Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I notice Gerry Harvey is in the news again, this time with his innovative new method of reducing shrinkage before Christmas.

I've had a position in Harvey Norman since April 2020 in the depth of COVID when HVN was around $2.70, it was one of the first companies I bought as a relatively new investor into individual companies. I had held a position since with some trading around highs and lows in share price. I never saw it as a long term forever hold, more a company I could trade over time, buy when near NTA and sell in the $5 plus territory. According to Sharesight overall a 17.6% pa return about 4% pa above what A200 would have returned.

Keeping me in the position was the strong dividend (Gerry loves his dividends!), which was the main source of the above returns. I have continued to hold in recent times thinking profitability would be lower, around 20% down with the property a buffer from lower share prices. However, a 49% drop in profitability for the first four months of FY is far worse than I expected and hence why I sold out on open Friday. Thinking I was lucky to get out before the share price tumbles throughout the day to my surprise at the end of the day shares were up nearly 5%!! Seems the market liked the buyback announcement or the markets base case was worse than 49% drop in profitability? In terms of the buyback, it's going to be completed either by reducing the dividend or more debt so I don't see the benefit? Whatever the case, my conviction in the position is gone so I'm glad I'm out.

HVN and JB HiFi will both be on my watchlist for when retail confidence returns. I think they both now have relative duopoly on the physical retail market but of course they are under threat from online retailers. I think there could be more pain to come. My base case for interest rates is that they will be higher for longer and rates are yet to peak so I probably won't be looking at buying either for a while.

$HVN reported a YTD Trading Update today.

Australian franchisee sales down 13.9% on a LFL basis.

Unaudited operating PBT down 49.1% (before non-controlling interests and exclding AASB16 and property revals) again highlighting the strong negative operating leverage in this sector.

SP up almost 5% on the announcement of the share buy-back.

(Seems to be faring significantly worse than my pick $NCK, albeit with a longer period reported into FY24.)

Disc: Not held. I hold $NCK in RL

Sep 23

- Untouched property value to be conservative: =$3.54bn

- Using an underlying profit of $350m and 8 times multiple = $3.2bn (reduced profit by $50m)

Valuation = $5.08

Floor price = NTA of $2.96

Feb 23

Updating based on adjusted expectations:

- 10% discount on property value = $3.54bn

- Using an underlying profit of $400m and 8 times multiple = $3.2bn

Total valuation = $6.74bn

Valuation per share = $5.40

Sep 22

Conservative valuation based on:

- 10% discount on property value = $3.366bn

- Using an underlying profit of $500m (ie no profit growth and removing property segment profits) and 8 times multiple = $4.0bn

Total valuation = $7.376 bn.

Valuation per share = $5.88

Previous valuation for reference:

Valuation based on freehold property value + 10x PE of retail/franchising business using conservative ongoing earnings:

Property value = $3 050m

Franchising PBT ongoing = $550m (assuming a fall from the COVID peak)

Retail PBT ongoing = $200m

PBT ongoing = $750m

NPAT = $525 m

Valuation = 305 + 5250 = $8.3 bn

Shares on issue = 1.246bn

Valuation per share = $6.66

see how RBA sees CPI number at July 4th 2023

i could buy circa $3.30

Next Forecast Ex Div Date: 13/10/2023 (107 days away)

DYOR....

Now. 28/6/2023 report PBT: $670Mill ( $60.90m = 670 / 11 months )

30/6/2022 reported PBT: $1.140Bill ( $95m = 1140 / 12 months) monthly approx $95m vs $60.9m (158% change)

so reported PBT: has halved vs 12 months so discretionary retail shopping dived ..

Is HVN a buy? circa $3.30 see what the RBA presents in July, first Tuesday meeting..

So the share price has reflected this fall in PBT .. see what happens when HVN report on Thursday 31/8/2023

Checking comparible disclosure:

June 2022 . PBT $1.140Bill

Microsoft Word - PRESS RELEASE_30 June 2022_FINAL FOR RELEASE 310822 (markitdigital.com)

Further back dated below: Reported PBT $522.67Mill

Announced Feb 28th 2022

Microsoft Word - PRESS RELEASE_31 December 2022_FINAL FOR RELEASE 280223.docx (markitdigital.com)

Hey @Tom73 - I enjoyed your pros and cons straw about HVN - very comprehensive - and shows how confirmation bias could really reinforce somebody's high conviction in HVN being either good or bad - if they don't take the time to seek out and consider the opposing views. Just one quick note - you called them HVN about half the time and you called them NVN the other half through your straw. I was going to direct message you about that rather than write a straw, but you do not have Direct Messaging switched on here so I couldn't.

Anyway, because it's a straw, any changes will set the vote count back to zero, so if you are going to change it, do it soon, before you get too many votes. And I reckon you WILL get plenty of votes, because it's an excellent piece of work!

I know it’s wrong, but I can’t help coming back to NVN and asking LOVE or HATE the big G?

So as a part of my therapy I have decided to walk in the shoes of both sides of the argument on the business – the Lovers and the Haters – maybe it will make sense then.

WE LOVE YOU HARVEY (BULL)

· Pretext: Gerry is the best, he is the Warren Buffet of Australian retail and property investing and one of the few who put their money where their mouth is.

1. EPS and DPS have grown relatively consistently up to COVID and took off in COVID.

2. ROE and ROC have averaged the mid-teens for the last decade.

3. His performance during COVID for shareholders, makes Alan Joyce look like an amateur.

4. Despite a PE re-rating from in line with the market to around half the market, TSR has beaten the market over the last 10 years.

5. HVN holds property assets valued at $3.4b, the company only has a $4.6b market cap and it returned a 7.3% fully franked dividend (10.4% yield inc FC),

6. The franchise model NVN operates provides great flexibility and performance management options of locations as well as efficient working capital (Inventory) management.

7. Working capital growth (Inventory & Receivables) commensurate with sales growth has masked cashflows but will unwind and normalise to improve FCF.

8. HVN is a leading and long-standing brand the value of which is unrecognised.

9. Overseas operations offer pathways to growth for the business and is self-funding.

10. Gerry was the great disrupter in retail and has faced many economic downturns, he is one of the most experienced retailer in Australia, a true asset in facing turbulence ahead.

WE HATE YOU HARVEY (BEAR)

· Pretext: Gerry is the worst, he is as transparent as Madoff and runs HVN as his private business betting syndicate, underwriting it’s value on paper profits and hot air.

1. EPS growth has been underpinned by opaque valuation adjustments on the property portfolio whereas cash flow per share has been flat in the 6 years up to COVID showing stagnant returns on operations.

2. ROE and ROA are messy comparative measures of performance due to the unusual franchise model used and inclusion of valuation adjustment in returns.

3. COVID stimulus covered up the sins of under investment in online that was Myer like.

4. EPS and DPS are set to return to pre COVID levels and probably much lower if the highly anticipated recession occurs, which will be the first real recession the business has faced in over 20 years and in a very different world of retail.

5. Property portfolio valuations are not market tested and even if they had been they face significant downgrades like REITS that specialise in retail space.

6. The property portfolio is unsellable as it is inexorably linked to the franchise arrangements with the stores and debt forgiveness on rents (aka aggregate financial accommodation) used to protect franchise operations.

7. The franchise arrangements mask inventory issues which should be treated as being on consignment rather than owned by franchises because when they get into difficulty the inventory is ultimately NVN’s problem.

8. Cash has been consumed by growing working capital, up from A$916m to A$1,333 YoY for H1 FY23 which is dangerous heading into an economic downturn where high inventory levels will be hard to clear and franchisee debts harder to fund and repay.

9. Overseas expansion is where Aussie retails go to die, another role of the desperation dice.

10. HVN faces growing competition and disruption and due to it’s operating model and legacy will fail to maintain its market position, Gerry being the anker to the change needed.

Gerry isn’t going to live forever, that’s for sure, but is that a good or bad thing for Harvey Norman? Either way it doesn’t look like he is going anywhere soon, so any ownership of NVN has to be happy with Gerry running the show.

The above exercise has been helpful, but not conclusive. I recently bought HVN on the post results drop on value grounds and having just pocketed the dividend today I am still trying to assess that decision.

Valuation: If sales fall about 5% in the next year and then return to a 5% growth, with margins in line with pre-COVID (19%) then I value HVN at around $6.00 currently. But acknowledge that even if this does happen (ie more the above Bull than Bear), the market will dutifully undervalue it and I will have to make good with high yielding dividends to provide an above market return.

Disc: I own - just

Adding to the info from @Dominator HVN seems to have cracked the Asian secret and been successful where many Aus companies have failed. Should they execute on growing their store foot print in Malaysia from 28 to 80 through 2028 they will continue to reward holders with a steady growing dividend. The 3 slides below summarise key info regarding their Malaysian expansion. This much maligned and dismissed business continues to succeed and grow when a lot of so called “experts” had written this dinosaur off. Currently, returning over 9% with a significant payout ratio buffer it’s not hard to see this dividend return at the current share price being well into double figures by the end of the decade.

Aggregate sales up 6.9% for the period from July to October (inclusive) compared to PCP in FY22 and 6.3% compared to FY21. These aggregated sales were negatively affected by 6.6% depreciation in the Euro, 7.2 % depreciation in the GBP and 5.9% depreciation in NZD. While the Singaporean dollar appreciated 1.2%. This is a decent result given the two previous FYs were COVID boosted years overall, though this period in FY22 NSW and VIC were in lockdowns so it should be expected that this result is better than FY22.

Harvey Norman is looking to continue its expansion in Malaysia with an aim of growing from 28 stores to 80 stores by 2028, having doubled store numbers in the last 5 years the team is now in place to make this happen from managements point of view. This is a source of revenue and profit growth into the future. The expansion plans will be funded through operating cash flows and existing cash reserves in Malaysia.

Overall Comment

Adding to position again due to the large margin of safety. The results were down on FY21 as expected due to lockdowns and cycling effects. The NTA of $3.72 per a share (mostly backed by freehold property) provides a nice margin of safety. The dividend continues to provide a strong yield, though I believe it is at its sustainable limit so wouldn't be surprised if this drops next FY. The market seems to price HVN as though the operating business will struggle to be profitable in the future or the property is worthless, effectively you get one of these for near free valuation at the current share price. The company everyone seems to love to hate (or is that just Gerry Harvey? Fair enough in that case...) continues to execute with sustainable growth and provide a more than acceptable return to shareholders through dividends.

General Notes

- Financial notes:

- Revenues:

- Products to customers - $2.8bn

- From franchisees - $1.3bn

- Other items - $397m

- Net debt to equity = 10.31%

- NPAT = $811m including property revaluations for comparison, excluding AASB16 net impact and net property revaluation profit was $673m.

- Freehold property portfolio of $3.74bn, 95 properties in Australia, 26 overseas or as Australian joint ventures.

- NTA = $3.72

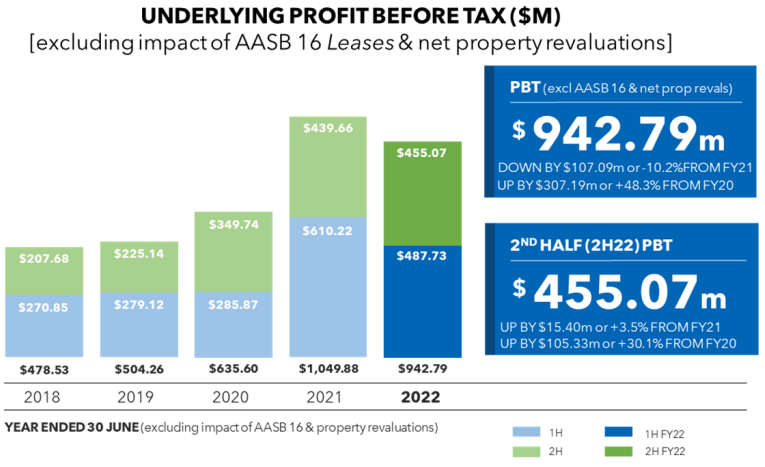

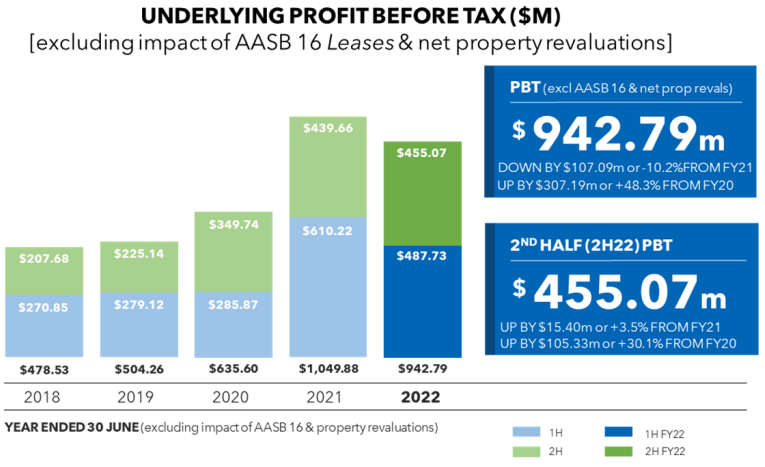

- To compare to FY19 for the COVID cycle, NPAT not including revaluations in FY19 was $386m compared to FY22 of $673m. On that basis profit is up 74%. These figures also don't include AASB16 impacts so are comparable. Total system sales of $9.56bn in FY22 compared to $7.65bn in FY19, a 26.5% increase. If these results continue the business has hit a point of operating leverage. Underlying PBT results below for the last 5 FYs.

- Footprint:

- 195 franchised complexes in Australia with 544 franchisees

- 109 overseas company operated stores.

Positives

- Overall, a decent result, nothing glaringly negative.

- Dividend of 17.5c, giving a total FY dividend of 37.5c fully franked. At a share price of $4.17 this is a yield of 9% or 12.8% gross yield.

- International segment continues to grow strongly, FY19 PBT was $129m now up to $232m and increase of 80%. The overseas segment now creates 25% of PBT (excluding revaluations). Given Australia has 195 complexes there is still significant growth for this segment into the future. 4 new stores overseas expected in FY23 and 10 new stores in FY24.

Negatives

- Looking at the cash flows the high dividend doesn't seem sustainable (or able to grow), partly funded by debt potentially. Not significantly over a sustainable level especially considering increase in inventory but reaching the limit of what is available.

- Gerry Harvey continues to make public comments throughout the year that turn off younger customers from entering Harvey Norman stores.

Has the thesis been broken?

- No, adding again to make a full position. This is a value play/trade. I believe HVN is significantly undervalued at the current price. There is a large margin of safety from the profitability and NTA backing (backed by the large property portfolio). The dividend yield also helps. The company is more diverse than on first thought given the multiple geographies and property holdings the company has.

Valuation

- Conservative valuation based on:

- 10% discount on property value = $3.366bn

- Using an underlying profit of $500m (ie no profit growth and removing property segment profits) and 8 times multiple = $4.0bn

- Total valuation = $7.376 bn.

- Valuation per share = $5.88

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Thesis only requires continued results around current levels of profitability. Some pull back is expected cycling off the COVID and higher interest rate impacts. Housing build completions seems still to be at higher than previous levels so I think this helps HVN and JB Hifi, will have to wait and see on that....

- Continue to expand the overseas business.