Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

The Good

- Operating expenses remain flat.(Slight increase in admin costs over the last couple of quarters)

The Not So Good:

- No growth in ARR and Revenue QoQ. Revenue for H1 is down on H2FY23.

- SaaS revenue is not growing as a portion of total revenue. Sitting at 52% for H1FY24 which is the same as what it was in H1FY23.

- Only $2.5m in cash available at the end of the quarter. (After $1m placement with Maptek). There is an additional $2m in an undrawn loan facility, but this does not leave much room before another placement may be looking necessary. Q4 has typically been the strongest quarter for cash flows which may assist slightly.

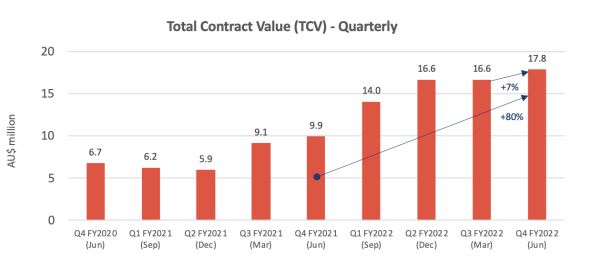

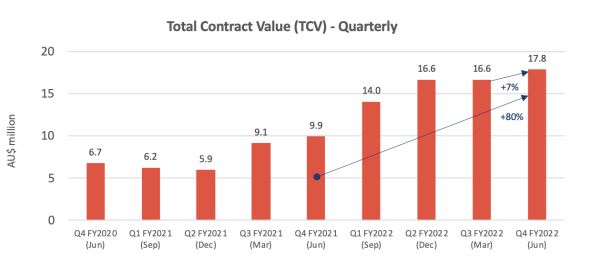

- TCV dropped from $17.7m to $16m which shows forward contracts are not replacing delivered work. Not included as a chart in the Q2 update.

Watch Status:

- Downgraded further due to stagnation of wins and low cash position

Valuation Status:

- Shifted weighting from bull case leading to decrease in valuation

What To Watch:

- Strategic review ongoing without any substantial updates. Likely leading to a whole business sale? Maptek is currently a substantial holder and would be the most logical acquirer.

- New global sales leader appointed in October 23 leading to a “considerably strengthened” pipeline for H2. (No announcements to date in Q3)

- New sales role to assist in expanding into adjacent markets (No announcements to date in Q3)

- Partnership with Asset Assurance Monitoring in the U.S to distribute dams and tailings solution.

- Reduction in investing spend. This has the potential to impact improvements in software and ongoing development.

- Release of update to JORC code. Likely not until the end of 24. Reported as "immanent"

- Migration of clients across to new Resource Disclosure modules started with Newmont Mining. Newmont migration to be completed by April / May.

The Good

- ARR continues to improve and is up 5.3% QoQ to $7.9m

- Second platform added for Roy Hill with TCV of $2m

The Not So Good:

- Cash position is in a precarious position even after the capital raise which has led to a strategic review to identify the best structure for access to capital. This is due to an increase in negative operational cashflow for the quarter along with $863k of investing expenses.

- Roy Hill was the only material contract awarded during the quarter.

- TCV remains steady at $17.7m

What Status:

What To Watch:

- Product release process should help onboard the current projects in progress: Anglo American, Arcelor Mittal and Eramet. Completion of implementation milestones should assist in improving revenues after a decrease in Q1

- Maptek continues to build a position with $1m placement at premium to share price. This has increased their holding to 17.7% with a further 12 months standstill agreement.

The Good

- Quarterly revenue at $4.0m up from $3.4m the prior quarter. Revenue has tended to be lumpy from quarter to quarter, so it is likely that this may not be as high in Q1FY24. Revenue for FY23 is also up 28% on FY22 which indicates although K2F has had some issues with cash burn, they still are maintaining a reasonable growth rate.

- Free Cash Flow positive for the quarter with $400k added to cash reserves. This leaves a cash balance of $4.4m (along with the working capital facility of $2m). Cash reserves have been an issue for K2F in the past, however with the improving quarterly cash flow position, this may be enough to reach a position where no further capital raises are required. Note. K2F has been in this position before, but then cash receipts quickly fell away in the following quarter.

- No significant changes in operating expenses, however staff costs are rising again.

- ARR $7.5m and TCV $17.7m are both slightly higher than I was forecasting in an earlier straw. (After quarter end a new contract with Roy Hill puts these figures now closer to $7.8m and $19.7m)

The Not So Good:

- Material contract signings are quite infrequent with only 2 announced in Q4FY23 and none in Q3

What Status: Turning

What To Watch:

- Mineral Resources & ArcelorMittal contracts were announced in November so these contracts should be live in Q1FY24.

- Time to implement Eramet & Roy Hill contracts

- The 12 month standstill agreement with Maptek expired in April. Given the current weakness in K2F’s share price, Maptek may look to continue to build a position in the company. (Carried over from the previous quarter - No indication of this yet)

- Further details on Maptek collaborations / integrations

K2F has closed out what has been another quiet quarter with 2 new contracts.

New customer to K2F, which is a positive sign that customer base is growing (albeit very slowly)

BHP extending their 1 year contract to 3 years demonstrates that they are happy with K2Fs product, however K2F may not have much pricing power with new customer contracts as the ARR rate has only increased ~7% and is held for 3 years ($664k up from $620). I'm not sure how much their hosting and support costs will increase over this period, but likely at a higher rate than that. What is also positive is this ARR will be effective immediately as the contract is already up and running.

Overall there should be some minor improvements over last quarters numbers from the above contracts (Note: estimated values)

TCV

- $17.1m @ end of Q3

- +$2.55m

- -$1.55m RR

- -$0.3 implementation (estimate based on anglo america)

- $17.6m which is down on $17.8m in Q4 2022 but still indicates around 2 years of contracted ARR

ARR

- $7m @ end of Q3

- +$0.82

- -$0.62

- $7.2m which would be ~20% increase from $6.0m in Q4 2022

The Good

- Revenue for Q3 improved over previous quarters to $3.4m.

- Staff expenses have largely levelled out after previous spikes.

The Not So Good:

- Total Contract Value has taken a hit for the first down and is down on the previous quarter. This indicates that as K2F is delivering on projects and services, they are not replacing this with new work along with no new major contract wins announced this quarter.

- ARR is flat for the quarter but up 35% over the pcp.

- Cash balance of $4m provides ~ 1 yr runway (including investing expenses) which given funds were raised only 12 months ago, additional capital could be hard to come by. Operating cash burn continues to improve, however cash receipts have been lumpy over previous quarters.

What To Watch:

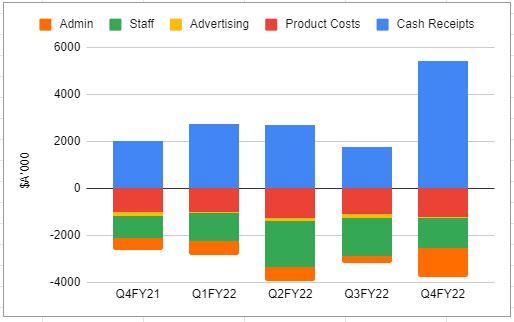

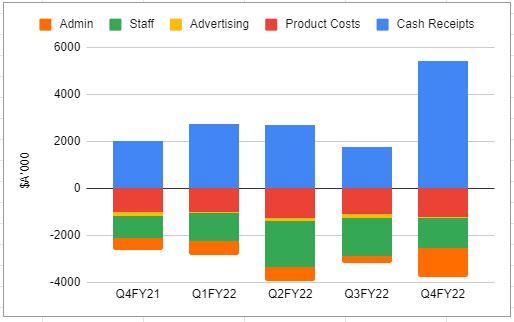

- Product costs are significantly up on previous quarters. This along with the increase in invoices raised over the quarter of $3.6m may indicate a rise in cash receipts for Q4. This will likely still be down on the $5.4m in Q4FY22.

- So far the land and expand strategy execution is questionable as there haven’t been many significant additions across the existing customer base.

- BHP ground disturbance & Rio Ground Disturbance have gone live. These were announced in May 22 & Nov 22 respectively. So in the future I need to factor in 6-9 months of implementation time before ARR goes live.

- The 12 month standstill agreement with Maptek expired in April. Given the current weakness in K2F’s share price, Maptek may look to continue to build a position in the company.

The Good

- Minor growth of ARR and TCV. This would have been a bit higher, however the result has been negatively impacted by the cancellation of the Rio contract.

- Expenses continue to remain controlled reducing operating cash burn

- The quarterly doesn’t provide much new information outside of the previously announced contracts, however there were several large customers signed to new contracts at the end of the year.

The Not So Good:

- Cash receipts are still lagging behind the growth in ARR & TCV and continue to remain cyclical. This can be seen if the timeline on the cash receipts chart is extended a bit further than indicated in the report.

- Cash balance down to $5m which gives only 4 quarters of cash available. There was no mention of the expected time to reach a cash flow neutral / positive position. I would expect this to be around the $4m mark.

What To Watch:

- Further Resource Reporting platform contract wins

- Additional contracts with Anglo and ArcelorMittal would be a positive confirmation of the land and expand strategy.

- Further capital raises?

Ouch. The day after I write a post about the positive momentum that K2Fly is starting to generate, they come out with a doozy of an announcement as Rio walks away from the remaining 4 years of a 5 year contract. The original contract value was for $3.44m with $2.6m remaining.

ARR is now likely back down around $6.5m and TCV $18.4 inline with the numbers at the end of Q1.

Rio is one of K2Fly’s largest customers, and has contracts for multiple models across the K2Fly range, so this is a significant warning sign going forward.

The only potential silver lining in this cloud is that Rio has only just recently (21st November) signed a new 3 year contract for the resource governance module which is an indication that the issue is not with K2Fly itself, but more the ground disturbance platform. Currently out of the major companies only two remain who are using this.

I think this space will be very hard for K2F to compete in going forward with the likes of 3DP itching to get into the mining space. Readily updatable, navigable, visual, permitting systems are where this space is heading and I don’t think K2F can currently compete with their technology base. The partnership with Maptek may help in this area, but time will tell. The ground disturbance software doesn’t form the backbone of my thesis as the key compliance software modules are the tailings management and resource disclosure but this will need to be watched closely.

K2Fly ended November strongly with a series of announcements for contract wins:

Rio entered $360k contract with 3Yr $75k ARR component - First sale of the new Reconciliation model with a Tier 1 Miner

Mineral Resources entered $1.75m contract with 3 Year $475k ARR component - Use of Ore Blocker platform which is currently a smaller part of K2Fs sales

ArcelorMittal entered $1.9m contract with 5 Year $332k ARR component - First contract with the company. AcelorMittal operates globally offering further exposure for K2Fs product offerings, where Australian customers make up 60% of the customer base

The series of contract wins has added a nice improvement to the TCV and ARR metrics as we enter end of the quarter

The series of contracts wins follow updates to the platform and integration with the Maptek offerings which was previously forecast for a December release so its good to see K2F meeting their targets and contracts being announced around the same time. This is potentially a coincidence with the timing however it is something to continue watching over the coming months.

*Screengrabs from the AGM presentation slides

The Good

- Ongoing ARR growth to $6.5m, however growth rate is still slower than expected.

- Total Contract Value growth to $18.8m which demonstrates ending contracts are being renewed / replaced.

- Operating expenses levelling out, which should improve cash flow in coming quarters. This is important with the low cash balance.

The Not So Good:

- Cash receipts decreasing over previous quarters and lagging growth comparable with ARR growth

- -$2.1m in Free Cash Flow with only $6.1m in cash available

What To Watch:

- New K2F Resource Reporting platform to be released in December. First integration with Maptek since their strategic investment

- Started reporting quarterly revenue as a metric to capture one off consulting revenue which made up 55% of total revenue in FY22.

- Potential further expansion of sites under contract with Imerys

Contract Wins

K2Fly finished Q1 with a pair of contract wins. The first being a $1.2m contract for software development services for Fortescue. This is to be delivered over a period of 6 months with no ongoing services revenue.

This is a substantial win for the consulting side of the business as the total value of similar revenue (time and material) in FY22 was $3.54m.

Another positive of the contract announcement is the potential upselling of other product lines when working with the companies IT and services teams. Currently FMG only uses 3 of the 9 products in K2F’s suite.

Working directly with clients on tailored systems also provides K2Fs team with specific insights into their customers needs and problems that need solving. While they may not be able to use the exact products they develop, there will be opportunities to take learnings to improve the existing systems.

The second contract is with Imerys group for use of the Land Access solution across 15 of their sites. The value of the contract is $860k with $123k of ARR over 3 years.

Whilst this ARR announcement is down on other recent announcements, the long term potential for this contract is that Imerys operates over 200 sites opening up opportunities that if Imerys find value in the software, it may be expanded across some of their other sites (~$8k per site / year).

At a rough estimate these two contracts should take ARR to ~$6.12m ($6m at Q4) and TCV to $18m ($17.8m at Q4 less $1.5m in delivered services)

The Good

- Cash flow positive quarter of $1.7m. This was driven by a significant increase in cash receipts for Q4 at $5.4m. Timing of cash receipts are likely to be lumpy going forward given some of the commentary around operational cash flow, this positive quarter along with the increase in invoices raised for the quarter means that going forward cash burn is likely to be reduced. With $8.2m of cash available, it is looking like there shouldn’t be any need for capital raises for ongoing business operations.

- BHP is now a customer. Given the extent of BHPs operations, there is an opportunity to sell other products and extend the use of the Ground Disturbance Software

- No significant change in product costs as ARR continues to grow, hints that there is potential there for operating leverage as further deals continue to be signed.

The Not So Good:

- ARR is up ~ $800k to $6m. On first glance this number is decent being the largest increase by value in the last 2 years, however this looks to consist of two contracts: The 1 Year BHP contract for $620k and $145k for Asarco. The rate of contracts signed has slowed over the last year which can be seen in the ongoing total contract value. I had expected that potentially the Maptek investment may lead to a burst of new contracts, but this may require a bit more time given the deal is only recent and the end of the financial year.

What To Watch:

- Cash receipts next quarter. I expect this to be down on the current quarter and more inline with the invoiced value of $3.8m

- Cost control looks to remain an ongoing focus with staff costs coming down, however this has been offset by a large increase in admin and corporate costs.

- Further updates on the fraud in overseas operations. No news in this update.

- Rate of contract wins amongst both existing and new customers. If this remains low it will be a sign to review investment thesis.

The Good

- ARR up 8% QoQ to $5.2m, which although has slowed compared to previous quarters, is still up 78% YoY.

The Not So Good:

- Cash outflow of $1.4m leaving cash balance of $1.5m. This has been boosted by the $6.2m investment by Maptek.

- Cash receipts down for Q3, however invoices are up to $3.3m so can expect higher cash receipts for Q4. Estimating around $1 operating cash burn next quarter, so the company needs to keep an eye on expenses otherwise there is only around 1 year of comfortable operating cash available.

What To Watch:

- Expanded client deals following Maptek investment. Even within the existing client base K2F still has a lot of potential for cross selling of products

- TCV has levelled out for the quarter which means some contracts are coming to an end. If these are on the smaller side, will only be able to determine at the next TCV update.

- Further updates on the fraud in overseas operations

- $2.1m Contract signed with BHP post Quarterly for initial 1 year ground disturbance across Iron Ore operations. (Worth ~ $620k to ARR if signed to a longer contract. They have called the 1 year portion ARR, but it’s a little presumptuous to call a 1 year contract recurring.)

K2F recently came out of a trading halt to announce that they have a new strategic investor in private mining software and services provider Maptek. In a $6.2m capital raise Maptek will end up as a 13.2% shareholder in the company.

First take-away from this is that the expected capital raise has surfaced, with the intent for ‘product development and working capital’. This will provide some further short term relief for funding ongoing operations during the growth stage.

Second, although the raise was for working capital, having a company like Maptek involved potentially opens a lot more doors for further sales opportunities for K2F through their existing user base. Although it looks as though there are existing integrations in place, I imagine through the investment Maptek will look to expand this further across both offerings.

https://k2fly.com/integrations/

Maptek has been limited in expanding their stake beyond 19.9% within one year. It will be worth noting if they continue to add to their holdings over that time. This would be an indicator on the goals for the ‘strategic’ investment. Perhaps they may be looking for a reverse take-over or looking to try to get ahead of competitors like Pointerra in providing a more complete offering.

On a side note, I really was hoping that 3DP would take a partnership with K2F, given their ambitions in the mining space and previous connections, but it looks like this is off the table now.

It will take a little while before there are likely any noticeable flow-ons from the investment but it will be something to watch in FY23.

K2F has had a mixed bag of a week, starting with the potential losses from the fraud event that @Noddy74 has previously posted increasing from $323,500 to $745,000.

It’s not a great look for a company that provides governance solutions to have had internal fraud issues, however the company is proactively addressing these and there may be avenues for some recovery. I see this as an unlikely outcome and this will be an additional cost the company has to bear (and consultant fees) at a time when cash is already an issue.

This has then been followed by two new contract announcements totaling $1.548m.

Around $400k of this is for implementation which depending on the billing cycle should offset some of the increased staffing costs. If we continue to see a few more announcements of this size in the near future, it will provide a level of confidence in management that they are executing to plan when upsizing staff levels and incurring additional operational costs prior to contract awards.

These two announcements also take the current ARR to ~$5.2m, up over 50% on end FY21 numbers and running on track for ~10% total growth for Q3.

From these updates I’d like to see the company hit the following near term goals to reaffirm my original thesis:

- Resolution of account audits and confirmation from management that systems have been put in place to prevent recurrence.

- ARR by end of FY22 at $5.8m

- Progressive reduction in cash burn over H2FY22 leading to cash flow positive report for Q1FY23.

The Good:

- Annual Recurring Revenue continued solid growth, now up to $4.8m (18% QoQ growth). This was mostly covered in the previously announced major contract awards.

- Increased deal average contract size. Given that not many contracts have been signed in H1FY22, I don’t think too much should be made of this, but it is still a positive sign.

The Bad:

- Significant increases in staff costs. I raised this in a straw 4 months ago, and this expense goes both ways for me. If they are increasing with the confidence that it is to facilitate growth in the software product offering then this is a good thing. The issue is that this cost has been increasing every quarter. If the software side of K2F has similar requirements to the consultancy side of the business then it’s unclear how the business will reach profitability.

- With a cash balance of $3.6m, this gives K2F 2 quarters of runway left based on Q2 cash out flow. A big section of the update was spent with justifications and reassurances that cash is coming, however the signs of an upcoming Capital Raise are there.

- Outside of the major contracts announced to the market, only two other contracts were awarded during Q2 with a value of around $200k. The company doesn’t need to be signing agreements every other week but to reach the medium term goal of $20m ARR a portion is going to need to come from the Tier II & III miners, which will be on the smaller value side. A fall off in contracts to this end of the market may start to signal a ceiling on the growth in the market that K2F can achieve.

What To Watch:

- Invoices raised have been flat for the last 3 quarters. This metric should be starting to increase in line with the ARR, however depending on billing cycles it will be lumpy until more contracts are awarded.

- The update is forecasting additional wins specifically for Tailings and Ground Disturbance platforms. A few announcements in this area will be a nice boost to confidence in management going out and doing what they say they will do.

- Once again making the list is management of cash outflows going forward, particularly now that the cash buffer doesn’t look as comfortable as it did in Q1.

Impacts To Price Forecast:

- My forecast needs to be adjusted to account for an increased ARR target

- Include potential Capital Raise in the near term adding to share count

- Decrease in multiples for market uncertainty - currently priced at ~6.6 x ARR

K2F released the Q1FY22 quarterly which highlighted the positive start to the year the company are having. Nothing significantly new was in the announcement, however it was a reinforcement of the recent contract wins. 20% ARR growth was recorded for the quarter with current ARR value sitting at 4.7m post September which is comparable to my previous estimate of 4.6m.

Another key point to note is a net operating cash outflow of $159k was reported for the quarter. K2F is likely to reach positive operating cashflow territory in the near future given the ongoing increase in contract value as long as there are no significant changes to organisation costs.

Items to watch:

Conversion of the PoC Tailings contract to an ongoing service contract will cement the market appetite for the Decipher offering.

K2F continues to add to company ARR with an annoucement today with a further $620k taking total ARR to ~ $4.6m (my estimate) from $3.38m at the end of FY21.

The contract with Rio demonstrates K2F starting to execute on their land and expand stratetgy, being able to offer a wide range of services to the biggest players in the mining industry with the Ground Disturbance solution being the 5th out of the 9 products K2f offer that Rio is now utilising.

A few days late on the notes for this one, but a solid announcement for K2Fly showing some good traction with the newly released tailings solution.

Key takeaways:

This announcement adds $475k (increase of ~13% to ARR at my estimate). My recent FY22 price target had an ARR of $4.3 million. This deal should take the current ARR to just over $4 million, so at this rate, my target is going to be well and truly exceeded.

It is stated that this is the fifth ICMM member to sign up for the tailings solution. The previous announcement for Alcoa in August stated they were the third, so there has been another deal signed between these two, however likely it is only minor to not warrant a market update.

Using the values from this deal and the Alcoa deal, it puts a rough value of the ARR rate per tailings facility in the range of $12.5k to $25k. This may assist in looking at the value of potential contracts with other ICCM members as an input for future forecasts.

As @francisfogliani noted it’s also good to see the deal with Descartes Labs getting some early runs on the board.

Disclosure: Held

There were two Director on market purchases today to the value of $33,577.65 with the main one from outgoing CEO Brian Miller ($26,436.65). Brian is still going to be involved going forward but in a reduced capacity. I feel seeing on-market purchases from the Board is generally a positive indicator and can be taken as a vote of confidence in K2F’s future prospects.

Disclosure: Held

Having a bit of a scan through the preliminary final report to try find some indicators on how my thesis is playing out for K2F given the share price has been on a bit of a slide for some time now.

The main thing I think I have overlooked in my initial reviews of the company is assuming that K2F is a full technology company. Currently the sales of software only makes up 37.5% of revenue.($2.6 million in FY21 up 113% on FY20). At the last announcement on 06-08-21, ARR has grown to around $3.5 million so growth in this area is continuing.

Putting together a rough price target for FY22:

Assume consultancy revenue stays flat at $4.3million (no change from FY20 to FY21)

Assume ARR reaches 50% of total revenue $4.3 million

Total Rev - $8.6 million

Maintaining current Price / Sales ~ 5 = MC $43 million

Using current Price / ARR ~ 13 = MC $55.9 million

Take the middle of the two given annual revenue growth ~ 23% = MC $49.5 million & a share price of $0.36 which is +40% premium on current price. Based on this I will continue to hold while I continue to research further.

Things to watch:

Current CEO has stepped down as of 01/09/21 and management is restructuring. Replacement CEO is being promoted from within the company so there shouldn’t be any major changes in company direction.

Continuing contract announcements leading to growth in ARR which is the basis of price forecast.

Growing employee expenses. This cost grew significantly over FY20 and currently makes up a significant portion of the business costs. Need to investigate the makeup of this line item further.

K2Fly (K2F) posted an average update for the fourth quarter of FY21. Total Contract Value (TCV) reported was up to $9.9 million. This was up 48% on Q4FY20. The TCV consists of Annual Recurring Revenue (ARR) of $3.38 million which has grown by 50% on Q4FY20. One thing to note, is given K2F typically sign fixed length contracts, I haven’t fully identified how this figure is determined.

$2.56 million work of work was invoiced in Q4 with cash receipts lagging slightly at $2.03 million. After expenses the company had a $0.7 million cash outflow, which is close to the value of the announced product development costs $0.6 million. Which means K2F could be approaching consistent positive cashflow again. The last quarter this was reported was Q1FY21. Management have indicated that product development costs will continue to remain high in the near term. Therefore, it is unlikely positive cashflow will be reported in the next several quarters.

While it is concerning that the growth rate of spending is currently outpacing the growth rate incoming cash, this won’t be an issue if it leads to further contracts. Reported spend has been directed at further development of current products:

- Mine Technical Assurance (SATVEA)

- Tailing Governance Solution

- RCubed Mineral Inventory

- NextGen land management solution (This looks to be an integration of the Decipher and Infoscope products)

Currently K2F has $6.9 million of cash from the recent capital raise. This should provide enough runway to continue ‘Land and Expand’ plans, however $3.0 million of the funds have been allocated to potential acquisitions. (No detail provided on what or when)

I wanted to have the quarterly review completed prior to any other announcements so that my judgement wouldn’t be clouded but I was too slow for that. Since the recent update, K2F have announced they have signed 5 Year, $1.5 Million contract with Alcoa for the tailing’s solution offering. Alcoa is an International Council for Mining and Metals (ICMM) member, currently only 3 of the 28 ICMM members are using K2Fs tailings solution and the ICMM only represent around 1/3 of mining industry, indicating opportunity for continued contract to be won in this area.

Current EV / Sales ratio ~3.7, which is on the low side for a software company, but K2F only saw an 18% increase in sales YoY which has dampened multiple applied by the market.

Nothing has jumped out as major warning signs that indicate a change to the original thesis, however items to watch going forward:

- Ongoing spend on product development and rate at which these projects are completed. If product updates are followed closely by contract announcements it will be a positive sign for the allocation of funds.

- Where management decide to grow via acquisition. So far there have generally been synergies between the existing portfolio and new additions. If this trend continues, it will likely be a positive outcome, but if management start buying revenue growth it could be a warning sign.

Disclosure: Held

Post a valuation or endorse another member's valuation.