Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

His extensive experience leadership experience includes serving as Chief Legal Officer, Executive Vice President and Corporate Secretary for McDermott International; General Counsel and Executive Vice President for Technip S.A.; Global Ethics and Compliance Director for Baker Hughes, in addition to other legal and compliance positions within that organization. Mr. Freeman has also served as Prosecuting Attorney for the U.S. Office of Special Counsel and Special Assistant U.S. Attorney for the District of Columbia.

J. Freeman: Has the cred' can these blokes execute the plan?

announcement here: 2924-02608843-2A1418541 (markitdigital.com)

And Paying the directors, LKE - Placement Performance Rights # securities: 465,000 ( at what price unknown at the moment? )

Whats LKE do? - digging up the dirt and sell n ship, So some other dude can make batteries.. Then put wheels on, ship the item back for us.

Lake Resources NL (ASX: LKE; OTC: LLKKF) is a clean lithium developer utilising direct extraction technology for production of sustainable, high purity lithium from its flagship Kachi Project in Catamarca Province within the Lithium Triangle in Argentina among three other projects covering 220,000 ha.

5. Prime Location, Large Projects: Flagship Kachi project in prime location among low-cost producers with a large lease holding (74,000 ha) and expandable resource (4.4 Mt LCE) used for 25 years production at 50,000tpa (JORC Resource: Indicated 1.0Mt, inferred 3.4Mt, refer ASX announcement 27 November 2018). Prefeasibility study at 25,500tpa by tier 1 engineering firm shows large, long-life low-cost operation with US$1.6 billion NPV pre-tax, and annual EBITDA of US$260 million from 2024 using past pricing of US$15,500/tonne lithium carbonate (refer ASX announcement 17 March 2021; 28 April 2020). (No changes to the assumptions in the resource statement or the PFS have occurred since the announcement date.) 6. Other Projects: Lake’s other projects include the Olaroz and Cauchari brine projects, located adjacent to major world-class brine projects in production or construction, including Allkem’s (Orocobre’s) Olaroz lithium production and adjoins the impending production of Ganfeng Lithium/Lithium Americas ’Cauchari project. Lake’s Cauchari project has shown lithium brines over 506m interval with high grades averaging 493 mg/L lithium (117-460m) with up to 540 mg/L lithium. These results are similar to lithium brines in adjoining leases and infer an extension and continuity of these brines into Lake’s leases (refer ASX announcements 12 June 2019, 23 March 2021). Drilling commenced on the Olaroz leases in February 2022. For more information on Lake, please visit http://www.lakeresources.com.au/home/.

Jcap after LKE again

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/http://watermark.jcapitalresearch.com/Lake_Resources__1.pdf?data=AeADE6g7Tnz3nEtr39wTy7GhksYXiXFX2UFbltYoGEcIQSDpSo0tpVv2EUyxh4HhtYDbP2xIWLmbohiIic3bB36gKvqD1V2GzalMBPCpwgjWLJXX2svEQXsGYqTjFXMvXDDOOvBrsegxzHCzqTnnxzH8%2BLOHEt78IdixoXSjrGJ95JCShbr5HW3qP2EO8iBMESkh3r4JV7ne7Ig633eHbmJH1tgc3jJJmW7RX952c31sJGn%2FUJNKceexy24Kb9FIqSca19MzG6ZvlEEDQTKLPZmZaChfzTGQJBiUL%2BCJcqI8hcc9nVIk%2BN0i73lj36%2FWCGiOVVmRSzi%2Bk%2BhH1cgzilULxUqYX8oMYPI3s1jRo8abhQDezPo5KRYL4YWKDm0Zdi7JI6FM6OWkpSYBCZSN%2FWI%2B46a%2F5JMQpIFqLzG6Y3inJX9dctvEmv1ikv%2B2Sohlzfpas4jajuQGcddIoLjLLwMIVEvwv2i584038%2FueCqFmXBh8gklETcO1zTrIGCHgKLNgtnclO2GENk88X5yKtX44OfQSxWvCGazGpb6Ou4Y4a5rgxF6U8CnQmrubpqUyxiCq7GMHBQKOW7fyL14UcisyIIIS7f%2FOHLos0OTGesAheklKoDixPMhzDkfIwue%2F%2BgyCP2Prc0%2BMaQi8sAGj420S%2FwCy4LH0ckUFxldEHKYqjvX39PLWxVJPIPi6lRwxP4yLCJszaZno9T%2FlvoGtz8ikedlqkN8i76f1Rg%2FWmWs%3D&s3Url=https%3A%2F%2Fjcap.s3.amazonaws.com%2FLake_Resources__1.pdf%3FX-Amz-Signature%3Df18a216ca36ec20e8f892311ecb90d364e1ecc51fd8db4fd2f77127a8b4b608d%26X-Amz-Algorithm%3DAWS4-HMAC-SHA256%26X-Amz-Credential%3DAKIAID6CGZTRDI4SU7ZA%252F20221107%252Fus-east-1%252Fs3%252Faws4_request%26X-Amz-Date%3D20221107T000000Z%26X-Amz-Expires%3D86400%26X-Amz-SignedHeaders%3Dhost

Another follow up article in the AFR today: Lake Resources scrambles to respond to short report

Nothing really new covered - it mainly focuses on the doubt over the Lilac DLE (direct lithium extraction) technology aspect, and Lake’s practice of issuing share options to brokers and research firms to produce (favourable) reports on the company’s prospects

Two articles in todays AFR also touched on this as well

The first: ‘Remote chance’: JCap attacks Lake Resources’ lithium project

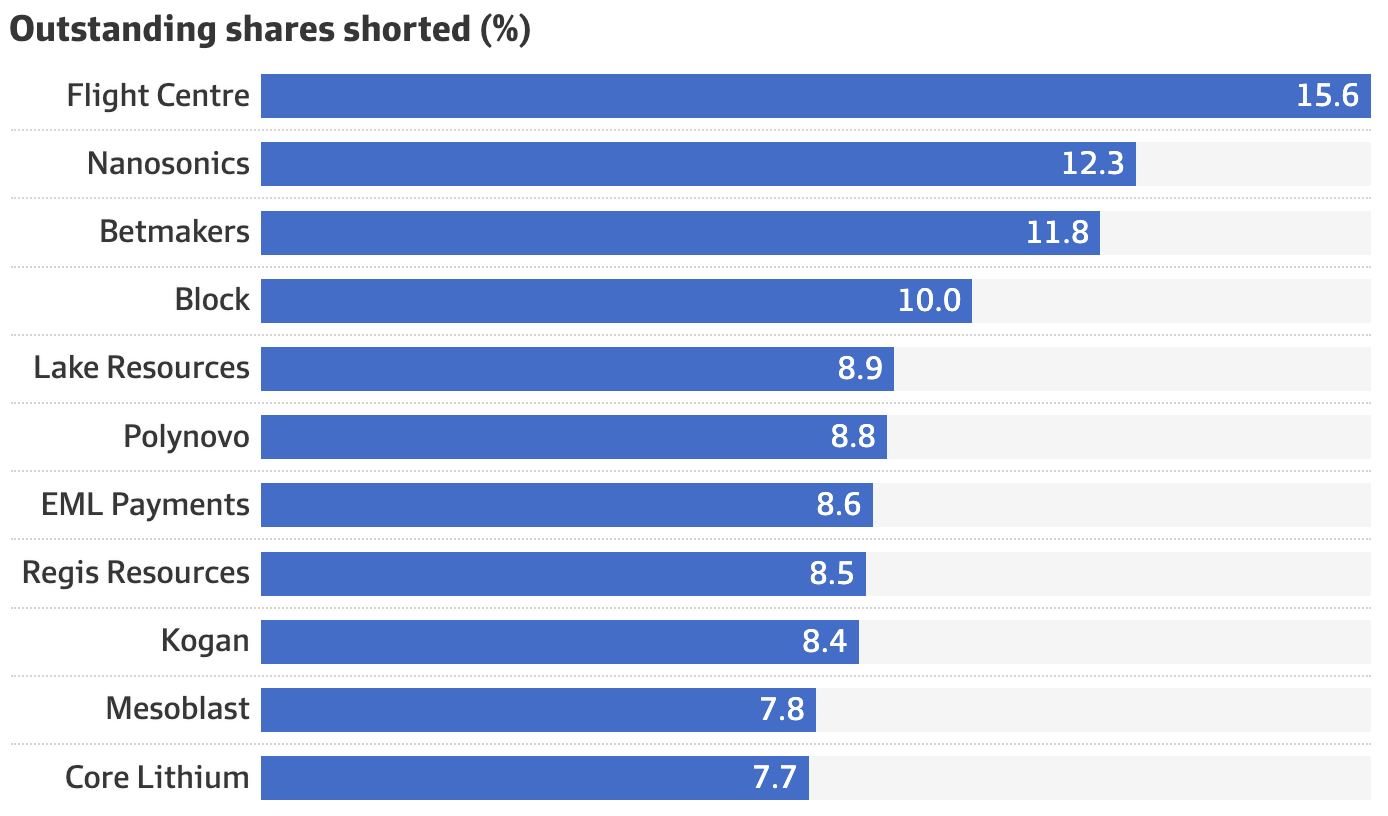

and the second was not specifically about LKE but rather on recent levels of shorts on the ASX in general and the areas of the market it's happening: Short sellers raise bets against ASX retailers, lithium plays - also included an interesting visual of the top shorted companies

Quoting a part at the end of the later article:

"Hedge funds versus lithium fans

It would be remiss not to highlight speculative lithium explorers as another heavily shorted sector especially popular among young investors keen to buy anything boasting an electric vehicle theme

Recent S&P/ASX 200 entrants Lake Resources and Core Lithium have 9 per cent and 7.7 per cent of their shares shorted, respectively

Morningstar said short interest in the pre-revenue duo doubled over June as professional hedge funds bet against retail investors

Europe-focused lithium explorer Vulcan Energy has 6 per cent of its shares shorted and, like Lake Resources, claims it can extract lithium directly by using technologies as yet unproven at commercial scale

Morningstar also said short interest in AVZ Minerals is up an incredible eight times since March. Shares in the lithium play are suspended amid a legal dispute over ownership rights to its Manono tenement in the Congo"

To follow up Andrew's Post.

Shorting is very hard and doing requires you to really optimise the asymmetry of the bet. A few items in the report I think are meh, some others are critical issues. The biggest one being the efficacy of the Lilac process. However, even if LKE had to walk it back and go down a different path like peer ASN, or worse case, go to a conventional brine process rather than any DLE, its a big set back but not terminal

As such, if LKE is anything short of an actual fraud thus a full zero then your risk reward shorting here is way off and there is the added risk of a reboot of a hot lithium trade that reverse sentiment and price action.

Chart below is to illustrate when you should think about a short if you have the conviction to do so. I'm a firm believer that you want a tailwind in your sail (i.e. negative price momentum) to consider the risk but waiting until the stock is already down 73% from the high seems like wasted potential and to be asking for trouble.

I do note that charts in the report cut off around May 22 so chance is they're short way higher and the report was caught up in review/legals, however, the mark is when the report goes live.

Notes: I'm not long LKE and don't care for it otherwise either way.

For what it's worth, JCap just published a short report on Lake Resources.

Read here

16-Nov-2021: 3:50am: What the heck am I doing? I should be asleep!! OK, to @Billow, in reply to your "##advice" straw for Lake Resources (LKE). You said, "I have some Lake Resources Shares (RL as well as Strawman) and saw in my Commsec account today 2500 Lake resources options (expiry June 2022)

What is the mechanism for dealing with them? If I convert them to shares, does that mean I pay the difference between the option price and the share price, if I sell them can I do that through commsec in the same way as shares, or is there another mechanism needed?"

OK, first off, have a read of this 05-Nov-2021 announcement from LKE. Click on the link (the underlined blue bit) to open that announcement in a separate tab in your browser. They described the new options as "1-for-1 unlisted Additional Bonus Options (86,094,394 options), with an exercise price of A$0.75 and an expiry date of 15 June 2022." Furthermore, they added that they intended to make application to the ASX to have those options listed. That application was subsequently made, and was successful, and those options are trading now with the ticker code LKEOC.

LKE shares closed yesterday (Monday 15-Nov-2021) at $0.975, and the LKEOC options closed at $0.37 each, which is a good price.

Each LKEOC option gives you the right (but not the obligation) to apply for ordinary LKE shares at a price of $0.75 each. At the moment people are paying around $0.37 for that privilege, so they are clearly not planning to apply for those shares now; they would be holding the options hoping for LKE shares to go higher. To buy LKEOC options for $0.37 and apply for shares @ $0.75 would cost $1.12 per LKE share, and you could buy LKE on-market for less - their trading range Monday was $0.9675 to $1.025. However, if option holders waited and LKE shares were trading at $1.50 in May 2022, they could buy LKE shares for half of that ($0.75/share). The downside is that if the options are not exercised or sold by June 15th, they expire worthless.

So, you have three options as I see it:

(1) You can sell the options (any time between now and June 14th 2022) just as you would any share, using Commsec, just make sure it is LKEOC you are selling not LKE.

(2) You can exercise your options - either some or all of them at any time between now and early June 2022. The LKE share registry will either email you or post out to you an application form that you can use to exercise those options. You should have already received it, or it could still be in the mail, give it a week and if you still haven't received the form (which is sent out to all option-holders automatically), chase it up through the share registry. LKE's share registry is Automic. You can email them at: [email protected] or you can use their website: Automic Registries Investor Portal

This information is from the LKE website: My Shareholding - Lake Resources

The form will likely have two options, with the easiest one being to BPay the money - in which case you would not have to return the form, or to return the form with a cheque - but who uses cheques these days?

Obviously the higher the LKE share price is (above 75c), the better the deal is - to exercise the options @ 75c each.

(3) Wait and see what happens to the LKE and the LKEOC share/option prices. Just remember to NOT let the options expire worthless (on June 15th 2022). If you don't exercise them, just sell the options on-market instead, then at least you'll get some financial benefit from them. Also, when exercising them, allow a few days for your application to be processed. That's why I said early June, not mid-June - at number (2) above.

To answer your specific question, no, you don't pay the difference between the option price and the share price, you pay 75c/option to convert them to LKE shares, and the difference between 75c and the share price of LKE at the time would be the gain you would make, assuming that the LKE share price doesn't drop during the period from when you applied to exercise the options and the time the additional LKE shares (from the exercised options) are issued to you (which should be no longer than a week or two). All options have a set price at which they can be exercised, and you usually have to trawl through the company announcements (as I have) to find out what the exercise price is for those particular options, or read it off the form they will send to you.

Hope that helps.

John.

LKE announces agreement with (ASX listed) Novonix Battery Technology Solutions to test their lithium

Lake appoints respected Novonix Battery Technology Solutions in Nova Scotia, Canada, to produce high-performance lithium-ion battery test cells using Lake’s lithium carbonate samples compared to industry leading materials

Data from battery technology and materials company Novonix will allow potential users and off-takers of Lake’s high purity, responsibly sourced product to make direct comparisons of its performance.

https://asx.api.markitdigital.com/asx-research/1.0/file/2924-02272650-2A1245638?access_token=83ff96335c2d45a094df02a206a39ff4