Goldman Sachs has revised its list of highest conviction stocks going into 2025 - and one of the new inclusions is Iluka Resources (ASX: ILU)

GS states that Iluka Resources leads global zircon production with a 30% market share, operating in an industry where the top 3 producers control 65% of output. Beyond zircon, which supplies ceramics and chemical industries, Iluka is a major producer of high-grade TiO2 feedstock for paint manufacturing, holding a 20% market share. The company is also expanding into rare earths, constructing an Australian refinery to supply Western manufacturers with both light (Nd & Pr) and heavy (Tb & Dy) rare earths — critical components for magnets used in electric vehicles, wind turbines, robotics, and electronics.

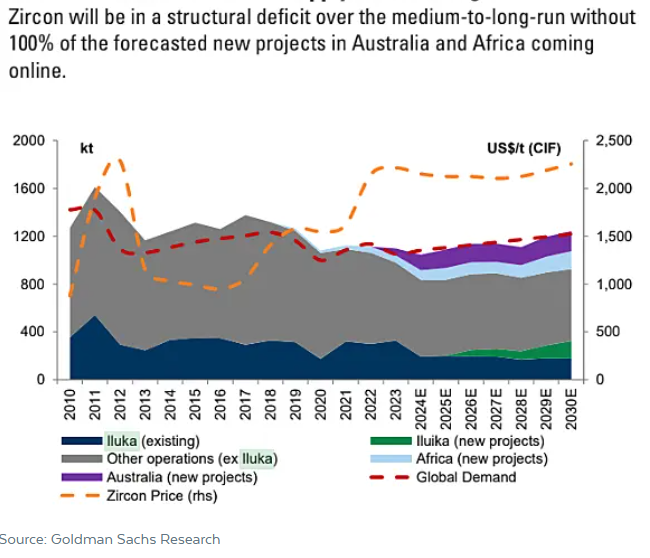

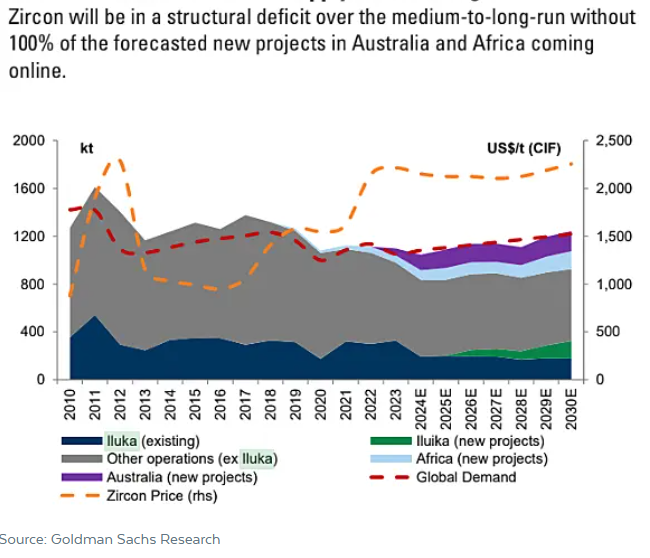

They believe that the zircon market is one of the best structural supply-side stories in commodities currently due to decline in the current industry and lack of new investment in new mine supply and believes the company to be a major beneficiary given its world-leading market share of 30% and forecasts the company's EBITDA to double by 2028.

The Australian Government recently approved $400 million in additional funding for Iluka's Eneabba Rare Earth refinery in Western Australia, bringing total government funding to $1.65 billion. The refinery is now fully funded and construction of the 3-4ktpa (NdPr) facility will begin in the first quarter of 2025, representing a significant milestone for the company. The development of Eneabba will be a strategic and highly valuable Western World critical mineral asset and only the fifth rare earth refinery outside of China, according to Young.

From a valuation perspective, Goldman Sachs believes the stock is undervalued for several reasons.

· Iluka is trading at 0.55x NAV or $9.34 per share

· The stock is pricing in almost no value to the rare earths refinery and Wimmera rare earths project

· The stock is trading at approximately 5x EBITDA (next twelve months) vs. key rare earth peers trading at 16x and mineral sands players at 6x

· Iluka is trading on a free cashflow yield of 14% in 2025-26 without the rare earths refinery capex and is in a net cash position

· At the current share price, it makes sense for Iluka to announce a share buyback, funded by free cashflow from mineral sands

Currently Iluka trades around $5.14 but GS believes there will be a significant re-rating to around $7.70/share