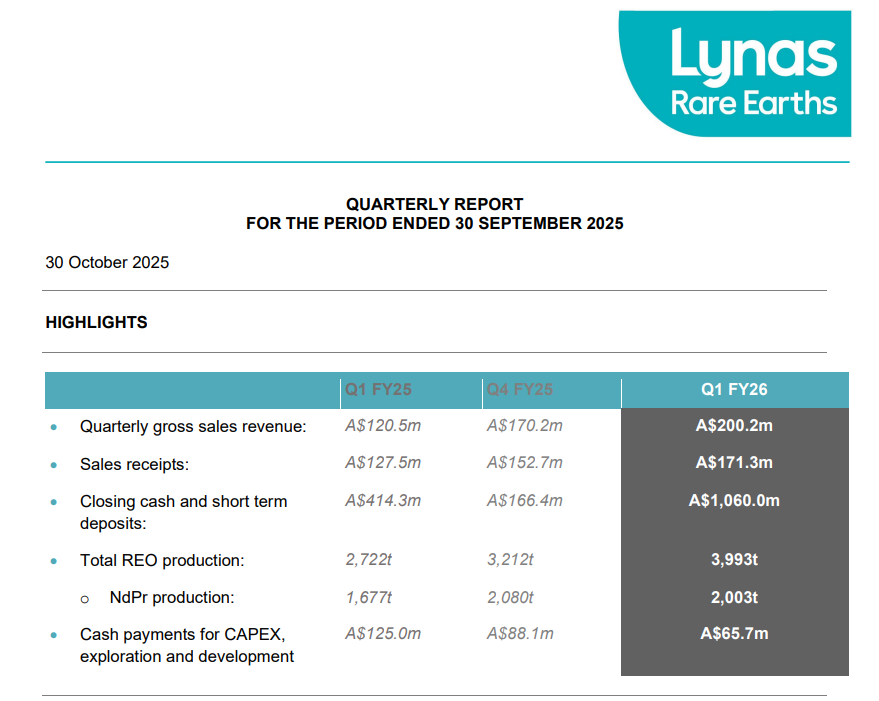

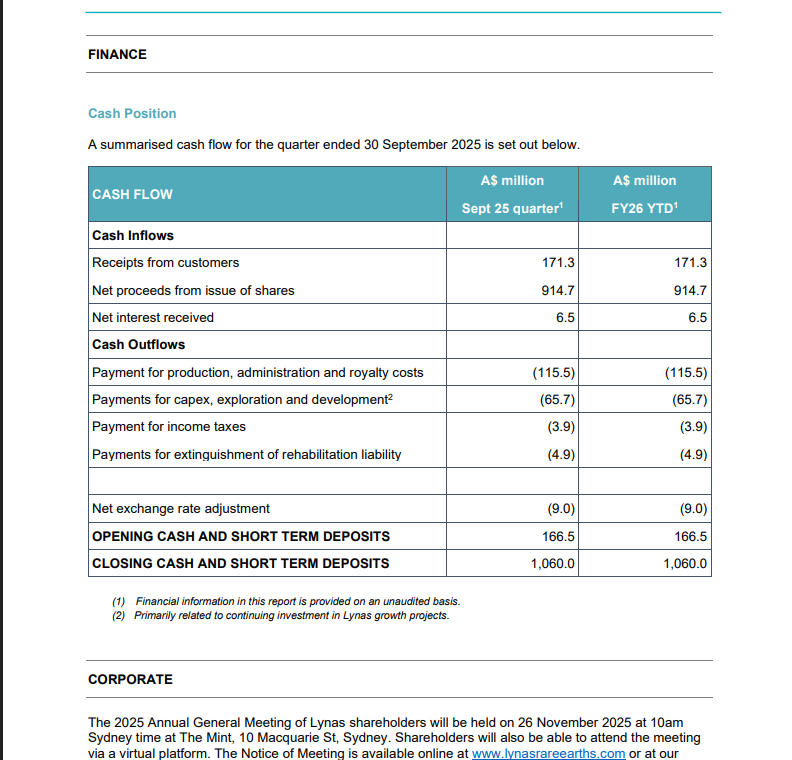

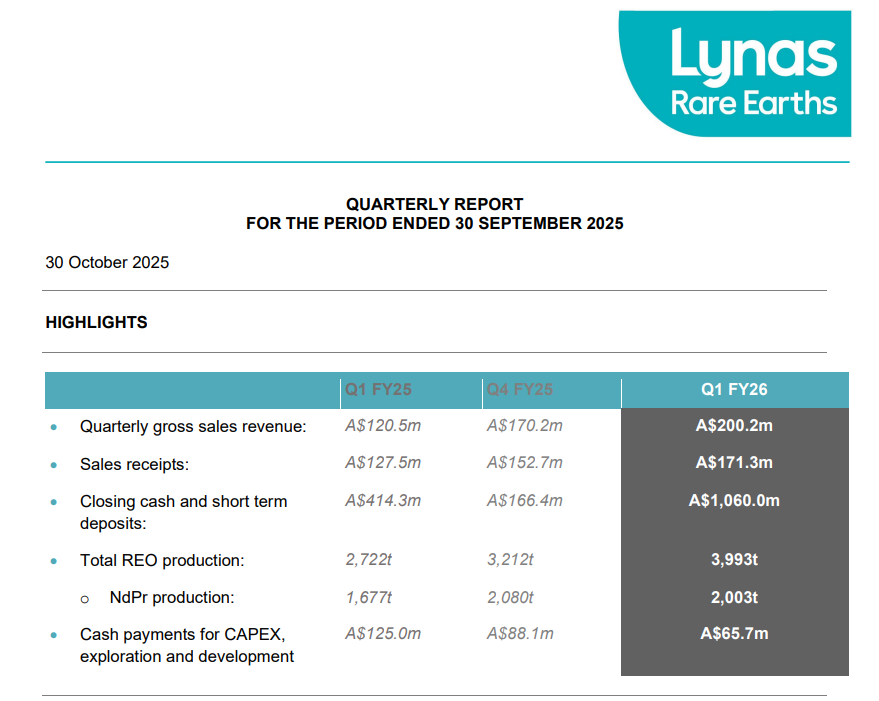

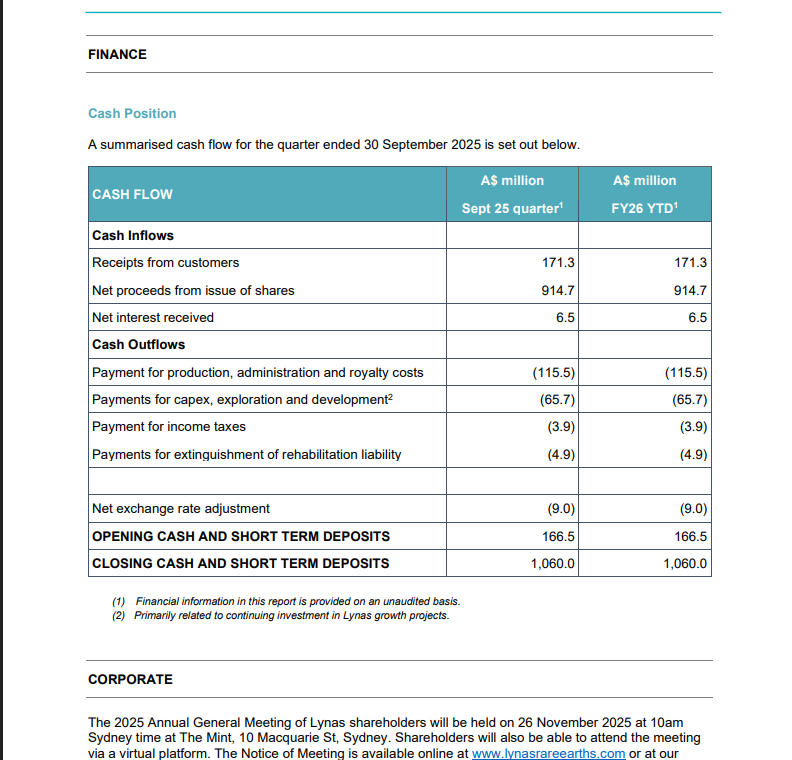

CEO REVIEW The September 2025 quarter was significant for Lynas with the announcement of the Towards 2030 growth strategy, alongside our FY25 financial results on 28 August 2025, and the completion of an equity raising.

The equity raising, which comprised a $750 million institutional placement and a Share Purchase Plan for retail shareholders, further strengthens our Balance Sheet, enabling Lynas to pursue a strong growth agenda.

Share Purchase Plan increased to ~$182 million from the initial target of $75 million.

Yes the outlook is good for Fy 2026 - Lynas have invested. The eps has been in the 'red' since 2022 so holders are looking for positive eps growth now.

https://hotcopper.com.au/threads/ann-quarterly-activities-report.8856595/

Snippets of the Q report below:

Mt Weld Expansion Construction of the Mt Weld Expansion processing plant is now complete and on budget. Phase 2 of the Tailings Storage Facility (TSF) is the only works remaining and is not required for ramp-up. This will be completed in the new year.

United States Following achievement of the first U.S. Heavy Rare Earth oxide sales, discussions have continued with multiple U.S. rare earth buyers, including new metal and magnet projects.

CORPORATE The 2025 Annual General Meeting of Lynas shareholders will be held on 26 November 2025 at 10am Sydney time at The Mint, 10 Macquarie St, Sydney. Shareholders will also be able to attend the meeting via a virtual platform. The Notice of Meeting is available online at www.lynasrareearths.com or at our share registry’s website https://boardroomlimited.com.au/meeting/lynas.

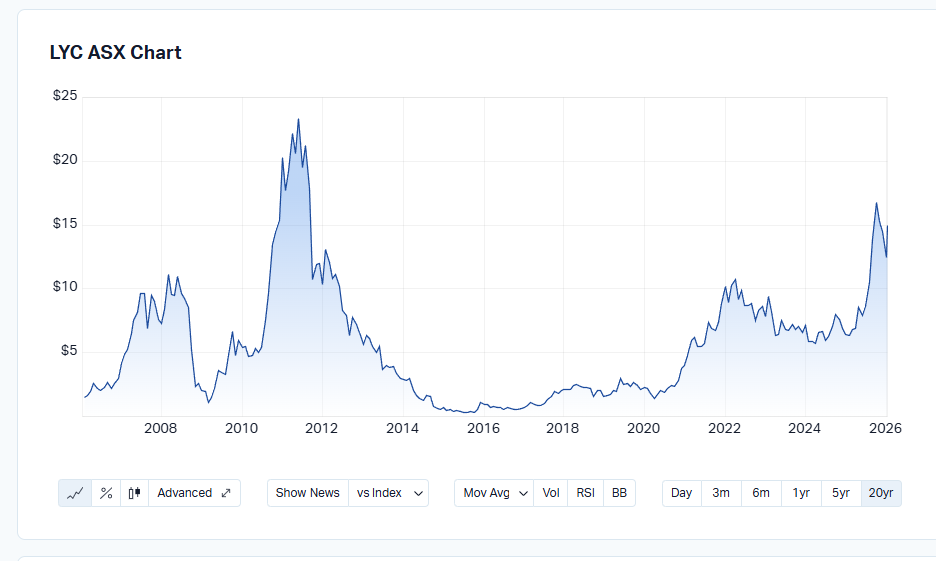

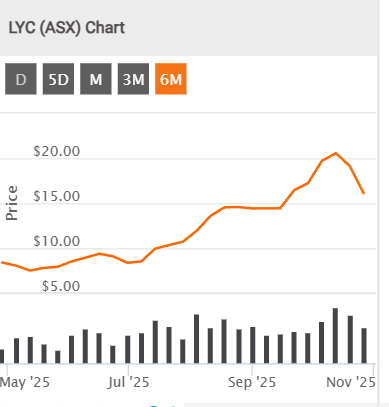

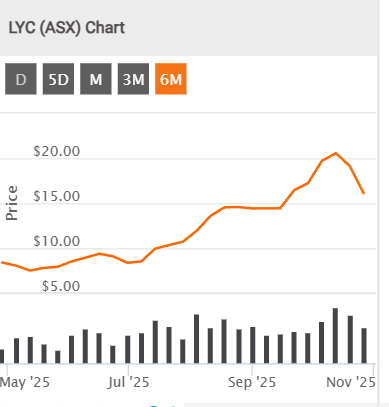

Return (inc div) 1yr: 97.67% 3yr: 23.51% pa 5yr: 40.21% pa

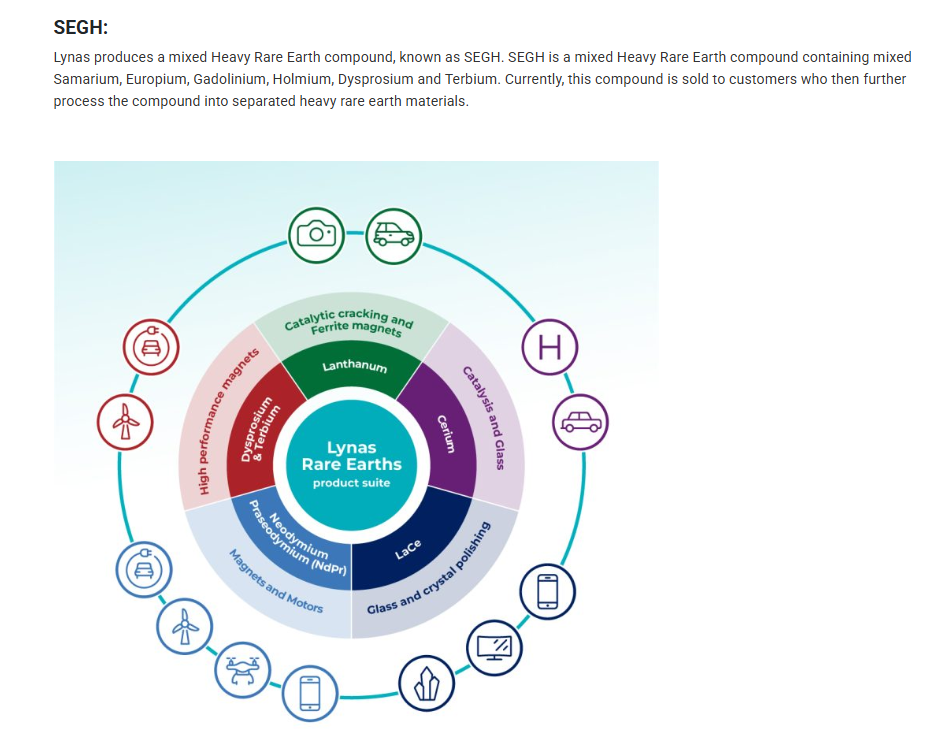

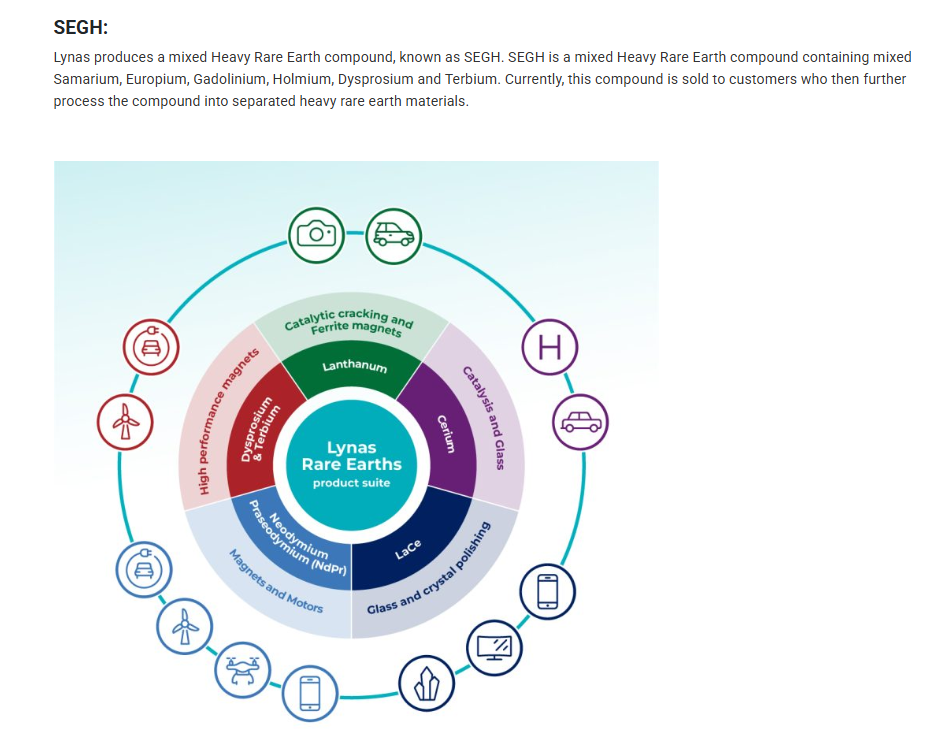

Lynas produces a mixed Heavy Rare Earth compound, known as SEGH

Market prices

- No direct SEGH spot price: The market does not typically quote a single "SEGH spot price" because it is an unseparated mix of elements.

- Prices of individual elements: Instead, prices are set for the individual, separated rare earth oxides. For example, Fastmarkets publishes prices for dysprosium oxide and terbium oxide.

- Market context: Prices for these separated oxides are used to determine the value of the SEGH feed material. The values of Dy and Tb have a direct impact on the final profitability of the SEGH product line.

Magnets:

Lynas Rare Earths' main produce is neodymium and praseodymium (NdPr), which are used to make high-performance permanent magnets. The company also produces other separated rare earth materials and compounds, including Lanthanum (La), Cerium (Ce), and a Mixed Heavy Rare Earths (SEG) concentrate, which is processed into materials like dysprosium and terbium for high-tech applications like electric vehicles and wind turbines.

- Neodymium and Praseodymium (NdPr): This is the company's main product, vital for powerful magnets used in electric vehicle motors and wind turbines.

- Mixed Heavy Rare Earths (SEG): This is a concentrate that customers further process into separated heavy rare earths like dysprosium and terbium, which are crucial for high-temperature performance in magnets.

- Lanthanum (La) and Cerium (Ce): These are other key products that are used in a variety of applications, such as catalysts and glass.

Future plans:

- Lynas is reconfiguring a circuit at its Malaysian facility to separate dysprosium and terbium from SEGH.

- This project is expected to start producing these separated elements in mid-2025.

- This will expand the company's heavy rare earth product range beyond the mixed SEGH compound.

Market prices

- No direct SEGH spot price: The market does not typically quote a single "SEGH spot price" because it is an unseparated mix of elements.

- Prices of individual elements: Instead, prices are set for the individual, separated rare earth oxides. For example, Fastmarkets publishes prices for dysprosium oxide and terbium oxide.

- Market context: Prices for these separated oxides are used to determine the value of the SEGH feed material. The values of Dy and Tb have a direct impact on the final profitability of the SEGH product line.

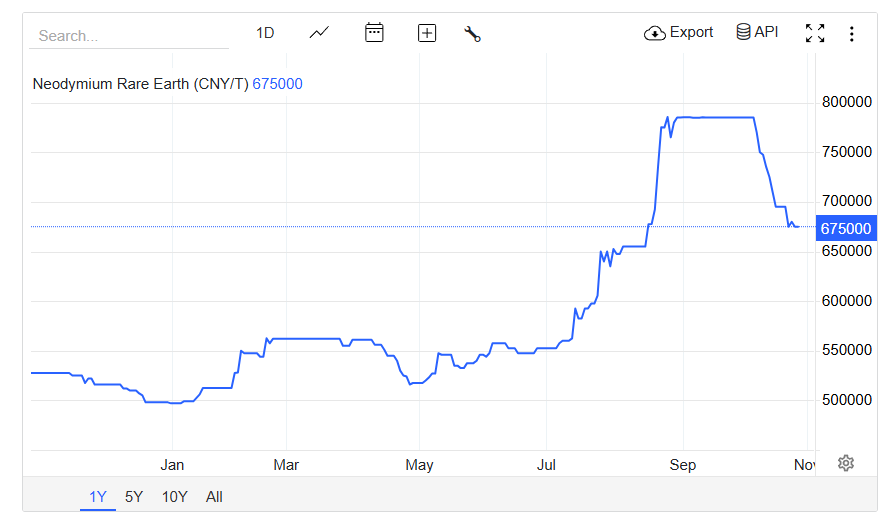

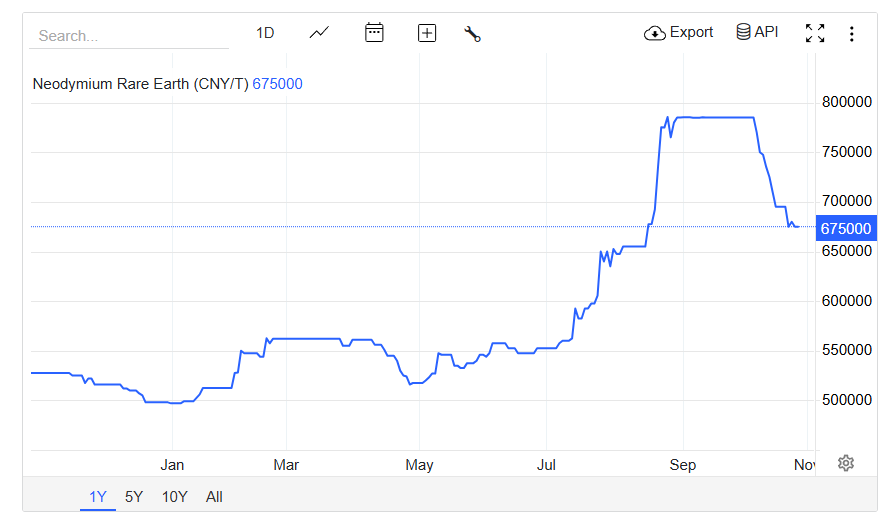

A look at NdPr (Neodymium Praseodymium) below:

Spot Price:

Neodymium traded flat at 675,000 CNY/T on October 29, 2025. Over the past month, Neodymium's price has fallen 14.01%, but it is still 27.96% higher than a year ago, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity.