$NEA reported its full year results today. If you missed the presentation and are interested in the detail of what was said, especially the Q&A, the full transcript is here:

https://newswire.iguana2.com/af5f4d73c1a54a33/nea.asx/2A1391345/NEA_FY22_Results_Transcript

I added the links to presentation, release, and analysts pack at the bottom of this straw.

Rather than do a poor job of rehashing content from these materials attached, here I will share some of my key takeaways and impressions. (I will return and flesh out some items and valuation another time.)

Overall Investment Thesis is Intact Driven By Strong NA Progress

Overall contract and revenue growth were strong, and towards the top end of guidance. This was underpinned by very strong NA market and less strong ANZ. Given the much greater scale of NA, this is a good place to be.

Incremental ACV grew a second year in a row, by a record $33.3m – underscoring that they have cracked the NA market, which was a real question-mark 2-3 years ago.

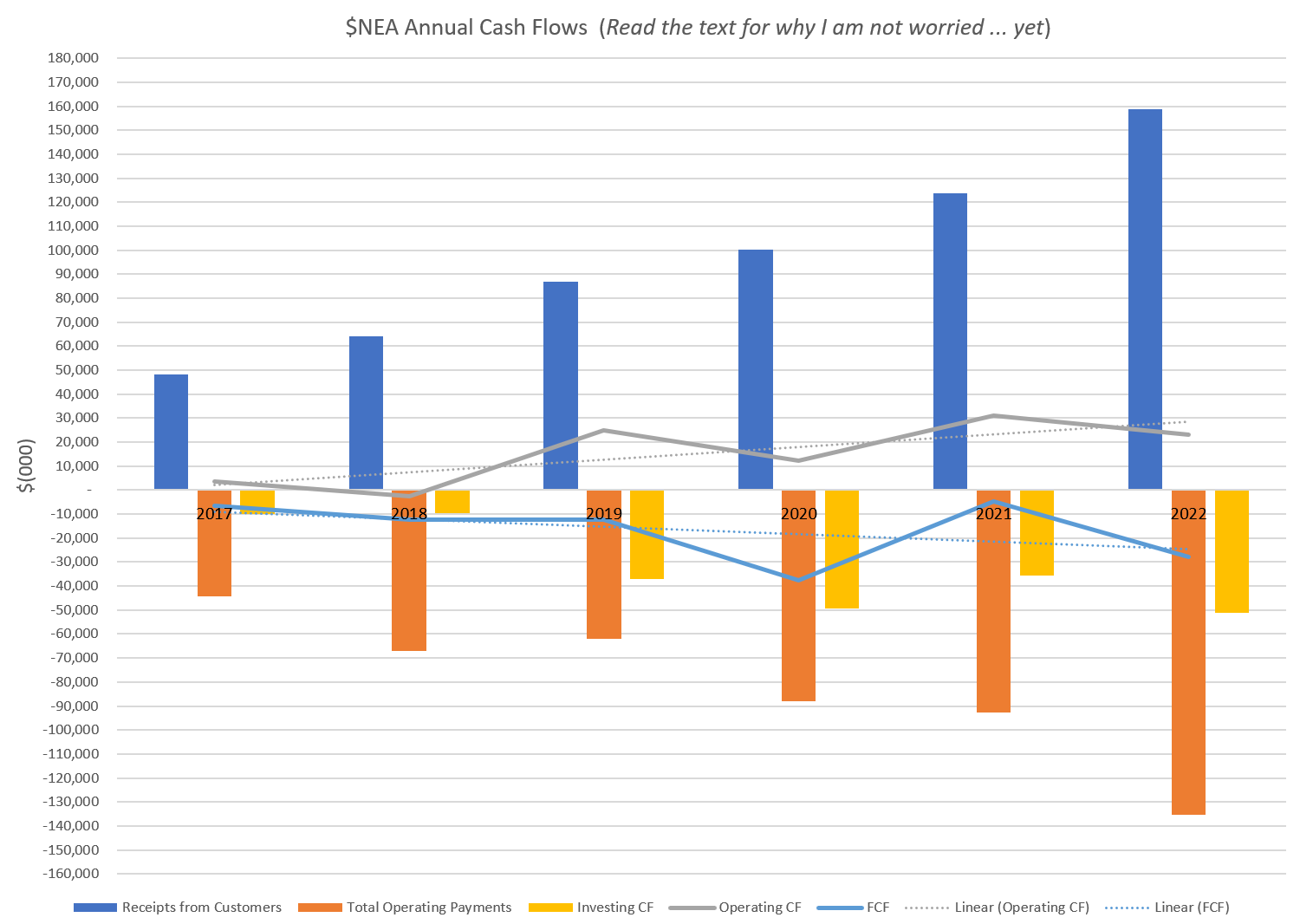

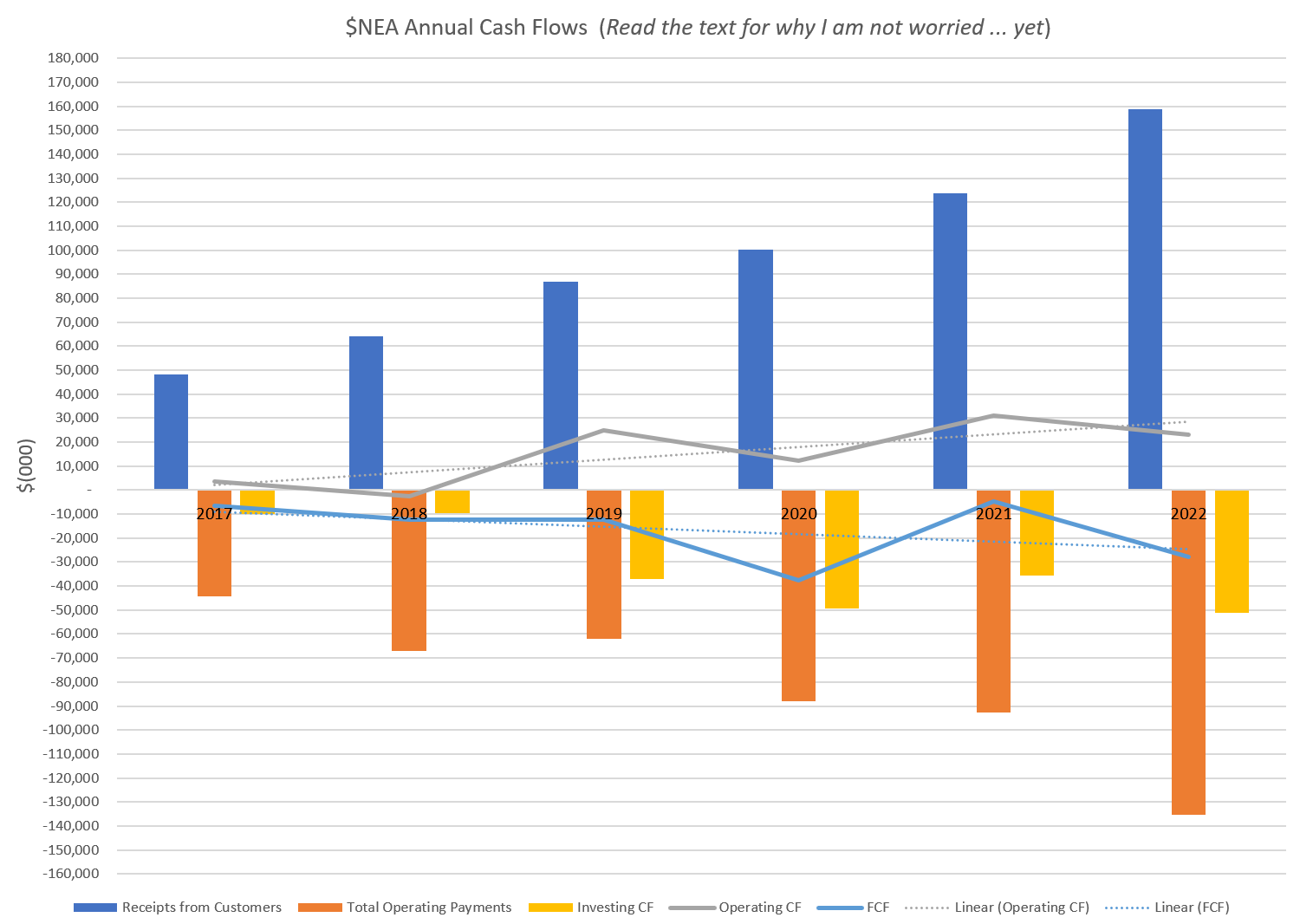

There has been heavy cash investment in: NA coverage, in Hypercamera 3 development/rollout and in Sales and Marketing. Therefore, my usual CF trend analysis below doesn’t look so great. Based on the CF numbers, there isn’t any trend to cash generation.

Should we be worried?

Normally, I would be. But both Rob Newman and CFO Penny Diamantakiou stated repeatedly that $NEA will be CF positive in FY2024. Cash outflow would peak in 1H23, trend toward breakeven in 2H23 and then FY24 would be Free Cash Flow positive for the full year. (This was clarified in the Q&A by one of the analysts, and it was reiterated so as to be completely unambiguous. You cannot get a more explicit setting of expectations, in my view.) They have ample cash and debt capacity to achieve this with a good margin of safety.

Secondly, there was no change to the short-to-medium term target of ACV growth of 20-40%, which is clearly needed to underpin turning $NEA cash generative in that timeframe. Rob remains adamant that it is still early days in penetrating NA.

These top-level metrics are underpinned by:

· Annual Churn is steady, with retention at 93%

· Subscriptions are growing steadily at +8% (7% pcp)

· ARPS is accelerating at +21% (+11% pcp)

· The distribution of revenue per subscription is trending to larger values, more multi-year deals, more premium content. Overall, customers are using more with time and getting more value.

Hypercamera 3 technology is being rolled out. (1 in operation in Aus. Plan for one more in Aus and 4 in NA through FY23). Importantly, the “efficiency” of HC3 is double that of HC2 (I think that should be productivity, not efficiency). This will increase optionality. Either cover the same area at half the cost, or fly lower and provide higher-value content. This optionality lever is clearly one of the key sources of competitive advantage, and it was referred to in general terms to support the path to cash generation narrative.

There are of course some aspects of the results that are no so good, and I will deal with these later. Overall, they don’t affect my top line summary: $NEA is succeeding because is has cracked the NA market.

Often, I find, there is more to a presentation than the numbers and explanations. For me today there were two overarching points:

1. There was nothing remarkable or surprising in this presentation. I’ve been listening to Rob Newman now for 5 years and, with respect to America, the story evolves consistently and gets more granular each time. I really get the sense that $NEA is coming to grips with how to compete and win in NA.

2. Both Rob and Penny came across as very confident and fact-based both in presentation and in the Q&A. (I have a strong BS detector, and it didn’t go off once!)

Making a Virtue of Churn

I can’t see it in the numbers, but there was a reported significant churn event in NA. As it turned out, this was a (what was clarified under Q&A as insurance) partner who $NEA chose not to renew because $NEA is increasingly providing more of the value-added services through its premium content. Nice story… even if a bit of spin. Seriously, they were making the point that the value-added data-analytics and AI services being provided with the data are becoming more important, so they want to provide this directly to end customers and will be prepared to cut out partners. If this is true, we should continue to see strong growth in ARPS over time. That’s part of the investment thesis, so good to see it coming through anecdotally.

Capital Discipline Being Demonstrated

Part of my confidence in management is that they are starting to demonstrate capital discipline:

· FY22 spending of funds from capital raise was closer to $20m than initially guided $30m

· CF breakeven in FY2024 looks like a stake in the ground

· Reference of goal to be CF breakeven with a strong remaining cash balance

· Not now looking at Europe until CF breakeven delivered (because NA opportunity so big)

· Prepared to use “optionality” to keep to guidance (capex; cash burn; coverage etc.)

The Not So Good

There were some areas of weakness in the results.

Gross Margin(pre-capitalisation): This was down from 75% to 72%. However, Rob made it clear that this is due to the increased contribution of NA, compared to more mature and higher margin ANZ. He said “cost of capture in NA is 4 x ANZ”. So, we should see some further trending down of this metric. NA is 10x+ ANZ in terms of potential. So I’d rather win in this market even if margins are lower. Its total value that counts.

Sale and Marketing: The key sales productivity metric- Group Sales Team Contribution Ratio (STCR) was down again this year to 85% from 89% in FY21. Explanation: they pushed hard in NA, added a lot of heads with a stronger focus on direct sales and marketing, relative to indirect (via partners). With more heads still being added, this might not have bottomed out yet. But by arguing that the result was as a result of rapid team growth, there is no sense that it’s getting harder to make the sales. Which would be a concern, and something to keep track of. They also didn’t blame external factors like COVID or concern about the macro-environment. On the contrary, Rob said most of their customers are 1) acyclical and 2) looking to implemented $NEA to drive out costs. (Long live the forthcoming recession!)

ANZ is Maturing or Is It? We’ve seen several periods of softening growth in ANZ. For the last three years, ACV addition has averaged about $5.5m which is starting to look anaemic alongside NA. (It was not always thus.) We have had prior reports where Rob has admitted that the focus on NA has meant that management has taken the eye off the ANZ ball. Now a new, focussed GM is in place, they have learnings from NA and are about to refresh a new focused verticals strategy. I given them the benefit of doubt - they have shown they can learn in NA. In any event, ANZ is more mature. If they can kick things into gear there, then it is cause for future optimism. But it is not a thesis breaker given the quality of the ANZ business and materiality of NA.

The Lawsuit

Not much news. Spending serious money and treating expenditure here as below the line – unwilling to guide, but order of magnitude is $10m p.a. Taking on Eagleview by challenging validity of their patents. Confident theur will prevail.

The Takeover

No comment. Will act in shareholders interests. (OK, but what do we think $NEA is worth.) Blah Blah.

Disc: Held IRL and SM