PDF STATUS AT RISK

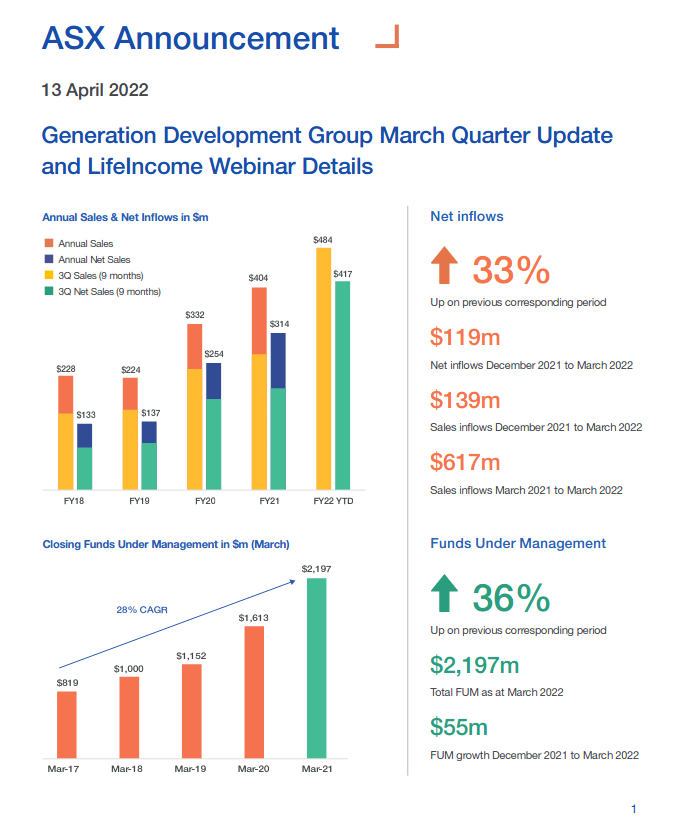

Generation Development Group Limited (ASX: GDG) is registered as a pooled development fund (PDF) under the Pooled Development Funds Act (the PDF Act).

Various taxation concessions are available to both GDG and its shareholders as a consequence.

GDG announces that the Innovation Investment Committee of Industry, Innovation and Science Australia (the PDF Committee) has advised that it has made an in principle decision to revoke GDG's PDF status.

The basis for this is that the PDF Committee has formed an in principle view that there are various requirements of the PDF Act which are not satisfied in relation to GDG.

The PDF Committee has invited GDG to provide submissions by 22 July 2022 why its PDF status should not be revoked.

GDG disagrees with the in principle views of the PDF Committee and intends to make strong submissions by the requested date that the PDF Act requirements are satisfied and that there is no basis for a revocation.

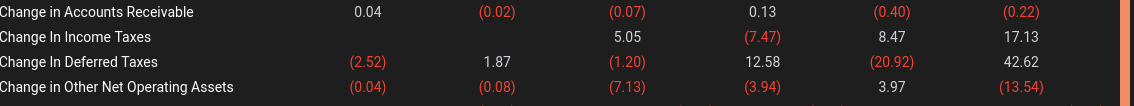

Notes: Was wondering if that deferred tax on the cashflow statements had something to do with this tax concession from being a PDF (last col 2021).

[held]