I've had a position in Harvey Norman since April 2020 in the depth of COVID when HVN was around $2.70, it was one of the first companies I bought as a relatively new investor into individual companies. I had held a position since with some trading around highs and lows in share price. I never saw it as a long term forever hold, more a company I could trade over time, buy when near NTA and sell in the $5 plus territory. According to Sharesight overall a 17.6% pa return about 4% pa above what A200 would have returned.

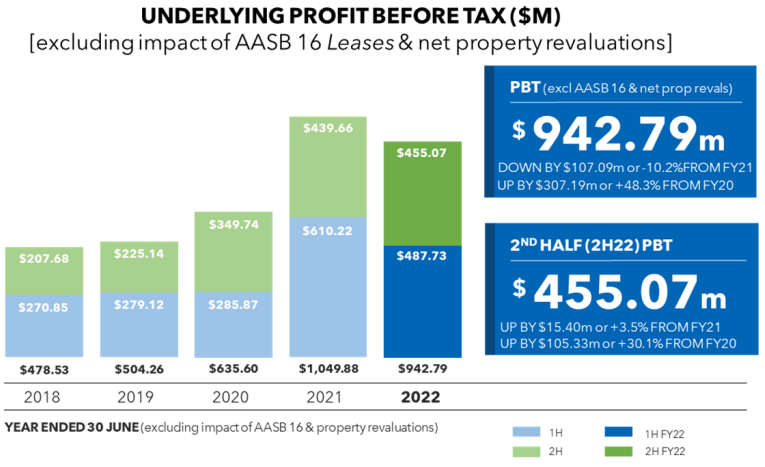

Keeping me in the position was the strong dividend (Gerry loves his dividends!), which was the main source of the above returns. I have continued to hold in recent times thinking profitability would be lower, around 20% down with the property a buffer from lower share prices. However, a 49% drop in profitability for the first four months of FY is far worse than I expected and hence why I sold out on open Friday. Thinking I was lucky to get out before the share price tumbles throughout the day to my surprise at the end of the day shares were up nearly 5%!! Seems the market liked the buyback announcement or the markets base case was worse than 49% drop in profitability? In terms of the buyback, it's going to be completed either by reducing the dividend or more debt so I don't see the benefit? Whatever the case, my conviction in the position is gone so I'm glad I'm out.

HVN and JB HiFi will both be on my watchlist for when retail confidence returns. I think they both now have relative duopoly on the physical retail market but of course they are under threat from online retailers. I think there could be more pain to come. My base case for interest rates is that they will be higher for longer and rates are yet to peak so I probably won't be looking at buying either for a while.