Two articles in todays AFR also touched on this as well

The first: ‘Remote chance’: JCap attacks Lake Resources’ lithium project

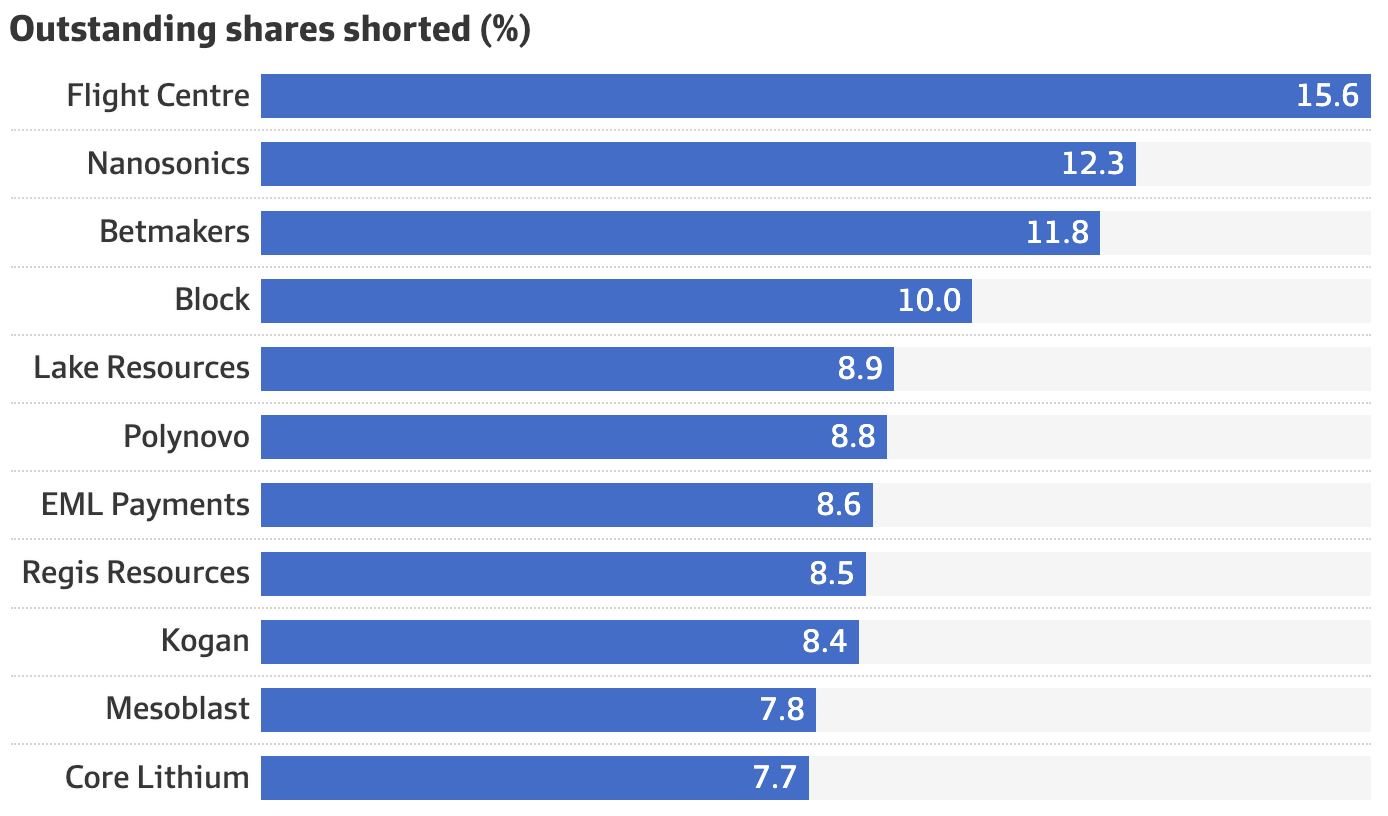

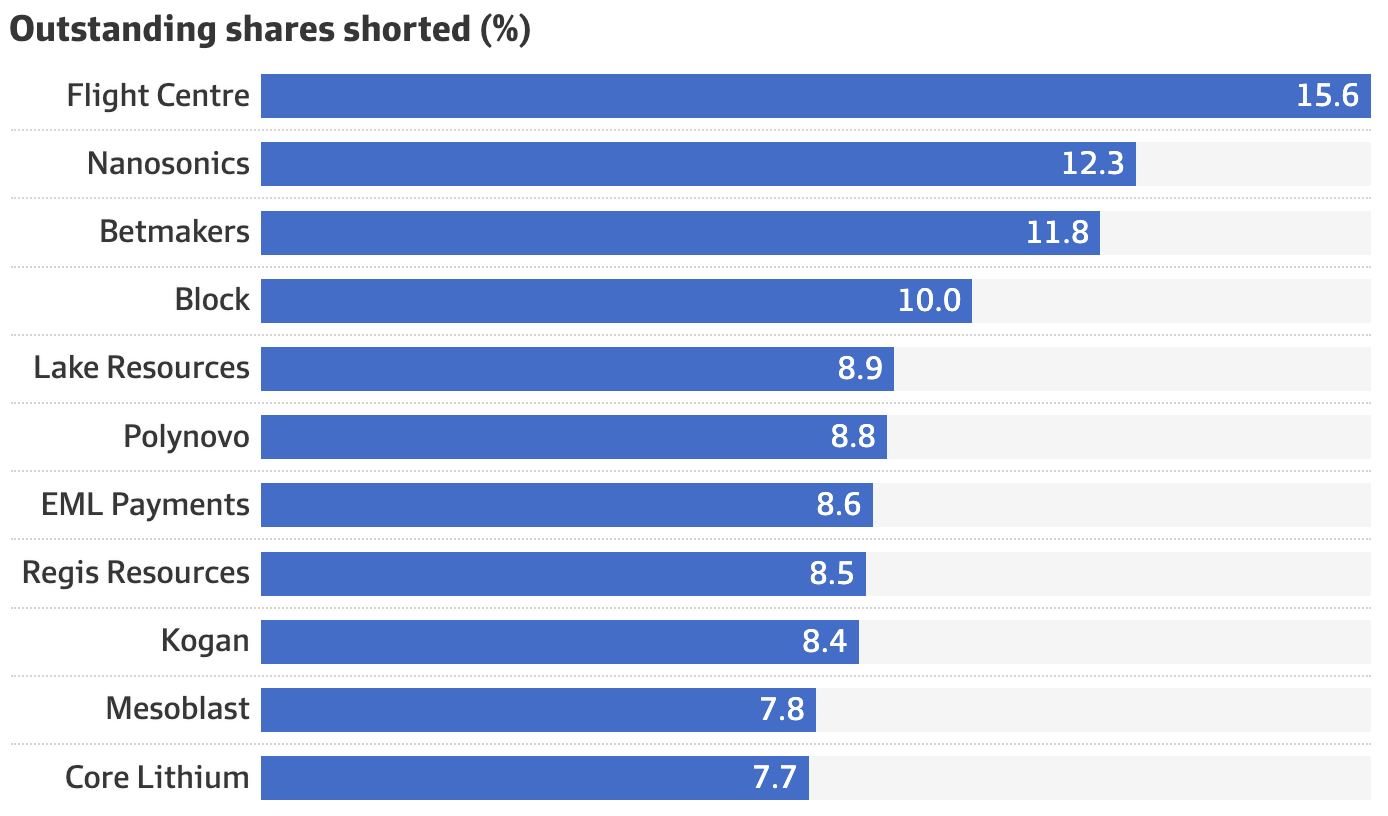

and the second was not specifically about LKE but rather on recent levels of shorts on the ASX in general and the areas of the market it's happening: Short sellers raise bets against ASX retailers, lithium plays - also included an interesting visual of the top shorted companies

Quoting a part at the end of the later article:

"Hedge funds versus lithium fans

It would be remiss not to highlight speculative lithium explorers as another heavily shorted sector especially popular among young investors keen to buy anything boasting an electric vehicle theme

Recent S&P/ASX 200 entrants Lake Resources and Core Lithium have 9 per cent and 7.7 per cent of their shares shorted, respectively

Morningstar said short interest in the pre-revenue duo doubled over June as professional hedge funds bet against retail investors

Europe-focused lithium explorer Vulcan Energy has 6 per cent of its shares shorted and, like Lake Resources, claims it can extract lithium directly by using technologies as yet unproven at commercial scale

Morningstar also said short interest in AVZ Minerals is up an incredible eight times since March. Shares in the lithium play are suspended amid a legal dispute over ownership rights to its Manono tenement in the Congo"