Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Quarterly Activity report

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02940296-3A666948&v=7bc42bd11d853ed5e8c28f2ffcd6a069ee5cd6b4

Well the market certainly liked it (up over 30% so far today)

Nice to see genuine cash flow positivity

Things seem generally headed in the right direction. I like the management focus on reducing costs and concentrating on Australia and Europe

Main concern is the lack of increase in revenue from the main pain relief segment and well as the poor outlook for the second half due to "phasing" and "currency". I need to understand better what is going on there

Remains very cheap. EV/revenue is less than 1, even with the big SP rise today

IF they can continue to grow revenue in Aus/Europe and control costs, this could easily multibag.

The product has always been good. From here it's all about management executing

The historical pattern seems to be that the SP jumps on positive announcements and then drifts back down. If that pattern repeats, I may be tempted to add to my small irl holding

Been meaning to take a look at Medical Developments International (MVP) for some time now. I did mention this to @acarbone1 and @Arena42 at our recent catch up.

Well, they released their quarterly report (find it here) today, safe to say it must have been good with it being up ~25% at time of accessing this from Commsec and now up ~43% at time of posting.

So what's good?

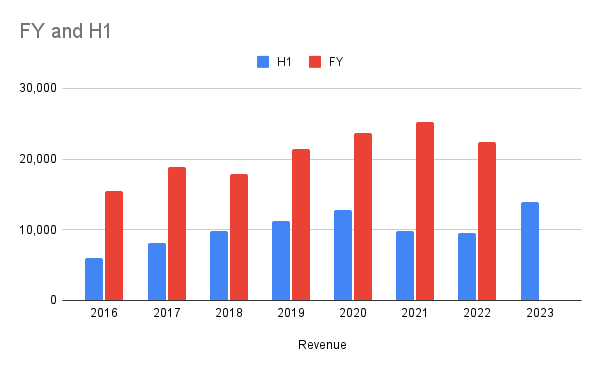

- Strongly improved operating cashflow - with Group revenue for Q2 FY25 coming in at $10.9 million which is $1.8 up on Q1

- H1 FY25 was $20 million was nearly $5 million higher than pcp.

- Continued growth for Penthrox in Australian hospital segment.

- Cash balance at 31 December 2024 of $17.6 million.

- Positive operating cashflow expected by the end of FY25.

A few ticks in the win column there.

Further, here's some outlook statements:

FY25 OUTLOOK: The Group expects underlying EBIT in FY25 to be strongly improved on FY24, driven by higher average Penthrox prices and operational efficiencies of ~$4 million.

CEO Brent MacGregor said, “We have delivered a pleasing improvement to earnings and cashflow in the first half through enhanced pricing and cost efficiencies. We remain on track to deliver positive operating cashflows by the end of FY25.”

They list 3 strategic priorities for FY25:

- Improve Margins through pricing and efficiency: The Group's new pricing initiatives are expected to improve annualized margins by ~$3.5 million, with higher pricing in Australia, the UK, and Ireland. Additionally, efficiency measures have reduced operating costs by ~$4 million for the first half of FY25 compared to the previous period.

- Accelerate penetration of Penthrox in Australia: significantly advanced its strategy to grow Penthrox in hospital emergency departments, achieving a 52% increase in demand in the first half of FY25 and implementing initiatives to accelerate its adoption as a standard of care.

- Grow Penthrox in Europe: European in-market demand for Penthrox in 1H FY25 increased by 22%, and the Group has submitted an application to broaden its use to children as young as 6 years old, with positive initial feedback from the regulatory agency. Partner negotiations for distribution in France and the transfer of distribution in Switzerland to Labatec are progressing well, with the latter expected to complete in Q4 FY25.

Well, that appears to address the SP pop.

For those who have been watching this one for some time (insert me) - they butchered their China rollout plan and incinerated capital, and their US roll-out has also been a furry-dragon-riding-never-ending story of "it's gonna happen". It's reassuring to see that neither China or the US mentioned - TBH if China was mentioned I'd frisbee my laptop out the window after they did announce full withdrawal of this plan years ago. But was also good not to be reminded of their US hopes and dreams.

This announcement does seem different and more considered, it appears management have woken up to the need to push further in where they do have more control (Aus and UK), with Europe also being a potential further driver of growth.

I'm going to need to take a closer look at them (again), but I recall that I always seem to walk over the end of a rake when I get to the management section of my screen/review. There is a serious lack of insider ownership (from my last check), and they simply never passed my pub-test.

But this announcement does give me hope, and it appears to give the market hope... I'll be back for a closer look.

Hoping some other SM gurus can take a look to help me out with this.

This is one that I got terribly wrong. I sold out at least a year ago for a big loss but glad I got out when I did.

They have a great product in Oz and should have been able to make it work internationally. Execution and capital management have been abysmal and it doesn't seem to be getting any better.

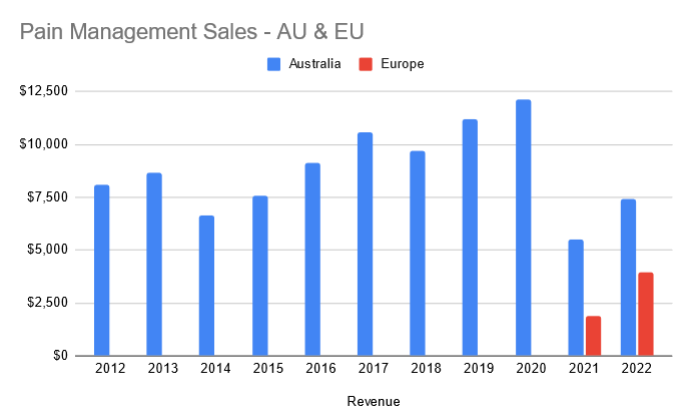

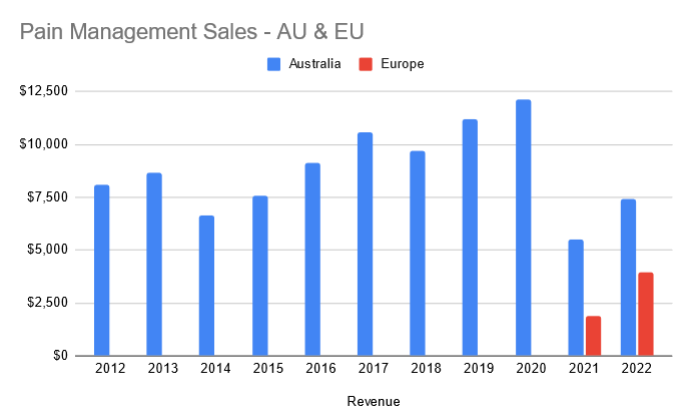

Another example of an Australia health company that cannot turn a great product into a viable business. So disappointing. This slide tells you all you need to know:

good luck to anyone still holding !

Another strong move leading up to the New Year.

Up something like 45% in barely over a week. The last move, which was almost identical, fizzled out pretty quickly. Hopefully this one has more legs and is backed by imminent positive news.

23 Half Year Results - Results

MVP announced it's half year results last week, at a high level revenue up 45% to 13.9 and a net profit of 2,658. However this was only due to a refund from the termination of the China contract. Taking out that revenue and impairment net profit sits at -8,864 which is an 8% increase on the PCP.

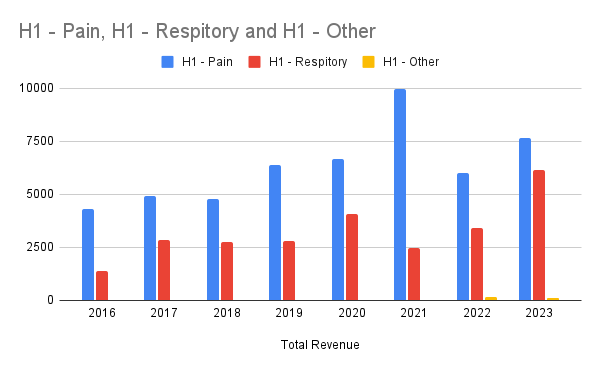

Overall, mixed results. Not the growth required in the pain management and a surprise 80% growth in the respiratory business. After listening to their announcement below is my take on the good, bad and progress based on my watch list.

The good

- Increasing prices in December for Australia resulting in higher gross margins

- Gross profit margin increased to 71% from 67.9%

- 29% Growth in UK and Ireland with the current distributor even with a deferred shipment in UK. Revenue is only recognised when shipment is made so this will flow into the FY results.

- Positive feedback from all customers, CEO mentioned he has never heard a negative thing about the product

- Re-launched in Canada with a new partner

- 80% growth in respiratory and expected double digit growth in US moving forward

The bad

- 24% growth in France is well behind the > 50% they needed to achieve 110k units. Current run rate is at 60k units which is the same run rate presented for Jun-22 quarter. Effectively meaning no growth from June quarter.

- Negative growth in pain management units in Australia by 6k

- Expenses increased by 16% on PCP and 27% on the last half.

H1 / FY Total Revenue

Good growth in revenue, slightly beating H120

The split based on franchise

Continued penetration of Penthrox in France

At FY22, MVP were targeting ~110k units sold in France. Currently they are tracking on a run rate of 60k units. Well short of expectations.

Management have expressed multiple reasons which include

- Retaining / Recruiting: MVP uses a contract sales organisation in France. They are seeing issues retaining staff as they are going to companies which are offering permanent roles.

- Hospital Staff Shortages: Staff shortages in hospitals have made it harder to get the right decision makers on-board to add the green whistle to the hospital

- Bed Closures

- Budget Constraints

At a high level I get the sense that for pain management, they have to invest a lot of time in education. As this is a new product to majority of French hospitals there is effort in education to promote the benefits - ease of use and quick pain relief. I would imagine after time this education will reduce as this becomes the standard of care.

Market entry planning for Germany, Italy & Spain

Not much news on this apart from the next market they would target would be Germany sometime in FY24.

With the cash bleed at the moment, it does make sense to focus on growing and learning from France before spending more in entering another market.

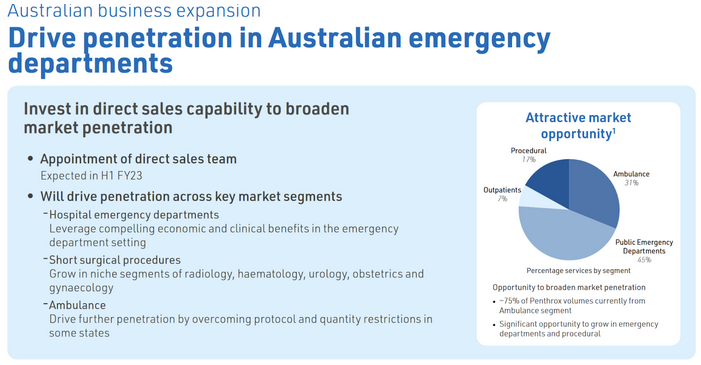

Direct in-market sales capability in Australia

Slight decrease in Australia units sold in the pain management section. However promising that they have on-boarded 2 ED's in Australia since October. Interestingly the indication in Australia is wider than anywhere else in the world. Overall not much of an improvement here with the direct sales team so expecting more.

Cash Burn

MVP cash position is now 37m, free cash flow for this half was -11,604. Management still expect break-even / cash-flow positive in FY25.

For the US trials, they are currently assessing a funding plan. Currently the group has no planned capital investment activities and plans to seek partner or third party funding.

23 Half Year Results - Watch list

MVP announced it's half year results will be on Feb 24th. Thought I would do a straw on items I'll be looking out for in those results. All my watching is on the pain management side of the business (The Green Whistle) as I believe that is where the greatest opportunity lies (not in respiratory).

Progress to their strategic priorities in FY23

From the FY22 report, below are the strategic priorities for FY23

- Continue penetration of Penthrox in France

- Market entry planning for Germany, Italy & Spain

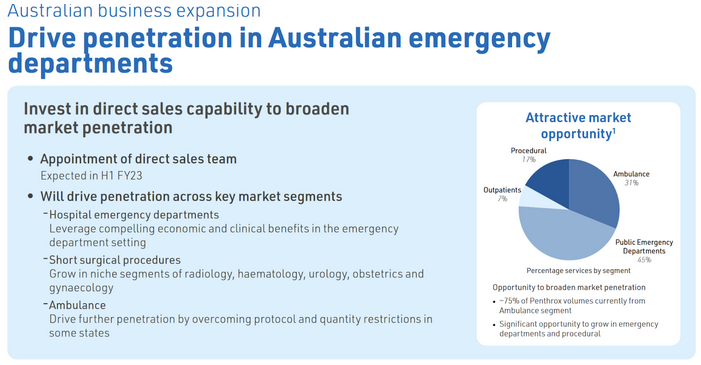

- Investment in direct in-market sales capability in Australia to drive penetration of Penthrox in hospital ED and the ambulance segment

- Further investment in platform capability to support growth

Continued penetration of Penthrox in France

France has a population size of roughly 65 million, as of FY22, MVP had 720 units sold per million population in France. This compares to 11,577 units per million population in Australia. There is considerable growth opportunity available, as part of this strategy management is expecting to sell circa 110k units in FY23, more than doubling FY22 sales (49k) but well short of the penetration of Australia.

Market entry planning for Germany, Italy & Spain

I’m not expecting too much here as the word “planning”. However there is opportunity for MVP in these markets. The population of these four is ~260 million, taking out France of ~65 million there leaves 195 million in the remaining 3 markets.

With Australia’s benchmark of 11,577 units per million population If these 3 markets get to that then that would be an extra 2.25 million units sold per year.

Direct in-market sales capability in Australia

MVP have now hired a direct sales team after taking the distribution rights back from Mundipharma in December 2020. I'll be watching to see how this translates to sales and turning around the recent decline in sales, two ways it might:

- Lock downs & Sell Through Over: The decline can be attributed to lock downs and Mundipharama selling through it's stock levels so hopefully they can get the levels back to FY20.

- Penetration in Emergency Departments: Secondly, MVP have said they want to target emergency departments. Currently the ambulance segment makes up around 75% of AU sales, roughly 223k units based on FY22 sales of 298k units. MVP believes the ambulance segment makes up roughly 31% of the market opportunity however there is 45% opportunity in Public ED departments.

Cash Burn

Cash burn, currently MVP has roughly 50m in cash. Management have expressed that they believe they will be cash flow positive in FY25 and the recent capital raise will get them to 2025 (with the options exercised). Study costs for the US trials will be around 12m.

China Exit

Lastly, my two cents on the recent decision to cease planned trials in China. I think this is a good idea to allow the company to focus on growth in existing markets. China is a very difficult market to get into with Medical Devices, not only is the registration time for foreign companies longer with the China FDA but China has a 2025 made in China vision (Article 104). Although I’m not certain article 104 would apply to MVP, if it does, manufacturing would have to be set up in the country which adds its own costs and risks.

A prudent approach from management (IMO) discontinuing the preparation for trials of Penthrox in China.

Whilst everyone looks to China with dollar signs in their eyes, I think this is a smart move due to the complex regulatory system and geopolitical risks associated with any activity in China.

Extract from announcement:

CEO Brent MacGregor said, “A commercial launch in China is not a strategic priority at this time. We are directing our resources into those projects that have greater capacity to generate shareholder value in the nearer term. “These projects include accelerating penetration of Penthrox in select European markets and in Australia. In the longer-term, we intend to deliver the next wave of growth through Penthrox entry into the US. Following the FDA’s lifting of the clinical hold, this process has already commenced"

Shares are essentially close to a 5-year low, whilst the business is quite different to what it was, I'm quite interested in the potential for Penthrox to further penetrate the European market, and the potential for this grow in the US.

Watching on the sidelines at the moment, not held in Strawman or IRL, but will take a closer look over coming days and may enter with a small parcel here first to wet my appetite.

Interested to hear others thoughts on the business.

Hey @ValueDownunder On the subject of MVP director buying, just to play devils advocate for a moment,

What do you make of the fact that despite the share price being very depressed David Williams hasn't bought any more shares here for years now meanwhile he has been maniacally buying up his other large positions such as PNV.

I am not concluding anything just an observation.

Sep 7th update - David Williams ASX announcement this morning shows he also went in the raise. As you would expect given the large offer discount at the time.

Placement at $2 then a proposed Retail SPP

Passing the hat around!!

I think anybody that has been paying attention to MVP knew this one was coming. A Capital Raise has been announced, the important info - 1 share issued for every 9.5 held at a price of $2 a share. Options will also be issued at a price of $2.80, 1 share for every 2.5 of the new shares issued expiring on the 30th of September 2024.

Total funds to be raised is $30m with the money directed to go towards Australian expansion and European growth. An update was also given on guidance;

• revenue: A$22.4m; +37% on prior corresponding period (PCP)

o Penthrox revenue: A$13.7m; +29% on PCP

o Respiratory revenue: A$8.2m +53% on PCP

• underlying EBIT1: A$(14.7m)

• EBIT: A$(15.9m)

• cash at bank: A$20.4m

Personally I hate this new trend of options that come with capital raises. If one like the business then buy more shares instead of this nonsense but I'm sure others opinion differ for a variety of reasons. I will be taking up my allocation in full as I hold this company IRL and still believe in the product and have used it first hand (I'm sure plenty on strawman members have). The real question is if management have the capability to execute their growth in Europe and North America so shareholders will be rewarded which still make this a high risk company to be invested in as that answer seems less than straight forward.

Endo International plc to distribute Penthrox in Canada

- Release Date: 10/05/22 15:35

- Summary: MVP signs new Penthrox licensing agreement in Canada

- Price Sensitive: Yes

I thinking the share markets were bearish in May 2022..So MVP could get some momentum going forward..

Valuation as at 01/03/2022 based on FDA Removal of Full Clinical Hold allowing Phase III trial to commence.

Details of trial;

▪ First patient enrolled late 2022

▪ Expected study duration - 2 years

▪ 10 sites to be selected

▪ 200 patients in total

▪ Study costs circa A$12m

Protocol

– treatment of moderate to severe acute trauma pain in prehospital participants

14-Oct-2020: Appointment of CEO - Brent MacGregor and Appointment of Non-Executive Director - Gordon Naylor

I don't hold MVP shares, however I note the market liked today's news because MVP's share price rose +12.21% today, making them one of today's MVPs. This is the "green whistle" company by the way (Penthrox).

About Penthrox®

Penthrox is a fast onset, non-opioid analgesic indicated for pain relief by self-administration in patients with trauma and those requiring analgesia for surgical procedures. Penthrox is now approved for sale in more than 40 countries and has been used safely and effectively for more than 40 years in Australia with more than 7.0 million units sold. There is growing interest in Penthrox being used in patients undergoing investigatory procedures, as well as operational procedures such as colonoscopy.

About Medical Developments International Ltd

MVP is an Australian company delivering emergency medical solutions dedicated to improving patient outcomes. MVP is a leader in emergency pain relief and respiratory products. The Company manufactures Penthrox®, a fast-acting trauma and emergency pain relief product. It is used in Australian Hospitals including Emergency Departments, Australian Ambulance Services, the Australian Defence Forces, Sports Medicine and for analgesia during short surgical procedures such as Dental and Cosmetic surgery as well as in other medical applications. MVP is expanding internationally and manufactures a range of worldleading Asthma respiratory devices.

30-June-2020: Phillip Capital: MVP: Updating our view: Accumulate (from Buy)

Recommendation: Accumulate (downgraded from Buy), Risk Rating: High, 12-month Target Price: (AUD) $7.80 (No change).

05-May-2020: Penthrox approved - Netherlands and Bosnia and Herzegovina

28-Apr-2020: Penthrox is approved in Thailand

Go the Green Whistle! MVP perhaps not today's Most Valuable Player, but up +8.62% nonetheless.