a financial services company, FOS designs, manufactures and markets lights and controls, mainly for commercial and industrial customers. (FOS is the Greek word for 'light')

The origins go back to the 70’s when it was first established as a fluorescent lighting manufacturer. It's undergone a long series of acquisitions, and in June 2021 it listed on the ASX after raising $3m at 25c per share. Now it's 27c

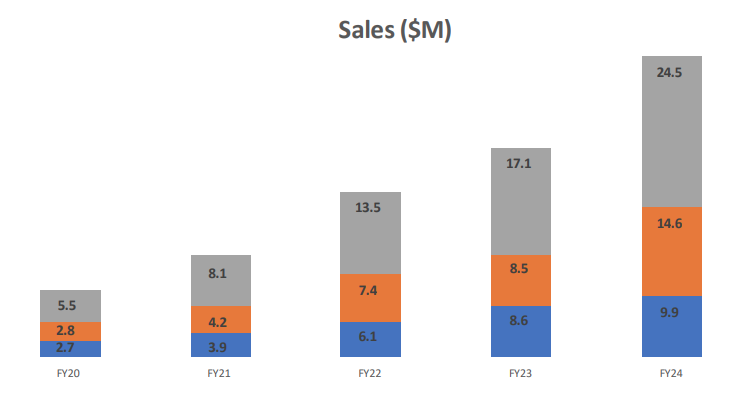

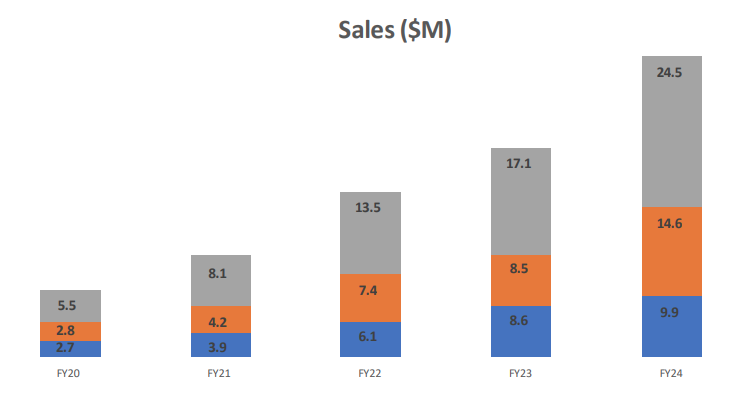

Since then, sales have roughly tripled, and grew at 72% in the second half just ended (24% organic):

Moreover, the business has been profitable for 10 consecutive half-year periods. In the year just ended they did $2.1m in EBITDA and $1.1m in NPAT, a record result.

The PE is like 13x and they also pay 3.7% ff dividend.

And it looks like there's a bit of growth ahead, with a strong order book and growing quotes (up 20% in last 6 months). There's also a recent acquisition (KLIK) which should drive more growth and has some duplicated costs that they think they can strip out (they seem to have some form on this front -- having done 5 acquisition since listing, all while expanding margins).

In fact, they are doing 8.6% in operating margin today, but (reminiscent of Stealth) they think they can improve this and have a 10% medium term target. They have about 5% market share, but aim to get to 15% in the coming years.

The company reckons there's a tailwind in terms of govt. infrastructure spending, and tapping into new markets.

Management own 57% through SKM Investment group.

Anyway -- not without risks. A construction or CAPEX downturn would hurt, there's always acquisition risk and as mentioned it's super illiquid.

There's a bit of debt too -- $1.5m as a business loan and $1.1m in invoice financing, all held against $1.7m in cash. There's almost $5m in brands and goodwill as intangible assets given all the acquisitions. All told, the net asset value is just shy of $10m, or $5m if you strip out the intangibles.

Still, aligned management, history of successful execution, low multiple and reasonable growth outlook make it interesting

To be clear, I do not own any shares, and given the potential risks/perception of a ramp I wont buy without first disclosing here first. I want to speak to the CEO first anyway, and have asked if he'd be keen to do a Strawman interview

Keen for any thoughts from others.