This review is based on information from the Q1 update and AGM presentation, both in mid-October (hardly new). FY25 was a relatively ugly year results wise with the company saying revenues were down due to temporary events and costs up due to the PNG market entry and Loop JV, with FY26 offering a return to the highly profitable operations of pre-FY25 with additional options coming online.

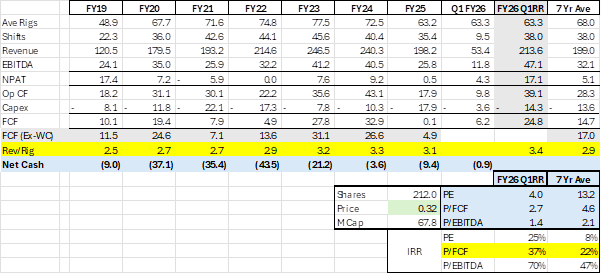

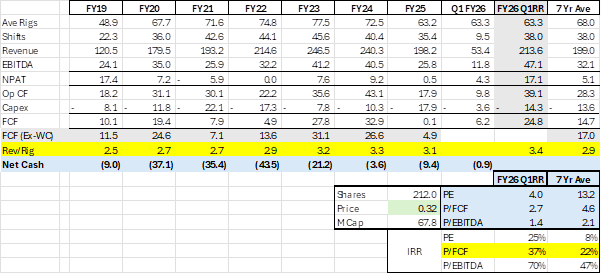

The Q1 results were very much a validation of that assertion, if annualised (FY26 on Q1 Run Rate) you get the highest NPAT since FY19 and FCF not far off the extremely high FY23 and FY24 figures. MSV is on a PE of 4.0 and P/FCF of just 2.7, implying that if it maintains this with no growth then investors get a 25% or 37% return each year respectively…

Comparing the FY26 Q1RR to the 7-year average (FY19-25) and Rig’s are down but revenue per rig has trended up (FY25 the exception), more revenue is generated from fewer rigs but the same number of shifts. EBITDA and NPAT (70% of EBT) have improved as well as FCF, which makes FY25 look very much like an aberration rather than a change in direction of the business.

MSV is gushing cash, the market has remained fixated on poor NPAT figures since FY19, it seems sceptical on the gap which needs explaining. As @Noddy74 covered in his comprehensive analysis that first brought this company to my attention, accelerated depreciation rates and amortisation of goodwill is why we have seen NPAT lag FCF, with a 7 year average of $5.1m for NPAT and $14.7m for FCF, and if you strip out WC movements the FCF average is $17.0m.

Also, Debt (negative net cash) has been a valid concern for the market even though most of it was equipment financed (ie secured on assets with market value). It’s paydown has been where FCF has mostly been applied with some buybacks and sporadic dividends. However, debt is now down so that net cash is just -$0.9m at the end of Q1 FY26 (ie basically debt free).

So why is the market so glum on MSV? The debt overhang is gone, it’s generating profit and cash flow at very strong rates, yet the price has drifted down to $0.32 having hit $0.36 on the Q1 announcement and is trading at a PE of 4.0 based on Q1 results annualised. It may have something to do with Comsec has the PE at 128! Which assumes FY26 NPAT will be the same as FY25 (ie $0.5m), or investors are still unsure given the halting of dividends in FY25 has not re-commenced (singling a brighter outlook) or maybe its something to do with the below which I am watching.

Things to keep an eye on or think about:

- Loop JV: notional value of $25m based on Sumitomo investment, MSV’s share would be worth $9-10m. MSV has invested $1.5m in the JV and Q1 includes a profit share of $0.7m which is a promising start. So it looks like it is value adding, but it may be a long time before we get a good idea if it is and what it may off. So, like the market, I am excluding upside from the JV and see downside as less likely.

- Depreciation Rates: There is a risk that depreciation rates in the P&L are in fact more appropriate than the capital replacement rates we are seeing in cash flows. However, this has been the case for at least 7 years and such variances usually iron out over this time horizon – but it remains a possibility, even if remote, that would undermine value.

- Industry: Mining is cyclical, but as is covered well by @Noddy74, the services MSV offer are mostly to Tier 1 customers running long lifetime mines plus there is diversity across resources, geography, type of mining (above/below ground) and additional diversity that the Loop JV may provide. The business has been successfully managed through cycles and has consistently performed well on a FCF basis, so it is reasonable to expect it will continue to do so, but it remains a risk.

- Management Plans: The 2022 pivot from capital and debt driven growth to a limited debit (assuming they remain committed to limiting net debt to $15m) and shareholder return approach has so far played out. A return to Empire building could be destructive to shareholder wealth, the JV and move into PNG shows a growth mindset remains, but have been done without dilution and while reducing debt. A dividend policy may also give investors some additional confidence that their returns are being prioritised and cash is not left burning a hole in management pocket to spend unwisely.

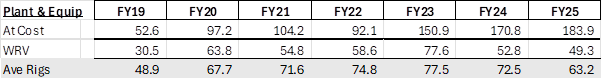

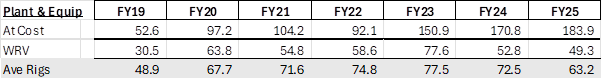

The Future is Rigged (in a good way): Per the below table, the value at cost of rig’s owned has doubled from FY20 to FY25, yet the average rig’s used is lower. I haven’t been able to find the number of Rig’s MSV actually owns (as opposed to those in use), but this suggests that half or fewer of the fleet is in use. Sure the cost of new rigs will have gone up, but they wouldn’t have had 100% utilisation in FY20.

So there is a scenario where MSV gets more business and improves the average rig’s to well above previous highs of 77.5 (23% higher). Add the opportunity from the Loop JV and FY26 cycling against a very week FY25, there may be some very attractive YoY figures being reported over the next 6-12 months that may attract market attention.

Value

I hold as highly credible the valuation work done by @Noddy74 which valued the company at $0.72 (PE of 8 on Q1 FY26 RR) about a year ago and am using it as my base valuation with the following upside opportunities:

1. FCF and NPAT start to merge as the accelerated depreciation slows to align with capex, so the PE would drop from 4 to 2.7 (P/FCF) at the current price – effectively a 50% upside to valuation (~$1.00).

2. Loop JV: Notionally adds $10m (5c) to the market cap now, but this could be a lot more if successful.

3. Disposing excess Rigs: Equipment is $184m at cost and $49m written down through accelerated depreciation. The market value will be somewhere between the two, the midpoint is $116m which is $0.55 a share… the price is currently $0.32

I generally don’t like mining services which have results that whipsaw with the cycle, but MSV shows more stability and as @Noddy74 said it's fracking cheap!!!

I bought a small position in January and topped up in April and today, average around $0.325. Still a little short of a full position but getting there.

Disc: I own RL