Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Shoots of growth with phosphate

I’m posting this as it is a detailed description of Minbos to date. All credit goes to a Red baron from a different forum who formulated this summary in response to aggressive persistent down ramping.

Minbos - The Facts

Background - Angola lies in the tropics lies between 5°S and 18°S. 18°S is about the latitude of Townsville or Broome so is well suited to agriculture with good rainfall. Agriculture was very big in Angola until they discovered oil, now only 10% of it’s arable land is farmed with over 80% of harvests by “family farms”. Over 50% of Angola’s food is imported, 100% of fertiliser is imported. The Government is very proactive in reestablishing the Agricultural sector. The soils are acidic and Phosphate depleted, our 5 years of trials have shown our Phosphate works better than the more expensive fertilisers high in Nitrogen & Potassium.

Market Cap ~ $70m

Minbos is a fully permitted ASX listed company with a JORC Resource/Reserve of 8.4mt @20.4% / 4.7mt @30.1% using a 19% cutoff, it is significantly higher with a lower cutoff. Unlike most Phosphate Resources, this does not require concentration (by flotation). (asx 23/11/22 and 17/10/22 )

Minbos is currently constructing it’s Processing Plant in Cabinda, Angola. It is only 16km from Port & is a simple flowsheet of crushing the drying the phosphate, unlike most phosphate companies because of the high % reserve/resource no concentration is needed. Construction started last December and is scheduled to take 8 months including 1 month commissioning. Stage 1 is based on 187k tonnes pa, stage 2 expansion at an extra capex cost of < $4m brings it up to 400kt pa. The company has indicated it will build to stage 2 expansion, but has yet to formalise this. (asx 5/12/24 )

Construction is being carried out under contract by a well respected Portugese company Grupo Arlizhttps://www.grupoarliz.pt/en/grupo-arliz-en/

They announced on Aug 8th the pouring of the main slab. You can view the progress looking at posts on Minbos’ Xhttps://x.com/MinbosResources

The DFS showed a NPV of US$203.2m for our 85% ownership. Since the DFS the flow sheet has been simplified, the production site relocated closer to mine + port, and capex reduced. The price of TSP (which our pricing is based on) is also higher than the DFS figure. (asx 17/10/22 pricinghttps://businessanalytiq.com/procurementanalytics/index/triple-superphosphate-tsp-price-index/#google_vignette The June TSP price increased by about 18% compared to May when it also had a good increase.

Minbos has already paid for, manufactured & stored on site the majority of the processing equipment. This included over 26 (40’) shipping containers and 3 (20”) shipping containers plus several items too large to fit in a shipping container such as the rotary dryers. As at October 31 2024 US$12.5m around A$20m has been spent (Annual report 2024 + Sept’24 Qtly )

The Sovereign Wealth Fund of Angola (SWF) invested in Minbos to the tune of US$10m, we have received the 1st 2 tranches. We have now received last tranche of US$1.17m which completes their US$10m investment. (asx 7/3/25 + 30/4/25)

Minbos have signed a revised Term Sheet with Angola’s largest bank, Bank BAI for US$12m at 7.5% + 2.5% for a loan guarantee provided by FGC on up to 80% of the loan. FGC loan guarantee was the only outstanding CP, but have now agreed to provide the guarantee. (asx 15/5/25) The only outstanding CP to complete to access the funds is BAI’s desire for Soul Rock (Minbos’ Angolan subsidiary) to restructure from a private company to a public company (unlisted) This is purely administrative. At the AGM the CEO actually said the BAI are pushing Minbos to complete their side of what is required to change this structure.

Minbos has a signed debt facility (contract) with IDC for US$14m. It has one CP outstanding before funds can be drawn down which is the above BAI loan. All the other CPs have been satisfied including the offtake requirement. The offtake requirement was for a minimum of 120,000 tonnes pa, which was satisfied with LOIs to various internal entities and export customers. This debt facility time expired (due to outstanding CPs) and is currently being renewed - considered a formality. (asx 2/10/24)

Once producing we will have a monopoly on Phosphate sales, by Presidential Decree no. 213/23 local businesses have to buy from local vendors, not import, presently Angola imports 100% of fertilizers. (asx 15/4/24 )

Minbos has a MoU with Foskor, A South African company for the possible export of 200,000t pa, other export opportunities include Brazil (asx 1/7/24 )

Minbos is a Mauritius based company, tax is minimal there, they also have some very generous tax concessions in Angola, tax paid will be minimal, though not paying any Australian taxes, any dividends will be unfranked. ( asx 9/1/23)

We have done 5 years of growing trials, the acidic soils of Angola require phosphate before other eg nitrogen based fertilisers will work. ( asx many announcements)

Pricing is based on TSP, with the present TSP price of $641/t we’d receive US$430/t (asx DFS, Carrinho MOU, June’25 TSP prices)

Green Ammonia business. (100% owned) The Angolan Government has leased a site to us for 60 years at $300 pa(yes thas right no k after the 300) it is within 5km of the Capanda Hydro plant (ASX 1/8/23), where they have a power purchase agreement of 0.4 cents for 100MW for 1st 5 years then 0.8c for 20 years, an additional 100mw at 1.5c a KWH for 25 years. This is the cheapest electricity in the World and Green Ammonia’s main cost is electricity (asx 14/12/22)

Minbos have a MoU with Talus who provide a BOO (Build Own Operate) type of modular Green Ammonia (no capex to us) plant that can be used as direct application or further processed (asx 27/5/24)

Overseas players, UAE, Brazil, China to name a few areinvesting heavily into the Angolan Agricultural sector which has millions of hectares of undeveloped arable land with good rainfall, just needs Phosphate. The 1st link an agreement between Brazil & Angola giving Brazil 500,000 hectares to develop for agriculture. The 2nd link UAE investing in a Tractor plant to produce 3,000 tractors PA. Recently Chinese firm CITIC plan to invest US$250m for maize & soybean farms on 100k hectares

https://africa.cgtn.com/angolan-president-inaugurates-countrys-first-tractor-assembly-plant/

The Government has come out in full force backing Minbos.

Firstly a planned mining conference in October, features Lindsay with the Minister for Mineral Resources Petroleum & Gas - they choose Lindsay to feature out of over 200 mining companies attending the conference. (link below)

Then Minister Massano (an ex CEO of Banko BAI), probably the most powerful minister after the President, chairs a meeting to reduce reliance on imported fertiliser, and talks of lines of credit to business to support “their operators”(Minbos is the only company with near term fertiliser production in Angola)

Then the Secretary of State for Industry, Carlos Rodrigues visits our site. Unlike Australia, when a minister visits your site, it means they are backing that project - no minister will put their face to a project that fails in Africa.

https://www.linkedin.com/company/minbos-resources/posts/?feedView=all

Minbos set for construction to get underway.

It’s been quite awhile for any action to take place and I’ve been patiently waiting but recently the first tranche of funding hit there account and now with the construction contract signed it should be full stream ahead for production next year. With the low capex simple build and all equipment and plant on or near site depending upon winter weather it should be straightforward. Therefore It looks like sentiment and momentum has now changed with the more positive news flow and media coverage. Also there’s more localised positive news with Biden’s recent visit, huge US$2.9B+ US investment, Government support for agricultural development. I don’t think the timing could be much better.

Minbos’s phosphate project is forecast to deliver circa US$55M EBITDA per year over a 20 year mine life. They are currently capped at AU$66M. And there’s the green Ammonia project on top of that.

Biden visit: Mining Weekly

Minbos: Construction announcement

Minbos; Finance news

US$10M Subscription Agreement signed with Angolan Sovereign Wealth Fund

It’s been crickets for my Angolan Fertiliser play. It looks like working with local timeframes have led to longer than expected delays in getting the final funding to start construction. Consequently the SP has taken a bit of a beating. Now after this announcement it’s all coming together and we should see the construction commencement announcement soon. With the simple plant layout I’ve more confidence that Minbos will now get back on track for production next year.

ASX:Announcent

Next Investors also promote Minbos:.Report

Minbos presenting this week at the Gates Foundation ( invite only) Fertiliser news symposium in Marrakech

Theme: Low-Carbon Decentralized Nitrogen Fertilizer Production in Africa

Presenting between Fortescue and ocpgroup ( OCP, are responsible for the world's largest phosphate reserves)

CAPANDA GREEN AMMONIA PROJECT UPDATE

”Partnership discussions well advanced, confirming Capanda as the most commercially attractive zero-carbon green ammonia project globally”

Early days but there seems to be little or no value associated with the potential for this Ammonia project. Near term there is still funding that needs too be finalised with the hope of the fertiliser project going into production this year.

other recent announcements were the Field trials

FIELD TRIALS CONTINUE TO DELIVER OUTSTANDING CROP PRODUCTIVITY RESULTS

Great Presentation and update for any one interested in a Fertiliser Company striving to make a dramatic impact.

Minbos edges closer to production next year. Final finance may be the next catalyst although it may have kept the brakes on the SP. Minbos currently maintains the stance final funding will be non dilutive.

Angola Rising: Announcement

An important note I found in the Preso is the bringing forward of production from the DFS by 6yr, up circa 40% for that period (quite significant)

The anticipated cash flow has changed significantly since the DFS due in part to Lower capex and now the bringing forward of production

DFS; Announcement

There's also activity with

CAPANDA GREEN AMMONIA PROJECT

Tender work for key engineering providers is underway in preparation for the PFS.

The PFS will further investigate the use of electrolysers to generate green hydrogen, designed to deliver 112,000 tonnes p.a. of Green Ammonia to produce 255,000tpa of Ammonium Nitrate, including fertilizer and mining explosives.

Driven by 100%-renewable power from the Capanda hydroelectric complex and supported by a competitive power concession, the study will access what the Company believes is one of the only cost competitive zero-carbon Green Ammonia projects being developed globally.

P4 (YELLOW PHOSPHOROUS) PROJECT

In early September, the Company announced it had engaged an engineering, construction and project management company to complete a study to investigate producing P4 otherwise known as yellow phosphate as part of its phosphate-based product offering.P4 is an essential critical mineral in the battery materials supply chain, required to produce lithium hexafluorophosphate (LiPF6), the electrolyte used in lithium-ion batteries. However, exploding growth in the battery sector is putting pressure on P4 supply to the agricultural sector.

Held SM and RL

Minbos: delivering projects to grow a company and lift a nation.

“This is not a phosphate story – this is a change a whole country story”

Special feature : Mining.com

Although a sponsored article, it is great update if you’re not aware of Minbos Resources ambitions and potential impact it may have for food production in Angola.

“OFFTAKE AGREEMENT WITH ANGOLA’S LARGEST FOOD AGGREGATOR TO UNDERPIN 66% OF STAGE 1 PRODUCTION”

Highlights

• MOU represents a significant milestone, the first offtake for Cabinda Phosphate Rock signed with Angola’s largest and most influential agro-industrial group.

• Fertilizer supply agreement for up to 869,000 tonnes of Cabinda Phosphate Rock over the first 7 years of production (to 2030), representing 66% of stage-1 production over the corresponding period.

• The MOU includes a proposed pricing mechanism, pegging the relative agronomic effect of Cabinda Phosphate Rock fertilizer to the price of Triple Super Phosphate. The pricing mechanism is in line with the assumptions used in the Definitive Feasibility Study1.

Notes; This agreement does take all the first three years of production as per the dfs. Production slated for this year and Final debt funding conditions should now be satisfied as per previous agreements. Another point was the relatively small (us$1.7-3.3m) required to double production which I expect will now go ahead due to the other projects under consideration. This phosphate production could be very lucrative but also may be the smallest of there projects. With work underway on Yellow Phosphorus and with the cornerstone of Mr. Liang Feng, the Chairman of US $18 Billion Shanghai Putailai New Energy who they have signed a strategic cooperation agreement with aim to develop ferro phosphate, lithium Ferro phosphate and the large scale Green Ammonia project

Next investors have also sent out there email update

TECHNICAL STUDY AFFIRMS CAPANDA AS ONE OF THE MOST PROMISING GREEN AMMONIA PROJECTS GLOBALLY

Theres a lot to take in from the study. But bare in mind this is for the Green Ammonia project. Minbos is still well under NPV for the phosphate project.

The next investors (paid report) will also give some ideas. In one scenario they postulate potential revenue

There are a plenty of highlights in the report but still early although exciting days.

Minbos has been quietly ticking boxes and going against the trend at the moment. The phosphate project is the bases of my initial interest but there have been a lot of additional opportunities under development . I am currently holding my breath for the imminent report from Stamicarbon in regards to the Green Ammonia Project. Minbos have highlighted that this may be a more valuable opportunity. Would be a nice bonus;)

From the chairman’s letter

“The last six months of 2022 saw Minbos seize a myriad of opportunities that Angola presents. The Company is now firmly ensconced as more than just a phosphate explorer, developer and near- term producer, with development projects that now span agriculture, fertilizers, mining explosives, carbon-abatement and LFP battery-grade phosphate paste.

Some of this growth - green ammonia, explosives and carbon abatement - has come organically, a positive externality from being a good development partner with the Angolan Government. However, opportunities in the battery metals space have locates from new relationships born from the use of phosphate in battery metals.

Phosphate paste is a critical material for the production of Lithium-Iron-Phosphate batteries, with our interest in the product driven by our phosphate production profile with assistance from our new partners who invested in Minbos in mid- 2022, corner-stoning our $25 million placement and bringing a wealth of experience in the battery space.

Our phosphate project has now entered its most exciting phase, construction and near- term production. Daily we are getting updates that the phosphate plant is arriving in its various parts into Angola, and we look forward to watching the plant turn on later in the year.”

held SM and IR

Positive announcement from Minbos today that the "SIMPLIFIED FLOWSHEET DELIVERS SIGNIFICANT CAPEX

REDUCTION FOR PHOSPHATE FERTILIZER PLANT"

The $10m reduction estimate is very significant when the original estimate was for $40m Capex. With the capex now $30m and the Cornerstone investors offering $25 million (Not yet signed off) Minbos now have just a $5m shortfall. This should be covered if the SP can get > 0.15c by the end of April when Minbos Options expire (I hold some).

Short term expected events

- Plant and Equipment due off the Boat any day and production Due Q4.

- While there is also expected significant Cash flow once Production is up and running of further note is that Stamicarbon are due to release the results of their technical study into the "Green Ammonia Project" using the cheapest Hydro Power in the World. Announcement 30 jul 22 . Study underway 20 sep 22 This may be a significant bonus as it appears that no value has yet to be placed on this project which may potentially be more valuable than the current Phosphate Project.

From DFS 17 Oct 22

Minbos planting all the seeds now for future growth, The market liked the news. up 18% on the day

The main news for me was that the,

- Initial construction activities at the Cácata phosphate deposit are on target and within budget.

- Fertilizer plant and equipment are now enroute to Angola with Development and EPCM activities ramping up in anticipation of first production H2 2023.

I expect a flurry of announcements over the next few months prior to production

CABINDA PHOSPHATE FERTILIZER PLANT ENROUTE

More progress and Media Promotion for the Fertillizer and Green Ammonia Projects in Angola. Compelling DFS for the Phosphate Project and MOU from the Green Ammonia Project. It essentially seems there has been no SP value attributed to the Green Ammonia project, which could be a bigger project than the Fertiliser Project.

- Historic Green Ammonia MOU The Agreement represents a global green energy first, outlining the framework and conditions for the supply of 100%-renewable and installed hydroelectric power from the Capanda Dam and Electric Substation to the proposed site of the Capanda Green Ammonia Plant

- Strong Field and Greenhouse trials Trail results underpin recently released DFS, delivering a phosphate fertiliser product from a simple flowsheet that meets the market with strong relative performance at an attractive price point for compelling economics.

- Next Investors Additionally helping the recent price movements was the Paid for Promotion by Next Investors announcing Minbos as there Wise Owl "Stock of the Year". Looks like they agree with me LOL.

- DFS 85%-ownership: Spot-Price Case Post-Tax NPV10 of US$399 million and 61% IRR,,underpinned by Base Case assumptions (Minbos will have an 85% ownership interest in the project, with the other 15% held by local partners).

It looks like it may be a big 23 for Minbos and all the Angolan farmers once they start using the locally produced fertilisers.

Minbos "Our vision"

Our vision is to build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the broader middle african region.

Angola remains one of the worlds great untapped agricultural regions, with +35 million hectares of arable land (the size of France), high rainfall and some of lowest rates of fertilizer use globally. Currently, 100% of all nitrogen, phosphate and potassium (NPK) is imported.

The Angolan Government has a renewed focus on agriculture to diversify economy, promote food security and alleviate poverty.

With one of the fastest growing populations in Africa, Angola is primed to significantly scale-up its agricultural production.

QUARTERLY ACTIVITIES REPORT FOR THE PERIOD ENDING 30 JUNE 2022

Minbos continue to work towards Phosphate Fertiliser production next year, with the added interests now in Ferro Phosphate and Lithium Ferro Phosphate for Batteries as well as the Green Ammonia Project.

Im hoping for positives with the new involvement of the Cornerstone syndicate of investors led by Mr. LIANG Feng, the Chairman of Shanghai Jayson New Energy Materials (Jayson) the world’s largest Battery Anode Producer and Stamicarbon who have overseen more than 250 fertiliser plants and numerous Green Ammonia initiatives including the world’s first industrial-scale renewable energy Ammonia project.

"Stamicarbon are eminently qualified to help deliver what will be perhaps the most compelling Green Energy-Powered-Project Globally."

As part of the recent CR Next investors (S3 Consortium) were again commissioned to provide Marketing services. While I feel this is great for awareness (and they do write a good story) I do watch the influences on sentiment closely.

With the recent CR and share holder dilution we at least are now fully funded to production next year (debt funding subject to DFS conditions). The DFS is now expected in September and should be interesting with all the new developments. Plenty of Risk with Minbos and I hold for the Fertiliser story. There hasn't been any value put on the new developments yet.

Commentary may be worth a read.

Now Phosphate for batteries, Fertiliser and Green Ammonia

Minbos in a trading halt. Due to a CR and Debt Funding. It may have been better for Holders short term to see the imminent DFS first but overall a cornerstone investor helps with the derisking and should now see Minbos Fully funded to production next year.

Im watching closely as we have now had 2 CR before the DFS but I’m hoping the delays are more due to rapid developments, incorporating higher phosphate production rates and the Green Ammonia project.

Fertiliser chemicals biz Minbos Resources in $20m placement

Anthony Macdonald, Sarah Thompson and Kanika Sood Jul 8, 2022 – 10.16am

Listed ammonia and phosphate explorer Minbos Resources was asking investors to chip in for a $20 million share placement, telling them it had already cornerstoned $15 million.

The two-tranche placement, of which $14.45 million was under the company’s existing placement capacity, was priced at 11¢ a share, an 18 per cent discount to the last close. It had room for $5 million in oversubscriptions, according to the term sheet.

Potential investors were told Minbos had locked in $15 million of cornerstone commitments. Of this, the term sheet said, $10.5 million was from an entity controlled by the chairman of Shanghai Putailai New Energy, the world’s largest battery anode producer.

Minbos planned to use $17 million of the placement for its Cabinda phosphate project, while $2 million would go towards working capital and $1 million towards green ammonia technical and market assessment studies.

In tandem with the share placement, Minbos said it had executed a non-binding term sheet for a US$25 million debt facility with Long March Capital to cover the remaining capital costs of the Cabinda phosphate project.

Evolution Capital was the lead manager for the placement, and called for bids by 1pm Monday.

TECHNOLOGY PARTNER MOU WITH STAMICARBON - A GLOBAL LEADER IN GREEN AMMONIA

More welcome news on the developing Green Ammonia Project.

Commenting on the MOU, Minbos CEO Lindsay Reed:

“Having overseen more than 250 fertiliser plants and numerous Green Ammonia initiatives including the world’s first industrial-scale renewable energy Ammonia project located in Kenya, the team at Stamicarbon are eminently qualified to help deliver what will be perhaps the most compelling Green Energy-Powered-Project Globally. The hydro power-to-Ammonia plant will support Angola’s low-carbon and inclusive growth, its agricultural output and its smallholder farmers and communities.”

Commenting on the MOU, Stamicarbon Director of Technology Licensing, David Franz

“Minbos has secured 200MW of very inexpensive green power which sets up the Capanda Green Ammonia Project to be not only one of the best Green Energy-Powered-Projects globally, but potentially the first Green Ammonia project that is truly competitive with traditional fossil-fuel alternatives. Additionally, and importantly, the project brings the possibility to unlock local agricultural potential in central Angola with readily available power and a low to no-carbon profile.”

THE MOST COMPELLING GREEN HYDROGEN- AMMONIA PROJECT GLOBALLY

Minbos just released this announcement with some more information on the proposed Project. The news did help MNB have a green day so it was welcome timing. Minbos is still hoping to have phosphate production up and running next year and that is the driver for the current value. It will be interesting to see whether this project will add value, how much and when.

Presentaion Green Hydrogen Ammonia Project

$2.46M AMBATO SALE COMPLETED AS MOMENTUM BUILDS FOR GREEN HYDROGEN-AMMONIA PROJECT

Highlights

- Sale completed on Minbos’ Ambato Rare Earths Project with the Company receiving A$2.46M sale proceeds

- Receipt of updated Formal Resolution from Angolan power authority (RNT-EP) on 200MW long term Zero Carbon hydro electrical power for Green Hydrogen- Ammonia Project confirming key commercial parameters of the proposed commercial arrangement

- Significant enquiries received from potential technical, offtake and investment partners for the Green Hydrogen-Ammonia Project

- Review being undertaken on ability to develop a Lithium Iron Phosphate battery business unit following initial enquiries from large global battery producers

I originally invested in MINBOS for the fertiliser project, Options keep growing and in this announcement they managed to sneak in a few more Buzz words (Lithium Iron Phosphate Battery). Its an unexpected but positive announcement and it will be interesting to see what comes from all the additional interest.

Commenting on the announcement, Lindsay Reed, CEO, said:

“Our hard work and persistence in Angola is starting to pay dividends, with multiple potential business opportunities on the table that we believe will quickly overtake our phosphate project in relation to returns for shareholders.

Our positioning with the Green Hydrogen-Ammonia Project puts the Company ahead of most, if not all, other ASX listed peers giving Minbos a significant time, infrastructure spend and power pricing advantage. These advantages cannot be underestimated.”

Our positioning with the Green Hydrogen-Ammonia Project puts the Company ahead of most, if not all, other ASX listed peers giving Minbos a significant time, infrastructure spend and power pricing advantage. These advantages cannot be underestimated. Minbos is pleased to confirm completion of the divestment of its interests in Madagascan Rare Earths Project to ALS (Hong Kong) Limited. Proceeds of the divestment (A$2.46M) are to be applied to complete the Definitive Feasibility Study (DFS) for the Cabinda Phosphate Project and studies for the Capanda Green Hydrogen-Ammonia Project.

The Capanda Green Hydrogen-Ammonia Project is set to become another key value driver for the Company as the Cabinda Phosphate Project proceeds towards DFS completion.

Further to the announcement on 10 May 2022, the Company can now confirm it has received an updated resolution from RNT-EP, Angolan’s power network operator.

This updated resolution confirms the key commercial parameters of the power supply arrangement and is in lieu of the Memorandum of Understanding (MOU) that the Company previously expected by mid month (with the MOU now expected following an initial technical discussion process).

In addition to above, the Company has received initial in-bound enquiries on the ability to use phosphate from the Cabinda Phosphate Project for the production of Lithium Iron Phosphate batteries. Lithium Iron Phosphate batteries (LiFePO4 or LFP) offer multiple benefits compared to lead-acid batteries and other lithium batteries. Longer life span, no maintenance, extremely safe, lightweight, improved discharge and charge efficiency, to name a few.

The quality of the phosphate proposed to be produced from the Cabinda Phosphate Project (grade and impurities) has attracted initial interest from potential global battery partners and established battery producers.

10 MAY 2022

SUPPORT FOR MINBOS’ ZERO-CARBON HYDROELECTRIC GREEN HYDROGEN & AMMONIA PROJECT

Minbos has just came out of a Trading Halt with anticipated News on the proposed green Ammonia Project. My initial Interest in Minbos is in the Phosphate Fertiliser Project. It looks like with a little serendipity Minbos has opened the door to a completely new Project that should end up bigger than the Fertiliser with a proposed MOU to secure 200MW of the cheapest power in the world for a Green Ammonia Project with no need for the investment in the power generation infrastructure. There has been a delay in the DFS for the Phosphate project which is scheduled for production next year. The delay caused by the Ammonia Project developments prompted a sp decline prior to the recent sell off. Interesting development.

https://www.investi.com.au/api/announcements/mnb/5c006568-9b6.pdf

Highlights

- Confirmed its support for a long- term offtake agreement with Minbos for Zero-Carbon hydro electrical power

- Zero-Carbon Power to underpin the Company’s Green Hydrogen & Ammonia Project in Angola which seeks to address world shortage of nitrogen fertilizer

- Green ammonia is critical to global food production in a carbon constrained world

- The Company to immediately commence both feasibility studies & technology partner search

- Draft Memorandum of Understanding (“MOU”) will be exchanged between the parties to formally confirm the arrangement, expected mid-May 2022.

- The Zero-Carbon Power is proposed to be delivered to the Company’s project site where the Company plans, based on its preliminary work completed to date, to build a green ammonia production facility with capacity to produce nitrogen fertilizer.

- As part of the proposed production process, the Company plans to convert the Zero-Carbon Power first into green hydrogen which in turn will be converted into green ammonia (ammonium nitrate).

- While the final terms are still to be negotiated and agreed in the MOU, the key commercial terms that have been proposed between the parties to date are:

- Pricing

- Initial 100MW at $US0.004 (0.4c) per kilowatt hour for 5 years then $US0.008 (0.8c) per kilowatt hour for 20 years.

- Subsequent 100MW at $US0.015 (1.5c) per kilowatt hour for 25 years.

Upon execution of the MOU, the Company anticipates that the Zero-Carbon Power offtake arrangement will deliver:

- Weighted average cost of power of $USD0.011 (1.1c) per kilowatt hour – c.90%1 cheaper than Australian power grid pricing and c.55%2 cheaper than natural gas prices (most common power input into current hydrogen and ammonia production);

- long-term power security (25-year offtake);

- long-term power price stability (no risk of increased costs associated with potential carbon pricing regimes); and no upfront capital costs required to establish power generation (versus the capital- intensive development of solar and wind power infrastructure).

- By 14 May, RNT-EP will provide a letter to the Company outlining technical clarifications required for the supply of power to the Project. This will include the despatch voltage options from the Capunda substation commensurate with the power needs of the Project, and the allocation of the practical, legal and financial responsibilities of maintaining the power lines and substation at the green ammonia plant. Angola’s hydroelectric potential is enormous and is key to a project like the Company’s Green Ammonia Project being successful.

- Hydropower ringfences the Company’s Green Ammonia Project from the “perfect storm” created by a surge in gas prices to near record levels in Europe and Asia with a shortage of ammonium nitrate caused by the shuttering of grey, brown and blue hydrogen/ammonia projects globally. Even if gas prices were to normalise to long term averages, the Company’s’ Green Ammonia Project will remain one of the most compelling, globally protected from any impacts associated with global carbon pricing and without substantive capital investment required in new renewable energy production.

ABOUT ZERO-CARBON GREEN AMMONIA

Green ammonia technology is an established technology, having been in use for almost 100 years to produce ammonia using only electricity, air and water as inputs.

Green ammonia is a natural evolution of this established technology, 100% renewable electricity (feedstock) with the hydrogen from water electrolysis combined with nitrogen from air separation to create ammonia, the building block for ammonium nitrate and nitrogen fertilizers

By eliminating the use of fossil fuels, an environmentally friendly process is created in which hydrogen is made via water electrolysis instead of the steam reforming of fossil fuels. The energy needed will come from spare renewable hydroelectric capacity. The output is carbon-free ammonia, also known as green ammonia, the primary feedstock (or Greenstock) for green and carbon-free fertilizers.

One tonne of traditional brown, grey, blue ammonia emits two tonnes of CO2 while the production of green ammonia from hydroelectric energy emits zero-carbon, delivering an environmental, social and governance (ESG) hedge against future fertilizer development activities.

Green ammonia plants are best placed in countries with an abundance of renewable energy sources that have inherently limited intermittency issues and minimise operating costs with sites ideally close to end-user markets. With its hydroelectric capacity Angola has an abundance of both.

Green ammonia also has other applications, including mining explosives and power generation. Agriculture and mining currently absorb more than 80% of global ammonia production, which is almost exclusively sourced from fossil fuels. Competition for green ammonia from the hydrogen fuel sector and pressure from carbon emission reduction activities is forecast to rapidly increase the demand for green ammonia.

Green ammonia plants can be scaled to market size and located at the market doorstep. With access to low-cost sustainable electricity Greenstock, these plants are already competitive in stranded markets remote from port infrastructure.

For Angolan agricultural industries, the current situation involves the importation of ammonia and/or fertilizer. Transportation and internal handling costs currently comprise ~45% of the cost of landed product in Angola. By developing a green ammonia facility close to end markets, there is a significant margin that can be captured whilst remaining competitive with alternative sources. Low-priced and abundant power supplies make locally produced green ammonia significantly more attractive than imported ammonia

ANGOLA - AN EMERGING GREEN ENERGY POWERHOUSE

Bloomberg

Nitrogen Fertilizer Jumps by Record on Russian Supply Concerns

I hold both Minbos and South Harz Potash who will be helped by upward prices, Theres not much joy in positives from the current world crisis though.

ByElizabeth Elkin26 February 2022, 1:33 am AWST

Fertilizer prices are skyrocketing on concerns that Russia’s invasion of Ukraine will curtail global supplies.

Prices for the popular nitrogen fertilizer urea in New Orleans surged 29% to $705 per short ton Friday, a record increase in the 45-year existence of the gauge.

Russia was the world’s largest exporter of nitrogen products as recently as last year and the potential for reduced supplies in light of U.S. and European sanctions are weighing heavily on the market.

“Reduced exports would tighten balances in Northern Hemisphere agricultural markets first,” Alexis Maxwell, an analyst for Bloomberg’s Green Markets, wrote in a report.

The risk of supply disruptions comes as fertilizer costs already are elevate because of soaring natural gas costs in Europe that prompted some manufacturers to curtail or halt production. The spike for the nutrient is stoking concerns about rising food inflation as crop prices climb.

Minbos Vision "To build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the broader middle african region.

Angola remains one of the worlds great untapped agricultural regions, with +35 million hectares of arable land (the size of France), high rainfall and some of lowest rates of fertilizer use globally. Currently, 100% of all nitrogen, phosphate and potassium (NPK) is imported."

- Minbos may be currently priced at this advanced PFS at 10%NPV. This value was before the significant and ongoing fertiliser price rises and also developments in a Green Ammonia project.

- DFS is due any day.

- Strong Angolian government support and the IFDC (International Fertilizer Development Center) to get this project up and running.

- While there has been little news on the green ammonia project, it looks like it hasn't been priced into the the current share price, but if they are able to secure there request for 200MW from the 100MW already highlighted, it may become a significant project in its own right.

- I think the SP may already be discounted for some sovereign risk.

- Early site works underway, Long lead items paid for a due for delivery Q2, production 2023. Low capex

https://www.investi.com.au/api/announcements/mnb/b50a5f90-260.pdf

With Sky rocketing Fertiliser prices, Minbos may be due for a re-rate very soon. DFS due Q122. What will it be with the higher MAP price and also the proposed reduction in the % of MAP in the Blend (50% -15%).Current mc of $46 million with potential NPV of around US$600+ million

LOW CAPEX US$28M

DFS 1Q22 TO PRODUCTION 2023 Around $8.1M Cash after Placement, expect a lot of news flow in 22

SHARES SOLD DOWN TO CR LEVELS Minbos just had a CR via a placement @10c Directors and Management taking $595k of the capital raise. MNB was at 21c in Oct

https://www.investi.com.au/api/announcements/mnb/b50a5f90-260.pdf

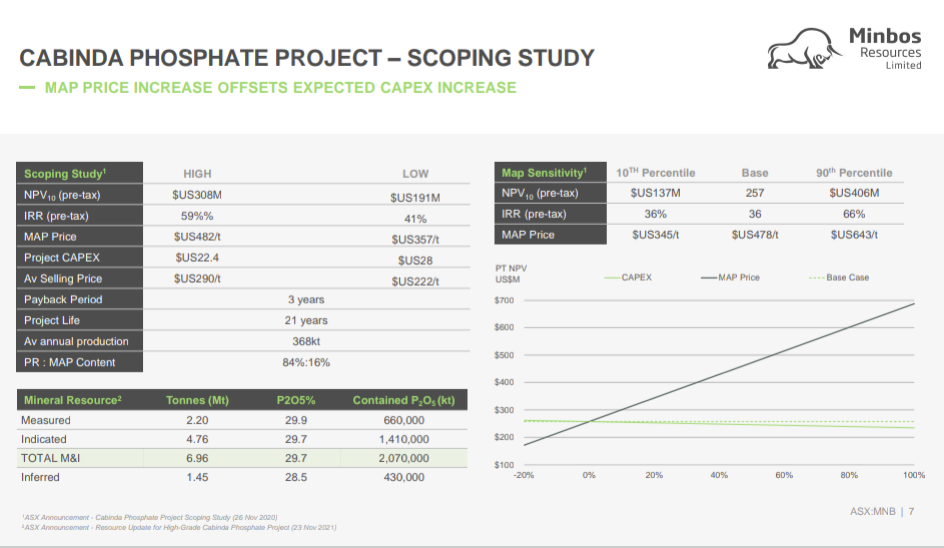

NPV Scoping Study RESOURCE High-grade Resource 8.4MT @ 29.6% P2O5 (85% ownership) Scoping Study

NPV $257M | IRR 58% Scoping Study MAP Price $478/t

AUG 2020; DAP FOB price increased to $328/t as Minbos published its Scoping Study using $428/t FOB ($478/t ex port)

DEC 2021; DAP FOB reaches $820/t after USA introduces countervailing duties on imports and China halts exports.

PRODUCTION Long lead items ordered ,DFS and approvals Q1 2022, Plant shipping ex USA Q2 2022 ,First sales 2023

MINBOS ADDITIONAL PROJECTS AND INTERESTS

Hydrogen & Green Ammonia

Green Ammonia

Government support to establish a Green Ammonia Project

Currently Engaging with technology partners

Land allocated for Green Ammonia Plant

Access to local markets to sell Ammonia Fertilizer through the IFDC and AFFPP

Access to continuously available and clean hydropower with pricing negotiations underway

Angola’s Hydro Power

World-leading Hydro Power Generation

Some of the cheapest power prices globally

Currently negotiating even lower tariff for engaging with technology providers

THE FUTURE

Future Opportunities

NPK Blending and Distribution – Lime

Nitro Phosphates

Soil Carbon

Angola Agriculture

57M ha arable land

1,000 -1,500mm annual rainfall

100% of fertilizers imported

Not directly about MNB but an Interesting update on Ferilliser out yesterday. More food for thought.

Minbos Resources Limited (ASX:MNB) (Minbos or the Company) and Angolan agribusiness Sociedade Agroquímica Industrial, S.A. (Sagrind) are pleased to announce they have entered into a Memorandum of Understanding (MoU).

Highlights

• Minbos and Sagrind have signed a MoU to establish a Nitrogen, Phosphate, Potassium (NPK) fertilizer blending plant and distribution business in Angola’s Malanje region.

• Sagrind is an Angolan agribusiness established to supply fertilizers, herbicides, pesticides and seeds for farmers in the Malanje growing corridor.

• Minbos is an ASX-listed fertilizer developer with plan to build a nutrient supply and distribution business that stimulates agricultural production and promotes food security in Angola and the wider Economic Community of Central African States (ECOCAS) region.

• Sagrind will provide local agricultural management and knowledge, including its network, to fulfil administrative and legal aspects of the projects.

• Sagrind and Minbos share the view that Malanje is the epicentre of the development of agriculture and the agro-industrial sector in Angola and will work in partnership to pursue local and regional fertilizer market opportunities.

• The Government of Angola has allocated a 20-hectare site in Malange for the NPK plant.

https://www.investi.com.au/api/announcements/mnb/b9d7d77d-ced.pdf

LOW CAPEX Angola Fertilliser

SCOPING STUDY OUTCOME LOW - HIGH

EBITDA LoM (US$M) $747 - $1,101

Pre-tax NPV (US$M) $191 - $308

Pre-tax IRR (US$M) 41% - 59%

After-tax NPV (US$M) $159 - $260

After-tax IRR (%) 40% - 58%

Pre-production Capex (US$M) $27.9 - $22.4

Average Selling Price (US$/t) $222 - $290

Cash Operating Costs LoMa (US$/t) $121 - $141

Payback Period (Years) 3

Life of Mine (Years) 21

Average Annual Production (ktpa 368

26 Aug 20 Scoping study has a MAP Price range (US$/t) 357-482 Currently topped at (US$/t) 776

Scoping study link

https://www.investi.com.au/api/announcements/mnb/2252c2e1-51d.pdf

Invester presentation Africa Down under

https://www.investi.com.au/api/announcements/mnb/55004ab6-170.pdf

Food demand from middle Africa’s expanding population is unmet by local primary agriculture.

Angola has significant unutilised arable land, high rainfall and no primary fertiliser manufacturing facility.

Our plan is to mine Phosphate Rock from the Cácata Deposit and transport it to Porto de Caio where a granulation plant will be built and operated at the industrial site to produce Enhanced Phosphate Rock (EPR) granules. The EPR granules will become the P nutrient feed stock to blend with imported Nitrogen (N), and Potassium (K) granules in NPK blending plants to exact specifications suited to Angolan crops and soils.

The Cabinda Phosphate Project is the first step in developing a high impact self-sustaining agricultural sector throughout Angola and middle Africa and the first step in alleviating poverty for millions of subsidence farmers who use no soil nutrients.

HIGHLIGHTS

- Definitive Feasibility Study (DFS) progressing with Environmental and Social Impact Assessment (ESIA) commenced.

- IFDC farm and fertiliser market survey identifies 3 million farmers cultivating 5.5 million hectares with potential to increase fertiliser consumption by an order of magnitude.

- Australian provisional patent application lodged for a new phosphate rock fertiliser blend, with potential to produce 100% organic phosphate fertiliser.

- Post quarter end, purchase was approved for two key long lead items for construction of the Cabinda Phosphate Granulation Plant. A$1.5 million forward order deposit to be paid to FEECO International.

DEFINITIVE FEASIBILITY STUDY

During the quarter, the Company was actively progressing its DFS on its high-grade phosphate deposit, with ESIA now underway with a team from HCV Africa on site in Cabinda

PHOSPHATE FERTILISER PRICES

Phosphate fertiliser prices have more than doubled since the Company submitted its tender for the Cabinda Phosphate Project in late 2019. The Project sensitivity to fertiliser price movements is explained in the Scoping Study released by the Company on 26 August 2020. The Enhanced Phosphate Rock (ERP), produced for sale by the Project, includes Mono-Ammonium Phosphate (MAP)that equates to approximately half the product cost.

Currently, the ex-port warehouse price for MAP in Brazilian ports is trading at US$800, which is significantly more than the US$478 used in the Scoping Study. The Scoping Study sensitivity analysis showed the Project is most sensitive to MAP price and relatively insensitive to OPEX and CAPEX .This is important because COVID stimulus measures and supply chain impacts are expected to increase OPEX and CAPEX , but the impact on project metrics should be small compared to the positive impact of the increased MAP price. Prices can move up and down but are currently higher than the high case used in the Scoping Study.

Capitalising on rising fertiliser prices, with the price of Mono-ammonium Phosphate (MAP) currently US$780/t, more than US$300 higher than the Scoping Study benchmark price, which delivered the US$247M pre-tax NPV.

It looks like I am the only one holding a position in Minbos, I would welcome any thoughts

Post a valuation or endorse another member's valuation.