Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

The Good

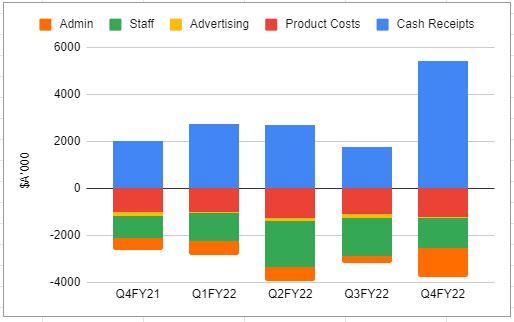

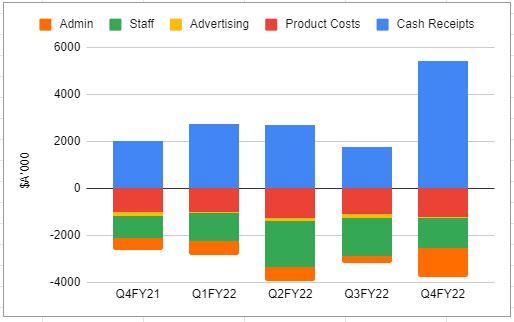

- Operating expenses remain flat.(Slight increase in admin costs over the last couple of quarters)

The Not So Good:

- No growth in ARR and Revenue QoQ. Revenue for H1 is down on H2FY23.

- SaaS revenue is not growing as a portion of total revenue. Sitting at 52% for H1FY24 which is the same as what it was in H1FY23.

- Only $2.5m in cash available at the end of the quarter. (After $1m placement with Maptek). There is an additional $2m in an undrawn loan facility, but this does not leave much room before another placement may be looking necessary. Q4 has typically been the strongest quarter for cash flows which may assist slightly.

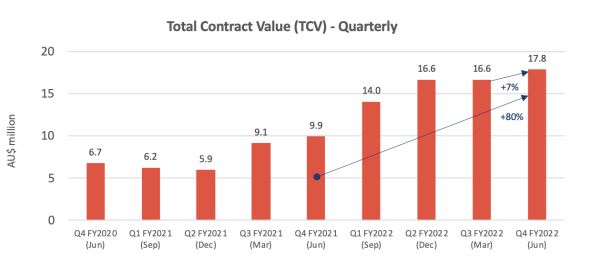

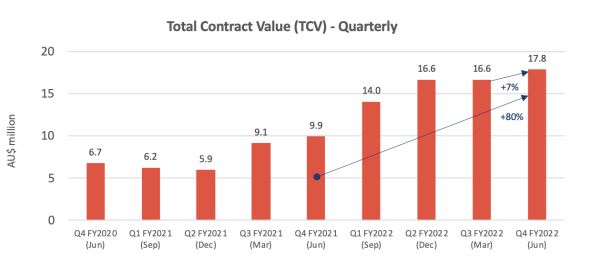

- TCV dropped from $17.7m to $16m which shows forward contracts are not replacing delivered work. Not included as a chart in the Q2 update.

Watch Status:

- Downgraded further due to stagnation of wins and low cash position

Valuation Status:

- Shifted weighting from bull case leading to decrease in valuation

What To Watch:

- Strategic review ongoing without any substantial updates. Likely leading to a whole business sale? Maptek is currently a substantial holder and would be the most logical acquirer.

- New global sales leader appointed in October 23 leading to a “considerably strengthened” pipeline for H2. (No announcements to date in Q3)

- New sales role to assist in expanding into adjacent markets (No announcements to date in Q3)

- Partnership with Asset Assurance Monitoring in the U.S to distribute dams and tailings solution.

- Reduction in investing spend. This has the potential to impact improvements in software and ongoing development.

- Release of update to JORC code. Likely not until the end of 24. Reported as "immanent"

- Migration of clients across to new Resource Disclosure modules started with Newmont Mining. Newmont migration to be completed by April / May.

The Good

- ARR continues to improve and is up 5.3% QoQ to $7.9m

- Second platform added for Roy Hill with TCV of $2m

The Not So Good:

- Cash position is in a precarious position even after the capital raise which has led to a strategic review to identify the best structure for access to capital. This is due to an increase in negative operational cashflow for the quarter along with $863k of investing expenses.

- Roy Hill was the only material contract awarded during the quarter.

- TCV remains steady at $17.7m

What Status:

What To Watch:

- Product release process should help onboard the current projects in progress: Anglo American, Arcelor Mittal and Eramet. Completion of implementation milestones should assist in improving revenues after a decrease in Q1

- Maptek continues to build a position with $1m placement at premium to share price. This has increased their holding to 17.7% with a further 12 months standstill agreement.

The Good

- Quarterly revenue at $4.0m up from $3.4m the prior quarter. Revenue has tended to be lumpy from quarter to quarter, so it is likely that this may not be as high in Q1FY24. Revenue for FY23 is also up 28% on FY22 which indicates although K2F has had some issues with cash burn, they still are maintaining a reasonable growth rate.

- Free Cash Flow positive for the quarter with $400k added to cash reserves. This leaves a cash balance of $4.4m (along with the working capital facility of $2m). Cash reserves have been an issue for K2F in the past, however with the improving quarterly cash flow position, this may be enough to reach a position where no further capital raises are required. Note. K2F has been in this position before, but then cash receipts quickly fell away in the following quarter.

- No significant changes in operating expenses, however staff costs are rising again.

- ARR $7.5m and TCV $17.7m are both slightly higher than I was forecasting in an earlier straw. (After quarter end a new contract with Roy Hill puts these figures now closer to $7.8m and $19.7m)

The Not So Good:

- Material contract signings are quite infrequent with only 2 announced in Q4FY23 and none in Q3

What Status: Turning

What To Watch:

- Mineral Resources & ArcelorMittal contracts were announced in November so these contracts should be live in Q1FY24.

- Time to implement Eramet & Roy Hill contracts

- The 12 month standstill agreement with Maptek expired in April. Given the current weakness in K2F’s share price, Maptek may look to continue to build a position in the company. (Carried over from the previous quarter - No indication of this yet)

- Further details on Maptek collaborations / integrations

K2F has closed out what has been another quiet quarter with 2 new contracts.

New customer to K2F, which is a positive sign that customer base is growing (albeit very slowly)

BHP extending their 1 year contract to 3 years demonstrates that they are happy with K2Fs product, however K2F may not have much pricing power with new customer contracts as the ARR rate has only increased ~7% and is held for 3 years ($664k up from $620). I'm not sure how much their hosting and support costs will increase over this period, but likely at a higher rate than that. What is also positive is this ARR will be effective immediately as the contract is already up and running.

Overall there should be some minor improvements over last quarters numbers from the above contracts (Note: estimated values)

TCV

- $17.1m @ end of Q3

- +$2.55m

- -$1.55m RR

- -$0.3 implementation (estimate based on anglo america)

- $17.6m which is down on $17.8m in Q4 2022 but still indicates around 2 years of contracted ARR

ARR

- $7m @ end of Q3

- +$0.82

- -$0.62

- $7.2m which would be ~20% increase from $6.0m in Q4 2022

The Good

- Revenue for Q3 improved over previous quarters to $3.4m.

- Staff expenses have largely levelled out after previous spikes.

The Not So Good:

- Total Contract Value has taken a hit for the first down and is down on the previous quarter. This indicates that as K2F is delivering on projects and services, they are not replacing this with new work along with no new major contract wins announced this quarter.

- ARR is flat for the quarter but up 35% over the pcp.

- Cash balance of $4m provides ~ 1 yr runway (including investing expenses) which given funds were raised only 12 months ago, additional capital could be hard to come by. Operating cash burn continues to improve, however cash receipts have been lumpy over previous quarters.

What To Watch:

- Product costs are significantly up on previous quarters. This along with the increase in invoices raised over the quarter of $3.6m may indicate a rise in cash receipts for Q4. This will likely still be down on the $5.4m in Q4FY22.

- So far the land and expand strategy execution is questionable as there haven’t been many significant additions across the existing customer base.

- BHP ground disturbance & Rio Ground Disturbance have gone live. These were announced in May 22 & Nov 22 respectively. So in the future I need to factor in 6-9 months of implementation time before ARR goes live.

- The 12 month standstill agreement with Maptek expired in April. Given the current weakness in K2F’s share price, Maptek may look to continue to build a position in the company.

The Good

- Cash flow positive quarter of $1.7m. This was driven by a significant increase in cash receipts for Q4 at $5.4m. Timing of cash receipts are likely to be lumpy going forward given some of the commentary around operational cash flow, this positive quarter along with the increase in invoices raised for the quarter means that going forward cash burn is likely to be reduced. With $8.2m of cash available, it is looking like there shouldn’t be any need for capital raises for ongoing business operations.

- BHP is now a customer. Given the extent of BHPs operations, there is an opportunity to sell other products and extend the use of the Ground Disturbance Software

- No significant change in product costs as ARR continues to grow, hints that there is potential there for operating leverage as further deals continue to be signed.

The Not So Good:

- ARR is up ~ $800k to $6m. On first glance this number is decent being the largest increase by value in the last 2 years, however this looks to consist of two contracts: The 1 Year BHP contract for $620k and $145k for Asarco. The rate of contracts signed has slowed over the last year which can be seen in the ongoing total contract value. I had expected that potentially the Maptek investment may lead to a burst of new contracts, but this may require a bit more time given the deal is only recent and the end of the financial year.

What To Watch:

- Cash receipts next quarter. I expect this to be down on the current quarter and more inline with the invoiced value of $3.8m

- Cost control looks to remain an ongoing focus with staff costs coming down, however this has been offset by a large increase in admin and corporate costs.

- Further updates on the fraud in overseas operations. No news in this update.

- Rate of contract wins amongst both existing and new customers. If this remains low it will be a sign to review investment thesis.

K2F recently came out of a trading halt to announce that they have a new strategic investor in private mining software and services provider Maptek. In a $6.2m capital raise Maptek will end up as a 13.2% shareholder in the company.

First take-away from this is that the expected capital raise has surfaced, with the intent for ‘product development and working capital’. This will provide some further short term relief for funding ongoing operations during the growth stage.

Second, although the raise was for working capital, having a company like Maptek involved potentially opens a lot more doors for further sales opportunities for K2F through their existing user base. Although it looks as though there are existing integrations in place, I imagine through the investment Maptek will look to expand this further across both offerings.

https://k2fly.com/integrations/

Maptek has been limited in expanding their stake beyond 19.9% within one year. It will be worth noting if they continue to add to their holdings over that time. This would be an indicator on the goals for the ‘strategic’ investment. Perhaps they may be looking for a reverse take-over or looking to try to get ahead of competitors like Pointerra in providing a more complete offering.

On a side note, I really was hoping that 3DP would take a partnership with K2F, given their ambitions in the mining space and previous connections, but it looks like this is off the table now.

It will take a little while before there are likely any noticeable flow-ons from the investment but it will be something to watch in FY23.

Sucks to be them.

How does anyone think $745k won't be missed in a company that booked $4.6m revenue and had a cash balance of $3.6m in 1H FY22. It undermines all of their accounts.

[Not held]

There were two Director on market purchases today to the value of $33,577.65 with the main one from outgoing CEO Brian Miller ($26,436.65). Brian is still going to be involved going forward but in a reduced capacity. I feel seeing on-market purchases from the Board is generally a positive indicator and can be taken as a vote of confidence in K2F’s future prospects.

Disclosure: Held

Having a bit of a scan through the preliminary final report to try find some indicators on how my thesis is playing out for K2F given the share price has been on a bit of a slide for some time now.

The main thing I think I have overlooked in my initial reviews of the company is assuming that K2F is a full technology company. Currently the sales of software only makes up 37.5% of revenue.($2.6 million in FY21 up 113% on FY20). At the last announcement on 06-08-21, ARR has grown to around $3.5 million so growth in this area is continuing.

Putting together a rough price target for FY22:

Assume consultancy revenue stays flat at $4.3million (no change from FY20 to FY21)

Assume ARR reaches 50% of total revenue $4.3 million

Total Rev - $8.6 million

Maintaining current Price / Sales ~ 5 = MC $43 million

Using current Price / ARR ~ 13 = MC $55.9 million

Take the middle of the two given annual revenue growth ~ 23% = MC $49.5 million & a share price of $0.36 which is +40% premium on current price. Based on this I will continue to hold while I continue to research further.

Things to watch:

Current CEO has stepped down as of 01/09/21 and management is restructuring. Replacement CEO is being promoted from within the company so there shouldn’t be any major changes in company direction.

Continuing contract announcements leading to growth in ARR which is the basis of price forecast.

Growing employee expenses. This cost grew significantly over FY20 and currently makes up a significant portion of the business costs. Need to investigate the makeup of this line item further.

Miller to step down as CEO, however, he is staying with the company to focus on investor relations, acquisitions and the consulting business, moving to working 4 days per week.

Nic Pollock who is currently ops manager is stepping into the CEO seat.

Assuming Miller and Pollock currently have a good working relationship this should be a positive. Not saying it's the case here, but its always a risk regarding the autonomy to execute.

The business is now also looking for a CFO.

https://k2fly.com/blog/k2fly-appoints-nic-pollock-as-ceo-following-executive-restructure/

This is not one of my holdings, however, here is my thought bubble.

Linkedin is a weird place. We all agree. Right? Well CEO Brian Miller who is around 60 has only worked at K2Fly according to Linkedin. https://www.linkedin.com/in/brian-miller-k2fly/

Which is strange as he, by all accounts, had a successful career in the UK with AMT. He walked away with over 100M sterling. Why would you not list that? It’s on the company website (sans the 100M sterling detail) https://k2fly.com/board-members/

I have been casually following the business for a few years. Initially I thought it was a bit of a vanity project wrapped around a few mates delivering some consulting services to mates in Western Australia. Western Australians after all are a pretty parochial lot. No offence intended for any Western Australian readers. Apologies from ‘over east’.

It has been some time since I have looked at this business. They are sensibly pushing software and their IP. We all know there is no multiple for sell one, build one services businesses. But then looked at the four software solutions. After reading the headlines, I don’t actually know what any of them do, other than assist with ESG.

As I didn’t understand, I went looking for more information. This video doesn’t help. All I took from the word jumble is K2fly get the consulting services from the software. So not a software business then. https://www.youtube.com/watch?v=OuOKTn4fFA8

ESG is getting more important, especially when the world’s largest miners cannot stop desecration of know cultural sites. Looking at you Rio. Can you build a business on ESG services?

The professional polish certainly seems to have improved. They have also bolstered the team, but some of these specialists must be coming at significant expense. Makes me wonder how they are paying them with revenue of only $1M per month.

You have to look at many to find the few. This one is still a pass for me.

Deal with Canary Capital for "marketing services" in October 2020, was a big red flag for me. Payment in the form of cash and options @ $7.5K per month.

K2Fly has negative net tangible assets, with intangible assets and goodwill making up over $6M in assets on the balance seet.

K2Fly also have a $3.2 M liability of future payments for the SATEVA acquisition. This liability is for 18% of all invoiced amounts for SATEVA Software products, but it includes consulting sales, which are low margin. This is a bad deal IMO.

Their gross margins have improved, and are now over 50%. However, the concern is SATEVA is incentivised to grow consulting services revenue, which is not high margin SAAS revenue.

Two trading updates in the space of a week prior to another capital raise - not a good look.

Q3 FY21 Flash Financials Update – Record Sales Invoices, ARR and TCV increased

Highlights:

- Decipher for Mining acquisition completed and creates leading commercial off the shelf (COTS) end-to-end tailings management solution in support of GITS (Global Industry Tailings Standard)

- CSBP Ltd (a subsidiary of Wesfarmers Limited) now has a 10% shareholding in K2fly

- Q3 FY21 record invoices of $2.06M raised (28% increase from March 2020 quarter)

- ARR (Annual Recurring Revenue) increases 26% from Q2 FY21 ($2.90m)

- TCV (Total Contract Value) increases 56% from Q2 FY21 ($9.13m)

- Milestone Heritage Agreements signed: o New 3-year Heritage Solution agreement signed for Rio Tinto Iron Ore in February 2021

GriffitUniversity Cape York Heritage 5-year agreement signed in March 2021

- • More RCubed deals from North America

- Alcoa USA signed new 5-year contract in January 2021

- Coeur Mining signed 5-year contract in March 2021

- Cash available on 31 March 2021 was $1.52M, $1.58M in receivables and no debt

DIsc: I hold

Hey @Storge, reckon this is the same "Paul Cozzi" ?

The address on the Form 605 and the 604s was PO Box 156, South Bexley, NSW 2207, very close to where Dr Paul Cozzi has a practice - at Hurstville.

If it IS the same guy, he doesn't seem to be very good with paperwork...

K2fly to acquire Decipher’s mining solutions business

Highlights:

• K2fly to acquire the business assets associated with ‘Decipher for Mining’ (Decipher) from CSBP Limited (CSBP) and Wesfarmers Chemicals, Energy & Fertilisers Limited (WesCEF).

• All scrip consideration comprising 11,366,691 ordinary K2fly shares valued at AUD$3.7 million plus up to 5,345,633 performance shares, both subject to voluntary escrow periods.

• Wesfarmers subsidiary CSBP will become K2fly’s largest shareholder with 10.13% holding. • Decipher provides cloud-based software-as-a-service (SaaS) monitoring and compliance solutions for mining industry customers.

• Decipher CEO Anthony Walker will be joining K2fly in a senior executive position along with the core of the Decipher team.

• Decipher will bring additional depth to K2fly’s growing solution suite in tailings and rehabilitation and extends K2fly's technical assurance and governance footprint inside existing global customers.

DISC:I Hold

Q2 FY21 Quarterly Activities Report (Attached)

Highlights

• SATEVA Acquisition completed and successfully captures increasing share of WA Iron Ore market

• K2fly achieved SAP Endorsed Apps Certification, one of only 11 companies worldwide to achieve this certification

• In Q2 FY21 invoices of $1.56M raised (compared $1.68M in Q2 FY20)

• Negative cash burn for Q2 FY21, includes expenditure to build capability and scale: o K2F significantly increasing expenditure and investment on new product developments including Tailings Solution and Model Manager o Investment in SAP Endorsed Apps Certification o $400K instalment payment for RCubed acquisition, due to achievement of performance milestones o Additional transaction costs from SATEVA acquisition o Payment of deferred government costs ($388k) granted during COVID

• Very positive start to Q3 FY21, 3 new contracts, 10% increase in ARR QTD o >$850k of Purchase Orders already taken for SATEVA o Alcoa USA signed new 5-year contract in January 2020 o FMG extended its Infoscope agreement to overseas operations o New Heritage Solution signed for major WA Iron Ore producer o Total Contract Value (TCV) increased by $1.292M in January

• K2F overall remains cash positive from operations for last 3 quarters (Q4 FY20 to Q2 FY21)

• Cash available on 31 December 2020 was $2.56M, $0.92M in receivables and no debt

Appendix 4C

https://k2fly.com/download/11/asx-updates/1763/appendix-4c-quarterly-cashflow.pdf

Disc:I hold

Alcoa Signs 5-year SaaS Resource Inventory contract with K2F Highlights:

• Alcoa USA Corp has signed a 5-year contract with K2F for its RCubed resource inventory solution across 6 global sites commencing in February 2021.

• Alcoa is a global industry leader in the production of bauxite, alumina, and aluminium with operating mines in Western Australia and Brazil

• (TCV) Total Contract Value* for this transaction is AUD $573,600

See attachment on prev Straw

Disc: I hold

Sateva Acquisition Progress

Highlights:

• Purchase Orders related to SATEVA business >$850k since acquisition completed in November

• Model Manager is now released and being demonstrated to major mining houses globally

• Results from trial of new ore block optimisation solution at major iron ore mine demonstrate significant customer benefit and value that will be applied across the market for bulk miners

K2Fly announce acquisition of SATEVA.

Announcement talks up SATEVA's software solutions. However, SATEVA do not appear to have any software products per se, and provide "Providing technology consulting services to the mining, metals, and rail industries" - SATEVA's website.

K2Fly are paying $4M for 180k of EBITDA in a professional services company, that may be developing an unproven SAAS solution that may complement K2Fly's RCubed software...That is 20x EBITDA and 2.8x revenue.

DISC: I hold

Key takeaways:

1) Invocing up 15% on PCP. Noting Q1 is typically a weak quarter.

2) Cashflow positive for the 2nd consecutive month.

3) Reports propomising sales pipeline, flagging some significant wins to come in Q2 2021.

4) Development of tailings mamagement / governenace solution is ongoing.

Key takeaways - nothing new to report from previous announcements:

1) Positive operating cashflow in excess of $500k for the month.

2) ARR now at $2.36M, up from $800K on pcp. $500K of ARR won over the quarter. Recurring revenue is now more than 30% of revenue.

3) TCV won over the quarter: $2.77 M.

Funny how K2F are up on this, given this was all flagged July 6.

Operatinoal update. Key takeaways:

1) FY 2020 revenue of $6.626 M, up 60% on prior year.

2) SAAS ARR now $2.36 M, up 69% over the past six months.

3) RCubed SAAS business wins contracts with Kinross Gold, South32, Sibelco, an Orano. ove rtge past 3 months.

4) K2F cashflow positive, with $660K of positive cashflow for the quarter, with $600k improvement on pcp.

K2F report a strong pipeline, and anticiapte making further announcements in realtino to new contacts over the next 6 months.

Key takeways:

1) 3 of the top 4 iron produces now use a K2Fly product.

2) 5 of the top 10 gold producers now use a K2Fly product.

3) serving 460 sites worldwide.

4) Management report they have the only off the shelf solution for achieving the new SEC compliance requireents of NYSE listed companies.

5) 30 NYSE listed clients attended webinar earler this week, and are looking for a solution to their problem in Item 4 above over the next 6 months.

6) Q4 is traditionally the strongest quarter, with a promising sales pipeline.

Interview here: https://www.youtube.com/watch?time_continue=276&v=YusujVBfbO0&feature=emb_logo

Key takeaways:

1) Invoicing of $1.61M fo rthe quarter (up 92% on pcp

2) New contacts wins with Gold Fields, Newmont, Soth 323, Vale, Sibelco, and Kinross Gold. SAAS contract extension from Anglo Gold Ashanti. THAT IS A LOT OF WINS OVER 4 MONTHS.

3) ARR now at $2M pa, growing at +200% pa

4) SAAS revenue now represents 52% of reveue. The transition to SAAS revenue will mask underlying growth IMO.

5) TCV now at $6M, growing at +800% pa.

6) North America sales team established and off to good start wiith Newmont ans Kinross Gold sales.

7) Significant interst reported from NYSE companies in the RCubed platform due to US SEC regulation changes coming inot effect on January 2021.

8) only $800k in the bank, but Board expects K2F to be cashflow positive for Q4. This is being assisted by:

- In March, the reduction of staff /personnel by approximately 10 FTEs;

- Until at least 30 June:

- The Board have deferred all of their remuneration;

- The CEO voluntarily agreed to defer 50% of his remuneration;

- Some Senior Executives have voluntarily deferred part of their remuneration; and

- Significant reductions in travel, marketing, promotional and non-essential expenses.

It looks like the board is keen to avoid a CR. If K2F can continue winning work at its present rate (16% per month!), they may not need to do so, but it is a close call.

DISC: I hold a starter position (<1%)