Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This review is based on information from the Q1 update and AGM presentation, both in mid-October (hardly new). FY25 was a relatively ugly year results wise with the company saying revenues were down due to temporary events and costs up due to the PNG market entry and Loop JV, with FY26 offering a return to the highly profitable operations of pre-FY25 with additional options coming online.

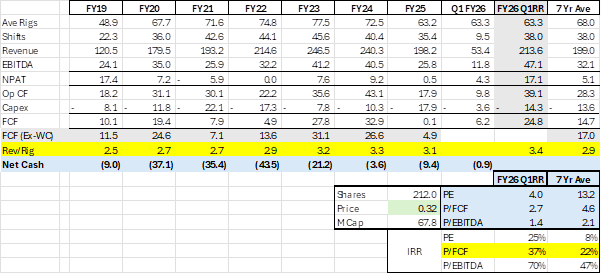

The Q1 results were very much a validation of that assertion, if annualised (FY26 on Q1 Run Rate) you get the highest NPAT since FY19 and FCF not far off the extremely high FY23 and FY24 figures. MSV is on a PE of 4.0 and P/FCF of just 2.7, implying that if it maintains this with no growth then investors get a 25% or 37% return each year respectively…

Comparing the FY26 Q1RR to the 7-year average (FY19-25) and Rig’s are down but revenue per rig has trended up (FY25 the exception), more revenue is generated from fewer rigs but the same number of shifts. EBITDA and NPAT (70% of EBT) have improved as well as FCF, which makes FY25 look very much like an aberration rather than a change in direction of the business.

MSV is gushing cash, the market has remained fixated on poor NPAT figures since FY19, it seems sceptical on the gap which needs explaining. As @Noddy74 covered in his comprehensive analysis that first brought this company to my attention, accelerated depreciation rates and amortisation of goodwill is why we have seen NPAT lag FCF, with a 7 year average of $5.1m for NPAT and $14.7m for FCF, and if you strip out WC movements the FCF average is $17.0m.

Also, Debt (negative net cash) has been a valid concern for the market even though most of it was equipment financed (ie secured on assets with market value). It’s paydown has been where FCF has mostly been applied with some buybacks and sporadic dividends. However, debt is now down so that net cash is just -$0.9m at the end of Q1 FY26 (ie basically debt free).

So why is the market so glum on MSV? The debt overhang is gone, it’s generating profit and cash flow at very strong rates, yet the price has drifted down to $0.32 having hit $0.36 on the Q1 announcement and is trading at a PE of 4.0 based on Q1 results annualised. It may have something to do with Comsec has the PE at 128! Which assumes FY26 NPAT will be the same as FY25 (ie $0.5m), or investors are still unsure given the halting of dividends in FY25 has not re-commenced (singling a brighter outlook) or maybe its something to do with the below which I am watching.

Things to keep an eye on or think about:

- Loop JV: notional value of $25m based on Sumitomo investment, MSV’s share would be worth $9-10m. MSV has invested $1.5m in the JV and Q1 includes a profit share of $0.7m which is a promising start. So it looks like it is value adding, but it may be a long time before we get a good idea if it is and what it may off. So, like the market, I am excluding upside from the JV and see downside as less likely.

- Depreciation Rates: There is a risk that depreciation rates in the P&L are in fact more appropriate than the capital replacement rates we are seeing in cash flows. However, this has been the case for at least 7 years and such variances usually iron out over this time horizon – but it remains a possibility, even if remote, that would undermine value.

- Industry: Mining is cyclical, but as is covered well by @Noddy74, the services MSV offer are mostly to Tier 1 customers running long lifetime mines plus there is diversity across resources, geography, type of mining (above/below ground) and additional diversity that the Loop JV may provide. The business has been successfully managed through cycles and has consistently performed well on a FCF basis, so it is reasonable to expect it will continue to do so, but it remains a risk.

- Management Plans: The 2022 pivot from capital and debt driven growth to a limited debit (assuming they remain committed to limiting net debt to $15m) and shareholder return approach has so far played out. A return to Empire building could be destructive to shareholder wealth, the JV and move into PNG shows a growth mindset remains, but have been done without dilution and while reducing debt. A dividend policy may also give investors some additional confidence that their returns are being prioritised and cash is not left burning a hole in management pocket to spend unwisely.

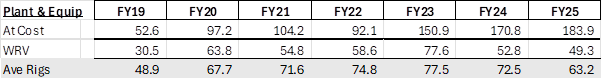

The Future is Rigged (in a good way): Per the below table, the value at cost of rig’s owned has doubled from FY20 to FY25, yet the average rig’s used is lower. I haven’t been able to find the number of Rig’s MSV actually owns (as opposed to those in use), but this suggests that half or fewer of the fleet is in use. Sure the cost of new rigs will have gone up, but they wouldn’t have had 100% utilisation in FY20.

So there is a scenario where MSV gets more business and improves the average rig’s to well above previous highs of 77.5 (23% higher). Add the opportunity from the Loop JV and FY26 cycling against a very week FY25, there may be some very attractive YoY figures being reported over the next 6-12 months that may attract market attention.

Value

I hold as highly credible the valuation work done by @Noddy74 which valued the company at $0.72 (PE of 8 on Q1 FY26 RR) about a year ago and am using it as my base valuation with the following upside opportunities:

1. FCF and NPAT start to merge as the accelerated depreciation slows to align with capex, so the PE would drop from 4 to 2.7 (P/FCF) at the current price – effectively a 50% upside to valuation (~$1.00).

2. Loop JV: Notionally adds $10m (5c) to the market cap now, but this could be a lot more if successful.

3. Disposing excess Rigs: Equipment is $184m at cost and $49m written down through accelerated depreciation. The market value will be somewhere between the two, the midpoint is $116m which is $0.55 a share… the price is currently $0.32

I generally don’t like mining services which have results that whipsaw with the cycle, but MSV shows more stability and as @Noddy74 said it's fracking cheap!!!

I bought a small position in January and topped up in April and today, average around $0.325. Still a little short of a full position but getting there.

Disc: I own RL

The Good

- They made a truckload of cash in the quarter. We won't know what free cashflow looks like till next month but they roughly made 15-20% of their EV in operating cashflow in the quarter!

- As a result what was already a very manageable debt level is down by 40% compared to 3 months prior, which strongly suggests free cashflow was high.

- The momentum is good with two mine shutdowns in the quarter back in operation and operating rigs nudging up over the quarter.

- There's a sense that if they can catch a break in terms of weather and other factors out of their control, they're in a good place to be able to generate decent cash in FY26. The mobilisation costs they had flagged since last year have largely been incurred and are now drilling.

- The Loop Decarb JV is operating ahead of expectation, with a second client having signed a Letter of Intent to engage Loop in drilling operations in 2025. More on that in a bit.

- Gold enquiries are up. They've repeatedly said, including when they met with us, that the booming gold price hadn't moved the dial on demand for gold drilling. However, in the last two quarters they've indicated that appears to be changing.

- Have flagged minimal capex with existing assets to continue to be sweated.

The Bad

- The full year comps largely aren't great, but we already knew that was case. They had consistently flagged FY25 as a transitional year and the quarterly updates had confirmed it. Q4 was actually pretty good.

- Two mine shutdowns for part of the quarter due to water ingress and a gas buildup didn't help. Both were back in operation by the end of the quarter. They estimated that deprived them of 180 shifts, which roughly equates to about $1 million.

- Revenue/shift lower than last year. They claim they won't compete on price and will accept lower utilisation instead but that's not entirely borne out in the numbers, albeit a single metric.

- The coal price is in the freezer and thus while operations at existing mines continue, they do so at a reduced scale.

- The Chair didn't entirely rule out dividend payments but strongly suggested that surplus cash will be prioritised for share buybacks (I'm not sure if that belongs in The Bad section).

Loop Decarb JV

They gave some decent commentary about the new JV they've entered into, in which they claim to be the only operator. Essentially this business is a response to changes to the Safeguard Mechanism in 2023, which requires large emitters to reduce their methane emissions by about 5% per year or else purchase carbon offsets i.e. get taxed. The nature of coal seams is to attract methane (Coal Seam Gas) and this means coal miners tend to be large emitters. The Loop JV provides a service to extract the methane so it's not released during coal extraction. However, the technical nature of the process means it's much more of an end-to-end proposition than their existing business. It sounds like there is much more planning and consulting involved, things like pit design, drilling sequencing etc. One area they flagged for the future is downstream selling of the gas (I'm trying to find out what they currently do with it). Who knows, maybe this boring drilling company might play a role in bitcoin mining!

Loop is currently in the drilling phase with one customer and is in the consultation phase with a second. During the quarter the second client signed a letter of intent to engage Loop for drilling services later this year. They expect the business to initially be lumpy, but I like it when a business has legislative tailwinds behind it.

Outlook

They didn't give a specific outlook but their expectation is it will be stronger than FY25. With fewer mobilisations, fewer shutdowns and some decent weather, it might be significantly better.

[Held, underweight still]

Drilling services provider Mitchell Services came out with its usual quarterly update this morning and, as they had previously flagged, it was a softer quarter. The quarter is seasonally the weakest, but this was exacerbated by the need to spend ahead of new contracted drilling commissions commencing in Q3. Management used the dreaded 'transition' word to describe 1H25, but the CEO was rhetorically bullish stating "...I maintain my view that the business is in the best position it has been...". Whether the market believes this and can see a stronger half ahead is the question.

Pessimists will find plenty of cause for concern in the metrics versus pcp. Optimists will point to:

- a multi-year multi-rig project with an existing global client due to commence in PNG in the next few weeks

- successful contract award of new service offering in the form of surface to inseam drilling (SIS)

- the newly created joint venture, Loop Carbonisation Solutions, progressing faster than originally planned with a drilling contract to commence in early February

- continued operating cashflow generation despite softer utilisation and investment ahead of new contracts

Overall I think this was a well flagged result that may give an opportunity to buy at a lower price in coming months. I would be concerned, however, if the metrics didn't start to turn in Q3 and especially Q4.

[Held]

This is where it gets spicy. The nature of the beast means a DCF is next to useless. One option is to look back the last two financial years and take the average FCF of $30 million and put a multiple on it - let's be really conservative and say 6x. That would give an implied market cap of $180 million and share price of $0.84. That's 140% upside from here. Full disclosure: I don't think FY25 will be as favourable as FY23 or FY24, but FY26 is prospective.

Incidentally, $180 million is also roughly the replacement value of its fleet. But let's not go there. Let's instead use what management says in the market value of the fleet, which is $120 million. If we calculate Net Tangible Assets off that I get an NTA of $122 million. That implies a share price of $0.57. Still a respectable 63% upside.

What about compared to listed peers? I don't like EBITDA as a heuristic for capital intensive businesses, but it's still widely used. Per below it suggests Mitchell may be undervalued by 100%, with an implied share price of $0.70.

EBITDA multiples are even more widely used in acquisitions, so what might that tell us?

I'm going to exclude Rado on the basis that it looks like an outlier. The rig multiple on this deal is lower than Mitchell paid for the distressed assets in 2014 and 2015.

On that basis the EBITDA multiple implies a valuation for Mitchell of $0.75. The rig multiple is significantly higher, suggesting a deal value closer to $200 million and an implied share price of $0.93. However, I acknowledge this is a less reliable indicator with muddy causation and I won't use this in the basis of the valuation.

In the absence of a better measure I'm going to average four of the measures above to approximate the valuation.

On that basis it's fracking cheap!

I've been drilling into the Mitchell Services story of late. It's not a company that has struck much support on Strawman but has garnered a bit of a following among international microcap investors. The thing that really stands out is that the window for getting outsized returns in this type of industry is narrow. It's not an industry that allows for just in time PP&E, so you've got to have a decent fleet of drills throughout the cycle. In fact, by far the best time to buy is when the industry is on its knees and you can score inventory for cents on the dollar, which means potentially buying and then mothballing drills for years at a time.

Then as the cycle starts to turn you have to spend money refurbishing existing fleets and/or buying additional kit, either of which means obtaining funding by borrowing or raising and diluting shareholders. Then you have to hope you get a decent share of the tender pipeline to justify all this spending. Then you spend another quarter or two ramping up, recruiting and training, getting kit to site and commissioning equipment to commence drilling. Then you have to hope you get paid, which is not a given and though more likely from tier 1 participants, they generally demand longer payment terms. Then, and only then, do you get the chance to hit paydirt. Long term shareholders spend most of the time getting shafted!

The good news is that Mitchell Services appears to have pretty solid management that have seen several mining cycles, may just have started to hit the sweet spot of the cycle (at least with regards to the commodities to which it is exposed), and it may be that majors are acting more rationally than in previous cycles, which augers well for a more stable and persistent period of success. Let's dig deep…

History

Like many fault line stories, the history of MSV starts in Queensland. But like ends of a banana it begins in two places, Drill Torque and Mitchell Drilling. Mitchell Drilling traces its genesis all the way back to 1969. It grew steadily in private hands until its 30-rig operation was sold to AJ Lucas in 2008 for a cool $150 million (it's probably worth pointing out here that MSV is currently a circa 100 rig operation with a market cap of $75 million). AJ Lucas was and still is one of the biggest players in the drilling market and included a five-year non-compete clause in the deal.

Meanwhile, Drill Torque broke ground with a single rig in 1992 and by 2011 had grown to a similar 30-rig operation when it IPO'd in 2011. The next couple of years were challenging, with a mining downturn being compounded with some management missteps. However, in late 2013 their luck was due to change. Nathan Mitchell - having served out the non-complete clause - was keen to chisel out a new niche in the industry and had a plan to ore-chestrate a turnaround for Drill Torque.

A deal was struck whereby Mitchell Services would effectively undertake a reverse acquisition of Drill Torque, existing management would stand aside and Mitchell Drilling would be re-spun as Mitchell Services (ASX:MSV). It is enlightening how Nathan Mitchell thinks when he wrote the following in the FY14 Annual Report:

"A cyclical market presents opportunity; this is why I decided to re-enter the Australian marketplace after the expiry of a five-year non-compete period. As the market was at a low point I believed it was the right time to invest."

Growth and acquisitions

Nathan Mitchell quickly began to implement his turnaround plan. His focus was to add capacity, build diversity of resource, drill type and geographic exposures, and build up the company's resilience by focusing on Tier 1 miners who were more likely to continue investment throughout the cycle.

To build capacity he chose to use the mining downturn to his advantage and undertook two significant asset purchases from competitors who had gone into receivership. This allowed him to more than double his fleet and while he couldn't hope to utilise the fleet in the short to medium term, the opportunity to use a crisis to his advantage was too tempting.

Later he acquired the assets and operations of east coast-competitors Radco Drilling and Deepcore Drilling. This added additional capacity, specialist services and, in the case of the latter, regional and resource diversity. In all its acquisitions there has been a focus on ensuring the majority of the assets are tier 1 ready.

The strategy is reflected in the numbers. In FY14, the year of the reverse takeover, Mitchell Services generated $15 million in revenue. It has grown this at a CAGR of 32% to $237 million in FY24. In 2014 it was overwhelmingly Queensland-based. Other east coast states now make up half of all business. In 2014 it was a coal driller. Coking coal is still a significant contributor but gold is now the biggest driver, with copper and other elements making sizable contributions. It's share of tier 1 clients in FY14 was 37%. They now represent 80-90% of all revenue. Finally, in FY14 underground drilling represented a claustrophobic 8% of Mitchell's revenue. It's now circa. 50/50 surface to underground drilling.

Capital management

What has changed a lot less since 2014 is the share price. In fact, it's been range bound for almost that entire period. Why is that? Management of MSV appears to be debt averse. In some of the acquisitions discussed above they've used it to an extent, but when they do, they are at pains to pay it down and their go-to is usually a capital raise. I would confess a similar predilection. However, the impact of that has been significant dilution up until recently. I'll leave it to the reader to decide whether the end justifies the means but will point out that although dilution has been undeniably heavy, it has fuelled growth of both revenue and more recently cash (not earnings - we'll get to that). Also, I'd point to the last two years of the graph below. Is it a temporary blip or has there been a lasting change?

In terms of allocation, it can take a while to make fair judgement but 10 years should be ample. The messaging is good with management consistently using ROIC as a key metric in recent years and this has been trending up. There are other indications. For instance, in 2022 the company sold two rigs that it had acquired as distressed assets in 2014. The rigs were acquired for a combined price of $400k. After eight years of use they were sold for $2.5 million and would have required $1.8 million to re-service had they been kept.

In 2022, after eight years of investment, dilution and growth, the company pivoted. Its ongoing focus would be cash generation and shareholder return, and it would do so by sweating its existing rigs. Shareholder return would include dividends, share buybacks and debt paydown. Since the pivot its ability to generate cash has been impressive. In FY23 and FY24 it generated a combined $60 million in Free Cash Flow (operating cash minus capex). It used this to retire debt (from circa $40 million to now negligible), pay dividends and buy back stock (combined circa $18 million). With debt now all but gone the Company has added a fourth pillar to its capital management strategy being 'growth'. It has indicated that this will be debt-funded and, with a soft $15 million ceiling on new debt, should be easily manageable.

Competition

After a decade of industry-wide consolidation Mitchell Services is left as the biggest operator on the East Coast of Australia. AJ Lucas - who bought the original Mitchell Drilling in 2008 - is the next biggest competitor. Perenti - who is the biggest operator in Western Australia - also has a presence on the East Coast, but is not of the scale as the other two.

Management say that it is very difficult to come in as a new player (funding, relationships etc.) and that is increasingly true if you're prospecting for tier 1 operators. To some extent this can be seen in daily rig rates, which have grown ahead of inflation.

10 years of screwing around

Obviously, the market doesn't have a bullish view on the Company with the share price basically where it was 10 years ago. There are a few things going on methinks. First, it doesn't screen well on an earnings basis. For instance, in the past two years when FCF has been $60 million, combined NPAT has been a meagre $17 million. Lower growth capex requirements are part of the answer. Instant asset writeoff policy has also meant new capex depreciation has been accelerated, while existing capex continues to depreciate, causing a P&L double-whammy (also tax benefits). Also amortisation of customer contracts (non-cash) from the more recent acquisitions also contributed. These have now been fully amortised.

Second, operational rigs have been in decline over the past year, and to a lesser degree over the past two years. To an extent management has been able to make this up via general rates and a greater proportion of higher-margin specialised work. However, it is not a trend we would want to see continue. Management has flagged the decline is due to temporary client-side dynamics and they haven't been losing contracts. In fact, they recently gained three new contracts, representing about ten rigs. However, these will add short term costs to scale up and won't contribute revenue until 2H FY25.

Third, it's caught up in the general malaise/uncertainty of the current mining cycle. Mitchell has no exposure to lithium or nickel, but equally they acknowledge the current elevated gold price hasn't resulted in a rush to accelerate exploration. The benefit to them of an exploration surge would be muted anyway given their focus on tier 1 producers, but the mind of the market isn't always open at depth.

Conclusion

Normally jumping into a company that has a flatlining share price and unchanged management would be something to avoid. It is just hubris to think you can predict the imminent rerate of a company that has stubbornly avoided doing so up to this point. However, the valuation is more than interesting and increasingly so. It is becoming something the market cannot forever ignore. That alone would not be enough but just as importantly, the capital management activities that are being undertaken mean you are being paid handsomely to stay while the market makes up its mind.

Arguably it's not as exciting as Kylie Minogue's hit single Spinning Around but at the very least I think it's worth a look.

[It's a small position for now as I want to see 1H results and probably Q3/Q4 as well.]