23 Half Year Results - Results

MVP announced it's half year results last week, at a high level revenue up 45% to 13.9 and a net profit of 2,658. However this was only due to a refund from the termination of the China contract. Taking out that revenue and impairment net profit sits at -8,864 which is an 8% increase on the PCP.

Overall, mixed results. Not the growth required in the pain management and a surprise 80% growth in the respiratory business. After listening to their announcement below is my take on the good, bad and progress based on my watch list.

The good

- Increasing prices in December for Australia resulting in higher gross margins

- Gross profit margin increased to 71% from 67.9%

- 29% Growth in UK and Ireland with the current distributor even with a deferred shipment in UK. Revenue is only recognised when shipment is made so this will flow into the FY results.

- Positive feedback from all customers, CEO mentioned he has never heard a negative thing about the product

- Re-launched in Canada with a new partner

- 80% growth in respiratory and expected double digit growth in US moving forward

The bad

- 24% growth in France is well behind the > 50% they needed to achieve 110k units. Current run rate is at 60k units which is the same run rate presented for Jun-22 quarter. Effectively meaning no growth from June quarter.

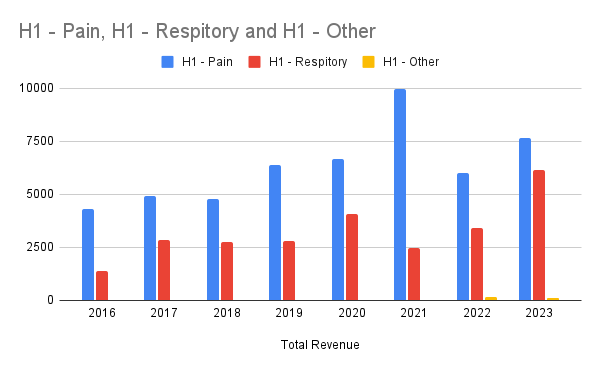

- Negative growth in pain management units in Australia by 6k

- Expenses increased by 16% on PCP and 27% on the last half.

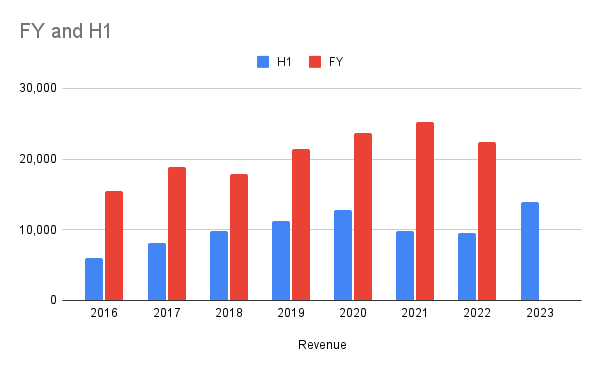

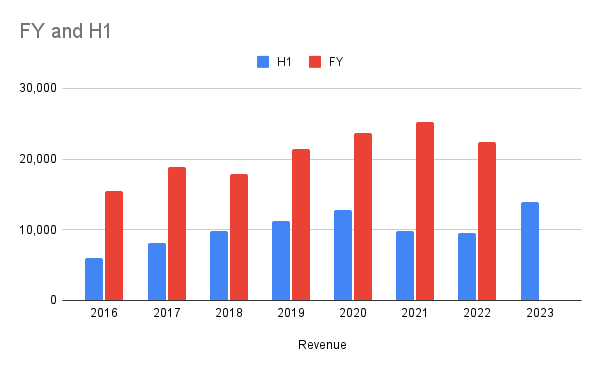

H1 / FY Total Revenue

Good growth in revenue, slightly beating H120

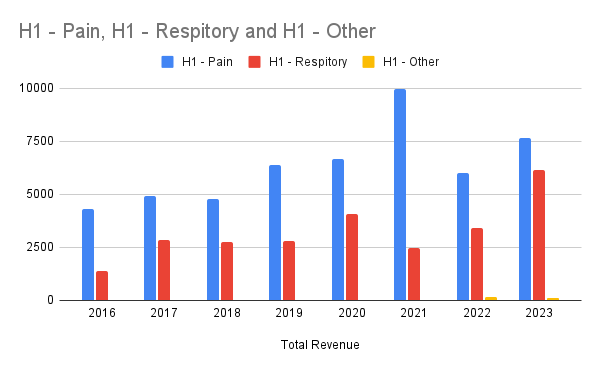

The split based on franchise

Continued penetration of Penthrox in France

At FY22, MVP were targeting ~110k units sold in France. Currently they are tracking on a run rate of 60k units. Well short of expectations.

Management have expressed multiple reasons which include

- Retaining / Recruiting: MVP uses a contract sales organisation in France. They are seeing issues retaining staff as they are going to companies which are offering permanent roles.

- Hospital Staff Shortages: Staff shortages in hospitals have made it harder to get the right decision makers on-board to add the green whistle to the hospital

- Bed Closures

- Budget Constraints

At a high level I get the sense that for pain management, they have to invest a lot of time in education. As this is a new product to majority of French hospitals there is effort in education to promote the benefits - ease of use and quick pain relief. I would imagine after time this education will reduce as this becomes the standard of care.

Market entry planning for Germany, Italy & Spain

Not much news on this apart from the next market they would target would be Germany sometime in FY24.

With the cash bleed at the moment, it does make sense to focus on growing and learning from France before spending more in entering another market.

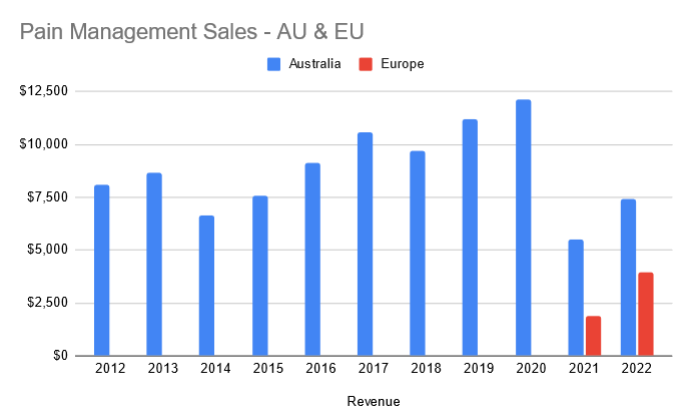

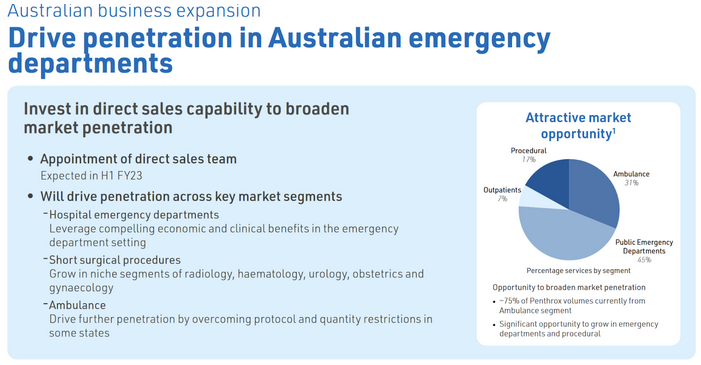

Direct in-market sales capability in Australia

Slight decrease in Australia units sold in the pain management section. However promising that they have on-boarded 2 ED's in Australia since October. Interestingly the indication in Australia is wider than anywhere else in the world. Overall not much of an improvement here with the direct sales team so expecting more.

Cash Burn

MVP cash position is now 37m, free cash flow for this half was -11,604. Management still expect break-even / cash-flow positive in FY25.

For the US trials, they are currently assessing a funding plan. Currently the group has no planned capital investment activities and plans to seek partner or third party funding.