Since there are verified trials for the IPD test and support from NCCN guidelines for BIS monitoring and the SOZO system, the use case seems clear to me. So what are the potential risks associated with it?

1. Implementation

IPD needs to execute effectively to integrate into clinical flow systems. This requires adoption and change to become part of the patient, clinician and hospital/clinic system. To achieve this, they need to:

- prove the ROI on hardware and tests,

- integrate into existing patient flow systems,

- manufacture enough units to meet demand,

- change perceptions so monitoring for lymphedema starts at the diagnosis/treatment plan stage rather than at the end rehab phase,

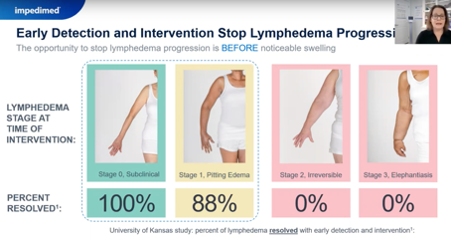

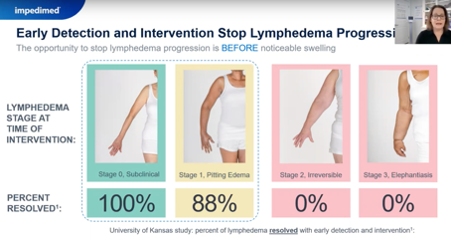

- raise awareness among clinicians and patients that early and ongoing monitoring and intervention can prevent the disease from developing. The test's sensitivity can detect early-stage Lymphedema before physical symptoms appear.

Secondly, implementation is hard.

https://youtu.be/C04AxtJoDXU

Webinar goes into this in more detail about the IPD implementation process. (above screen grabs from webinar)

2. Competition

Inevitably there will be competition in the space, with the NCCN guidelines covering all types of cancer, it is a big market to chase. IPD suggest there are similar tests available, but their test is more accurate, I have no idea how close a competing test is. Ensuring all the stakeholders understand the different testing parameters will be key for IPD as insurer’s adopt the guidelines.

3. Management

New management needs to prove they have the right structure of staff, sales, training, implementation, etc in place to capitalise on the opportunity. As noted by Rick V in the latest quarterly call “the market is ours to win or lose”, yep.

4. Capital management

Cash on hand is high since the latest CR, using this wisely will be a key criteria to watch.

Held