Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The Group is making progress across a range of logistics and data centre opportunities and is well positioned to support customer need for essential infrastructure, over the long-term.

The Group maintains its forecast FY25 Operating EPS growth of 9%.

DATACENTRES

PROPERTYINVESTMENT

DEVELOPMENT

MANAGEMENT

Financially not over leveraged, Cash flow 0.78cps and expected to grow in 2026

Last

$32.68

Change

-0.160(0.49%)

Mkt cap !

$66.37B

Disc: GMG I bought on the dip in April..

Chart Update 3rd sep24

Looking for major w4 down

Historically wave 4 retraces 38.2% of wave 3 which should take us down to the 100 shown on the left hand chart (3Day chart) however I dont think we will see that. We are currently in the 5 waves donw in the C wave on the right chart (1day). Im looking for it to reach my target box which means it has retraced 23.6% of wave 3. Wish I got in on this one back in 2020. Wow what a 3rd wave up from $9ish to $37ish back a month ago, on such a great stock.

GMG is big into and going bigger on data centers. No one can deny these are the digital infrastructure plays of the future. The demand might vary from the large scale DC (>50MW) to the Edge compute DC (<50MW), but the demand will not disappear. I've started to look into GMG as I mull over the options of the ongoing NextDC capital raise.

Limiting myself to the ASX, NextDC is the biggest focused Aus based player. But GMG provides the greatest global exposure. Biggest is usually best.

ROM of MW for each: (DC size is simplified to be measured in MW, i.e. the total device power lease-able inside the DC)

NXT; ~400MW in Aus, all overseas is in development (another couple 100 MW).

GMG; 200MW delivered in Australia and New Zealand in Sydney, Melbourne, and Auckland, 200MW available in Los Angeles, 1.5GW available across Europe and the UK in locations including London, Amsterdam, Frankfurt, Paris, and Madrid, 1.5GW available, and 300MW delivered in Asia across Tokyo, Osaka, and Hong Kong. Actual current is ~400MW across 14x DCs globally - so similar in size to NextDC.

GMG plans to use existing property it owns to redevelop into DC's (saving money). Pays a dividend along the way (vs NextDC growth play), and has the horizontal assets to make use of future DC's or to de-risk the DC 'narrative'.

More to follow. Eventually.

using McNiven's valuation:

required return 10% pa, ROE of 15%, 60% re-invested, 40% pay out

gives a valuation of $18.47

Morningstar give fair value of $19.40

split the difference = $19.00

A surprisingly bullish forecast.

REITs generally are expected to take a bit of a beating over the coming 6-12 months as their assets get revalued (down) and interest costs and gearing get re-stated (up). Currently most REITs are on a dividend yield of 4-5% which compares very unfavourably to a risk free cash deposit or government bond yield of marginally less: there is next to no risk premium for these assets.

GMG is a bit different in that it has direct holdings in industrial real estate (distributions and fulfilment centres) but is also an industrial property (re-)developer and manager of these assets for other clients. Clients provide the majority of the working capital. For these reasons I think it is considerably less risky than the only other REIT I hold ASX:CIP. (I am avoiding Retail and Office REITs like the plague). It is unlikely that the outsized recent returns are going to be repeated ad infinitum as the re-development opportunities become less obvious and competition for greenfield sites increases.

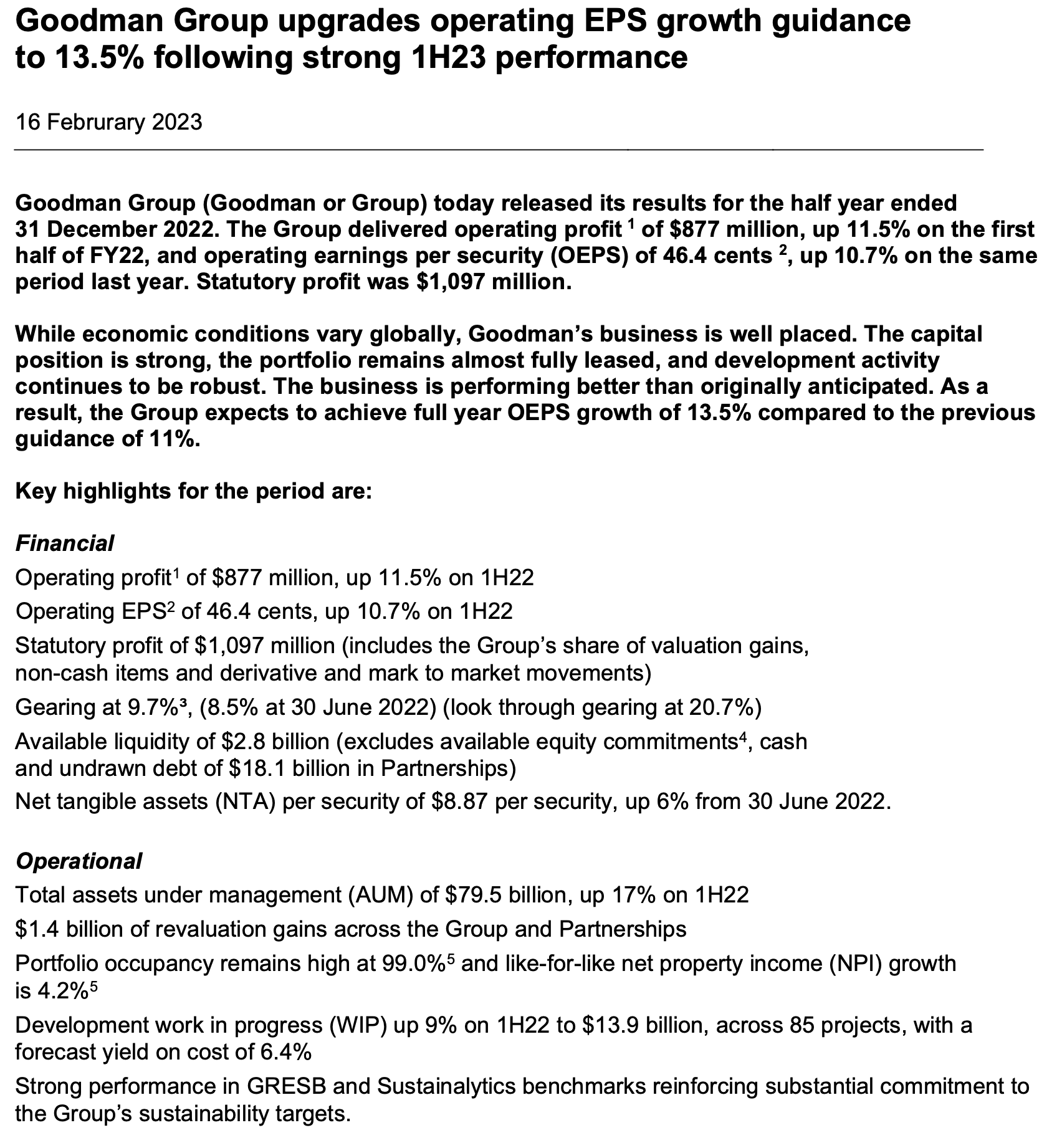

I like that it is geared very modestly 9.7% (20.7% look through) though I anticipate this will rise with asset price re-valuations.

They are forecasting a rise in EPS of 13.5% for the full year.

I would love to see an increase in the dividend which has stayed flat at 30cps for a number of years now, but management state they can generate attractive returns by re-investing into a growing business.

Price Targets:

Morgan Stanly $24.10

Macquarie $23.93

Citi $23.50

JP Morgan $22.00

Hate to say it though seeing weekness in 1 day and 3 day way ahead of itself so sold out.