Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Iluka announced today temporary (at this stage) C&M of two of its mineral sands sites. Minerals used in pigment manufacturing. It seems there is enough colour in the world - back to black and white (It was a simpler time back then!)

Sold down 14.22% today. Given they can sell down inventory, and dramatically reduce operating costs, I wonder if its an overly anxious reaction.

Chinese suppliers reducing price of Zircon to market as buyers slow down restocking inventory.

20th Aug mid year results (market reaction down 7.12%):

1H Ebitda A$218M Vs. A$252M, underlying Ebitda A$233M Vs. A$264M, A$502M Net Debt at June 30 Vs. A$115M at Dec 31, 1H Net A$92M, Down 31% on Year, 1H Rev A$577.8M, Down 8% on Year, Cuts Dividend to A$0.02 Vs. A$0.04

Rare Earths refinery progressing construction at Eneabba, forecast delayed commissioning from 2026 to 2027, having spent $570M (projected cost $1.7 to $1.8B) so far and implementing plant equipment currently. Federal government has provided $1.65B loan facility in support. Will use their produced mineral sands as feedstock but signing up external suppliers also, including Lindian in August representing 10% of refinery capacity for 15 years. Rare earth oxides produced at Eneabba will include neodymium, praseodymium, dysprosium, and terbium.

Today's announcement:

SYDNEY--Iluka Resources said it would suspend production activities at its Cataby mine and Synthetic Rutile Kiln 2 operation in Western Australia, citing subdued demand for mineral sands.

Iluka said output at Cataby would likely be halted for around 12 months, with the SR2 kiln offline for around six months. It would look to restart both operations when market conditions improve.

Managing Director Tom O'Leary said the decision is prudent given uncertainty around mineral sands demand. A world-wide economic slowdown has made customers leery about buying the commodity and is hurting their ability to forecast with certainty.

"The suspension will enable inventory and cash liberation, cost savings and the preservation of balance sheet strength," he said.

Iluka believes it has enough synthetic rutile and chloride ilmenite available to meet demand from its customers.

Disclosure - held in RL and SM

Goldman Sachs has revised its list of highest conviction stocks going into 2025 - and one of the new inclusions is Iluka Resources (ASX: ILU)

GS states that Iluka Resources leads global zircon production with a 30% market share, operating in an industry where the top 3 producers control 65% of output. Beyond zircon, which supplies ceramics and chemical industries, Iluka is a major producer of high-grade TiO2 feedstock for paint manufacturing, holding a 20% market share. The company is also expanding into rare earths, constructing an Australian refinery to supply Western manufacturers with both light (Nd & Pr) and heavy (Tb & Dy) rare earths — critical components for magnets used in electric vehicles, wind turbines, robotics, and electronics.

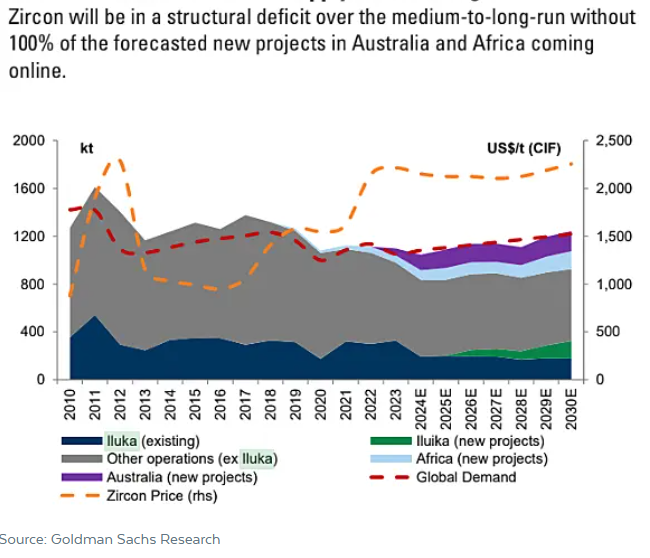

They believe that the zircon market is one of the best structural supply-side stories in commodities currently due to decline in the current industry and lack of new investment in new mine supply and believes the company to be a major beneficiary given its world-leading market share of 30% and forecasts the company's EBITDA to double by 2028.

The Australian Government recently approved $400 million in additional funding for Iluka's Eneabba Rare Earth refinery in Western Australia, bringing total government funding to $1.65 billion. The refinery is now fully funded and construction of the 3-4ktpa (NdPr) facility will begin in the first quarter of 2025, representing a significant milestone for the company. The development of Eneabba will be a strategic and highly valuable Western World critical mineral asset and only the fifth rare earth refinery outside of China, according to Young.

From a valuation perspective, Goldman Sachs believes the stock is undervalued for several reasons.

· Iluka is trading at 0.55x NAV or $9.34 per share

· The stock is pricing in almost no value to the rare earths refinery and Wimmera rare earths project

· The stock is trading at approximately 5x EBITDA (next twelve months) vs. key rare earth peers trading at 16x and mineral sands players at 6x

· Iluka is trading on a free cashflow yield of 14% in 2025-26 without the rare earths refinery capex and is in a net cash position

· At the current share price, it makes sense for Iluka to announce a share buyback, funded by free cashflow from mineral sands

Currently Iluka trades around $5.14 but GS believes there will be a significant re-rating to around $7.70/share

ILU released its latest quarterly yesterday.

The full announcement can be found here

but in summary it was another solid result in terms of revenue, but the volume of both production and sales is down.

Importantly, ILU has been selling off stockpiled product for the last 12-18 month. This is one of ILU's strengths (as per previous straws) it has the capacity to be the provider of last resort in the mineral sands market - my comparison was to Saudi Arabia in the oil market. So when prices are a bit crap, it keeps producing unprofitably until prices recover and then makes hay.

It has now made all the hay. The stockpiles are sold, and it become a higher risk proposition where any hiccup in production can crash forward estimates. They are also funnelling profits into the Eneabba rare earths project, so the recent high dividends are not likely to last IMHO.

For me, this result validates my decision to sell out after the last bumper dividend in September. They may well do well from here, but I think that my thesis of benefiting from the sales of their stockpile into a buoyant mineral sands market is now over. The thesis for ILU is now quite different. Their main resource has a limited LOM and they are transitioning into the Rare Earth space.

It is priced cheaply on a trailing PE of 8.7 but this is unlikely to be the case for a forward PE now the stockpiles are gone and the mineral sands prices will come under pressure in a likely global recession.

That said, the market put an extra 2% on the SP.

23-Oct-2020: Just a quick note that Iluka (ILU) has today gone ex-entitlement for their demerger (spin-out) of their MAC iron ore royalty into a new company called Deterra Royalties Limited (ASX: DRR). All shareholders who are on the ILU share register today will receive one DRR share for every ILU share they own. Obviously, anybody buying today will be added to the ILU share register tomorrow, and will miss out on the free shares in DRR. Hence, the 40% to 50% fall in the ILU share price today.

Further Details can be viewed here: https://www.iluka.com/getattachment/2d4847b2-f9fd-477f-9d62-1aec66251cbc/deterra-royalties-demerger-briefing-presentation.aspx

[I hold ILU shares.]

29-Jan-2020: Quarterly Review 31 December 2019

Things I found interesting:

Cash is building:

Net cash as at 31 December 2019 of $43 million (31 December 2018: net cash $2 million), reflecting free cash flow of $140 million in 2019 while investing $198 million in capital expenditure.

Review of Corporate and Capital Structure of Mineral Sands Operations and Mining Area C Royalty

As previously announced on 31 October 2019, Iluka has commenced a formal review (the Review) of the corporate and capital structure of Iluka’s two principal businesses – mineral sands operations and the Mining Area C royalty (MAC).

Work continues on the Review, and as previously stated the company expects to provide an update on the Review at the announcement of the Full Year Results.

2019 Full Year Results

Iluka is scheduled to release its 2019 Full Year Results on 20 February 2020. An investment market conference call will take place on the day.

Dial-in details for the conference call will be on the Events page of Iluka’s website in due course: www.iluka.com/investors-media/events

. . . . . .

The value of the MAC (Mining Area C) royalty will increase materially when BHP's new South Flank mine comes online next year, because Iluka is entitled to a royalty on every tonne of iron ore produced by South Flank (which falls within Area C). ILU are currently looking at a variety of options that include (but are not limited to):

- Divesting (selling) the royalty, which would likely result in a large special dividend to Iluka shareholders;

- Spinning off the royalty into another seperate listed business - which would result in Iluka shareholders being given shares in that new business, which they could sell or keep as they wish; or

- Keeping the royalty as a passive source of income that is entirely independent from their mineral sands business.

Option 3 has been Iluka's preferred option to date, but they're now at least prepared to entertain the idea of spinning the royalty out or selling it. I suspect that may have been at least partly as a result of some activist investors (such as Sandon Capital - SNC) who have been pushing for a divestment or spin-off because they believe that the Iluka share price doesn't adequately reflect the value of the MAC royalty - but really just covers the Iluka mineral sands business.

South Flank construction began in July 2018 with first production of iron ore anticipated in 2021. The project is expected to produce ore for more than 25 years.

What is the MAC Royalty (that Iluka own) worth? Joseph Kim from Montgomery Investment Management had a go at working it out in July 2019 - see here: https://www.livewiremarkets.com/wires/how-valuable-is-iluka-resources-mac-royalty - and his estimates vary from $1.5 billion up to $6 billion. He believes it is likely to be between $1.5 billion and $2.2 billion - using a DCF (discounted cash flow) approach. Iluka (at $9.54) has a current market capitisation (market cap) of just over $4 billion.

I suspect that Gabriel Radzyminski at SNC is correct (along with others) in saying that the Iluka SP does NOT adequately reflect the combined value of both Iluka's Mineral Sands business AND the MAC Royalty.

Roll on Feb 20th !

Disclosure: I hold ILU and SNC shares.

24 July 2019: Quarterly Review 30 June 2019

24 July 2019: Eneabba Mineral Sands Recovery Proj-Upd Mineral Resource Est