Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

https://newswire.iguana2.com/af5f4d73c1a54a33/nea.asx/2A1401437/NEA_Nearmap_Chairman_webinar_script

$NEA Chairman held the investor webinar today on the TB takeover.

The board recommended the $2.10 offer on the following grounds:

- The $2.10 per share consideration represents a significant premium to recent historical trading prices.

- The all cash consideration of $2.10 gives you an opportunity to realise certain value for your shares now – particularly at a time of increasing economic and market uncertainty;

- You will no longer be subject to risks and uncertainties associated with the Nearmap business. These risks include:

o Adverse impacts from ongoing litigation from EagleView and Pictometry

o Adverse impacts from industry consolidation – as flagged earlier

o Adverse impacts from a competitor being acquired by a financial buyer – as flagged earlier

Repeatedly, in the address, the Chairman referred to the macro conditions meaning that it was the Board's view that SP was unlikely to return to the level of the Offer in the near to medium term. He was very focused on the hit to loss-making tech stocks and rising interest rates, i.e., macro factors.

Explicitly, the Board was taking a "short to medium term" view. Which I find strange.

He reiterated that $NEA will become cashflow positive in 2024, including the costs of Eagleview litigation. That means, that in 2024 $NEA will hit an inflection point. If it hits that inflection point, and is still growing ACV at 20-40% p.a. (as my valuation implies), it is worth significantly more than $2.10, even accounting for another to years of time value of money ... or $2.54 in FY24.

The rise of financial players, industry consolidation and AI etc. also seem flakey to me. Is there something they are not saying? Do they expect drones or low orbit satellites or some other disruption to render their tech edge obsolete?

In my mind, the rationale as laid out doesn't make sense.

Or is something else going on?

Hypothesis One: $NEA wants to make a major strategic combination but can't see how to do this in the current environment and sees a better chance with TB. Might it even be agreed with TB as the next step?

Hypothesis Two: Key insiders (Rob with 10.5m shares and more options and Ross Norgard with 24.5m shares) have lost patience and want to cash out at favourable terms? There risk-reward appetite is different from mine, as $NEA was on 0.5% of my netwealth prior to sale.

Hypothesis Three: They expect to come out badly from the Eagleview litigation.

Does anyone else here find the strategtic rationale weak? On that grounds, the entire tech sector should pack up and go home. Surely, once interest rate peak, the recession has materialised and inflation is under control, then implied discount rates for tech and other growth stocks head back to a "mid-cycle" norm, albeit not the low levels of the last few years. So, by mid-2024 we could see a return to favourable macro just when $NEA is hitting the inflection point. I'd buy that any day.

Bemused.

Further to the statement from the Chairman of $NEA, I have today offloaded by entire RL position for $2.08. Will exit on SM tomorrow. Why? What's the calculation?

Initially, I was minded to hold out for a better offer. It appears the Board has shaken that tree and no other offer has emerged. Time is running out. So this branch of my "expected value" calculation has just become less probable.

Accordingly, my mind turns to the sharehold vote later in the year. In the unlikely event that shareholders vote this down, then we'd see a massive correction back to pre-deal SP. Potentially, a short/medium term issue, but if it happens, I get the change to buy back at - say - $1.30. So, I can position myself to access that option.

However, the funamental issue is that now we have a management team and Board who were seeing their future better in private hands and have clearly demonstrated in accepting $2.10 that they are not as bullish about the firm as I am (or was).

I remain disappointed in the Board's decision and will read the "Independent Expert Report" with interest. However, the rational decision is to take the money. I've been on this particular journey since 2017 and was a $NEA Bull.

Disc: Not Held in RL; Held in SM

P.S.

Can someone clarify that a vote on a scheme of arrangement requires a majority of voting shareholders to vote in favour of the scheme, as well as 75% of votes (shares)? Is that the path they have to follow, or is there an alternative?

Update on the acquisition. In this letter, it is stated that the "Board also considered a number of other non-binding expressions of interests for Nearmap, none of which were considered by the Nearmap Board to be in the best interests of Shareholders."

On this basis, it sounds less likely to me that a superior offer will emerge, as interested parties to date will have been encourage to better the Thomas Bravo offer.

I look forward to reading the Independent Expert Report confirming that the deal is in the best interests of shareholders. Inmaking that assessment, I assume they have to arrive at a valuation of the "do nothing" alternative?

Disc. Held

Thanks @nerdag for reminding me about the role of short sellers on volume and price action. That explains it. I wonder if now we’ll see a return to $2.10 as other holders assess opportunity cost?

At this stage, I still intend to vote against sale. Unless I need the capital for another idea. But as I have reasonable cash on SM and IRL, that gets deployed first.

@mikebrisy, a closing price of $2.15 does look like some buyers are positioning for either another offer, or TB raising the price to get more naysayers on board.

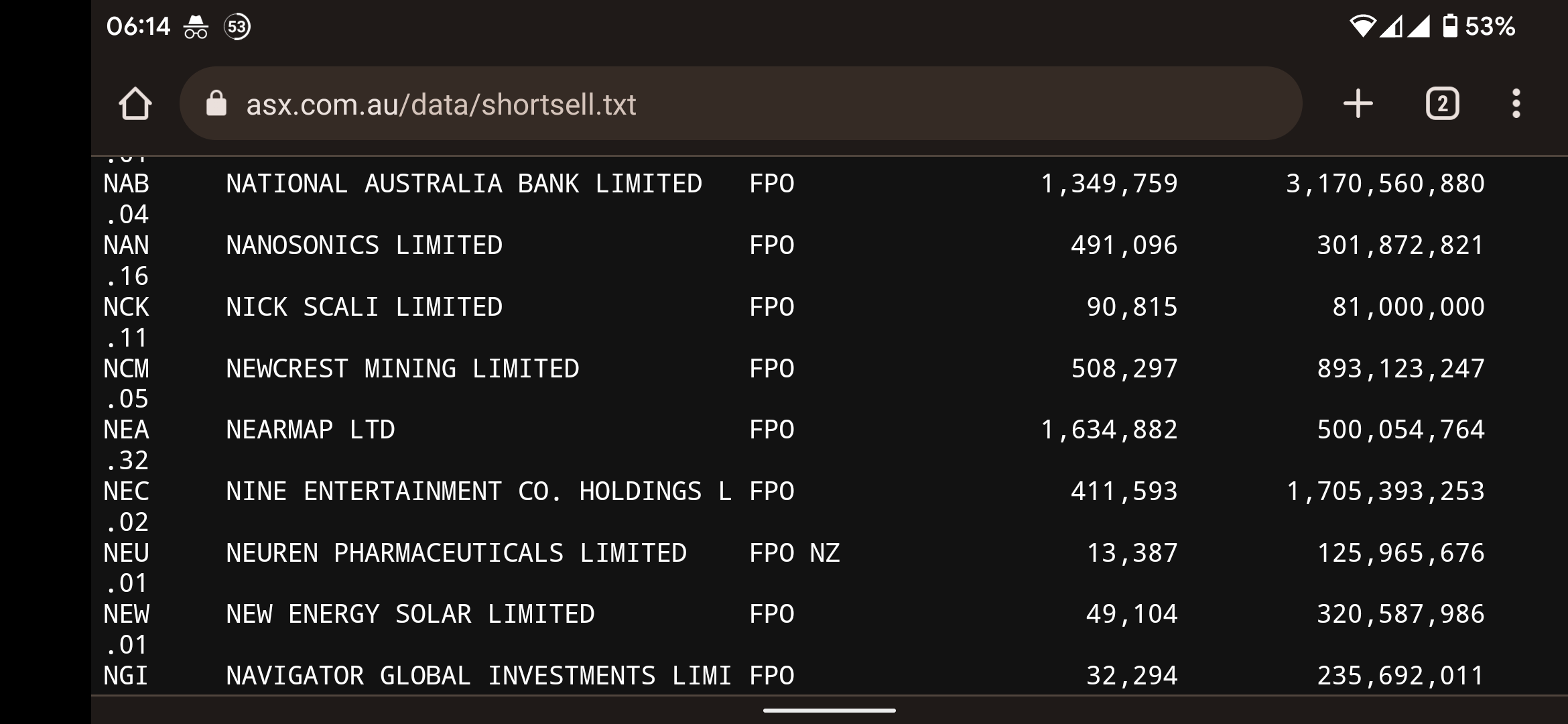

Most shorts have closed by now.

Two weeks ago, some 6% on offer was being shorted which started plummeting once the announcement was made.

Yesterday, 0.32% still shorted.

Source: https://www.asx.com.au/data/shortsell.txt

$NEA interesting. At $2.15 heading into the close on >15m shares traded. 3rd consecutive day of high volumes. Is this a bunch of buyers positioning/ expecting another bidder to emerge? What gives?

Disc. Held IRL and SM (and sitting tight)

Nearmap's board has endorsed the $2.10 all cash bid from US private equity firm Thoma Bravo.

That values the company at just over AUD$1 billion, which is over 7x FY22 sales.

Given the certainty of the all-cash nature of the bid, the relatively high multiple paid, and some of the uncertainty facing the business, it does seem like a compelling offer. A bird in the hand..etc

ASX announcement here

Here are the links:

Release

Presentation

Analyst Pack

https://newswire.iguana2.com/af5f4d73c1a54a33/nea.asx/2A1391172/NEA_FY22_Analyst_Pack

$NEA reported its full year results today. If you missed the presentation and are interested in the detail of what was said, especially the Q&A, the full transcript is here:

https://newswire.iguana2.com/af5f4d73c1a54a33/nea.asx/2A1391345/NEA_FY22_Results_Transcript

I added the links to presentation, release, and analysts pack at the bottom of this straw.

Rather than do a poor job of rehashing content from these materials attached, here I will share some of my key takeaways and impressions. (I will return and flesh out some items and valuation another time.)

Overall Investment Thesis is Intact Driven By Strong NA Progress

Overall contract and revenue growth were strong, and towards the top end of guidance. This was underpinned by very strong NA market and less strong ANZ. Given the much greater scale of NA, this is a good place to be.

Incremental ACV grew a second year in a row, by a record $33.3m – underscoring that they have cracked the NA market, which was a real question-mark 2-3 years ago.

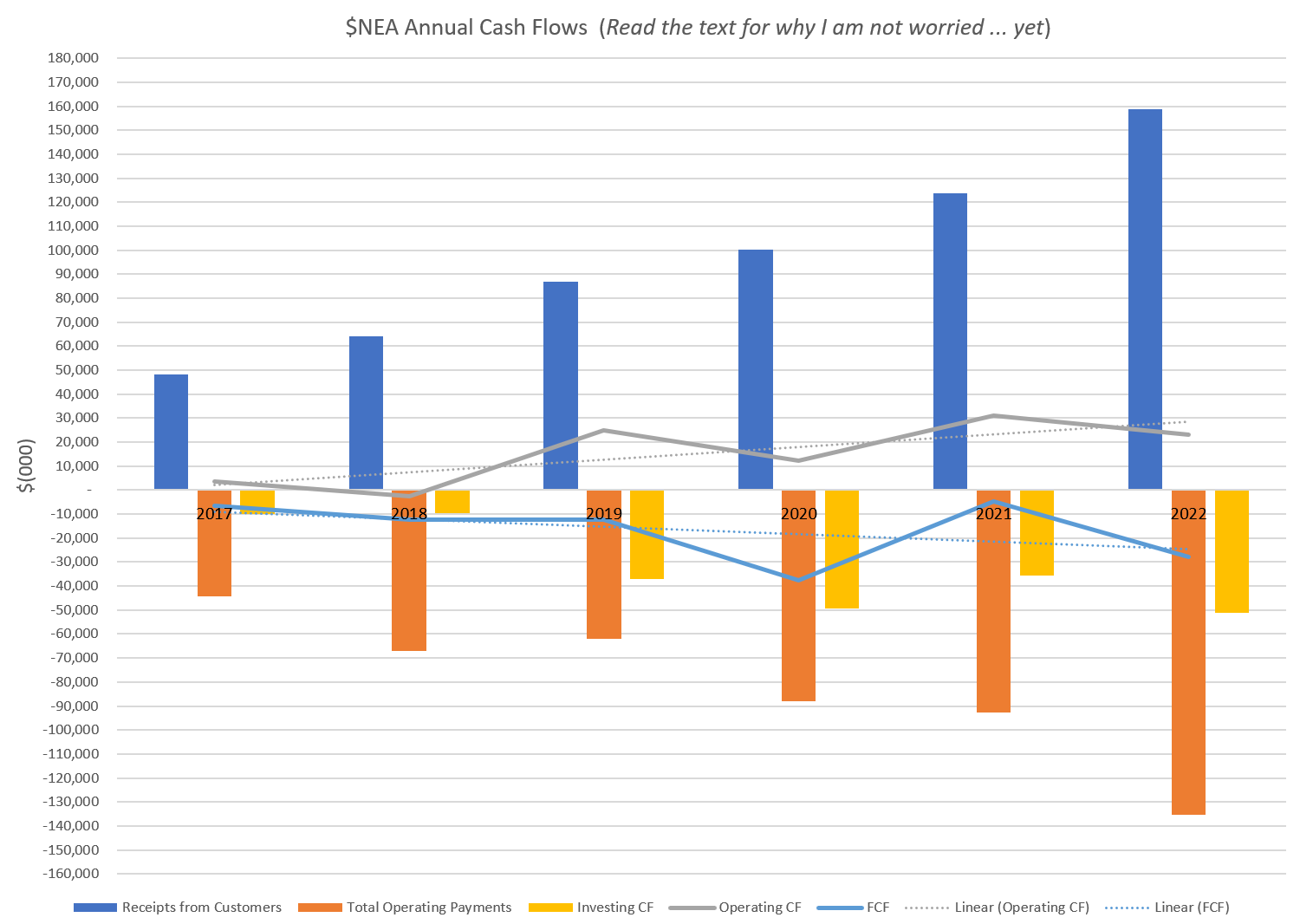

There has been heavy cash investment in: NA coverage, in Hypercamera 3 development/rollout and in Sales and Marketing. Therefore, my usual CF trend analysis below doesn’t look so great. Based on the CF numbers, there isn’t any trend to cash generation.

Should we be worried?

Normally, I would be. But both Rob Newman and CFO Penny Diamantakiou stated repeatedly that $NEA will be CF positive in FY2024. Cash outflow would peak in 1H23, trend toward breakeven in 2H23 and then FY24 would be Free Cash Flow positive for the full year. (This was clarified in the Q&A by one of the analysts, and it was reiterated so as to be completely unambiguous. You cannot get a more explicit setting of expectations, in my view.) They have ample cash and debt capacity to achieve this with a good margin of safety.

Secondly, there was no change to the short-to-medium term target of ACV growth of 20-40%, which is clearly needed to underpin turning $NEA cash generative in that timeframe. Rob remains adamant that it is still early days in penetrating NA.

These top-level metrics are underpinned by:

· Annual Churn is steady, with retention at 93%

· Subscriptions are growing steadily at +8% (7% pcp)

· ARPS is accelerating at +21% (+11% pcp)

· The distribution of revenue per subscription is trending to larger values, more multi-year deals, more premium content. Overall, customers are using more with time and getting more value.

Hypercamera 3 technology is being rolled out. (1 in operation in Aus. Plan for one more in Aus and 4 in NA through FY23). Importantly, the “efficiency” of HC3 is double that of HC2 (I think that should be productivity, not efficiency). This will increase optionality. Either cover the same area at half the cost, or fly lower and provide higher-value content. This optionality lever is clearly one of the key sources of competitive advantage, and it was referred to in general terms to support the path to cash generation narrative.

There are of course some aspects of the results that are no so good, and I will deal with these later. Overall, they don’t affect my top line summary: $NEA is succeeding because is has cracked the NA market.

Often, I find, there is more to a presentation than the numbers and explanations. For me today there were two overarching points:

1. There was nothing remarkable or surprising in this presentation. I’ve been listening to Rob Newman now for 5 years and, with respect to America, the story evolves consistently and gets more granular each time. I really get the sense that $NEA is coming to grips with how to compete and win in NA.

2. Both Rob and Penny came across as very confident and fact-based both in presentation and in the Q&A. (I have a strong BS detector, and it didn’t go off once!)

Making a Virtue of Churn

I can’t see it in the numbers, but there was a reported significant churn event in NA. As it turned out, this was a (what was clarified under Q&A as insurance) partner who $NEA chose not to renew because $NEA is increasingly providing more of the value-added services through its premium content. Nice story… even if a bit of spin. Seriously, they were making the point that the value-added data-analytics and AI services being provided with the data are becoming more important, so they want to provide this directly to end customers and will be prepared to cut out partners. If this is true, we should continue to see strong growth in ARPS over time. That’s part of the investment thesis, so good to see it coming through anecdotally.

Capital Discipline Being Demonstrated

Part of my confidence in management is that they are starting to demonstrate capital discipline:

· FY22 spending of funds from capital raise was closer to $20m than initially guided $30m

· CF breakeven in FY2024 looks like a stake in the ground

· Reference of goal to be CF breakeven with a strong remaining cash balance

· Not now looking at Europe until CF breakeven delivered (because NA opportunity so big)

· Prepared to use “optionality” to keep to guidance (capex; cash burn; coverage etc.)

The Not So Good

There were some areas of weakness in the results.

Gross Margin(pre-capitalisation): This was down from 75% to 72%. However, Rob made it clear that this is due to the increased contribution of NA, compared to more mature and higher margin ANZ. He said “cost of capture in NA is 4 x ANZ”. So, we should see some further trending down of this metric. NA is 10x+ ANZ in terms of potential. So I’d rather win in this market even if margins are lower. Its total value that counts.

Sale and Marketing: The key sales productivity metric- Group Sales Team Contribution Ratio (STCR) was down again this year to 85% from 89% in FY21. Explanation: they pushed hard in NA, added a lot of heads with a stronger focus on direct sales and marketing, relative to indirect (via partners). With more heads still being added, this might not have bottomed out yet. But by arguing that the result was as a result of rapid team growth, there is no sense that it’s getting harder to make the sales. Which would be a concern, and something to keep track of. They also didn’t blame external factors like COVID or concern about the macro-environment. On the contrary, Rob said most of their customers are 1) acyclical and 2) looking to implemented $NEA to drive out costs. (Long live the forthcoming recession!)

ANZ is Maturing or Is It? We’ve seen several periods of softening growth in ANZ. For the last three years, ACV addition has averaged about $5.5m which is starting to look anaemic alongside NA. (It was not always thus.) We have had prior reports where Rob has admitted that the focus on NA has meant that management has taken the eye off the ANZ ball. Now a new, focussed GM is in place, they have learnings from NA and are about to refresh a new focused verticals strategy. I given them the benefit of doubt - they have shown they can learn in NA. In any event, ANZ is more mature. If they can kick things into gear there, then it is cause for future optimism. But it is not a thesis breaker given the quality of the ANZ business and materiality of NA.

The Lawsuit

Not much news. Spending serious money and treating expenditure here as below the line – unwilling to guide, but order of magnitude is $10m p.a. Taking on Eagleview by challenging validity of their patents. Confident theur will prevail.

The Takeover

No comment. Will act in shareholders interests. (OK, but what do we think $NEA is worth.) Blah Blah.

Disc: Held IRL and SM

@Strawman it also struck me as strange, particularly given that we are in the indicative non-binding phase. (I have never agreed such an arrangement in my time doing deals at this stage, but I wasn't in tech.)

I wonder if this was the price that the suitor extracted from $NEA for them to announce ahead of the results? Lot's of share options riding on SP progression, and (cynically) it is in $NEA's interest for the market to view the latest results against the backdrop of potential acquisitions rather than a more general market that is still uncertain about valuation of growth stocks. Suitor would have preferred finishing their work and coming to a definitive price, but then Board could have been accused of not fulfilling their continuous disclosure obligations had they not annouced. Or perhaps, if Board has no choice, then suitor might have threatened to withdraw unless compensated. I'm not clear as I am not expert on continuous disclosure and how it works in Oz.

Others more experienced with takeovers could correct me here, but I don't think I've seen this before.

From Nearmap's announcement today:

In other words, A US Private Equity frim knocks on the door and says they're interested in buying the business. They get access to the books in a non-exclusive agreement on July 6 and spent a month pouring through all the detail. Eventually, they reach a point where they lob a $2.10 bid which, it's important to stress, is non-binding and indicative (i.e. they can walk at any stage).

They now have 7 days of exclusive access. I guess there are still things they want to look at before committing to the deal, and don't want others to come in during this period and gazump them -- which is fair enough i guess -- but why is it on Nearmap to compensate them to the tune of $3m if they decide not to go ahead with the deal?

Maybe I'm missing something, and I realise this is one of the least important aspects of today's announcement. It just strikes me as unusual, and very generous to the suitor.

In light of this morning's reported takeover offer of $2.10/share cash for $NEA, I note the following:

Strawman Consensus sitting at $2.736

Broker Vals average $2.16 (n=8, range $1.40 - $4.49; source: Marketscreener.com)

My own valuation $2.48

We should expect a revised offer after due diligence and potentially other offers may crystallised. This is time for M&A of quality beaten down tech stocks (although $NEA "quality" remains unproven).

I hope the Board holds out for the Strawman Consensus AT MINIMUM!

Disc: Held IRL and SM

Takeover offer at $2.10.

I think it's still way under fair value, so watch the price shoot up from here as other suitors come out of the woodwork.

Nearmap approved as a General Services Administration Contractor for the US federal government.

https://view.nearmap.com/index.php/email/emailWebview?md_id=16268

MESSAGE FROM THE CEO

Dear Investor,

I am pleased to provide you with an end of financial year update, outlining continued progress in our business as we close out the 2022 financial year (FY22), including the news overnight that Nearmap has been approved as a General Services Administration contractor for the Federal Government in the United States. This news continues to build upon the momentum within our North American government portfolio, following the ASX announcements in March and April whereby we communicated that for the first time Nearmap generated US$2 million of incremental Annual Contract Value (ACV) in our North American government portfolio in a single quarter, and that we successfully signed our largest ever government contract in North America. Again, this demonstrates the underlying strength of our business and the value proposition we offer government agencies.

Nearmap will report financial results for FY22 on Wednesday 17th August and in coming weeks you will receive an email with further details as to how you can join our CFO, Penny Diamantakiou, and I, on a webcast outlining our results. I hope you can join us then.

Regards,

Rob Newman

Managing Director & Chief Executive Officer

ASX announcement this morning. Validation for Nearmap holders with largest ever US government contract signed.

One thing I do love Simply Wall St for- is its solid tracking of insider buying. There has been a slow steady gain in Nearmap over the past few months after a rather depressing share price discount. However, the light at the end of a rather dismal tunnel appears to be a photopic mixture of time, patience and an understanding that Mr. Market is a fickle master. The spectral peak can now be credited to a recent share accumulation by Non-Executive Chairman - Peter Richard James.

According to Simply Wall St, Peter bought 81K shares on market at roughly AU $1.22 ps. Furthermore over the past 12/12 he has added a total of $AU 199K worth of shares on market. I feel that it may be time to follow Peter's lead IRL. I have been waiting and watching for my accumulation cue. The stock turnaround seems to be here. The confidence of insider buying, the excellent recent AUS before and after flood coverage and the Armageddon style service Nearmap is geared to cover for impending climate change/ weather and insurance disasters......I think the turnaround is here.

Humans’ fascination with navigation and exploration seems somehow innate. I guess our mammalian brains are inherently looking for greener pastures, food or water sources. And those who control the maps control the world, right? An understanding of mapping and navigation has been the key to conquering new lands or opening up new trading routes. And now apparently, it’s the key to working out whether your roof gets enough sunlight for those new solar panels.

I am sure a lot of us remember the first time that we saw google maps and how exciting it was. We all gathered around our PCs or Macs and eagerly zoomed in looking for our letter boxes or if we were really lucky we got a view of our cars parked out on the street.

Technology has come a long way since those first days of google maps. The camera systems today are a different beast with orders of magnitude more detail than their prehistoric ancestors. Data capture is becoming increasingly fast and more cost effective. So much so that companies like Nearmap no longer have to offer a bespoke service but can fly multiple times a year capturing huge amounts for RGB data that can be captured ahead of demand. Currently this company flies roughly 90% of Australia and 80% of the US.

For those interested in tech changes occurring in the geospatial / GIS/ remote sensing space – I highly recommend Daniel ODonohue’ s MapScaping podcast (“Map” not man).

When investing in tech you never know when the next disruptor or advancement will come along. This podcast series has several great interviews with key industry insiders that have really helped me to broaden my understanding of this unique and fastmoving space.

Nearmap has not had a good run of late. As mentioned by others the market was not impressed by its updated guidance or level of churn and SP took a huge hit this week. Nearmap can be a tough stock to hold. It’s previous history of creative accounting, its recent short report attacks and legal entanglement with Eagleview have been hard to weather. As Strawman has mentioned it is tough to see the value upside with all these risks. I can see why many are selling.

I have decided to continue to hold for now. I am betting on Nearmap AI to provide a very helpful solutions based proposition for Nearmap’s customers. I believe this is where the value lies solving problems not just in data capture.

So this week I wanted to look further at the industry.

My goal this week has been to further understand:

1). Whether there is a potential risk of disruption to Nearmap’s data capture space. How likely is it that drones or more specifically satellites will usurp aerial mapping in the near future.

2). Do Nearmap’s AI algorithms themselves widen the MOAT of this geospatial player?

Advantages of plane capture vs satellite

I have frequently heard throw away lines about how pinpoint accurate satellite imagery is and how this will likely be the way we map the world in future. I never really thought much more about this and took these comments at face value. It is only after a little digging that surprisingly I don’t think this statement is accurate or realistic. Well at least not for the foreseeable future.

Joe Morrison from Umbra (a satellite start up) risked his professional reputation recently and wrote an article lamenting his frustration with the utter lack of standardisation in capture and data interpretation in this space. He received a lot of praise for his brave and honest article and it resonated deeply with his peers in this community.

After a little research I feel even better about plane mapping. Why?

1. Firstly hurling large, heavy, metallic objects into space is a hugely expensive endeavour.

2. Optics of satellites mean you can’t get RGB images when there is cloud cover (the majority of urban capture areas are equatorial and this area has particularly dense and regular cloud cover).

3. Defence Forces are the major customer of satellite data (I will explain this further below).

4. The current optical resolution of satellites is not as good as planes.

5. Satellites are too expensive and the cost of capture is not going to reduce any time in the near future.

The service that Nearmap provides requires details. Good resolution is essential. The smaller pixels also help to build more accurate AI models that can quickly provide data insights - how many pools are there in such and such area? useful insights for pool product suppliers or how many rooves in the area look like they need repair for an insurer post hail storm. The Hypercam 3 due to roll out in 2022 has 6 cm pixel resolution. You will see that rust on your roof with this level of resolution. This detail is essential for mapping urban areas.

Satellites on the other hand at their best provide about 30cm pixel data. There are a few new startups launching satellites that offer 70cm-1m+ pixel resolution. At this sort of level imagery is only really suitable for land or terrain mapping, it is not good enough quality for seeing the details of builds on a job site for instance.

Cost is the other huge difference. Satellite imagery is very expensive as mentioned and it is worth repeating. The barrier to entry for a satellite player to compete with Nearmap will be cost prohibitive for now……unless Elon Musk wants a new hobby on weekends.

Really there are only 2 players in the US that are capturing satellite data for sale Maxar and Airbus. So if you want to gain access to satellite data you will be waiting for months wading through legal contracts and paying 100s of millions of dollars to task a satellite to fly over the area you care about. So accessing satellite data is a super long, difficult and expensive process. Something that I did not realise.

Defence is the primary customer for satellite imagery. These customers have very deep pockets and can afford to keep Maxar and Airbus in business. There aren’t many commercial customers – Google and Apple obviously but with the lack of demand and competition in the industry there is no downward pricing pressure and I don’t see this area getting cheaper any time soon.

The satellite imagery space is in its infancy.

My very basic Neanderthal understanding is that the complexity of satellite capture is staggering:

1. You have the variability in cameras and capture type RGB vs non-visible light spectrum etc….

2. The math in the geospatial plotting is fraught (matching the movement of satellite through space while targeting a point on earth repeatedly and accurately is complex)

3. Analysis ready data (ARD) problems - so what is captured and sold varies and doesn’t have a standard. This means it is very hard if not impossible to switch data platforms or readily switch algorithms to provide answers to your imagery questions quickly.

I can see why this area is still so expensive. In reality due to the lack of standardisation, the cost and the variability in quality imagery it does not sound like Satellites will be a direct threat to more traditional ways of aerial mapping with planes anytime in the near future.

Drones are a companion operator in my mind. Drones are brilliant for low lying monitoring. LIDAR capture is also brilliant with drones. LIDAR can penetrate gaps in trees etc.. to produce incredibly detailed point clouds however they will not likely replace RGB capture in planes any time soon. The camera systems used by capture companies are incredibly heavy. Hence planes are required to carry the weight and for fuel efficiency to increase flight times and hence reduce data capture cost.

AI algorithm and MOAT

Dr. Michael Bewley discussed insights about Nearmap technology and Nearmap AI, in Mapscapes most recent podcast.

What is clear to me is that Nearmap has a huge MOAT of capture data as well and the detailed resolution to train incredibly specific AI algorithms. The semantic pixel training on the data sets allows Nearmap to classify and provide answers for customers incredibly quickly and accurately.

The power of the AI is huge as result of the huge data training sets that Nearmap has access to. Furthermore RGB data seems to provide incredibly effective detailed information to customers. I don’t see LIDAR replacing Nearmaps capture imagery any time soon.

Nearmaps edge over its competitors is coming from the following:

1. The camera tech – it allows for very fast high flying capture

2. The AI self-labelling system. The more data Nearmap captures feeds into these models making them more and more accurate, better and faster. -There will be endless use cases for these data sets and tech insights.

3. Change detection – because Nearmap has so much old data from previous flights this can be overlayed with more recent captures to see small changes which is very handy for customers like insurers.

4. Because Nearmap is a first mover and growing so quickly in the US it’s AI technology is shaping the development of a universal mapping language for AI models.

The accuracy of the AI algorithms is everything and will be a major MOAT for companies like Nearmap. Furthermore Nearmap’s management understands that its data needs to solve problems. Capture will only be a part of the business. Predictive ability from AI data sets will be the next big advancement.

Nearmap can provide answers for companies say insurers – take the latest aerial images – overlay flooding risk history and land elevation and voila – prediction models for which houses are likely to flood in the next big rain event. Nearmap is entering into the space of processing the data and providing answers for companies.

For now I am happy to hold. I see a bright future for Nearmap and I don’t see a tech disruptor managing to provide affordable competition to plane capture in the near future. Hopefully there will be greater growth than predicted in helping businesses find answers to problems – not just providing data sets. I am happy to see if this stock can turn around in the next 12 months.

Cheers

Nnyck777

Nearmap's preliminary results show a beat on their recently upgraded guidance.

In early May they raised Annualised Contract Value guidance from $120-128m to $128-132m. Today they said ACV should come in at $133.8m (in constant currency terms) for FY21, a 26% increase on FY20 (or 20% accounting for FX movements). This is all about good sales momentum from new and existing clients.

The US was again the biggest contributor, with ACV up 54% and now representing about 46% of total ACV.

The balance sheet also remains strong (they did a capital raise not too long ago), with $123.4m in cash.

Development of the next generation capture system appears to be going well too, with the HyperCamera 3 tested in flight and patents filed. It remains on track for relase in FY22.

It also briefly touched on its pending legal challenge in regard to accusations of patent infringement from competitor EagleView, saying it had engaged "globally recognised patent litigators" and would defend itself vigorously.

FY21 results will be out on August 18

Disc. I no longer hold (either on Strawman or real life), having sold out just before the short seller report was released -- pure luck in terms of timing. Largely that was on some valuation concerns, and a lack of conviction on the competitive landscape. There's some accounting treatments that are less than ideal too, such as a lot of capitalisation of costs.

I'd be prepared to buy back if there's a positive resolution of the legal case, sales momentum continues and I get a better price

Claude Walker's take on Nearmap's results here

I tend to agree with most of this.

When looking at the bear arguments, the issue of outright accounting fraud isn't one i give a high probability to. So i'm going to assume the reported numbers are accurate.

Bear's say NEA is guilty of capitalising way too much capture and development costs to the balance sheet, and being pretty optimistic with amortisation rates. That was definitely true at one stage.

But after agitation from shareholders this policy has been greatly improved. Although, I admit that it could still be a lot better.

Practically, i think it just means that it's sensible to heavily discount the true value of intangibles on the balance sheet, and to increase the true operating costs of the business when making an assement. And given the reported growth and increasing margins, these costs are more comfortable.

Overall, I thought the response to the short attack was reasonable.

At a point, unless you have real first-hand experience with NEA's offering and that of its competitors, it's a bit of 'he said, she said' in terms of product strength and market fit.

But the very decent rate of ACV growth, especially in North America, certainly offers a lot of solace.

I tend to remain favourably disposed towards Nearmap, but as you'll see on my valuation I dont think it's any great bargain.

NEARMAP RESPONDS TO ERRONEOUS SHORT SELLER REPORT

Nearmap Ltd (NEA:ASX) is aware of a recent report by short-seller firmJ Capital Research Limited (“the Report”). The Report contains many inaccurate statements and makes unsubstantiated allegations of a very serious nature.

The Report was created without prior consultation or discussion withNearmap and follows a pattern of overseas domiciled funds making speculative claimsin order to generate uncertainty through adverse publicity and directly profit fromsuch claims. Nearmap has reviewed and rejects the Report.

The consistency and fullness of Nearmap’s market disclosures ensures market participants have a great deal of information against which to assess the merit, or lack thereof, of claims such as those in the Report. Nearmap is in compliance with its continuous disclosure obligations and the Company remains highly confident and committed to its long-term strategy and outlook.

Nearmap does not wish to engage in detail with each individual erroneous, self-serving and unsubstantiated opinion contained within the Report and therefore will only focus on addressing the Report’s key factual misstatements(“False Claims”)

Nearmap Ltd (NEA:ASX) is aware of a recent report by short-seller firmJ Capital Research Limited (“the Report”). The Report contains many inaccurate statements and makes unsubstantiated allegations of a very serious nature. The Report was created without prior consultation or discussion withNearmap and follows a pattern of overseas domiciled funds making speculative claimsin order to generate uncertainty through adverse publicity and directly profit fromsuch claims. Nearmap has reviewed and rejects the Report. The consistency and fullness of Nearmap’s market disclosures ensures market participants have a great deal of information against which to assess the merit, or lack thereof, of claims such as those in the Report. Nearmap is in compliance with its continuous disclosure obligations and the Company remains highly confident and committed to its long-term strategy and outlook. Nearmap does not wish to engage in detail with each individual erroneous, self-serving and unsubstantiated opinion contained within the Report and therefore will only focus on addressing the Report’s key factual misstatements(“False Claims”)

Nearmap Ltd (NEA:ASX) is aware of a report published yesterday which commented on aspects of the Group’s performance.

Nearmap will provide a response to this report on Monday, 15 February 2021. As such, Nearmap will also bring forward its 1H FY21 result to Monday, 15 February 2021 (from Wednesday, 17 February 2021 as previously announced) and will hold a result briefing at 09:30 AEDT.

Participants wishing to attend the briefing will need to pre-register at the webcast link below

Webcast link: https://event.webcasts.com/starthere.jsp?ei=1421321&tp_key=7ad9530070

Trading Halted til Mon 15th Feb

The Trading Halt is requested in connection to a report released by J Capital Research USA LLC (Report)

Heads up to Rapstar for posting "The Report"

JCAp Short report is here. You have to click not Australian resident to see it.

Report claims include these:

1) Nearmap technology inferior to Eagleview (spookfish tech), resulting in higher imagery costs.

2) Eagleview has 44% of US market share vs Nearmap's 5% and lack scale to compete.

3) Former chairman selling 50% of shares over last 12 months.

Nearmap is raising $70m through an institutional raise, and up to a further $20m through a shareholder purchase plan (SPP).

This will involve the issue of at least 26m new shares, or 33m if the SPP is fully subscribed. That's a ~7% increase to the total share count.

The reason is to "accelerate growth opportunities" which basically means increased Sales & Marketing (especially in North America) and development costs. With a minimum of $105m in cash post-raise, NEA also said the raise will give them a lot of strategic "opportunities in a dynamic market", which I assume means potential acquisitions.

It's worth noting that Nearmap capitalises a lot of development and capture costs, and last year reported negative $37m in free cash flow. That's a deterioration from the previous year due to a 47% lift in operating expenses. So although it wasnt highlighted in the announcement, i dare say a good portion of the capital will be used for working capital.

To wit, Nearmap said the cash balance at the end of FY21 is expected to be between $32-35m. Put another way, the total value of the institutional raise will be spent in less than a year.

As always, whether this is a good or bad move depends on the Return on Investment (ROI) they can get on this capital. The business has achieved 27% compound annual growth in Annualised Contract Value (ACV) in the past couple of years, and US subscription revenue is already twice what it was in Australia & New Zealand at the same stage of maturity. There's defeinitly very solid sales momentum, and the market opportunity is large and growing. Nearmap appears to be very well placed competitively.

I like the tech and the offering and think top line growth will remain strong for a good while yet. But although the scalability of the business model has been touted for many years, we're yet to really see that realised in the financials due to an ever growing cost base. Granted, these increased costs have helped underpin very solid top-line growth, but at some stage -- hopefully sooner rather than later -- we really need to see expenses stablise and the operational leverage of the business unlocked. At the very least, it'd be good to see them move much closer to a positive free cash flow position.

It's also worth noting that a good deal of growth is already assumed by the market. Based on the raise price of $2.69, the company is valued at $1.3 Billion -- over 12x the ACV.

Still a bit too rich for me.

[disc. I don't hold on Strawman, but have a small parcel in my real portfolio that was purchased in 2015 and mostly sold down in 2019]

Details of the raise here.

Nearmap has achieved an Annualised Contract Value (ACV) of $106.4m for FY20, up 18% on the previous year.

This was a combination of a 7% lift in subscriptions growth and (encouragingly) an 11% lift in average revenue per subscription.

Statutory revenue was up 25% to $96.7m.

However, a big increase in capture costs and an increase in their rate of amortisation saw a drop in gross margins. Combined with a 47% lift in operating expenses, the after tax loss more than double to -$36.7m.

This added spend is (obviously) hoped to have laid the foundations for scalable growth into the future. It will be something to watch though; Nearmap's costs have always grown at a pace that offsets its strong revenue growth and has kept the business in a cash losing position.

At present, Nearmap has $33.8m in cash. Due to cash management initiatives implemented in April, the business expects to be cash flow breakeven in the current year. Safe to assume the market will very much welcome this if achieved.

North America, which accounts for 17% of total subscriptions but has about double the average subscription per user (greater proportion of larger enterprises), saw 27% growth in ACV. The pace of revenue growth is much greater than where ANZ was at the equivalent point after launch.

Growth so far in FY21 is on pace with last year. Combined witha resilient second half, it appears Nearmap's sales have held up really well during COVID.

At present, shares are on a P/S of about >12, which is certainly up there. That being said, should the business pivot to cash flow positive, maintain strong growth and show improved cost discipline, it could well be at a price that appears cheap in the medium to long term.

I think they continue to hold a very favourable competitive position, are showing good traction in their key growth market, and continue to broaden the product offering.

Nevertheless, I still see shares as a bit overvalued (see valuation).

You can read the results presentation here

A great update from nearmap today.

Key points:

- Annualised Contract Value (ACV) now exceeds $102m. Passing the lower bound of earlier guidance from February. (that's at a FX rate of 0.7 AUD-USD, but at the current rate of 0.66 ACV is $104m)

- FY20 ACV now expected to be between $103-107m (prior range was $102-110)

- New AI functonality to be launched on June 1

- Company on track to be cash flow breakeven by June 30

- Cash balance expected to be $32-35m at and of year

- Despite the impact of COVID-19, Nearmap has continued to grow its portfolio month on month

- Churn has reduced to 10% from 11.5%

Glad i added it to my Strawman portfolio last month -- just wish i'd bought more! :)

You can read the ASX announcement here

Nearmap has provided another trading update. Key pionts:

- Claims it has seen no material impact on trading conditions

- It is however seeking to reduce operating and capital costs by up to 30%

- including a 25% pay cut for board and CEO and 20% cut for everyone else

- Reducing heacount by 10%

- Expects to be cash flow breakeven by the end of FY20

You can see the full ASX announcement here

Nearmap has provided an update in light of the coronavirus pandemic.

No detail was provided in terms of the impact to sales experienced or expected, with the company only saying that it's offering helped facilitate remote working and that it was well placed to endure any impact due to its near $50m in cash.

You can read the full update here