Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Amanda ends up with a good report card CV here,,,

announces that Chief Executive Officer and Managing Director Amanda Lacaze has advised the Board of her intention to retire after 12 years in the role. The Board has initiated a search process to select a new CEO to lead the company through its next stage of growth. This process will consider both internal and external candidates. Ms Lacaze intends to remain with the company until the end of the current financial year to enable a smooth transition.

Amanda Lacaze said: “I’ve loved every day of my 12 years at Lynas. It has been a great privilege to lead the company from a troubled startup to an ASX50 company. I am extremely proud of our achievements over this time. I am leaving the company in good hands with a fabulous team with unique skills and know-how, and a balance sheet to support future growth plans.

Having successfully concluded the Lynas 2025 capital investment program and launched the Towards 2030 growth strategy, it is the right time to make this transition.” Board Chair John Humphrey said: “Amanda has made an outstanding contribution to Lynas and the rare earths industry over the past 12 years. On behalf of the Board and the whole Lynas team, I thank Amanda for her leadership and dedication to our people and our company.

This company was in a very difficult position when Amanda took on the role of CEO. It is thanks to Amanda’s hard work, drive and tenacity that Lynas is today a leading rare earths producer and critical supplier to global manufacturing supply chains.

Under Amanda’s leadership, the company’s production and operating footprint has grown and our market value has increased from around $400 million in 2014 to close to $15 billion. This provides an excellent foundation for the company’s continued growth and development.”

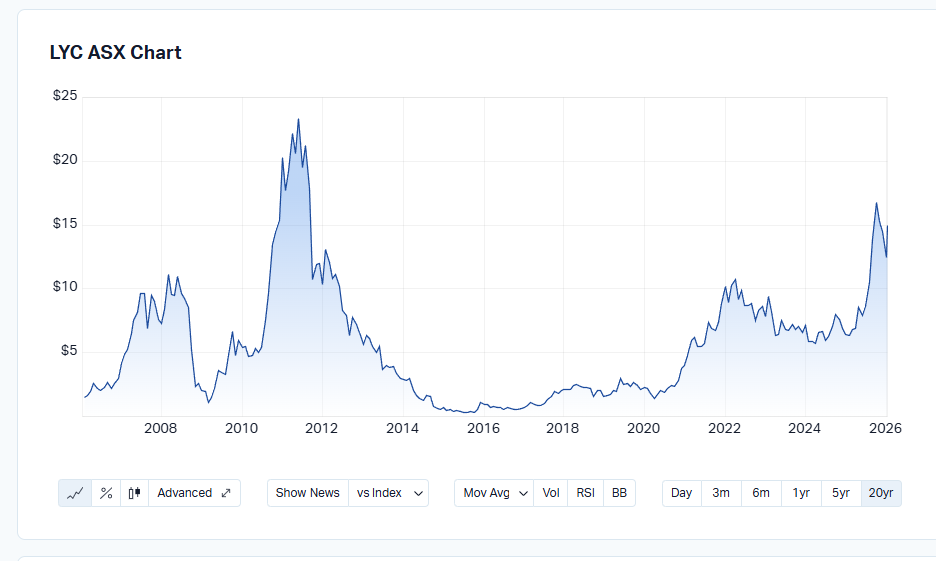

2014 chart shows price below $2

Now circa $15 share price.

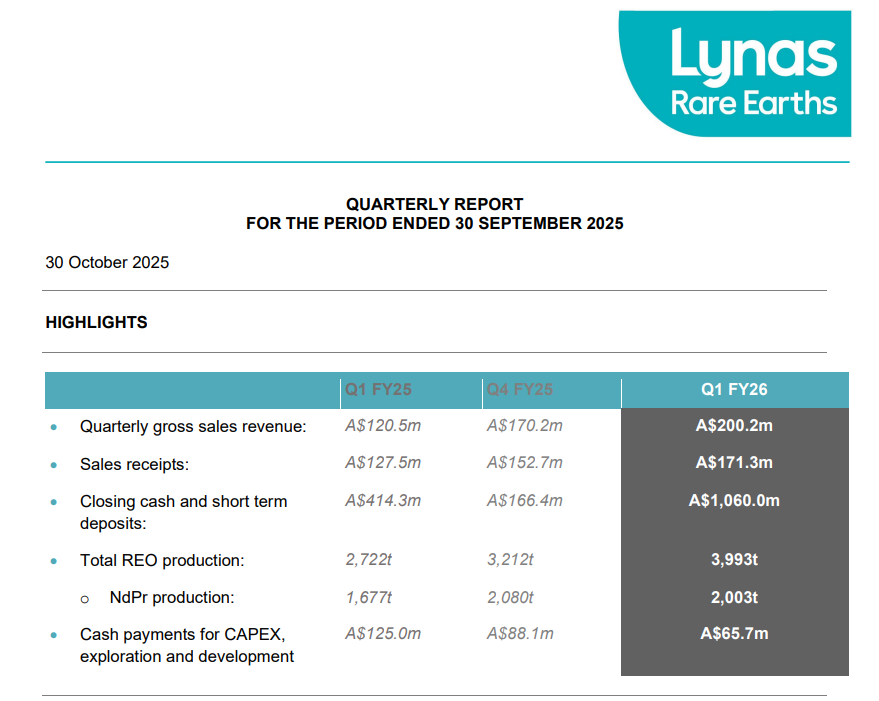

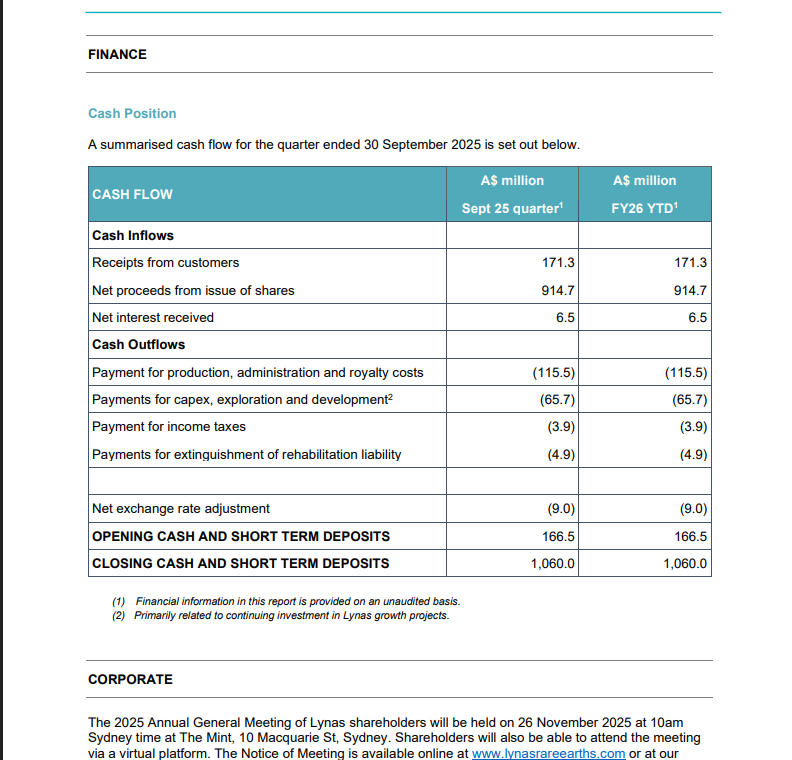

CEO REVIEW The September 2025 quarter was significant for Lynas with the announcement of the Towards 2030 growth strategy, alongside our FY25 financial results on 28 August 2025, and the completion of an equity raising.

The equity raising, which comprised a $750 million institutional placement and a Share Purchase Plan for retail shareholders, further strengthens our Balance Sheet, enabling Lynas to pursue a strong growth agenda.

Share Purchase Plan increased to ~$182 million from the initial target of $75 million.

Yes the outlook is good for Fy 2026 - Lynas have invested. The eps has been in the 'red' since 2022 so holders are looking for positive eps growth now.

https://hotcopper.com.au/threads/ann-quarterly-activities-report.8856595/

Snippets of the Q report below:

Mt Weld Expansion Construction of the Mt Weld Expansion processing plant is now complete and on budget. Phase 2 of the Tailings Storage Facility (TSF) is the only works remaining and is not required for ramp-up. This will be completed in the new year.

United States Following achievement of the first U.S. Heavy Rare Earth oxide sales, discussions have continued with multiple U.S. rare earth buyers, including new metal and magnet projects.

CORPORATE The 2025 Annual General Meeting of Lynas shareholders will be held on 26 November 2025 at 10am Sydney time at The Mint, 10 Macquarie St, Sydney. Shareholders will also be able to attend the meeting via a virtual platform. The Notice of Meeting is available online at www.lynasrareearths.com or at our share registry’s website https://boardroomlimited.com.au/meeting/lynas.

Return (inc div) 1yr: 97.67% 3yr: 23.51% pa 5yr: 40.21% pa

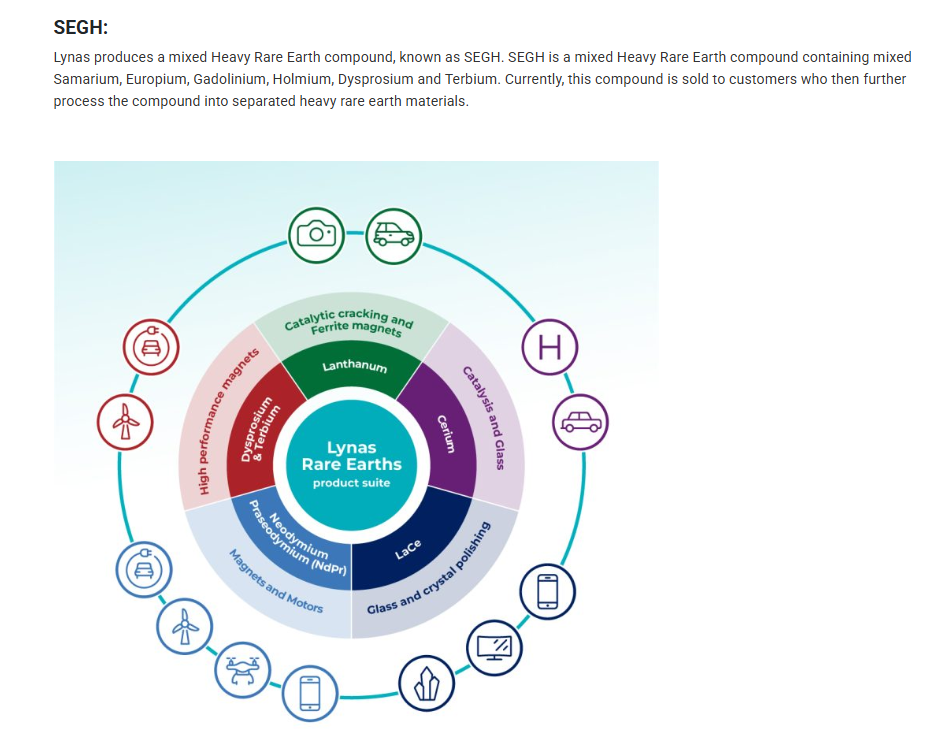

Lynas produces a mixed Heavy Rare Earth compound, known as SEGH

Market prices

- No direct SEGH spot price: The market does not typically quote a single "SEGH spot price" because it is an unseparated mix of elements.

- Prices of individual elements: Instead, prices are set for the individual, separated rare earth oxides. For example, Fastmarkets publishes prices for dysprosium oxide and terbium oxide.

- Market context: Prices for these separated oxides are used to determine the value of the SEGH feed material. The values of Dy and Tb have a direct impact on the final profitability of the SEGH product line.

Magnets:

Lynas Rare Earths' main produce is neodymium and praseodymium (NdPr), which are used to make high-performance permanent magnets. The company also produces other separated rare earth materials and compounds, including Lanthanum (La), Cerium (Ce), and a Mixed Heavy Rare Earths (SEG) concentrate, which is processed into materials like dysprosium and terbium for high-tech applications like electric vehicles and wind turbines.

- Neodymium and Praseodymium (NdPr): This is the company's main product, vital for powerful magnets used in electric vehicle motors and wind turbines.

- Mixed Heavy Rare Earths (SEG): This is a concentrate that customers further process into separated heavy rare earths like dysprosium and terbium, which are crucial for high-temperature performance in magnets.

- Lanthanum (La) and Cerium (Ce): These are other key products that are used in a variety of applications, such as catalysts and glass.

Future plans:

- Lynas is reconfiguring a circuit at its Malaysian facility to separate dysprosium and terbium from SEGH.

- This project is expected to start producing these separated elements in mid-2025.

- This will expand the company's heavy rare earth product range beyond the mixed SEGH compound.

Market prices

- No direct SEGH spot price: The market does not typically quote a single "SEGH spot price" because it is an unseparated mix of elements.

- Prices of individual elements: Instead, prices are set for the individual, separated rare earth oxides. For example, Fastmarkets publishes prices for dysprosium oxide and terbium oxide.

- Market context: Prices for these separated oxides are used to determine the value of the SEGH feed material. The values of Dy and Tb have a direct impact on the final profitability of the SEGH product line.

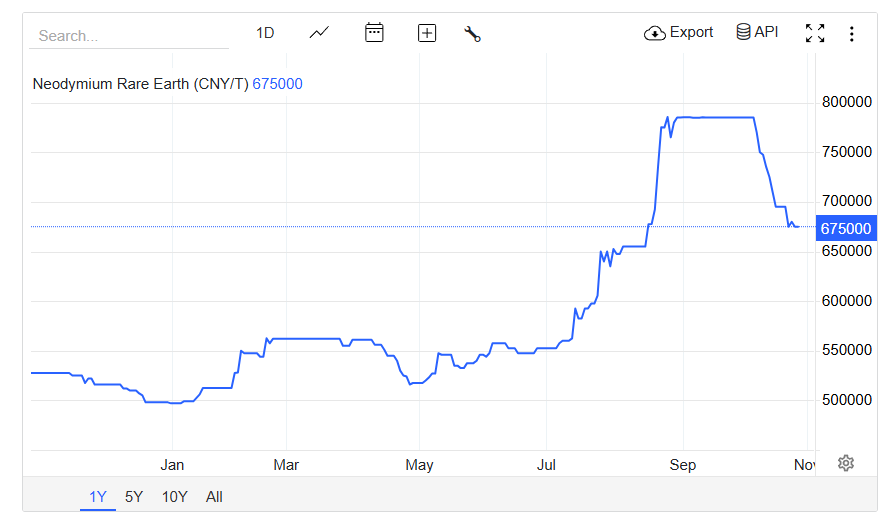

A look at NdPr (Neodymium Praseodymium) below:

Spot Price:

Neodymium traded flat at 675,000 CNY/T on October 29, 2025. Over the past month, Neodymium's price has fallen 14.01%, but it is still 27.96% higher than a year ago, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity.

Lynas Rare Earths announces the signing of a Memorandum of Understanding (MoU) with Korean permanent magnet manufacturer JS Link to develop a sustainable rare earth permanent magnet value chain in Malaysia.

Under the terms of the MoU, Lynas will collaborate with JS Link on the development of a 3,000 tonne capacity NdFeB permanent sintered magnet manufacturing facility near the Lynas Malaysia advanced materials plant in Kuantan, Malaysia. Lynas and JS Link will also collaborate in respect of the supply by Lynas of Light and Heavy Rare Earth materials to JS Link to support production of NdFeB permanent sintered magnets. The MoU is non-binding and subject to a definitive agreement.

( my opinion generally these MOU just hot air! no quantitative use for shareholders )

Lynas is delighted to report a number of ‘firsts’ in the quarter to 30th June 2025.

- At 2,080 tonnes, quarterly production of NdPr exceeded 2,000 tonnes for the first time

- Dysprosium Oxide (Dy) and Terbium Oxide (Tb) were produced on the new production line at Lynas Malaysia in May and June respectively, the first commercial production of separated Heavy Rare Earths (HRE) for Lynas and the first commercial production outside China in decades

- The installation of the first wind turbine at Mt Weld and the completion of the solar farm as we transition to largely renewable energy sources at Mt Weld

- A first MOU has been signed with the Kelantan Menteri Besar (MB) Inc for the collaborative development of rare earth deposits and the future supply of mixed rare earth carbonate (MREC) to the Lynas Malaysia plan

Idea is that the free cash flow to improve from today

Return (inc div) 1yr: 68.44% 3yr: 6.90% pa 5yr: 37.00% pa

Return (inc div) 1yr: 14.91% 3yr: 3.72% pa 5yr: 27.23% pa

5yr chart:

LYC has charted $10 back in 2022

During the March 2024 quarter Lynas expects maximum production rates of approximately 300tpm growing to 750tpm in the June 2024 quarter.

24/10/23, Share Price Reaction: $6.82 up 12.4%

Return (inc div) 1yr: -13.23% 3yr: 33.60% pa 5yr: 34.26% pa

05-Sep-2023: I've been trawling through some recent MoM (Money of Mine) podcast episodes today while doing other things, and I came across a very interesting discussion on Lynas, and why they are not well liked by the locals in Kalgoorlie. It suggests that they don't rate a Social Licence to operate as being particularly important, and may give some insight into why things went so pear-shaped for them in Malaysia - apart from the court challenges and protesting from Chinese-sponsored protest groups that may have been mostly "rent-a-crowd" participants, or so I was previously led to believe.

If you're interested in Lynas as a prospective investment, or are already invested in the company, or even if you're just interested in how a company like Lynas can piss off the local community in a big way and how that might affect their future prospects, this is worth a listen:

Lynas Confirms Kalgoorlie Cost Blowout and Red 5 cash? | Daily Mining Show - YouTube

Plain Text: https://www.youtube.com/watch?v=iW78Zhs8tyo

August 29th, 2023: Their Show Notes: "More annual results with intriguing company commentary for us to pull apart today. We get the ball rolling with a snippet from Monday’s Fortescue (FMG) investor call, honing in on why Fiona Hick departed after just 6-months in the job. We have an in-depth discussion on Lynas (LYC), looking into their Kalgoorlie plant build, the social licence to operate and their current rare earth strategy. Then, Red 5’s (RED) annual result caught our eye, with a close look at trade payables. Ramelius (RMS) get a mention with majority ownership at Musgrave (MGV), while Hillgrove Resources (HGO) is our final talking point of the day, with the aspiring copper producer releasing some copper intercepts from depth."

CHAPTERS

0:00 Preview

1:11 Intro (with Brodes)

7:07 Fortescue investor call

10:16 Lynas Kal update, Community standing & Rare-earth strategy

24:16 Red 5 post up annual numbers

37:11 Ramelius get majority ownership at Musgrave

37:35 Hillgrove approaching first production

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

-------------------------------

Disclosure: I do not hold Lynas (LYC) shares, but I have done in prior years, and it was far from a smooth ride. I would be worried about a company that is prepared to drain Kalgoorlie's parks and reserves irrigation water reservoir - because they (LYC) have the right to - a very stupid decision by the Kalgoorlie-Boulder City Council to be sure - and then spend so little supporting the local community. The locals already hate them and Lynas are doing very little to try to improve their standing in the community in which they wish to operate.

29th FY23 Report LYC Trades at ~$7.00

Noted: FY23 headline Numbers are all down lower. NPAT , Sales Revenue, EPS

REE spot price:?

year 2030 could be 'ho hum' once supply meets demand.

Rare but not necessarily clean:

Noted the slide no percentage comparison: - 43%=310 / 540 Sales: -20% ( Return not Good )

Phew, not easy to read LYC financials.

mmm. Cannot see ant Out Look statement,

- FIN FY23 Financial Results Announcement

Revenue of $739.3m remained strong. EBITDA, at $377.7m was 51% of revenue with NPAT at 42% of revenue. Whilst strong, these results were lower than those in FY22 when market prices were at record highs. “During the year, we invested $595m in capital projects and completed the year with a cash balance of $1 billion, providing funding certainty for completion of our key growth projects.

Heres more a better view of position

Appendix 4E and FY23 Financial Report

EPS -43%= 34/59

State Street Corporation and subsidiaries named in Annexures to this form..

Class of securities Number of securities Person’s votes Voting power

Ordinary 46,783,709 46,783,709 5.01%

...will announce its quarterly results for the period ending 31 March 2023 on the morning of Friday 21 April 2023

As intimated by the string of recent broker upgrades, the Lynas sell-off has been getting folks' attention (including mine). Whatever Lord Elon or his minions say apparently strikes fear and panic (or joy) into the hearts of the herd and would appear to have turbocharged Lynas' descent.

As part of my Lynas homework, I came across references to research and commentary from Adamas Intelligence who seem to be a (the?) go-to rare earths research house. They've provided some quite useful commentary regarding the Tesla announcement and authored the pay-to-read "Rare Earth Magnet Market Outlook to 2035" report (though posted some useful excerpts/findings here). They also authored + released for free the "State of Charge: EVs, Batteries and Battery Materials" report covering 2022 H2 global passenger xEV (i.e., HEV, PHEV and BEV) market performance which is tangentially relevant to Lynas.

In a nutshell, Adamas are forecasting a structural supply deficit for rare earths through 2035. Combined with concerns over China's supply dominance and the comparative environmental "dirtyness" of their supply operations vs other non-China minor players, there seems to be a pretty solid outlook for Lynas who are proven, profitable, and growing their production capacity (their Malaysian licencing woes notwithstanding).

Forward estimates look up and to the right if you ignore last year's result as a PCP anomaly, and extrapolating out 2-3 years using some low to mid range PEs suggests there are better than average odds of easily achieving 10-15%p.a. growth at the current ~$6 SP.

I took a ~1% starter position today @ $6.05 and will probably average down if it keeps tanking.

Quarterly announcement attached. They seem to be over the water issues in Malaysia.

-Works progressing now in Malaysia (to process mixed rare Earth carbonate feedstock / construction of the permanent disposable facility) and Perth (rate Earths processing facility). Full steam ahead.

This morning in the AFR Barrenjoey named it’s top battery metal picks ahead of earnings season. Lynas was one of its top picks with a $12.50 price target and a 46% upside from the current share price. The section on Lynas is copied below:

“Barrenjoey is positive on $7.7 billion Malaysia-based rare earths miner Lynas Corporation and Mr Morgan expects its Kuantan processing plant to deliver for shareholders.

“I think Lynas could beat expectations,” he said. “Last quarter the town water supply they used to run their plant had a catastrophic event and that issue’s been fixed. They’ve got the opportunity to get the plant flat out, so I think there’s upside risk to the numbers.”

Lynas shares are down 22.8 per cent over the past year, but remain 333 per cent higher over the past five years as Western governments support rare earths producers outside China, as strategic assets.

Barrenjoey forecast Lynas to post a net profit of $363.6 million on sales of $896.9 million in financial 2023 on an EBITDA margin of 54.9 per cent. It has an overweight rating on the stock and $12.50 share price target, which represents 46 per cent upside to the $8.58 market price on Wednesday.”

Disc: Held IRL

As an ethical and environmentally responsible rare earth producer, with capability and customer relationships built over the past decade, Lynas was well positioned to benefit from the robust rare earths market during the year.

All ethical here.

So looks ok, What we can mine and cannot mine is all ok. The choices we make could be governed by a few......

LYC under the ASX query microscope

- Release Date: 05/10/22 10:18

- Summary: Response to Appendix 3Y Query

- Price Sensitive: No

5/08/2022

@suttree’s straw has prompted me to check in on Lynas. I tend to pay more attention to holdings in my portfolio when the share price is struggling, which is a mistake!

I notice there are no current valuations for Lynas on Strawman. I think it’s a difficult business to value because of so many unknown future variables. However I am bullish on the future for EVs and the increasing demand for NdPr to produce light weight permanent magnets required to reduce the weight of EVs. I believe the cost of NdPr for an electric car is in the ball park of only $300, so it’s a no brainer for EV companies to use it.

My valuation is based on earnings forecasts provided by S&P Global on Simply Wall Street. It is important to note that forecast earnings data on Commsec is less optimistic than this.

The forecast future revenue, earnings and free cash flow all look good, at least heading in the right direction!

Using McNivens StockVal formula and the following variables (see the StockVal forum on Strawman for the spreadsheet)

APC = 24.5% (future ROE over next 3 yrs based on analyst forecasts. Historical ROE was 22%)

Shareholder Equity = $1.20

Dividend = 0

Reinvested earnings = 100%

Required Return = 8.6% (fudged this to match todays share price)

I get a valuation of $9.20 which is around the current share price. Keep in mind this is NOT a target price. This means you could buy the shares today and expect a return of 8.6%, that is IF the analysts forecasts turn out to be correct. As Scott Philips says, ‘IF’ is the smallest big word in the English dictionary!

When I buy a business I am looking for an annual return of at least 10%, preferably closer to 20%. However, valuation is far from an exact science and I wouldn’t be selling a business like Lynas at the current price. For me it’s a HOLD.

Disc: Held IRL (2% weight)

13/07/2021 Assuming Value/share = E/share X PE Forecast earnings: (Consensus of 4 analysts Simply Wall Street) E (2023) = 350 million Value (2023) = $350 million / 901 million shares x 30^ = $11.65 ^ I have used a PE of 30. I think this is reasonable given forecast growth of 60% and forecast ROE of 20%. Current value discounted at 10% per year = $11.65 X 0.8 = $9.32/share Simply Wall Street DCF value based on a discount rate of 6.9% is $10.27 Using the lower value estimate of $9.30/share. Disc: shares held in RL portfolio.

According to a story in the AFR this morning, Lynas suspects fake social media accounts are spreading disinformation and political agendas hostile to its rare earths business.

Some key points from the story:

- Lynas has received evidence it was the target of a coordinated cyber campaign that acted in the Chinese national interest.

- US cybersecurity firm Mandiant told Lynas that fake social media accounts had sought to incite protests in April and May against the company’s plan to build a rare earths processing plant in Texas.

- coincided with final negotiations between Lynas and the US government over a $US120 million financial support package for the Texas project which is part of a US plan to break China’s stranglehold on production of the 17 rare earth elements needed for electric vehicles and defence tools like drones

- Two other North American producers of rare earths were targeted

- consistent with a broader, pro-China cyber campaign dubbed as “Dragonbridge”

Mandiant has no proof the Chinese government was involved.

Lynas has been the subject of disinformation campaigns in Malaysia for some years, however, this is the first time Lynas has seen evidence of direct links between fake social media accounts spreading disinformation and political agendas.

Disc: Held IRL

LYNAS AWARDED US$120M CONTRACT TO BUILD COMMERCIAL HRE FACILITY

Lynas Rare Earths Ltd (ASX: LYC, OTC:LYSDY) (Lynas) is pleased to announce that wholly owned subsidiary, Lynas USA LLC, has signed a follow-on contract for approximately US$120 million with the U.S. Department of Defense (DoD) to establish a first of its kind commercial Heavy Rare Earths (HRE) separation facility in the United States.

This mutually beneficial contract supports Lynas to establish an operating footprint in the United States, including the production of separated Heavy Rare Earth products to complement its Light Rare Earth product suite. As a result, U.S. industry will secure access to domestically produced Heavy Rare Earths which cannot be sourced today and which are essential to the development of a robust supply chain for future facing industries including electric vehicles, wind turbines and electronics.

Lynas worked closely with the DoD on the Phase 1 contract for a U.S. based Heavy Rare Earth separation facility (announced 27 July 2020) and the company is delighted to have reached agreement for a full-scale commercial HRE facility.

Construction costs for the HRE capability as submitted in June 2021 are fully covered by this DoD contract, which is sponsored and funded by the U.S. DoD Industrial Base Analysis and Sustainment (IBAS) program.

Lynas plans to co-locate the Heavy Rare Earths separation facility with the proposed Light Rare Earth separation facility (announced on 22 January 2021) which is sponsored and half funded by the U.S. DoD Title III, Defense Production Act office.

Following a detailed site selection process, the facility is expected to be located within an existing industrial area on the Gulf Coast of the State of Texas and targeted to be operational in financial year 2025.

Feedstock for the facility will be a mixed Rare Earths carbonate produced from material sourced at the Lynas mine in Mt Weld, Western Australia. Lynas will also work with potential 3rd party providers to source other suitable feedstocks as they become available.

Lynas Rare Earths CEO and Managing Director Amanda Lacaze commented: “The development of a U.S. Heavy Rare Earths separation facility is an important part of our accelerated growth plan and we look forward to not only meeting the rare earth needs of the U.S. Government but also reinvigorating the local Rare Earths market. This includes working to develop the Rare Earths supply chain and value added activities."

Disc: Held IRL

note, generally these reports are called Quarterly Report Appendix 4C

The bears are in the market so skittish holders all over the markets at present 2022.

The 2Q22 production update revealed a 33% lift in total Rare Earths Oxide production on 1Q22. Strong demand translated to favourable commodity pricing, which resulted in a record sales revenue of $202.7m over the quarter (vs $121.6m in 1Q22).

And for Comparison 30th September 2021

so the trend is still up going on these #s eg Sept Q Sales R': $121.6m vs Dec 2021 $202.7m up $81Mill at 67%

Discl: RL,

Lynas released its 4Q21 report this morning.

My take

- Record quarterly sales revenue ($185.9 million) and sales receipts ($192 million)despite the Malaysian restrictions on the number of workers permitted on site during COVID.

- FY21 revenue ($465.5 million) appears to be in line with analyst forecasts ($473 million, SWS data)

- Strong cash balance of $860.8 million, up from $101.7 million FY20. Although $413.9 million of this was revenue from capital raising (see Cash Position attached below)

- NdPr oxide prices have more than doubled over FY21 but prices have softened slightly since April.

Highhlights:

- Quarterly Sales Revenue: A$185.9m (Q3 FY21: A$110m

- Sales receipts: A$192m (Q3 FY21: A$133m)

- Closing cash balance: A$680.8m (Q3 FY21: A$568.5m)

- Total REO production: 3778 tonnes (Q3 FY21: 4463 tonnes)

- NdPr production 1393 tonnes (Q3FY21:1359 tonnes)

Lynas Rare Earths Limited has just been been awarded a $14.8 million grant as part of the Australian government’s Modern Manufacturing Initiative.

The grant will enable Lynas to commercialise an industry-first Rare Earth carbonate refining process that has been developed by our inhouse research and development team. The new process has been tested at bench scale and has proven effective in producing a higher purity Rare Earth carbonate that can feed the Lynas Malaysia plant as well as the proposed U.S. Rare Earth processing facility.