Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Quarterly Activity report

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02940296-3A666948&v=7bc42bd11d853ed5e8c28f2ffcd6a069ee5cd6b4

Well the market certainly liked it (up over 30% so far today)

Nice to see genuine cash flow positivity

Things seem generally headed in the right direction. I like the management focus on reducing costs and concentrating on Australia and Europe

Main concern is the lack of increase in revenue from the main pain relief segment and well as the poor outlook for the second half due to "phasing" and "currency". I need to understand better what is going on there

Remains very cheap. EV/revenue is less than 1, even with the big SP rise today

IF they can continue to grow revenue in Aus/Europe and control costs, this could easily multibag.

The product has always been good. From here it's all about management executing

The historical pattern seems to be that the SP jumps on positive announcements and then drifts back down. If that pattern repeats, I may be tempted to add to my small irl holding

Been meaning to take a look at Medical Developments International (MVP) for some time now. I did mention this to @acarbone1 and @Arena42 at our recent catch up.

Well, they released their quarterly report (find it here) today, safe to say it must have been good with it being up ~25% at time of accessing this from Commsec and now up ~43% at time of posting.

So what's good?

- Strongly improved operating cashflow - with Group revenue for Q2 FY25 coming in at $10.9 million which is $1.8 up on Q1

- H1 FY25 was $20 million was nearly $5 million higher than pcp.

- Continued growth for Penthrox in Australian hospital segment.

- Cash balance at 31 December 2024 of $17.6 million.

- Positive operating cashflow expected by the end of FY25.

A few ticks in the win column there.

Further, here's some outlook statements:

FY25 OUTLOOK: The Group expects underlying EBIT in FY25 to be strongly improved on FY24, driven by higher average Penthrox prices and operational efficiencies of ~$4 million.

CEO Brent MacGregor said, “We have delivered a pleasing improvement to earnings and cashflow in the first half through enhanced pricing and cost efficiencies. We remain on track to deliver positive operating cashflows by the end of FY25.”

They list 3 strategic priorities for FY25:

- Improve Margins through pricing and efficiency: The Group's new pricing initiatives are expected to improve annualized margins by ~$3.5 million, with higher pricing in Australia, the UK, and Ireland. Additionally, efficiency measures have reduced operating costs by ~$4 million for the first half of FY25 compared to the previous period.

- Accelerate penetration of Penthrox in Australia: significantly advanced its strategy to grow Penthrox in hospital emergency departments, achieving a 52% increase in demand in the first half of FY25 and implementing initiatives to accelerate its adoption as a standard of care.

- Grow Penthrox in Europe: European in-market demand for Penthrox in 1H FY25 increased by 22%, and the Group has submitted an application to broaden its use to children as young as 6 years old, with positive initial feedback from the regulatory agency. Partner negotiations for distribution in France and the transfer of distribution in Switzerland to Labatec are progressing well, with the latter expected to complete in Q4 FY25.

Well, that appears to address the SP pop.

For those who have been watching this one for some time (insert me) - they butchered their China rollout plan and incinerated capital, and their US roll-out has also been a furry-dragon-riding-never-ending story of "it's gonna happen". It's reassuring to see that neither China or the US mentioned - TBH if China was mentioned I'd frisbee my laptop out the window after they did announce full withdrawal of this plan years ago. But was also good not to be reminded of their US hopes and dreams.

This announcement does seem different and more considered, it appears management have woken up to the need to push further in where they do have more control (Aus and UK), with Europe also being a potential further driver of growth.

I'm going to need to take a closer look at them (again), but I recall that I always seem to walk over the end of a rake when I get to the management section of my screen/review. There is a serious lack of insider ownership (from my last check), and they simply never passed my pub-test.

But this announcement does give me hope, and it appears to give the market hope... I'll be back for a closer look.

Hoping some other SM gurus can take a look to help me out with this.

This is one that I got terribly wrong. I sold out at least a year ago for a big loss but glad I got out when I did.

They have a great product in Oz and should have been able to make it work internationally. Execution and capital management have been abysmal and it doesn't seem to be getting any better.

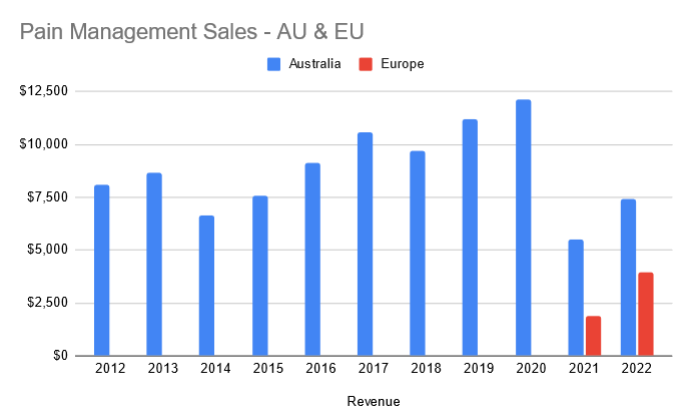

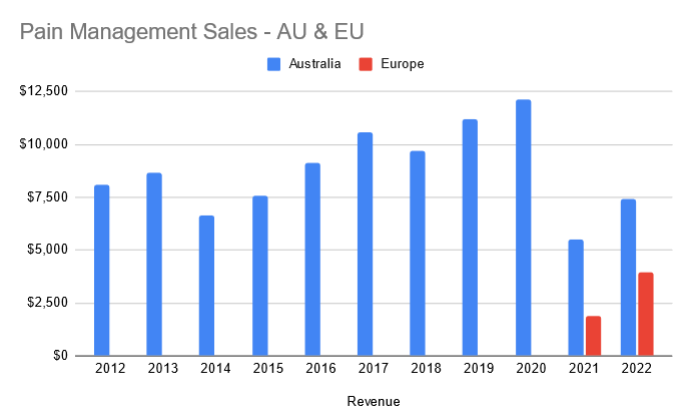

Another example of an Australia health company that cannot turn a great product into a viable business. So disappointing. This slide tells you all you need to know:

good luck to anyone still holding !

I got high on the green whistle today while getting my wisdom teeth extracted, while high I seemed to have become a shareholder in MVP again. I've now got a week off work to regret my decision and do a deeper dive on MVP. On a high level though:

The good things happening with MVP:

- Demand is growing in Australia, and prices are to be increased in Australia

- UK paediatric trial - submission expected Q3 FY24.

The concerning things happening with MVP:

- Australia still seems to be golden country for Penthrox.

- Penthrox is still the crown jewel of this company with limited diversification.

- The "US Re-entry" is STILL being played out - FDA has cleared Penthrox for a clinical trial.

- Exit of China market - need to look into this further but it seems like a missed opportunity? Poor execution?

- Review of Europe model and scale back of spend in France due to "market conditions"

- Revenue up 47% but EBIT (-$18.3) and NPAT (-$5.6m) still at a loss. Capex is still large, approx 24% of revenue

- I last exited MVP at $8.70 in 2020 - 4 years later the share price is now $0.835

Disclosure: Held IRL.

Another strong move leading up to the New Year.

Up something like 45% in barely over a week. The last move, which was almost identical, fizzled out pretty quickly. Hopefully this one has more legs and is backed by imminent positive news.

Medical Developments has gone from $0.75 last week to $1.10 close yesterday. On no news. Anyone with insights?

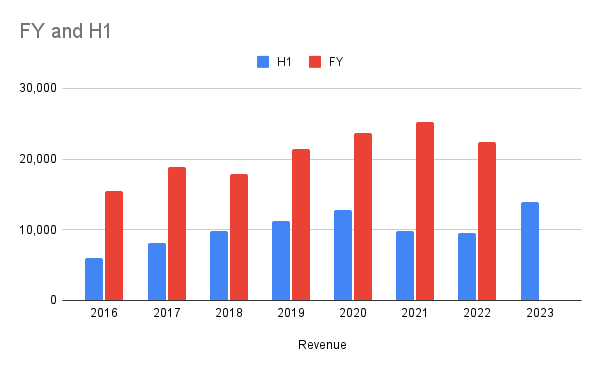

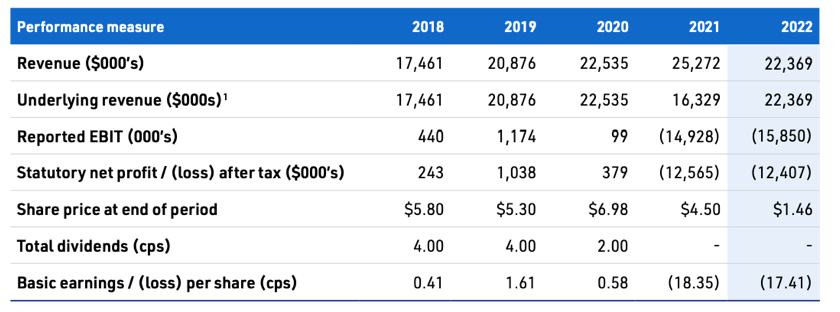

23 Half Year Results - Results

MVP announced it's half year results last week, at a high level revenue up 45% to 13.9 and a net profit of 2,658. However this was only due to a refund from the termination of the China contract. Taking out that revenue and impairment net profit sits at -8,864 which is an 8% increase on the PCP.

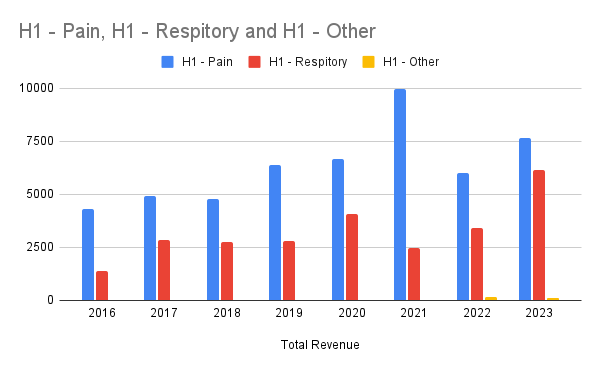

Overall, mixed results. Not the growth required in the pain management and a surprise 80% growth in the respiratory business. After listening to their announcement below is my take on the good, bad and progress based on my watch list.

The good

- Increasing prices in December for Australia resulting in higher gross margins

- Gross profit margin increased to 71% from 67.9%

- 29% Growth in UK and Ireland with the current distributor even with a deferred shipment in UK. Revenue is only recognised when shipment is made so this will flow into the FY results.

- Positive feedback from all customers, CEO mentioned he has never heard a negative thing about the product

- Re-launched in Canada with a new partner

- 80% growth in respiratory and expected double digit growth in US moving forward

The bad

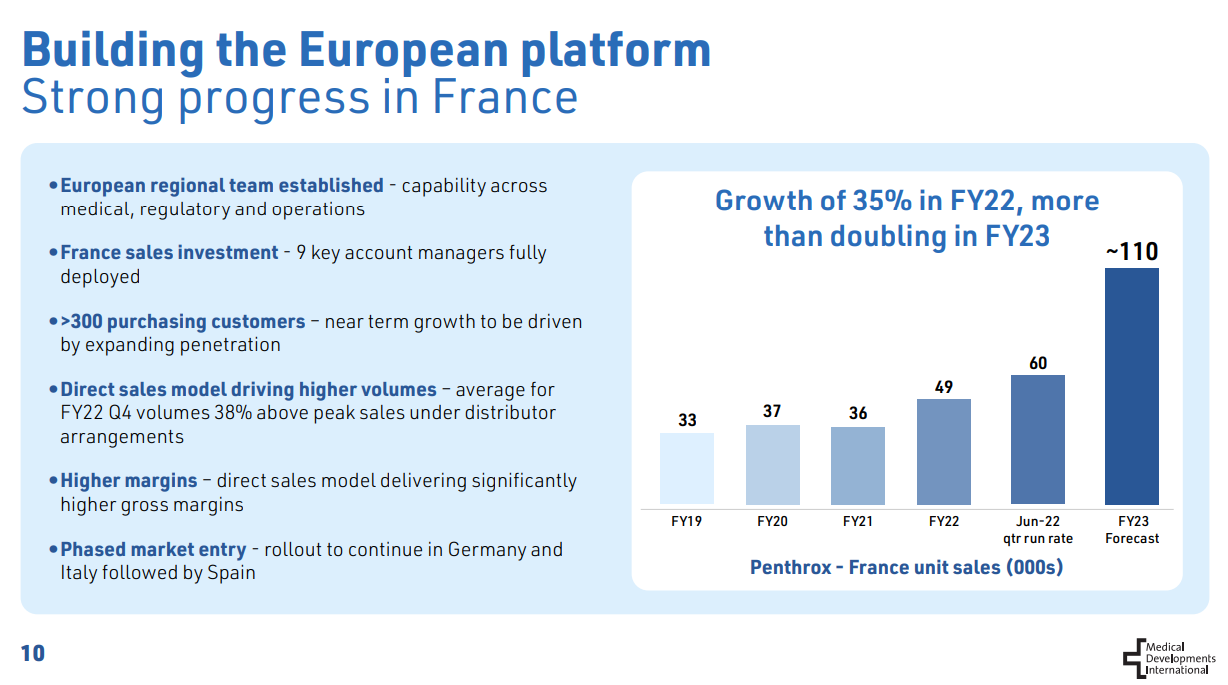

- 24% growth in France is well behind the > 50% they needed to achieve 110k units. Current run rate is at 60k units which is the same run rate presented for Jun-22 quarter. Effectively meaning no growth from June quarter.

- Negative growth in pain management units in Australia by 6k

- Expenses increased by 16% on PCP and 27% on the last half.

H1 / FY Total Revenue

Good growth in revenue, slightly beating H120

The split based on franchise

Continued penetration of Penthrox in France

At FY22, MVP were targeting ~110k units sold in France. Currently they are tracking on a run rate of 60k units. Well short of expectations.

Management have expressed multiple reasons which include

- Retaining / Recruiting: MVP uses a contract sales organisation in France. They are seeing issues retaining staff as they are going to companies which are offering permanent roles.

- Hospital Staff Shortages: Staff shortages in hospitals have made it harder to get the right decision makers on-board to add the green whistle to the hospital

- Bed Closures

- Budget Constraints

At a high level I get the sense that for pain management, they have to invest a lot of time in education. As this is a new product to majority of French hospitals there is effort in education to promote the benefits - ease of use and quick pain relief. I would imagine after time this education will reduce as this becomes the standard of care.

Market entry planning for Germany, Italy & Spain

Not much news on this apart from the next market they would target would be Germany sometime in FY24.

With the cash bleed at the moment, it does make sense to focus on growing and learning from France before spending more in entering another market.

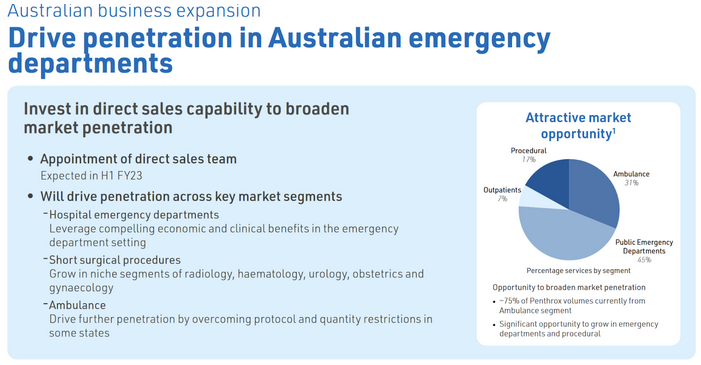

Direct in-market sales capability in Australia

Slight decrease in Australia units sold in the pain management section. However promising that they have on-boarded 2 ED's in Australia since October. Interestingly the indication in Australia is wider than anywhere else in the world. Overall not much of an improvement here with the direct sales team so expecting more.

Cash Burn

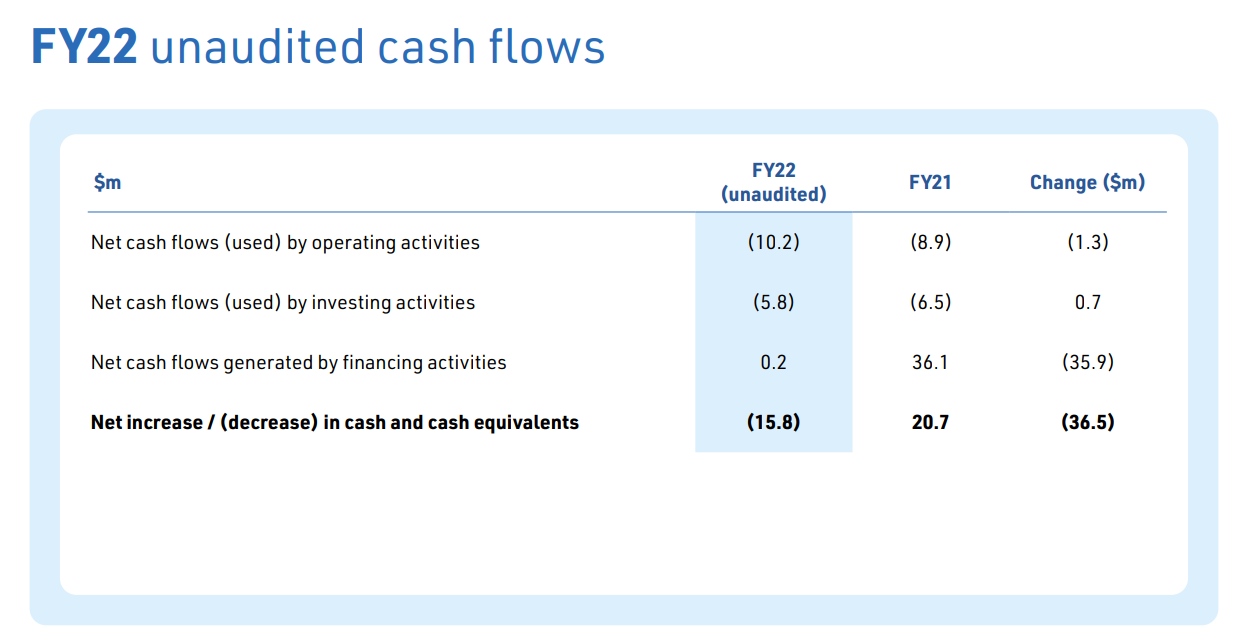

MVP cash position is now 37m, free cash flow for this half was -11,604. Management still expect break-even / cash-flow positive in FY25.

For the US trials, they are currently assessing a funding plan. Currently the group has no planned capital investment activities and plans to seek partner or third party funding.

23 Half Year Results - Watch list

MVP announced it's half year results will be on Feb 24th. Thought I would do a straw on items I'll be looking out for in those results. All my watching is on the pain management side of the business (The Green Whistle) as I believe that is where the greatest opportunity lies (not in respiratory).

Progress to their strategic priorities in FY23

From the FY22 report, below are the strategic priorities for FY23

- Continue penetration of Penthrox in France

- Market entry planning for Germany, Italy & Spain

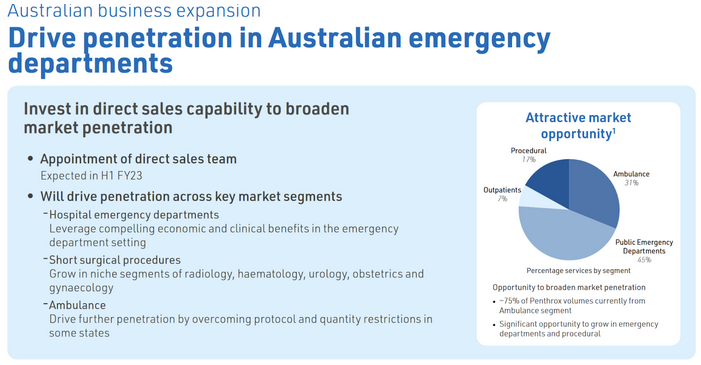

- Investment in direct in-market sales capability in Australia to drive penetration of Penthrox in hospital ED and the ambulance segment

- Further investment in platform capability to support growth

Continued penetration of Penthrox in France

France has a population size of roughly 65 million, as of FY22, MVP had 720 units sold per million population in France. This compares to 11,577 units per million population in Australia. There is considerable growth opportunity available, as part of this strategy management is expecting to sell circa 110k units in FY23, more than doubling FY22 sales (49k) but well short of the penetration of Australia.

Market entry planning for Germany, Italy & Spain

I’m not expecting too much here as the word “planning”. However there is opportunity for MVP in these markets. The population of these four is ~260 million, taking out France of ~65 million there leaves 195 million in the remaining 3 markets.

With Australia’s benchmark of 11,577 units per million population If these 3 markets get to that then that would be an extra 2.25 million units sold per year.

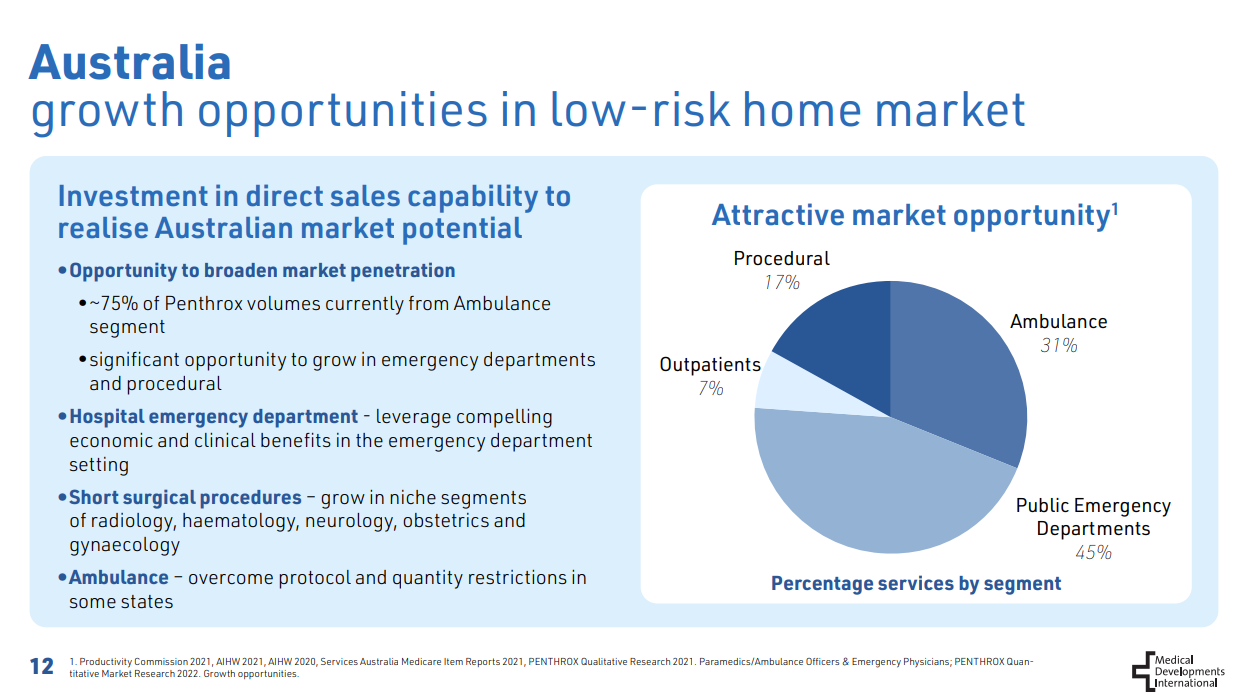

Direct in-market sales capability in Australia

MVP have now hired a direct sales team after taking the distribution rights back from Mundipharma in December 2020. I'll be watching to see how this translates to sales and turning around the recent decline in sales, two ways it might:

- Lock downs & Sell Through Over: The decline can be attributed to lock downs and Mundipharama selling through it's stock levels so hopefully they can get the levels back to FY20.

- Penetration in Emergency Departments: Secondly, MVP have said they want to target emergency departments. Currently the ambulance segment makes up around 75% of AU sales, roughly 223k units based on FY22 sales of 298k units. MVP believes the ambulance segment makes up roughly 31% of the market opportunity however there is 45% opportunity in Public ED departments.

Cash Burn

Cash burn, currently MVP has roughly 50m in cash. Management have expressed that they believe they will be cash flow positive in FY25 and the recent capital raise will get them to 2025 (with the options exercised). Study costs for the US trials will be around 12m.

China Exit

Lastly, my two cents on the recent decision to cease planned trials in China. I think this is a good idea to allow the company to focus on growth in existing markets. China is a very difficult market to get into with Medical Devices, not only is the registration time for foreign companies longer with the China FDA but China has a 2025 made in China vision (Article 104). Although I’m not certain article 104 would apply to MVP, if it does, manufacturing would have to be set up in the country which adds its own costs and risks.

The real potential here is the drug methoxyflurane and its penetration into the US and Europe.

A quick primer on the product:

Methoxyflurane provides rapid short-term analgesia using a portable inhaler device. Its primary role is in acute trauma but it might also be used for brief procedures such as wound dressing or for patient transport. It is a non-opioid alternative to morphine and is easier to use than nitrous oxide.

Methoxyflurane is a volatile anaesthetic originally used in the 1960s until it was found to be nephrotoxic at anaesthetic doses (typically 40–60 mL). Since the 1970s it has been used in Australia in lower doses for acute analgesia (up to 6 mL), largely by paramedic services.

Methoxyflurane is supplied with an inhaler device (Penthrox inhaler), which patients use to self-administer. It can be used by conscious haemodynamically stable patients, under supervision.

Pain relief begins after 6–8 breaths and continues for several minutes after stopping inhalation. Continuous use of methoxyflurane 3 mL provides analgesia for up to 25 minutes; a second 3 mL dose can be administered if required for up to 1 hour's analgesia. No more than 6 mL should be given in 1 day.

(from NPS.org.au)

From a medical perspective I see it as

- Safe (difficult to OD with minimal side effects)

- Effective

- Probably quite limited in its potential applicability

- Don’t have to be as worried about people stealing it as not typically abused

For over 10 years MVP have been probing its applicability into different settings and beyond prehospital it hasn’t really found decent traction.

This isn’t surprising to me as soon as you have IV access you likely have better / more familiar / cheaper options for acute analgesia. Essentially as a rule of thumb just assume anywhere an IV is likely to be in situ methoxyflurane isn’t going to be your first choice or even second choice (or your third choice if I’m honest) and this is in a country where it has been used for 30+ years.

If I had to say where I say applicability reducing dislocations in ED and prehospital minor trauma.

Therefore the company should focus on EDs and prehospital. Everything else is marginal at best and likely a waste of time and money. It could easily replace most nitrous oxide use in EDs and for quick pain relief and minor short procedures is a great option.

The reason I have become interested is management have been doing a lot of things that I like to see recently:

- Become more focused. Appears they have realized the value lies in the penthrox product so have ceased marginal business activities like a vet segment and an experiment in continuous flow manufacturing. These were unnecessary unprofitable distractions.

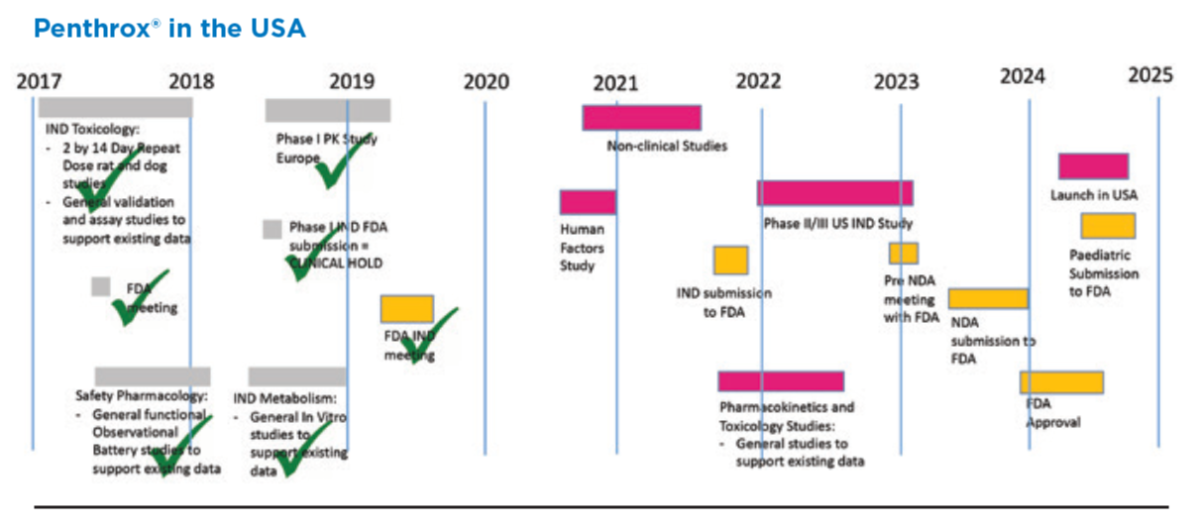

- Phase 3 clinical trial in US is actually approved and underway meaning a product launch in 2026 is a real possibility. The outcome of the trial, unlike many pharma trials is almost assuredly positive given its long history of clinical use in Australia and preexisting safety data.

- The company is well capitalized with $50mil in the bank which should get it through the trial and to US product launch.

- European expansion / distribution has been insourced and beginning to show real traction.

- There is strong insider alignment with ongoing insider buying and participation in capital raise and mostly at much higher prices.

Why now?

Losses have been exacerbated by a blowout in employee wages as they hire to begin direct sales at the same time as revenue falls on account of the previous distributor winding down stock. That will likely begin to work itself out this year with accelerating revenue growth. As the business metrics turn around I expect the share price will follow.

Price Catalysts

- Revenue acceleration

- Some sort of underlying profitability inflection once trial costs are excluded

- Phase 3 trial conclusion expected 2025: We basically already know the outcome but will still be a big day.

Downside

- $50mm in cash currently and $130mm MC suspect downside could be as low as $40mm so SP of ~$0.50

Upside

- More difficult but with growth in European segment and phase 3 US trial completion I can’t imagine a MC of less than $500mm due to the market size. Should equate to a share price of $5-6

I’m basically discounting the respiratory business as it appears only marginally profitable and if it were up to me I would look to sell it off.

A prudent approach from management (IMO) discontinuing the preparation for trials of Penthrox in China.

Whilst everyone looks to China with dollar signs in their eyes, I think this is a smart move due to the complex regulatory system and geopolitical risks associated with any activity in China.

Extract from announcement:

CEO Brent MacGregor said, “A commercial launch in China is not a strategic priority at this time. We are directing our resources into those projects that have greater capacity to generate shareholder value in the nearer term. “These projects include accelerating penetration of Penthrox in select European markets and in Australia. In the longer-term, we intend to deliver the next wave of growth through Penthrox entry into the US. Following the FDA’s lifting of the clinical hold, this process has already commenced"

Shares are essentially close to a 5-year low, whilst the business is quite different to what it was, I'm quite interested in the potential for Penthrox to further penetrate the European market, and the potential for this grow in the US.

Watching on the sidelines at the moment, not held in Strawman or IRL, but will take a closer look over coming days and may enter with a small parcel here first to wet my appetite.

Interested to hear others thoughts on the business.

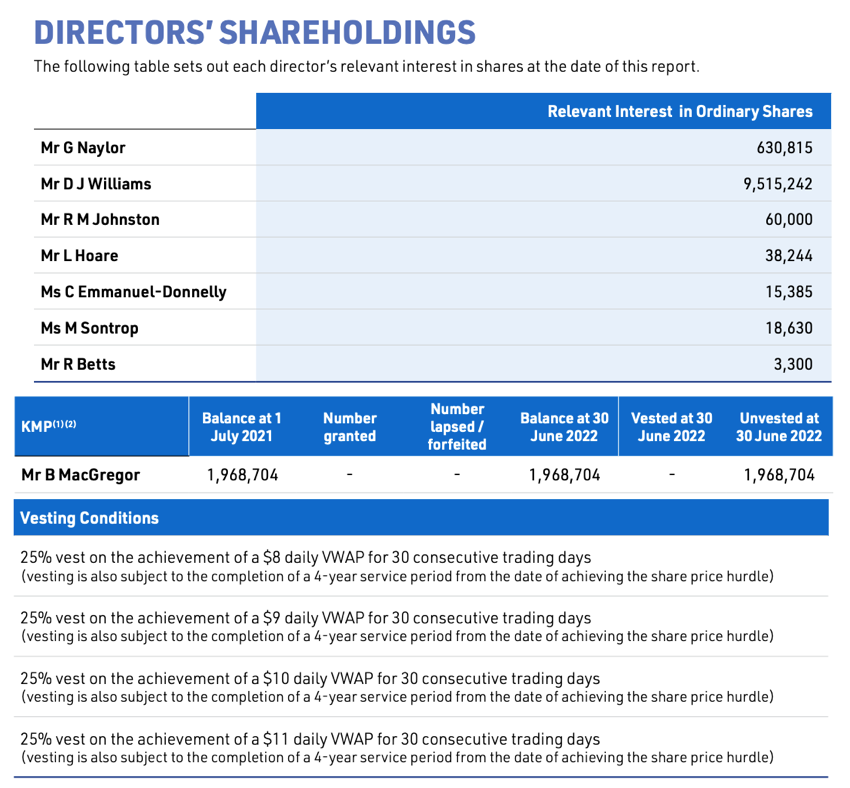

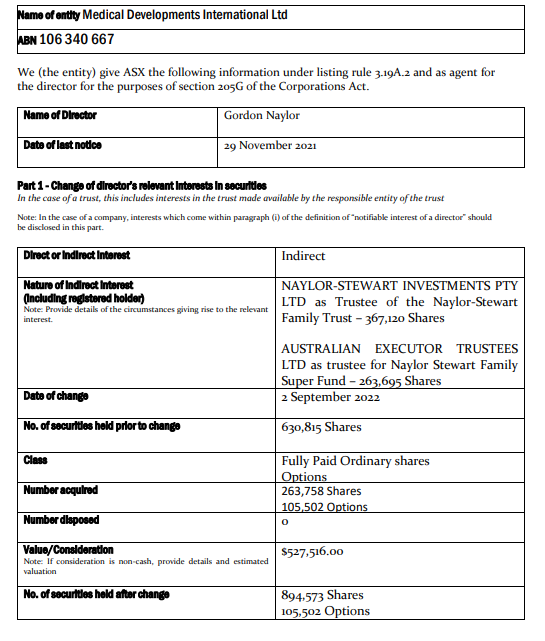

Hey @ValueDownunder On the subject of MVP director buying, just to play devils advocate for a moment,

What do you make of the fact that despite the share price being very depressed David Williams hasn't bought any more shares here for years now meanwhile he has been maniacally buying up his other large positions such as PNV.

I am not concluding anything just an observation.

Sep 7th update - David Williams ASX announcement this morning shows he also went in the raise. As you would expect given the large offer discount at the time.

Gordon Naylor has doubled down *again* with MVP, buying up a further half a million in the most recent capital raise at ~$2 per share. This takes him to a total of ~1m shares/options, worth around $2m. I note that the first entry point was a $1m of shares when he first joint MVP, at a price of around $6 per share. So he would be heavily under water, and continues to buy up more.

While Gordon bought his shares when he started, Brent McGregor took a small pay and a large incentive based scheme. He has ~2m options that kick in at $8, $9, $10 and $11 per share, each 25% based on 1/2/3/4 years of service. So the long term view still remains in tack while insiders keep buying up.

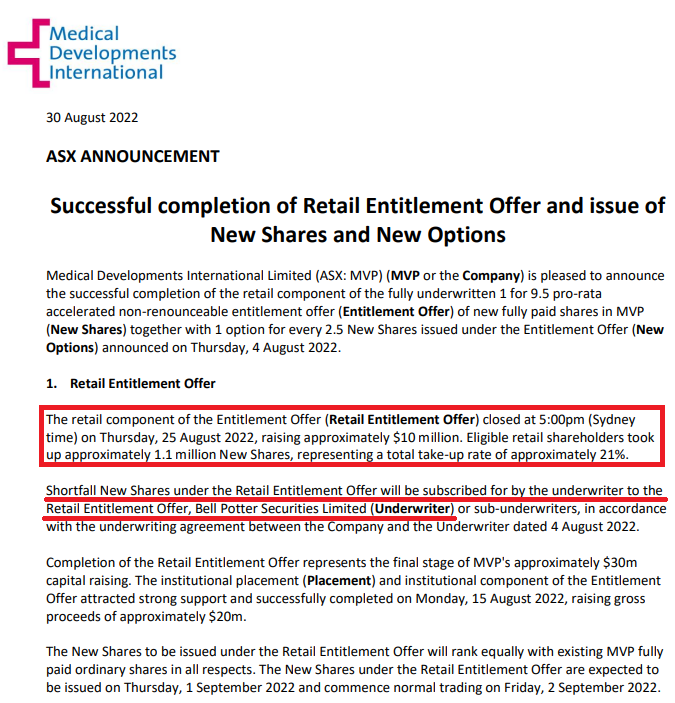

The retail entitlement offer closed, with only 21% take up. That is not surprising considering the shares have been trading at a discount to the offer, currently sitting around 12%. Why take up the offer when you can just go on the market and buy the shares?

That means that Bell Potter will need to underwrite ~$20m. And they are not going to want to be left holding the bag. So they are going to want to sell those shares over time no doubt. Which means, there could be further downward pressure on MVP. This is obviously exacerbated by the recent result which was not fantastic (Europe grew slower than expected, etc).

In terms of cash flow for MVP however, I think they will have enough cash to fund the expansion for some time. We shouldn't need to worry about further dilution unless there is a massive failure in the FDA approval process requiring an expanded clinical trial, or massive failure in the European scale-up requiring more SG&A without the incoming cash flow.

Thanks @ValueDownunder

its always gratifying to have someone else come along and validate one’s beliefs. Sadly, I do think they are beliefs rather than reasoned calculations.

I see this product in use every day, and having worked in a number of countries in the Emergency care field, cannot understand why this wouldn’t be used everywhere- it’s brilliant.

So my baseline assumption is for sales per head of population to approximate those in Australia, but in every other Developed country, with a similar prehospital health structure.

If you read any of my other posts on health/biotech companies, you can see I have been extremely successful at wealth transfer when using similar high level thinking applied to investing on the ASX.

Surely, this time is different (…… yeah, I know)

As an aside, I struggle to see the rationale for expanded use - happy to talk more on the subject, but this is not a base case for the thesis, and a very low probability event

Might take some time for this particular Titanic to turn around

(Fellow bag holder)

Howdy Strawfolks,,

The fourth stock in my Strawman Portfolio to start with is MVP. Now I am clearly a bag holder in real life and have lost money watching things unfold of late, but I believe the fundamentals and the investment thesis remains in place. If you wish to see my full analysis it is on another platform that remains nameless.

Penthrox European Sales

Penthrox is a great product and has been expanding it's sales. Even in the most recent FY22, it was +29% revenue which seems OK. But most of that is driven through European sales as Australia is largely a saturated market. The problem is that the distribution has severely been lacking over time, and this has been insourced to MVP now. So they are burning cash today to set up new sales teams, get new distribution/approvals in place in France etc, but the revenue will come later. And because Penthrox is a 2-year shelf life, it's actually got a decent recurring revenue once contracts with the likes of ambulances and hospitals are in place. But for now, they burn cash. And still, the European sales growth has been slower (35%) than expected. But there is a long runway and they just need to keep investing in this area.

US-FDA Approval

The big fish of course is US-FDA. They recently secured the Phase 3 clinical trial approval, which should cost around $12m. It's a very small clinical trial because they get approval for most of the data they already have - that's a huge win. So now they are planning for the trials and results to be done in the coming years, and by FY25/26 they should be ready for approval and then distribution (all going well). If the SAM for the US is +$250m per year, as once mooted and prior to the expansion of use applications, then a rule of thumb for value is 3xSAM=$750m. That's the price that medical devices get bought out for. So this is a big part of the investment thesis. Note the picture below is 1 year old and there was a delay, but you can see the timeframe is for 2025 basically.

Expanded Applications

I am not sure how substantial this is, but the team at MVP think it is very important to expand the SAM by looking at further applications. This could include for example the use of Penthrox in day care surgery etc.

New Management

I have been fortunate enough to talk with Gordon and Brent, and I back their plans. They have a lot of experience with their work in Seqiris, and have a good team around them. Plus, they have performance rights that kick in at $11 per share, and they have bought substantial shares and taken low salaries. So they have huge skin in the game.

Risks? Cash burn.

The main risk is that they continue to burn cash to try and step-up their expansions. Or they don't get the FDA approval I suppose. But right now they have a cap raise at $2 which aint great for shareholders, but if the additional $30m gets them to scale up their European sales quicker, it should be worthwhile.

Placement at $2 then a proposed Retail SPP

Passing the hat around!!

I think anybody that has been paying attention to MVP knew this one was coming. A Capital Raise has been announced, the important info - 1 share issued for every 9.5 held at a price of $2 a share. Options will also be issued at a price of $2.80, 1 share for every 2.5 of the new shares issued expiring on the 30th of September 2024.

Total funds to be raised is $30m with the money directed to go towards Australian expansion and European growth. An update was also given on guidance;

• revenue: A$22.4m; +37% on prior corresponding period (PCP)

o Penthrox revenue: A$13.7m; +29% on PCP

o Respiratory revenue: A$8.2m +53% on PCP

• underlying EBIT1: A$(14.7m)

• EBIT: A$(15.9m)

• cash at bank: A$20.4m

Personally I hate this new trend of options that come with capital raises. If one like the business then buy more shares instead of this nonsense but I'm sure others opinion differ for a variety of reasons. I will be taking up my allocation in full as I hold this company IRL and still believe in the product and have used it first hand (I'm sure plenty on strawman members have). The real question is if management have the capability to execute their growth in Europe and North America so shareholders will be rewarded which still make this a high risk company to be invested in as that answer seems less than straight forward.

Endo International plc to distribute Penthrox in Canada

- Release Date: 10/05/22 15:35

- Summary: MVP signs new Penthrox licensing agreement in Canada

- Price Sensitive: Yes

I thinking the share markets were bearish in May 2022..So MVP could get some momentum going forward..

update:

02/03/2021

as already flagged, a big win!

I have bought in at $4.40 (bit late to the announcement!)

I think this now represents a real sable entry point given the turnaround of the business structure has pretty much been completed. But more importantly if they can execute on campturing the IS pre-hospital market (which is not unreasonable given it is doing that through the rest of the anglophone medical world) then the revenue multiple will be huge. I will try and do some maths when I get free but the US market is likely to be several 10x what they are currently doing

clearly there are risks, but for me an extraordinary asymmetric bet

18/10/2021

This straw was going stale so I thought I'd add a few comments, to update things:

It was a shocker of a year for MVP. Revenue plummeted, they made a 12 mill loss, compared to profits for the previous 7 years. They also had to do a cap raise, diluting shareholders by ~10%. The SP has dropped from a high of $7.29 to $3.21 in July. It is now back up to $4.89 after a recent sharp run up on no news in particular.

They have instituted a turn around plan which mostly involves taking back control of the sales of their primary money earner - Penthrox. This has cost them $9.5mill.

The world is opening up again, people will start to break bones once more in the pursuit of sporting glory or a carbon-free method of commuting to work. The green whistle will begin to provide succour to the maimed. The number of countries that have sales agreements continues to go up and up. The future is bright, the future is green.

Except the US. Still no news from the FDA. MVP are likely to have to run a (very expensive) phase III trial, and also run in it in the US (even more expensive). It's difficult to know how expensive this will be until the design requirements are known, primarily how big it will need to be to satisfy the FDA it is powered to provide statistical significance.

Putting it all together, it is likely that the ROW sales are going to improve and on better terms than previously. I dont think they will shoot out of the starting blocks given that they are going to have to renegotiate all the sales details.

Who knows what will happen in the US. It should get waved through, but it is difficult to see that happening and the phase III could easily take years to design, run, submit and get processed by the FDA before approval. And then they will need to negotiate 3rd party sales conracts or build up a sales network themselves, so meaningful revenue is a hell of a long way away.

The longer it takes the higher the risk of a new innovation, though it too would have to clear the same barriers.

If MVP were still in the 3's I would be buying.

I'm not so sure at the moment. As the old saying goes, "most turn around stories never turn"

18/04.2021

Below is a very recent study of Penthrane in the US emergency setting.

Currently Penthrane is not approved by the FDA despite numerous trials elsewhere in the world and widespread adoption but the rest of the western world's medical systems.

It has been a staple of Ambulance services in Australia for many years, an excellent safety profile, so there is no real expectation that it's use should be declined.....but this is the FDA.

MVP has fallen off most investor's radar as COVID has significantly impacted their business, for a number of different reasons (reduced trauma, difficulty executing sales and regulatory hurdles, changed distribution model

Many of those reasons could reasonably be expected to disappear in the next few months. and there are encouraging signs of increasing uptake in Europe (despite the above factors). Trials are planned for China as well.

There has been recent Director buying.

I do not currently hold

HOT OFF THE PRESS

Free Access

Hot off the press: the RAMPED trial—methoxyflurane for analgesia in the emergency department

First published: 26 March 2021

https://doi.org/10.1111/acem.14257

Discussing:: Brichko L, Gaddam R, Roman C, et al. Rapid Administration of Methoxyflurane to Patients in the Emergency Department (RAMPED): a randomized controlled trial of methoxyflurane versus standard care. Acad Emerg Med 2021;28(2):164–171.

Associated podcast: https://www.thesgem.com/2021/02/sgem320?the?ramped?trial?its?a?gas?gas?gas/

Supervising Editor: Esther K. Choo, MD, MPH.

BACKGROUND

Pain is one of the primary reasons that patients present to the emergency department (ED).1-6 Oligoanalgesia is a significant problem and effective pain management is an important indicator of the quality of patient care.7-12 Multiple factors have been thought to contribute to oligoanalgesia including overcrowding, language barriers, age, sex, ethnicity, and insurance status.13-16 Delays in providing adequate analgesia lead to poorer patient outcomes, prolonged ED length of stay, and reduced patient satisfaction.17, 18 Previous research in Australian EDs has shown that the median time to analgesia administration can be between 40 and 70 minutes, while one study in the United States reported a mean of 116 minutes.19-21 To minimize delays, various strategies have been implemented to address the problem, including the use of novel analgesic agents that do not require intravenous access.22

Recently, there has been increased interest in using methoxyflurane (Penthrox), an inhaled nonopioid volatile anesthetic, to provide rapid short?term analgesia.23, 24 In Australia, methoxyflurane has been widely used at subanesthetic doses for analgesia in the prehospital setting since 1975. It has been used more widely recently and at low doses and has a very reassuring safety profile, with no reports of addiction or abuse related to its use.25-28 The majority of studies of methoxyflurane for pain focus on traumatic pain; this study aimed to assess its effectiveness in treatment of both traumatic and nontraumatic pain.

ARTICLE SUMMARY

This is a randomized controlled trial of adult ED patients with severe pain, defined by an initial numeric rating scale (NRS) pain score of greater than or equal to 8 on an 11?point scale. Treatment arm participants were given inhaled methoxyflurane at ED triage and the comparison group received standard analgesic care, which could include acetaminophen, nonsteroidal anti?inflammatory drugs (NSAIDs), tramadol, oral oxycodone, or intravenous morphine. The primary outcome was the proportion of patients who had at least a 50% reduction in pain score at 30 minutes. Secondary outcomes included median pain score at 15, 30, 60, and 90 minutes; the proportion of patients that achieved a >2?point drop in their NRS pain score, and data pertaining to adverse effects.

QUALITY ASSESSMENT

The most notable limitation of this study is the open?label design. There is substantial difficulty in blinding study participants to the use of an inhaled medication (methoxyflurane) that has a particular smell and taste, but the lack of allocation concealment likely biases the results toward the intervention group. Other limitations include the selection bias of nonconsecutive patient recruitment and the exclusion criteria which removed many patients with abnormal vital signs. These abnormal vital signs could have simply been due to severe pain and thus would be an excellent group of patients to study. Finally, only 4% of patients arrived by ambulance in this study, which may not be representative of many hospitals.

KEY RESULTS

Overall, 121 patients were randomized into the RAMPED study and there was no statistical difference in the primary outcome between methoxyflurane and standard analgesic care. In the methoxyflurane arm five (10%) patients had a reduction of pain score by >50% at 30 minutes compared with three (5%) in the standard care arm (p = 0.49). The administration of methoxyflurane was associated with a significant reduction in pain score at all time points and a notable secondary outcome was that the median time to rescue analgesia was longer in the methoxyflurane arm, 66 minutes compared with 46 minutes in the standard care arm (p = 0.024). There were no adverse effects attributed to the methoxyflurane.

AUTHOR'S COMMENTS

In this study of methoxyflurane versus standard analgesic therapy in the ED, there was no difference in pain reduction at 30 minutes. However, methoxyflurane does appear to be a safe and effective additional option for analgesic at ED triage.

TOP SOCIAL MEDIA COMMENTARY

Brent Driscoll: Great rapid analgesic for procedural and visceral pain even better when used in conjunction with opiates. Great synergistic effect. Fell out of favour for a while the excitement of intranasal fentanyl took hold but back in vogue as quick effective relief in trauma while IV access and opiates are readied. The ability of the patient to concentrate and titrate their dosage (“if it hurts, keep sucking”) and that it is self?regulating? if they have too much, they drop the inhaler and nod off is a great quality control. An Australian EMS staple for decades.

Minh Le Cong @ketaminh: It's a great piece of kit imo. I have one in my car kit for roadside attendances. Easy to use and effective in kids and adults. There is environmental contamination of exhaled gas to be aware of. It's like a portable mini nitrous oxide kit.

Julie Rankin @JulieRa00539796: Regular analgesia use for msk injuries in Northern Ireland ? great quick easy effective analgesia.

Prof Tim Hardcastle @vemadoc: They use it for burn dressing changes here. Works well in kids.

Evan Schwarz @TheSchwarziee: This seems to be very popular in countries outside the US. It's nice as no IV required and can be another component of multimodal pain medication whether an opioid is necessary or not.

PAPER IN A PIC BY DR. KIRSTY CHALLEN

TWITTER POLL BY KEN MILNE

TAKE?TO?WORK POINTS

In this randomized controlled trial, methoxyflurane was an effective analgesic agent for severe pain but was no more effective than standard analgesic care at 30 minutes. If available it remains an alternative analgesic strategy to usual therapies.

CONFLICT OF INTEREST

The authors have no potential conflicts to disclose.

FDA clears US Penthrox clinical trial

MVP have just announced the US Food & Drug Administration (FDA) have lifted it's clinical hold on Penthrox. Effectively opening the way for Medical Developments to begin Phase III US clinical trials later this year on it's green whistle. MVP are expecting a 2 year trial commencing late 2022.

A big win for MVP as Penthrox has been banned in the US preventing trials and ultimately sales of the green whistle. Large market opportunity if trials are successful especially with the opioid crisis in the US.

14-Oct-2020: Appointment of CEO - Brent MacGregor and Appointment of Non-Executive Director - Gordon Naylor

I don't hold MVP shares, however I note the market liked today's news because MVP's share price rose +12.21% today, making them one of today's MVPs. This is the "green whistle" company by the way (Penthrox).

About Penthrox®

Penthrox is a fast onset, non-opioid analgesic indicated for pain relief by self-administration in patients with trauma and those requiring analgesia for surgical procedures. Penthrox is now approved for sale in more than 40 countries and has been used safely and effectively for more than 40 years in Australia with more than 7.0 million units sold. There is growing interest in Penthrox being used in patients undergoing investigatory procedures, as well as operational procedures such as colonoscopy.

About Medical Developments International Ltd

MVP is an Australian company delivering emergency medical solutions dedicated to improving patient outcomes. MVP is a leader in emergency pain relief and respiratory products. The Company manufactures Penthrox®, a fast-acting trauma and emergency pain relief product. It is used in Australian Hospitals including Emergency Departments, Australian Ambulance Services, the Australian Defence Forces, Sports Medicine and for analgesia during short surgical procedures such as Dental and Cosmetic surgery as well as in other medical applications. MVP is expanding internationally and manufactures a range of worldleading Asthma respiratory devices.

30-June-2020: Phillip Capital: MVP: Updating our view: Accumulate (from Buy)

Recommendation: Accumulate (downgraded from Buy), Risk Rating: High, 12-month Target Price: (AUD) $7.80 (No change).

25-May-2020: Penthrox approved in Hungary

Medical Developments International Limited (ASX: MVP) is delighted to announce that Penthrox has been approved for sale in Hungary. The Marketing Authorisation issued by the National Institute of Pharmacy and Nutrition (OGYÉI), is for Penthrox® to be used for emergency relief of moderate to severe pain in conscious adult patients with trauma and associated pain.

The approval in Hungary is part of a set of four countries.

Bosnia & Herzegovina were approved earlier this month, and approvals for Greece and Malta are expected soon.

Whilst both the European Decentralised Procedure and the National phase is complete, Penthrox is yet to achieve government reimbursement in Hungary. However sales can be made to the private market immediately.

05-May-2020: Penthrox approved - Netherlands and Bosnia and Herzegovina

28-Apr-2020: Penthrox is approved in Thailand

Go the Green Whistle! MVP perhaps not today's Most Valuable Player, but up +8.62% nonetheless.

The CEO, John Sharman and the Non Executive Chairman, David Williams, sold a shit tonne of shares in 2018. A former director Allan McCallum sold at the same time. I am unsure whether this was a way to introduce liquidity during a capital raising, or another reason... Still I don't like it. Shares have not been sold in in other years.???

The CEO only owns 239274 shares... David Williams, owns 14.67% of the company 9608754 or shares.

Dave Williams is in similar roles with Rate my Agent, Mobile Tyre Shop, & Polynovo. Managing Director Of Kidder Williams Capital Raisings.

John Sharman was Managing Director of CVC Ventures, Vita Life Sciences. Before then CEO at Cyclopharm.

3 other directors are also directors of Polynovo and other companies.

I have not found any reviews on Glassdoor or Seek about the culture within MVP

27 June 2019: Phillip Capital: MVP - "China Pathway Open" - update.

14 June 2019: http://www.asx.com.au/documents/products/MVP-190614-PhillipCapital-Scoresby-site-visit-and-meeting-with-management.pdf

That's a link to a client note by Phillip Capital on their recent site visit to MVP's Scoresby offices where they met with Mark Edwards, MVP's CFO, for a general update.

PC have an "accumulate" call on MVP, with a 12-month price target of $6.40 (previously $5.70). They regard MVP as a "High" risk investment.

MVP closed yesterday (Friday 21 June 2019) at $5.39, being down 3% (or -17c) on the day.

Disclosure: I don't hold MVP shares.

25th July 2018: USA Update from MVP

Some may view this as a temporary setback, but MVP has fallen 19% since the 24th (the day before that announcement) from $5.85 to finish today (July 30th, 6 days later) at $4.74, after making a new year low today of $4.69.

It's been a bad year for MVP. They were trading as high as $8 during the first 3 months of 2018, and 4 months later they're 40% below those levels. Their trading update on the 14th May resulted in a 25% share price fall over 4 trading days:

14th May Trading Update from MVP

It makes me wonder how Penthrox, a self-medicating strong-pain-relieving drug widely used in Australia since the '70s, and now used extensively in over 15 countries worldwide, with very few adverse side-effects associated with short-term use (i.e. when used as intended) could concern the FDA this much. It's almost like the conspiracy theorists who contend that the FDA is run by US "Big Pharma" stooges to protect their own - might not be miles away from the truth...

I had a bad motorcycle accident 2 days before my 21st birthday and I sucked that green whistle dry - & had just started on a second one (after a lively argument with the ambos) when they got me to the local regional hospital. Ahh, the memories... 31 years ago - seems like yesterday. Even if I was mildly allergic to methoxyflurane (as I am to pethidine), I would still have used it - I was in that much pain. It works! I was actually pretty cheerful when we arrived at Bunbury Hospital.

Due to the risk of organ (especially kidney) toxicity, methoxyflurane (Penthrox) is contraindicated in patients with pre-existing kidney disease or diabetes mellitus, and is not recommended to be administered in conjunction with tetracyclines or other potentially nephrotoxic or enzyme-inducing drugs.

It's not always possible to fully screen patients in emergency situations (like in ambulances after accidents) for all of those conditions and existing medications.

The max recommended dose is 6 ml per day or 15 ml per week because of the risk of cumulative dose-related nephrotoxicity, and the inhaler should not be used on consecutive days. When used this way (as indicated), very few adverse side-effects have been observed.

The USA already has major issues with the illegal trade and use of Oxycodone ("Oxy") and other opioids and strong analgesics. Perhaps they're concerned with their own ability to control another one.

29-Oct-2018: SP now $4.40. More pain to come?

22 October 2019: MVP - FY19 Results and Outlook: Catalysts Approaching from Phillip Capital's Wayne Sanderson.

- Recommendation: Buy

- Risk Rating: High

- 12-mth Target Price (AUD): $8.20 (was $6.45)

- Share Price (AUD): $5.17 ($5.67 on 25-Oct-19)

- 12-mth Price Range: $3.48 - $6.50

2 Positive Announcements in 2 days.

Everyone knows that penthrox works, and is safe, as an emergency pain reliever, MVP is slowly grinding through the beauracracy that is each countries regulators.

23 October 2019 Penthrox launch in Italy. this is good news as Italy is one of the Big 4 European countries.

I have held my valuation at $6 to wait and see what traction it can get in Italy.

11 July 2019,

this is a make or break year, the approvals are in place, not to see if the market really exists.

MVP is an Australian company delivering emergency medical solutions dedicated to improving patient outcomes. MVP is a leader in emergency pain relief and respiratory products. The Company manufactures Penthrox®, a fast acting trauma & emergency pain relief product. It is used in Australian Hospitals including Emergency Departments, Australian Ambulance Services, the Australian Defence Force, Sports Medicine and for analgesia during short surgical procedures such as Dental and Cosmetic surgery as well as in other medical applications. MVP is expanding internationally and manufactures a range of world-leading Asthma respiratory devices.

I agree with 90% of the above apart from the fda points

The fda set a ridiculously high bar, and often require high quality randomised controlled trials which is partly why most quality drug companies ser up their trials to pass the fda requirements (and the us market is big and lucrative)

given how long penthrox has been around for, I doubt there is any recent high quality phase 3 rct studies? I believe mvp are trying to run some now - but big trials need big funding costs that mvp may be a bit cheap to pursure????

this would not be the first drug the rest of the world considers standard of care but is unavailable in the usa

still a fan of mvp and looking to buy again, but sold out a while ago due to valuation. That and the fact I couldnt figure out when their patents might run out given how long the drug itself has been around for

but the fda looks like they will want a big (costly) trial

Post a valuation or endorse another member's valuation.