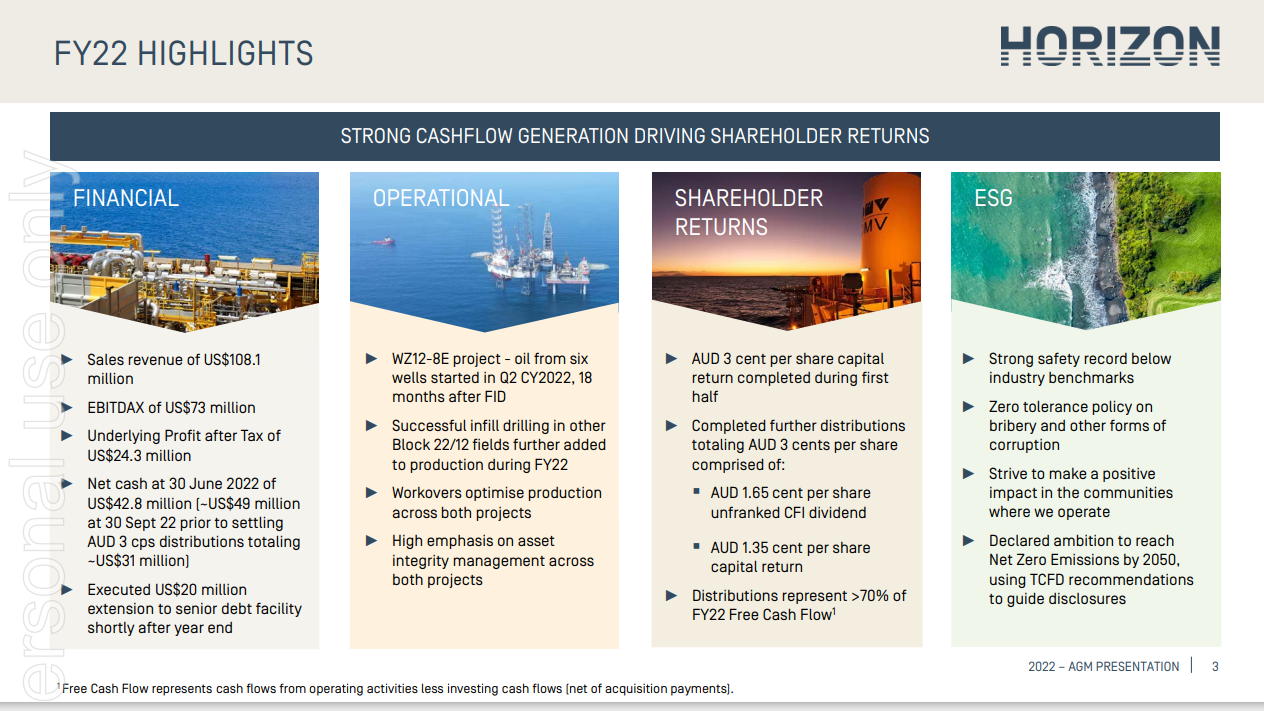

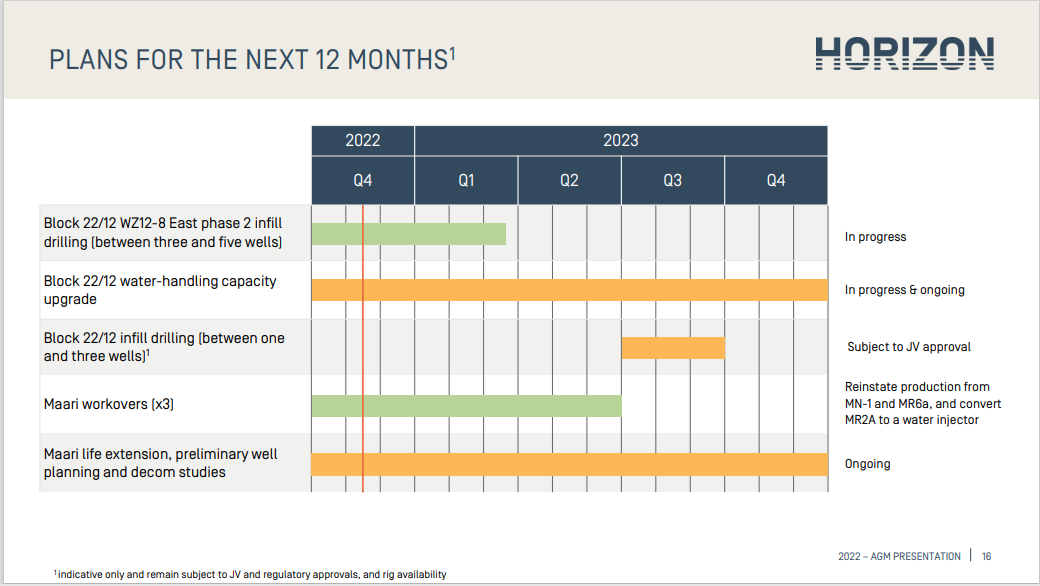

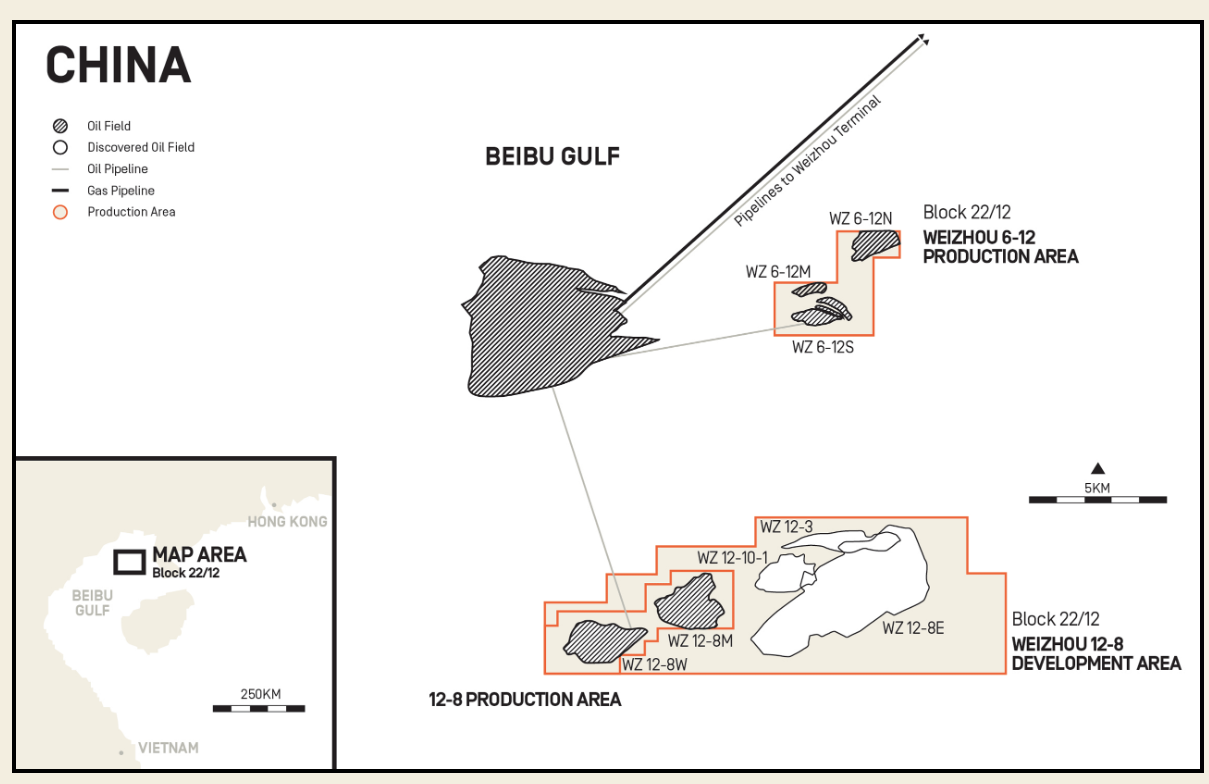

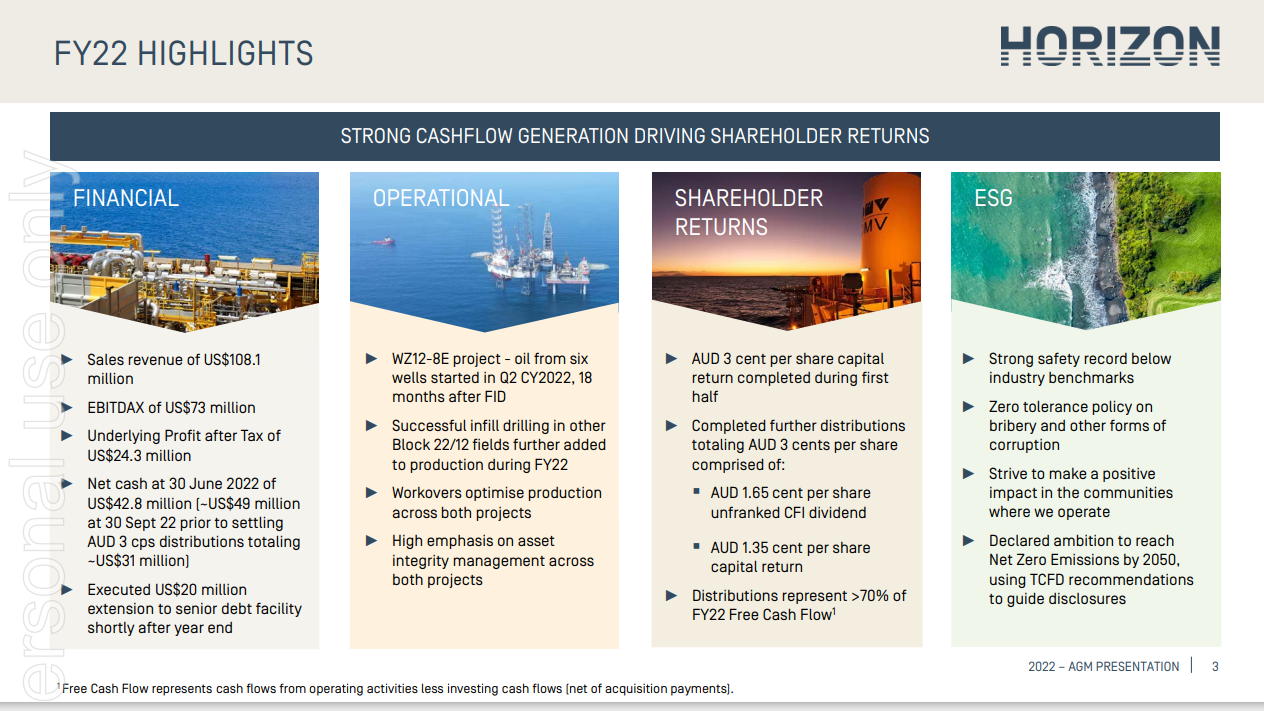

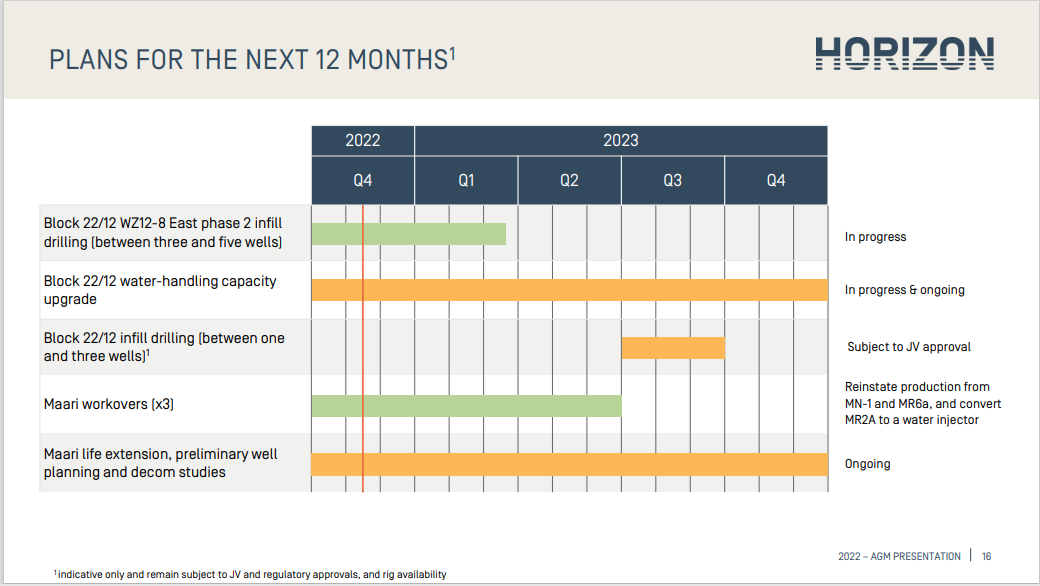

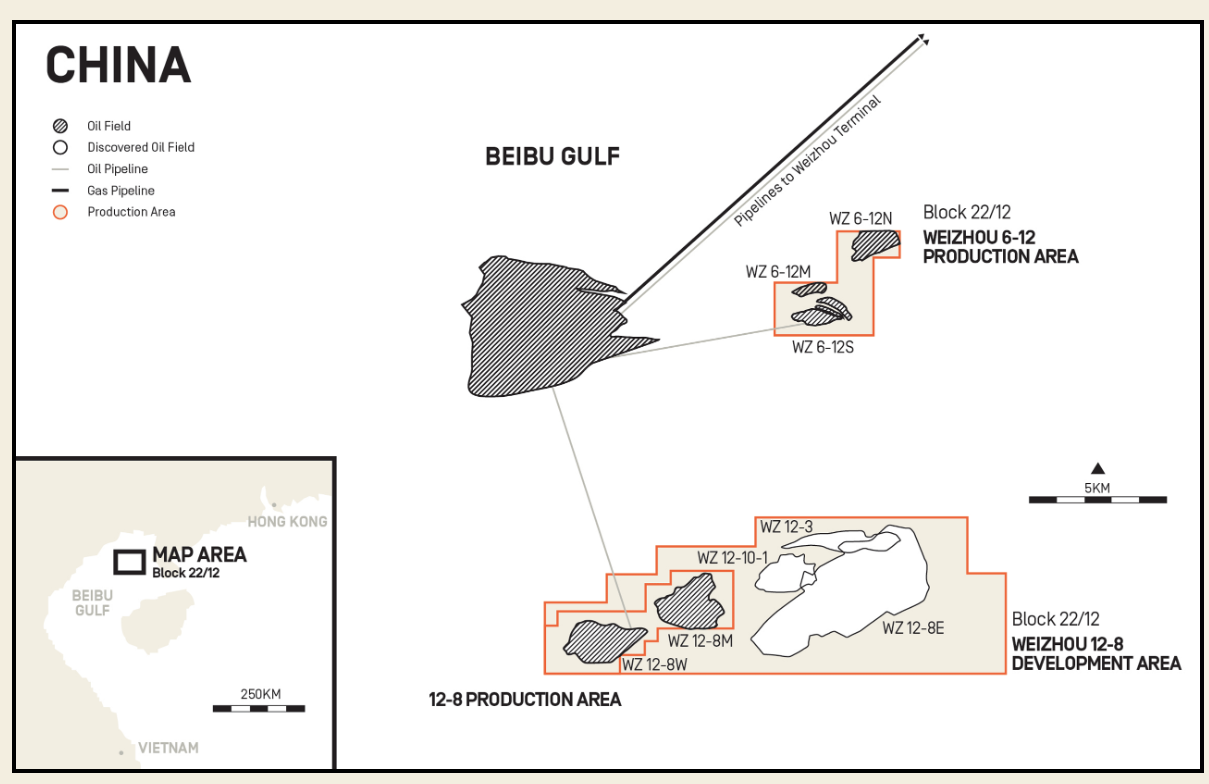

Chairman report 'snap shot': >> Looking to the future: - we will continue to work to maximise production and value from our producing assets in Block 22/12, China and Maari in NZ and continue to actively pursue infill well drilling and other production enhancing initiatives in our producing assets which provide excellent value;

and - we will continue to review our cash position regularly to consider further shareholder distributions, whilst always keeping an eye out for opportunistic growth options.

Note here >>>>>>We have continued to progress work on enhancing our ESG strategy, particularly in response to growing climate related concerns. We acknowledge the part we have to play in an increasingly low carbon future. We were pleased to present a further enhanced sustainability report this year which transparently discloses our impact and the actions we are taking to be a more sustainable company. To this end, earlier in the year we announced our ambition to achieve Net Zero GHG emissions by 2050. Work will continue to refine a roadmap for achieving this ambition

keepin the oil up....

General note: i am observing Australian business generally setting ESG road maps this yr 2022 eg CBA and CSIRO partnership

CEO >>>>>>On climate change - we declared our ambition to reach Net Zero Emissions by 2050 and are developing a roadmap to achieve this. We enhanced our governance with formal ESG oversight by the Board supported by a Sustainability Steering Committee.

For the first time, the Group purchased just under 15,000 tonnes of voluntary carbon units to offset the majority of Horizon’s share of Block 22/12 Scope 1 emissions, whilst continuing to purchase carbon credits covering 100% of Maari Scope 1 emissions. Going forward our desire is to focus on direct emission reduction initiatives at our operations and are proactively pursuing this with the operators of our assets. As part of our overall decarbonisation strategy, we continue to evaluate various institutional grade carbon removal projects, however for any project to be considered it will need to have appropriate investment returns.

CEO >> Looking to the future: - we will continue to work to maximise production and value from our producing assets in Block 22/12, China and Maari in NZ and continue to actively pursue infill well drilling and other production enhancing initiatives in our producing assets which provide excellent value; and - we will continue to review our cash position regularly to consider further shareholder distributions, whilst always keeping an eye out for opportunistic growth options.

We have continued to progress work on enhancing our ESG strategy, particularly in response to growing climate related concerns. We acknowledge the part we have to play in an increasingly low carbon future.

We were pleased to present a further enhanced sustainability report this year which transparently discloses our impact and the actions we are taking to be a more sustainable company. To this end, earlier in the year we announced our ambition to achieve Net Zero GHG emissions by 2050. Work will continue to refine a roadmap for achieving this ambition

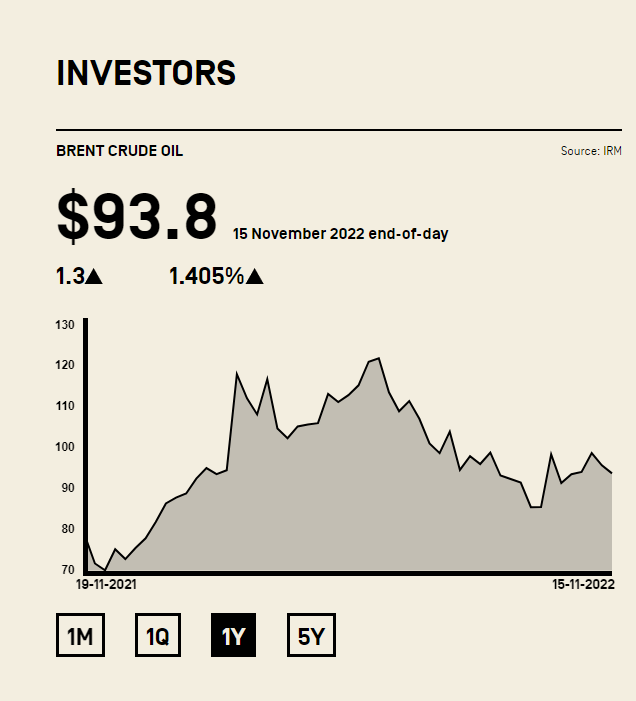

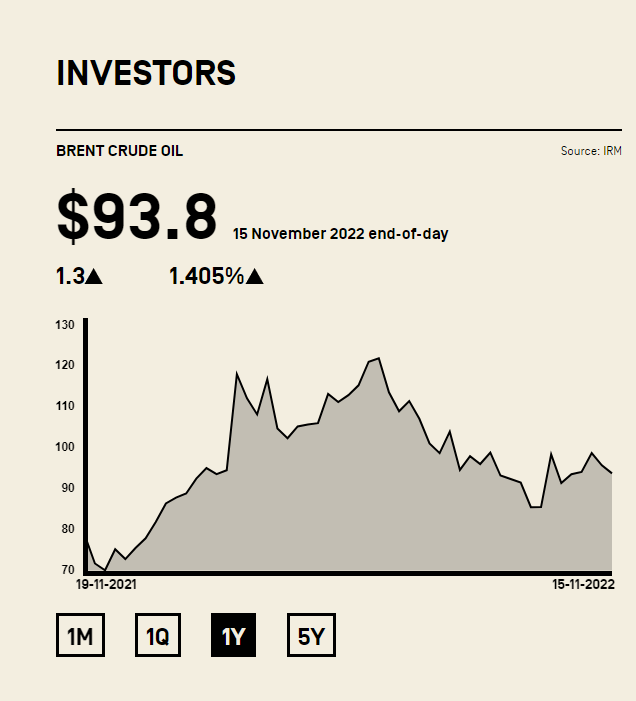

BUT all Hinges on the supply vs demand of oil.

A look at the oil price: down for the year. But over 5yrs the trend is up.

Chins & New Zealand

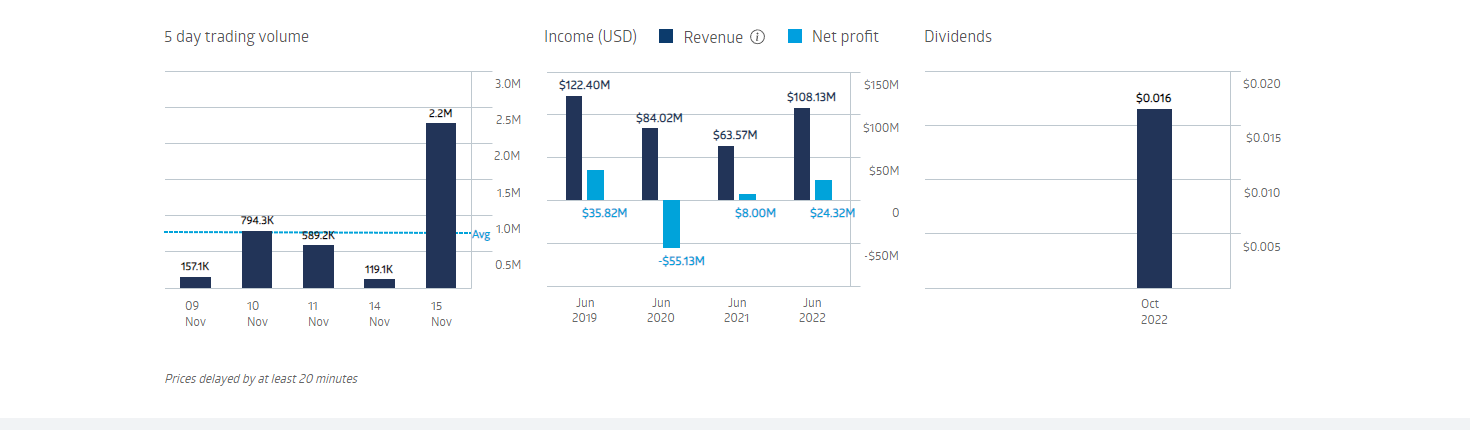

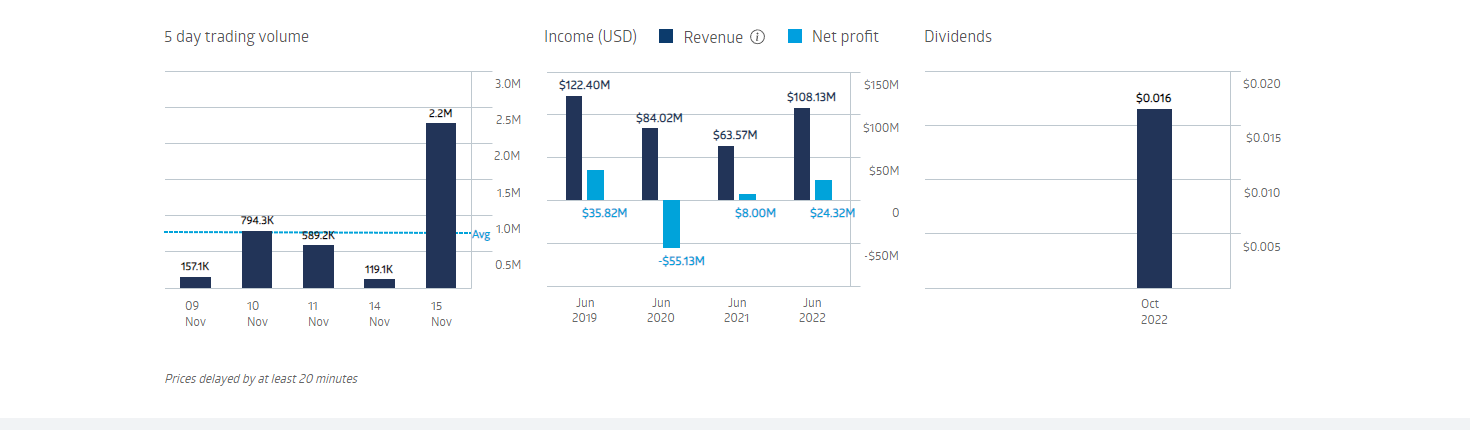

HZN performance

HZN return on invested capital up 70%

Huge dividend yield of 11% plus