Staying safe also requires that we maintain prudent balance sheet settings and consistently manage risk with discipline. Collective provisions as a ratio of credit risk weighted assets remain well above pre-COVID 19 levels at 1.42% and our CET1 ratio of 12.21% is above our target range of 11.0-11.5%(6).

The share of lending funded by customer deposits remains high at 81% and our liquidity position is well above the regulatory minimum. Deliberate actions taken over many years mean our lending exposures are in good shape with modest exposure to segments most at risk in an environment of higher interest rates and higher inflation.

Our Australian SME business lending book is well diversified with less than 20% exposure to discretionary retail related sectors, and highly secured with only 6% of the book unsecured. Our exposure to commercial real estate as a percentage of total lending has been on a downward path since September 2009 and is now less than 10%.

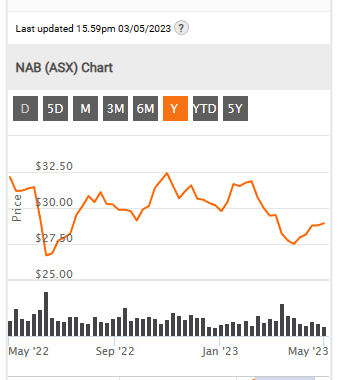

We expect further challenges to emerge as the economic transition continues but we remain confident in the outlook. While growth is slowing, the Australian economy appears resilient and we have attractive options for growth across our business with strong balance sheet settings. We remain focused on executing our long term strategy to deliver sustainable growth and attractive returns for shareholders