I note there are zero people interested in Fonterra. I have just a bit of a look into them on valuation basis.I only chose the title for the miserable bovine related puns. I apologise. I am not particularly bullish, but there are a couple of points I would like help clarifying

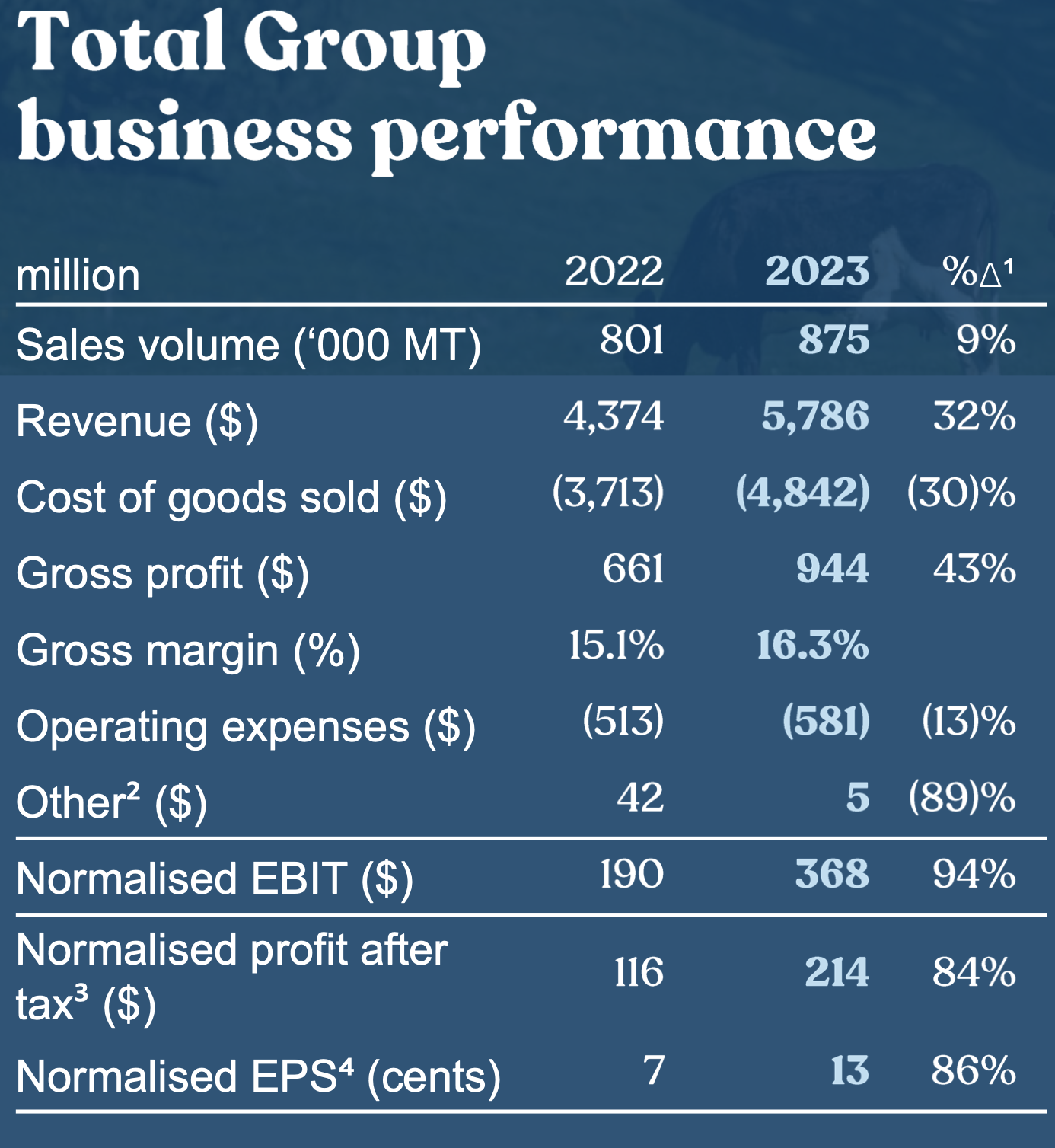

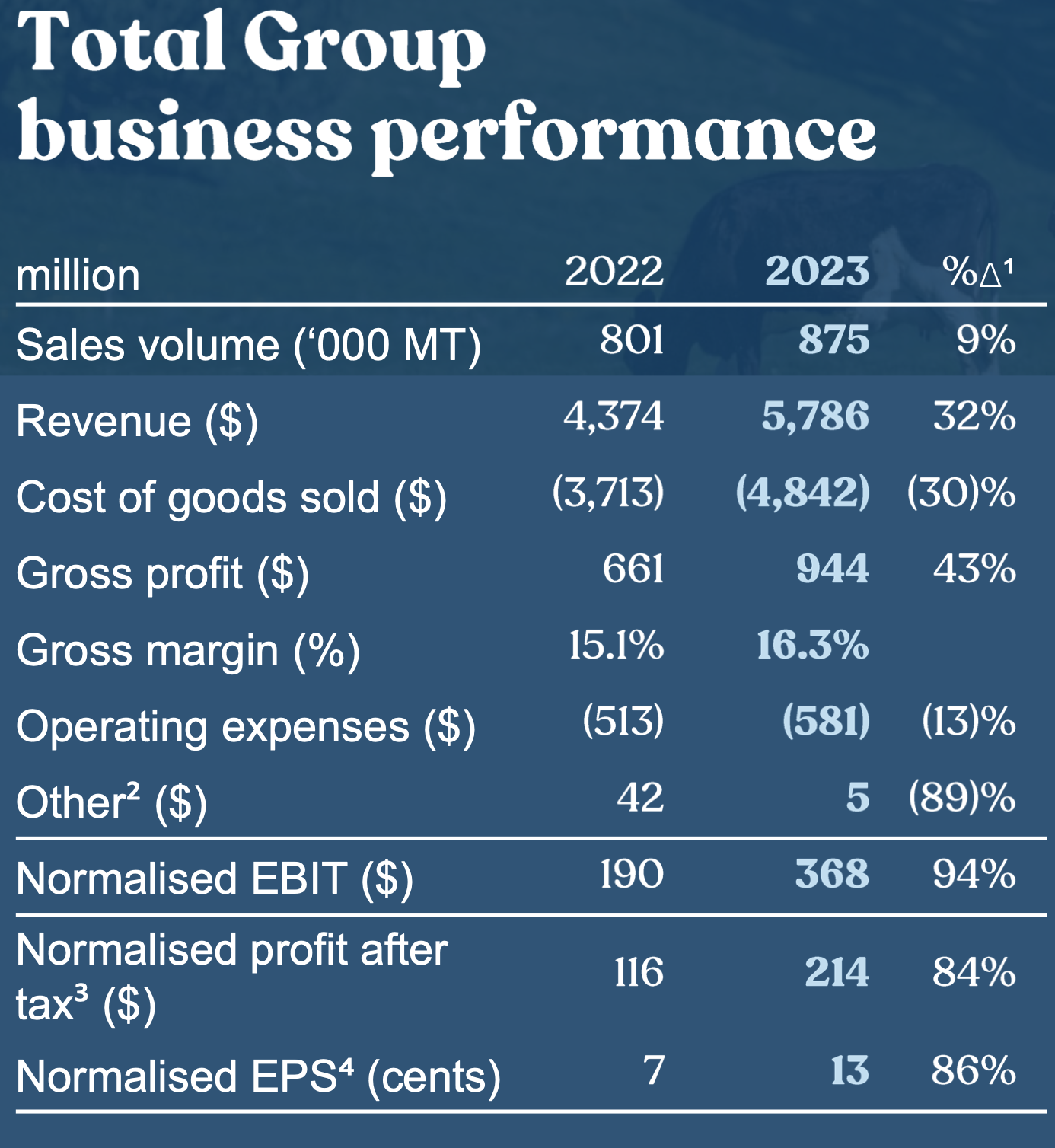

This is their quarterly

Which all looks rosy.

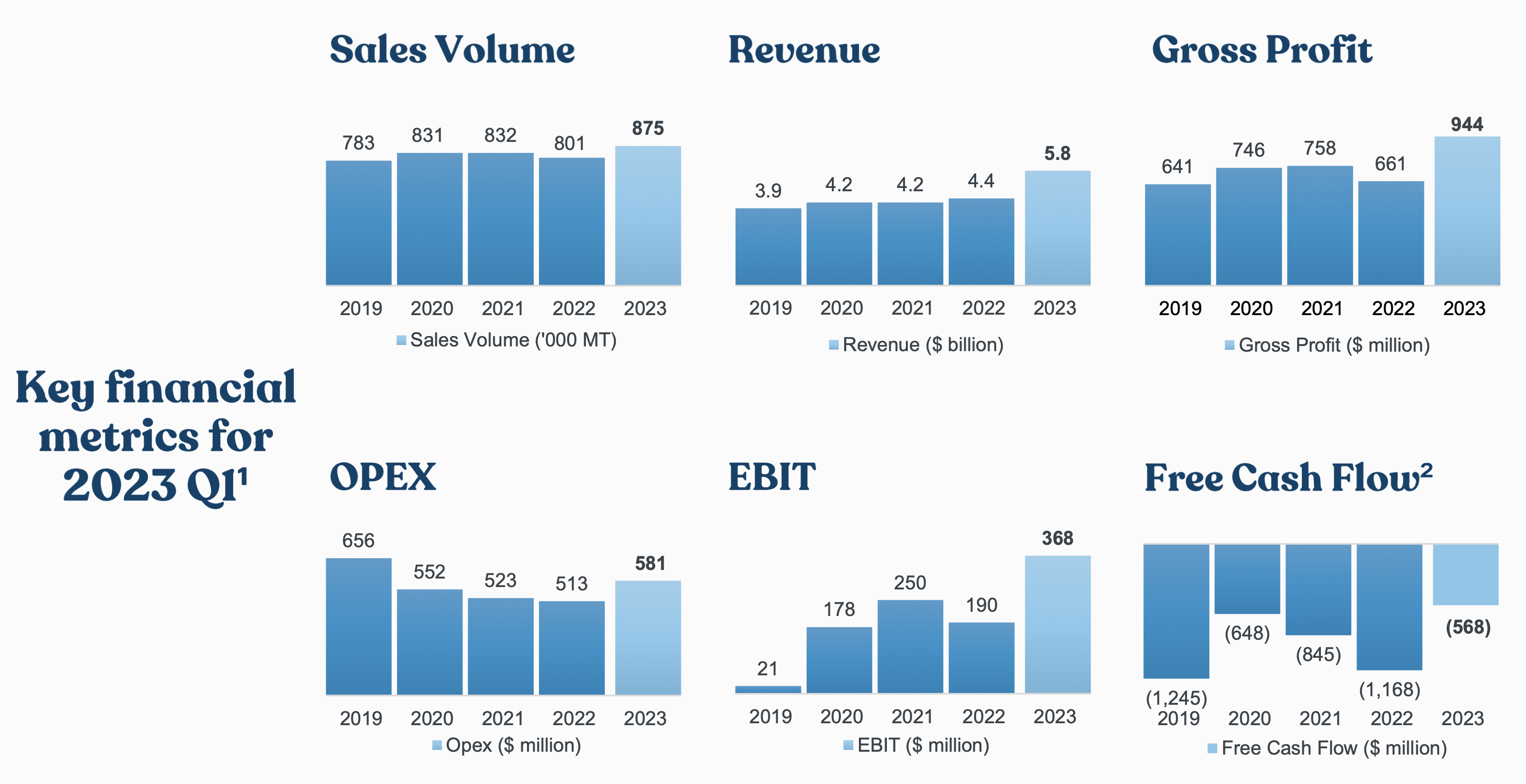

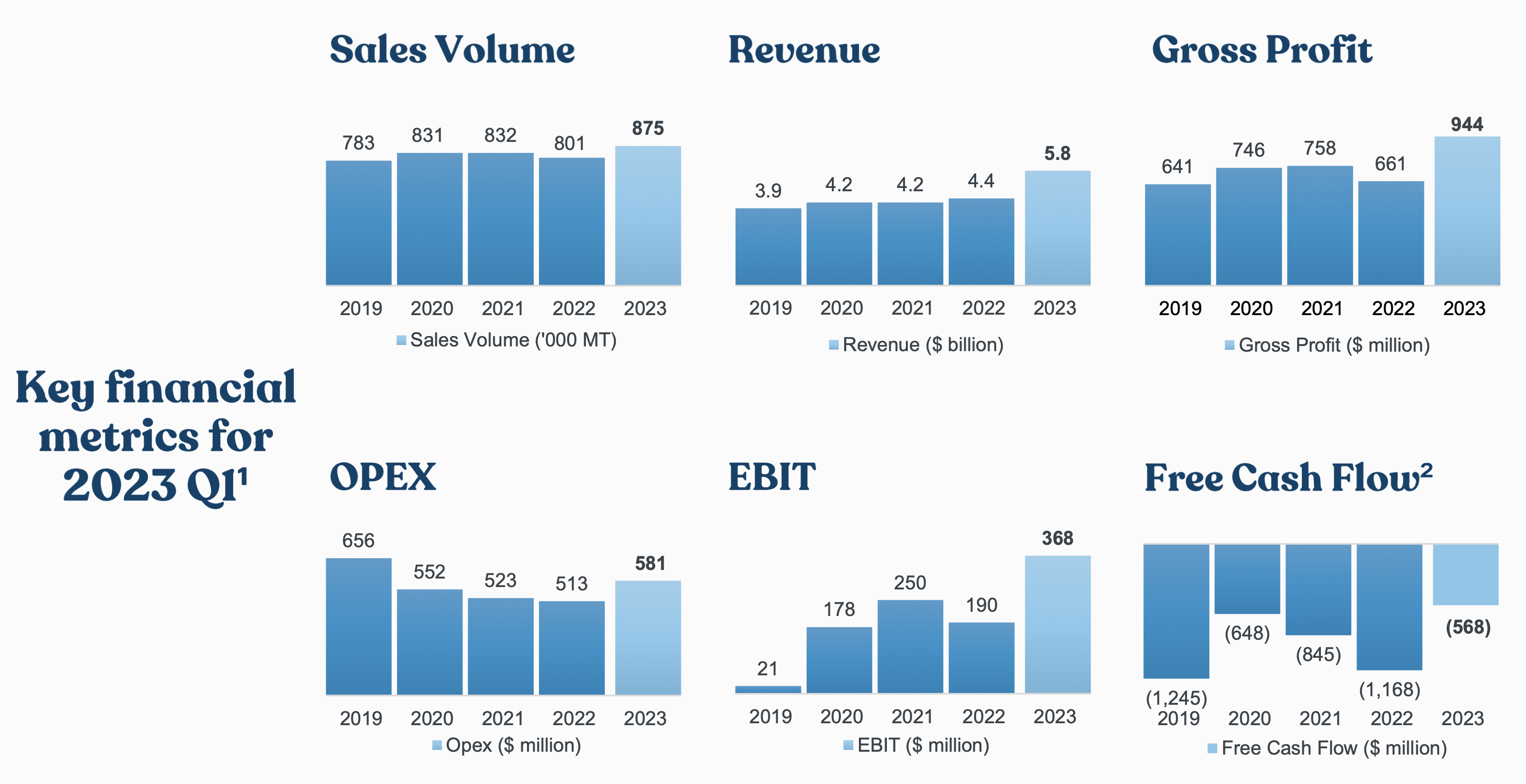

Yet later their NOT-normalised FCF looks abysmal:

As OPEX and cost of goods sold is significantly less than revenue, where is the -ve FCF coming from? Is this because of their Share buy back?

Secondly, they have announced the sale of their Chilean business for $NZD 1bn and their Brazilian business for $NZD 210m. They have not announced how this will be returned to shareholders. They currently already have a share buyback in process.

I'm trying to work out whether this represents an opportunity to benefit from a significant capital return in an otherwise robust but cyclical agricultural business, that does not appear expensive on headline metrics.

Thanks for any help on this.

C