Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The current share price of $1.28 implies an EV/FCF ratio of 28.5, and a P/E of 77. This feels quite high, all things considered.

Assuming they hit the $8m of FCF as per guidance with an assumed growth of FCF of 9%, I get a valuation of $1.16 per share.

Prologue

Hipages is an online marketplace where home owners can advertise jobs they need done and then tradies can provide quotes. Tradies, rather than the home owners, are Hipages’ customers as tradies pay a subscription model to use the platform.

Hipages might be one of the lowest quality marketplace companies around:

- Once a job is complete, home owners could choose to build a relationship with their tradie outside of Hipages, circumventing the platform.

- Home owners can easily shop around on the various other classified sites (Yellow Pages, Oneflare/Airtasker, search engines etc).

- Tradies also could shop around on the same other platforms.

- Customers may simply choose to not go ahead with a transaction if it is not urgent repairs.

Because of this, network effects do not really come into play like with other platforms such as realestate.com.au.

Chapter 1: The Changing Business Model

Management have long acknowledged the above problem with their business model. By the end of FY25 they have laid the foundations for a change to a new, hopefully more profitable, business model.

- They have transitioned from a commissioned-based model to a subscription model. 100% of their NZ tradies are now on the subscription model generating $1,190 average revenue per user (ARPU). As of their FY25 report, 81% of Australian tradies were on the new platform, generating $2,381 ARPU.

- In FY24 they unified their marketplace and their ‘Tradiecore’ SaaS product into the ‘Single Tradie Platform’ (STP). Tradiecore was a job management and admin software that tradies could integrate into their accounting systems and manage their job leads. Hipages hopes that this combined STP will become a ‘mini-ERP’ for tradies (their words not mine).

Overall, the change in the subscription model has resulted in the business generating much better free cash flow from a step change in the ARPU.

The fact they seem to have experienced minimal churn is a good sign that tradies are getting value out of the platform and that Hipages has at least some pricing power.

The strategy is to use this newfound FCF to build out the SaaS components and features to make the tradies even stickier, add incremental ARPU and attract more tradies to the platform.

Chapter 2: The Outlook

Management have provided guidance for FY26 of:

- Revenue growth of 10% - 12%;

- EBITDA margin of 24%-26% (FY25:24%); and

- FCF of $8m - $10m (FY25: $5.6m).

When the remaining 19% of Australian tradies transfer over to the new pricing, this should add $1.43m of revenue alone (+1.72%).

They have CAGR of 12% ARPU growth over the last four years for the Australian business. They can easily hit revenue guidance if they achieve ARPU growth of 7.8% over the new pricing model for the Australian business alone. This is assuming the number of tradies remains constant and does not rely upon growth in the NZ business.

Given they have achieved revenue CAGR of 10.5% over the last four years, this guidance seems quite reasonable and very achievable.

Chapter 3: The Valuation

The current share price of $1.28 implies an EV/FCF ratio of 28.5, and a P/E of 77. This feels quite high, all things considered.

Assuming they hit the $8m of FCF as per guidance with an assumed growth of FCF of 9%, I get a valuation of $1.16 per share.

Epilogue

What I like:

- Consistent revenue and ARPU growth since IPO. However, this is only a short history of 5 years.

- Founder-led business with management KPIs are aligned to revenue growth and growing the tradie base which is much needed for the long-term success of this company.

What I don’t like:

- They capitalise ~75% of their software development which is why FCF is a better metric of profitability. I would prefer to see them expense more moving forward given they have merged the two platforms.

- Their strategy may not provide much of a moat, if at all. Competitors will be able to replicate relatively easily.

- Management have a very small share in ownership. The Founder/MD holds all the shares owned by management, while the remaining board members have a tiny fraction of shares on issue.

Overall, the company seems like a solid business. It is growing and the strategy seems sound to address the key problems of the business.

If I was to ask myself, is this the best idea I could do with my money? Probably not. I think that I would wait to buy this on a pull back, but I see the vision.

Great 24 results released today… cashflow positive, decent growth.

See my recent straws for more details behind this valuation.

FY22 rev approx $60m.

Forecast growth averaging 12%, reaching rev of $108m in FY27.

NPAT in FY27 of 15% = $16m.

PE of 23 (5 + 1.5 x ongoing growth of 12%).

FY27 market cap of $368m compared to current $170m = estimated 17% annual return over next 5 years.

Current valuation using 10% discount = $1.87.

Recommendation: buy below $1.50 for 15+% annual return.

Moving this summary out of my previous valuation so it doesn't get deleted when I update my valuation based on latest Q4 FY22 results:

1. Overview: HPG is a clear market leader as an online marketplace for tradies, serving residential, corporate and government end-users of tradies. They have recently introduced Tradiecore, a tool available as part of subscriptions, for CRM, scheduling and payments. There is also some longer term optionality for them to play a role in the larger lifecycle of tradie work including financing, insurance, supplies, etc.

2. Management: CEO owns 6.5%. Management has been reasonably grounded and transparent in investor presentations. They haven't nailed their business model yet, but have been willing to change where needed, and recent move to subscription pricing rather than taking % of leads was sensible. Interestingly, News Corporation owns 25% - not sure if this is a pro or con, so I'll treat it as neutral.

3. Revenue: Looks like they'll do around $60m in FY22. They grew 22% in FY21 and 9% in FY22. TAM is anywhere from $10b to $100b depending on who you believe and what you include.

4. NPAT: REA and CAR are the gold standards of online marketplaces. They have averaged NPAT of around 1/3 of revenue over many years. I'm not assuming HPG can reach these lofty heights, partly because HPG doesn't yet have the scale, and also because I think the tradie marketplace is more complicated than for property or cars. HPG has achieved 26% EBITDA in the past, and said in their HY22 investor presentation they said they believe they can return to that level. FY22 operating cash flow was 20% of rev, and Q4 operating cash flow was 35% of rev. So reaching an NPAT of 15% in 5 years seems achievable..

5. Risks: 1) Recent momentum has been downward, having dropped about 60% since highs end of 2021. 2) If News Corp decides to bail from their 25% holding, there will be big downward pressure on price. 3) They haven't yet shown they can produce positive NPAT. 4) Aftermath of Covid still poses headwinds given tradie shortage, waiting list of work, meaning tradies finding it easy to find work, and aren't feeling desperate need for marketing offered by HPG.

Q4 update from Hipages: https://hipagesgroup.com.au/investor-centre/asx-announcements/

Shares got a 7% bump but I'm mixed on quality of results and will revise down my valuation a little (but still think price is in mildly attractive territory).

Revenue for Q4 up 9% on pcp, and looks like rev for FY22 will be $61m up 9% on FY21. But half of this is from acquisition, with management being open about only 4% increase like-for-like. Their explanation for slower than expected revenue growth is the high and backlogged demand for tradie work arising out of Covid. Management expressed their belief that revenue should increase as the backlog of work is fulfilled and perhaps also if economic activity slows down and tradies are looking for channels to source new work.

A strong positive is solid and growing cash flow, with Q4 operating cash flow $5.5m (35% of rev) and FY22 operating cash flow $12.6m (20% of rev).

So they are borderline for the thesis I presented 3 months ago. Back then my valuation was based on $60m rev for FY22 (tick), 15% growth for next 5 years (questionable - they grew 22% in FY21 but only 9% with acquisitions in FY22), and achieving 15% NPAT in 5 years (tick, based on current operating cash flow).

I'll revise down my valuation slightly to assume slightly lower 5-year growth of 12% pa and terminal PE of 23 (5 + 1.5 x growth).

Recommendation: buy below $1.50 for 15+% pa return.

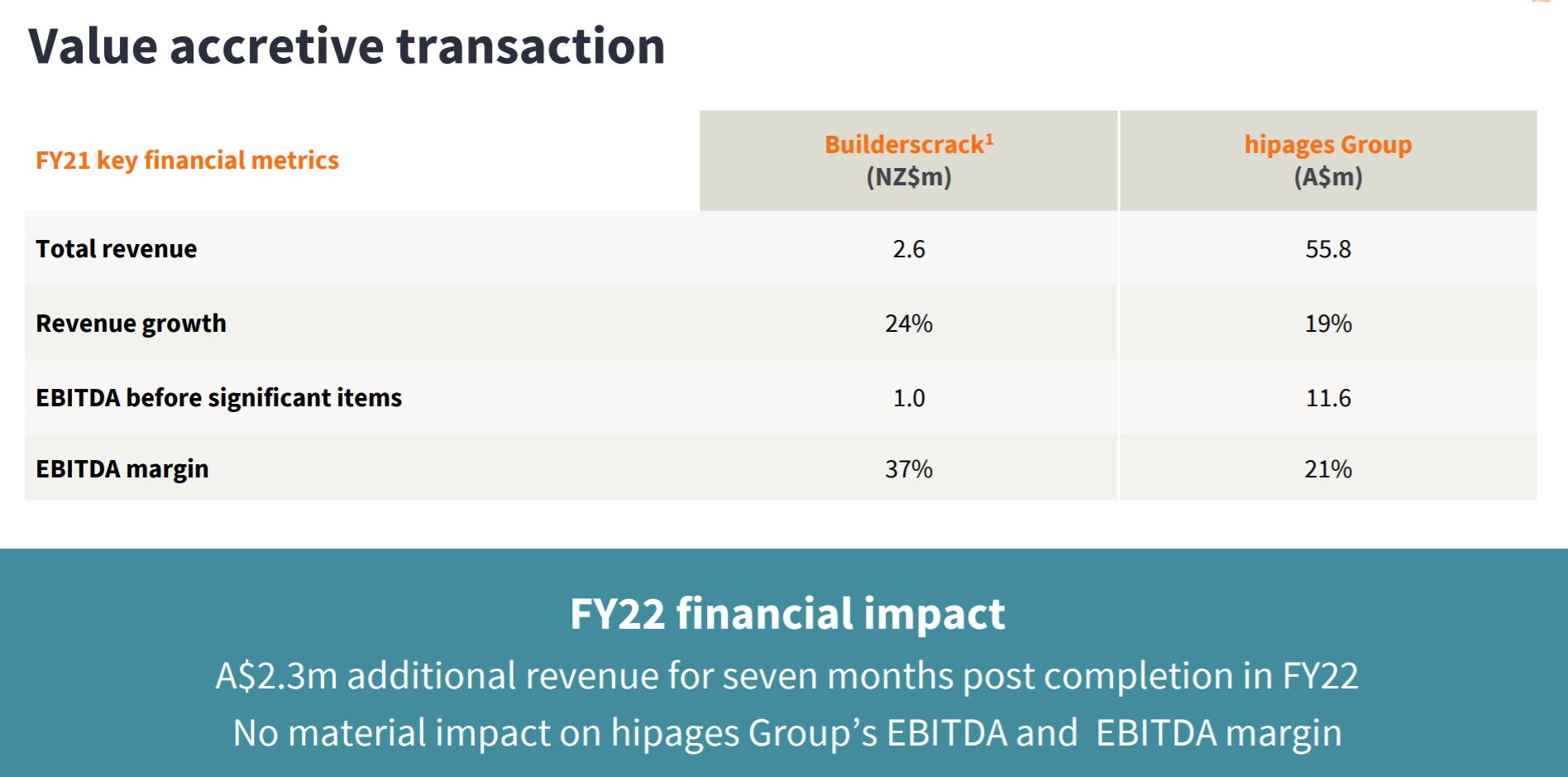

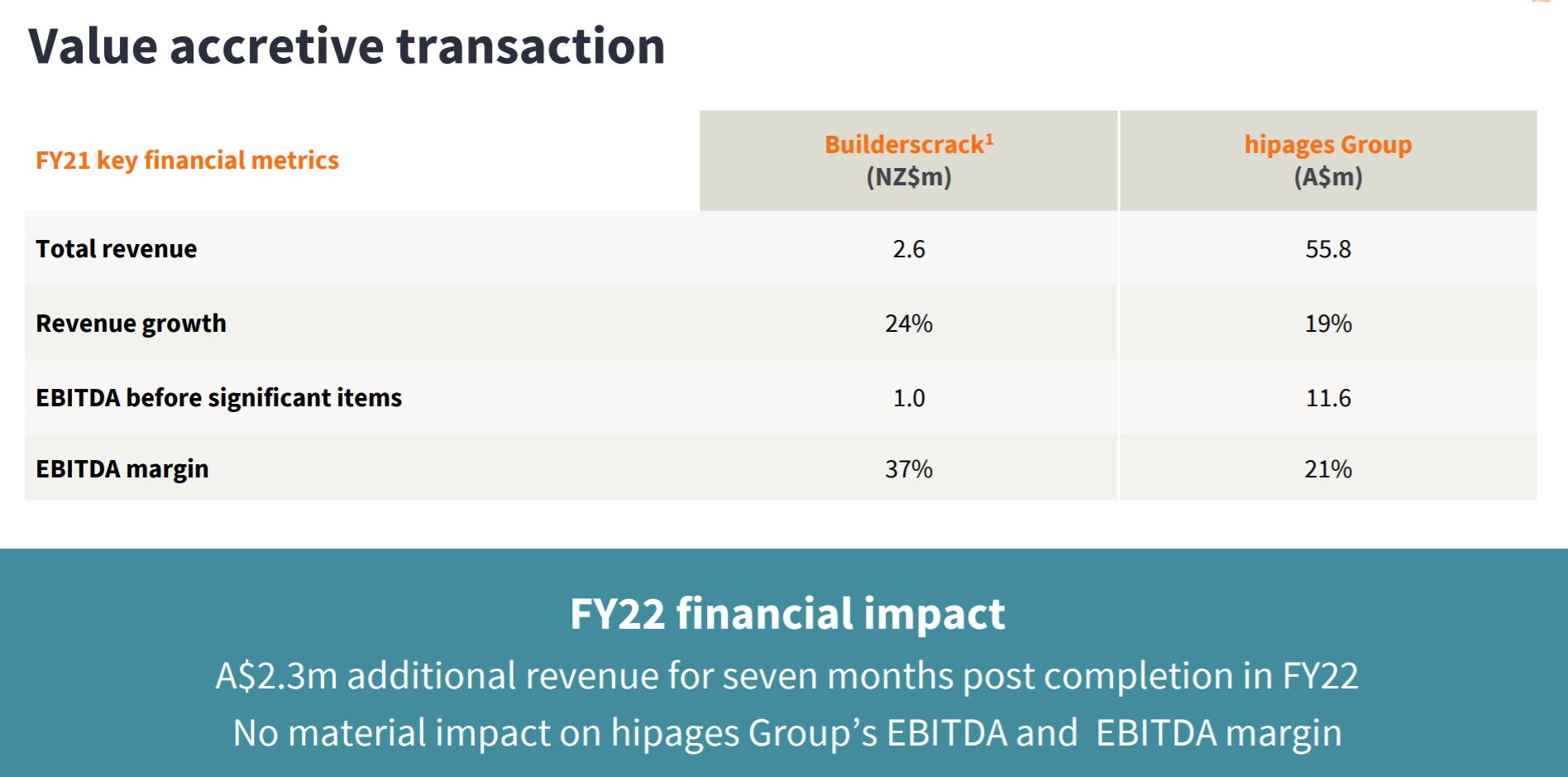

- Hipage spends $11.8m in cash and equity to acquire similar NZ tradie marketplace (builderscrack)

- It has 4000 active tradies

- more than 95000 jobs per year

- FY21 Revenue = 2.6m (NZ$)

- FY22 expected Revenue for 7 months post acquisition = $2.3 ( if we annualize that equates to $3.9m, i.e 50% growth)

- CEO and CFO said that there will be an investment for the initial couple of years - importantly it gives them exposure to NZ market where they can go and sell other hipage's products like tradicore

- HPG is also currently in process of developing payment solution

- The acquisition increases TAM for total business

- Hipages acquired 25% interest in Bricks + Agents in November 2021

- It seems very good partnership - Hipages will gain exposure to B+A's user and tradie base and residential and commercial property management market while B+A will get capital to grow -- and as B+A grows -- it also feeds into Hipages

- Hipages were awarded second place in WRK+ Best place to work award 2021

- Release new product TradieCore: https://tradiecore.com.au

Business seems to have progressed well from all my digging around. It seems like a good company with a founder at the helm of things with long-term plans. It has good employee engagement and culture ( at least from the outside).

I like that company isn't that promotional as other marketplaces. It looks to be doing a lot of things right. I will continue to monitor.

I had a sparky (one man owner operator) over to do some work this morning and sought some scuttlebutt on HiPages.

He said he had been on it but left the platform because it was too expensive. This also mirrrored the experience that other tradies he knows have had.

There are a lot of other platforms out there (plus FB community pages where we found him, etc) and none are as expensive as HiPages.

The way he sees it is that it's free for customers, so tradies end up paying premium prices to fund the expensive ads on the block.

Hard to argue but on the plus side tradies should get the biggest funnel from HiPAges as they have the biggest brand awareness - especially from block watchers, etc, (I assume their SEO is sector leading too).

His attitude is that there's a lot of work on there but for $40 just to quote (against max 2 other quotes) it feels like a rip off unless you can't find work. Also, you;ve got to be quick when a job comes in to quote on it because they go quickly.

If this is how a lot of other tradies see it, HiPages will be the place for the worst / least referred tradies (notwithstanding their internal rating system).

Disc: Not held.

HiPage released its FY21 result today. they also released - HiPage Product Vision ( I found it useful and I intend to monitor how it evolves in FY22 and beyond)

Strong growth across all key metrics

Highlights

- Monthly Recurring Revenue (MRR)1 of $4.6m @ December 2020 up 31%

- Statutory Recurring revenue2 of $25.3m, up 26% on a pro forma basis

- 94% of total revenue is recurring revenue

- Statutory Total revenue2 of $26.9m, up 18% on a pro forma basis

- Gross Profit Margin3 of 87%

- Pro Forma EBITDA4 of $6.9m, up from ($0.1m)

- Statutory EBITDA5 of $1.4m including non-recurring IPO related costs

- Pro Forma Net Profit after Tax (NPAT) of $1.5m, up from ($5.3m)

- Statutory NPAT5 of ($5.9m) includes non-recurring finance and IPO related costs

- Pro Forma Operating Cashflow (OCF) of $6.7m, 98% EBITDA4 to OCF conversion

- Closing cash and funds on deposit of $31.5m, no debt

- COVID-19 Update: No adverse impact from recent outbreaks

- On track to meet FY21 Prospectus forecasts for key financial and operating metrics