Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

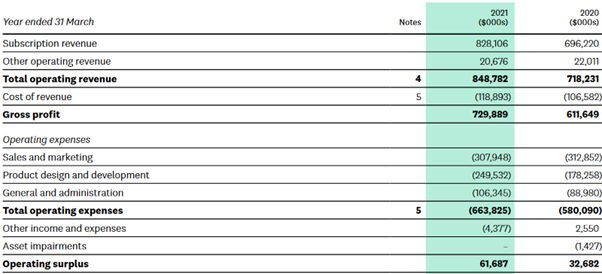

IME presented their full year report today.

As usual present a rosy future but...

they don't make money on radiology. This is the business they bought from CEO. A step for this year is to set minimum contribution margin. So have been going for revenue over profit. Really!

The annual report said the following

The Group has experienced growth in revenue in the year ended 31 December 2023 of approximately 10% on a consistent currency basis, however, there has been a significant increase in costs in radiology and corporate overhead to deliver. The Group has performed a profitability assessment and is reviewing customer pricing and delivery costs. The Group has commenced a process to improve margins in radiology through higher prices on new contracts and increased prices on existing contracts and tighter cost control. The forecasted growth for the year ended 31 December 2024 will likely require additional working capital.

They also have a debt from a customer that they have had to escalate for government intervention. Chances of getting this?

They need to raise money

In response to those matters and to support growth and the likely additional requirements for working capital, the Board and management have been considering various options, including but not limited to external debt funding, owned equipment re- financing, the issuance of a preference shares, convertible note(s) or undertaking ordinary equity capital raise(s).

I bought on the promise of the early traction that their SME, cloud offering gained. This hasn't continued plus they also had to revisit the customers they chased, had delays in rollout for billing. This is the same sort of problem they have just repeated with radiology so they haven't learnt.

This loss of faith in management plus the need for additional funding is the reason for selling.

Sold.

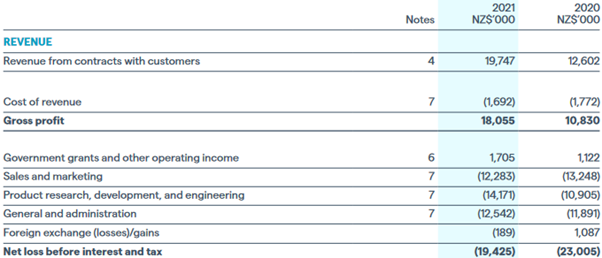

IME reported today for Q4 and full year.

- • Q4 FY23 Revenue of $5.7m, up 48% vs pcp; up 22% on a constant currency basis2.

- • Q4 FY23 Underlying EBITDA3 break-even.

- • FY23 Revenue of $19.7m in line with guidance, up 15% vs pcp; up 11% on a constant currency basis.

- • 2H FY23 Revenue up 23% vs 1H FY23 and 42% vs pcp.

- • FY23 Underlying EBITDA was a profit of $0.4m; up $0.5m vs pcp loss of ($0.1m).

- • Annualised Recurring Revenue (ARR)4 of $25.0m, up 27% vs pcp; up 1% on a constant currency basis.

- • Cash of $2.4m at 31 Dec-23, up from $1.9m at 31 Dec 22.

- • Debt of $1.3m at 31 Dec-23, up from $1.1m at 31 Dec-22.

Bottom line is that they are almost cash positive for the year. They conveniently remove some costs to achieve it. That's better than burning cash though.

They have some more hosting costs to come out.

They have started writing contracts in $US. Ironically this went against them as some of the local currencies appreciated against the $US (one of their main ones by 20%). Ouch. They are to remain writing contracts in $US, which is a good thing.

I'll give them more time but there is something missing. It all sounds good but for some reason their software just isn't getting the traction it should.

Seeing as the company gives you nothing to go on, anyone got a view on short-medium term ebitda margins/operating leverage?

Going through the cost line, I expect most items to increase in line with sales/usage

R&D and admin costs probably flat

This compares to the latest morgans note who have IME generating 14% EBITDA margins in CY23..... seems a stretch but maybe I am missing something

IME has had two radiology contract wins in the past month.

- Colombia’s 5th largest insurance provide - AUD$1.1M ARR but only 4 month contract (seems bizarre - maybe fy based?)

- Grupo Avidanti hospital group for a new hospital. A$750,000 ARR on year term with extensions. 2nd year expected to be $1M. They say Grupo Avidanti is growing rapidly across LATAM so it is an important win with the hope IME can grow with them

This should raise revenue to $20M/yr with marcap cap of $26M. THese should be enough to make them truly cash flow positive. I say that because Directors are being paid in shares ATM rather than cash

"me too" stock that has no reason to be listed yo other than to raise capital though why on the ASX i do not know.

Rhyming moron I may be,

but three years later it's there to see.

Despite the baggies' adulation,

the price has moved towards my valuation!

IME is arguably a new low in reporting,

claiming "ARR" from low margin radiology services has me snorting,

The promotional mislead is surely a red flag,

Past believers in this rubbish are now holding the bag!

Bull Case

At first glance, founder led ImExHs (IME) appears to be a very interesting opportunity. They are expanding globally, process 5.3M new studies per year, are leading the digital transformation of hospitals & clinics with a radiology imaging software platform while claiming to be focused on recurring SaaS revenue. They report a 95% customer retention rate, have 940M images to train their AI on, have 11 current job listings suggesting growth, approximately ¾ of their medical imaging platform is proprietary and are showing strong growth in sales (30% qoq) and annual recurring revenue (40% yoy). IME has grown sales from $2.2M in 2018 to $10.9M in December 2020. If that’s not enough, the company also boasts strong insider ownership.

Despite all these positives the market has punished IME with its share price down 17% since listing in 2018 and declining steadily over the past year (below).

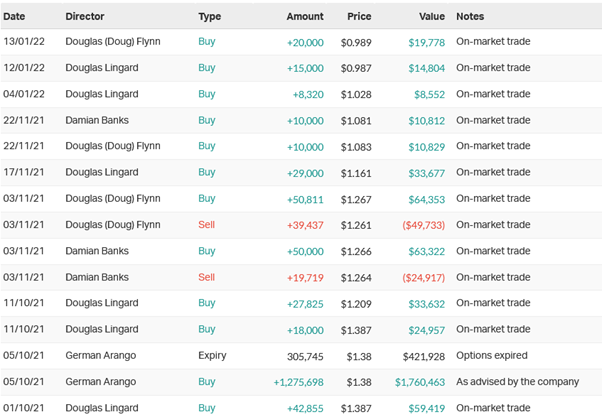

Management clearly disagree with several directors buying on market over the past 3 months according to marketindex.com.au (below). As Peter Lynch states:

“insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

On the surface IME appears to have an appealing bull case; however, the market clearly disagrees. Does this provide an appealing buying opportunity or has the market got it right?

Bear Case

ImExHs cash burn has increased over the past 4 quarters with cash outflows from operating activities of $1.5M in September 2021. With a moderately strong balance sheet they have 4 quarters of funding available. Further dilution is to be expected in 2022.

A high cash burn and some dilution in a growing company with a large TAM doesn’t concern me. What does concern me is the lack of transparency around how the company makes money and their expenses. Management continually tout themselves as having “recurring contract revenues from core SaaS model” and a “scalable business” and pride themselves on their ARR. However, strong top line growth is meaningless if they can’t outpace expenses.

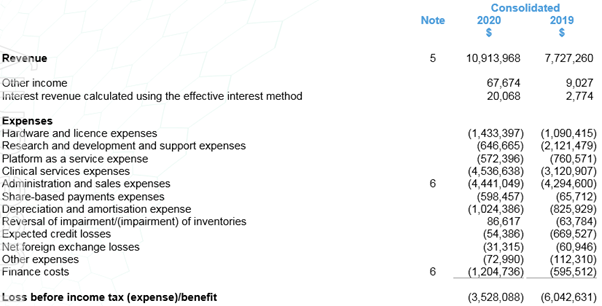

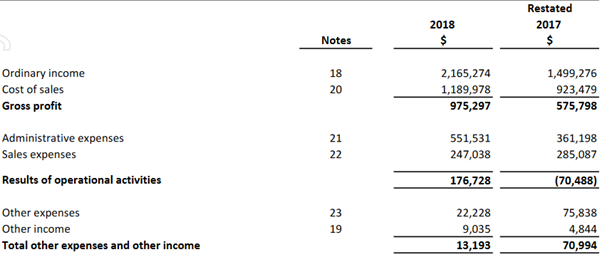

Below is a list of IMEs expenses

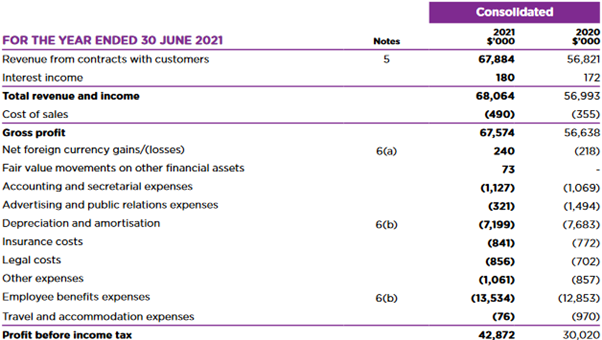

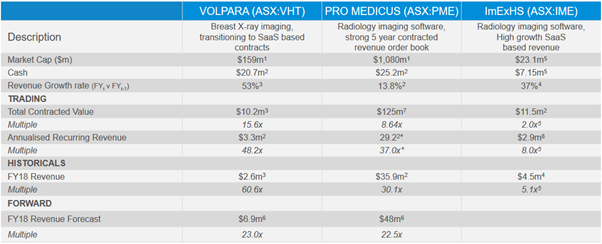

Let’s compare that to a few other SaaS companies both within IMEs industry and outside; paying attention to the expenses of each.

Promedicus PME

Volpara VHT

Xero XRO

Xero may not be a fair comparison but the point is to show how clean the expenses look for a true SaaS company. IME has the expected R&D, platform, admin & sales and D&A expenses but they also list a Hardware and licence expense and Clinical services expense. Why does this matter?

Hardware and licence expenses have made up 14 and 13% of revenue over the past 2 years, while Clinical service expenses have made up 40 and 41%. Combined that’s 54% of revenue going towards 2 expenses none of the above companies have. Will this continue to stay flat at 54%? It’s hard to tell as the company doesn’t list either of these expenses in 2018 (below).

Why is a software company selling hardware? Why are they providing clinical services? Management’s refusal to explain these expenses with notes or to break down revenue by segment make it difficult (impossible?) to get a grasp of the unit economics, margins or operating leverage. As per Note 4 in the most recent annual report regarding segment revenue:

“The Group is organised into one main operating segment. All of the Group’s activities are interrelated and discrete financial information is reported to the Board… as a single segment.”

With expenses accounting for such a high proportion of revenue and appearing to be non SaaS, it seems disingenuous to label yourself a “core SaaS model”. I’d also disagree with management stating they’re “scalable”, especially when they have compared themselves to both Volpara and Promedicus in 2018 (see below); neither of which are burdened by these additional expenses.

I don’t understand how this company makes money; particularly with regards to the above expenses. It’s entirely possible that’s a reflection on myself; however, based on management presentations I’d argue this is being done deliberately. In the most recent half-yearly report the only mention of ancillary services is the following:

“IMEXHS Limited (ASX: IME) is a leading imaging Software-as-a-Service ('SaaS') and ancillary solutions provider…”

They then go on to describe their business highlights for the half year mentioning Aquila in the cloud, enterprise imaging, universal viewer, lung segmentation artificial intelligence (AI) algorithm, Alula in the cloud, IMEXHS portal 2.0 and Aquila in the cloud once more. No mention of their ancillary services.

It’s disappointing that a brief one sentence description hidden in their half-year report gives me the only insight into how the company makes money than do any of the company’s most recent presentations. Management is conveniently forgetting to mention the healthcare services/ancillary services aspect of the company. They refuse to report segment revenue or provide enough notes to their financials and investor relations have yet to respond to these questions.

The income statements used are over a year old now. Maybe ImExHs truly is a SaaS company and they’ve shed or reduced their hardware and clinical services expenses. Maybe these divisions are hiding a growing SaaS operating segment not burdened by these expenses. Or one that can expand into a large American market. I won’t really know until the annual report is released in March and even then I have my doubts management will be transparent enough to address these concerns.

Despite having many appealing characteristics, the bear case wins out over the bull for me. I’m looking forward to reading the next annual report.

Morgans rates IME as Add (1) -

ImexHS has announced a strong FY21 trading update and tightened guidance.

Morgans estimates the company's annual recurring revenue is already sitting at $19m after recent acquisitions and contract wins.

ImexHS shares have take a pounding on the rotation out of growth stocks in the past year but Morgans says the company continues to grow volume across existing clients, win new contracts and improve execution on contract implementation.

The company has also announced a strategic partnerships with global distributor Neusoft Medical, which Morgans expects will extend its distribution reach.

The broker views the stock as materially undervalued, announcements demonstrating strong progression to breakeven in FY22. Speculative Buy rating retained. Target price steady at $2.55.

Target price is $2.55 Current Price is $0.99 Difference: $1.56

If IME meets the Morgans target it will return approximately 158% (excluding dividends, fees and charges).

The company's fiscal year ends in December.

Forecast for FY21:

Morgans forecasts a full year FY21 dividend of 0.00 cents and EPS of minus 12.00 cents.

At the last closing share price the stock's estimated Price to Earnings Ratio (PER) is minus 8.25.

Forecast for FY22:

Morgans forecasts a full year FY22 dividend of 0.00 cents and EPS of 3.00 cents.

At the last closing share price the stock's estimated Price to Earnings Ratio (PER) is 33.00.

Market Sentiment: 1.0

All consensus data are updated until yesterday. FNArena's consensus calculations require a minimum of three sources

Rhin20 thanks for the link to arichlife.com.au article. I hold quite the opposite view on IME and of course could be wrong. Here are my thoughts.

Firstly, I can understand why the comparison to PME but PME has also been a once in a generation opportunity. IME only needs to be half as good to be a fantastic investment.

I feel that the information in the 'arichlife' article is out of date. Perhaps in the past IME offered hardware, but now offer SaaS products. They have two. Once is a customisable product and the other is off the shelf and aimed at smaller enterprises. This second product has grown from nothing to $2M is ARR in one year. Within two months of launching in FLorida and the AUS they had made sales.

Their strategy is to land and expand. They land with their off the shelf offering with 60% of that now being sold via resellers. Behind that they will put in dedicated sales staff and then try to sell the custom offering to bigger clients. They are still waiting to get into Brazil, which they have been accredited to do, but Brazil has been hit hard by the pandemic. Brazil is the largest LATAM market.

'arichlife' also mentions options. That information is out of date by more than 2 years There was a share consolidation in OCt 2019. Options are shy of 10% of current total shares. Most are held by the CEO and are substantially out of the money. Current share price needs to double before any reach there exercise price.

ARR is now $12.7M for a market cap of $42M. So a multiple of 3.5. ARR has grown 57% year-on-year on constant curreny.

I think the current share price is a low multiple for a strongly growing company off a small base. They don't compete with PME so I think they have plenty of growth. On the down side monthly run rate EBITDA breakeven by December 2021 may not be achieved.

I've had plenty of doubts about this Columbian business, particularly after watching Narcos.

But in the last 6-12 months they made a few really nice moves:

- Incentivised really good directors to come in (Doug Flynn who chairs NXT and the ex-MD of KKT)

- Brought in a new CFO who is highly competent (also ex-KKT)

- Cleaned up loose unmarketable parcels to save registry costs

- Partnership with Canon which adds credibility to the technology / platform

- Aquila in the Cloud - moving away from platform as a service and other services to more software

"the next pro medicus" says the pumper

but one day they'll become the dumper

or maybe they do not know

that the technology isn't there to show

and in that case (I hate to naggy)

I think that they'll become the baggy!