Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Inside Ownership Ordinary Shares %IPD Issued Net Value at $0.08

Christine Emmanuel-Donnelly 389,809 0% $31,185

Parmjot Bains 21,673 0% $1,734

Janelle Delaney 3,930,122 0% $314,410

Andrew Grant 400,000 0% $32,000

Total 4,741,604 0.23% $379,328

Current Market Cap ~$161.8m

Management Buying

Christine Emmanuel-Donnelly

· 14 May 2024

Indirect 100,000 shares average price $0.08 ($8000)

Andrew Grant

· 6 May 2024

Direct 100,000 shares average price $0.0805 ($8050)

Janelle Delaney

· 6-8 May 2024

Indirect 634,177 shares average price $0.079 ($50099.983)

Christine Emmanuel-Donnelly, BSc -Non-Executive Chair

Christine Emmanuel-Donnelly was appointed to the Board in September 2023. Christine is an experienced ASX listed company Director and Intellectual Property specialist. She is currently a Non-Executive Director for PolyNovo and Medical Developments International and non-ASX listed Pikcha Holdings Pty Ltd (trading as Seminal). Previous executive experience includes commercialisation and intellectual property roles at CSIRO,and RMIT. CSIRO is the premier Australian science agency covering all scientific disciplines, where she led and managed the Intellectual property portfolio and led the IP team, the commercialisation team and the equity portfolio team across all Business Units. Christine previously practised as a patent and trade marks attorney in leading AU and UK firms and Unilever (UK).

Parmjot Bains, MD - Managing Director & Interim CEO

Dr. Parmjot Bains was appointed Managing Director and Chief Executive Officer of ImpediMed in January 2024. She is a high caliber healthcare executive with diverse experience including strategy, sales and marketing, commercial execution, and change management across the United States, Asia, Middle East, and Australia. Most recently, Dr. Bains was Pfizer’s Gulf Cluster Country Manager, responsible for setting commercial strategy, aligning team capabilities, driving private and public reimbursement, accelerating sales and marketing activities and key account management. Dr. Bains managed a large team across six countries and six therapeutic areas including breast cancer, and successfully delivered significant growth against clear metrics and targets in various markets. Her other former roles include joint CEO and COO at Neuren Pharmaceuticals, CEO of Perseis Therapeutics, a Manager at McKinsey and Company. Dr Bains trained and practiced as a Medical Doctor in New Zealand and Australia.

Janelle Delaney, MBA - Non-Executive Director

Janelle Delaney was appointed to the Board in September 2023. Janelle has over three decades of extensive IT experience covering all facets from sales through software development, project/program delivery and business management. As a Partner at IBM Consulting, she is responsible for the quality of project delivery across IBM Consulting Asia Pacific’s portfolio of several thousand projects and across all solutions (including digital transformation, AI, package implementations, application management services).

Andrew Grant, BEE, MBA - Non-Executive Director

Andrew Grant was appointed to the Board in September 2023. Andrew is a highly qualified and globally experienced healthcare management professional. His experience covers Australia, USA, Europe and Asia as a medical device and hospital sector executive. He spent five years with ResMed in roles encompassing VP Global Product Marketing and VP Corporate Development and three years with Luye Medical International where he facilitated a technology transfer of Cleveland Clinic’s cardiac and oncology service lines to Luye’s International Hospital start-up project in China. Prior experience included engineering design and development of implantable pacemakers and defibrillators, and management consulting with McKinsey & Co.

McGregor Grant, BEc, cA, GAICD, FGIA, FCIS

McGregor joined the Board in September 2023 and was appointed as Chair at that time. He was appointed as Executive Chair and interim CFO in November 2023. Mr. Grant has over 26 years’ experience in the medical device and healthcare industries in Australia and the United States. Most recently, Mr. Grant was the CFO and Company Secretary of Nanosonics Limited. In that role he gained extensive commercial experience leading Nanosonics from start up through growth and business maturation to become a successful global business with operations in North America, Europe and Asia Pacific. Mr. Grant has extensive international experience gained with Invacare as the Asia Pacific Finance Director, and Abbott Laboratories in a number of senior finance roles located in Australia and the United States. Previously Mr. Grant worked for Coopers & Lybrand (now PwC) in Australia and Europe.

Not exactly a new announcement but a couple of weeks ago Janelle Delaney one of the new board members bought another 100 odd thousand dollars on market through her super fund. This takes her total share count to close to 3.3 million, about 300k. 200k in super and 100k in her own name. I don’t necessarily think we will have an amazing quarter of sales this quarter however she is obviously looking long term and believes in the new CEO’s direction.

On a side note: I have been reflecting on why I’m so bullish on this stock. I think I want a simple solution to a complex problem. That is you stand on a SOZO and get your body water content (Intracellular, extracellular and total body water) objectively handed to you at any given moment. In the current context this is being used for lymphodaema but has so many more prospects in the cardiac and renal (kidney) space as well. My long relationship with fluid and fluid status of patients starts 14 years ago.

- Young me as an intern on my renal term. Hot shot professor that scared the living daylights out of me standing at the end of the bed asking me if a patient is fluid overloaded (too much water in extracellular spaces) usually due to heart or kidney issues. There are essentially 3 main ways we assessed it.

- Look at the JVP (jugular venous pulsation) notoriously subjective and used by seniors to make junior doctors look stupid since the beginning of time,

- weight changes

- peripheral or sacral pitting oedema (press over bone in your leg and if it pits down and the skin doesn’t come back its fluid). This is what SOZO could replace, the completely subjective assessment of fluid assessment and management, which drives medication changes on a daily basis.

- Moving on to anaesthetics training and the PTSD that came with the exams. 10min broad short answer questions such as:

- Discuss the physiological responses to administration of 2 litres of Hartmann’s solution intravenously over 1 hour to a conscious, healthy, euvolaemic 70kg adult

- Outline the determinants and regulation of extracellular fluid volume

- Explain how oxygen supply to organs is maintained during isovolumic haemodilution

- Now dealing every day with fluid balance in mainly the acute setting which is different from the chronic setting SOZO is used in currently.

This I guess is my background of where I’m coming from with this company.

SOZO’s 1st commercial case use; detecting Lymphodaema early (extracellular fluid where it shouldn’t be in the arm) and allowing early treatment rather than waiting for a tape measure and symptoms to come along. Then extrapolation to other markets in the heart failure and renal space, as well as pharma wanting machines to test drugs with(already provided meaningful revenue). Do i think the clinical implications could be huge? Yes. Is it too simplistic? Maybe. Does it give an objective reproducible solution? Yes.

Am I just wanting a simple solution to a complex problem? And do I have too much confirmation bias? Maybe.

Now just to work out if this new board and CEO are actually going to deliver on this lip service… That I find so much harder.

So I have had a trip across the Nullarbor to really let everything sink in from the quarterly. I was not expecting a good one and if i was a trader probably would have tried to time it. But I’m not so copping a decrease to close to my average buy in of 8.2 cents IRL. The toughest thing having to reflect on why a punt on META 13 months ago based on sentiment is my best performing share over the past year, being 280% up.

So the question in my mind was, is there anything fundamentally different about this business and will it be around in 5 years growing cash flow? What is the risk benefit? At the end of the day it is a similar price right now to a year ago prior to NCCN guidelines being announced. So I’ve come to the conclusion after initially feeling a little bit of despair that It is better placed now, at realistically a much more genuine price that may even be attractive. The reimbursement per test and the cost of the SOZO seem to make economic sense to provide benefit for patient, profit for hospital and a reasonable recurring revenue for company. (Listed below and makes me the most bullish)

My main thoughts on the conference call.

New CEO Dr Parmjot Banes started on 8/1/24: She didn’t shy away from negatives and didn’t inflate TAM, all whilst finally having a plan moving forward for sales. Was very measured. Frankly I like female CEO’s in conference calls better, need to listen to a greater sample size though.

- Background: last 8 years with Pfizer. Most recently overseeing product launchers in 6 therapeutic areas and navigating the reimbursement landscape. Familiar with the launching of new products to healthcare facilities, requiring “a very clear and well thought out go to market strategy to be successful” Last role grew a flat business to greater than double digit growth in less than 18 months from a first principal approach.

- She focussed on clinical application of SOZO first and creating a holistic approach to treatment plans for lymphedaema in all cancers. Creating an environment where SOZO will be at the forefront of this with leading clinical partners. This will be done by using the resources we have (taken as no more hires) and focussing on IDN’s (groups of hospitals, anywhere from 9-70) in 11 critical states of which 7 already have critical mass for reimbursement. This will be helped in the US by Medicare funding pressure garments for treatment of lymphedaema from Feb 2024, overall a big push in the US for treatment of lymphedaema.

- Reimbursement coverage: remain confident 85% reimbursement coverage across US by end of financial year. With reimbursement expected to provide at minimum revenue neutrality from the SOZO in hospitals. (See a bit further below)

- She states “while reimbursement is a requirement for adoption, it does not drive adoption, there is work to be done” The previous CEO etc… seemed to think the opposite of this and didn’t even really have a plan in place. In the old CEO’s words when they got NCCN guideline approval. I am surprised that this is the case. Talk about belief. (Makes me wonder why i held through this period, it was a lesson learnt, that I still have a bias when I see a good product despite the management).

- Negative feedback:

- Both McGregor and Dr Banes were asked feed back from negative customers. Sighted low churn rate and also subjectively/objectively no negativity of the product. However the difficulty of implementation from the customer is getting the contracts to time with hospital budgets and clinical changes. This is a slow process.

- Clinically: There has been a recent LANCET publication which is independent https://www.thelancet.com/action/showPdf?pii=S2589-5370%2824%2900020-8page 7 shows the recommendations, stopped short of saying its the standard of care but everything moving to regular screening is a must. One of their main reasons for not having BIS (kind of interchangeable with SOZO, as its the only thing on the market using this tech at the moment) was its expense compared to perometry/tapemeasure. This may change with reimbursement, I always am sceptical of medical physicians evaluating cost. We are extremely poor at looking at the what is true societal cost and personally hate it when it’s mentioned in clinical studies. We should use the best clinical device/drug and let the health economists come up with the decision.

Reimbursement: There was never the candour from previous management in regards to the process of actually how long it would take to get into the hospitals, and how they will do it. This disconnect I think led to the market cap rising to an unrealistic 400 million and a lot of angry people on the way back down. Hoped up expectation is a bitch…

- she stated that usually need at least 6 points of contact to implement into a hospital over a 6 month period. So realistically if the S curve eventuates the beginning is still 6-12 months away.

- The amount of reimbursement is amazing really. 13 states have critical mass (>80% of people covered). 7 of the 11 critical states they see as strategic are there already and they expect the next by April this year.

- Reimbursement means that they will pay per test. Each individual test is paid for at worst by Medicare which was stated as >150 US dollars per test. McGregor stated the negotiated price with the insurance companies and hospital is private. However likely quite a bit more per test than Medicare.

- I called the physio’s at wollongong hospital to see how they do the test. They stated the pilot program in NSW has a few ways you can do it. they are not funded for a specific technician so have to do it themselves. This is a 30minute pre operative appointment for baseline testing and information. Post operatively the appointment is usually 60 minutes but encases a holistic approach assessing scars, answering questions and providing information on prevention. If they are just doing the test it’s 10-15 minutes. So feasibly in a larger hospital centre in the US with more volume you could have one technician doing the tests not associated with the appointment. Let’s conservatively use the base price of 150 dollars per test (only if Medicare pays for it, likely a lot higher). Let’s look at half a day of tests at 15 minutes each 4 hours at 16 tests. That’s 2400 dollars for the morning. Admittedly there is a bunch of other costs like space, personnel costs, electricity etc… but max price for a SOZO is 5000 dollars for a month and looking increasingly worth while purely economically. Often they start at 2000 a month so an even better situation for the first year.

Revenue reporting change - reporting revenue as average of monthly payment over life of contract rather than step wise. Essentially brings revenue forward with less cash receipts in the first year. Eg. First year of contract revenue larger than cash receipts, second year revenue equal to cash receipts, 3rd year cash receipts greater than revenue in their usual step wise contracts. This was a slight orange flag but they were upfront about the cash receipts and with the churn rate low it shouldn’t matter but something to keep an eye on.

Sales/costs/forecasts:

- Not giving a forecast which I’m stoked about.

- Poor sales this quarter 37 SOZO systems of which 13 in US, 24 in mainly Australia.

- 20 in previous quarter, 19 in US

- Costs solid at 5.5 million with a few one off costs for 84 staff. Approx 20 million for the year though. Stated that they are not in the business of cutting for profit and have to have this number for a biotech to grow. Not planning on bringing anyone on though and see costs as stable. If this is the case then enough cash for >18 months.

Overall after initially a little worried I see a positive risk benefit still. However we may see the share price drop even further over the next couple of months. The company despite sales not skyrocketing is kicking goals with reimbursement and I think the evaluation of the strategy to make the most of this will become apparent soon, wether that be negative or positive.

Recent chair address.

- look there may be some confirmation bias, but I was done with the previous CEO. My inital Thought a year ago was I don’t like him but was hoping that his dry non engaging persona would just be a results driven powerhouse to make up for that weakness. Well he seemed deer in headlights at each positive turn and although would say how wonderful something was didn’t seem to have a plan to then take advantage of that.

- Now we have an accountant in charge (McGregor grant) (interim) and all the right things are said in this address below. He does have precedent of helping to grow a similar style of company in the past (12 years at nanosonics). But does he have the ability to help complete the vision? There is an argument for and against that saying he is trying to cut too many costs for a growth driven company. Well if you are spending just north of 3 mil a quarter with only about 4-5 sales people. I think there is fat to trim to be fair. Also saying anyone new has to buy on market not get any special diluting deals is a positive. Will see what this looks like.

- Dr Bains, the CEO starting in January. Originally a Dr in Auckland, progressed as far as Sydney kids Senior resident after a year as intern with WHO(4 years but not super far into the world of medicine). I am generalising and stereotyping here from watching multiple people go through speciality training and also going through it myself. But it takes guts to realise medicine is not something you want to do after finishing it (mind you, Sydney paediatric resident breaks people, so hopefully not that. Such an uncaring place to work) So I see this as a positive that she goes after things and is willing to pivot if needed. Then COO and CEO at neuren pharmaceuticals for neurodegenerative paediatric disorders. Then bounced around a bit before Pfizer for last 8 years. I look forward to hearing her talk, will have a much better idea about what she is about when that happens.

- as for the financials in the last year in the address. Nothing new, rather ordinary for growth company at 280 market cap. But picking an inflection point is tricky and that’s what I’m trying to do with this stock as upside is huge.

bit more of a diatribe than I meant to write.

Interesting changes for the top management of IPD announced this morning.

How does the brains trust view these changes???

Just interested whether you think this is going to be a positive move. TIA.

New directors share ownership

The new board’s stake in IPD is minimal at this stage. I’ve been monitoring share purchases to potentially indicate their confidence in their new roles, the restructured board and company’s prospects.

So how does it look?

Grant McGregor Value 205K held prior to spill

Andrew Grant 0

Janelle Delany 0

Christine Emmanuel-Donnelly 10.5k purchased on market 3/11/23

I couldn’t find updated details of the boards remuneration, perhaps they are receiving shares as a part of that, as per the old structure?

On the investor call 31/10, post the board spill, board alignment was asked about. I had scribbled down, my notes/words: Buy on market, currently black out period Given Christine E-D’s change of directors’ interest notice 3/11, I assume a window was open for share purchases.

The board presentation at the Nov AGM may reveal something, no AGM date at this point

Watching for:

- Director remuneration details

- Board presentation AGM

- On market share purchases, directors

Rick the CEO Lead with the statement that the fundamentals are unchanged. A 2 billion dollar market with no obvious competitor and NCCN guidelines and rollout of insurance payor reimbursement. I agree with @Slew he sounds tired, however he has never been a charismatic character, not sure what to take of this.

The big change since the investor presentation is united healthcare a national payor coming on board. Detailed below.

Summary of 4C:

- slow down in private payors publishing: expected decrease from 95% —>85% by end of financial year.

- Critical mass 2 states currently Michigan and Alabama (80% of insured people covered), aiming for 3-6 more —> already hit target.

- Core SaaS revenue 2million +20% YOY, Total revenue 2.5million -12% YoY due to AstraZeneca’s trial finishing.

- 19 systems sold this quarter new contracts at 2500 US a month.

- 42 million cash on hand

- Cash outflows (- 3.1million)

Thought processes from the recent investor presentation/National insurance guideline change.

Insurers:

- There are 2 different focus’ National and state insurers: Within this an insurance company will have a new medical device under the following: a) experimental (unproven) b)silent (still gets reimbursement) c) published with reimbursement (company seems to be treating b and c as the same.

- There is a change with blue shield, previously you would just apply to one entity. Blue shield has now changed this so that each of the 22 entities will need to be approached individually. We have already got 7 Blue shield paying reimbursement but the other 22 will need personal contact now.

- Usually if you can get the top 3 insurers in each state you get >80% coverage which seems to be the number the company wants. Aiming for another 3-6 states this quarter, with united health care coming on board that increases to 4 more states so already reached this goal for the quarter.

- When the investor call was done there was only 1/5 (Cigna) national now there are 2/5 national with united healthcare updating from experimental to silent coverage.

Summary: Accelerated update to medical policies from insurance companies, these are all out of cycle reviews initiated in response to NCCN guidelines. Some extra work to do with individual states however a huge announcement with United healthcare updating from experimental (requiring clinical review) to silent coverage for 47 million Americans (into effect on 1st January 2024). Leading to 2/5 national insurance companies now providing reimbursement about 9 months from NCCN guideline changes.

Personnel:

- New chief medical officer: Dr Steven Chen (surgical oncologist) Practicing breast surgeon who was past president for the US society of breast surgeons. Not a bad contact to have in the business.

- 4 new board members: The board spill went ahead and we have 4 Australians replacing 4 Americans. I find it difficult to evaluate this without knowing them personally. Speculatively I would hopefully say that they are looking now to grow organically rather than growth at all costs. Balance first mover advantage and growth. There is only a right way when we have hindsight.

Summary: This was a huge decrease in the momentum with the board spill and vote. I don’t think this will matter when hopefully I still own the shares in 5 years time. Will they change the direction? We will find out. My hope is that they continue running cardiac and renal in the background (which the other board were specifically not doing). I also for some biased reason like Australians in the role, for some reason I’m biased to them running the company into the future rather than having a takeover and quick profit. Pure bias however, with no evidence.

Sales:

- Only 19 sold this quarter, not great. Jury is out how they scale this with all the insurance companies coming on board. It will not happen overnight which some investors feel it should.

- Michigan initiated delivery network (IDN’s): Master service agreement for their entire provider enterprise: these will start at 2500 in first month. I’m a bit annoyed at the company here as the Michigan sales team consisting of one, sent their resignation in just after NCCN guidelines were announced. It has taken until now to get someone trained up and in the sate. The reason they sold in this state was that the IDN came to them not the other way around.

- Rick states that we have to build the sales team from scratch in the last few months.

https://www.heartofgoldpt.com - this is an example of a small business using it. Extrapolates SOZO’s use even for small businesses, this is a single physiotherapist owner who has bought one in California.

Summary: Proof will be in the pudding with how they build the sales team and approach the IDN’s. Sales in Michigan were due to the IDN coming to the company and wanting to buy more not the other way around, negative being we didn’t have someone on the ground selling, positive the product sells itself.

Churn rate 3%:

- CEO states churn in the past was due to lack of use and inability to build energy around the program in advance of private payor reimbursement.

- They can’t leave for a better system or cheaper price. There is none.

SaaS margin still greater than 90%.

- Currently 2500 US a month

- Historical contracts are less.

Cardiology/renal:

- Continue to work on these areas, however not the main focus at this point.

- no contraindication in pacemakers.

I guess we will know soon how good they are at keeping costs down whilst increasing sales. High margin, no competitor and the simplicity of the product and ease of use have me invested heavily. Management have not inspired me quite yet however, so this is very big orange flag i understand people will have. The risks for me still out way the massive upside. Objective measure vs putting a tape measure in a sweaty underarm or groin… will win out with healthcare providers every day of the week.

Yesterdays, IPD released its 4C, I listened into the investor call.

Financials:

At this stage financials seem ok. Growth in recurring revenue although hardware sales were down qoq, nothing jumped out at me here, some lumpiness can be expected with customer wins and onboarding. I didn’t glean anything new outside what was in the ASX presentation

Management:

My observations are on the management team, it was a phone call so no visual cues.

Rick CEO sounded tired/weary which is expected giving the board spill which started several months ago. He said all the right things, support for new board etc, but what choice do you have.

Rick admitted that the spill was a distraction taking time away for the business for himself and the CFO and now they are back to managing the business.

On the positive they did not dodge any questions, patiently answered everyone asked, even if they were repetitive in nature and ran over time to do so.

There was no board input, the new board has been meeting in the US and reviewing strategy, operations etc. The board will be presenting their plan at the AGM next month, to me this is a key issue to watch in the short term.

Position:

I have held for some time, but sold half when this broke out, so at this stage I can afford to wait and see what happens. I have no doubt the product has a clear place in oncology clinics and processes, what I have doubts about is whether IPD have the plan and structure to successfully commercialise this. I won’t be increasing my position until I see evidence there is a clear plan of attack and the business fundamentals start to reflect that.

I’ve been a bit tardy posting on the whole board spill/no-confidence/vote, partly because i haven’t encounter something like this before and for a long time really didn’t know how to see it. Evaluating the board and what it actually does is something of a weak point in my understanding which I am trying to rectify. But not being around finance during my career it doesn’t come naturally.

Despite all this.

- There is no other product like this. Has a wide moat due to NCCN guidelines approval and peer reviewed studies.

- Scalable (has renal and cardiac to go). Is right on the inflection point for cancer care with 2billion TAM approx. I could even see it being used in anaesthesia which is my specialty in the not to distant future. For studies pre and post operatively to assess our fluid management during cases.

- High gross margin on SaaS >80%.

- NCCN guidelines have only come out in April, sometimes I feel as investors we can be extremely impatient. It will take time for this to convert to sales.

- Despite the lack of communication I was willing to judge on results and i was happy to give them a year. I’m much happier with growth of revenue and cashflow rather than over the top communication and promises.

So my thesis for the company has not changed therefor i still hold a sizeable amount in real life (over a million shares) and haven’t been too worried about this process. Feeling like even if this is done not to well there will still be sizeable growth due to community and clinician push for product.

The dissatisfaction with BOD from my understanding stems from: (The Arcadia park pdf attached spells it out pretty damn well).

- Lack of plan or communication once the NCCN guidelines came out with Impedimed in it. They almost seemed surprised it was approved and didn’t really have a plan of action. This compared with the recent pdf from Arcadia park which really in simple terms gives their main goals.

- Are we getting the the return on capital for the capital raise? My thought process is No. They don’t seem to be using it to get first mover advantage. So why did they capital raise in the first place.

- Lack of personal money buy in from a few of the BOD’s.

- The recent investor relations call was a nightmare… I had no confidence in them after that. Rather than focussing on the positives of what they could bring it was all doom and gloom if you vote for the BOD to be removed. I really really really dislike this type of negative play (reminds me too much of some recent elections… but I’ll leave it there). Positives should be focussed on and plans of how to implement.

- All directors are American with an American CEO. Pro’s and cons for this, honestly not sure which is better. I want a board that supports organic growth with limited share dilution from this point onwards. I have a feeling that this BOD doesn’t really care about that.

- We don’t want a buy out, I want this company to not be looking to be acquired. THe CEO needs to be held accountable here, his linked in suggests he is a specialist at this.

The goals of Acadia park are in the PDF below. I like the simplicity of their goals. I also like how they will bring renal back into the thought process, they need to keep this rolling in the background.

I am voting yes to all changes because the new guys actually seem to have a plan whereas the articulation from the current group is not that great. THe last straw for me was the BOD hiring proxy advisors to recommend who to vote for. If you have to hire someone to tell others why you should keep your job they can get stuffed.

I do have a sizeable moat as my buy in real life is averaged at 8 cents. So happy to see this out. At the end of the day I can see how this would have a revenue in the next 3-5 years of 60-100million (their recent puff piece suggests in 2.5 years) and with the margin and what other bio companies are rated at i still feel this is a buy. If it wasn’t such a large part of my portfolio I’d see this uncertainty as an opportunity.

Cheers,

ipd-acadia-park-response-pdf.5587792.pdf

Does anyone have any thoughts on the announcements from IPD?

31/7/23 ASX announcement by IPD

“On behalf of Acadia Park Pty Ltd (AP), regarding the intention of AP, with the support of a small handful of private investors, to move resolutions for the removal of four directors of the Company, being Mr Donald Williams, Mr Amit Patel, Mr David Anderson and Mr Daniel Sharp.”

1/8/2023 ASX announcement by Acadia Park

Significant shareholder announcement 8%, (I count around 20 shareholders to get to the 8% holding)

So, they are disgruntled with the board, but why? Past board/company performance, inappropriate cap raise, undisclosed take-over offer, I have no idea. I do know that boardroom conflicts make me nervous

Any comments?

Following up my straw from a few weeks ago, is this the breakout price action we have been looking for?

Above the significant zone of resistance on good volume, and a close near the high of the day. If this holds and/or follows through, you have to be bullish.

Looks like things may be moving quickly.

One of the top 5 payors Cigna now has medical policy for covering SOZO testing. Impedimed named in the policy.

Shares up 24% to 23c on news

Announcement below.

[held]

Since there are verified trials for the IPD test and support from NCCN guidelines for BIS monitoring and the SOZO system, the use case seems clear to me. So what are the potential risks associated with it?

1. Implementation

IPD needs to execute effectively to integrate into clinical flow systems. This requires adoption and change to become part of the patient, clinician and hospital/clinic system. To achieve this, they need to:

- prove the ROI on hardware and tests,

- integrate into existing patient flow systems,

- manufacture enough units to meet demand,

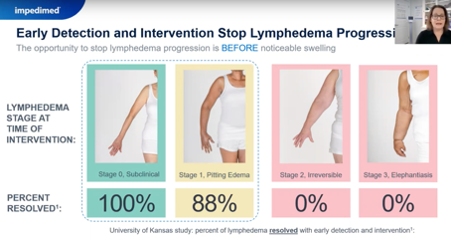

- change perceptions so monitoring for lymphedema starts at the diagnosis/treatment plan stage rather than at the end rehab phase,

- raise awareness among clinicians and patients that early and ongoing monitoring and intervention can prevent the disease from developing. The test's sensitivity can detect early-stage Lymphedema before physical symptoms appear.

Secondly, implementation is hard.

Webinar goes into this in more detail about the IPD implementation process. (above screen grabs from webinar)

2. Competition

Inevitably there will be competition in the space, with the NCCN guidelines covering all types of cancer, it is a big market to chase. IPD suggest there are similar tests available, but their test is more accurate, I have no idea how close a competing test is. Ensuring all the stakeholders understand the different testing parameters will be key for IPD as insurer’s adopt the guidelines.

3. Management

New management needs to prove they have the right structure of staff, sales, training, implementation, etc in place to capitalise on the opportunity. As noted by Rick V in the latest quarterly call “the market is ours to win or lose”, yep.

4. Capital management

Cash on hand is high since the latest CR, using this wisely will be a key criteria to watch.

Held

Visiting the scene of the crime after my last technical update a couple of months ago, and after a brief halt in the momentum and pullback due to (yet another - this business has a habit of doing these!) capital raise, the shares seem to be building up the energy to break out of that 20-21c range again. On close watch.

Share purchase heavily oversubscribed which is surprising given it was not underwritten.

Didn't take part in the CR as I thought it would be better to watch and wait and didn't like the idea of it not being underwritten. Worth seeing how the share price performs in the next week.

[held]

20million dollars at 13 cents. Well this happened a little quicker than I thought it would considering they actually already have 20million at 3million burn per quarter. Initially I wasn’t super happy about this last night but reading the companies reasons today has me actually really stoked. I just inherently don’t trust management for capital allocation until they have proved themselves and this CEO hasn’t yet since he’s taken over 4-5 months ago. How well will they scale. Richard Valencia the CEO does have experience (from LinkedIn) scaling companies but he also markets himself as great at Mergers and acquisitions as well. That is something I don’t want.

Pro’s:

- Richard Valencia (CEO) “Following the inclusion of our technology on the NCCN Guidelines ®in March, the speed at which payors and providers are reacting to the news continues to accelerate. The funds raised will be used to accelerate the Private Payor opportunity and enable the scaled roll-out of SOZO systems in the U.S. With the impending publication of nearly all Private Payor policies in the coming quarters and no direct competition at present, the opportunity is ours to win or lose. The opportunity to prepare for scaling this business in order to achieve the success we all envision is now.”

- The expected timeline of published policies has been brought in by six months, with nearly 50% of Private Payors now projected to publish policies by the end of calendar year 2023. ImpediMed has received written confirmation that the first regional payor will be publishing its policy to include BIS by the end of May.

Cons:

- The main one centres around different peoples perspective on a private meeting with shareholders in April. Unfortunately I couldn’t go so relying on here say. That is at that time Richard was asked multiple times about capital raising. Some people heard it as we are going to aim for cash flow positive first and then potentially capital raise if needed. Some people heard a caveat that was if things progress at a greater speed it may be earlier. So depending on which side you look at it this capital raise is a positive or a lie. I would prefer to have the problem that they state Initially we thought it would be 3-18 months until they got answers from private payors. Now its 3-12 months and everything has been brought forward by 6 months.

- The obvious dilution.

I’ve come around to feel that the capital raise is more a reflection of the speed in which they will have to roll this out. (At the moment they only have 6 sales staff in all the US). So am willing to give the management the benefit of the doubt and would rather a quick move whilst we are ahead as this would be very sticky SaaS revenue.

I have seen a lot of capital raises for biotech and this one feels like it actually has a purpose rather than just staying afloat. The proof will be in the pudding though with capital allocation and how they roll this out to profitability. With the best in class and a TAM of 3billion dollars estimated hopefully they balance quick growth and expenditure.

ImpediMed Limited (ASX.IPD) is pleased to announce clearance of SOZO® Pro, the company’s next generation bioimpedance spectroscopy (BIS) system, by the U.S. Food & Drug Administration (FDA).

A change of management (with the new CEO buying a reasonable amount of shares on-market), positive developments on the push towards making bioimpedance spectroscopy the standard of care for lymphodema from the NCCN, and an overarching risk-on sentiment in pockets of the biotech market have together conspired to re-rate the shares sharply higher here (@Metis must be stoked with his huge 33% stake!).

Technically, the stock has behaved well, consolidating its initial thrust where it more than doubled in a day, retesting that breakout and then beginning its next leg higher over the past few trading sessions. If it breaks through resistance at around 20-21c on good volumes, it could push well higher. Worth watching on account of fundamental and technical improvements conspiring to reward risk tolerant punters.

Pro’s:

- Achieved what they set out to do with cash burn <3million. I think this is the delicate balance between spending required for growth and no capital raise (got 8 quarters left at this rate). With the moat that is around the business in regards to the length of time a competitor would need to get FDA approval and do a trial I see this as a positive. I’m not a fan of growth at all costs.

- The approval for all cancers rather than just breast cancer lymphoedema took management by surprise and provides a much larger TAM.

- My valuation before looked at having machines in 700 different clinics/hospitals. The business estimates that it could potentially have machines in 25,000+ clinics. Which if actually possible takes the business a hell of a lot further. A quick look if machines where in half of those clinics puts that at a revenue of 180 million at 1500 a month SaaS and 600 million at 4000 a month which are the two bookend prices depending on where the buyer is in the contract.

- The product has been named in the NCCN guidelines leading to 42 payors including the NCCN guidelines in off cycle reviews, only 3 are keeping the review on cycle which will be happening in the next 2-3 months. (2 of these are in the top 5 payors in the US). 17 awaiting notification. This is apparently huge news, with management stating it is very rare to have off cycle reviews, especially this many.

- Mentions competitors and their progress. No one really close.

- <2% churn rate

Con’s:

- Very minimal sales this quarter, I think this is due to the payors waiting on the NCCN guidelines to see where it fits in the treatment of lymphodaema but the next 1-3 quarters will really let us know this.

- Revenue has decreased slightly this quarter. Mainly due to one off payments by pharmaceutical companies ending. SaaS revenue only slightly increased, YoY 25% however failed to mention from previous quarter.

Any thoughts would be extremely appreciated.

Overall I am extremely happy owning this business, will see how they scale and if they do it well hope a take over doesn’t come and can ride the SaaS.

Held RL (33% now, going to try and keep out of the way and not sell any, see how it goes).

Simply a quick reminder for those interested to pre-register for the IPD Investor conference call on Monday morning.

ImpediMed Quarterly Results and Investor Conference Call Notification:

ImpediMed Limited (ImpediMed or the Company) (ASX:IPD) advises it will release its Appendix 4C Cash Flow Statement and Quarterly Results for the period ending 31 March 2023, on Monday 17th April 2023.

Investors are invited to join a live conference call and Q&A hosted by Managing Director and CEO, Rick Valencia at 9.30am (AEST) on Monday 17th April 2023.

To pre-register, please follow this link: https://s1.c-conf.com/diamondpass/10029861-svnw7h.html Registered participants will receive a calendar notification with dial in details and a PIN for fast-track access to the call.

Approved for release by the Managing Director and CEO, Mr Rick Valencia.

The reason I see this business as a buy and so much less risky than when I wrote about it 6 months ago is.

1. It is newly (2 weeks ago) written into the NCCN (national comprehensive cancer network) survivorship guidelines (USA). Made up of 32 “member institutions” hospitals that write the guidelines for cancer care within the USA. They already have machines in at least 20 of them as trials.

a. The aim was to get it in for lymphodaema post breast cancer. Instead they included it for all cancers. Not just for diagnosis but for pre-testing and prevention. Potentially leading to this being a test done before all cancer surgery in those that are at risk for lymphodaema. (Breast, prostate, lymphoma, bladder, ovarian, head and neck)

2. There is no competitor apart from a tape measure. I struggle to see how it doesn’t have at least a 3-4 year advantage (length of peer reviewed medical trial that led to it being written into the guidelines) as a monopoly in the the setting of lymphodaema.

3. Being an anaesthetist myself the clinical examination of water content within the body is such a subjective process. This product turns it into an objective one, that can be used in so many other places eg. Someone presents to hospital with cardiac failure/renal failure, the test is a way to potentially decrease re-admission to hospital and costs to insurance companies. (Thinking business in the US) Or post renal dialysis rather than just using scales to see the distribution of water within the body. The use in these diseases is a secondary area the business is investigating.

4. Multiple buy ins at 10-13 cents (currently 9.6c) post this announcement by management.

So I feel the benefit outweighs the risk and the business is at a massive inflection point. Please give me feedback if you have thoughts as this is my first valuation, coming from a clinical background not a financial one. If you have another view tear this down, baring a takeover or management completely stuffing this up I am too bullish for my own good and need a cold shower.

Currently Market Cap = 166 million

Shares on issue: 1785 mil shares

Price: 0.096 cents

The cost per device is difficult as its on a sliding scale and is SaaS (90% gross margins) with a monthly fee. There is no updated price on their website the last one that I can find (as of march 2021) had it at $1150 US per month for the first 36 months. The final price management states will be up to $5000 per month or $60,000 per year per device. But this is a process over 3-4 years, increasing every year. However I feel the fact it is written into the cancer survivorship guidelines now means they may be able to charge this a little earlier, but this is an assumption and I’ll stick to 3 years. (They have raised the price for them 30% each quarter for the last 3 quarters according to their last quarterly report which would put it at $2526 a month, this is prior to getting it written into the guidelines).

I’m going to try and work out a conservative case scenario:

Calculating only the US part of the business. (Excludes NSW/QLD health and any European sales. There are currently >940 across the world with around 400 in the US and another 200 units needed to be sold to break even according to management.

Management haven’t really given a calculation of how many machines they think is feasible and wether they are targeting outpatient clinics as well. I think there next meeting will help clarify that. I tried to find the amount of hospitals that treat cancer within the USA. The journal of the American medical association (JAMA) in 2021 looked at 1351 hospitals across the US. Now this is not looking at private clinics or diagnostic imaging centres that could also start to use them (or their use in cardiac and renal disease). I’m going to go with what I feel a conservative half of these cancer centres investing in this device over time. Hospitals with 2 devices each. Reference: The Illawarra (wollongong) has a population of about 312,000 and has 3 devices.

Conservatively: That’s 675 hospitals with 2 devices each. 1350 devices total at current price of $30,000 a year each (2500 a month), with potential to go to $60,000 a year each (sounds a lot however would only need to do about 1500 tests a year to break even as a hospital with reimbursement, currently greater than 50,000 tests a quarter total). Leads to somewhere between 40-80 million a year revenue. Given a 3 year time frame at least for the price to increase and if the price can’t increase for whatever reason then I will use the 40million.

Currently management has changed so their was one off expenses last quarter however they say they are on track for 3 million expenses per quarter with 27 million in cash.

Working off the 40million in 3 years, say expenses go up 75% to 20million per year. Keeping the current 90% gross margin that is 18million EBITA and 12 million NPAT.

The average P/E ratio for Australian Biotech companies is about 100. Nanosonic an ASX darling is at 150. This puts it at a market cap of about 1.2-1.8 billion dollars or 7-8 times more than it is currently worth. Not sure if I can just discount back at 10% with market Cap changes the range to 900 million -1.45billion. With the number of shares on issue this puts my valuation at 50 cents. I am going to halve the P/E ratio to 50 from the average to add an extra bit of safety. so therefore 25 cents.

At the end of the day I can’t see how this company will not be worth more in 3 years time than it is now. I have tried to use conservative numbers, but so much of it is just a guessing game when a company is at an inflection point. However there is no competitor, with the peer reviewed research further validated in guidelines.

The NCCN survivorship (US cancer guidelines that all the major hospitals use) guidelines are out and it’s good news. The company now has their product written into them. There are no other competitors to this other than a tape measure and a set of scales. I hope they don’t get a take over offer from Medtronic or similar.

This means that both their pathways to reimbursement in the US have gone well and this will accelerate sales.

- private payer reimbursement already achieved with main insurer in 12 states through case assistance program demonstrating clinical need.

- NCCN survivorship guidelines have now established it as a standard of care. Now the question is how well does management scale and how quickly.

Still not profitable but 26.2 million on hand with a projected cash burn of 3 million per quarter gives it a good buffer.

Pros: SaaS model with low churn rate 2% with 90% gross margins on this stream of income. monopoly on this type of testing.

cons: how will they scale this, other heart failure and chronic renal arms will be even bigger and will require capital.

Below is the new guidelines which mention the specific product. Critically it recommends regular testing as early stages can be reversed.

Held IRL 13% of portfolio.

Since my Bull case the updates are:

1. Genesiscare oncology arm has announced it will pilot 5 SOZO units to Lymphoedema screening services in the US, with view for wider implementation. Genesis care is a large multinational with 440 cancer/cardiology/sleep medicine centres across the UK/US/AUS/Spain.

2. NCCN guideline updates are under review.. What are the chances that it gets written into the US cancer guidelines first time. BIG upside if…. But who really knows. Will likely have an answer prior to Christmas, but these things can go back and forth for 6 months.

3. About 5million shares purchased at market price over last month by board members. 2 million (approx 150k worth) by interim CEO.

4.Presentations at cardiology conferences recently in their heart failure arm.

Really at the end of the day I think the swing is mainly on sentiment towards a positive NCCN guideline result plus larger centres like genesis care recognising the product, trialing it then implementing it.

To break even the CEO stated another 200 units need to be sold. Currently 1,100 units in circulation globally (includes those in trials which are not monthly contracted) with 500 in the US business. I’m finding predicting revenue hard to model as the SaaS licensing is kept under raps and negotiated differently with each major centre. Currently based on revenue a device gets about $1,100 a month working backwards from revenue and number of devices. However in explanation of the 200 units to break even is the ramping of pricing which is increased every year with the thought that a device will be able to get up to around $5000 a month or 60k a year. Outside contracts for trials that would result in about 700 devices in the US and is easily the break even. However a lot of IF’s and what will be the churn rate when the price increases.

I am still bullish however the share price increase of this magnitude recently is based on no real results at this time other than than the positive wins from insurers in the US and Pilot programs with large oncology companies. Speaking of this I will ask the company the timeframes of these pilot programs. If the NCCN comes back negative expect to be back at 5-6 cents. I’m for 5 years time so don’t really care.

Held and now 10% of portfolio.

Hi, this is my first post. Coming from a health background as an anaesthetist my business knowledge is poor. So I can easily get caught up in an idea that I think is good but struggle to understand the amount of money that is needed to realise that. That is why I am on this forum to help gain a better understanding while also hopefully bringing a few medical ideas that I think have very good clinical application and are best in class. Please feel free to rip apart my reasons.

ImpediMed 6.2c Market cap 110million. Still early on, making a loss. What I like about it is the gross margins of 90% (on main SaaS product) and best in market that is peer reviewed research to back it. Also a game changing way of evaluating fluid status in patients. The right leadership with the new CEO having a long term background in medical insurance in the US for the runway to reimbursement (this will determine I think when, not if it becomes profitable and the main point of conjecture). I like the combination of SaaS model into health care from a business perspective, from a societal perspective not so sure. Issues like with all small cap medical companies, will it become profitable before the next dilution.

I am a buy currently as I think the long term upside outweighs the risk.

Overview:

ImpediMed produces a group of FDA cleared bioimpedence spectroscopy devices including its main flagship SOZO for multiple indications with the focus currently on lymphoedema, Heart failure and Renal failure.

It does this by providing a snapshot of fluid status and tissue composition in 30 seconds. Results are available immediately online with easy data access for sharing across an entire health system. The primary business has positive peer reviewed research backing the early detection of secondary lymphoedema (post breast cancer). The idea is to provide treatment earlier than the current gold standard of a tape measure. Secondary use will be the development in fluid status for patients living with Heart failure and renal disease. The idea here will be it is used to determine readmission rates (high cost to health care in the US) as well as medication changes in these chronic diseases. (The closest competitor is the tape measure, a set of scales or a physicians subjective fluid exam, having done 1000’s of these subjective exams in my life it is amazing this is still the basis for fluid management including medication changes)

The research the product is based around (See at the end of this for a longer summary, admittedly from the 2022 shareholders report, but it is a peer reviewed, randomised controlled study and statistically significant for primary endpoints.

Other notes are:

- AstraZeneca is currently using the SOZO in a trial for renal failure resulting in revenue of 5.5million but more importantly adoption of the product for clinical decisions in the future.

- Monopoly of cross site clinical data for research in the future.

The Results of PREVENT trial 2021 (see below for more info)

1. The trial met its primary endpoint.

2. In patients with early detection using L-Dex, intervention resulted in a 7.9% rate of chronic lymphoedema compared to a 19.2% rate of chronic lymphoedema in patients with early detection using tape measure (p=0.016).

3. represents an absolute reduction of 11.3% and relative reduction of 59%.

4. 92% of patients with early detection of cancer-related lymphoedema using L-Dex and intervention did not progress to chronic lymphoedema.

5. A risk-adjusted analysis showed a significantly consistent benefit of L-Dex monitoring in a large group of patients with key risk factors for BCRL including body weight, stage of cancer, type of cancer surgery, lymph node dissection, chemotherapy, and radiation (odds ratios: 0.23-0.39).

In summary this is pretty significant.

Business:

880 SOZO units globally including in Kaiser permanente, mayo clinic, cleaveland clinic and NSW health to name a few.

Ok where to start:

Total revenue: 10.6 million Increase of 26% PCP

Gross profit of 8.8 million

Cash on hand of 40 million due to smart capital raise at 15c (current share price 6 c).

SOZO revenue however SaaS in nature with ARR 7.3 million 19.3% PCP

- Note that under the pricing model years 2-3 of contract have increasing in price and 7.3 million in 2022 will be considered around 10 million in 2023 with 34% increase in monthly licensing fees.

Gross margins: 90% on SOZO revenue.

Churn rate globally of 2%.

However:

Net loss of 19.8 million down from last year of 20.7 million.

16.4 million of that is salaries and benefits but decreased from previous year.

Gives two years to become profitable. So works on the premise of much higher rates of adoption with the CEO’s aim to become profitable before then. This is assuming the business is getting close to its inflection point. That being early reimbursement with the help of the National comprehensive cancer network (this is not a given and may take longer) and 99% wins on reimbursement through networks.

Note the tests here are important as the Data that is collected is stored by ImpediMed at the moment and may become a very important tool and the largest data set for specific diseases.

CEO (interim):

- Recent change and I think for the better. Worked for Health now New York as CEO, so a large insurance company. This will help in working out reimbursement.

Remuneration packages:

It seems like the 1 year bonuses are cashflow based and the 3 year are both cash flow and share price based. Not keen on the share price being a reason for remuneration but at least it is over a 3 year benchmark.

Information bias’s:

Local: I work in a healthcare institution (NSW health) that uses these. I do not use them, however my friend does and anecdotally it decreases the amount of time she has to spend with a patient and provides her with reproducible reliable data. Which she actions with treatment at a far earlier time along the disease process. Prior to this she was measuring multiple different circumferences of the arm and comparing them with previous measurements. This device allows her to see more patients.

Personal: My own bias is seeing the amount of work that goes into Breast cancer vs any other cancer. Due to the high community recognition and the amount of people that it touches this is a very well known disease. As an anaesthetist I see quite a few people with lymphoedema as I am not allowed to do any sort of intervention such as a cannula on their arms or blood pressures. It has a high morbidity once the patient has it and really does effect their lives. There is however better and better treatments for breast cancer that would be great from a societal perspective and could lead to a decreased burden of disease however heart disease and renal failure are never going away.

Summary:

Positive:

Healthcare product (difficult to for competitor just to spring up), that has a SaaS model with large gross margins >90%. A positively peer reviewed randomised controlled trial that is currently being reviewed by the NCCN (25thAugust 2022) which will give 2 ways to get reimbursement in the US. The other tradition way of appeals and case assistance program has a 99% win rate on 3600 cases, with the current CEO’s knowledge in the insurance industry paving the way forward. The churn rate of 2% is stable.

Negatives:

Branching into cardiac and renal too quickly could result in costly trials before the business is profitable, if the NCCN does not approve or takes it’s time (if its anything like the Australian version) this will extend the runway. However the counter argument is the appeals process for reimbursement is a much higher win percentage than other areas of care that have won reimbursement (referencing the CEO for this statement). Still not profitable and at its current growth will not be profitable prior to needing another capital raise.

More information on the primary trial that is being used for National comprehensive cancer network (NCCN) approval a set of US guidelines for baselines of care.

PREVENT Trial Peer Reviewed and Published The Group announced that the PREVENT Trial results have been peer-reviewed and published in Lymphatic Research and Biology, a journal dedicated to research on lymphatic biology and pathology from the world’s leading biomedical investigators. The study demonstrated that intervention in patients with early detection of cancer-related lymphoedema using ImpediMed’s L-Dex technology resulted in a lower rate of progression to chronic disease than patients with early detection from volume measurements using a tape measure, a result that is statistically significant.

The results were as follows

6. The trial met its primary endpoint.

7. In patients with early detection using L-Dex, intervention resulted in a 7.9% rate of chronic lymphoedema compared to a 19.2% rate of chronic lymphoedema in patients with early detection using tape measure (p=0.016).

8. represents an absolute reduction of 11.3% and relative reduction of 59%.

9. 92% of patients with early detection of cancer-related lymphoedema using L-Dex and intervention did not progress to chronic lymphoedema.

10. A risk-adjusted analysis showed a significantly consistent benefit of L-Dex monitoring in a large group of patients with key risk factors for BCRL including body weight, stage of cancer, type of cancer surgery, lymph node dissection, chemotherapy, and radiation (odds ratios: 0.23-0.39).

The paper concluded the following:

These statistically significant results demonstrate that bioimpedance spectroscopy (BIS) screening should be a standard approach for prospective breast cancer-related lymphoedema surveillance.

BIS is more specific for lymphoedema detection than tape measure (TM), as it had fewer triggers and longer times to intervention trigger.

While the BIS protocol can be easily replicated in clinical settings, the rigor of the TM protocol for this study exceeded what is practical in most clinics. Thus, BIS may offer even more benefit across clinical settings than what was demonstrated in this study.

BIS, as compared to TM, provides a more precise identification of patients likely to benefit from an early compression intervention.

The PREVENT Trial is a seminal study, the largest randomised controlled trial to be conducted on patients at-risk of lymphoedema. The study enrolled >1200 patients across 10 trial sites in the US and Australia, involving 13 hospitals. Of these, 3 of the 9 US sites are National Comprehensive Cancer Network ® (NCCN) Member Institutions. The trial was conducted over six and a half years and patients were followed for up to three (3) years, with primary aim to determine if subclinical detection of extracellular fluid accumulation via bioimpedance spectroscopy, and subsequent early intervention, reduces the rate of lymphoedema progression relative to the rate when using tape measurements.

22/4/21 FDA Clearance for SOZO Heart Failure Index

Brisbane, Australia – ImpediMed Limited (ASX.IPD), a medical technology company that uses bioimpedance spectroscopy (BIS) technology to generate powerful data to maximise patient health is pleased to announce the United States Food and Drug Administration (FDA) 510(k) clearance of ImpediMed’s SOZO® device to include a heart failure index (HF-DexTM) as a monitoring tool for patients living with heart failure

- SOZO HF-Dex analysis provides an objective measure of fluid levels to assist in the clinical assessment of heart failure patients. The HF-Dex analysis is obtained through a simple, noninvasive, easy to administer, 30 second test.

- HF-Dex, when used in conjunction with other clinical data, can be useful for clinicians to risk stratify heart failure patients with fluid management problems.

- HF-Dex is presented together with normal fluid volume reference ranges.

- The results are displayed graphically to enable tracking over time (example below).

- Reference ranges are provided from grey to dark blue to help visualise increases in extracellular fluid as compared to a normal healthy population.

- HF-Dex provides medically meaningful and actionable data which allows clinicians to more effectively and efficiently manage heart failure patients

DISC: I hold

SOZO Clinical Utility in Heart Failure Published

Brisbane, Australia – ImpediMed Limited (ASX.IPD), a medical technology company that uses bioimpedance spectroscopy (BIS) technology to generate powerful data to maximise patient health is pleased to announce that the full peer-reviewed manuscript demonstrating the clinical utility of ImpediMed’s SOZO device in monitoring heart failure patients has been published in Frontiers in Cardiovascular Medicine.

The publication, titled Clinical Utility of Fluid Volume Assessment in Heart Failure Patients Using Bioimpedance Spectroscopy, describes the BIS-derived HF-DexTM values, Extracellular Fluid expressed as a percentage of Total Body Water (ECF%TBW), in a clinically relevant way that can be used by physicians to aid in clinical risk stratification and fluid volume monitoring of heart failure patients.....

DISC: I hold.... I see the results as being a bit ambivalent (but are they?). I think I need another report done more in layman's terms? or at least to give some $ figures (projections)

ImpediMed’s COVID-19 US CARES Act Loan Forgiven

Brisbane, Australia – ImpediMed Limited (ASX.IPD), a medical technology company that uses bioimpedance spectroscopy (BIS) technology to generate powerful data to maximise patient health is pleased to announce that the Paycheck Protection Program (PPP) loan under the U.S. Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) has been forgiven in full.

In May 2020, the Company announced receipt of loan proceeds of US$1,140,202. Forgiveness of the loan required the Company to file for forgiveness through the Small Business Administration (“SBA”) after meeting certain requirements related to the use of funds. The Company’s request for forgiveness of the PPP loan was fully approved and the SBA loan is now paid in full. All obligations under the PPP promissory note have been satisfied in full.

About the Paycheck Protection Program The PPP is a program administered by the U.S. SBA that awards loans to help businesses keep their workforce employed during the Coronavirus (“COVID-19”) crisis. A borrower can apply for forgiveness once all loan proceeds for which the borrower is requesting forgiveness have been used.

For a small cap this is really good,

Disc: I hold

Revenue Summary:

- Record period for Total Revenue for 1 st Half FY’21 of $3.6 million, +26% the previous corresponding period (pcp) (1st Half FY’20: $2.8 million).

- Record period for SOZO® Revenue for 1 st Half FY’21 of $3.3 million, +54% pcp (1st Half FY’20: $2.1 million).

- Record period for SOZO SaaS Revenue for 1 st Half FY’21 of $2.3 million, +48% pcp (1st Half FY’20: $1.6 million).

o SOZO SaaS Revenue of $2.0 million from Core Businessi , +25% pcp.

o The appreciating AUD is underrepresenting the strength of the SaaS Revenue from the Core Business in the translated results. When reported in USD, SOZO SaaS Revenue from the Core Business was +36% pcp.

o SOZO SaaS Revenue of $0.4 million, when rounded, from Clinical Businessii .

Cash Flow Summary:

- Cash on hand as at 31 December 2020 of $19.0 million.

- Cash receipts from customers for 1 st Half FY’21 of $3.3 million.

- Receipt of an additional $8.0 million, before costs, during 1 st Half FY’21 from the exercise of options issued to subscribers in the entitlement offer. o A total of $9.1 million has been received for the first three expiry periods. o There is potential for up to a further $9.1 million to be raised by 31 March 2021, from remaining options issued in the offer.

- Net operating cash outflows for 1 st Half FY’21 of $6.6 million, which is significantly better than the forecasted $8.0 million net operating cash outflow announced to the market on 27 October 2020.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02343954-2A1281747?access_token=83ff96335c2d45a094df02a206a39ff4

- DISc: I hold

American College of Cardiology Accepts SOZO HF Abstract

ImpediMed Limited (ASX.IPD), a medical technology company that uses bioimpedance spectroscopy (BIS) technology to generate powerful data to maximise patient health is pleased to announce that an abstract evaluating the use of ImpediMed’s SOZO® BIS technology in identifying heart failure (HF) patients at risk of hospital readmission at the time of discharge has been accepted for poster presentation at the American College of Cardiology (ACC) 70th Annual Scientific Session on 15-17 May 2021 in Atlanta, Georgia, USA....

“The ACC annual meeting is the leading scientific session for US cardiology and has global reach,” commented Richard Carreon, Managing Director and CEO of ImpediMed. “Presenting data here lends important credibility to our technology and its potential to integrate into existing patient care pathways for the reduction of hospital readmissions. These results will support our commercialisation effort in heart failure, which is one of our three strategic focus areas.”

Disc: I hold