The real potential here is the drug methoxyflurane and its penetration into the US and Europe.

A quick primer on the product:

Methoxyflurane provides rapid short-term analgesia using a portable inhaler device. Its primary role is in acute trauma but it might also be used for brief procedures such as wound dressing or for patient transport. It is a non-opioid alternative to morphine and is easier to use than nitrous oxide.

Methoxyflurane is a volatile anaesthetic originally used in the 1960s until it was found to be nephrotoxic at anaesthetic doses (typically 40–60 mL). Since the 1970s it has been used in Australia in lower doses for acute analgesia (up to 6 mL), largely by paramedic services.

Methoxyflurane is supplied with an inhaler device (Penthrox inhaler), which patients use to self-administer. It can be used by conscious haemodynamically stable patients, under supervision.

Pain relief begins after 6–8 breaths and continues for several minutes after stopping inhalation. Continuous use of methoxyflurane 3 mL provides analgesia for up to 25 minutes; a second 3 mL dose can be administered if required for up to 1 hour's analgesia. No more than 6 mL should be given in 1 day.

(from NPS.org.au)

From a medical perspective I see it as

- Safe (difficult to OD with minimal side effects)

- Effective

- Probably quite limited in its potential applicability

- Don’t have to be as worried about people stealing it as not typically abused

For over 10 years MVP have been probing its applicability into different settings and beyond prehospital it hasn’t really found decent traction.

This isn’t surprising to me as soon as you have IV access you likely have better / more familiar / cheaper options for acute analgesia. Essentially as a rule of thumb just assume anywhere an IV is likely to be in situ methoxyflurane isn’t going to be your first choice or even second choice (or your third choice if I’m honest) and this is in a country where it has been used for 30+ years.

If I had to say where I say applicability reducing dislocations in ED and prehospital minor trauma.

Therefore the company should focus on EDs and prehospital. Everything else is marginal at best and likely a waste of time and money. It could easily replace most nitrous oxide use in EDs and for quick pain relief and minor short procedures is a great option.

The reason I have become interested is management have been doing a lot of things that I like to see recently:

- Become more focused. Appears they have realized the value lies in the penthrox product so have ceased marginal business activities like a vet segment and an experiment in continuous flow manufacturing. These were unnecessary unprofitable distractions.

- Phase 3 clinical trial in US is actually approved and underway meaning a product launch in 2026 is a real possibility. The outcome of the trial, unlike many pharma trials is almost assuredly positive given its long history of clinical use in Australia and preexisting safety data.

- The company is well capitalized with $50mil in the bank which should get it through the trial and to US product launch.

- European expansion / distribution has been insourced and beginning to show real traction.

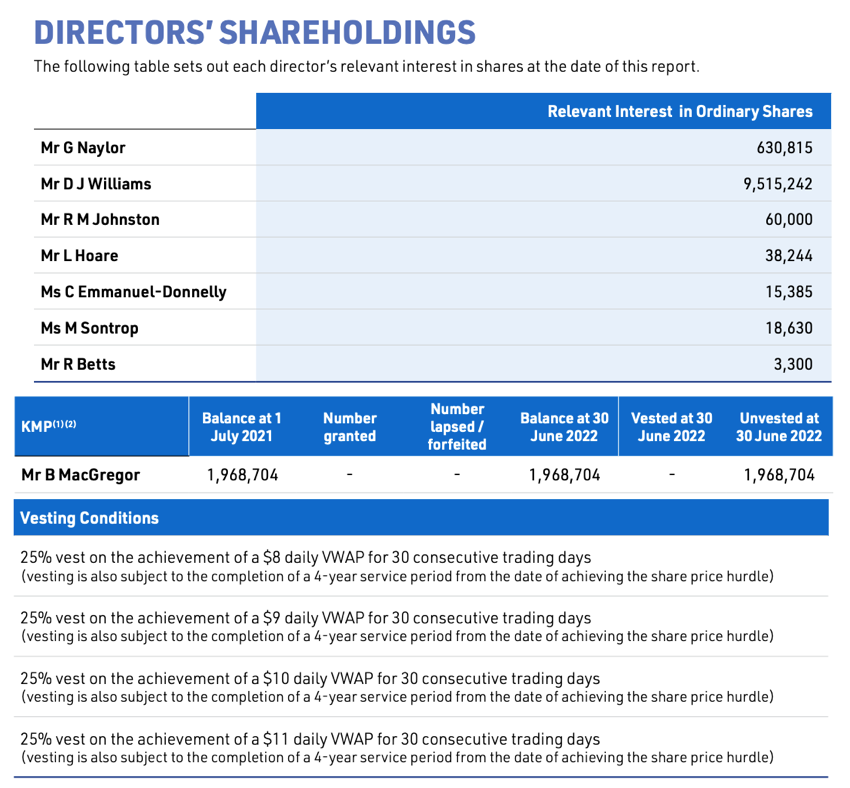

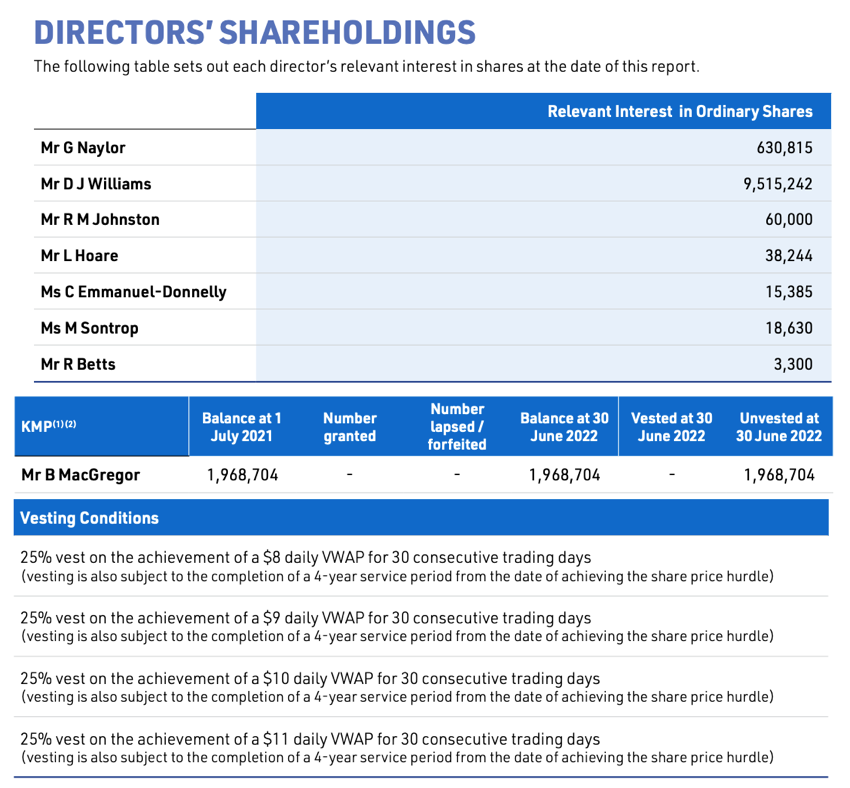

- There is strong insider alignment with ongoing insider buying and participation in capital raise and mostly at much higher prices.

Why now?

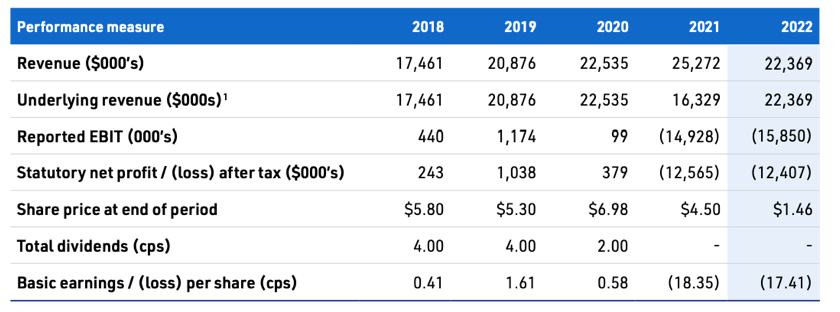

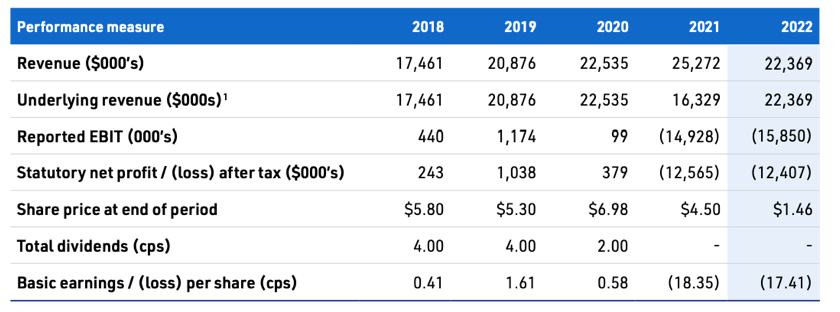

Losses have been exacerbated by a blowout in employee wages as they hire to begin direct sales at the same time as revenue falls on account of the previous distributor winding down stock. That will likely begin to work itself out this year with accelerating revenue growth. As the business metrics turn around I expect the share price will follow.

Price Catalysts

- Revenue acceleration

- Some sort of underlying profitability inflection once trial costs are excluded

- Phase 3 trial conclusion expected 2025: We basically already know the outcome but will still be a big day.

Downside

- $50mm in cash currently and $130mm MC suspect downside could be as low as $40mm so SP of ~$0.50

Upside

- More difficult but with growth in European segment and phase 3 US trial completion I can’t imagine a MC of less than $500mm due to the market size. Should equate to a share price of $5-6

I’m basically discounting the respiratory business as it appears only marginally profitable and if it were up to me I would look to sell it off.