Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

$M7T have released their 4C this morning.

Their Highlights

• Sales orders of A$16.0M (TCV1 ) in Q2 FY24 (A$22.4M in Q2 FY23, A$22.6M in constant currency)

• Contracted Annual Recurring Revenue (CARR) of A$26.8M at 31 December 2023, up 5% on 30 September 2023 (A$25.5M).

• Annual Recurring Revenue (ARR) run rate of A$18.6M at 31 December 2023, up 1% on 30 September 2023 (A$18.4M).

• Cash on hand of A$22.7M at 31 December 2023, up 10% on 31 December 2022 (A$20.6M) and marginally lower on 30 June 2023 (A$23.4M).

• Reaffirm FY24 guidance with sales order outlook supported by strong pipeline of opportunities with new and existing customers.

My Analysis

I have covered the key points in my commentary last week on the Guidance Update, so I'll not repeat here.

The usual CF analysis is included below for completeness. Its another medical software business struggling to generate cash with two softer quarters on receipts, with the unavoidable advance of costs.

I have now exited $M7T in RL and SM.

Medical imaging software provider $M7T provided an update on their FY24 guidance today.

I'm a little slower than usual in my analysis due to having a day job today (finishing soon!), however, $M7T was falling towards the bottom of my conviction lsit, despite great progress in renewals, and today's announcement tipped me over the edge.

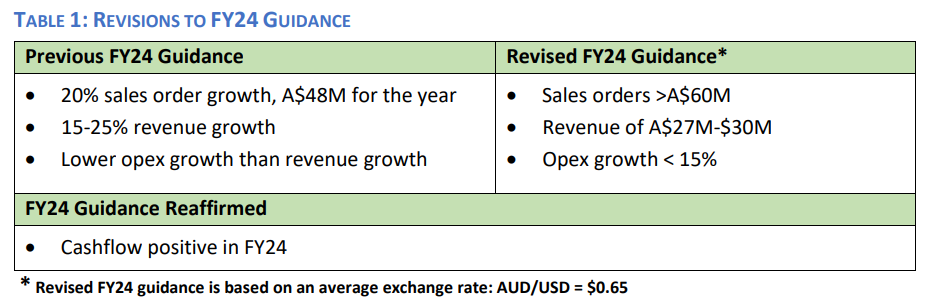

Their Summary

My Analysis

I'm not going to summarise the entire release. The release is long and detailed and is clearly aimed at preparing investors for the HY result. Rather, I'll get straight to my analysis.

As those following the business will know, FY24 is a huge year for renewals of key contracts - and management has clearly and correctly focused on those renewals. Several have been accounced previously, and I have commented positively on several because they have expanded some key accounts on renewals - a good sign. And don't forget the new huge Veteran's Health deal signed last year, which can be expected to drive revenue for years to come.

However, those of us who invest in SaaS have become conditioned to the idea of a subscription business being one of perpetual renewal, moderated only by hopefully modest or low churn. However, it is wrong to think of $M7T (or other SaaS businesses) in this way. They are fixed term contracts which must be renewed to sustain a flat revenue base. The growth has to be on top, including expansion of customers buying more of the product because it adds value or the pricing structure allows revenue to grow as customers grow.

On renewals, $M7T has outperformed the expectations they set - by some margin. However, sales orders of $60m - largely renewals - have to be understood in the context of $30m revenue in FY23 and sales contract terms of 3 to 5 years.

So there is some significant bad news in the release. They had targeted 15-25% revenue growth, which on $30m revenue for FY23 implies an expectation of $34.5-37.5m (Indeed, the market consensus for FY24 revenue is $35.7m; n=5). So to be guiding now to FY24 revenue of $27-30m isn't just a downgrade, its indicating that revenue is expected to decline. Not good.

There is a narrative about FY24 having lower capital sales, with this being positioned as "subscription transition accelerates". I'm not so sure.

There is further bad news on costs. A key part of the premise of moving to positive operating cashflow, is that opex growth would be lower than revenue growth. Today, we learn that opex growth will be <15%. OK, but renvenue isn't expected to grow. What?

There is an effort to point to $8,2m of contracted ARR which is yet to reach the "first productive use" milestone. True, that is material in the context of the gap between FY23 revenue and forecase FY24 revenue. Further, if much of that revenue is activated in H2 FY24, its revenue impact in FY24 will be modest and it will contribute materially to FY25.

But that's the problem with the growth treadmill. My investment thesis is predicated on $M7T maintaining >20% revenue growth with growing operating leverage. So a year of going backwards, makes the challenge for the next year even harder. As you will see from my threads on this firm over the last 1-2 years, I have been on watch on this factor. Today, the double-whammy of lower revenue and higher costs has pushed me over the edge.

Divestment Decision

Today, I lost my remaining conviction in my thesis for $M7T. I sold my entire RL holding (during my lunch break between classes). While I understand the critical importance of supporting the FY24 renewal program, today $M7T have indicated to me that they might not be able to simultaneously renew AND grow.

I'm disappointed to have to have exited this business. There is still a long way to go for imaging operations to transition to the cloud, particularly outside the US. I like Mike Lampron, as he is a matter-of-fact CEO, who isn't unduly promotional and historically sets targets his team can outperform.

This might well be a bad decision. With a solid year of renewals in FY24, FY25 might turn out to be a stellar year in new business growth as new accounts come back into focus. However, I am not convinced.

To be honest, I've had the feeling for a while that $M7T isn't going to meet MY expectations at the more speculative end of my portfolio. I need to see strong, sustained growth and cost control leading to operating leverage.

Overall, this was a minor capital loss, but today I have called time.

Disc: No longer held in RL; Held in SM

For the record, my SM order didn't clear as I set a price limit of $0.73 which the SP has sunk below by close. I'll have to figure this out in due course - but I no longer hold $M7T in RL, which is unique in my SM portfolio. In future, I think I'll not set price limits in SM for trades executed in RL. Today, I had to go back into class, so I didn't know until 5pm that the RL trade had cleared. However, the SM portfolio isn't real money, and I do try to maintain my SM portfolio as a reasonable reflection of the higher risk part of my RL portfolio.

Mach7 signs A$10.2m, 5-year renewal with Sentara Healthcare

Sentara Healthcare renews five-year subscription agreement for Enterprise Imaging Platform and eUnity Diagnostic Viewer

ARR doubles under new agreement to approximately A$2.0m for Total Contract Value of A$10.2m

My Analysis

FY24 is a huge year for $M7T renewals. So far, all are progressing well. The good news is that this renewal doubles the ARR for this customer, which is further evidence that FY24 will have strong NRR.

Disc. Held in RL and SM

(Turning out to be a great day for my healthcare portfolio!)

Medical imaging software firm $M7T annouced thei 4C today.

Their Highlights

♦ Record quarterly sales orders of A$33.5M (TCV1 ) in Q1 FY24 (A$3.4m in Q1 FY23, A$3.6m in constant currency).

♦ Contracted Annual Recurring Revenue (CARR) of A$25.5M at 30 September 2023, up 24% on 30 June 2023 (A$20.6M).

♦ Annual Recurring Revenue (ARR) run rate of A$18.4M at 30 September 2023, up 8% on 30 June 2023 (A$17.0M).

♦ Cash on hand of A$23.8M at 30 September 2023 (A$23.4M at 30 June 2023).

♦ Reaffirm FY24 guidance with sales order outlook supported by strong pipeline of opportunities.

♦ Board renewal process with appointment of Robert Bazzani as Chair and Rebecca Thompson as Non-Executive Director.

My Analysis

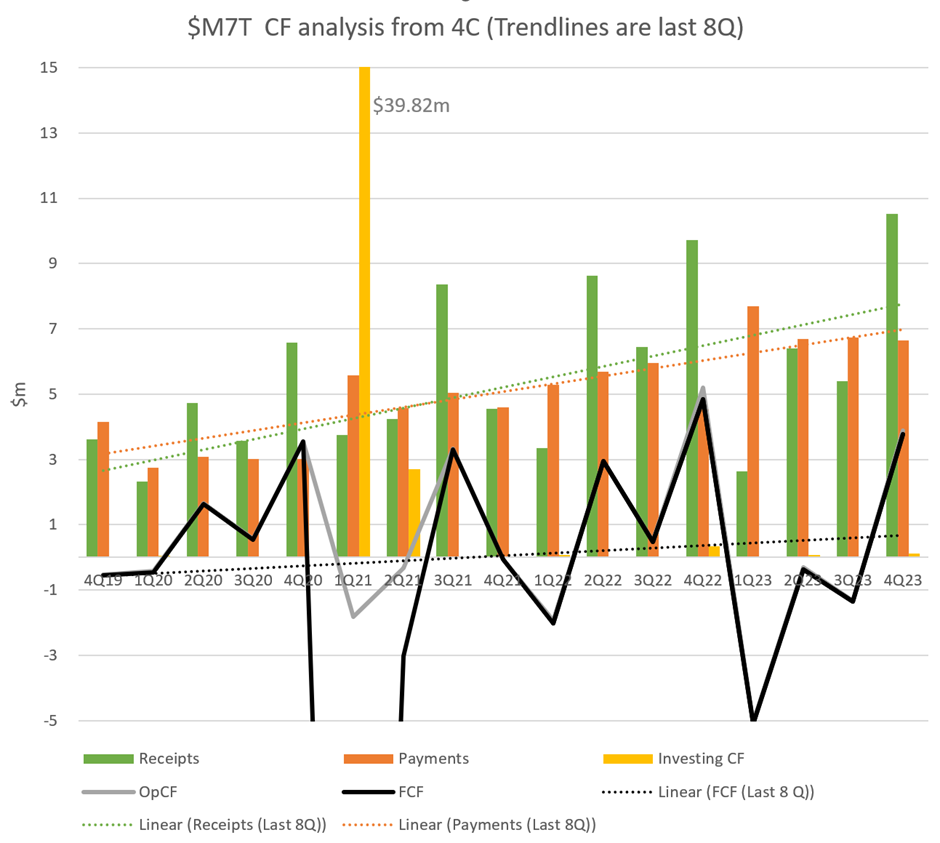

The usual CF trend below. Note the FCF is flipping all over the place at the moment - so no overall trend to achieving this goal consistently. Mike Lampron reaffirms 2024 guidance and commitment to return to positive OpCF in FY24. Its not an immediate concern as cash balance is strong compared to the average cash burn across quarters which is minimal.

Figure 1: CF Trend Report

There is somewhat of a bump up in staff costs in this Q, although I note the same happended last year.

Q1 tends to not be a particularly strong Q for receipts, so the result is good for a 1Q result. Receipts still above trend.

FX and proceeds from erercise of option helped keep the cash pile growing from $23.40m to $23.76m, which is encouraging given the observation of weaker receipts and stronger costs for the quarter.

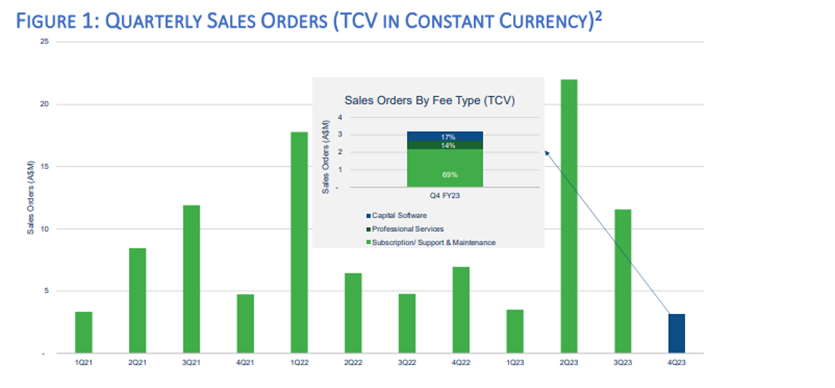

The good news lies within the progress on contracts, so I'll pull up 2 of their charts to highlight.

Figure 2- Quarterly Sales Orders

As expected, it was a record quarter for Sales Orders.

Figure 3: Sales Orders by Type

Importantly, sales orders came from a healthy mix of new customers, renewals and add-ons / expansions.

It was well-signalled that FY24 is a key year for renewals, and this was a big Q within the year. So we don't expect every quarter to be so strong. However, this bodes well for future revenue growth.

My Key Takeaways

The result is OK and in line with previous newsflow and expectations.

It is good to hear Mike stick to guidance for the year and the commitment of growing ARR over 3 years to covering operating expenses.

My decision to hold, increase or move elsewhere depends on both of the following:

- How well $M7T can start to generate case over the next two years

- Can it continue to expand the contracted base from the three sources shown above.

I don't yet have the confidence in the quality of the business being built to build a larger positoin, but I consider it can still get there so I am staying on board for the journey.

Disc: Held in RL and SM

Mach7 signs contract extension with total value of $15.26m

- Hospital Authoirty of Hong Kong renews five-year Service and Support agreement

- Continuation of Support and Maintenance for 5 years

- Professional Services value of $2.9m

HAHK is one of $M7T's larger clients and Mike Lampron highlighted at the FY23 results that FY24 is a key year for renewals, so good to get this one in the bag. On an annual basis, this is c. $3.05m p.a., so it is a significant chunk of annual revenue.

The only observation I would add is that this was an $15m deal when announced back in 2018. At the time, it was annouced as a 5-yr plus 5-yr extension option. Looks like the customer might have locked in a good deal for pricing the extension option?

Disc: Held in RL and SM

Imaging software firm $M7T presented their results today. There were no material new disclosures, given that we get quarterly 4C reports and presentations.

Their Highlights

- Record sales orders of A$40.3M (TCV), up 21% on FY22 and exceeding the A$36M FY23 target

- Record Revenue of A$30.1M, up 11% on FY22; recurring component up 22% on FY22

- NPATA of A$7.2M, up 61% on FY22; NPAT of -A$1.0M, a 75% improvement on FY22

- CARR A$20.6M as of June 2023, up 19% on June 2022; CARR of A$24.8M in July 2023

- ARR run rate A$17.0M as of June 2023, up 18% on June 2022; ARR of A$17.7M in July 2023

- Cash on hand of A$25.9M at 3 July 2023, up on A$25.7M at 30 June 2022

- Management restructure confirms CFO and creates COO; Board renewal process commenced

- Significant contract wins with new customers Akumin, Nuvodia, St Paul’s HK, Veterans Health Administration and Diagnostic Imaging Associates signed in the last 12 months

- Strong start to FY24 with over A$15.4M TCV of sales orders and a large renewal program

Further Details from the Presentation

FY24 Outlook

CEO Mike Lamprom provided a more detailed outlook than I recall previously:

- 20% sales order growth

- 15-25% revenue growth

- Lower opex growth than revenue growth

- Cashflow positive in FY24

An important feature of the outlook is that FY24 is a big year for renewals. $31m in contract renewals are due in FY23, and Mike indicated that this is on a current contract basis, and does not represent the potential for price increases. In Q&A he said he did not consider any of these contracts to be at risk. On churn, he indicated that only two small customers did not renew in FY23.

Given the amount of expected renewing TCV in FY24, $31m vs $5.3m in FY23, there was a Q&A discussion as to whether the 20% sales order growth was a soft target. Mike batted this away by saying that this is what they have expected to achieve on average each year over several years, and stated that of course they hoped to exceed that level of sales. (He couldn't have come any closer in my opinion to saying that he agreed with the question and expects to outperform!)

Revenue

While on the face of it the midpoint of the 15-25% revenue growth outlook range is essentially the same growth rate as the FY23 target, the FY23 target was stated as 20% growth on the FY22 Target. But because actual FY22 revenue exceeded target significantly, they were able to beat the FY23 target with only an 11% growth in revenue.

As stated, this year's target implies 15-25% revenue growth on FY23 revenue. So it is actually a step up. All that said, FY23 revenue of $30.1m was a miss against consensus (n=2) at $31.9m. And the outlook range for FY24 guidance of $34.6-37.6m compares with the current consensus of $38.9m.

There was of course a lot of excitement a few months ago with the VHA deal (especially the prospect of the material Phase 2). However, Mike pointed out that this would not go live until June-24 and therefore will not contribute materially to FY24 (as it is a subscription model). Of course, it follows that it will make a significant and full year contribution in FY25 - so it is good to have that locked in.

EBITDA

EBITDA was another miss vs. expectations and, at $1.7M, was down on FY22 at $2.8m. MIke put this down to some priority "cost investments" late in the year. In Q&A he clarified that these were for cyber security and labour.

Indeed, operating expenses grew at 19%, which is not great when your revenue growth 11%.

NPAT

NPAT was -$1.0m, a significant improvement from -$4.2m in FY22, down to increased income tax benefits.

Cash Flow

Free Cash Flow for the year by my estimation was -$3.2m a reversal of $6.0m positive in the prior year. Of course, given the 4C reporting this was not news, and it reflects the lumpiness in the $M7T business, which is only 60:40 recurring:capital sales.

The outlook was to be cashflow positive in FY24. And with cash on hand of $25,9m at 3 July, actually up on end-FY22, cash is not a concern.

Operating Leverage

Given the modest revenue growth in the year and the cost increases, Q&A inevitably turned to operating leverage. $M7T is wallowing around at the inflection point and not exactly blasting through. Mike made clear that opex would grow slower than revenue in FY24, pointing to progress on EBITDA and NPAT. (Might we see a statutory profit in FY24?)

My Key Take Aways

The result was OK - nothing exceptional. And the guidance is OK, if a little soft on the expected sales side, given that Mike reported that the sales pipeline is strong.

Unlike pure SaaS players in the space, unpicking $M7T results each year is a challenge given the mix of capital and recurring revenue, and therefore it is important not to over-react in either direction in pcp comparisons. Overtime, the model is trending to high subscriptions, but they maintain the strategy of allowing customers to buy in a way that suits the customer. Fair enough.

What is keeping my interest is the progress in FY23 and the first weeks of FY24 to land significant contracts with new customers (Akumin, Nuvodia, St Pauls HK, VHA and DIA). The product is highly ranked in KLAS and customers are, for the most, part renewing.

The SP is undemanding, however, my conviction is not strong enough to increase my position and so I am a hold.

If the strong base of renewals can be delivered, and if news sales outperform, then I still think $M7T can be interesting and am prepared to give it time. It is a slow burn and with Mike I always feel that I am getting a clear and factual account without any gloss.

Disc. Held in RL and SM

$M7T reported their 4C today and I attended the investor call.

Their Highlights

- Q4 FY23 sales orders of A$3.2M (TCV ) bringing FY23 sales orders to A$40.3M, up 21% on FY22 and exceeding FY23 target of A$36M

- Contracted Annual Recurring Revenue (CARR) steady at A$20.6M as of June 2023

- Annual Recurring Revenue (ARR) run rate largely unchanged at A$17.0M as of June 2023

- A$23.4M cash on hand at Friday, 30 June 2023 plus customer’s A$2.5M electronic payment advice bringing cash on hand to A$25.9M at Monday, 3 July 2023; (A$19.4M at 31 Mar 2023)

- Management restructure elevates David Madaffri to COO; confirms Dyan O’Herne as CFO

- Strong start to Q1 FY24 with over A$15.4M TCV of sales orders secured

My Analysis& Observations from the Investor Call

Contracts

Overall, it was a soft Q for $M7T contract wins but quite strong from a CF perspective. Recent SP advance has been due to announcements made following the close of the reporting period of the Phase 1 of the Veterans Health Administration (VHA) contract (A$11.7m) and the Diagnostic Imaging Associates a$3.7m 5-year contract.

The chart below shows the lumpiness of $M7T’s contract wins and, I suspect, this morning’s 11% SP drop at time of writing is a response to that, after the kicker following the recent contract win announcements.

It is at this moment that I reflect just how funny the market is. On their own, the individual wins, or periods of few wins, say nothing about the fundamental value of this business. You have to zoom out and look at the bigger picture. (Ok, so I admit to maybe feeling a little $3DP-exit regret. We are all human. But perhaps that case illustrates the same point.)

Looking forward, this lumpy story will continue, because one month in to 1Q FY24, they’ve already contracted for $15.4m, making 1QFY24 already their second strongest 1Q and 3rd strongest Q ever. And there are still 60 days to close more contracts, with America now back to work after the summer holidays!

Mike stated that several of the contracts had seen volume-based revisions. The example he gave was that a customer who has a contract for 100,000 studies per year and hits 105,000 within the period, has to purchase a licence for a further 15%, to take their contract up to 115,000. In this way, organic growth within existing customers drives $M7T revenues. He noted, however, that not all customers are winning, and some of the recent contract revisions has been from customers experiencing reducing volumes.

Cash Flow

Once more, they came close to achieving cash flow neutral for the year, citing a late receipt against the payment schedule of A$2.5m (received on 3 July) meaning they just missed the goal. (Our good friend Claude Walker had a go at Mike asking if they’d missed opportunities to report this earlier, which Mike batted back saying that the payment was expected on time, and was just a few days late. Storm in a teacup, I think, Claude.)

Again, zooming out I plot my usual CF trend analysis, with the trends calculated on the last 8Q.

You can see the favourable trend in OpCF by the clearly different slopes of the Receipts and Payments line. The trend on FCF is also positive, and now in cash generation territory. (Note that the acquisition investments in 2021 are now outside the trend window.)

Outlook

Mike has once again set expectations for FY24 of 20% top line growth. He reported that the sales funnel provides 3X coverage of the target. He also commented that more of the pipeline was for two-product sales, whereas two years ago, the majority was for single products.

There was some discussion about prosects in Asia and Middle East, as these have been discussed previously over the last year with no recent newsflow. Mike confirmed that there were multiple prospects in HK, Singapore and Middle East and that he expected to see more of a contribution here in FY24 than in FY23.

On staffing, costs appear well controlled. Headcount has risen to 96 from 87 a year ago. That’s an increase of 13%, with the top line growing at 20%. In terms of further staff growth, Mike indicated that they are focused on delivering an excellent customer experience and will staff up ahead of demand, to ensure that staff working on deployments have the required product and system knowledge. He said the management are about to meet to finalise FY24 plans. My interpretation is this means that the recent contract wins and, in particular, the transformational VHA contract will require additional staffing.

VHA Contract

The discussion yielded some important insights about the recently announced VHA contract, which has a first phase worth A$11.7m, and a second phase with a potential to increase the TCV to $59.6m, which far exceeds any contract won to date.

- $M7T will integrate products from several providers, covering the prime vendor, IT infrastructure, cloud services and AI analytics. $M7T has undertaken integrations with (at least some of) these vendors before, which lowers execution risk.

- Year 1 will focus on the phase 1 deployment

- Once Phase 1 deployment (and presumably performance) milestones are met, the contract can proceed to Phase 2. This is important, in that Phase 2 does not need to wait until the 3-year term of Phase 1 is completed. Indeed, Mike indicated that Phase 2 could start soon after the successful deployment.

- The VHA NTP program can be opted in to by the many service providers and centres within the VHA. These are autonomous organisations which make their own decisions about PACS procurement. Mike commented that many have legacy PACS that will roll off contract in the coming years, and he believes that with M7T being the exclusive provider to the NTP, then M7T is well-positioned to replace existing PACS at the renewal point. He stated that they were very much focused on doing just that.

- Mike also pointed out that this program could potentially lead to analogous programs in other public health services. He cited the Defense Department and Indian Affairs. Clearly, these would be separate, competitive processes, however if M7T can demonstrate success in the VHA contract, then that would be an important calling card.

Competition

In the Q&A Mike indicated that $M7T (eUnity) and $PME (Visage) were starting to compete for contracts. He explained that Visage started out focused on the radiologists’ work flow, whereas eUnity focused on connecting radiologist and other healthcare professionals outside the walls of the centre with a zero-code solution. Over time, he commented, each has developed the functionality of their product to be able to do more and more of the competitor’s offering.

Market Development

Mike re-iterated a comment made on previous calls that he saw tailwinds in the demand for solution in outpatient (ambulatory) imaging services for which $M7T’s products are advantaged. He cited market research which pointed to this moving from 40:60 (ambulatory:inpatient) to 60:40 (and maybe even 65:35). There are two drivers. First, the staff shortages of radiologists in hospitals is driving more hospitals to have images read externally. The second driver is insurers, as it is cheaper to have radiologist read images outside the hospital.

My Key Take Aways

This quarter was a soft result and, over the last two years, although revenue is growing above the 20% p.a. level (Mike would not be drawn on FY23 Revenue, so we’ll have to wait a few weeks), $M7T has been making slower progress on contract wins within FY23.

This explains today’s negative SP response, bringing the SP back to reality after the euphoria following the two recent contract wins at the start of FY24.

To Mike's credit, he focused the results call on the quarter which was unexciting.He didn't do anything to deflect from that. Inevitably, the Q&A focused much more on the recent contracts and the outlook, which is strong.

I am still on the fence regarding $M7T. For me, the thesis is holding together for three reasons:

· Continuing to grow revenue while managing costs;

· Positive benchmarking with other industry solutions (KLASS customer surveys);

· Periodic news flow on larger contracts (>$2.5m), with VHA a gamechanger.

At a multiple of EV/EBITDA (FY25) of 12x, $M7T is very good value within the sector. The lower multiple is a direct consequence of the more lumpy deal flow and cashflows. Over time, as $M7T grows, this should become less and less of a problem, and earnings quality will improve.

However, as the imaging software space becomes more competitive among the market leaders, it remains an open question whether $M7T can continue to win more of the larger deals. With a strong pipeline of 3x what is needed to grow top line at 20%, FY24 should help answer the question. The VHA deal is, however, a gamechanger. If $M7T can will more of these programmatic deals for large services, then it would certainly deserve a closer look (i.e., a bigger position).

For now, I continue to hold.

Disc: Held in RL (2.0%) and SM

$M7T Signed up 22 hospital Adventist in Jan 2021 for a $7.9m contract, with $2.4m of inital order covering 7 hospitals.

Today, further orders totalling $7.1m for remaining 15 hospitals are announced, indicating to me that the contract size has grown.

In any event, this is good news - an existing customer cotninuing to roll-out the full offering after having implemented in a first wave of hospitals.

Full text of announcement follows.

ADVENTIST’S FINAL DEPLOYMENT PHASE BEGINS

♦ Existing customer, Adventist Health System, orders Mach7 PACS1 for remaining 15 contracted hospitals

♦ Latest hospital orders have Total Contract Value (TCV) of A$7.1 million2

♦ Capital contract expected to contribute A$3.0 million to revenue in FY23

Mach7 Technologies Limited (“Mach7” or the “Company”) (ASX:M7T), a company specialising in innovative medical imaging software solutions, is pleased to announce that existing customer, Adventist Health System/West (“Adventist Health”), has signed sales orders for the remaining 15 contracted hospitals that are yet to deploy Mach7’s PACS. A contract regarding Adventist Health’s PACS replacement program for its 22 hospitals was announced in January 2021. The initial, overarching agreement was valued at over A$7.9 million and included A$2.4 million of sales orders for the first seven hospitals. The remaining order forms for 15 hospitals have now been received and have a value of A$7.1 million including scope expansion.

The Adventist Health PACS solution involves the Mach7 Enterprise Imaging Platform, eUnity Diagnostic Viewer, Mach7 Universal Worklist, Mach7 QC Module and Mach7 Clinical Portal. The capital contract covering the 15 Adventist Health hospitals is expected to contribute A$3.0 million to revenue in FY23. Headquartered in Roseville, California, Adventist Health is a faith-based, non-profit integrated health system serving more than 80 communities on the West Coast of the United States and in Hawaii. Founded on Seventh-day Adventist heritage and values, Adventist Health provides care in hospitals as well as in clinics, home care agencies, hospice agencies and joint-venture retirement centers in both rural and urban communities.

Mach7’s Chief Executive Officer, Mike Lampron said: “We have developed a strong and collaborative partnership with Adventist Health over the last few years and we are delighted that its enterprise imaging growth strategy will soon be fully realised. Our implementation and support teams have delivered high quality outcomes for the hospitals in the initial deployment phase, and this positive experience has helped accelerate the rollout program to cover the entire Adventist hospital network.”

Disc: Held RL (1.3%) SM (6.7%)

Medical imaging firm $M7T announced their 1H FY23 results today. As they publish 4C's I'll refer you to earlier 4C reports and @Hogajo's valuation of $1.50 (which is a north of where I stand, which is more like $1.00-$1.30).

So I'll get on to the insights from the discussion with CEO Mike Lampron, which was very helpful particularly because H2 will look different from H1.

Revenue

Top line, is Mike re-affirmed guidance that they will exceed their target revenue of at least $36m, which is +20% on their FY22 target, albeit only +10% on their achieved FY22 sales of $32.8m. (Mike is looking even more comfortable on this than at the 4C call, so I'm expecting a result over $36m.)

The was a slightly embarrassing discussion about the de-booking of $1.7m of revenue from the previously preliminary announcement of $18.1m 1H to a revised $16.4m. Mike was very upfront sayng that the auditors considered part of the revenued recognised in the large, recent Akumin contract as a financing component, which needed to be recognised over the life of the contract. No contract value is lost, and there is no cash impact. Mike made clear that this was because they have not had to deal with a 10-year contract before. (Clearly, this is a blunder by the new CFO, but I was encoraged with the very clear explanation Mike gave. No doubt, the CFO will be sent on some training on revenue recognition in long term contracts!)

Costs

While Gross Margin % expanded from 96% in the PCP to 98%, Operating Expense increased by 27% - problematic, on the face of it, given now weaker revenue growth of +14%,

Here again, Mike was very clear. H1 had higher travel and sales & marketing costs (including the recent big Middle East healthcare IT conference), due to both the loading of trade shows in 1H and a number of internal team meetings (sales and engineering functions.) These costs will be much lower in H2, and Mike advised against estimating FY costs as 2 x 1H.

He noted that with employee costs being 75% of the cost structure, that inflation had impacted this, citing onerous healthcare plan increases of 10-15% as something they cannot control. Mike made clear that they have to look after their people!

Sales Outlook

Mike confirmed that the revenue pipeline is strong and being replenished, even given the record half of new contract signings.

M7T were recently ranked #2 again (seond year running) in the KLAS product rankings for the Universal Viewer Segment and #7 in the Vendor Neutral Archive (down from #5). He cited that these are important, because the rankings help to get them included on the RFP list when customers are going to market for new systems. Mike pointed out that the release of V12 of their software wont yet have impacted customer feedback on the surveys, so he is looking forward to the next round of results.

M7T typically sign 5-year contracts, and FY23 is not a big year for renewals, with <$2m revenue up for renewal. FY24 is another matter with c. $11m up for renewal. In the Q&A I asked about churn rate, and Mike responded that they are running at <2% per year. So that bodes well for FY24. In fact, one investor commented that, with such low churn, the market needs to rethink the quality of the 40% of revenue which is sold on a capital basis. Good point.

Mike continues to see strong tailwinds of customers wanting their imaging systems to work across vendor technologies and departmental silos. There is strong growth in 1) the ambulatory segment (where patients walk into mobile or local clinics for their scans), which then need to be accessed by their clinician AND 2) from clinicians who want to access images from outside the four walls of the hospital. He believes M7T is strongly positioned to serve this need.

Cash Flow

With cash outflow of $5.3m in 1H, it was heartening to her Mike recommit to achieving Cash Flow breakeven for the full year. Again, he seemed quite confident on this. Drivers for a stronger second half will be i) catchup on receiveables from 1H, ii) new contract receipts and iii) lower expense burn. Again, being 8/12 months through the year, I wouldn't expect to see him so confidence if there wasn't substance to back it up.

Market Response

Market has given $M7T a hard time today, varying between 5% and 10% down. It is an illiquid stock, so anyone who wanted to get off the bus today will have made their mark. And, in truth, the result isn't strong enough to have a lot of passengers waiting at the bus stop to get on.

My Key Take Aways

While I am not bothered by the volatility, I am on the fence with $M7T.

CEO Mike is very confident about a good result for FY23. However, those results would be the minimum outcome for me to stay onboard (1.4% RL and 7.4% SM). For now, M7T remains a speculative holding for me, and given the strength of the medical imaging market, I need to see stronger top line growth.

What keeps me onboard, is that Mike is very clear in his communication. There is no hiding of less favourable numbers. On the contrary, he focuses time during the presentation and Q&A to fully discuss areas of concern. All questions in the Q&A were answered fully and candidly. So even though he quite reasonablly sells the company when explaining the product, the strategy, and the market position, he doesn't come across as doing a sales job on the numbers. Big Green Flag.

Overall, a hold for me for now.

Disc: Held

$M7T released their Q2 FY23 4C today.

Their highlights:

- Record quarterly sales orders of $22.4M (TCV) in Q2 FY23; up 280% on $5.9M in Q2 FY22 (or up 240% on $6.6M in constant currency )

- Record revenue of $18.1M in H1 FY23; up 27% on $14.3M in H1 FY22; positive EBITDA

- Contracted Annual Recurring Revenue (CARR) of $20.0M; ($17.9M at 30 Sept 2022)

- Annual Recurring Revenue (ARR) run rate of $16.4M; ($15.5M at 30 Sept 2022)Increased exposure to high growth radiology outpatient market with new customers Nuvodia and Akumin

- Cash on hand $20.6M; ($21.5M at 30 Sept 2022 )

Discussion Points from the Investor Call

M7T is on track to achieve tageted FY23 reveneue of at least $36.0m, with over 70% of revenue achieved in 1H. This was helped by the recognition of a portion of the revenue from their largest ever $16.7m Akumin contract announced in December

There was a question on the call about the large difference between revenue recognised and cash receipts in the half ($18.1m revenue in H1 vs. $9.031m receipts). This was explained in terms of the recognition of a component of the large contract, and the lag between revenue (a portion of which is recognised on deal signing) and receipts which follow invoicing after the delivery of services and beneficial use. The CFO made clear that they would be working in H2 to achieve receipts from this contract so as to achieve an overall cashflow positive outcome for the year. (Watch this space and progress towards this in Q3.)

CEO Mike Lampron discussed the industry trend for an increase in remote viewing of images by radiologists, citing an industry report that the current trend of on-premises to off-premises viewing of 60:40 is expected to shift to 40:60 over the coming years. Mike considers this a positive for M7T due to its positioning as an off-prem solution (cloud-based SaaS meaning no need for on-prem. software and vendor neutral platform).

Our mutual friend (Claude Walker) asked for more info on last year’s CFO departure. Mike wouldn’t be drawn on this beyond saying that it was a mutually-agreed departure, and that there had been a handover of several months to the new CFO, who has been with the firm for 7 years and understands the business “inside out”. “We haven’t missed a beat” said Mike.

In terms of the sales prospect pipeline, Mike indicated that the Akumin deal was unusually large and that they did not have any more of that scale. He described current prospects as being of “medium scale” for $1-3m CV and “large” for “>$3m” CV and indicating there was a large set of opportunities in front of them, most of which are medium-sized.

My Takeaways

M7T continues to grow, albeit the option for capital sales means that there is a lumpiness in revenues from quarter to quarter. They clearly don’t expect a repeat of furthers contracts of the scale of the Akumin deal, so will need a larger number of smaller deals to sustain growth.

I have updated the usual cash flow trend analysis. The firm is yet to demonstrate a positive trend at the operating cash flow level. That said, as receipts from recent larger contracts flow, we may start to see a positive trend emerging. Management sees the prospect of stronger receipts in H2, which will be needed to deliver a positive cashflow result for the year. Provided this is achieved, then current cash on hand of $20m is a strong position.

For me, M7T remains a small, speculative position and a HOLD.

Disc: Held in RL and SM.

@NewbieHK My view on the macro hasn't changed much in 4 months and I want to reply by starting that I'm not a fan of Revenue multiples for valuation.

In the case of M7T I resorted to a revenue multiple so that I could calculate some sector comparables with $PME and $VHT as two bookends within which the value of $M7T should reasonably lie.

Rationale:

- $PME now has scale and proven, attractive economics

- $VHT has comparable scale to $M7T and evidence to date is that it can't make money

- $M7T is at the inflection point (CF positive) but not yet at scale

As of today, based on FY23 consensus numbers the Revenue to Market Cap multiples are:

- $PME = 48

- $VHT = 4.2

- $M7T = 5.0

Revenue growth FY22 to FC FY23 are:

- $PME = 26%

- $VHT = 34%

- $M7T = 20% albeit today's announcement offering potential for upside surprise.

So, in answer to your question, I am still comfortable holding a valuation of 10x revenue on a comparables basis.

Moving to an FY23 revenue FC valuation basis of $32.5m, the value per share would increase to $1.36.

I'm not updating my valuation because it is flakey as it is and I'd rather see what the results for FY23 reveal, when I will do an update.

$M7T is a speculative holding for me, but contracts like today's are definitely de-risking the proposition. If we say another large contract in the next 6 months, I'll definitely consider increasing my position.

From a macro perspective, M7T it not burning cash and healthcare sector should do relatively well in a recession. so I see only upside risk to the share price if they continue to execute.

Disc: Held in RL and SM

M7T signs a $16.7m, 10-year deal with a new customer, with $7.5m revenue to be recognised in FY23.

The deal is M7T's largest to date, and underscores its traction to major providers of outpatient imaging services.

https://app.sharelinktechnologies.com/announcement/asx/15fbcaa2097d5fe69796d11223ec7d1a

Disc: Held IRL and SM

Mike Lampron, CEO presented last week on the Share Cafe Webinar Micro/Small Cap Hidden Gem Webinar.

The Mach7 segment runs from 20:00 mins to 34:00 mins.

Covers ground from recent FY22 presentation (refer to my recent Straw) in case you missed the Investor Call.

Mach7 is growing streadily across 15 countries. CEO Mike indicated that 2023 is looking like 20% sales /revenue growth. It was cash generative last year.

Mach7 appeared for the first time in the Best in KLAS 2022 Awards, ranking as #2 Universal Viewer (Imaging) and #3 Vendor Neutral Archive. The following report on the 2022 KLAS awards is interesting, as it shows how important the equipment makers are in the imaging software space, and also lists some of the other players to follow.

Three institutional shareholders account for 36% of shares, although as noted by other StrawPeople, insider holdings are low.

Disc. Held in RL and SM

Mach7 Technologies reported their annual results today.

A few words of introduction, as M7T is largely below the radar screen in ASX small-cap world. Headquartered in VT, USA, it was one of many small companies listing on the ASX pre-GFC. So, it is not really an Aussie company at all, and it derives no revenue in Australia.

The CEO is Mike Lampron, an experienced medical imaging software industry executive. Chairman David Chambers was Pro Medicus CEO from 2007 to 2010.

Up front, one of my major concerns is lack of insider shareholding, at only 5%. However, Directors have been buying over the last year, so that’s a positive. I dont really understand the share register, and need to do some work on that.

$M7T is a recent addition to my portfolio (RL and SM). Having done my PhD in imaging decades ago, when I had to write much of my own image processing code (!), I have always understood the great potential for software, integration, and SaaS in this space. I could just never bring myself to pay the $PME SP over recent years, and have been in constant regret. So, $M7T has, in a small way, allowed me to scratch that itch.

In this straw, I want to focus on the recent results, having attended the call this morning. I will start a separate forum for discussion as I am keen for any insights from fellow StrawPeople on M7T. (Maybe @Strawman could put it forward for discussion at Baby Giants?)

The first few slides of the presentation give a really good description of the company for those interested.

1. THE HIGHLIGHTS

- Record sales orders of $33.2M (TCV¹) in FY22; up $7.6M or 30% yoy.

- Record revenues of $27.1M for FY22; up $8.1M or 42% yoy

- Annual recurring revenue (ARR) run rate $14.4M; up 7.5%

- Record cash receipts of $28.2M in FY22; up $7.2M or 34% yoy

- Record positive operating cashflows of $6.3M in FY22; up $4.8M or 320% yoy

- Record gross margin of $26.1M or 96%; up $7.7M or 42% yoy

- EBITDA of $2.8M; up $4.6M or 253% yoy

- Cash on hand 30 June 2022 $25.7M; up $7.4M or 40% yoy

It was worth noting that these were the first results that allowed an organic y-o-y comparison, given that the Client Outlook acquisition closed on 14 July 2020, so was almost entirely included in FY21 results.

2. INSIGHTS FROM THE RESULTS CALL

Business model

$M7T are agnostic as to whether customers choose a capital or subscription-based model. The detailed structure of both models was illustrated, as investors had previously requested clarification. They are observing a trend towards subscription, with 58% of FY22 sales orders being subscription, up from 49% in FY21.

Strong Customer Renewals / Churn Low

Existing customer renewals of $8.0m accounted for 24% of total sales showing that customers are sticking with the platform. Importantly, Mike reported that many of these legacy contracts had been signed at historically low rates, and that it was encouraging that customers saw sufficient value that they accepted the higher rates applying today. Churn was reported to be very low, at <1% of revenue and <2% of customer numbers. With a typical 5-year contract cycle, 8-10 renewals are expected in FY23.

Slide 18 also highlighted significant contract wins during the year, including existing cusomters who are expanding their adoption of Mach7’s modular product suite.

Growth Outlook - Targeting $36m FY23 Sales Orders

Mike emphasised that the targeted +20% growth in sales orders from $30m in $36m should be considered a floor to what would be delivered, given that in FY22 sales exceeded the target to stand at $33.2m and that since the end of June 22, the sales pipeline has already expanded by 30%! Even though it is a oft target that should be readily exceeded, it is good for management to have the confidence to speak externally about their short term targets.

Sales growth was put down to the good performance of an experienced sales team, noting that a new VP Global Sales has been in place for a year and has made several changes to staff to build the sales team.

Mike also commented that the pipeline contained a wide distribution of sales sizes from <$2m right up to larger deals of $5m-$10m (Mt note: more akin to what we are seeing $PME signing).

Industry trends driving growth

Mike noted that from $M7T’s perspective, hospital investment programs have returned to pre-COVID19 BAU. He noted that in the USA, hospital chains are on the move again with M&A, and that this would be a growth driver as their larger customers implemented their systems in acquired hospitals.

Capital Management

Now solidly cash generative, closing cash of $26m and no debt, one of the analysts on the call asked if a share buyback was being considered by the Board. Mike responded that the Board wanted to keep a strong balance sheet and that they wanted to maintain the capacity for further bolt-on acquisitions, if the right target was found. In addition, they want to maintain a strong balance sheet to be able to continue to invest in the platform.

3. MY KEY TAKEAWAYS

This was a year of solid progress for $M7T, and it is great to be able to review a clean set of results based on strong organic growth. While costs increased driven by staff churn following the acquisition in 2020 (something to monitor), the company moved significantly forward in FCF generation. If they can achieve the 30% targeted sales growth in FY23, then we should be able to get a good handle on the quality of operating leverage for the company into the future.

I don’t have a sufficient understanding of $PME to understand how $M7Ts offering lines up against it. This is something for the “to do” list. But with over 6,000 hospitals in the USA and 15,000 in Europe, and many, many more specialist imaging centres and clinicians that use imaging software, $M7T estimate the global market to be $2.bn. So, it sounds like there is an opportunity for several quality firms to grow for some time.

Litigation

For almost two years, $M7T has been subject to patent infringement litigation. The litigation was recently dismissed by the District Court of Delaware, but the dismissal has been appealed. There was no reference to this on the call today, and I can’t find any reference to it in the annual report, so they don’t appear to be burning material legal fees on the defence.

Valuation

As with nearly all tech, the SP has taken a beating this year, sitting this morning at $0.67 down from a high of $1.59 in Feb 2021. However, not only does M7T have good positive OpCF at $6.4m, up from $1.5m in FY22, they also generated just under $6m in FCF.

The current value is undemanding at <6 x revenue, particularly given that M7T now appears to be solidly cash generative.

Prior to today, broker estimates are $1.20 and $1.34 (mean of $1.27). At $1.27 this would represent a valuation of 11 x revenue.

(Comparables: Other imaging stocks $PME is 47x at one extreme and $VHT at 4.72x at the other).

There is a world of difference between $VHT (which can’t make money) and $M7T (which can). So , I will put a SM valuation of 10x revenue, as a placeholder.

My Holdings and Future Strategy

Prior to this morning I held a 1.4% holding IRL, which I have now increased to stand at 2%. That is an upper limit for me for a company with this risk profile. I need to do more work to understand the company, its history, management, and the Board. However, it looks to be a good quality, global, medical software.

Disc: Held RL and SM

Post a valuation or endorse another member's valuation.