update 31/08/2022

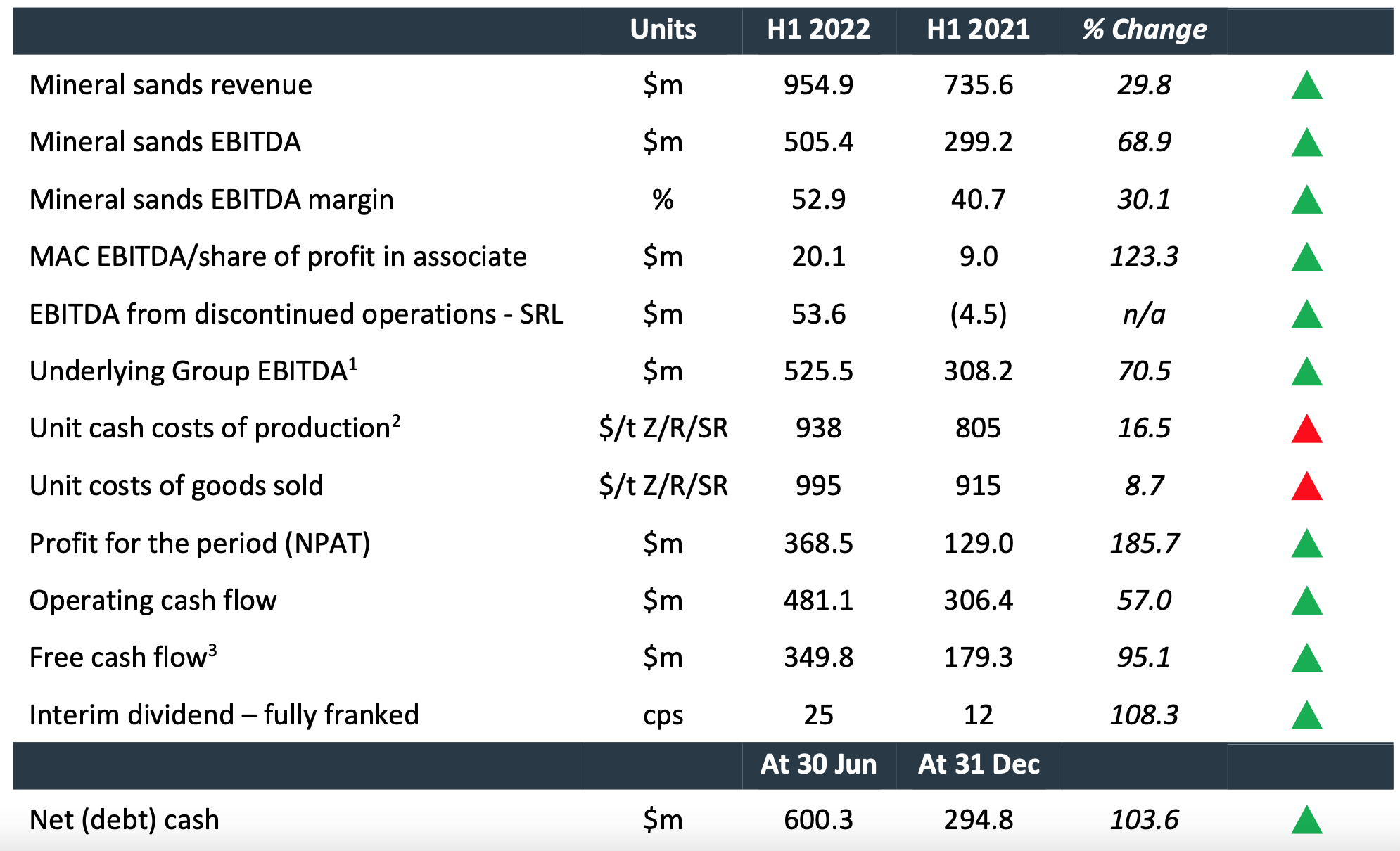

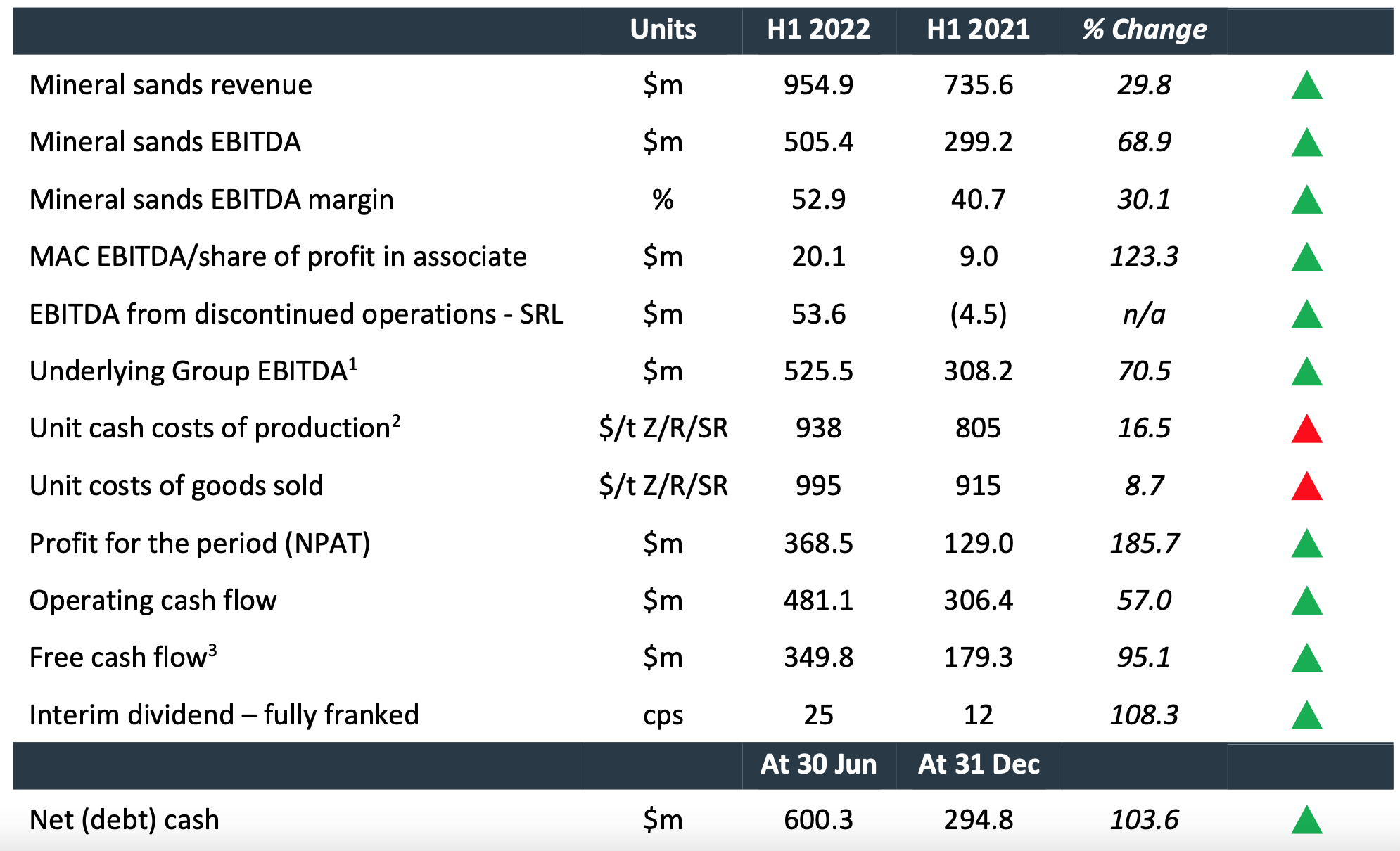

Things have played out pretty much as hoped, as per table above

Mineral sands prices continued to improve over the last 12 months, which allowed ILU to sell off its stockpile into favourable market conditions and realise a huge increase in FCF and NPAT. The increase in costs (labour and fuel) were more than offset by increases in mineral sands prices.

It offloaded Sierra Rutile as a new listing, which will cauterise the ongoing loss from this operation

The Deterra royalties holding generated good earnings given the resilient iron ore price

The Australian government awarded ILU generous terms for them to develop Australia's first Rare Earths processing plant in WA.

ILU is paying a FF dividend of 25c for the 1/2 putting it on a yield of ~5%.

As mentioned below, the good times are likely to roll for a little longer:

- mineral sands prices remain robust for the immediate future

- they have essentially no debt and a big pile of cash

- they are operating at maximum output and will continue to be a cash machine

But, shortly they will need to develop new areas of poorer quality, margins will reduce and the economic clouds are gathering that will reduce demand for their product.The rare earths development will take attention and skills away from their core business, and the risk:returns are not easy to forecast.

Having bought in at ~$6.50 I think I will look to take my profits and re-deploy elsewhere over the next few months.

(1.5% holding in super)

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Iluka has benefitted, to quote Lemony Sniket, from a series of unfortunate events. In this case affecting others.

Rio Tinto has a large Mineral sands facility in Richards Bay, S Africa which has been shut down, at least temporarily due to security issues. It is not clear when, or indeed if, it will re-open.

The Chinese tile making factories have returned to full swing production with historically low reserves of in country zircon and rutile feedstock.

The combination of the above has driven a sharp increase in prices.

I have no insider knowledge but some reports I have read suggest there is still and ongoing shortage of supply and further prices rises are expected. Worldwide supplies are very tight with very little flex to the upside that can come onstream. If we go back to the last resource boom, mineral sands prices quadrupled! In some ways ILU act a bit like Saudi Arabia in the oil market being the supplier of last resort, or swing producer. It has increased production significantly + 40% from previous quarter.

But, again like Saudi Arabia, sales have increased 89% as ILU has a stockpile to get rid of.

Ilu runs with high fixed costs. Which is terrible when things arent going very well. Volume reduction does not hurt too badly, but price reductions are a killer. This is a terrible business to own when prices are decreasing.

The flipside is that when prices are rising, which they are now, ILU get to print money. Who knows what will happen to Rio's Richard's Bay facility but the longer it stays mothballed, the sharper and longer the price increase for mineral sands will run.

This should result in massive FCFs. ILU has no debt and a stated policy of returning proceeds to shareholders, so I would suggest a huge increase in dividends in the short to medium term.

It's not all rosy, though. The high grade Jacinth-Ambrosia mine is nearing end of life (10 years to go). The Sierra Rutile operation is massive but cannot be run efficiently so makes no money and negotiations are ongoing regarding its future.

I would see any investment in ILU as relatively short term ie 1-2 years maximum as I believe the current re-rate will have some room to run for a while longer.

Love to hear if people agree or disagree, or if they hahve any other insights that I might not have considered. I have deliberately not included the Deterra Royalties in this discussion, but given the price of Iron ore, these wont hurt either!