Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Amanda ends up with a good report card CV here,,,

announces that Chief Executive Officer and Managing Director Amanda Lacaze has advised the Board of her intention to retire after 12 years in the role. The Board has initiated a search process to select a new CEO to lead the company through its next stage of growth. This process will consider both internal and external candidates. Ms Lacaze intends to remain with the company until the end of the current financial year to enable a smooth transition.

Amanda Lacaze said: “I’ve loved every day of my 12 years at Lynas. It has been a great privilege to lead the company from a troubled startup to an ASX50 company. I am extremely proud of our achievements over this time. I am leaving the company in good hands with a fabulous team with unique skills and know-how, and a balance sheet to support future growth plans.

Having successfully concluded the Lynas 2025 capital investment program and launched the Towards 2030 growth strategy, it is the right time to make this transition.” Board Chair John Humphrey said: “Amanda has made an outstanding contribution to Lynas and the rare earths industry over the past 12 years. On behalf of the Board and the whole Lynas team, I thank Amanda for her leadership and dedication to our people and our company.

This company was in a very difficult position when Amanda took on the role of CEO. It is thanks to Amanda’s hard work, drive and tenacity that Lynas is today a leading rare earths producer and critical supplier to global manufacturing supply chains.

Under Amanda’s leadership, the company’s production and operating footprint has grown and our market value has increased from around $400 million in 2014 to close to $15 billion. This provides an excellent foundation for the company’s continued growth and development.”

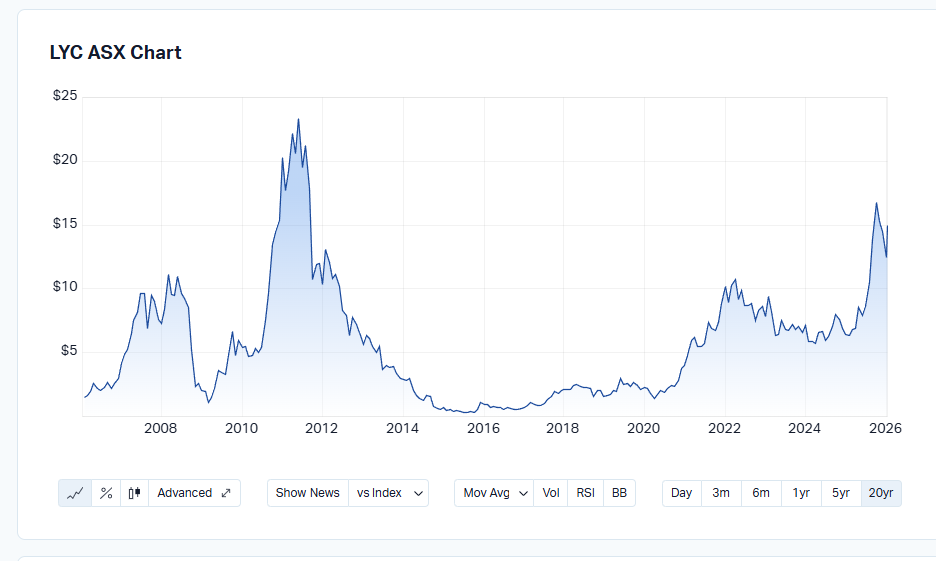

2014 chart shows price below $2

Now circa $15 share price.

Lynas Rare Earths announces the signing of a Memorandum of Understanding (MoU) with Korean permanent magnet manufacturer JS Link to develop a sustainable rare earth permanent magnet value chain in Malaysia.

Under the terms of the MoU, Lynas will collaborate with JS Link on the development of a 3,000 tonne capacity NdFeB permanent sintered magnet manufacturing facility near the Lynas Malaysia advanced materials plant in Kuantan, Malaysia. Lynas and JS Link will also collaborate in respect of the supply by Lynas of Light and Heavy Rare Earth materials to JS Link to support production of NdFeB permanent sintered magnets. The MoU is non-binding and subject to a definitive agreement.

( my opinion generally these MOU just hot air! no quantitative use for shareholders )

Lynas is delighted to report a number of ‘firsts’ in the quarter to 30th June 2025.

- At 2,080 tonnes, quarterly production of NdPr exceeded 2,000 tonnes for the first time

- Dysprosium Oxide (Dy) and Terbium Oxide (Tb) were produced on the new production line at Lynas Malaysia in May and June respectively, the first commercial production of separated Heavy Rare Earths (HRE) for Lynas and the first commercial production outside China in decades

- The installation of the first wind turbine at Mt Weld and the completion of the solar farm as we transition to largely renewable energy sources at Mt Weld

- A first MOU has been signed with the Kelantan Menteri Besar (MB) Inc for the collaborative development of rare earth deposits and the future supply of mixed rare earth carbonate (MREC) to the Lynas Malaysia plan

Idea is that the free cash flow to improve from today

Return (inc div) 1yr: 68.44% 3yr: 6.90% pa 5yr: 37.00% pa

Return (inc div) 1yr: 14.91% 3yr: 3.72% pa 5yr: 27.23% pa

5yr chart:

LYC has charted $10 back in 2022

During the March 2024 quarter Lynas expects maximum production rates of approximately 300tpm growing to 750tpm in the June 2024 quarter.

24/10/23, Share Price Reaction: $6.82 up 12.4%

Return (inc div) 1yr: -13.23% 3yr: 33.60% pa 5yr: 34.26% pa

05-Sep-2023: I've been trawling through some recent MoM (Money of Mine) podcast episodes today while doing other things, and I came across a very interesting discussion on Lynas, and why they are not well liked by the locals in Kalgoorlie. It suggests that they don't rate a Social Licence to operate as being particularly important, and may give some insight into why things went so pear-shaped for them in Malaysia - apart from the court challenges and protesting from Chinese-sponsored protest groups that may have been mostly "rent-a-crowd" participants, or so I was previously led to believe.

If you're interested in Lynas as a prospective investment, or are already invested in the company, or even if you're just interested in how a company like Lynas can piss off the local community in a big way and how that might affect their future prospects, this is worth a listen:

Lynas Confirms Kalgoorlie Cost Blowout and Red 5 cash? | Daily Mining Show - YouTube

Plain Text: https://www.youtube.com/watch?v=iW78Zhs8tyo

August 29th, 2023: Their Show Notes: "More annual results with intriguing company commentary for us to pull apart today. We get the ball rolling with a snippet from Monday’s Fortescue (FMG) investor call, honing in on why Fiona Hick departed after just 6-months in the job. We have an in-depth discussion on Lynas (LYC), looking into their Kalgoorlie plant build, the social licence to operate and their current rare earth strategy. Then, Red 5’s (RED) annual result caught our eye, with a close look at trade payables. Ramelius (RMS) get a mention with majority ownership at Musgrave (MGV), while Hillgrove Resources (HGO) is our final talking point of the day, with the aspiring copper producer releasing some copper intercepts from depth."

CHAPTERS

0:00 Preview

1:11 Intro (with Brodes)

7:07 Fortescue investor call

10:16 Lynas Kal update, Community standing & Rare-earth strategy

24:16 Red 5 post up annual numbers

37:11 Ramelius get majority ownership at Musgrave

37:35 Hillgrove approaching first production

-------------------------------

DISCLAIMER

All Money of Mine episodes are for informational purposes only and may contain forward-looking statements that may not eventuate. The co-hosts are not financial advisers and any views expressed are their opinion only. Please do your own research before making any investment decision or alternatively seek advice from a registered financial professional.

-------------------------------

Disclosure: I do not hold Lynas (LYC) shares, but I have done in prior years, and it was far from a smooth ride. I would be worried about a company that is prepared to drain Kalgoorlie's parks and reserves irrigation water reservoir - because they (LYC) have the right to - a very stupid decision by the Kalgoorlie-Boulder City Council to be sure - and then spend so little supporting the local community. The locals already hate them and Lynas are doing very little to try to improve their standing in the community in which they wish to operate.

Noted the slide no percentage comparison: - 43%=310 / 540 Sales: -20% ( Return not Good )

Phew, not easy to read LYC financials.

mmm. Cannot see ant Out Look statement,

- FIN FY23 Financial Results Announcement

Revenue of $739.3m remained strong. EBITDA, at $377.7m was 51% of revenue with NPAT at 42% of revenue. Whilst strong, these results were lower than those in FY22 when market prices were at record highs. “During the year, we invested $595m in capital projects and completed the year with a cash balance of $1 billion, providing funding certainty for completion of our key growth projects.

Heres more a better view of position

Appendix 4E and FY23 Financial Report

EPS -43%= 34/59

U.S. DoD STRENGTHENS SUPPORT FOR LYNAS U.S. FACILITY

LYNAS RARE EARTHS AWARDED $20M AUSTRALIAN GOVERNMENT GRANT

The Malaysian government has kicked the can down the road by granting Lynas a reprieve in the form of an operating licence variation which will allow Lynas to continue processing lanthanide concentrate in Malaysia until 1 January 2024. This should give Lynas the breathing room to complete the build and commissioning of their West Australian processing operations, which will be critical if the Malaysian government ultimately decide to reinstate the operating licence restriction from 1 January 2024 (or some later date).

This decision avoids a huge hole being blown in Lynas' P&L for the latter part of 2023 and potentially early part of 2024, which is why the stock has rallied so hard over recent days.

It's unclear which way the Malaysian operating licence discussions will ultimately go, but it smells to me like the Malaysian government is gearing up to reimpose the restriction. I think this extension is indirectly acknowledging the dissonance and harm the policy pivot will have on Lynas, and is a consolation prize that at least gives Lynas the time to get their plan B in place even though it won't compensate them for the devaluation of their investment in Malaysia.

...will announce its quarterly results for the period ending 31 March 2023 on the morning of Friday 21 April 2023

As intimated by the string of recent broker upgrades, the Lynas sell-off has been getting folks' attention (including mine). Whatever Lord Elon or his minions say apparently strikes fear and panic (or joy) into the hearts of the herd and would appear to have turbocharged Lynas' descent.

As part of my Lynas homework, I came across references to research and commentary from Adamas Intelligence who seem to be a (the?) go-to rare earths research house. They've provided some quite useful commentary regarding the Tesla announcement and authored the pay-to-read "Rare Earth Magnet Market Outlook to 2035" report (though posted some useful excerpts/findings here). They also authored + released for free the "State of Charge: EVs, Batteries and Battery Materials" report covering 2022 H2 global passenger xEV (i.e., HEV, PHEV and BEV) market performance which is tangentially relevant to Lynas.

In a nutshell, Adamas are forecasting a structural supply deficit for rare earths through 2035. Combined with concerns over China's supply dominance and the comparative environmental "dirtyness" of their supply operations vs other non-China minor players, there seems to be a pretty solid outlook for Lynas who are proven, profitable, and growing their production capacity (their Malaysian licencing woes notwithstanding).

Forward estimates look up and to the right if you ignore last year's result as a PCP anomaly, and extrapolating out 2-3 years using some low to mid range PEs suggests there are better than average odds of easily achieving 10-15%p.a. growth at the current ~$6 SP.

I took a ~1% starter position today @ $6.05 and will probably average down if it keeps tanking.

BELL POTTER - Raised to Buy from Hold PT $8.06

CITI - Buy PT $8.20

Quarterly announcement attached. They seem to be over the water issues in Malaysia.

-Works progressing now in Malaysia (to process mixed rare Earth carbonate feedstock / construction of the permanent disposable facility) and Perth (rate Earths processing facility). Full steam ahead.

This morning in the AFR Barrenjoey named it’s top battery metal picks ahead of earnings season. Lynas was one of its top picks with a $12.50 price target and a 46% upside from the current share price. The section on Lynas is copied below:

“Barrenjoey is positive on $7.7 billion Malaysia-based rare earths miner Lynas Corporation and Mr Morgan expects its Kuantan processing plant to deliver for shareholders.

“I think Lynas could beat expectations,” he said. “Last quarter the town water supply they used to run their plant had a catastrophic event and that issue’s been fixed. They’ve got the opportunity to get the plant flat out, so I think there’s upside risk to the numbers.”

Lynas shares are down 22.8 per cent over the past year, but remain 333 per cent higher over the past five years as Western governments support rare earths producers outside China, as strategic assets.

Barrenjoey forecast Lynas to post a net profit of $363.6 million on sales of $896.9 million in financial 2023 on an EBITDA margin of 54.9 per cent. It has an overweight rating on the stock and $12.50 share price target, which represents 46 per cent upside to the $8.58 market price on Wednesday.”

Disc: Held IRL

As an ethical and environmentally responsible rare earth producer, with capability and customer relationships built over the past decade, Lynas was well positioned to benefit from the robust rare earths market during the year.

All ethical here.

So looks ok, What we can mine and cannot mine is all ok. The choices we make could be governed by a few......

LYC under the ASX query microscope

- Release Date: 05/10/22 10:18

- Summary: Response to Appendix 3Y Query

- Price Sensitive: No

MACQUARIE - Lynas raised to Outperform PT $9.40

JARE SUPPORTS LYNAS’ DEVELOPMENT WITH NEW AGREEMENTS

Lynas Rare Earths Ltd (ASX: LYC, OTC:LYSDY) (“Lynas”) is pleased to announce the signing of agreements with Japan Australia Rare Earths B.V. (“JARE”) which reconfirm our shared commitment to work together on future development opportunities.

MACQUARIE - Outperform PT $12.50

CLSA - Outperform PT $8.95

According to a story in the AFR this morning, Lynas suspects fake social media accounts are spreading disinformation and political agendas hostile to its rare earths business.

Some key points from the story:

- Lynas has received evidence it was the target of a coordinated cyber campaign that acted in the Chinese national interest.

- US cybersecurity firm Mandiant told Lynas that fake social media accounts had sought to incite protests in April and May against the company’s plan to build a rare earths processing plant in Texas.

- coincided with final negotiations between Lynas and the US government over a $US120 million financial support package for the Texas project which is part of a US plan to break China’s stranglehold on production of the 17 rare earth elements needed for electric vehicles and defence tools like drones

- Two other North American producers of rare earths were targeted

- consistent with a broader, pro-China cyber campaign dubbed as “Dragonbridge”

Mandiant has no proof the Chinese government was involved.

Lynas has been the subject of disinformation campaigns in Malaysia for some years, however, this is the first time Lynas has seen evidence of direct links between fake social media accounts spreading disinformation and political agendas.

Disc: Held IRL

MACQUARIE - Outperform PT $12.80

BARCLAY PEARCE CAPITAL - Buy PT $10.23

LYNAS AWARDED US$120M CONTRACT TO BUILD COMMERCIAL HRE FACILITY

Lynas Rare Earths Ltd (ASX: LYC, OTC:LYSDY) (Lynas) is pleased to announce that wholly owned subsidiary, Lynas USA LLC, has signed a follow-on contract for approximately US$120 million with the U.S. Department of Defense (DoD) to establish a first of its kind commercial Heavy Rare Earths (HRE) separation facility in the United States.

This mutually beneficial contract supports Lynas to establish an operating footprint in the United States, including the production of separated Heavy Rare Earth products to complement its Light Rare Earth product suite. As a result, U.S. industry will secure access to domestically produced Heavy Rare Earths which cannot be sourced today and which are essential to the development of a robust supply chain for future facing industries including electric vehicles, wind turbines and electronics.

Lynas worked closely with the DoD on the Phase 1 contract for a U.S. based Heavy Rare Earth separation facility (announced 27 July 2020) and the company is delighted to have reached agreement for a full-scale commercial HRE facility.

Construction costs for the HRE capability as submitted in June 2021 are fully covered by this DoD contract, which is sponsored and funded by the U.S. DoD Industrial Base Analysis and Sustainment (IBAS) program.

Lynas plans to co-locate the Heavy Rare Earths separation facility with the proposed Light Rare Earth separation facility (announced on 22 January 2021) which is sponsored and half funded by the U.S. DoD Title III, Defense Production Act office.

Following a detailed site selection process, the facility is expected to be located within an existing industrial area on the Gulf Coast of the State of Texas and targeted to be operational in financial year 2025.

Feedstock for the facility will be a mixed Rare Earths carbonate produced from material sourced at the Lynas mine in Mt Weld, Western Australia. Lynas will also work with potential 3rd party providers to source other suitable feedstocks as they become available.

Lynas Rare Earths CEO and Managing Director Amanda Lacaze commented: “The development of a U.S. Heavy Rare Earths separation facility is an important part of our accelerated growth plan and we look forward to not only meeting the rare earth needs of the U.S. Government but also reinvigorating the local Rare Earths market. This includes working to develop the Rare Earths supply chain and value added activities."

Disc: Held IRL

EDITED BECAUSE I CAN'T LIVE WITH TYPOS

Lynas achieves another record result.

CEO and MD Amanda Lacaze attributes this to the excellent market dynamics and continued strong customer demand for rare earths. And yes, sure, the rare earths space as we all know is buoyant. But I reckon Lacaze and her management team and employees are doing pretty well to navigate Lynas through covid, supply chain disruptions, once in 50 year Malaysian floods, political upheaval etc etc. As I've written before, I don't know how they do it.

Record Profit

$156.9M vs 1H 21 NPAT: $40.6M

Record Sales

$314.8M vs 1H 21 : $202.5M

EBITDA $189.8M vs 1H 21: $80.6M

Cash and Short Term Deposits

$674.2M vs 1H 21: $512.6M

Here's the ASX Release 25 Feb. And then below that is a link to the full results presentation.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02491664-6A1078820?access_token=83ff96335c2d45a094df02a206a39ff4

And for a snapshot of the Rare Earths Market and where it's heading have a look at Slide 6 in the full presentation

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02491665-6A1078821?access_token=83ff96335c2d45a094df02a206a39ff4

Disc: Held in RL

After the market closed today, Lynas released the results of a 1 kilometre deep exploration hole drilled in fresh carbonatite below the current Mt Weld life of mine design and ore reserve.

The results confirm continuous Rare Earth Element (REE) mineralisation along the 1020m drill core at an average grade of 2.22% REO, no cut-off grade applied. Apatite Zones at shallower depths show enriched REE grade (7m zone of 7.6% REO at 0m to 27m below the current pit floor and 23m zone of 13.67% REO at 42m to 62m depth below the current pit floor). The successful completion of the 1 km deep diamond drill hole was announced on 2 August 2021. The drilling program was partially funded by the Western Australia Government Exploration Incentive Scheme (EIS).

The Mt Weld Carbonatite (MWC) is a sub-vertical cylindrical igneous intrusion approximately 3.6 kilometres in diameter. The MWC is concealed under a 25m thick layer of younger transported alluvial sedimentary cover. Prior to the sedimentation, a prolonged widespread lateritic weathering process over the Laverton geological region has concentrated REE minerals in the carbonatite’s upper saprolite zone. The saprolite zone has variable thickness from about 80m to 120m below the surface. Lynas’ current REE open pit mine is about 65m deep and is producing REE ore from the saprolite zone. Previous exploration activities focussed on the saprolite zone and shallow depths of less than 150m. The drilling of MWEX10270 was carried out to obtain a better understanding of the mineralogy and REE mineralisation within the fresh carbonatite below the Mineral Resource.

Analysis of samples obtained from the exploration drill hole have revealed:

- REE mineralisation was confirmed along the entire 1010m drillhole at an average grade of 2.22% REO, no cut-off grade applied

- The weathering process has significantly enriched the REE grade in the saprolite zone, due to the relative enrichment of monazite within the Apatite Zones. Apatite Zones at shallower depths show 27m of 7.6% REO (0m to 27m depth below the current pit floor and 65 to 92m below the surface) and 23m of 13.67% REO (42m to 62m depth below the current pit floor and 107 to 127m below the surface)

- All samples returned REE assay; the highest grade is 21.44% REO from 60m to 62.4m hosted in the apatite zone and the lowest grade is 0.17% REO in a 4m composite sample from 969m to 973m depth hosted in calcite-rich carbonatite

- The REE mineralisation continued beyond the end of the drillhole, with the last 4 meters of single metre samples analysed at an average grade of 1.47% REO from 1016m to 1020m

- Dolerite dyke emplacement has resulted in a metasomatic alteration / remelting zone in carbonatite from 600m to 800m depth, which has been identified in the MWC as favourable for relative enrichment of HREE

- Significant REE mineralisation observed is hosted within the dolomite and ankerite carbonatites of the upper 800m of the drill core.

The results reveal a large area of new exploration target in the fresh carbonatite below the zone of surficial weathering profile.

Lynas will establish a new exploration program on the identified target. This program is an important element in continuing to develop the Mt Weld resource to meet growing demand for Rare Earth materials. Detailed metallurgical testing will be conducted on the drillcore samples to guide development of a suitable ore beneficiation process for producing ore concentrate from the transition and fresh carbonatite.

Lynas CEO and Managing Director Amanda Lacaze commented, “I’m delighted to announce the results of this 1km deep core drilling and analysis which show a large endowment of Rare Earth Elements below the current Mt Weld open pit mine. The Mt Weld ore body is remarkable in its geology including its REE enrichment. We are excited to establish a new, targeted exploration program with the goal of meeting accelerating customer demand for many years to come.

CANACCORD - Raised to BUY PT $12

MACQUARIE - Outperform PT $12.60

Today's report. How the hell do they do it? (And it's a much bigger story than higher commodity prices).

What impresses me most about this company and management team is how in today's incredibly challenging Perfect Storm of covid, supply chain delays, revolving governments, floods....they still managed to increase profits and production.

They still managed to kick major environmental approval goals. They further progressed their expansion and consolidation plans in Australia, Malaysia and the US.

Their major Japanese financial backer gave them the long term seal of approval.

They nurtured and enhanced their relationship with local Malaysian communities and gave aid during a most challenging and stressful time.

But what jumped out at me today was the bit about supply chains. As we know delays are affecting everything in these beautiful times from iron ore to microchips to toilet rolls.

Back in December shipping delays and disruptions meant "Lynas transit time for concentrate shipped from Fremantle to Kuantan, has increased from 15 days in March 2021 to 33 days in December 2021"

Rather than keep their key customers waiting...

"To mitigate the impact of the global shipping delays, the team implemented solutions including chartering a ship to transport Lynas’ rare earth concentrate from Fremantle Port to Kuantan Port. Whilst this comes at an additional cost, it is outweighed by the benefit of ensuring continuity of supply to our customers. We expect to continue with a combination of charter and commercial shipping in the near term."

Can't get it to your customers on time using the pre covid way? HIRE A SHIP. Do whatever it takes to look after your customers. ATTITUDE

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02476773-6A1072752?access_token=83ff96335c2d45a094df02a206a39ff4

Disc: Held in RL

note, generally these reports are called Quarterly Report Appendix 4C

The bears are in the market so skittish holders all over the markets at present 2022.

The 2Q22 production update revealed a 33% lift in total Rare Earths Oxide production on 1Q22. Strong demand translated to favourable commodity pricing, which resulted in a record sales revenue of $202.7m over the quarter (vs $121.6m in 1Q22).

And for Comparison 30th September 2021

so the trend is still up going on these #s eg Sept Q Sales R': $121.6m vs Dec 2021 $202.7m up $81Mill at 67%

Discl: RL,

Lynas primarily produces Neodymium and Praseodymium or NdPr, when Neodymium is combined with Iron and Boron it forms the strongest magnets known.

These magnets are used in smartphones, wind turbines, EV''s and defense applications (F-35's have 35kg of Neodymium in them).

China has a monopoly on rare earths processing 90% of world wide supply; and although rare earths aren't actually 'rare' processing is intensive, hard and can have detrimental environmental effects. Lynas is the only major miner and producer of NdPr outside of China and has a couple of tailwinds:

- A geopolitical shift for domestic supply of critical elements post COVID

- Increased production and use of magnets made from Neodymium mentioned above

I'm watching for the following to determine whether the stock continues to appreciate:

- Price - neodymium price can be found here https://tradingeconomics.com/commodity/neodymium

- Production - FY21 Lynas product 5,641t of NdPr

- They've stated this is 75% of production capacity due to COVID restrictions in Malaysia

- Opening a production facility in Texas, USA with Dept of defence backing bring circa 1,000t of NdPr into production

- Operational efficiencies

- Increase JORC resource at Mt Weld - currently awaiting assay results

- Re-locating Malaysian processing facility to Kalgoolie, Australia by July 2023

If the above is executed (pro's are experience team who've done it before, defense backing, demand), (con's are building two production facilities in an inflationary environment) then I'd assume further SP appreciation.

The wolf on top of the hill is never as hungry as the wolf climbing the hill - happy hunting.

Lynas Rare Earths has just received official approval from Malaysian Regulatory Authorities.

Permanent Disposal Facility for Water Leach Purification approved. Nice enviro win. Nine year resilience/community and government engagement. Acknowledgement from new Malaysian Government and all international environmental standards measures.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02472288-6A1071030?access_token=83ff96335c2d45a094df02a206a39ff4

Disc: Held in RL

Rare Earths but serial reposter of stuff I think we should keep an eye on.

This Stockhead article was published June 30. RARE EARTHS/Punter's Guide. Posting here now because ABC Business just did a year-in-highlight best-of program. China stranglehold. Australia desperately ramping up. Lynas "massive head start".

https://stockhead.com.au/resources/a-complete-punters-guide-to-aussie-rare-earths-stocks/

Disc: Lynas held in RL

BARRENJOEY - Rated New Overweight PT $10.50

RECONFIRMATION OF JARE’S LONG TERM SUPPORT FOR LYNAS

452f524hs63v5x.pdf (asx.com.au)

JARE has been a good support for Lynas for many years now lyand it's good to see from this announcement that they continue what has been a solid relationship which seems to benefit both parties.

FY 21 Financial Results Announcement. As a long term holder very happy with these results. It has come such a long way from 10-15 years ago when it was just a penny stock to now where it is the real deal.

This might explain today's selloff in LYC given that LYC has been the subject of a political football since setting up their plant in Malaysia

- Malaysia’s Prime Minister Muhyiddin Yassin and his cabinet submitted their resignation to the king on Monday, according to a statement by the palace.

- The resignation comes as Malaysia grapples with its worst Covid-19 outbreak and the economic hit from multiple rounds of lockdowns.

- Muhyiddin will remain as a “caretaker” prime minister until a new leader is appointed, said the palace’s statement.

LYNAS EXPANDS KNOWLEDGE OF THE MT WELD ORE BODY WITH 1KM DEEP EXPLORATION DRILLHOLE

Key highlights:

- Successfully completed 1020m deep exploration drillhole MWEX10270 by diamond core drilling method.

- The drillhole is collared from the current mine pit floor, designed at -55 degree inclination and drilled in a due west direction below the 2018 design of Life of Mine (LOM) future expansion in saprolite zone.

- Geological and structural core logging as well as core photography is complete (photos on following pages). Half splitting and quarter splitting the core using a diamond saw is in progress.

- The entire drillhole remained in the Mt Weld Carbonatite. Core logging has identified four domains of carbonatite: dolomite, ankerite, calcite and phoscorite.

- Varying concentrations of coarse grained and fine grained REE mineralisation was observed in multiple domains during core logging. REE mineralisation is not always visible during geological logging. Previous drill holes (LWB025 and LWB026 Lynas ASX update 26 November 2020) in which REE mineralisation was not visible, assayed up to 2.5% average REE mineralisation and identified coarse grained aggregates of REE minerals upon microscopic mineralogical study. REE content will be quantified once geochemical assay data and mineralogical results are received.

- The current exploration drillhole has ended in visible coarse grained REE mineralisation.

- First pass geochemical assay results, microscopic petrology and mineralogical study reports are expected by November 2021 and the drilling report is expected to be completed in December 2021.

- Further detailed analytical work including metallurgical test work will be conducted on the drillhole samples and follow-up geological work will be conducted.

Miner/refiner of REO (rare earth oxides), is one of the largest rare earth mineral refiners outside of China, who currently dominate the industry of rare earths.

Currently their refinery in Malaysia is operating at 75% with COVID precautions in place, which will undergo an upgade of capacity.

They are also building an early stage refinery in Kalgoolie and a heavy and light REO refineries in USA.

All these strategies are to be completed around the 2022-25.

My first thread so be gentle ;-)

Are Rare Earth China's Real Lethal Weapon Against the US? | Zooming in

Lynas has joined the world’s largest corporate sustainability initiative known as the United Nations (UN) Global Compact. Encompassing human rights, labour, environment and anti-corruption.

Lynas Investor Day Presentation Powerpoint slides

The Wesfarmers takeover offer seemed out of the blue but for a behemonth with cash to spend and growth to buy it seems the offer reasserts the growth case for Lynas shares. My first straw referred to a well managed company. Assuming I am correct in this, the offer was too conditional, as I believe the risks are waining re Malaysian government and any real risk of the operation (in Malaysia) being shut down have gone. There may be increased compliance costs but these will be handled. Wesfarmers offer to me priced in the full risk and asked for no risk in the conditions. They may re offer at a higher price but in the least it reaffirms my confidence the business plan and growth prospects are real. Discl: I hold

Post a valuation or endorse another member's valuation.