Shares on issues : 130m

Insider ownership : 8.8m (6.76%)

Market cap = 455m ( $3.50 each Share)

EV = 425m

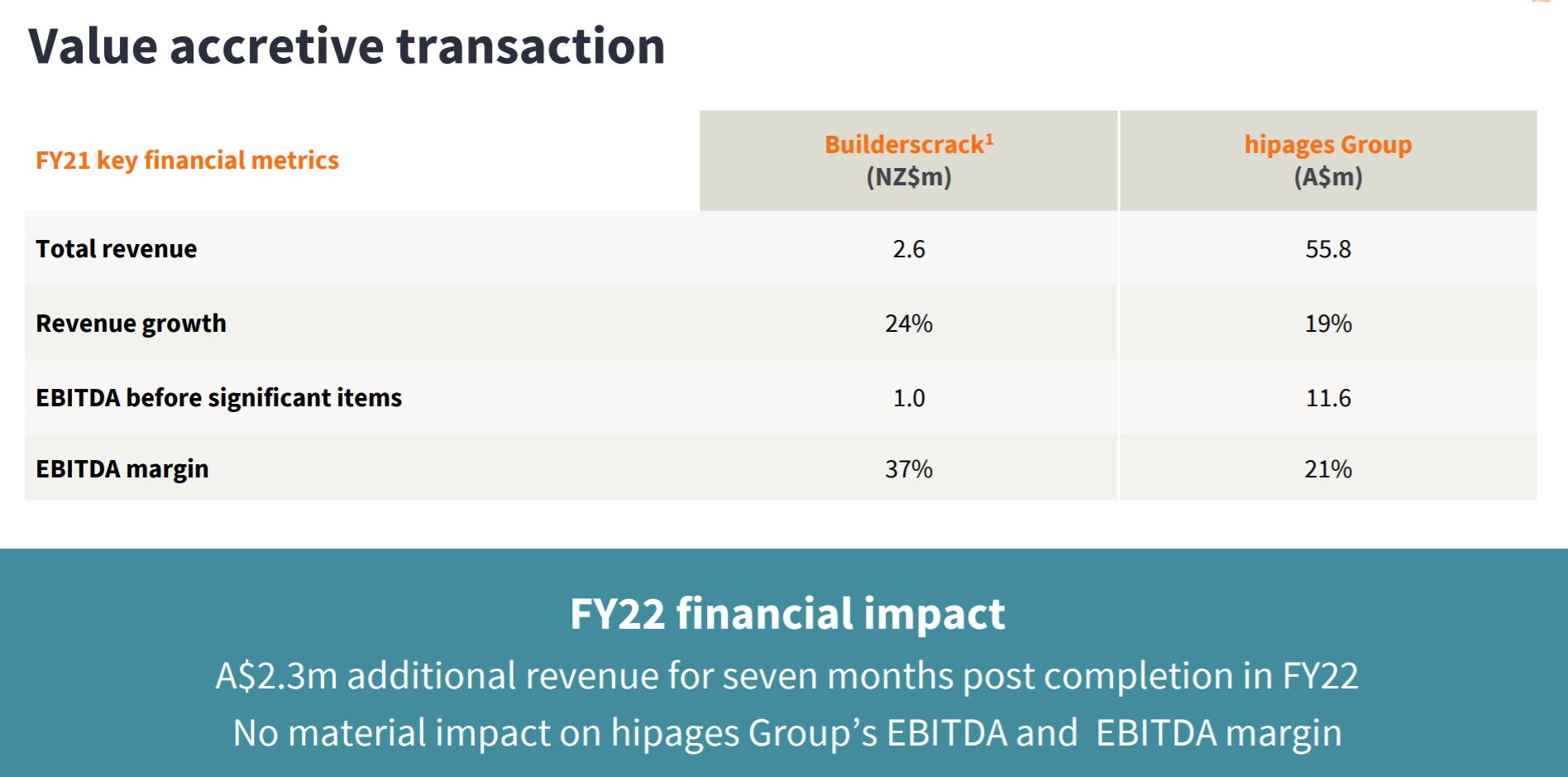

Revenue = 55.8m (52.7m ARR)

Underlying EBITDA= 11.7m

NPAT = 1.2m

Cash = 30m

hipages is online tradie marketplace and Software-as-a-Service (SaaS) provider connecting tradies with residential and commercial consumers across the country.

The platform helps tradies grow their business by providing job leads from homeowners and organisations looking for qualified professionals, while enabling them to optimise their business through our SaaS product.

The platform helps home and business owners simple and quick way to get job done and find trusted tradies.

Hipages gets jobs using key partneships as well, It broadens customer base beyond homeowner category, They have contracted partnerships across retail, real estate and government sectors ( example below)

- IKEA ( Established in 2013)

- Ray White concierge ( Established in 2016)

- Bunnings Warehouse ( Established in 2018)

- NSW Education ( Established in 2019)

Tradies

- Migration to Subscription for tradies

- Hipages traditionally had tradies on platform via transactional model i.e Small annual listing fee and tradie would pay each time they claimed a job lead.

- Post November 2019, Hipages moved to a subscription-only product offering for new tradies

- Currently they have 31.2K subscription tradies

Users

- 64% of jobs from repeat consumers

- 77% of jobs from unpaid channels

- From 2019, Hipages shifting marketing investment from Google to TV Advertisement and sponsorship

- Platinum sponsor of "The Block"

- Sponsorship of "Better Homes & Gardens" in March 2021

Other SaaS Offering

- July 2021, Hipages has launched TRADIECORE

- Quoting, invoicing and customer management tools for Tradie

- Look at the product vision straw ( which outlines their vision for future integration i.e Booking system, payment etc)