Bull Case

At first glance, founder led ImExHs (IME) appears to be a very interesting opportunity. They are expanding globally, process 5.3M new studies per year, are leading the digital transformation of hospitals & clinics with a radiology imaging software platform while claiming to be focused on recurring SaaS revenue. They report a 95% customer retention rate, have 940M images to train their AI on, have 11 current job listings suggesting growth, approximately ¾ of their medical imaging platform is proprietary and are showing strong growth in sales (30% qoq) and annual recurring revenue (40% yoy). IME has grown sales from $2.2M in 2018 to $10.9M in December 2020. If that’s not enough, the company also boasts strong insider ownership.

Despite all these positives the market has punished IME with its share price down 17% since listing in 2018 and declining steadily over the past year (below).

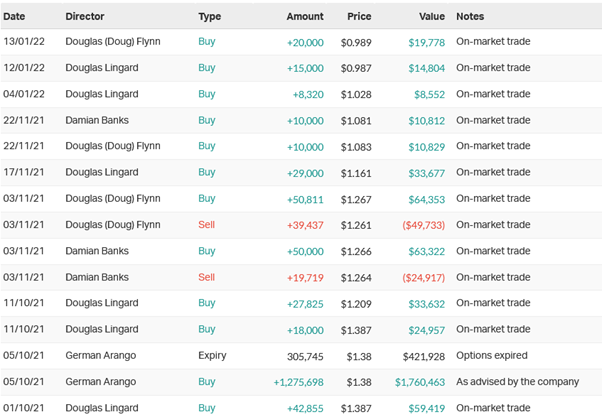

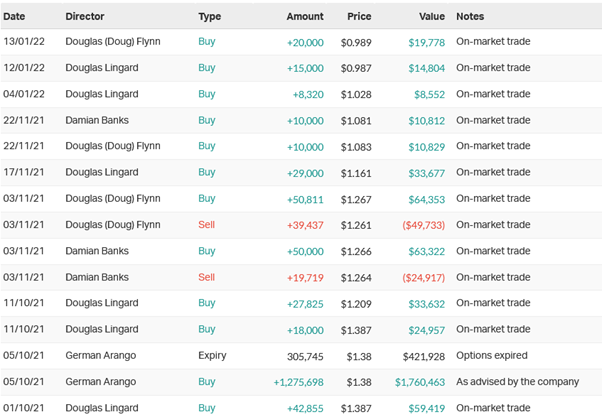

Management clearly disagree with several directors buying on market over the past 3 months according to marketindex.com.au (below). As Peter Lynch states:

“insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

On the surface IME appears to have an appealing bull case; however, the market clearly disagrees. Does this provide an appealing buying opportunity or has the market got it right?

Bear Case

ImExHs cash burn has increased over the past 4 quarters with cash outflows from operating activities of $1.5M in September 2021. With a moderately strong balance sheet they have 4 quarters of funding available. Further dilution is to be expected in 2022.

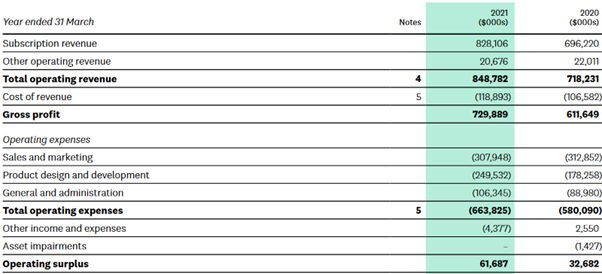

A high cash burn and some dilution in a growing company with a large TAM doesn’t concern me. What does concern me is the lack of transparency around how the company makes money and their expenses. Management continually tout themselves as having “recurring contract revenues from core SaaS model” and a “scalable business” and pride themselves on their ARR. However, strong top line growth is meaningless if they can’t outpace expenses.

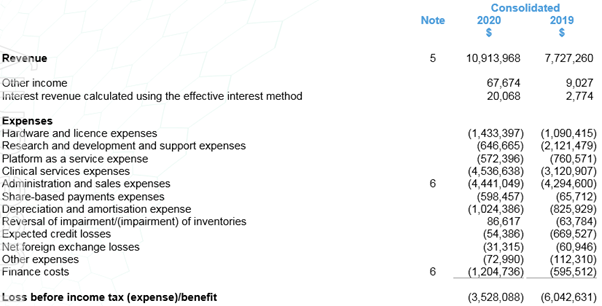

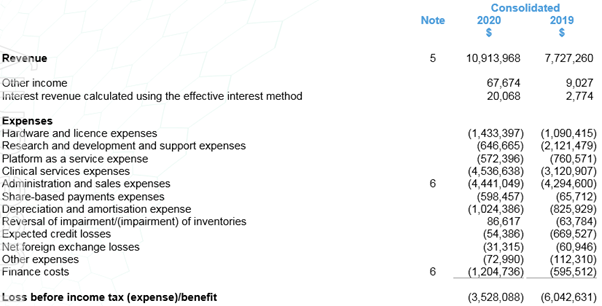

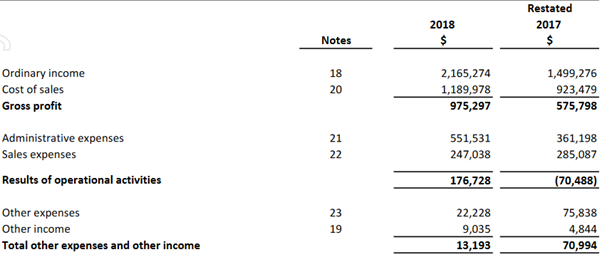

Below is a list of IMEs expenses

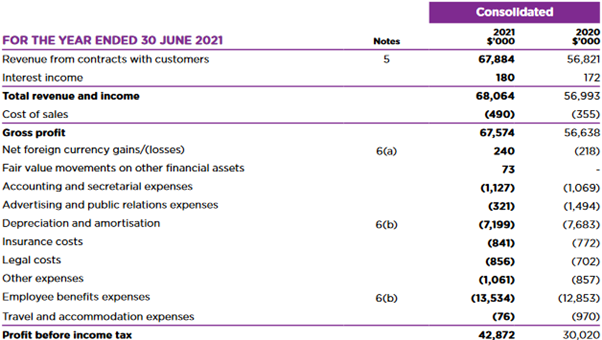

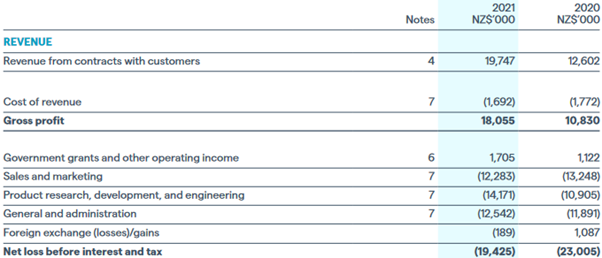

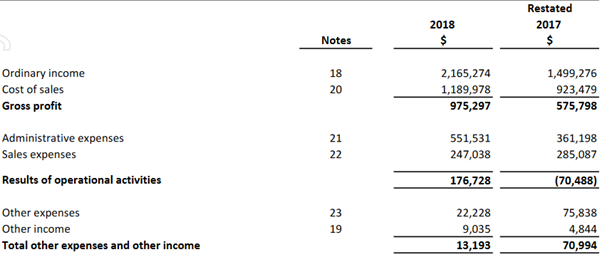

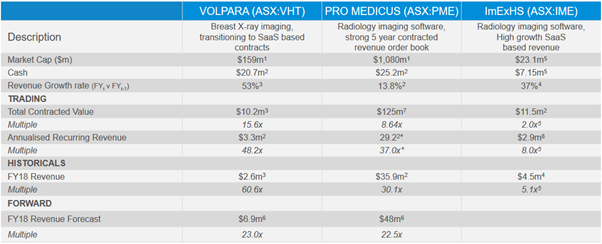

Let’s compare that to a few other SaaS companies both within IMEs industry and outside; paying attention to the expenses of each.

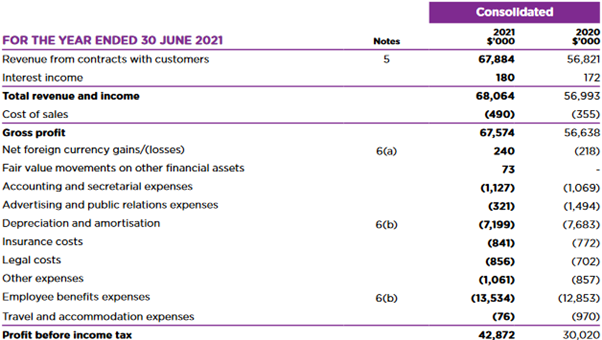

Promedicus PME

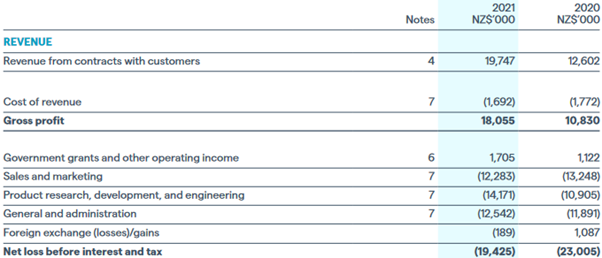

Volpara VHT

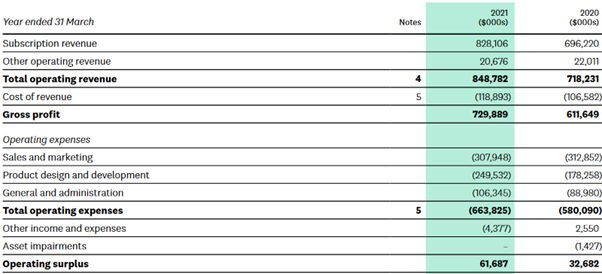

Xero XRO

Xero may not be a fair comparison but the point is to show how clean the expenses look for a true SaaS company. IME has the expected R&D, platform, admin & sales and D&A expenses but they also list a Hardware and licence expense and Clinical services expense. Why does this matter?

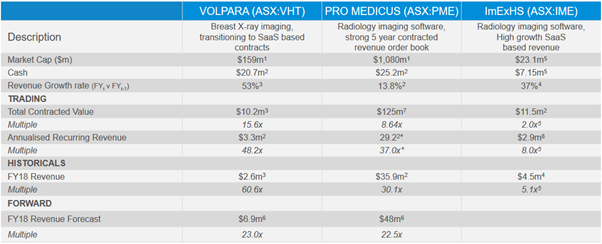

Hardware and licence expenses have made up 14 and 13% of revenue over the past 2 years, while Clinical service expenses have made up 40 and 41%. Combined that’s 54% of revenue going towards 2 expenses none of the above companies have. Will this continue to stay flat at 54%? It’s hard to tell as the company doesn’t list either of these expenses in 2018 (below).

Why is a software company selling hardware? Why are they providing clinical services? Management’s refusal to explain these expenses with notes or to break down revenue by segment make it difficult (impossible?) to get a grasp of the unit economics, margins or operating leverage. As per Note 4 in the most recent annual report regarding segment revenue:

“The Group is organised into one main operating segment. All of the Group’s activities are interrelated and discrete financial information is reported to the Board… as a single segment.”

With expenses accounting for such a high proportion of revenue and appearing to be non SaaS, it seems disingenuous to label yourself a “core SaaS model”. I’d also disagree with management stating they’re “scalable”, especially when they have compared themselves to both Volpara and Promedicus in 2018 (see below); neither of which are burdened by these additional expenses.

I don’t understand how this company makes money; particularly with regards to the above expenses. It’s entirely possible that’s a reflection on myself; however, based on management presentations I’d argue this is being done deliberately. In the most recent half-yearly report the only mention of ancillary services is the following:

“IMEXHS Limited (ASX: IME) is a leading imaging Software-as-a-Service ('SaaS') and ancillary solutions provider…”

They then go on to describe their business highlights for the half year mentioning Aquila in the cloud, enterprise imaging, universal viewer, lung segmentation artificial intelligence (AI) algorithm, Alula in the cloud, IMEXHS portal 2.0 and Aquila in the cloud once more. No mention of their ancillary services.

It’s disappointing that a brief one sentence description hidden in their half-year report gives me the only insight into how the company makes money than do any of the company’s most recent presentations. Management is conveniently forgetting to mention the healthcare services/ancillary services aspect of the company. They refuse to report segment revenue or provide enough notes to their financials and investor relations have yet to respond to these questions.

The income statements used are over a year old now. Maybe ImExHs truly is a SaaS company and they’ve shed or reduced their hardware and clinical services expenses. Maybe these divisions are hiding a growing SaaS operating segment not burdened by these expenses. Or one that can expand into a large American market. I won’t really know until the annual report is released in March and even then I have my doubts management will be transparent enough to address these concerns.

Despite having many appealing characteristics, the bear case wins out over the bull for me. I’m looking forward to reading the next annual report.