On Friday morning, MTM released the announcement that had seen it go into a trading halt on Tuesday.

They’ve executed a Binding Letter of Intent to collaborate with ElementUSA to extract gallium and scandium from bauxite tailings in Louisiana. The Gramercy tailing dam is said to be the biggest source of red mud in the USA.

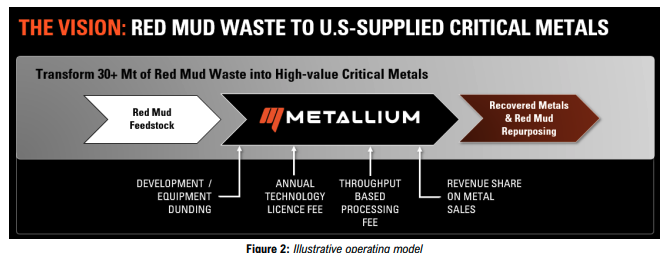

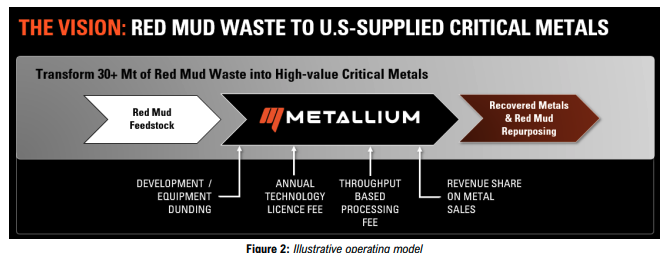

What I found particularly interesting was the explanation of how MTM is proposing to gain revenue from this facility, from the initial development funding (they get 1US0.1M, it seems upfront), and subsequently:

I found it noteworthy that, past that initial development funding, MTM have 3 different on-going revenue streams.

- An annual technology licensing fee - which presumably would be paid regardless of the activity or otherwise of the works

- A throughput-based processing fee

- A revenue share of the recovered metal sales.

The implication in the announcement is that this is going to be their revenue model going forward, not just with this project but with others in the future.

This seemed a smart way of setting up their revenue structure, with 3 different points at which they tap into the project. Perhaps this is the norm in this area, but regardless, knowing that this is how they’re approaching deriving revenue from projects is reassuring given that their primary input is IP, combined with the engineering know-how to make the IP work.

Of course, they have to get this Gramercy facility up and running before they’ll see any fee-derived income, and who knows how long that will take.

So far, the market has yawned and the SP has drifted southwards.

Discl: held IRL (1.3% Aus-SMID segment, 0.4% total PF)