Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

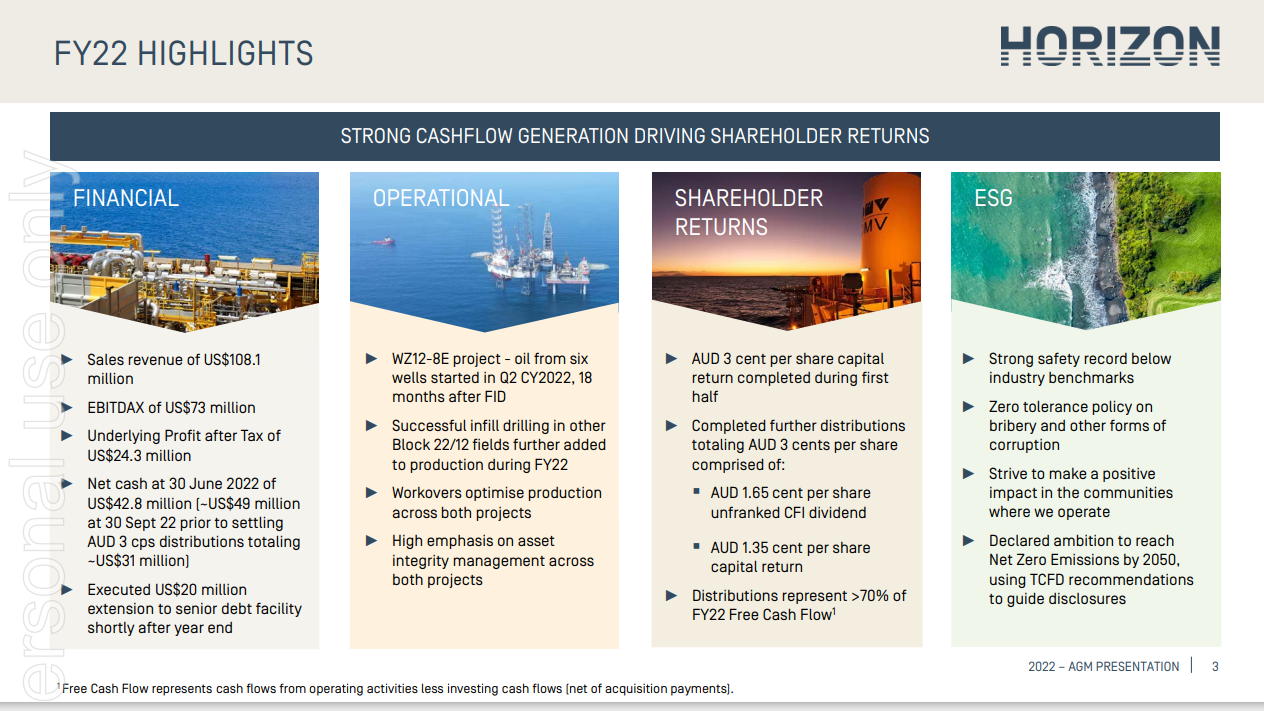

Production volume: 1.9 million barrels, up 44%.

Revenue: $152.1 million USD.

Cash operating costs: <$20 per barrel USD.

NPAT of $43.9 M USD, up 80%.

Reserves upgrade @ Block 22/12. 2P reserves fell by 0.9 million barrels. However, 2C contingent resources increased by 0.8 million barrels to 6.9 million barrels.

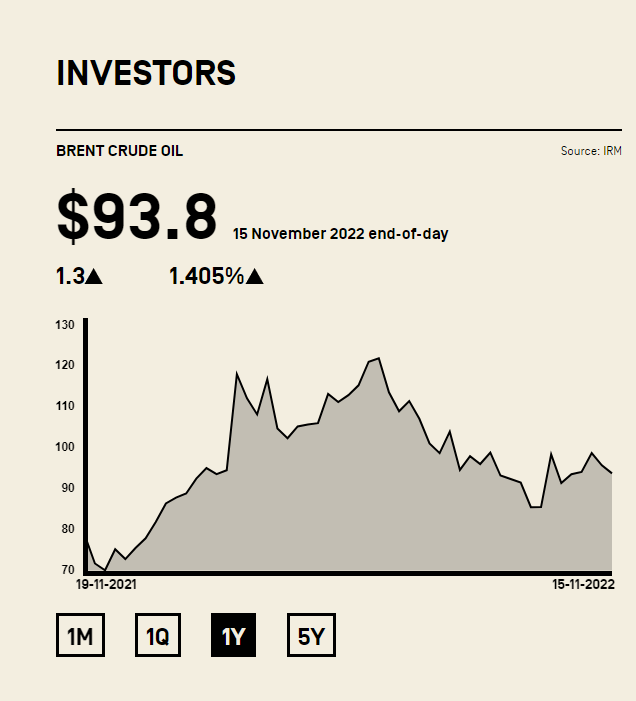

Minimal hedging of 40 000 barrels per annum @ $83.4 USD per barrel.

Unfranked dividend distribution of 2.0 cents.

DISC: HELD

Sales: median guidance of 1.90 mBBL

Revenue: median guidance of USD $165 million

EBITDAX median guidance of US $110 million.

Assuming NPAT is 36% of EBITDAX (as per H1), NPAT of USD $40 M or about $60 M AUD.

$60 M AUD =3.5 cents per share.

@ 16 cents per share, that is an EV/NPAT of 4.3.

RISKS: Oil price - global recession is the key risk. The recession may be 6-12 months away, however, there are signs the credit cycle is turning, which may bring this forward......

Key takeaways:

- Production volume up 40% over PCP.

- 2022 calendar year production up 18% on prior year

This indicates strong production volume increase in H1 FY 2023, providing good momentum into H2.

- H1 revenue up 93% to $75.7 M USD @ net realised price of $94.55 /bbl

- Cash operating costs just $16/bbl US.

- EBITDAX of $52.2 M USD for HY - 87% increase on prior year.

- Net cash of $24.8 M USD.

- NPAT of $19 M USD ($28 M AUD) - 1.67 cents per share - annualised PER <5.

- Dividend of 1.5 cents per share.

- increase reserve by 750 000 barrels.

DISC - HELD

substantial production growth driving free cashflow generation –

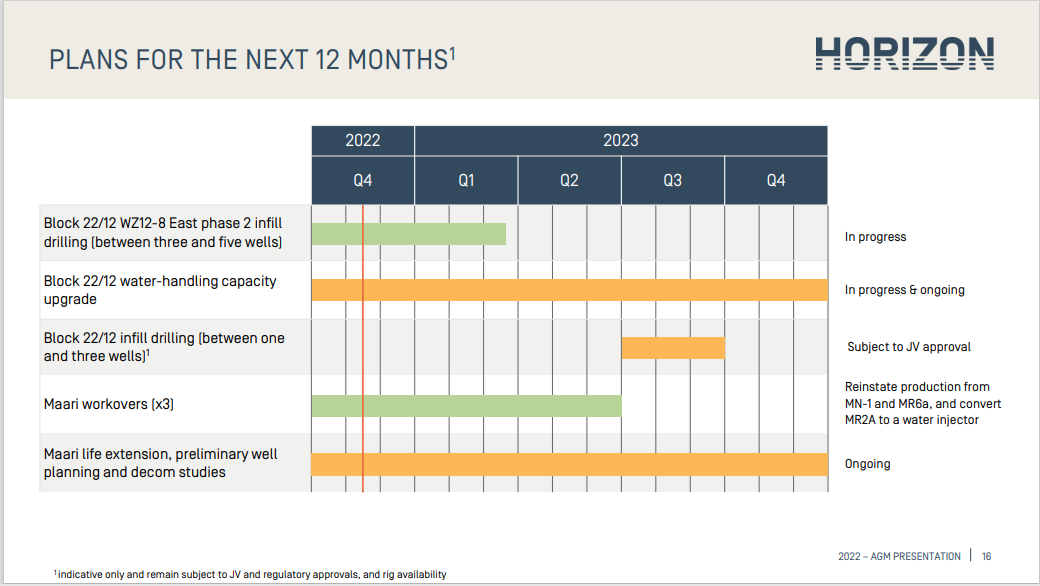

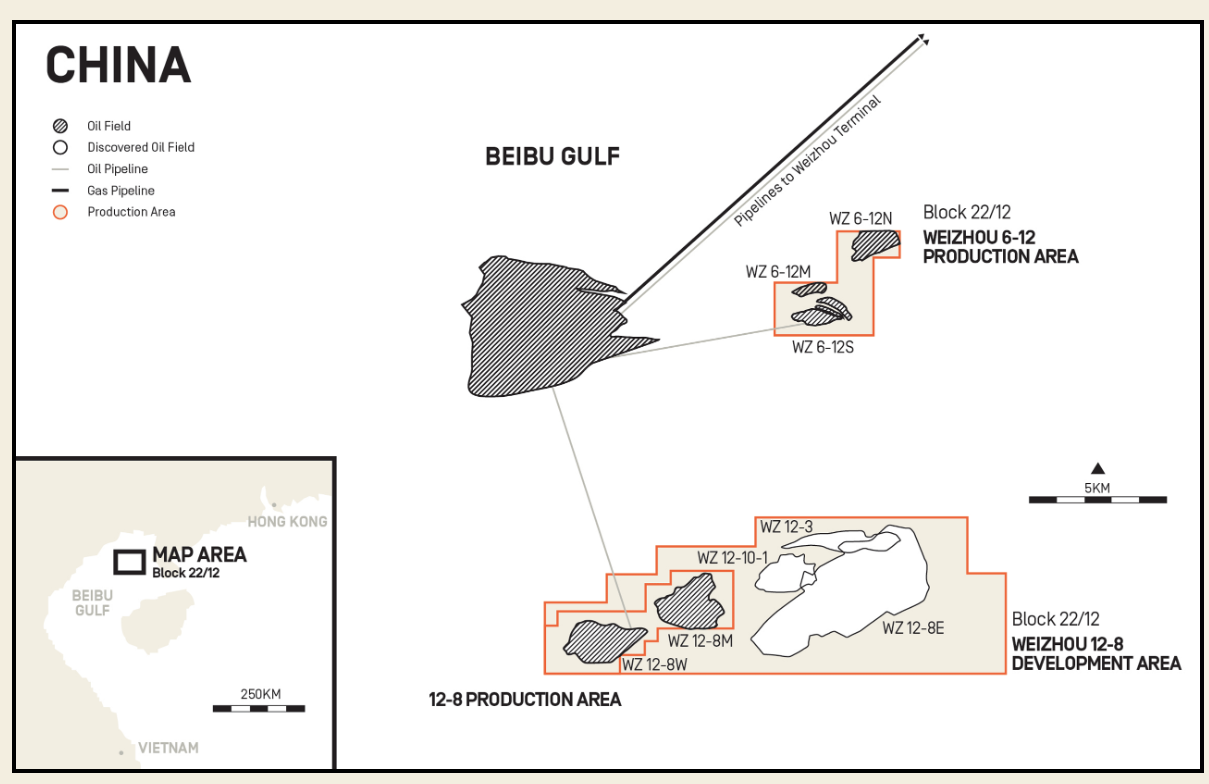

Production volumes increased 25% during the quarter to 517,746 bbls driven by a further 29% increase in Block 22/12 production and 9% increase in Maari production, building on an almost 30% increase in Block 22/12 production and a 18.9% increase in Group production during the prior quarter. – Sales volumes at Block 22/12 increased by ~30% during the quarter to 389,241 bbls owing to the successful execution of the WZ12-8E development program, infill drilling and workovers. Group sales volumes were 5% lower than the prior quarter owing to the deferral of a scheduled Maari lifting (up to ~125,000 bbls (net)) to January 2023. – Revenue for the quarter was US$33.7 million (~A$48 million) (including hedge settlements) at an average realised oil price of ~US$86.70/bbl. – Net operating cash flow1 for the quarter was US$24.1 million (~A$34.4 million). – Cash operating costs of US$18.65/bbl produced for the quarter, including the cost of workovers in China and NZ. – Cash reserves were US$40.4 million (net cash US$24.8 million) at 31 December 2022, with a further US$10.4 million received shortly after quarter end pertaining to the Block 22/12 November 2022 oil sales. – Completed distribution payments in October 2022 of 3 cents per share totalling AUD 48 million and obtained ATO class ruling confirming 1.35 cent per share capital return component. Further distributions under review. Successful completion of Block 22/12 WZ6-12 and WZ12-8E Phase 2 drilling programs – The Block 22/12 Joint Venture successfully completed a two well WZ6-12 development/appraisal drilling program followed by a four well WZ12-8E Phase 2 drilling program, marking the end of a 10-month Block 22/12 drilling campaign. – Record Block 22/12 production achieved during the quarter with daily production rates averaging just under 17,000 bopd (gross) and reaching peak production of ~20,000 bopd (gross) (5,400 bopd net), the result of a successful development, infill and workover campaign.

Share price up the stairs again!

HZN return on invested capital up 70%

Huge dividend yield of 11% plus ( not fully Franked though )

Strong - operating cash flow

Experienced board - lots of grey hair .. Senior management less grey.

ESG policy sustainable.

Chairman report 'snap shot': >> Looking to the future: - we will continue to work to maximise production and value from our producing assets in Block 22/12, China and Maari in NZ and continue to actively pursue infill well drilling and other production enhancing initiatives in our producing assets which provide excellent value;

and - we will continue to review our cash position regularly to consider further shareholder distributions, whilst always keeping an eye out for opportunistic growth options.

Note here >>>>>>We have continued to progress work on enhancing our ESG strategy, particularly in response to growing climate related concerns. We acknowledge the part we have to play in an increasingly low carbon future. We were pleased to present a further enhanced sustainability report this year which transparently discloses our impact and the actions we are taking to be a more sustainable company. To this end, earlier in the year we announced our ambition to achieve Net Zero GHG emissions by 2050. Work will continue to refine a roadmap for achieving this ambition

keepin the oil up....

General note: i am observing Australian business generally setting ESG road maps this yr 2022 eg CBA and CSIRO partnership

CEO >>>>>>On climate change - we declared our ambition to reach Net Zero Emissions by 2050 and are developing a roadmap to achieve this. We enhanced our governance with formal ESG oversight by the Board supported by a Sustainability Steering Committee.

For the first time, the Group purchased just under 15,000 tonnes of voluntary carbon units to offset the majority of Horizon’s share of Block 22/12 Scope 1 emissions, whilst continuing to purchase carbon credits covering 100% of Maari Scope 1 emissions. Going forward our desire is to focus on direct emission reduction initiatives at our operations and are proactively pursuing this with the operators of our assets. As part of our overall decarbonisation strategy, we continue to evaluate various institutional grade carbon removal projects, however for any project to be considered it will need to have appropriate investment returns.

Full Report here 2022 Annual General Meeting (markitdigital.com)

CEO >> Looking to the future: - we will continue to work to maximise production and value from our producing assets in Block 22/12, China and Maari in NZ and continue to actively pursue infill well drilling and other production enhancing initiatives in our producing assets which provide excellent value; and - we will continue to review our cash position regularly to consider further shareholder distributions, whilst always keeping an eye out for opportunistic growth options.

We have continued to progress work on enhancing our ESG strategy, particularly in response to growing climate related concerns. We acknowledge the part we have to play in an increasingly low carbon future.

We were pleased to present a further enhanced sustainability report this year which transparently discloses our impact and the actions we are taking to be a more sustainable company. To this end, earlier in the year we announced our ambition to achieve Net Zero GHG emissions by 2050. Work will continue to refine a roadmap for achieving this ambition

BUT all Hinges on the supply vs demand of oil.

A look at the oil price: down for the year. But over 5yrs the trend is up.

Chins & New Zealand

HZN performance

HZN return on invested capital up 70%

Huge dividend yield of 11% plus

Key Takeaways:

1) Production volume up 18.9% on prior quarter.

2) Revenue up 4.7% on prior quarter, with realised oil price of $102 USD / barrel.

3) Operating cashflow up 4.6% to $34 million USD. That is an operating cashflow margin of 80%, and equates to 3 cents per share.

4) Cash operating costs of $19.3 /bbl USD.

5) After the 20% distribution to shareholders this month, HZN has a net cash position of $29.8 million USD (circa $40 million AUD).

DISC - HELD

Horizon Oil reported infill wells completed, and Block 22/2 oil production on October 24 was 15337 bopd (Horizon share: 4133 bopd). Horizon Oil FY2023 production targets for Block 21/2 are 3234 bopd, so Horizon Oil on track to beat targets..

DISC - HELD.

Adjusted for going ex. Dividend/capital distribution.

Valuation based on base case of $80 / bbl oil price.

AUD/USD: 0.70 cents

Discount rate for profit: 8%

Production costs remain flat (or in line with oil price).

Ten year oil production life, yielding: 12.7 MMbbl (based on forward production guidance).

Note: Contingent on HZN expanding resources by about 7 MMbbl over the next 10 years at existing exploration costs / expenditure per bbl..

The Biden Administration has reportedly planned to begin re-stocking the the Strategic Petroleum Reserve at oil prices at or below $80 USD barrel.

The Biden administration has been de-stocking the SPL to contain oil prices. Currently, the SPR is about 200 million barrels below pre-2021 levels.

HZN announced Block 22/12, WZ12-8E Phase 1 has been a success, with Block 22/12 on Sept. 25 @ 14486 bopd. This is well in excess of the 2023 production forecast of 12000 bopd.

The recovery from 3 phase 2 production wells is estimated to be 200 000 barrels of oil @ US$7.5 million capex (or $37.5 USD / barrel).

Although it is early days, $HZN appears to be well on track to exceed the 2023 production target of 1.52 million barrels.

DISC - HELD

Horizon (HZN) has advised that they have the ATO ruling, and the 3cps recently given to shareholders has been classed as a Capital Return...

"Horizon Oil Limited

ABN 51 009 799 455

HORIZON – ATO CLASS RULING RECEIVED

Horizon (ASX: HZN) is pleased to confirm that the Australian Taxation Office has issued Class Ruling CR2021/77 (Class Ruling) in respect of the Australian income tax implications of the:

• A$47.4 million capital return (3 cents (AUD) per share) paid on 23 August 2021 to Horizon shareholders who held Horizon shares on 16 August 2021, following shareholders’ approval at its 10 August 2021 Extraordinary General Meeting (EGM).

The Class Ruling confirms the tax implications for Australian shareholders as disclosed in the Revised Notice of Extraordinary General Meeting dated 23 July 2021 and issued to shareholders for the purposes of the EGM. Importantly, the ruling confirms that no part of the return of capital payment will be treated as a dividend for Australian income tax purposes.

A copy of the Class Ruling is available on the Horizon EGM microsite at https://www.edocumentview.com.au/HZN2021 and is also available on Horizon’s website at https://horizonoil.com.au/wp-content/uploads/Class-Ruling-HZN-Return-of-Capital-2021-077.pdf. Shareholders may wish to have regard to the Class Ruling when submitting their tax returns in respect of the financial year ended 30 June 2022."

Still finding my feet around Strawman....

HZN provided a 3c return of capital to shareholders and was curious how this is managed on the Strawman accounts. Is this picked up automatically?