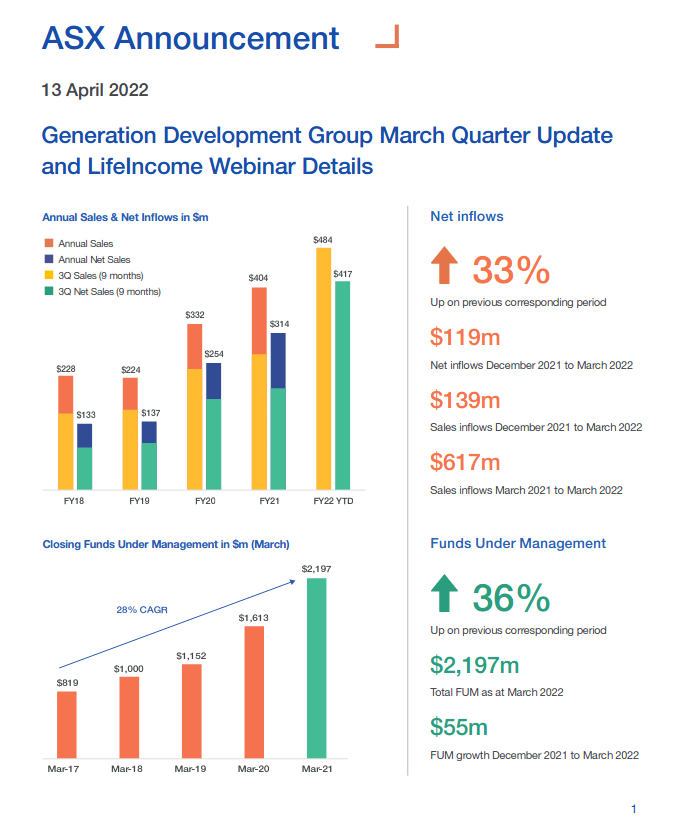

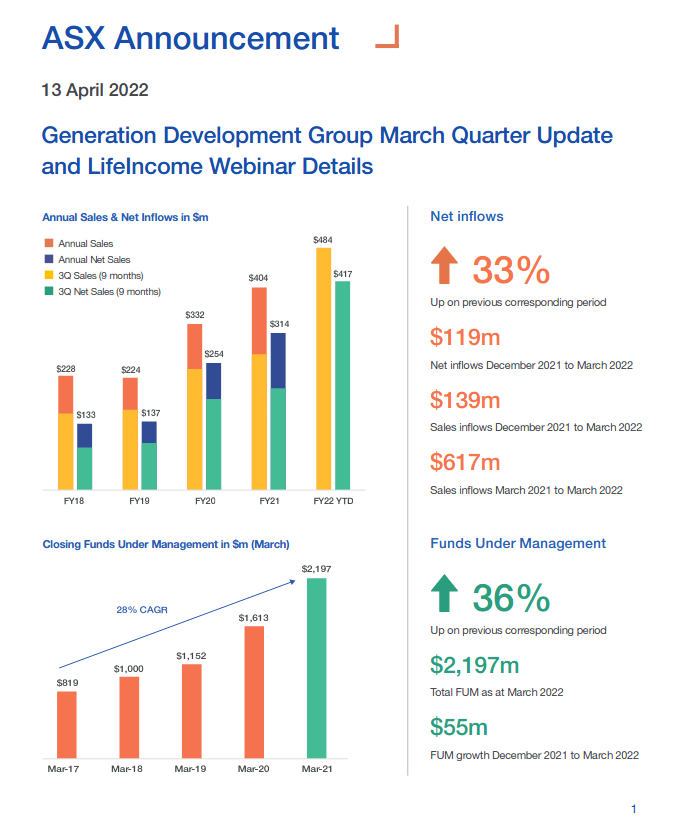

March Quarter Update

Good update from Generation Life.

Going back to the first half results, they achieved revenue of 17.5m from inflows of 344m

For some reason GDG did not put the revenue update, so my guess is they achieved 119*17.5/344=6.05m in revenue for the quarter.

If they get the same numbers for the final quarter, then Generation life is probably trading at Price / Sales of about 10 (300m/30m). So it is fairly priced at this point in time given the price spike today.

One of the positives I can see is they are launching a new annuity business called LifeIncome. Also Lonsec FUM has grown well too.

Just like in long distance swimming, Grant Hackett seems to have done well at the helm of Generation life. But like AEF, this is more of a growth stock especially last year they made a net loss before tax but managed to scrape a profit after adding back some tax benefits.

Held